Ahold Delhaize: Company Description

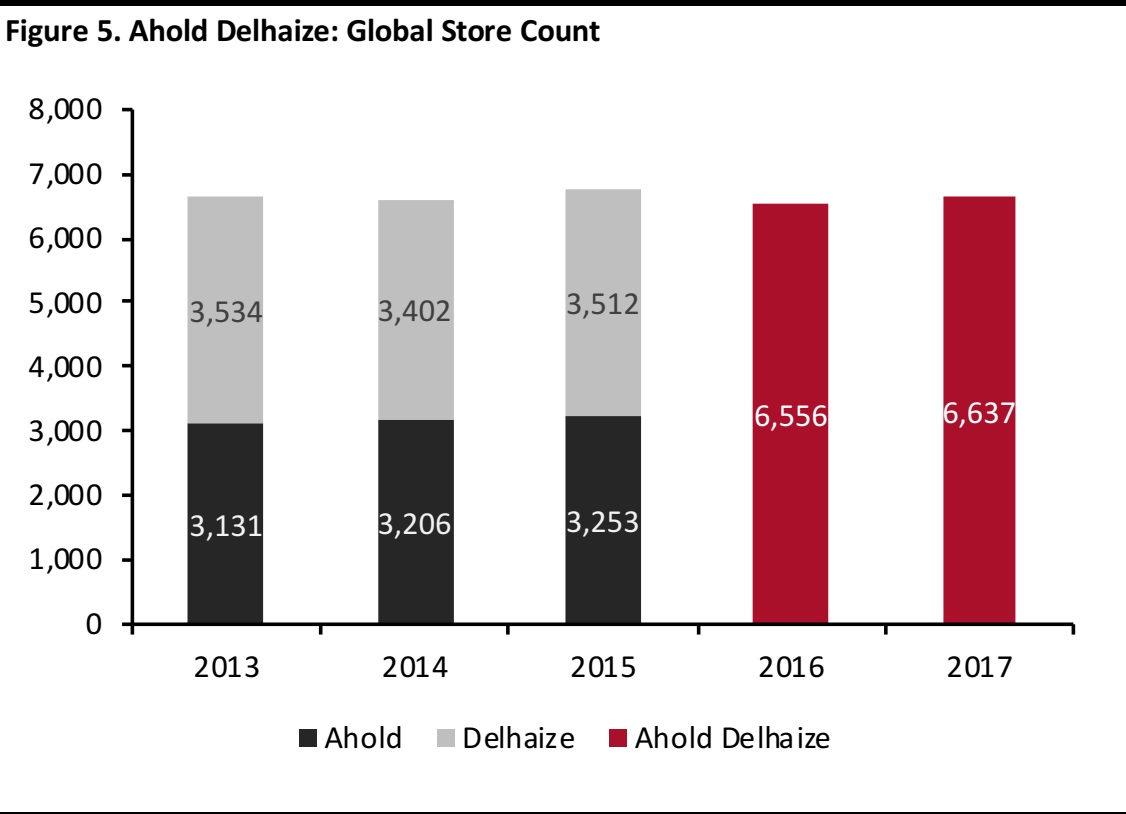

Ahold Delhaize is a Dutch retail company that operates grocery stores and food and nonfood websites mainly in the US and Europe. The company as we know it today was formed in July 2016 with the merger of retail groups Ahold and Delhaize Group. As of December 31, 2017, the company’s 20 banners employed roughly 370,000 individuals at 6,637 stores in 10 countries. The company’s formats include supermarkets, superstores, grocery websites, convenience stores, drugstores, wine and liquor stores, general merchandise websites, and compact hypermarkets and supermarkets.

Headquartered in Zaandam, Netherlands, Ahold Delhaize operates brands in the US, the Netherlands, Belgium, the Czech Republic, Greece, Luxembourg, Romania and Serbia. The company also operates through joint ventures in Indonesia and Portugal. Its US store presence is focused on eastern states.

