Web Developers

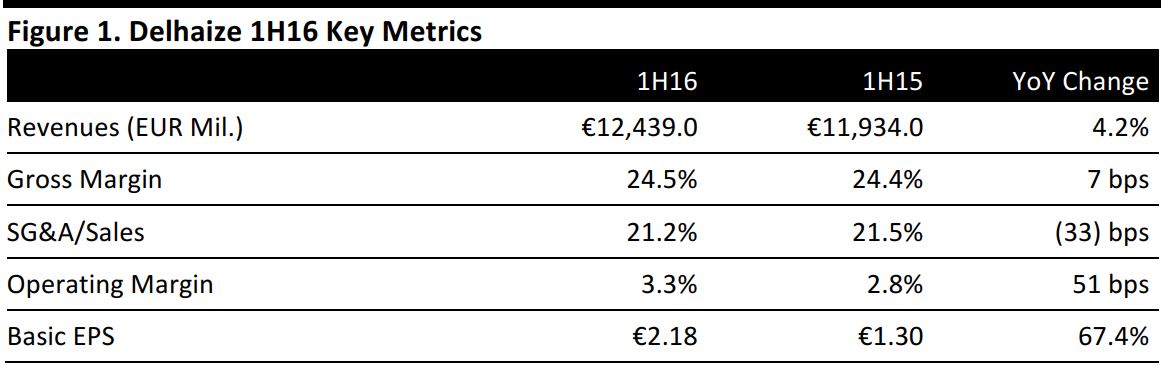

Source: Company reports/Fung Global Retail & Technology

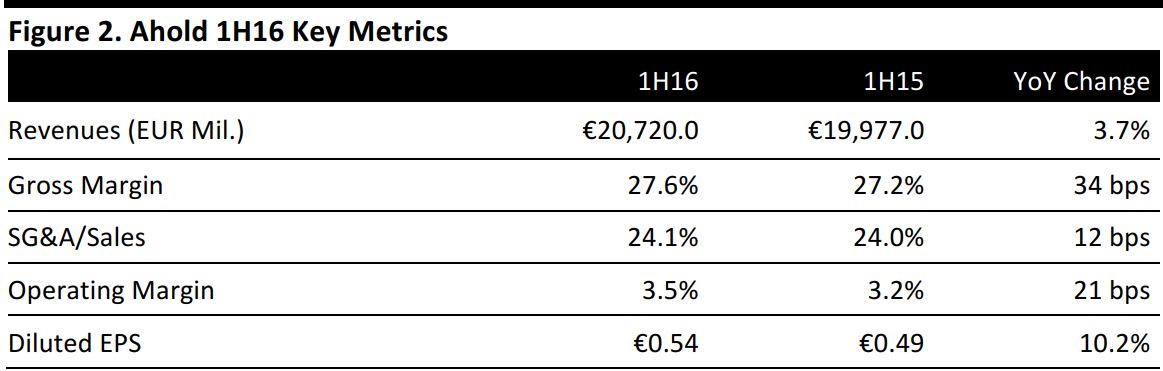

Source: Company reports/Fung Global Retail & Technology

The Ahold Delhaize merger was effective July 24, 2016. The company has published the 1H16 statements of Ahold and Delhaize Group separately, and will publish the pro-forma historical quarterly data on October 6 and the consolidated 3Q16 results on November 17.

The merger between Dutch grocer Ahold and Belgian supermarket group Delhaize was effective on July 24, 2016, and formed Ahold Delhaize. The recently-merged entity reported results for Ahold and Delhaize separately for 2Q16 and 1H16. It will begin to report consolidated results in 3Q16.DELHAIZE: 1H16 RESULTS

Delhaize reported revenues of €12,439 million for 1H16, up 4.2% from €11,934 in 1H15, and up 4.3% at constant exchange rates. The gross margin grew by 7 basis points at actual and constant exchange rates, as a result of less inventory shrink and the lower cost of products across some categories in the US, but was partly offset by price investments in the US and Belgium. The SG&A margin fell by 33 basis points at actual and constant exchange rates from the same period last year, due to cost savings from the Transformation Plan, a move to restructure and streamline its operations in Belgium, which Delhaize began in 2015. The US saw an increase in the SG&A margin due to increased labor and healthcare expenses. The operating margin grew by 21 basis points because of higher sales throughout the group. Southeastern Europe and the US saw particularly strong sales volumes. Cost savings from the Transformation Plan in Belgium also contributed to the positive growth in the operating margin. Net profit was €227 million for 1H16, up by 69.4% from €134 million in 1H15. Delhaize incurred financial expenses of €96 million in 1H16 compared to €139 million in 1H15 which included a one-off charge of €40 million related to a bond tender transaction, and thus resulted in a lower net profit last year.By Geographic Segment

During 1H16, revenues increased 2.4% in the US at local and constant currency, 3.2% in Belgium and 14.9% in Southeastern Europe, 15.5% at constant currency. For 2Q16, the company reported the following. All growth figures are in Delhaize’s reporting currency, the euro.- The US: Revenues in the US increased by 2.9% to $4.6 billion (€4.1 billion). Excluding a positive calendar impact of 0.3%, comparable-store sales grew by 2.9%. The company noted both Food Lion and Hannaford continued to experience a rise in comps and real growth.

- Belgium: Revenues in Belgium grew by 2.6% to €1.3 billion in 2Q16. Comparable-store sales grew by 2.1% during the period, excluding a 0.3% positive calendar impact. Chief Integration Officer at Ahold Delhaize, Frans Muller, confirmed Delhaize Belgium’s market share grew by 40 basis points during the year, to 24.3%, despite the disruptions from the Transformation Plan. He noted the top-line performance of company-operated stores remained below expectations.

- Southeastern Europe: Revenues in the region grew by 13.4% to €939 million, up 14.2% at identical exchange rates, mainly driven by strong comparable sales growth of 8.7%, a positive calendar impact of 0.5% and expansion of the network. Comps were particularly strong in Romania and Greece.

AHOLD: 1H16 RESULTS

Ahold reported net sales of €20,720 million in 1H16, up 3.7% at actual currency and up 3.6% at constant currency. Operating income grew by 10.5% at actual currency and up 10.4% at constant currency, to €715 million. Net income grew by 10.3% at actual currency and 10.4% at constant currency, to €450 million during the period. Basic EPS was €0.55 in 1H16, up by 12.2% at actual currency and by 10.8% at constant currency.By Sales Channel

In 1H16, Ahold’s store sales grew by 3% in reported currency and 3.6% at constant currency to €19,752 million. Online sales grew impressively by 21% in reported currency and 20.9% at constant currency, to €968 million, during the period.By Geographic Segment

- The US: Net sales in the US were €12,834 million, up by 3.3% in actual currency and by 3.1% at constant currency, in 1H16. The increase in sales was mainly driven by the addition of 25 A&P stores in the New York Metro area in the last quarter of 2015.

- The Netherlands: Sales in the Netherlands were €6,955 million, up 4.8% from last year. The company stated identical sales were up 3.2%, driven by strong online sales growth and growth in supermarket sales. New departments and product innovations continue to be rolled out under the Albert Heijn banner.

- Czech Republic: Sales in the Czech Republic grew by 1.7% at actual currency and 0.1% at constant currency, to €931 million in 1H16. A strong performance at supermarkets and hypermarkets in the country drove sales growth.