Web Developers

Retail group Ahold Delhaize hosted its 2016 Capital Markets Day in London on November 7. In this report, we pick out four key takeaways from its strategy briefings, which were given by Dick Boer, CEO, and Hanneke Faber, Chief E-Commerce and Innovation Officer.

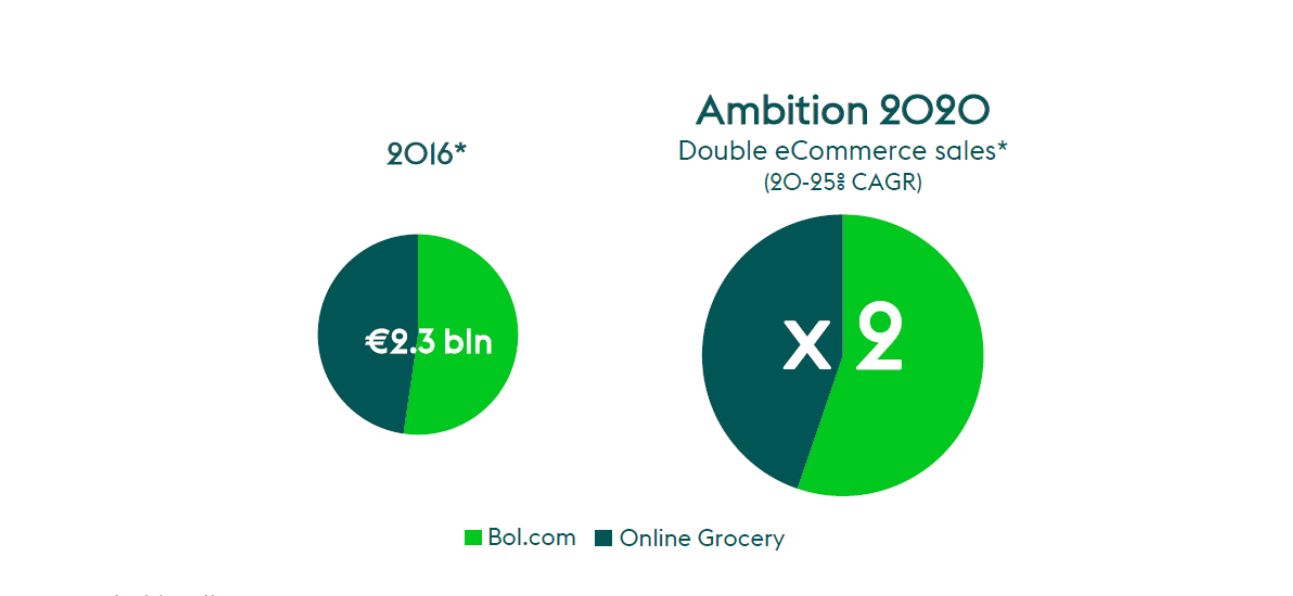

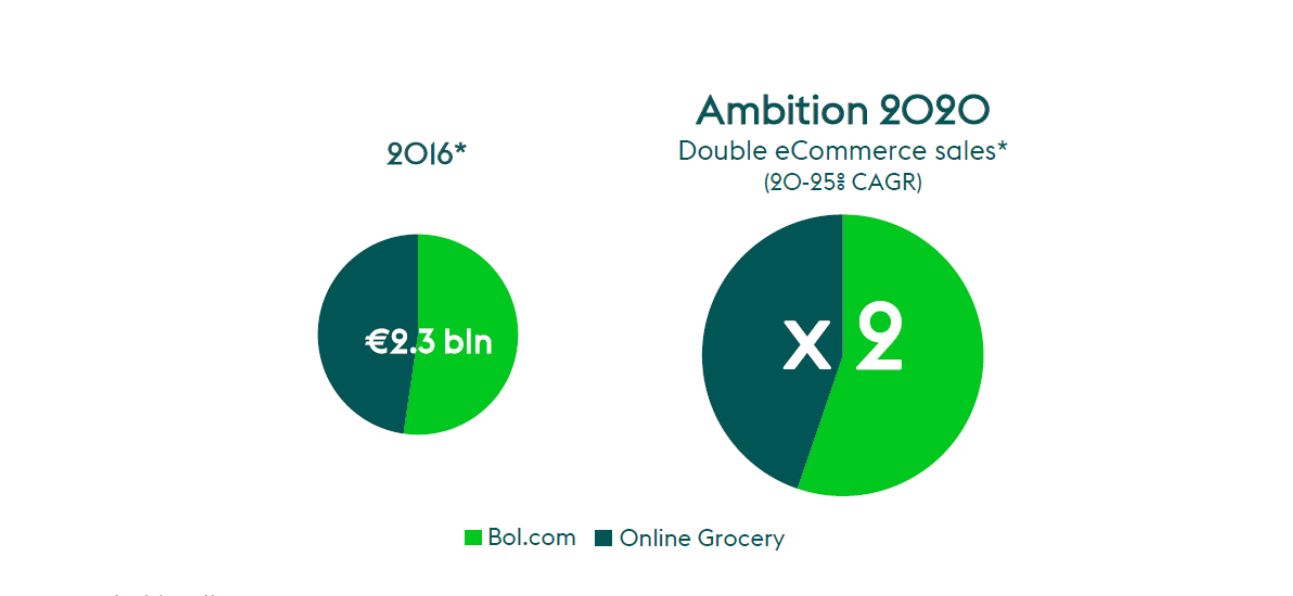

1. Doubling E-Commerce Revenues

Ahold Delhaize has a substantial presence in e-commerce, through its Bol.com general merchandise pure play in Europe, and its online grocery operations in Europe and the US. The company expects to generate some €2.3 billion in online sales in 2016, equivalent to just under 4% of its expected €62.5 billion in revenues. It used its Capital Markets Day to announce a target of doubling its annual online sales by 2020. Just over half of its sales now and in the future are from Bol.com, with the remainder from its online grocery operations.

Source: Ahold Delhaize