Source: Company reports

Source: Company reports

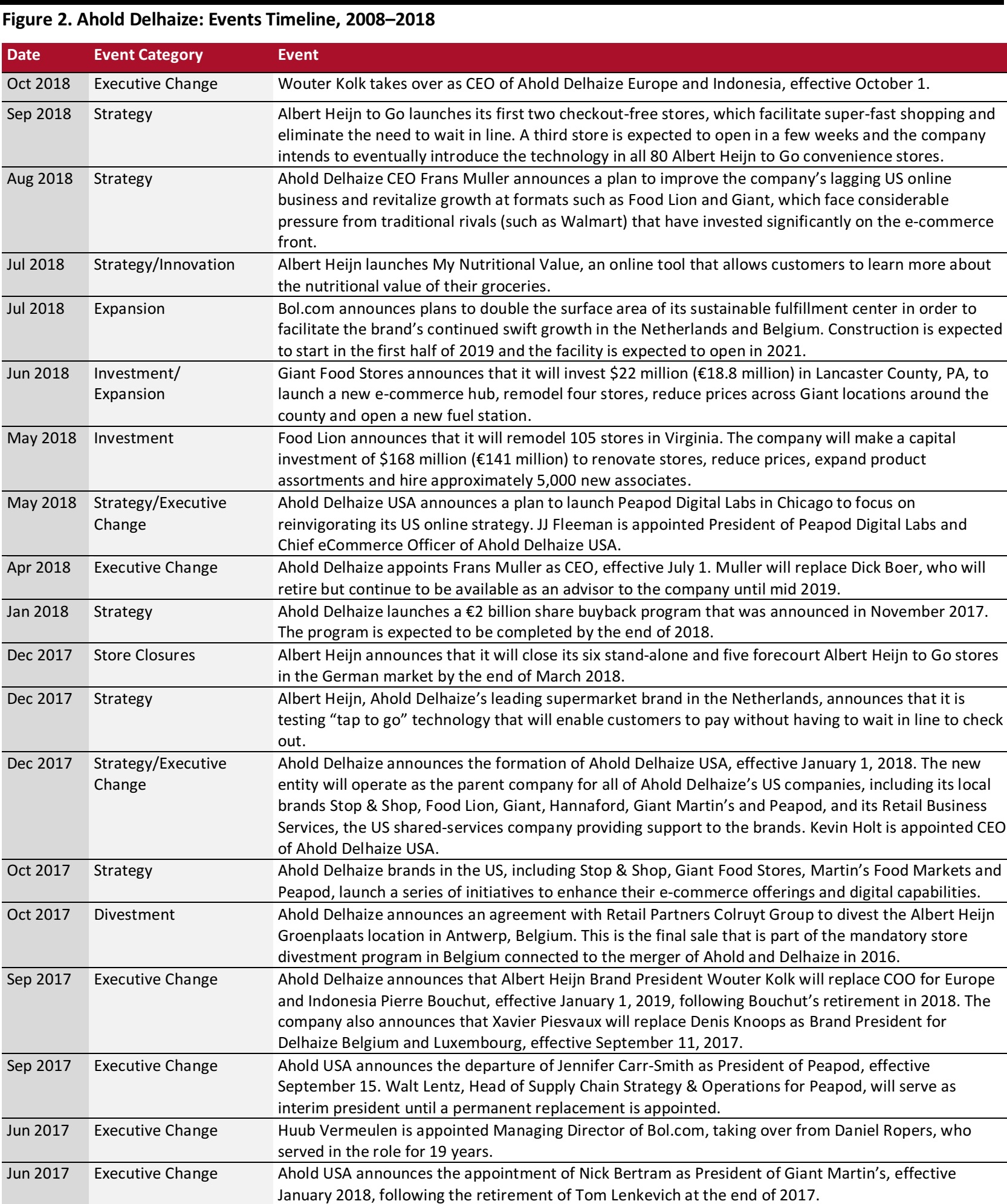

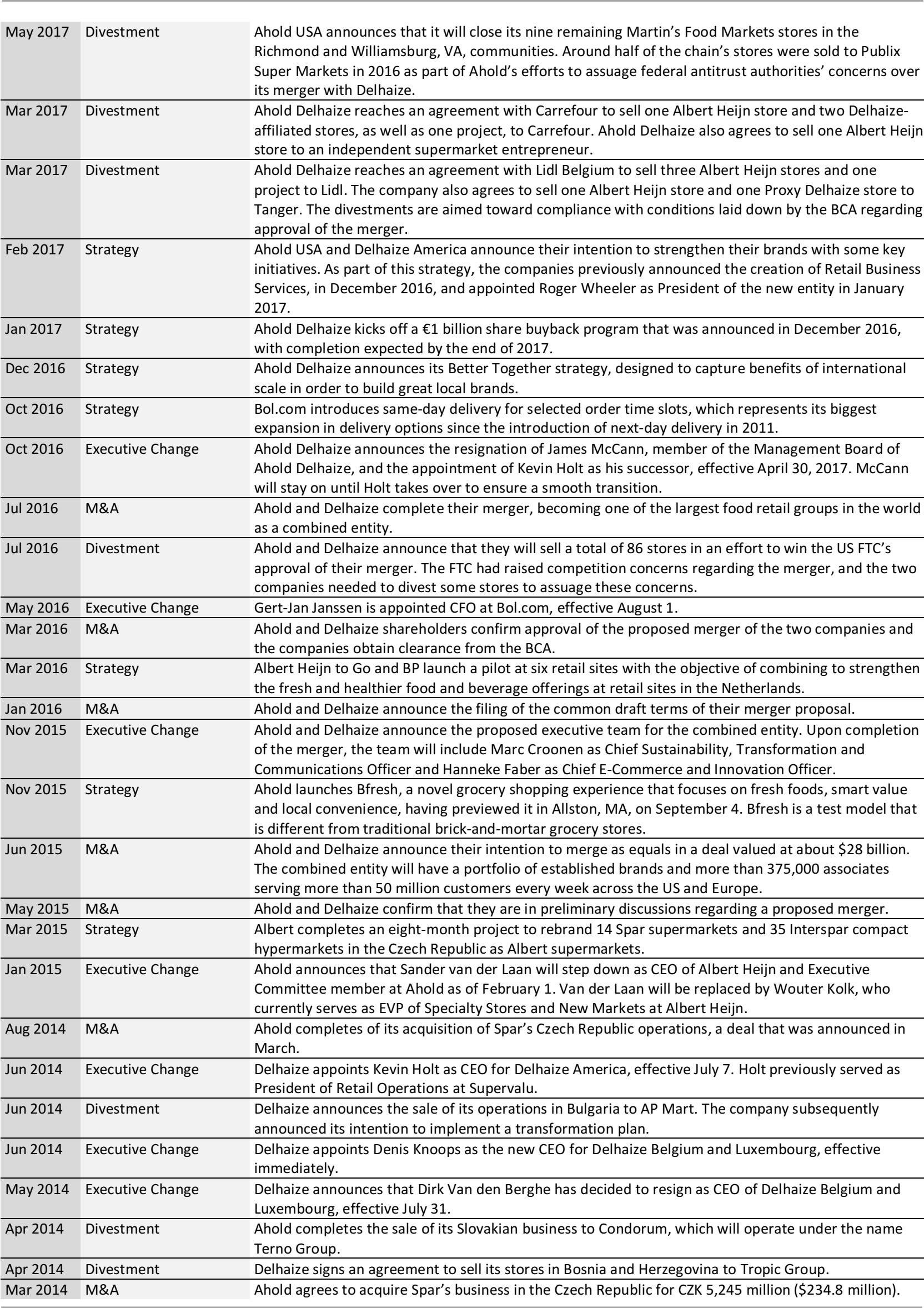

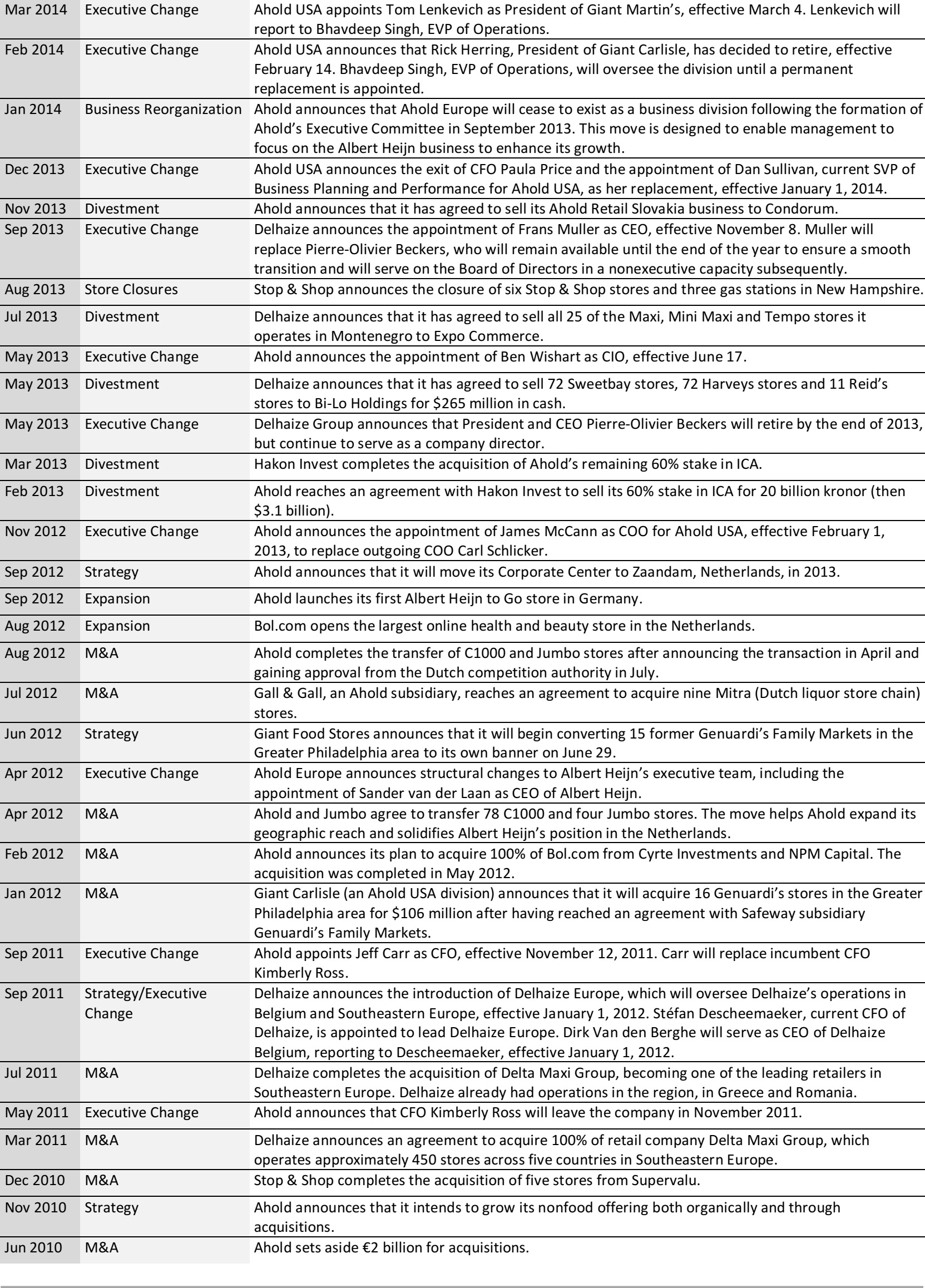

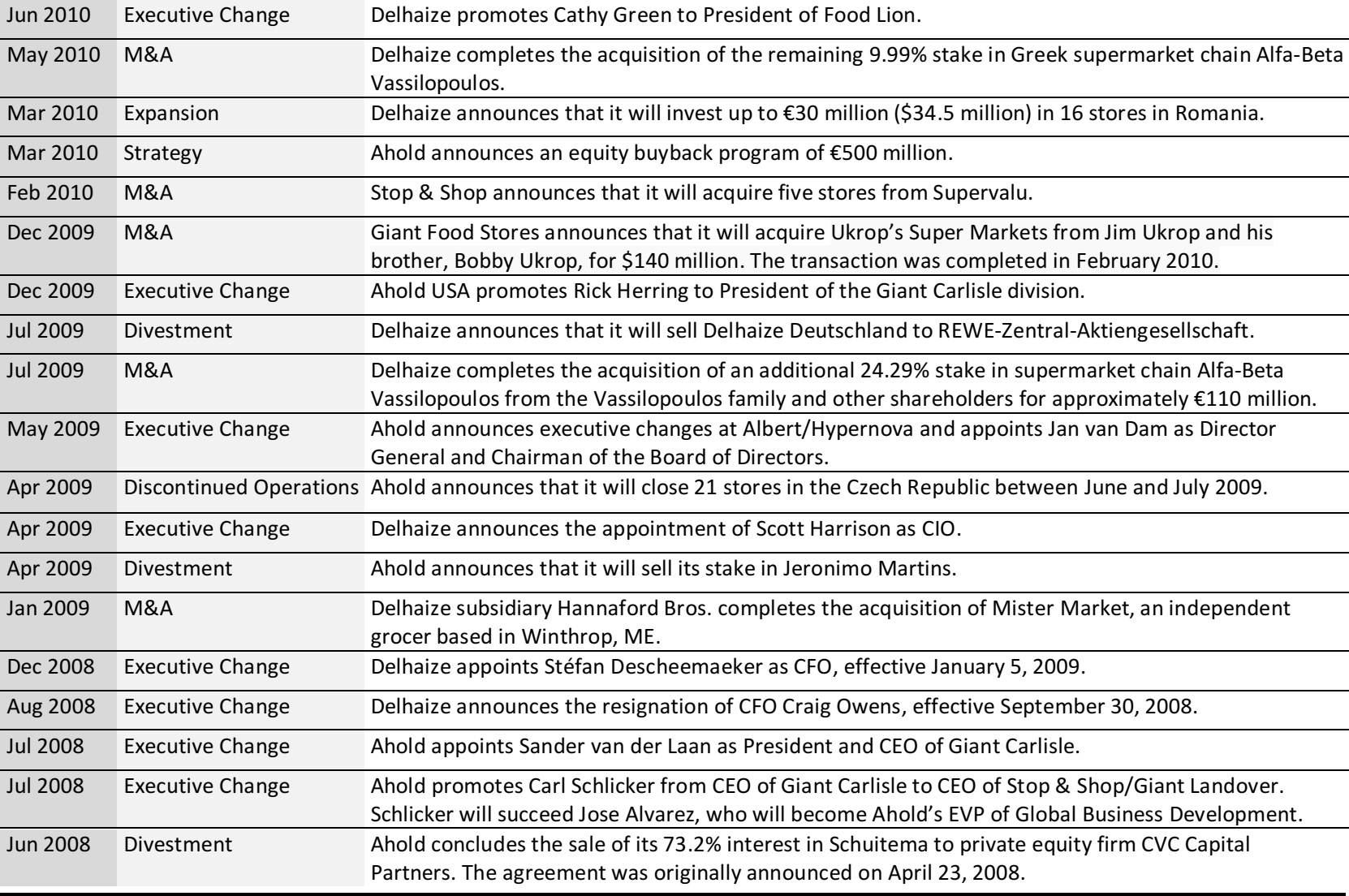

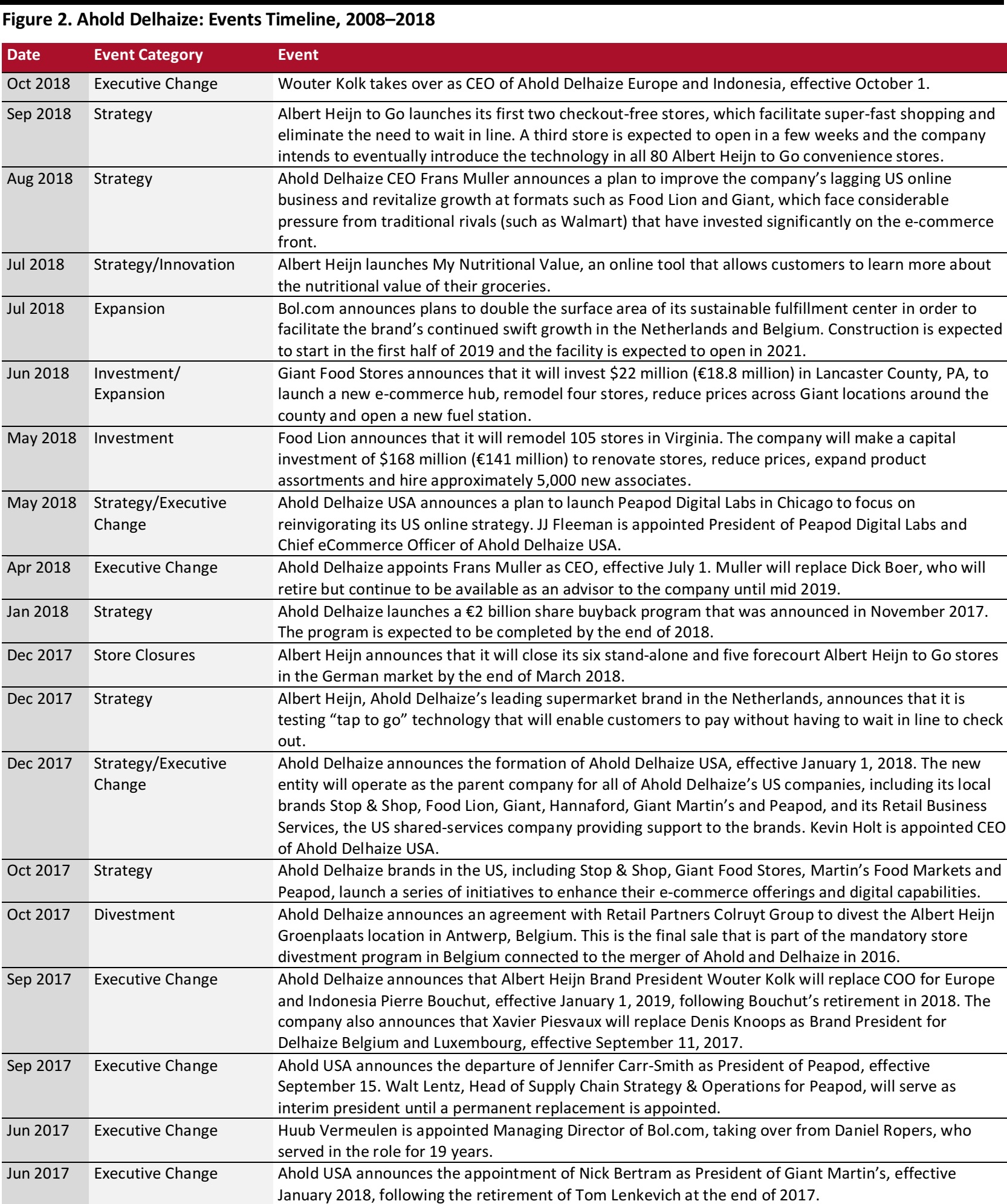

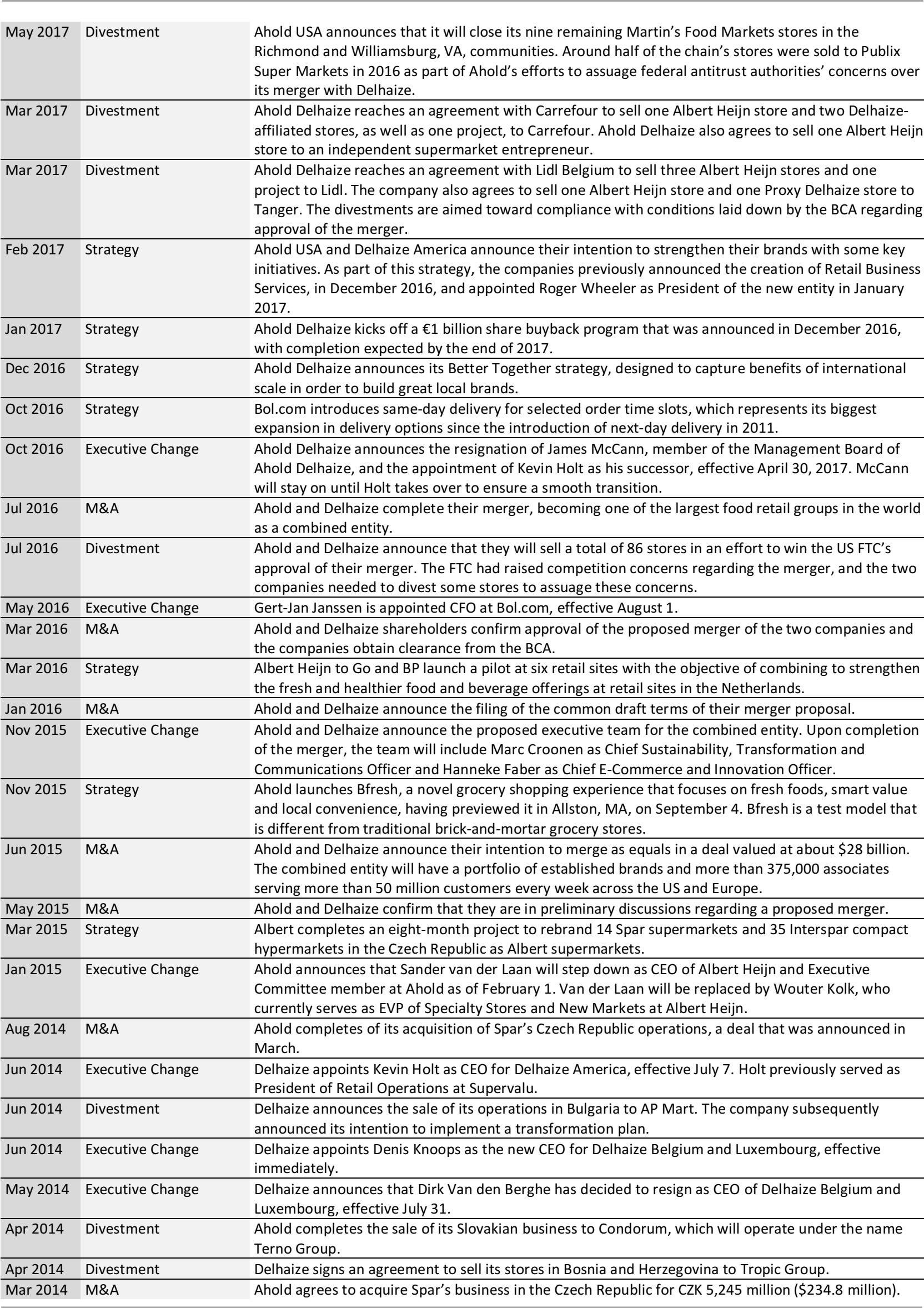

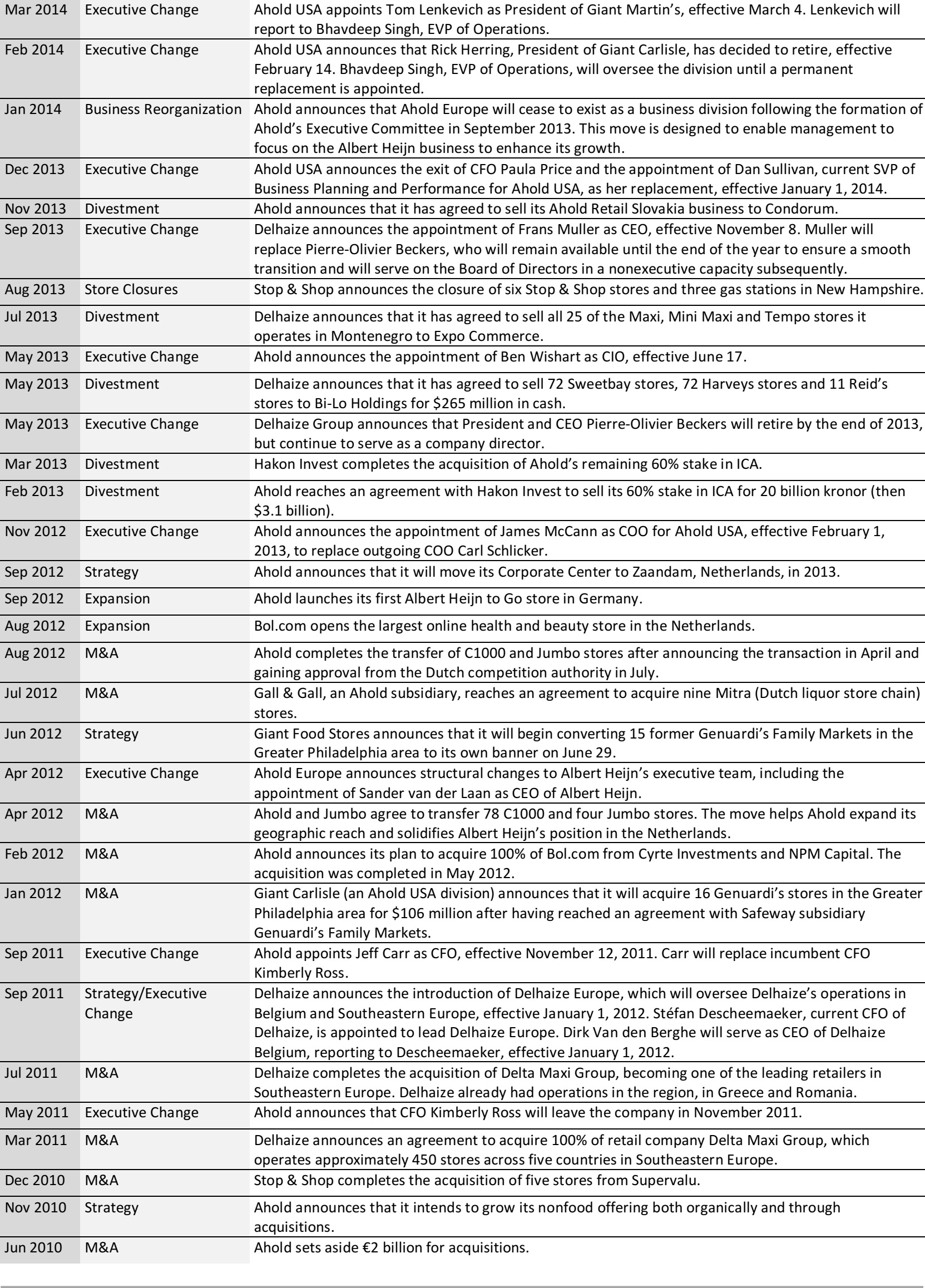

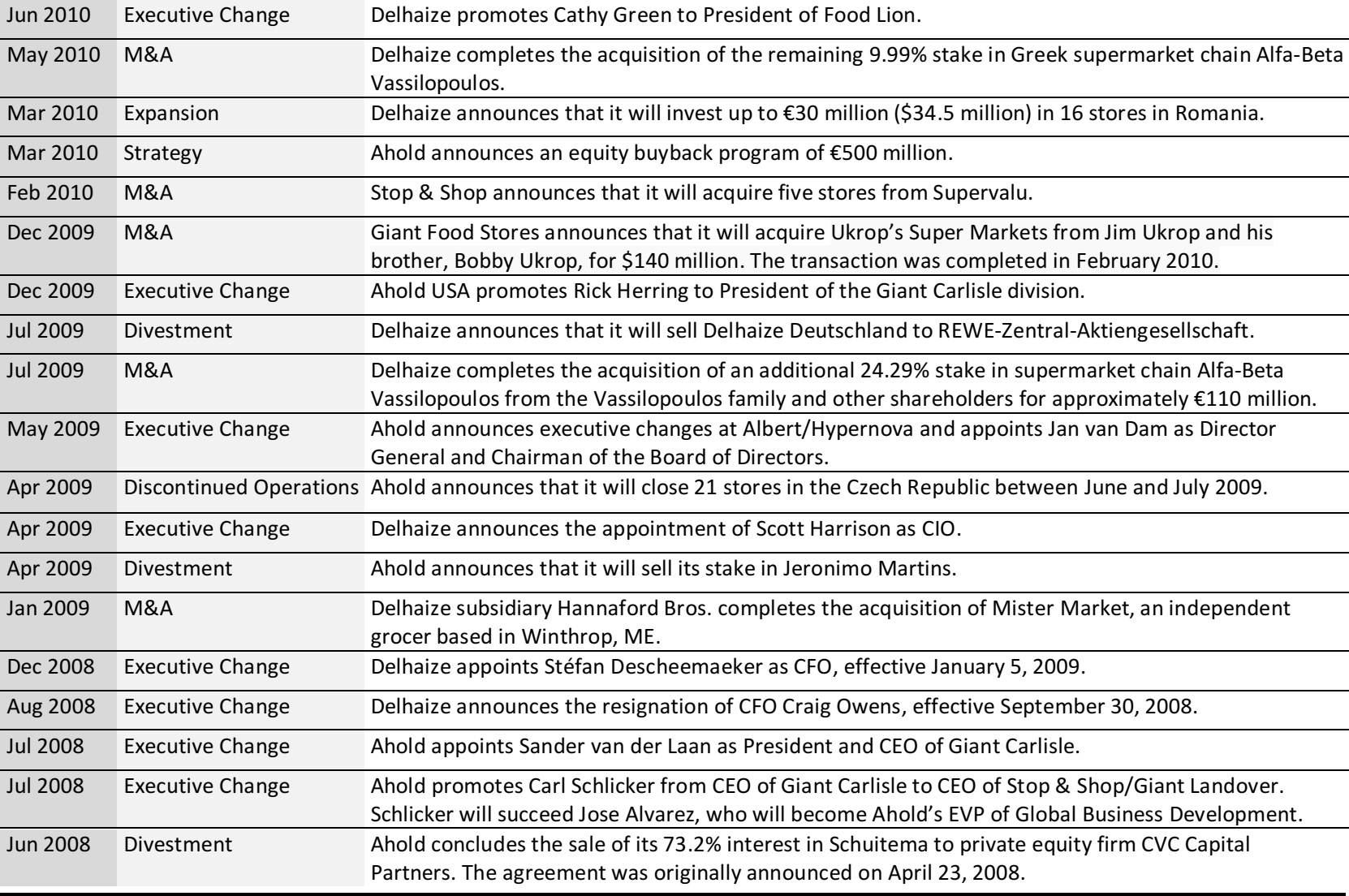

Key Events Overview: 2008–2018

Ahold Delhaize is a European company with more than 60% of its operations based in the US. The company reports transactions and developments