DIpil Das

What’s the Story?

This year’s iteration of the Adidas annual Investor Day was held virtually on March 10, 2021. In this report, we present insights from the event, covering the company’s performance in 2020 the three initiatives central to its “Own the Game” strategy moving forward.Adidas Investor Day 2021: Key Insights

A Recap of 2020 Kasper Rorsted, CEO at Adidas, offered a recap of the company’s performance in 2020:- Fast sales recovery in the second half of 2020—Sales declined by 16.1% in 2020, impacted by the Covid-19 pandemic, but recovered quickly in the second half of 2020. Adidas posted a 3% decline in currency-neutral revenues in the third quarter and a 1% increase in currency-neutral revenues in the fourth quarter.

- Strong e-commerce growth—E-commerce sales grew 53% in 2020, totaling more than €4 billion ($4.8 billion) and accounting for more than 20% of total sales.

- Overall healthy inventory level—Inventories were 8% higher at the end of December 2020 versus the previous year, mainly driven by evergreen and event-related products, which are intended for sale in the upcoming season.

Source: Adidas[/caption]

1. Strengthening the Credibility of the Adidas Brand

Brian Grevy, Executive Board Member of Global Brands at Adidas, and Aimee Arana, General Manager of Global Training at Adidas, explained that credibility means to deliver groundbreaking innovations in sports, as well as cutting-edge fashion items that are culturally connected.

