DIpil Das

What’s the Story?

There is a diverse ecosystem of companies engaged in providing retailers and other companies with hardware and software tools that have AI functions. Retailers and other companies can leverage these tools to automate the identification of opportunities for better customer engagement, improve their operational efficiency and remove friction from shopping and enhance the function of e-commerce and omnichannel platforms.Why It Matters

Retail is becoming increasingly competitive. We identify the following areas of continuous competition:- The rise of data-driven e-commerce vendors

- Increasing adoption of cross-border e-commerce, where global competitors are also data-driven

- The consequences of Covid-19, which has increased e-commerce penetration in general. This sales channel often has lower margins and many large, well-heeled e-commerce companies and retailers were allowed to remain open during the lockdown, which substantially increased their market shares.

AI Categories: In Detail

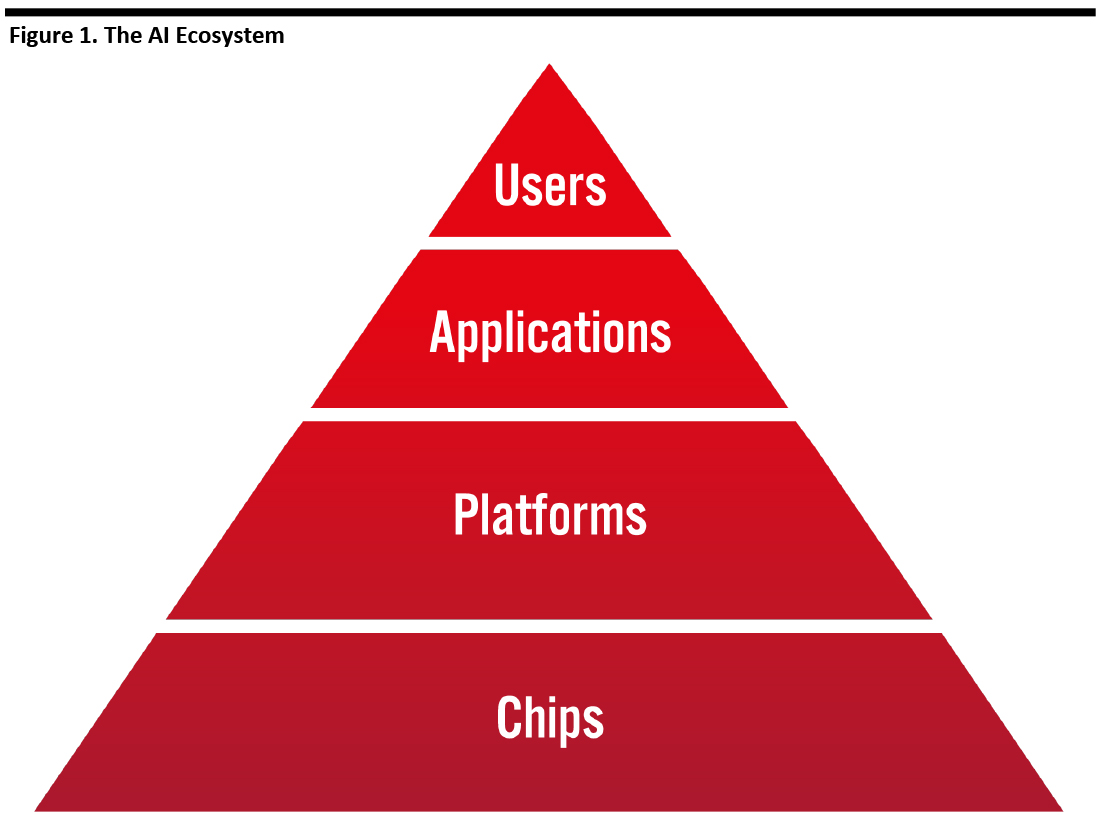

The section below discusses the major categories in the AI ecosystem, from the makers of AI-specific chips, to the platforms for using AI, the applications that use AI and retailers that employ the technology. The AI “Food Chain” Figure 1 shows the AI ecosystem, spanning from the AI chipmakers up to the retailers (and other companies) that use the tools. [caption id="attachment_120131" align="aligncenter" width="540"] Source: Coresight Research[/caption]

Starting from the bottom of the pyramid, we discuss the different levels below.