Here are some further takeaways on the company’s e-commerce operations:- Growth has been accelerating since 2014, and the company forecasts online sales will grow at a CAGR of 20%–25% through 2020.

- In dense, home-delivery areas, such as Amsterdam and Boston, the company’s online grocery services generate profitable EBITDA margins of 3%–5%. Overall, however, its online grocery operations generate a loss, due to investments.

- The company sees strong potential to grow online grocery sales in the US. This is not just through its Peapod pure-play operation, but through what it calls its “small gem,” Hannaford to Go, a pickup service. We flagged the central role of pickup services in growing the US online grocery segment in our recent report, Online Grocery Series: The US—Market Set to Boom as Basket Sizes Grow.

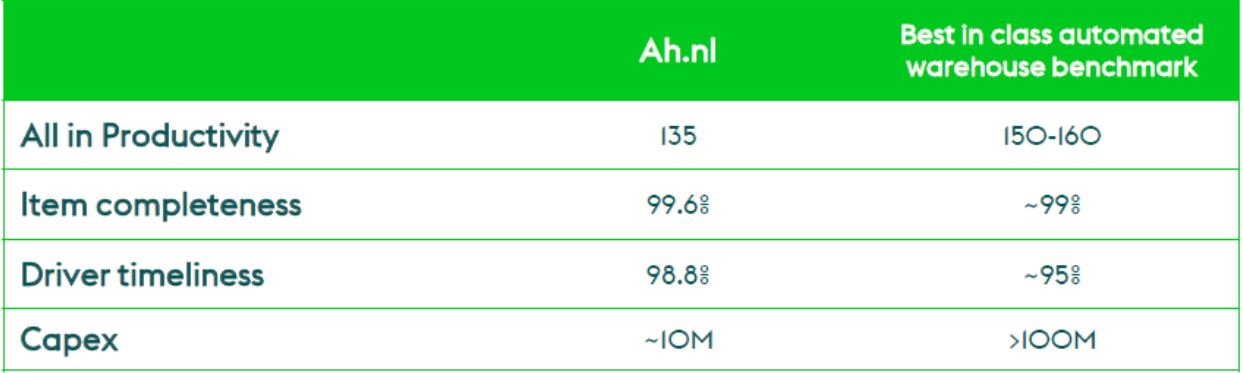

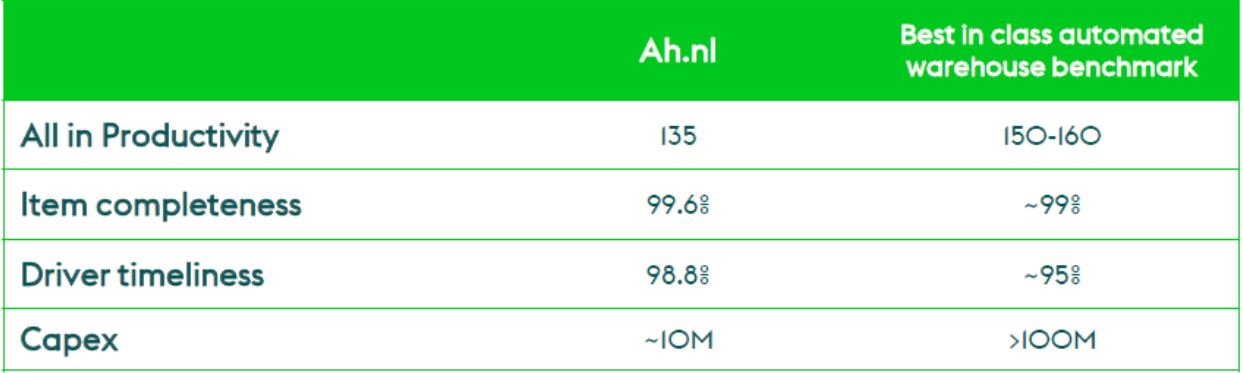

- Its online grocery warehouses are partly automated, and this means much lower capital investment than fully automated warehouses. As we show below, Ahold Delhaize rates itself highly on key benchmarks versus a “best-in-class” automated rival.

