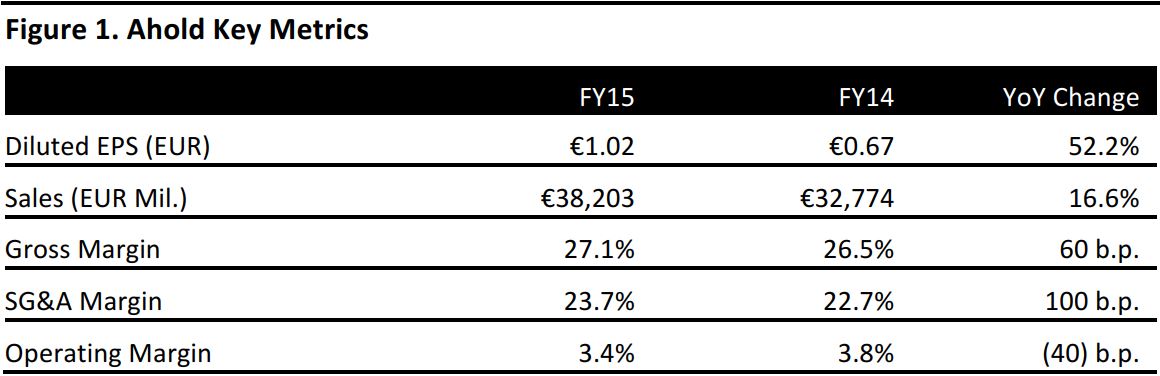

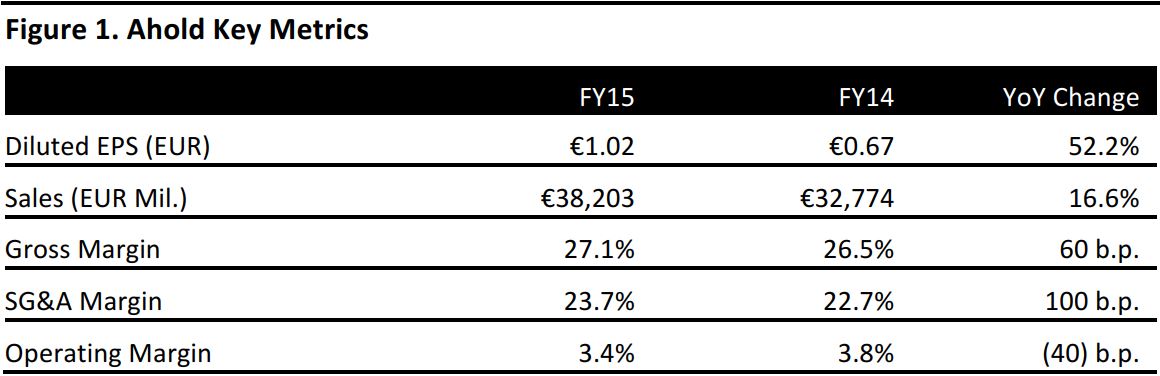

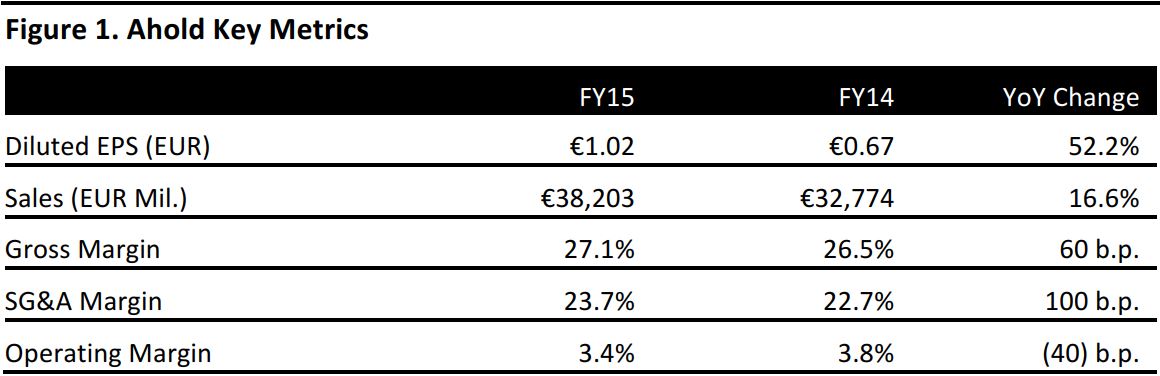

Source: Company reports

Ahold, a retailing group based in the Netherlands, reported a FY15 revenue increase of 16.6% at actual exchange rates (4.3% at constant exchange rates), to €38.2 billion, ahead of the consensus estimate of €37.7 billion.

Net income increased by 43.3%, to €851.0 million, beating consensus of €844.7 million. Diluted EPS was €1.02, an increase of 52.2% versus FY14, and above consensus of €1.00.

Ahold reported an increase of 15.3% in underlying EBIT, to €1.5 billion, above the consensus estimate of €1.4 billion. EBIT was up 5.4%, to €1.3 billion.

The company’s management commented that the results reflected efforts to serve the rapidly changing needs of customers, such as by delivering fresher products at great value. Strong sales momentum in the Netherlands (thanks to a successful omni-channel strategy), a favorable holiday season, strong online performance and market share gains in the New York metro area all helped to sustain revenue results.

4Q15 RESULTS

In 4Q15, Ahold’s revenue was up 21.4% at actual exchange rates (11.8% at constant exchange rates), to €9.8 billion, ahead of the consensus estimate of €9.5 billion. Underlying EBIT was up 39.4% at actual exchange rates, to €421.0 million, ahead of consensus of €379.3 million. Net income for the period was up 16.0% at actual exchange rates, to €254.0 million, ahead of consensus of €242.3 million. Diluted EPS for 4Q15 was €0.31, an increase of 19.2% versus 4Q14 and above consensus of €0.29.

SALES BY GEOGRAPHY