Chips

Nearly all major technology firms are involved in developing AI chips, including Alibaba, Amazon, AMD, Apple, Baidu, Facebook, Google, Huawei, IBM, Intel, Micron, Microsoft, NVIDIA, Qualcomm, Samsung, Toshiba, Xiaomi and Xilinx. NVIDIA offers AI chips for high-performance computer gaming and aims to move them into its data center as well.

Vertically integrated technology companies are using their own AI chips in their own products and platforms. Apple’s new line of computers uses its own M1 processor, which contains a 16-core neural engine that accelerates ML by 15 times. Amazon is using its own AI chips for some of the functions of its Alexa voice assistant as well as some of the functions provided by Rekognition, its cloud-based facial recognition service.

Our Introduction to Retail Tech report provides further information on AI chips.

Platforms

There are two ways in which platforms offer AI tools:

Source: Coresight Research[/caption]

Starting from the bottom of the pyramid, we discuss the different levels below.

Chips

Nearly all major technology firms are involved in developing AI chips, including Alibaba, Amazon, AMD, Apple, Baidu, Facebook, Google, Huawei, IBM, Intel, Micron, Microsoft, NVIDIA, Qualcomm, Samsung, Toshiba, Xiaomi and Xilinx. NVIDIA offers AI chips for high-performance computer gaming and aims to move them into its data center as well.

Vertically integrated technology companies are using their own AI chips in their own products and platforms. Apple’s new line of computers uses its own M1 processor, which contains a 16-core neural engine that accelerates ML by 15 times. Amazon is using its own AI chips for some of the functions of its Alexa voice assistant as well as some of the functions provided by Rekognition, its cloud-based facial recognition service.

Our Introduction to Retail Tech report provides further information on AI chips.

Platforms

There are two ways in which platforms offer AI tools:

- As part of cloud computing services

- Inclusion in other platforms, such as customer relationship management (CRM).

Figure 2. Selected Cloud and Supply-Chain Software Vendors Offering AI and Voice Recognition Tools [wpdatatable id=591 table_view=regular]