Source: Ahold Delhaize

2. Focused On Supermarkets And Smaller Formats

“We don’t have the heritage of very large stores. … We are focused on building supermarkets and smaller stores,” noted Boer, adding that it is well-placed to serve millennials who are demanding convenient, quick grocery options. In Europe, the shift over the past decade has been from hypermarkets to discount, Boer said. “Supermarkets are today, as always, the core of the industry.” Boer pointed to the “enormous opportunity” in bringing convenience-type retailing to the US. However, Ahold Delhaize has not yet learnt “how to crack the nut,” in part because its US supply chain is not set up for convenience stores. And “smaller” stores are likely to be much larger in the US than in Europe: the company is testing a 20,000 square-foot Hannaford format and a 10,000 square-foot b fresh format in the US. We concur that there are big opportunities for smaller, neighborhood store formats in the US, given the complement to online shopping for both grocery and general merchandise categories, and given the demands of millennials and seniors for quicker and easier shopping. In the past week alone, we have seen Walmart unveil its new gas-and-grocery format and Amazon announce its Amazon Go fresh-focused convenience-store launch. Moreover, Lidl is soon set to join Aldi in offering low prices in smaller supermarket formats. We think established grocery players must start to consider smaller-format stores to future-proof their offering.3. Points Of Difference Across Its Grocery Banners

Ahold Delhaize operates a substantial number of grocery banners in Europe and the US, and Boer pointed to four common themes that unite these chains. They are:- Affordable for All: “Every family in our trading areas should be able to do their weekly shopping with us, regardless of their income,” said Boer. Its Food Lion banner successfully rolled out a “Fresh, Easy & Affordable” positioning, which strengthened price perceptions.

- Best Own Brands: “Customers believe in and trust our own brands,” said Boer, pointing to an “astonishing” 50% own-brand penetration at its European stores and 40% own-brand penetration at its US banners. In the US, Boer said, retailers are seeing movement toward own brands in grocery.

Source: Ahold Delhaize

- Fresher and Healthier: Boer pointed to satisfaction with its fresh foods in Greece and moves to offer healthier products across its banners as evidence of the retailer catering to demands for better-for-you products.

- Most Local and Personal Service:This spans sourcing from local suppliers and bringing customers personalized offerings, the second of which we discuss in more detail below.

