Source: Company reports/Fung Global Retail & Technology

The merger between Dutch grocer Ahold and Belgian supermarket group Delhaize came into effect on July 24, 2016, to form Ahold Delhaize. This is the first consolidated statement reported by the firm. It covers the quarter ended October 9.

AHOLD DELHAIZE: 3Q16 RESULTS

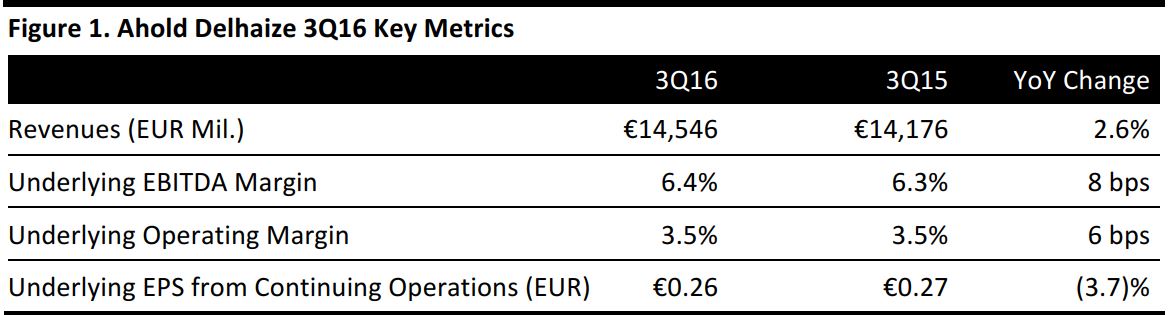

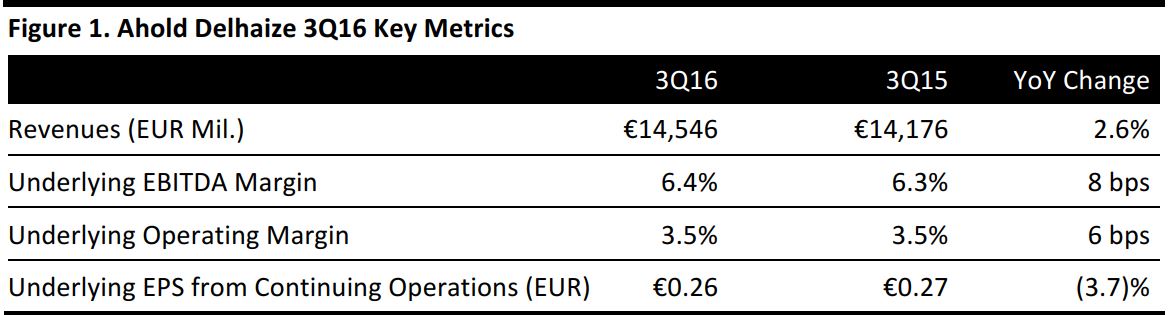

Ahold Delhaize reported 3Q16 pro forma revenues of €14,546 million, up 2.6% from €14,176 million in 3Q15, narrowly beating the consensus estimate of €14,516.98 million. Management remarked that despite the challenging environment in certain markets, it was able to drive top-line growth due to its continued focus on cost efficiencies.

The underlying EBITDA grew by 3.9% to €932 million, beating the consensus of €929 million, while the margin grew by 8bps to 6.4%. The underlying operating income grew by 4.3% to €513 million, beating the consensus estimate of €502.48 million, while the margin increased by 6bps to 3.5%.

Underlying EPS fell 3.7% to €0.26, missing the consensus estimate of €0.28.

By Geographic Segment

Ahold Delhaize reports on four geographic segments: the US (which it further splits into Ahold USA and Delhaize America), the Netherlands, Belgium, and Central and Southeastern Europe (CSE).

The following 3Q16 figures are on a pro forma basis only.

- The US: Sales at Ahold USA grew by 2.4% at constant currency, to €5,210 million. Comparable sales, excluding fuel, grew by 0.3%. Delhaize America saw net sales rise by 1.1% at constant currency to €3,888 million, while comps grew by 1.3%. For both of the sub-segments, the increase in sales was driven by positive volume growth, but was partially offset by a rise in retail price deflation. At the analyst presentation, management stated that in the food line, commodities as well as own-brand categories saw the most competitive activity.

- The Netherlands: Sales in the Netherlands grew by 4.3% to €2,900 million, and comps grew by 3.3%. The region saw positive performance under its Albert Heijn banner, thanks to continued innovations in its assortments. The banner began a trial of smaller-format ‘Albert Heijn to go’ stores at six gas stations in the country, during the quarter. Online sales grew by a strong 30% compared to the same time last year, driven by an increased number of unique visitors to its ah.nl website.

- Belgium: Revenues in Belgium grew by 1.7% to €1,213 million, and comparable-store sales grew by 1.3% during the period. Inflation and continued positive performance in the firm’s affiliated network drove growth, but was partly offset by negative volume growth in company-operated stores.

- CSE: Sales in the region grew by 8.9% at constant currency, to €1,335 million, mainly driven by strong comparable-store sales growth (excluding gas) of 6.0% and new store sales. Comps continued to be particularly strong in Romania and Greece, while it was almost flat in Serbia and the Czech Republic.

OUTLOOK

The company expects the full-year operating margin to be in line with its current year-to-date performance of 3.6% and slightly ahead of last year. It expects the deflationary environment with regard to food sales in the US to remain at the same level through the last quarter. At the analyst presentation, management stated that it expects a slight year-over-year increase in the pro forma numbers in the US.

Ahold Delhaize reiterated that it expects the free cash flow for 2016 to be €1.3 billion, capital expenditure to amount to €1.8 billion and an effective tax rate around the mid-20s. Free cash flow includes the FY impact of Delhaize Group and costs related to the transaction, integration and Delhaize Belgium’s Transformation Plan.