in either US dollars or euros. In this report, we include conversions to US dollars for some figures, using the latest exchange rates at the time of writing.

1) 2016–2018: The period from 2016 to present began with Ahold and Delhaize working together to finalize the terms of their proposed merger. The merger was completed in July 2016, with the two companies expecting to gain considerable financial and operational synergies as a combined entity. The first half of the postmerger period saw the new company strategically divest a number of stores in order to comply with the competition regulations imposed by the US FTC and the BCA. This had some impact on total revenues.

In the second half of the postmerger period, Ahold Delhaize made concerted efforts to upgrade its digital capabilities in order to keep pace with competitors. The company also invested considerably in remodeling the stores of some of its banners, such as Food Lion ($168 million) and Giant Food Stores ($22 million).

Ahold Delhaize appointed Frans Muller as its new CEO, effective July 1, 2018, after Dick Boer chose to step down from the CEO position.

Over the postmerger period, “Better Together” was one of the company’s key overarching strategies. The aim was to build on the strong foundations of local brands as well as local associates’ experience and realize the benefits of international scale. The company also focused on smoothly integrating operations of the combined entity.

Ahold Delhaize realized €268 million ($309 million) in net synergies during 2017 and has targeted net synergies of €420 million ($484 million) during 2018 and €750 million ($864 million) by 2019.

