DIpil Das

[caption id="attachment_96555" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

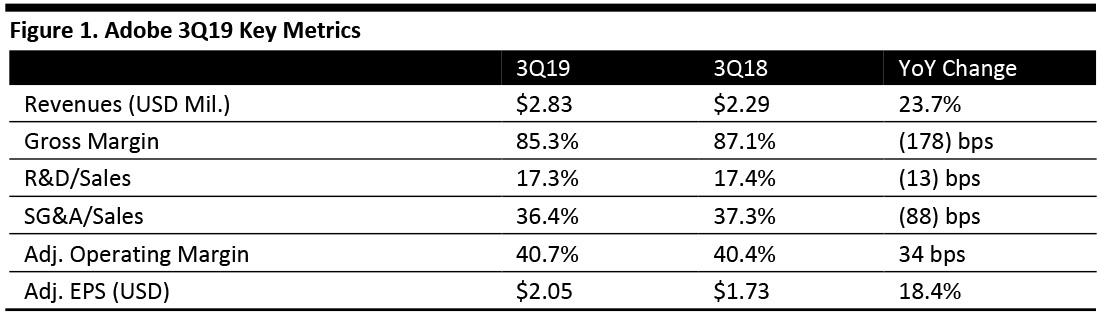

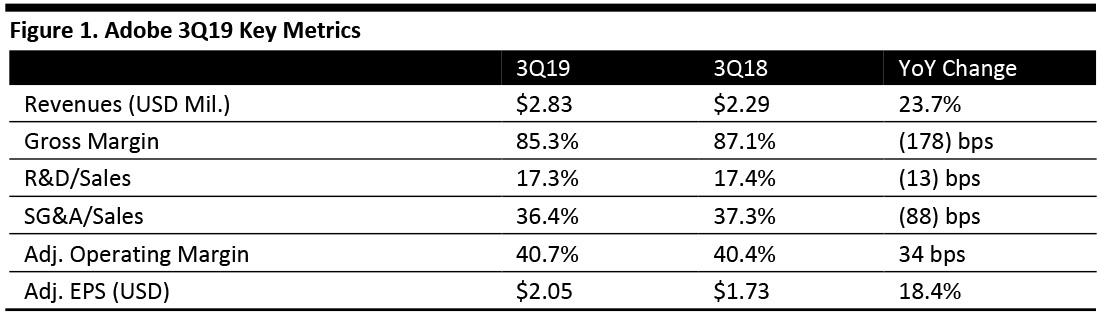

Adobe reported record 3Q19 revenues of $2.83 billion, up 23.7% year over year and in line with the consensus estimate of $2.82 billion.

Adjusted EPS was $2.05, up 18.4% year over year and beating the consensus estimate of $1.97.

Management characterized subscription revenue performance as strong.

ARR as of the end of the quarter breaks down as follows:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Adobe reported record 3Q19 revenues of $2.83 billion, up 23.7% year over year and in line with the consensus estimate of $2.82 billion.

Adjusted EPS was $2.05, up 18.4% year over year and beating the consensus estimate of $1.97.

Management characterized subscription revenue performance as strong.

ARR as of the end of the quarter breaks down as follows:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Adobe reported record 3Q19 revenues of $2.83 billion, up 23.7% year over year and in line with the consensus estimate of $2.82 billion.

Adjusted EPS was $2.05, up 18.4% year over year and beating the consensus estimate of $1.97.

Management characterized subscription revenue performance as strong.

ARR as of the end of the quarter breaks down as follows:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Adobe reported record 3Q19 revenues of $2.83 billion, up 23.7% year over year and in line with the consensus estimate of $2.82 billion.

Adjusted EPS was $2.05, up 18.4% year over year and beating the consensus estimate of $1.97.

Management characterized subscription revenue performance as strong.

ARR as of the end of the quarter breaks down as follows:

- Digital Media ARR was $7.86 billion.

- Creative ARR was $6.87 billion.

- Document Cloud ARR was $993 million.

- Creative revenue of $1.65 billion.

- Document Cloud revenue of $307 million.

- Mobile: Adobe aims for mobile devices and tablets to be used for creation and consumption. The number of Adobe Lightroom monthly active users grew 130% year over year. The number of new Adobe IDs created from Adobe mobile apps increased by more than 40% year-over-year, indicating that mobile continues drive subscriptions.

- Adobe Fresco: The company announced the launch of a new drawing and painting app called Adobe Fresco, which will be available this fall on iPad first. Apple will feature Fresco in hundreds of its retail stores as part of its iPad Pro “Big Draw” campaign.

- Education: Adobe has expanded its Ambassador Network to target more than 100 colleges across the country, getting students to evangelize products on campus.

- Adobe MAX: The company expects more than 15,000 live attendees and nearly one million virtual attendees at the upcoming Adobe MAX conference November 2-6, during which it plans to unveil significant new Creative Cloud products.

- Document Cloud: Key customer wins in the quarter included Deutsche Bank, Saudi Aramco, Dell and the US Department of Veteran Affairs. In the quarter, more than 2.5 billion PDFs were opened in Adobe Reader on mobile devices. Adobe Scan, the top document scanning app for both iOS and Android, has close to 35 million installs, with downloads increasing more than 30% year-over-year. The company recently launched new web-based services that offer instant access to Adobe PDF creation and compression capabilities from any browser. During the quarter, the company introduced Adobe Sign for Small Business, which provides small and mid-market businesses enterprise-level e-signature capabilities.

- Key customer wins in the quarter included Delta Airlines, T-Mobile, Capital One and Best Western.

- Management commented the integration of Adobe Experience Manager with Magento Commerce has led to strong performance of the integrated content and commerce offering, and Magento Commerce bookings grew more than 40% in the quarter.

- In Adobe Experience Cloud, the integration of Marketo with Adobe Campaign gives the customer journey management and orchestration space across both B2B and B2C.

- The company introduced the Adobe Experience Platform earlier this year, representing the industry’s first real-time platform for customer experience management. It stitches together data from across the enterprise to create real-time unified customer profiles, enabling the activation and delivery of hyper-personalized experiences. By combining it with Adobe Analytics, Adobe Audience Manager and the new real-time Customer Data Platform, the company has created a new, comprehensive customer data and insights offering.

- Total revenue of $2.97 billion, up 20.5% year over year and slightly below the $3.02 billion consensus estimate.

- Digital Media segment revenue growth of 20% year over year to $2.1 billion.

- Digital Experience segment revenue growth of 23% year over year to $839 million.

- Net new Digital Media ARR of $450 million.

- Adjusted EPS of $2.25, up 23% and below the $2.30 consensus estimate.