albert Chan

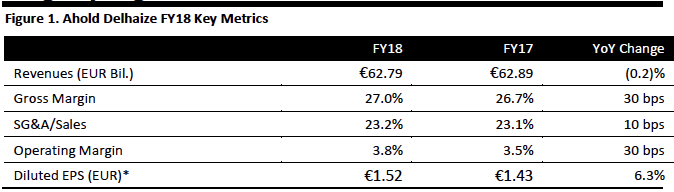

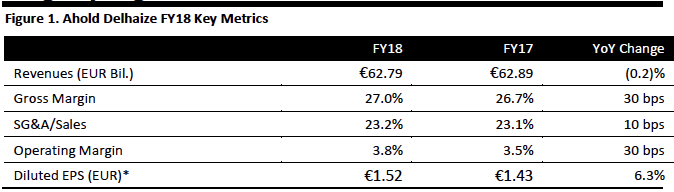

[caption id="attachment_78300" align="aligncenter" width="674"] *from continuing operations attributable to common shareholders

*from continuing operations attributable to common shareholders

Source: Company reports/Coresight Research[/caption] 4Q18 and FY18 Results Ahold Delhaize reported 4Q18 and FY18 results. 4Q18 Highlights:

*from continuing operations attributable to common shareholders

*from continuing operations attributable to common shareholdersSource: Company reports/Coresight Research[/caption] 4Q18 and FY18 Results Ahold Delhaize reported 4Q18 and FY18 results. 4Q18 Highlights:

- Ahold Delhaize grew net sales 3.0% year over year at constant exchange rates to €16.54 billion (up 5.0% as reported), compared to 3.6% growth at constant exchange rates (+4.3% as reported) in the previous quarter, marginally beating the consensus estimates of €16.5 billion by S&P Capital IQ. The growth was driven by strong sales in the US and aided by synergies.

- The company grew online revenues 18.5% year over year at constant exchange rates to €866 million (up 19.4% as reported), compared to 21.1% growth at constant exchange rates (up 21.5% as reported) in the previous quarter.

- The gross margin expanded 60 basis points (bps) to 27.1%.

- The operating margin expanded 20 basis points to 3.8%, due to higher selling, general and administrative costs.

- Underlying EBITDA was up 2.4% at constant exchange rates to €1.13 billion (up 4.5% as reported), compared to 4.6% growth at constant exchange rates (up 5.4% as reported) in the previous quarter.

- The company reported diluted EPS from continuing operations of €0.45, down 23.7% year over year, compared to 37.9% growth in the previous quarter and beating the consensus estimate of €0.42 by S&P Capital IQ.

- Strong momentum in the US continued as revenues were up 2.6% at constant exchange rates to €9.8 billion (up 5.9% year over year as reported), compared to 3.2% growth on constant currency basis (up 4.3% as reported) in the previous quarter, with same-store sales growth of 2.7% excluding fuel. The underlying operating margin for the US expanded 20 bps to 4.3%. The company noted it increased market share across its brands.

- For the Netherlands, revenues increased 3.6% year over year to €3.8 billion, compared to 5.8% growth in the previous quarter, led by same-store sales growth of 3.3%. The underlying operating margin for the Netherlands expanded 20 bps to 4.9%.

- Net sales in Belgium were €1.34 billion, up 3.6% year over year compared to 1.0% growth in the previous quarter, led by same-store sales growth of 3.0%. Underlying OPM for Belgium expanded 190 bps to 2.9%.

- For Central and Southeastern Europe (CSE), revenues increased 3.9% year over year at constant exchange rates to €1.6 billion (up 3.5% as reported), compared to a 3.0% constant currency growth (up 3.4% as reported) in the previous quarter, with same-store sales growth of 2.0% excluding fuel. The underlying operating margin for CSE contracted 10 bps to 5.3%.

- Net sales fell 0.2% year over year to €62.8 billion as reported; sales were up 2.5% at constant exchange rates, but slightly above the consensus estimate of €62.5 billion by S&P Capital IQ.

- The company grew online revenues by 17.7% year over year to €2.8 billion (up 19.3% at constant exchange rates).

- The gross margin expanded 30 bps to 27.0% driven by synergies.

- Operating margin expanded 30 basis points to 3.8%, mainly led by gross margin expansion.

- Underlying EBITDA increased 1.4% year over year (up 4.1% at constant exchange rates).

- The company reported diluted EPS from continuing operations of €1.52, up 6.3% year over year and above the consensus estimate of €1.49 by S&P Capital IQ.

- At constant exchange rates, US revenues were up 1.9%, though, as reported, they fell 2.5% year over year to €37.5 billion; the company grew same-store sales 2.1% excluding fuel. The underlying operating margin for the US expanded 20 bps to 4.2%.

- For the Netherlands, revenues increased 3.7% year over year to €14.2 billion, led by same-store sales growth of 3.8%. The underlying operating margin for the Netherlands expanded 10 bps to 5.0%. The Albert Heijn banner grew comparable sales in supermarkets and online, but reported a decline in market share.

- Net sales in Belgium were €5.1 billion, up 2.9% year over year, led by same-store sales growth of 2.2%. The underlying operating margin for Belgium expanded 60 bps to 2.8%.

- For CSE, revenues increased 3.1% year over year at constant exchange rates to €6.02 billion (up 3.9% as reported), with same-store sales growth of 0.9% excluding fuel. The underlying operating margin for CSE contracted 30 bps to 3.9%.

- Gross synergies will deliver €750 million in savings in 2019, resulting in €500 million net synergies from the integration of the two companies.

- Savings of €540 million in 2019 as part of its €1.8 billion “Save for Our Customers” program for 2019-2021.

- Underlying income per share from continuing operations to grow by high single digits as a percentage compared to last year.

- Free cash flow in 2019 to be about €2.0 billion, as the company expects to increase its capital expenditures to €2.0 billion mainly directed towards its Stop & Shop and e-commerce business, and in strengthening its digital capabilities.