Nitheesh NH

[caption id="attachment_94341" align="aligncenter" width="700"] *Restated

*Restated

**Statutory

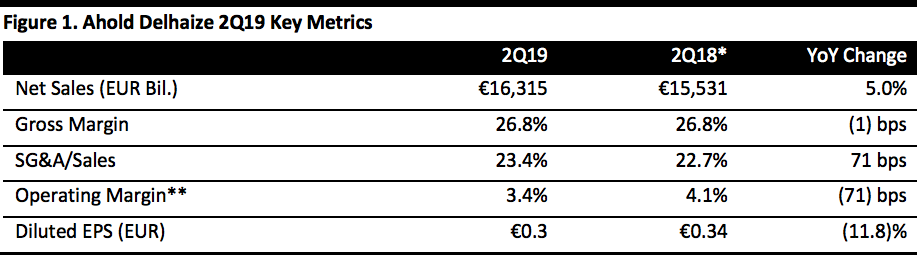

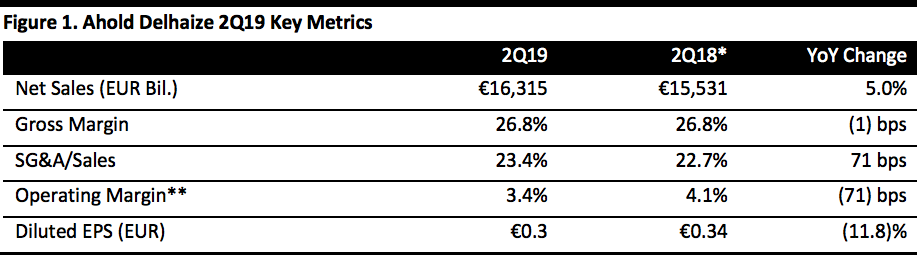

Source: Company reports/Coresight Research[/caption] 2Q19 Results In 2Q19, Ahold Delhaize reported net sales of €16.3 billion, up 1.5% at constant exchange rates (up 5.0% as reported) and in line with the consensus estimate recorded by StreetAccount. An 8.3% rise in selling, general and administrative (SG&A) expenses prompted a 71-bps erosion in the statutory operating margin. SG&A was driven higher particularly by labor costs, which rose 6.8%, and “other” expenses, which jumped 14.2%. Underlying operating income of €594 million was down 11.3% year over year but broadly in line with expectations. Underlying operating income includes adjustments for impairments (of €13 million), gains on leases and the sale of assets (of €7 million), and restructuring and related charges (of €27 million); the last item included €14 million of integration costs. This yielded an underlying operating margin of 3.6%. Net income came in at €334 million, down 18.1% year over year, impacted by the strike at Stop & Shop, offset by lower income taxes and higher income from joint ventures.

*Restated

*Restated**Statutory

Source: Company reports/Coresight Research[/caption] 2Q19 Results In 2Q19, Ahold Delhaize reported net sales of €16.3 billion, up 1.5% at constant exchange rates (up 5.0% as reported) and in line with the consensus estimate recorded by StreetAccount. An 8.3% rise in selling, general and administrative (SG&A) expenses prompted a 71-bps erosion in the statutory operating margin. SG&A was driven higher particularly by labor costs, which rose 6.8%, and “other” expenses, which jumped 14.2%. Underlying operating income of €594 million was down 11.3% year over year but broadly in line with expectations. Underlying operating income includes adjustments for impairments (of €13 million), gains on leases and the sale of assets (of €7 million), and restructuring and related charges (of €27 million); the last item included €14 million of integration costs. This yielded an underlying operating margin of 3.6%. Net income came in at €334 million, down 18.1% year over year, impacted by the strike at Stop & Shop, offset by lower income taxes and higher income from joint ventures.

- US comparable sales growth ex gasoline slowed to 0.2% from 1.2% in the prior quarter, but was in line with the consensus estimate. Ahold Delhaize reported that, adjusted for an 11-day strike at Stop & Shop and Easter timing, US comp sales ex gasoline were up 2.3%. Total US sales were up 0.2% at constant exchange rates. US online sales were up 14.4%, or 18% excluding the strike impact. The company is aiming to have 600 Click and Collect points by the end of the year, and added 124 such collection points in the quarter.

- In the Netherlands, comp growth came in at 3.8% (3.1% adjusted for Easter timing) versus 2.9% in the prior quarter and expectations of 3.2%. Online sales were up 34.4%, driven by 27.5% growth at Bol.com. Total sales in the Netherlands were up 4.2%.

- In Belgium, comparable sales declined 0.2% (declined 1.0% adjusted for Easter), compared to a 2.3% last quarter and the consensus estimate of a 1.4% increase. Total sales were flat year over year.

- Central and Southeastern Europe comp growth was 3.5% (3.0% adjusted for Easter), versus 0.8% in the prior quarter and the 1.2% consensus estimate. Total sales grew 5.1% at constant exchange rates.