DIpil Das

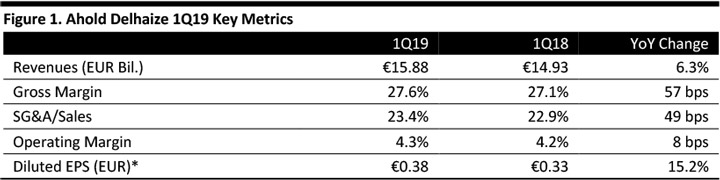

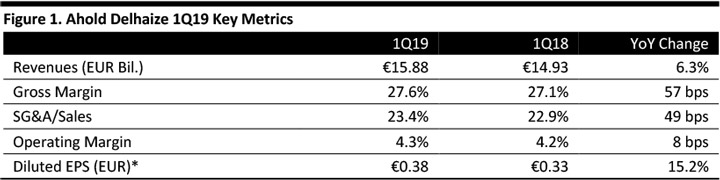

[caption id="attachment_87002" align="aligncenter" width="720"] *From continuing operations attributable to common shareholders.

*From continuing operations attributable to common shareholders.

Source: Company reports/Coresight Research [/caption] 1Q19 Results Ahold Delhaize reported 1Q19 results with revenues slightly missing the consensus estimate, while EPS was in line with expectations. The highlights for 1Q19 are as follows:

*From continuing operations attributable to common shareholders.

*From continuing operations attributable to common shareholders. Source: Company reports/Coresight Research [/caption] 1Q19 Results Ahold Delhaize reported 1Q19 results with revenues slightly missing the consensus estimate, while EPS was in line with expectations. The highlights for 1Q19 are as follows:

- Ahold Delhaize reported 1Q19 net sales of €15.88 billion, up 1.5% year over year at constant exchange rates (up 6.3% as reported), slightly below the consensus estimate of €15.96 billion recorded by StreetAccount. Revenues were negatively impacted by the timing of Easter.

- The company grew online revenues 17.9% year over year at constant exchange rates to €761 million (up 20.7% as reported).

- The gross margin expanded 57 basis points (bps) to 27.6%.

- The operating margin (OPM) expanded 8 basis points to 4.3%. Underlying OPM (after adjusting for impairments, restructuring and other one-time costs) was 4.4%, flat year over year. Underlying OPM expansion in the US and Belgium was offset by contraction in the Netherlands and central and southeastern Europe.

- Underlying EBITDA was down 0.4% year over year at constant exchange rates but up 4.6% as reported to €1.36 billion.

- The company reported diluted EPS from continuing operations of €0.38, up 15.2% year over year and in line with the consensus estimate.

- Ahold Delhaize adopted the IFRS 16 accounting standard on December 31, 2018 (the start of its 2019 financial year) and restated figures for 2018 as a result.

- For the first quarter of 2019, net cumulative synergies amounted to €122 million, an increase of €22 million compared to the same quarter last year.

- Ahold Delhaize grew US segment revenues 1.1% year over year at constant exchange rates to €9.67 billion (up 9.4% as reported), slightly below the consensus estimate of €9.72 billion recorded by StreetAccount. Comparable sales excluding gasoline grew 1.2% year over year, above the consensus estimate of 1% growth.

- Online sales increased 13.0% year over year at constant exchange rates to €221 million (up 22.3% as reported).

- Underlying OPM for the US expanded 30 bps to 4.9%, mainly due to a higher gross margin, synergies and cost-saving efforts, and was ahead of the consensus estimate of €4.6% recorded by StreetAccount.

- Stop & Shop has planned the next phase the reimagining Stop & Shop remodelling program in Long Island, New York.

- Food Lion announced it will invest $158 million to remodel 92 stores in the greater Myrtle Beach, Florence, Columbia and Charleston markets in South Carolina this year, and $40 million to remodel 23 stores throughout the Charlottesville and Harrisonburg markets in Virginia.

- Revenues increased 3.5% year over year to €3.53 billion, slightly above the consensus estimate of €3.51 billion recorded by StreetAccount. Comparable sales grew 2.9% year over year, in line with the consensus estimate.

- Online sales increased 20.2% year over year to €522 million.

- Underlying OPM for Netherlands contracted 20 bps to 5.0% and was slightly below the consensus estimate of 5.2%. The OPM excluding bol.com was 5.6%, down 30 bps due to higher transportation costs and ramp up costs for Albert Heijn's fully mechanized warehouse in Zaandam.

- com realized a net consumer online sales increase of 35.2% in the quarter.

- To boost growth at ah.nl, Albert Heijn plans to open a fifth fulfilment centre this year and is also expanding the number of distribution hubs. Albert Heijn remodelled 26 stores to its newest concept, with a strong focus on and more space for fresh categories.

- Net sales in Belgium were €1.22 billion, down 2.2% year over year and slightly below the consensus estimate of €1.25 billion. Comparable sales were down 2.3% year over year, below the consensus estimate of flat comps.

- Underlying OPM for Belgium expanded 10 bps to 2.4%, slightly below the consensus estimate of 2.5%.

- Ahold Delhaize grew its central and southeastern Europe (CSE) segment revenues by 2.4% year over year at constant exchange rates to €1.47 billion (up 1.7% as reported), slightly below the consensus estimate of €1.48 billion. Comparable sales excluding gasoline grew 0.8% year over year, in line with the consensus estimate.

- Underlying OPM contracted 50 bps to 3.2%, slightly below the consensus estimate of 3.7%.

The execution of our leading together strategy is on track as our results are starting to illustrate. During the quarter, we also launched our new purpose: eat well, save time, live better. These are the guiding principles in everything we do as we execute on our strategy. Throughout our businesses we help our customers make healthier choices. Innovative solutions, both in-store and online, make shopping more convenient and less time consuming. And to enable our customers to live better, we continue to support the local communities they live in.

Outlook For FY19, Ahold Delhaize expects to report the following:- Gross synergies of €750 million, resulting in €500 million net synergies from the integration of the two companies.

- Savings of €540 million as part of its €1.8 billion “Save for Our Customers” program for 2019-2021.

- Underlying operating margin for the group to be slightly lower than in 2018.

- Growth in underlying income per share from continuing operations is revised from high single digits to lower single digits.

- Free cash flow to be about €1.8 billion.