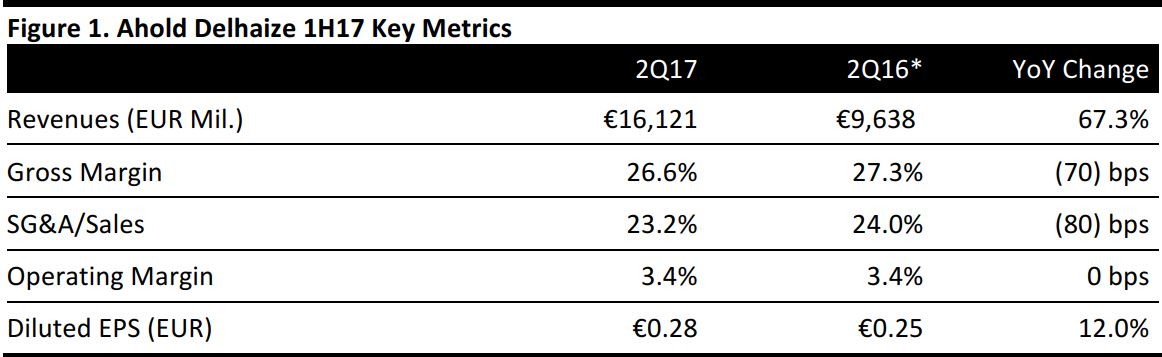

* Represents the pre-merger results of Ahold. Results from former Delhaize segments are included as of July 24, 2016. All data above are prepared on an IFRS basis.

Source: Company reports/FGRT

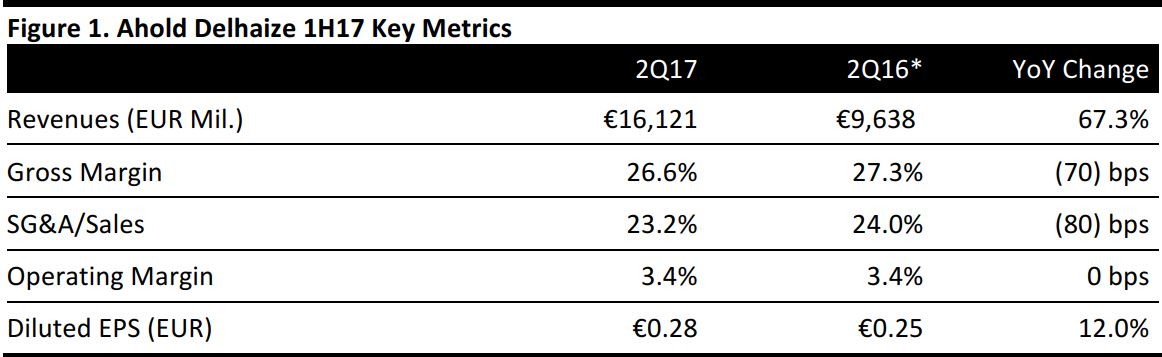

* Represents the pre-merger results of Ahold. Results from former Delhaize segments are included as of July 24, 2016. All data above are prepared on an IFRS basis.

Source: Company reports/FGRT

Note: The merger between Dutch grocer Ahold and Belgian supermarket group Delhaize was realized on July 24, 2016, to form Ahold Delhaize. The group began reporting consolidated results from 3Q16.

As the number of weeks included in reporting the previous performance of the former Ahold and Delhaize segments varied, the company has aligned their calendars and uses four 13-week quarters to report results for the consolidated firm, starting from this fiscal year. The 2016 quarterly information included in the latest statement has been compiled using the new 13-week quarters. The figures in the above table are as reported in the audited consolidated income statement. The company did not provide profit data for 2Q16 on a pro forma basis.

2Q17 Results

Ahold Delhaize reported an increase of 67.3% (+64.6% at constant currency) in 2Q17 revenues to €16,121 million. The jump in revenues is due to the merger in mid-2016.

Pro forma results provided in the statement represent the merged group as if the consolidation had occurred on the first day of Ahold’s 2015 fiscal year. In 2Q17, pro forma revenues were €16,044 million, up by 3.4% in reported currency (up by 1.8% at constant rates) and slightly above the consensus estimate of €16,011 million.

The gross margin fell by 70 bps, SG&A as a percentage of sales slid by 80 bps and the operating margin was flat. Diluted EPS leapt by 12.0% to €0.28 during 2Q17, slightly above the consensus estimate of €0.27.

On a pro forma basis, underlying EBITDA grew by 8.4% (+7.0% at constant rates) and the EBITDA margin improved by 30 bps. Underlying operating income strengthened by 11.4% (+10.2% at constant currency) and operating margin rose by 30 bps, reflecting continued merger synergy savings. Underlying EPS bounced 13.8% at constant rates to €0.33.

Performance by Segment

Ahold Delhaize reports on four geographic segments: the US (which it further splits into Ahold USA and Delhaize America), the Netherlands, Belgium, and Central and Southeastern Europe (CSE).

All figures below are on a pro forma basis and are at constant currency.

- Ahold USA: Net sales growth was flat and comps (excluding gas) were up by 0.3%, due to price inflation and the timing of the Fourth of July holiday sales, which offset the positive impact of the timing of Easter.

- Delhaize America: Sales grew by 1.2% and comps were up by 1.3%, less affected by the same factors that influenced Ahold USA’s performance.

- The Netherlands: Sales saw a strong quarter, increasing by 5.6% and comps were up by 4.9%, due to the positive impact of the timing of Easter.

- Belgium: Performance was slightly subdued, as sales grew by 0.2% and comps were flat, due to a decline in average basket size at company-owned stores.

- CSE: Sales in the region improved by 3.9% and comps (excluding gas) were up by 1.7%.

1H17 Results

On a currency-neutral basis, reported sales jumped by 63.0% to €31,991 million and net income grew by 67.3% to €711 million. EPS was €0.56, up by 9.1% at constant rates.

On a pro forma basis and at constant currency:

- Net sales grew by 1.2% to €31,810 million.

- Underlying EBITDA margin improved by 20 bps.

- Underlying operating margin rose by 30 bps.

- Underlying EPS increased by 10.5% to €0.63.

FY17 Outlook

For FY17, Ahold Delhaize expects the underlying operating margin to be broadly in line with that of 1H17, i.e., 3.9%. The company reiterated its target of achieving €220 million in net synergies by the end of FY17, including €22 million that was realized in FY16.

For FY17, analysts forecast:

- Pro forma revenues to be €63,907.5 million, representing 2.6% growth.

- Pro forma diluted EPS to be €1.28, representing 9.4% growth.

The consensus figures were collated prior to the company’s results announcement.

* Represents the pre-merger results of Ahold. Results from former Delhaize segments are included as of July 24, 2016. All data above are prepared on an IFRS basis.

Source: Company reports/FGRT

* Represents the pre-merger results of Ahold. Results from former Delhaize segments are included as of July 24, 2016. All data above are prepared on an IFRS basis.

Source: Company reports/FGRT