2) 2012–2015: The 2012–2015 period began with Ahold’s acquisition of Dutch online nonfood retailer Bol.com. Ahold announced the acquisition in February 2012 and completed it in May of that year. Around the same time, in April 2012, Ahold reached another agreement, this one with Dutch supermarket chain Jumbo, to acquire 78 stores in the C1000 chain (a subsidiary of Jumbo) and four Jumbo stores. The transaction was completed in August 2012.

In 2014, Ahold announced that it had completed the acquisition of Spar’s Czech Republic operations for an enterprise value of CZK 5,245 million ($234.8 million).

Both Ahold and Delhaize also made a number of executive changes over this period. Ahold appointed Ben Wishart as CIO, effective June 2013, among other changes, and

Delhaize announced that Frans Muller would succeed Pierre-Olivier Beckers as CEO, effective November 8, 2013.

In 2015, Ahold and Delhaize announced their intention to merge in a deal valued at around $28 billion and proposed the executive team that would lead the combined entity

once the merger was completed in 2016.

3) 2008–2011: Ahold and Delhaize subsidiaries made a series of acquisitions over the 2008–2011 period in an effort to expand their businesses. Key acquisitions included Delhaize’s purchase of Delta Maxi Group in 2011 and Ahold’s purchase of Ukrop’s Super Markets and five stores from Supervalu in 2010.

The period also saw some key executive changes for both groups. At Ahold, Jeff Carr replaced Kimberly Ross as CFO in November 2011. At Delhaize, Stéfan Descheemaeker took over as CFO in January 2009 and Scott Harrison as CIO in April 2009.

The period ended with the introduction of Delhaize Europe in September 2011. The division was created to oversee the operations of Delhaize Belgium and Southeastern Europe, beginning January 1, 2012. Stéfan Descheemaeker was appointed CEO of Delhaize Europe and Dirk Van den Berghe CEO of Delhaize Belgium, reporting to Descheemaeker.