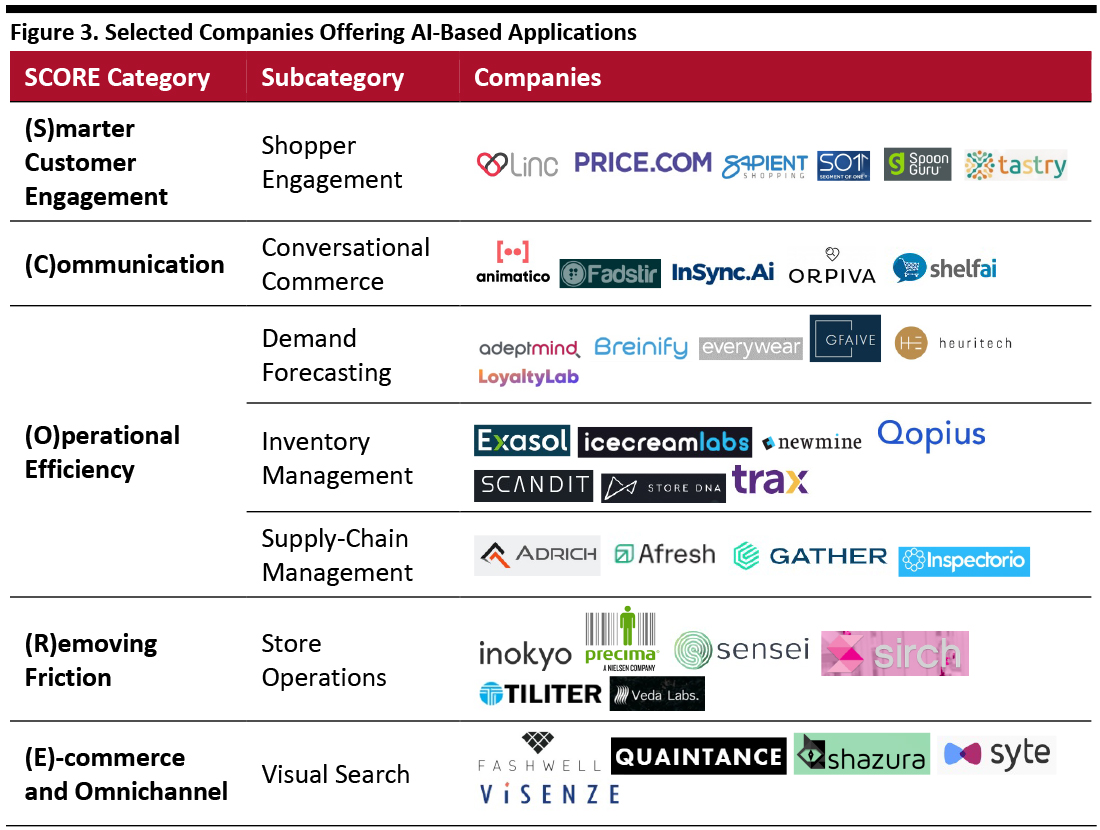

Note: * Alexa is Amazon’s consumer AI-powered voice platform. ** Cortana is Microsoft’s AI-powered voice platform. Source: Company reports Applications A large number of AI applications run proprietary AI software or leverage the functionality offered by AI chips or cloud-computing and other platforms. In some cases, the boundaries are blurred: For example, Amazon’s Alexa platform offers voice recognition and runs on cloud-based computing platform Amazon Web Services while also using the company’s own AI chips. The table below details several innovators that offer AI applications, organized according to Coresight Research’s SCORE framework, which highlights the value of AI in grocery retail. (SCORE is an extension of our CORE framework for retail overall.) We discuss the companies in more detail in our Retail-Tech Landscape: Artificial Intelligence in Retail report. [caption id="attachment_120132" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

There are many other platforms that use AI/ML, including the SAS analytics platforms and Zebra’s Prescriptive Analytics platform, which uses AI/ML to issue prescriptive actions that retailers can undertake to improve sales, profitability, efficiency and customer satisfaction.

Users

Many retailers use AI/ML applications or the tools that are included in ERP or cloud-computing platforms.

Source: Coresight Research[/caption]

There are many other platforms that use AI/ML, including the SAS analytics platforms and Zebra’s Prescriptive Analytics platform, which uses AI/ML to issue prescriptive actions that retailers can undertake to improve sales, profitability, efficiency and customer satisfaction.

Users

Many retailers use AI/ML applications or the tools that are included in ERP or cloud-computing platforms.

- Large retailers such as Costco, Target and Walmart have large in-house technology teams that can develop their own applications.

- Amazon uses AI, as it is embedded it its AWS platform.

- Other retailers using AI/ML include American Eagle, ASOS, Macy’s and The North Face.

What We Think

There is a healthy ecosystem of AI platforms, applications and services that retailers can employ to benefit from the advantages of AI/ML. Implications for Brands/Retailers- Brands and retailers can benefit from using AI/ML in the SCORE categories, including in smarter customer engagement, communication, operational efficiency, removing friction and in e-commerce/omnichannel.

- The competitive environment in retail is intensifying through heightened customer demands, competition from e-commerce and international vendors, and through competitors now making use of AI/ML technology. This creates an environment where retailers need to use AI at least at some level in order to compete.

- AI/ML is a flourishing category, receiving significant venture capital investment. There are still many opportunities for technology vendors in developing chips, software platforms and applications.

- There are also opportunities for partnerships between chipmakers and platforms and application developers, as well as between platforms and application developers.