Sales excluding gas in the US reached €23.7 billion in FY15, a year-over-year increase of 18.9% at actual exchange rates (a decline of 0.5% at constant exchange rates), excluding the 53rd week in 2015. The scale of the US growth in euros shows how the company’s group results benefited from a strong US dollar. 4Q15 sales in the US grew by 16.7% at actual exchange rates (2.2% at constant exchange rates), excluding the 53rd week in 2015, to €6.1 billion. Comps grew by 1.6% in the US during the same period, benefiting from the closure of A&P stores in the New York metro area.

In the Netherlands, FY15 sales grew by 6.3%, excluding the 53rd week in 2015, to €12.7 billion. In 4Q15, Netherlands sales, excluding the 53rd week in 2015, grew by 5.5%, to €3.3 billion. The growth in revenue was driven by the expansion of Albert Heijn’s market share, which was partially due to the conversion of the former C1000 stores, as well as by the strong online business, which grew by 30% year over year in the quarter.

In the Czech Republic, FY15 revenue increased by 14.5% at actual exchange rates (13.3% at constant exchange rates), to €1.8 billion. 4Q15 saw revenue up 0.2% at actual exchange rates (down 1.8% at constant exchange rates), to €461 million. Management commented that the results in the market were driven by a good holiday performance and strong comps. Revenue in 4Q15 was slowed by the disinvestment of five stores during 3Q15 as part of the company’s SPAR acquisition.

GUIDANCE

For FY16, Ahold anticipates underlying EBIT to continue to grow in line with FY15 EBIT, excluding the potential impact from its proposed merger with Delhaize. Ahold expects its online businesses to meet its target of €2.5 billion in sales in 2017, and it plans to continue investing in its consumer proposition and logistical infrastructure in the Netherlands, with a new distribution center for Albert Heijn and another for bol.com. These initiatives are expected to result in an increased capex of around €1 billion for FY16.

Analysts estimate that Ahold will generate €39.3 billion in sales in FY16, with €1.5 billion in EBIT and €954.0 million in net income.