Source: Company reports/S&P Capital IQ/Coresight Research

Source: Company reports/S&P Capital IQ/Coresight Research

Ahold Delhaize in Charts

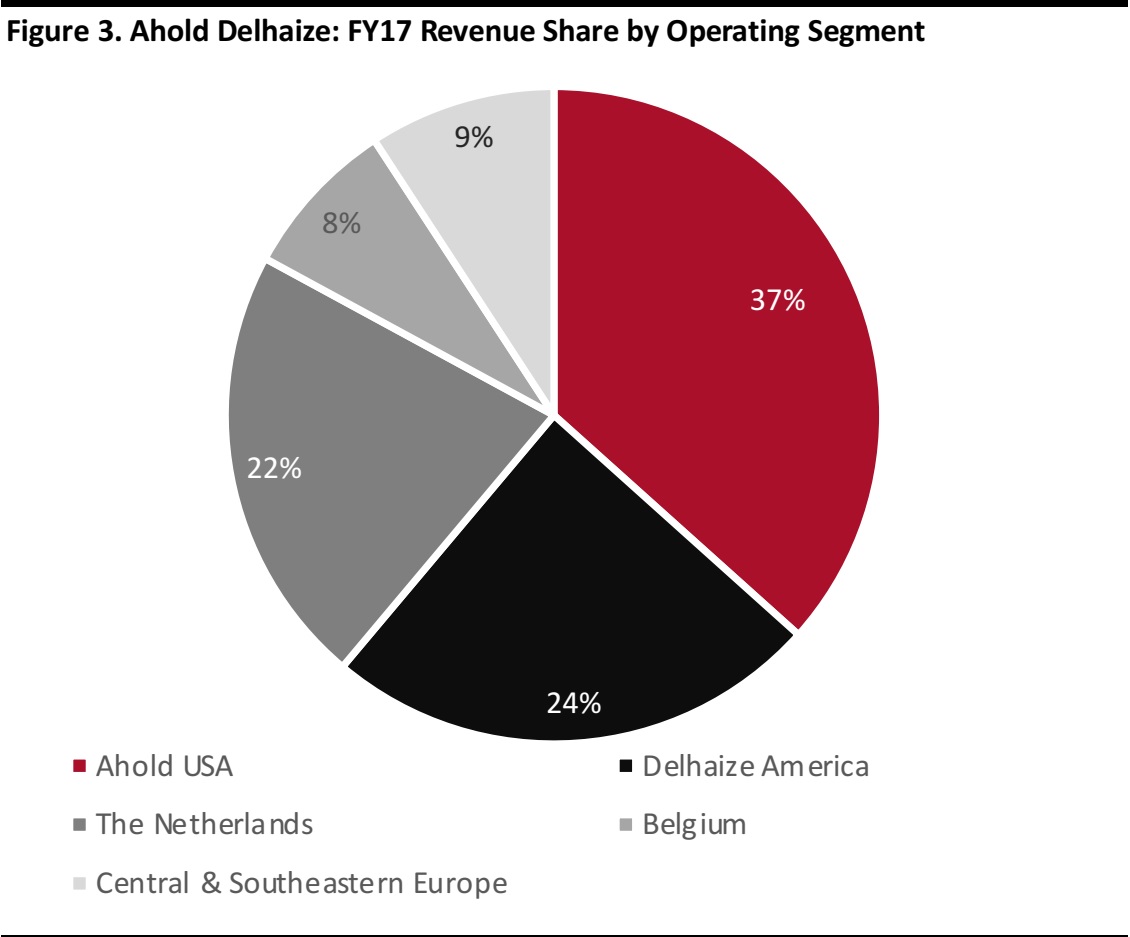

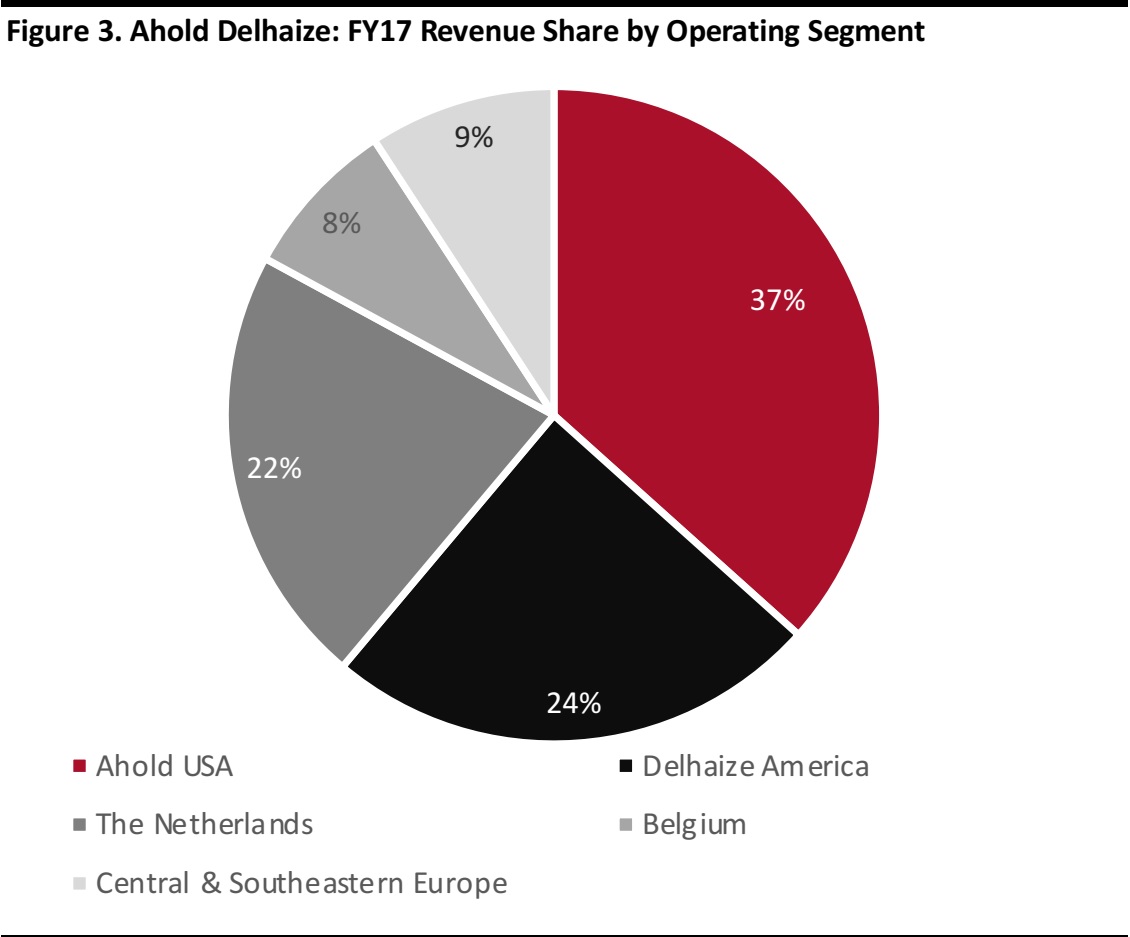

Revenue share by operating segment as reported in FY17. Ahold Delhaize has altered its segment reporting for FY18.

Source: Company reports/Coresight Research

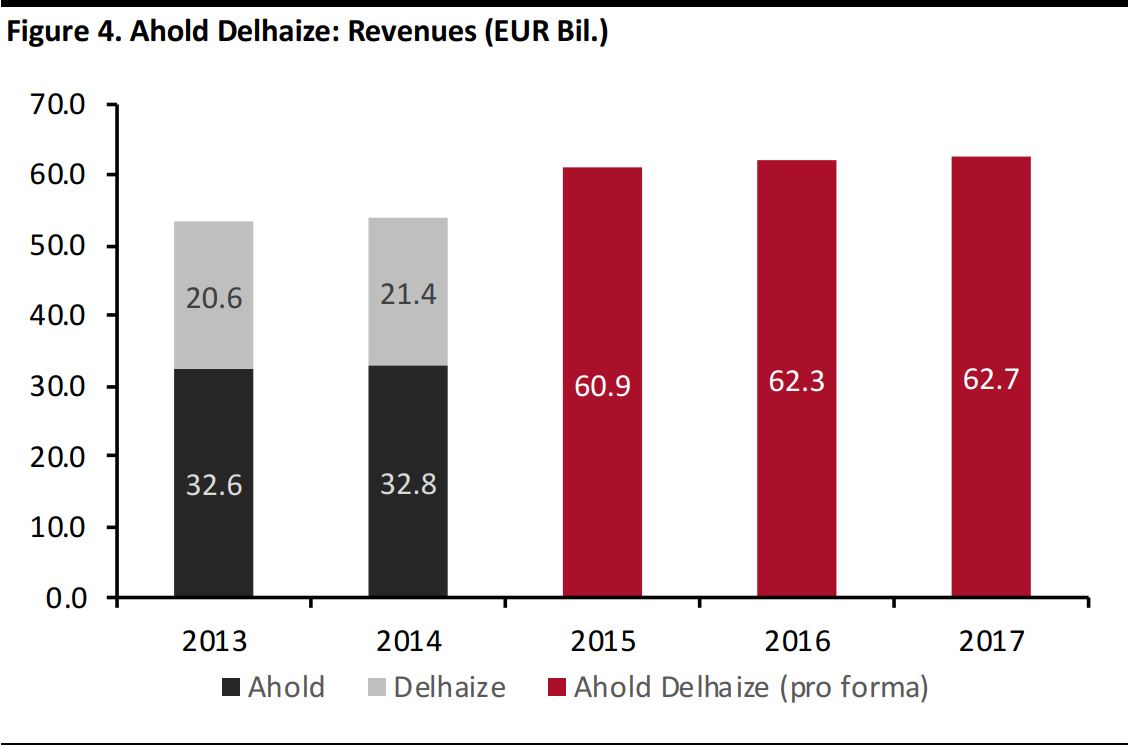

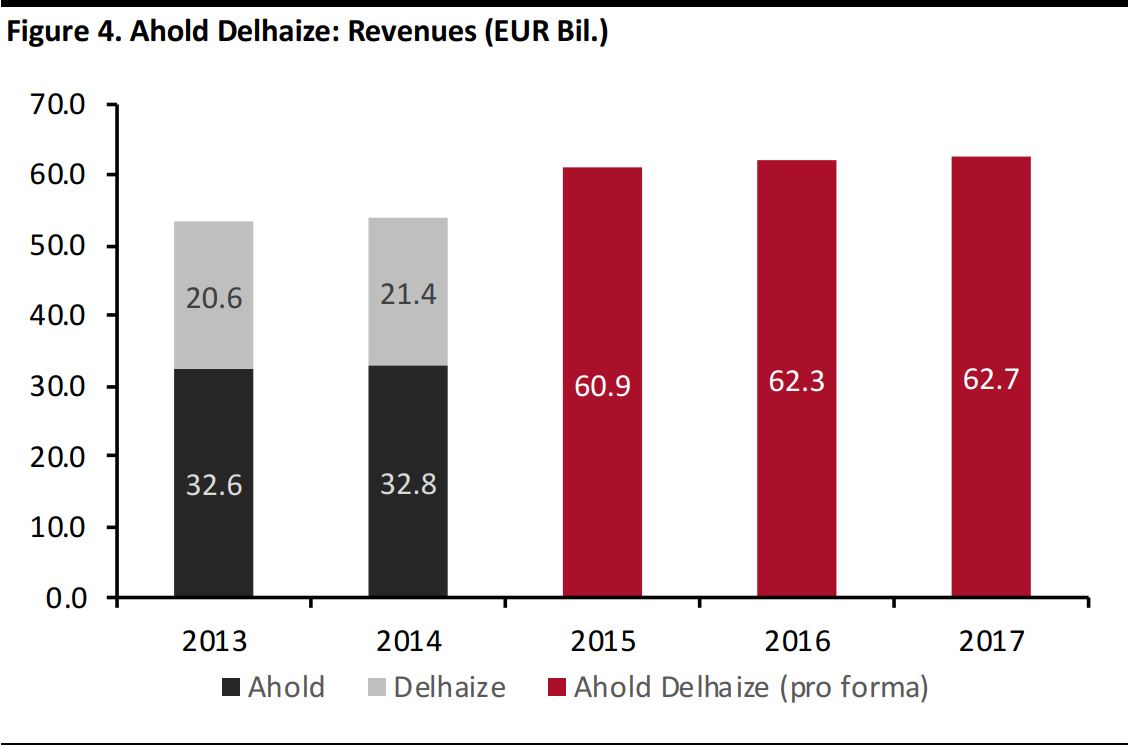

Revenue figures for 2013 and 2014 are depicted separately for Ahold and Delhaize, as they were operating as independent entities in those years. Figures for 2015–2017 are the consolidated pro forma figures for the merged entity. Pro forma figures are based on the assumption that the merger became effective on the first day of Ahold’s 2015 fiscal year and provide a better basis for comparison than reported figures.

