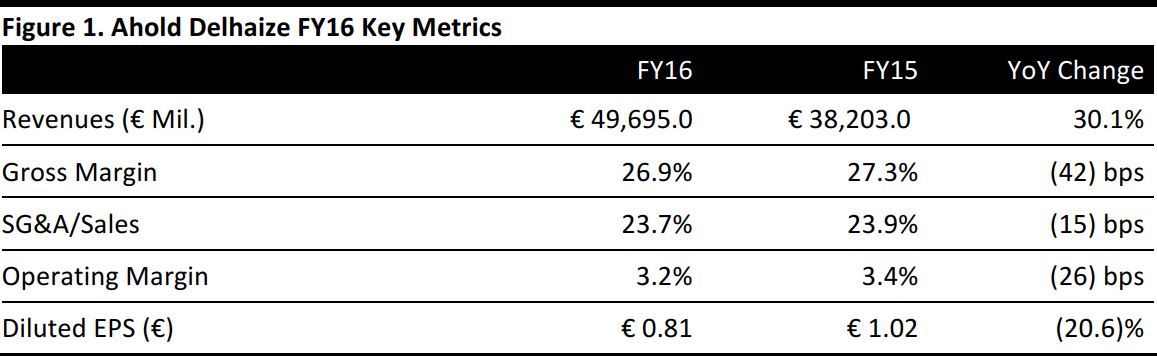

All data above are prepared on an IFRS basis. The data represent the former Ahold company for the full year plus the former Delhaize company post-merger, from July 24, 2016.

Source: Company reports/Fung Global Retail & Technology

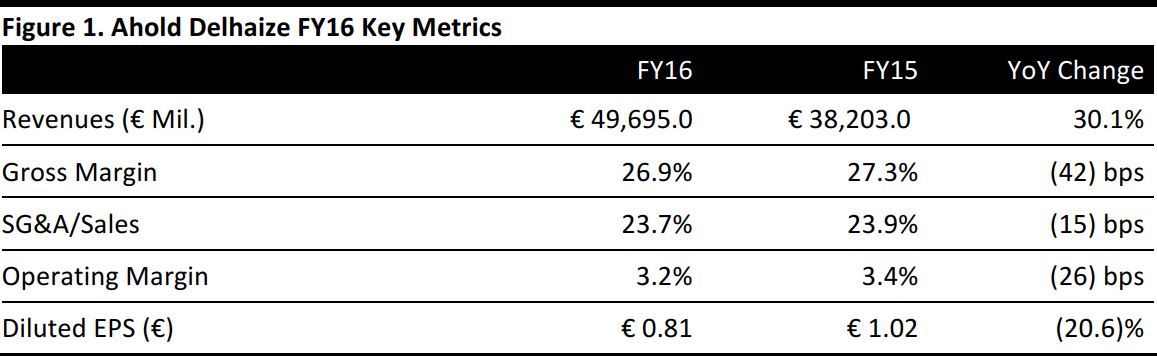

All data above are prepared on an IFRS basis. The data represent the former Ahold company for the full year plus the former Delhaize company post-merger, from July 24, 2016.

Source: Company reports/Fung Global Retail & Technology

Note: The merger between Dutch grocer Ahold and Belgian supermarket group Delhaize came into effect on July 24, 2016, to form Ahold Delhaize. The group began reporting consolidated results from 3Q16. Except where stated as pro forma, the company’s results represent the former Ahold company for the full year plus the former Delhaize company post-merger, from July 24, 2016. The company did not provide profit data for FY16 on a pro forma basis.

For the former Ahold segments, the number of weeks included for 2016 are 12 weeks for 4Q and 52 weeks for FY (2015: 13 weeks for 4Q and 53 weeks for FY). For the former Delhaize segments, the number of weeks included for both 2015 and 2016 are 13 weeks for 4Q and 52 weeks for FY. The numbers and percentage changes discussed below are not adjusted to exclude the extra week, except where stated. The figures in the above table are as reported in the audited consolidated income statement.

FY16 Sales

Ahold Delhaize reported FY16 revenues of €49,695 million, up by 29.6% from FY15 at constant exchange rates (up 30.1% in reported currency), due to the impact of the merger. Pro forma FY16 revenues, which represent the merged group, were €62,331, up by 2.1% at constant currency (up 2.4% in reported currency), including the impact of the 53rd week in 2015, and slightly below the consensus estimate of €62,419.14 million.

4Q16 Sales

In the fourth quarter ended January 1, 2017, Ahold Delhaize’s reported sales amounted to €15,119 million, an increase of 52.6% year over year at constant currency (up 54.4% in reported currency). Net income declined by 44.3% at constant currency and by 43.3% in reported currency to €144 million.

Pro forma net sales fell by 2.2% at constant currency and by 1.0% in reported currency to amount to €15,505 million.

Performance by Segment

Ahold Delhaize reports on four geographic segments: the US (which it further splits into Ahold USA and Delhaize America), the Netherlands, Belgium, and Central and Southeastern Europe (CSE).

All figures below are on a pro forma basis, including week 53 in 2015, and are at constant currency, except where stated.

The US: Ahold USA

- FY16 sales grew by 0.5%. When excluding fuel and week 53 in 2015, growth was 3.3%. Comps were flat (up 0.7% excluding fuel) during the year.

- In 4Q16, sales fell by 7.0% and comps were flat (down 0.2% excluding fuel). The company said that a deflationary environment and closures in its Stop & Shop New York Metro market impacted performance.

The US: Delhaize America

- FY16 sales rose by 1.9% (up 2.3% in reported currency) and comps grew by 2.1.

- In 4Q16, sales grew by 2.0% (up 3.8% in reported currency) and comps grew by 2.2%. The Food Lion and Hannaford banners saw positive comps growth and volume growth, which more than offset the impact of deflation which was around 1.7%.

The Netherlands

- Total FY16 sales improved by 3.1% and comps grew by 4.1%.

- In 4Q16, sales declined by 1.1% and comps grew by 6.6%. Ahold Delhaize said that assortment innovations and improved service at Albert Heijn stores and growth of 30% in online net consumer sales contributed to the quarter’s performance.

Belgium

- FY16 sales grew by 1.7% and comps grew by 1.7%.

- In 4Q16, sales fell by 1.0% and comps weakened by 0.9%. The company remarked that subdued holiday performance led to volume declines in the quarter compared to the same period last year.

CSE

- FY16 net sales grew by 8.1% (up 8.0% in reported currency) and comps increased by 5.5% (up 5.7% excluding fuel sales).

- During 4Q16, pro forma sales grew by 4.3% (up 3.8% in reported currency) and comps grew by 3.4% (up 3.4% including fuel sales).

All data above are prepared on an IFRS basis. The data represent the former Ahold company for the full year plus the former Delhaize company post-merger, from July 24, 2016.

Source: Company reports/Fung Global Retail & Technology

All data above are prepared on an IFRS basis. The data represent the former Ahold company for the full year plus the former Delhaize company post-merger, from July 24, 2016.

Source: Company reports/Fung Global Retail & Technology