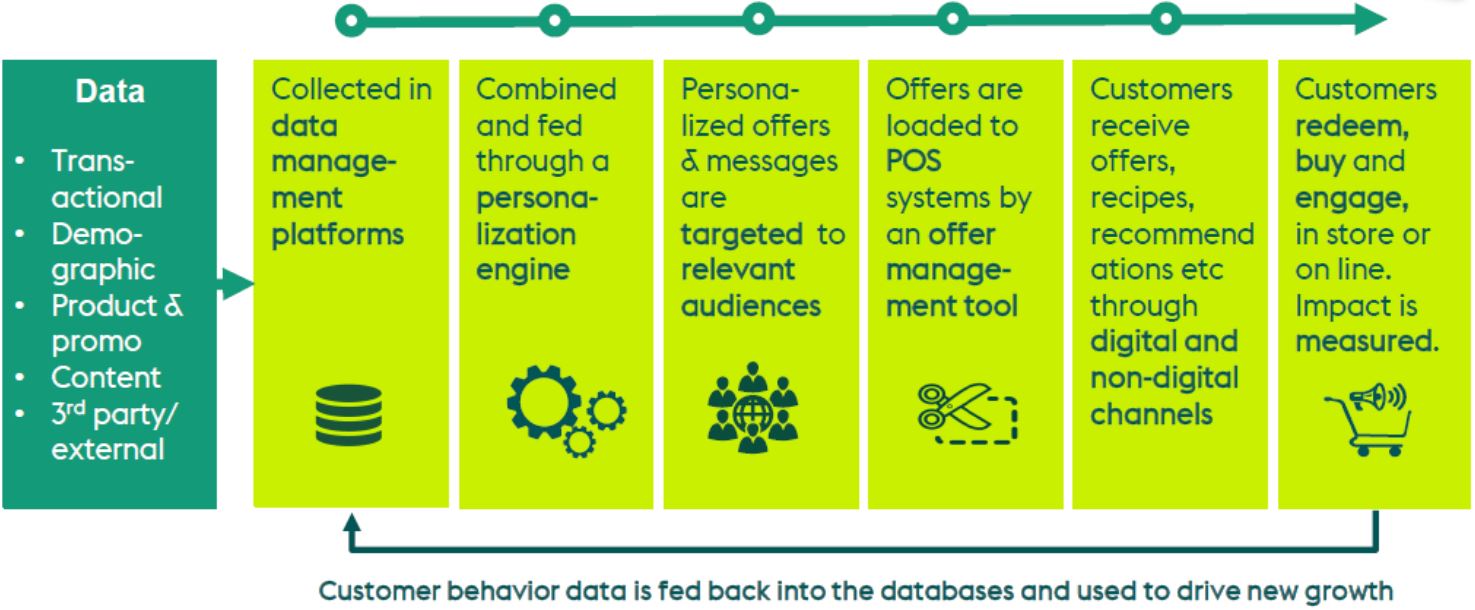

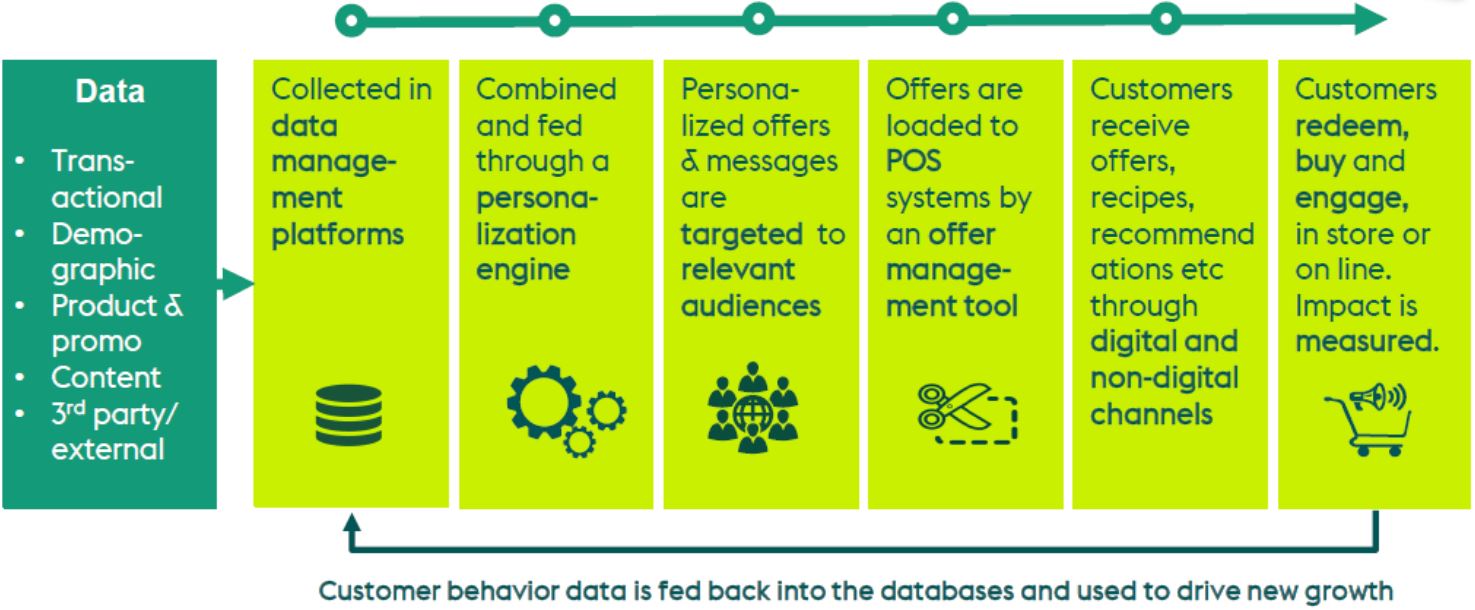

4. Delivering Personalization From E-Commerce To In-Store

“Customers demand relevant and personalized offers,” declared Boer. And Ahold Delhaize is taking lessons on personalization from its e-commerce pure-play operation, Bol.com, to its grocery division. Based on the “gargantuan” amount of data it collects, Bol.com serves up relevant products, promotions and follow-ups to its customers. And these personalized communications generate fully 20% of total sales at Bol.com. Faber flagged up that this gives Ahold Delhaize strong in-house capabilities, which it is sharing with its supermarket banners. Its supermarket chains take transactional, demographic, product and promo data and push out personalized offers, recipes and recommendations to their shoppers. Some 30 million consumers are in the loyalty programs that underpin this personalization, Faber noted, and incremental sales from the programs are up by more than 50% this year.