Reported revenue figures for the Ahold Delhaize combined entity for 2016 and 2017 were €49.7 billion and €62.9 billion, respectively. In 2015, Ahold and Delhaize reported revenues of €38.2 billion and €24.4 billion, respectively.

Source: Company reports/Coresight Research

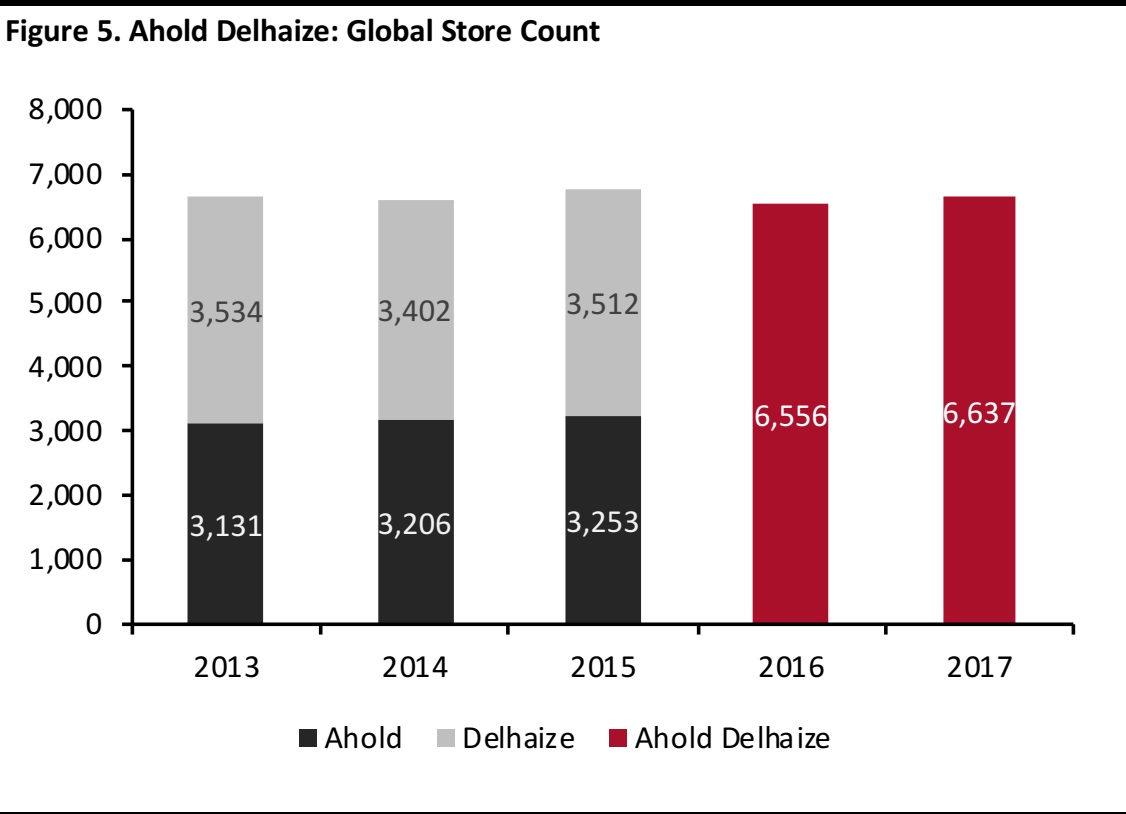

Global store count figures for Ahold and Delhaize are depicted separately for 2013–2015, as they were operating as independent entities in those years. The figures for 2016 and 2017 are the consolidated figures for the merged entity.

Source: Company reports/Coresight Research

Company Strategy

Ahold Delhaize’s key strategies for 2018 include improving its store network, remodeling stores, upgrading its digital capabilities and enhancing its omnichannel offering.

1. Innovation and improvement of offering and store network with a focus on health and convenience

Ahold Delhaize introduced multiple initiatives across the US and Europe that are designed to offer better choices to customers pursuing a healthier lifestyle. For example, the company introduced the My Nutritional Value online tool to enable Albert Heijn customers to learn more about the nutritional value of their groceries.

The company also worked to enable a more convenient shopping experience in stores. Ahold Delhaize expanded its range of meal kits and freshly made meals, affording an easy solution for time-constrained customers, and also tested and rolled out seamless checkout options.

To enhance the store experience, the company tested Marty the Robot, a store assistant that performs routine checks to ensure safety and smooth operations.

In the second quarter of 2018, the company announced plans to double the warehouse capacity of Bol.com by 2021. The project is set to begin in the first half of 2019.

2. Remodeling stores

Food Lion invested $168 million to remodel 105 stores in the greater Norfolk, VA, market in 2018. The move was designed to improve the checkout experience and store ambience, reduce prices, expand product assortments and recruit roughly 5,000 new associates. Food Lion had remodeled 164 stores in 2017.

Also in 2018, Giant Food Stores decided to invest $22 million in Lancaster County, PA, to install a new e-commerce hub, remodel four stores, reduce prices across Giant locations in the county and open a new fuel station.

3. Upgrading digital capabilities and omnichannel offering

Over the course of 2017, Ahold USA banners enhanced their digital capabilities, making investments in digital coupons, new websites, mobile app improvements and a new recipe center. Peapod, the company’s US online grocery business, continued to invest in promoting its PodPass membership program, which offers free delivery at a fixed fee. The initiative resulted in increased subscription numbers. Peapod also introduced voice-ordering capability for a popular home device: customers can now use the device to add items to their order, reorder their previous purchase or check on delivery schedule times.

In 2018, Albert Heijn to Go launched its first two checkout-free stores, which enable super-fast shopping for customers and eliminate the need for checkout counters. The company plans to use the technology in all 80 Albert Heijn to Go convenience stores eventually.

In May 2018, the company announced the creation of Peapod Digital Labs, to be launched in Chicago by the end of the year. The new entity is designed to drive e-commerce and digital strategies and innovation in the US. Ahold was an early player in the US online grocery market, having acquired Peapod in two stages, in 2000 and 2001.

These initiatives are in line with the company’s target to realize €5 billion in online consumer sales by 2020.

Company Outlook

In 2017, Ahold Delhaize registered year-over-year revenue growth of 0.6% on a pro forma net sales basis, driven by synergies attributed to the merger, new store openings and comparable sales growth. Euro-denominated revenue in 2018 is expected to decline by 1.4%, according to the consensus estimate recorded by S&P Capital IQ. The company’s free cash flow was robust in 2017, and analysts expect that it will continue to be strong in 2018.

Having already realized net synergies of €268 million in 2017, mainly in the US (€159 million), Europe (€78 million) and the Global Support Office (€31 million), Ahold Delhaize looks to be well placed to achieve its goal of realizing €420 million in net synergies in 2018. The company’s Better Together strategy, which supports this goal, appears to be on track.

In line with its 2017 strategy, the company will invest €1.9 billion in 2018 in order to extend its store network, expand its omnichannel offering and enhance its digital capabilities.

Source: Company reports

Source: Company reports

Source: Company reports/S&P Capital IQ/Coresight Research

Source: Company reports/S&P Capital IQ/Coresight Research