DIpil Das

[caption id="attachment_91243" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

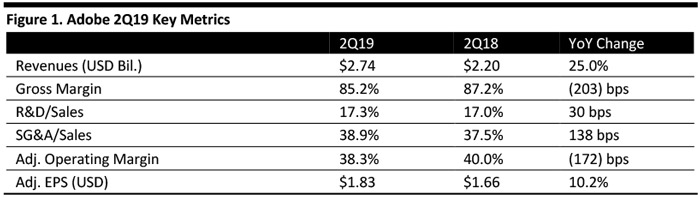

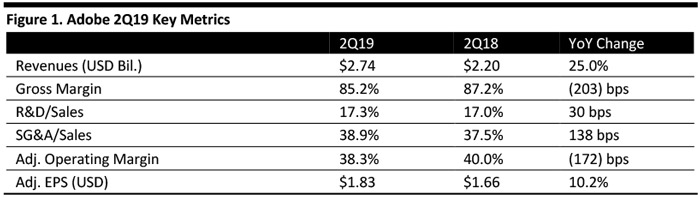

Fiscal 2Q19 Results

Adobe reported fiscal 2Q19 revenues of $2.72 billion, up 25.0% year over year and beating the consensus estimate of $1.78 billion.

Adjusted EPS was $1.83, up 10.2% year over year and beating the consensus estimate of $1.78.

Management commented that Adobe’s momentum is being fueled by the explosion of creativity around the globe, in addition to widespread business transformation. Management also made optimistic comments about fiscal 2H19 and beyond, based on the company’s technology platform, product roadmap, ecosystem and partners.

Digital Media Segment

The digital media segment reported revenues of $1.89 billion, comprising:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Adobe reported fiscal 2Q19 revenues of $2.72 billion, up 25.0% year over year and beating the consensus estimate of $1.78 billion.

Adjusted EPS was $1.83, up 10.2% year over year and beating the consensus estimate of $1.78.

Management commented that Adobe’s momentum is being fueled by the explosion of creativity around the globe, in addition to widespread business transformation. Management also made optimistic comments about fiscal 2H19 and beyond, based on the company’s technology platform, product roadmap, ecosystem and partners.

Digital Media Segment

The digital media segment reported revenues of $1.89 billion, comprising:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Adobe reported fiscal 2Q19 revenues of $2.72 billion, up 25.0% year over year and beating the consensus estimate of $1.78 billion.

Adjusted EPS was $1.83, up 10.2% year over year and beating the consensus estimate of $1.78.

Management commented that Adobe’s momentum is being fueled by the explosion of creativity around the globe, in addition to widespread business transformation. Management also made optimistic comments about fiscal 2H19 and beyond, based on the company’s technology platform, product roadmap, ecosystem and partners.

Digital Media Segment

The digital media segment reported revenues of $1.89 billion, comprising:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Adobe reported fiscal 2Q19 revenues of $2.72 billion, up 25.0% year over year and beating the consensus estimate of $1.78 billion.

Adjusted EPS was $1.83, up 10.2% year over year and beating the consensus estimate of $1.78.

Management commented that Adobe’s momentum is being fueled by the explosion of creativity around the globe, in addition to widespread business transformation. Management also made optimistic comments about fiscal 2H19 and beyond, based on the company’s technology platform, product roadmap, ecosystem and partners.

Digital Media Segment

The digital media segment reported revenues of $1.89 billion, comprising:

- Creative revenue of $1.59 billion.

- Document cloud revenue of $296 million.

- Digital media ARR was $7.47 billion.

- Creative ARR was $6.55 billion.

- Document cloud ARR was $921 million.

- Part of the company’s Creative Cloud growth strategy is attracting new segments of users. Adobe Spark, which turns ideas into stories, graphics and webpages, is gaining popularity among creators from the classroom to the boardroom. Traffic on web and mobile has more than doubled year-over-year. In the quarter, Adobe added support for Brazilian Portuguese, French, German, Italian and Spanish.

- Adobe has expanded supported platforms to include Facebook, Instagram and YouTube. Premiere Rush is a popular solution for YouTubers and social video creators and is now available on Android, iOS, Mac and Windows.

- The company released a major update to Adobe XD (for the design and prototyping of the user experience for web and mobile apps) in May.

- Adobe continues to expand Creative Cloud with value-added services. Adobe Stock, the service for stock images, videos, and millions of additional creative assets, grew more than 25% year over year.

- Adobe Reader for mobile and Adobe Scan continue to gain traction. Adobe Scan, which captures images from documents to forms, whiteboard sketches or business cards, and turns them into PDFs, is now the leading scanning app on iOS and Android.

- Management commented that a broad selection of B2B and B2C companies are choosing Adobe Experience Cloud – an end-to-end solution for marketing, advertising, analytics and commerce – to enhance customer experience management. Key Experience Cloud customer wins in the quarter include Amazon, Rite Aid, Vodaphone and Wyndham Hotels.

- Management commented that the acquisitions of Magento and Marketo have significantly increased Adobe’s value to existing customers, helped attract new logos, and expanded the addressable market. Magento adds to the Experience Cloud vision by enabling the offer of personal moments, making experiences shoppable in addition to attracting a large and vibrant developer community.

- During the quarter, Adobe announced the availability of Adobe Commerce Cloud, built on the Magento Commerce platform, with deep integrations across Adobe Analytics Cloud, Marketing Cloud and Advertising Cloud.

- Adobe also announced a new partnership with Amazon, creating Magento Commerce-branded stores for Amazon sellers, which offers merchants a seamless way to manage their businesses across both Amazon.com and their own storefront.

- At the Adobe Summit conference in March, the company announced the global availability of Adobe Experience Platform, a real- time platform for customer experience management. Brands already using Adobe Experience Platform include Best Buy, Sony Interactive Entertainment, The Home Depot and Verizon Wireless.

- New global partners include ServiceNow and Software AG.

- Total revenue of $2.80 billion (slightly below the $2.83 billion consensus estimate).

- Digital media segment revenue growth of 20% year over year.

- Digital experience segment revenue growth of 34% year over year.

- Net new digital media ARR of $360 million.

- Adjusted EPS of $1.95 (below the $2.05 consensus estimate.)