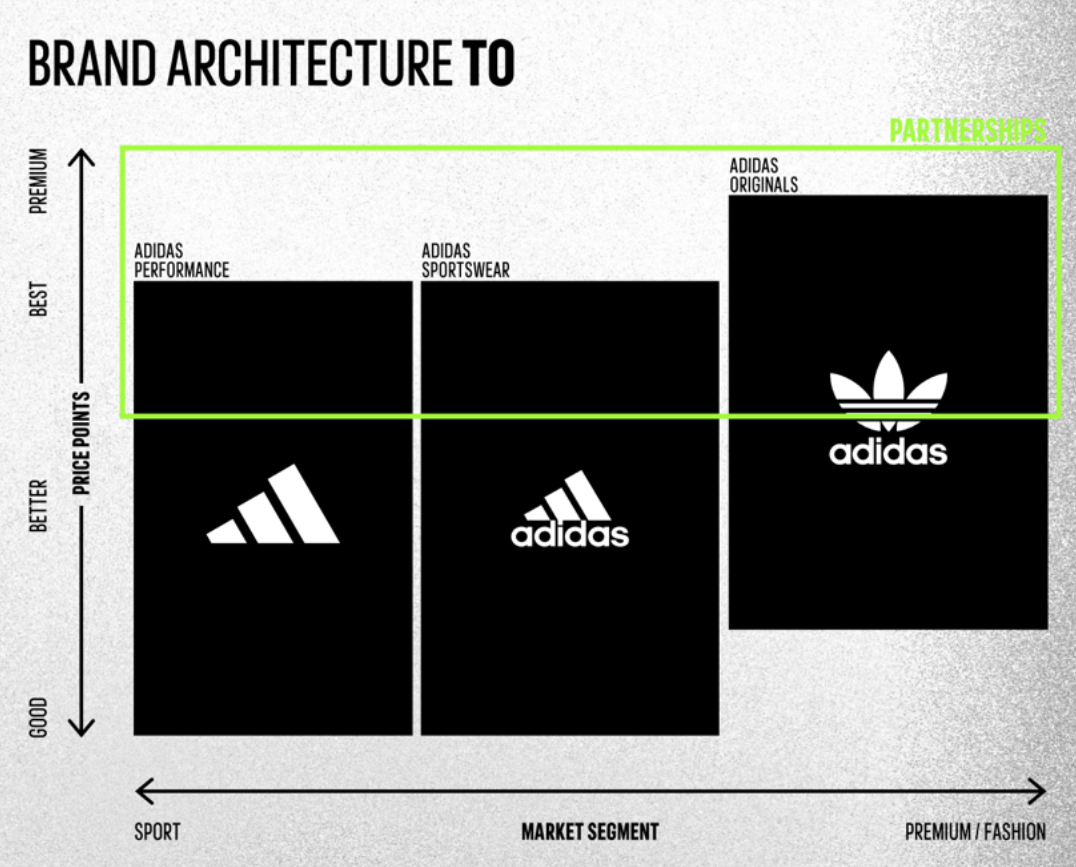

To successfully deliver on the brand credibility initiative, Adidas intends to build a clearer brand image in its Sport and Lifestyle segments. In Sport, Adidas plans to focus on Football, Running, Training and Outdoor. In Lifestyle, Adidas will upgrade its current sportswear offering to be more focused on athleisure, in order to address the growing casualization trend. The company will also extend its Originals brand into the premium segment “to ensure a stronger distinction of the respective product offerings going forward,” according to the company. Adidas expects the four Sport categories plus the Lifestyle segment to account for more than 95% of revenue growth combined by 2025.

In terms of its customer base, Adidas revealed that it intends to focus on attracting female consumers by executing a “cross-category plan to achieve product excellence and elevate the women’s experience.”

[caption id="attachment_124611" align="aligncenter" width="725"]

Source: Adidas[/caption]

1. Strengthening the Credibility of the Adidas Brand

Brian Grevy, Executive Board Member of Global Brands at Adidas, and Aimee Arana, General Manager of Global Training at Adidas, explained that credibility means to deliver groundbreaking innovations in sports, as well as cutting-edge fashion items that are culturally connected.

To successfully deliver on the brand credibility initiative, Adidas intends to build a clearer brand image in its Sport and Lifestyle segments. In Sport, Adidas plans to focus on Football, Running, Training and Outdoor. In Lifestyle, Adidas will upgrade its current sportswear offering to be more focused on athleisure, in order to address the growing casualization trend. The company will also extend its Originals brand into the premium segment “to ensure a stronger distinction of the respective product offerings going forward,” according to the company. Adidas expects the four Sport categories plus the Lifestyle segment to account for more than 95% of revenue growth combined by 2025.

In terms of its customer base, Adidas revealed that it intends to focus on attracting female consumers by executing a “cross-category plan to achieve product excellence and elevate the women’s experience.”

[caption id="attachment_124611" align="aligncenter" width="725"] Adidas plans to extend its Originals brand into the premium segment

Adidas plans to extend its Originals brand into the premium segment Source: Adidas [/caption] 2. Creating a Unique Customer Experience Roland Auschel, Executive Board Member of Global Sales at Adidas, and Scott Zalaznik, Head of Digital at Adidas, discussed the customer experience, with the company planning to accelerate its “transformation into a direct-to-consumer-led (DTC-led) business built around membership.” This will be fueled by more personalized offerings in both digital and physical stores. The company expects its DTC business to account for around 50% of total sales and generate more than 80% of the targeted top-line growth by 2025. The company expects its own e-commerce net sales to be €8–9 billion ($9.6–10.8 billion) by 2025—double its 2020 e-commerce sales. Adidas will continue to invest in e-commerce and expand its membership program. The company plans to build an industry-leading three-pillar program that offers premium, personalized experiences. First, the company will leverage commercial and brand moments to access consumer touchpoints and offer exclusive products. Second, it will design personalized stories and experiences for members across these touchpoints to drive engagement. Third, Adidas will use member data to inform product designs and decision-making. Furthermore, Adidas reported that it will expand its membership program through its engagement in megacities. The company will add six more target cities (Beijing, Berlin, Dubai, Mexico City, Moscow and Seoul) into its current portfolio of key cities (London, Los Angeles, New York, Tokyo, Paris and Shanghai). Adidas will focus more on Greater China, EMEA and North America, which the company expects to account for around 90% of sales growth to 2025. [caption id="attachment_124612" align="aligncenter" width="725"]

Adidas plans to focus more on Greater China, EMEA and North America

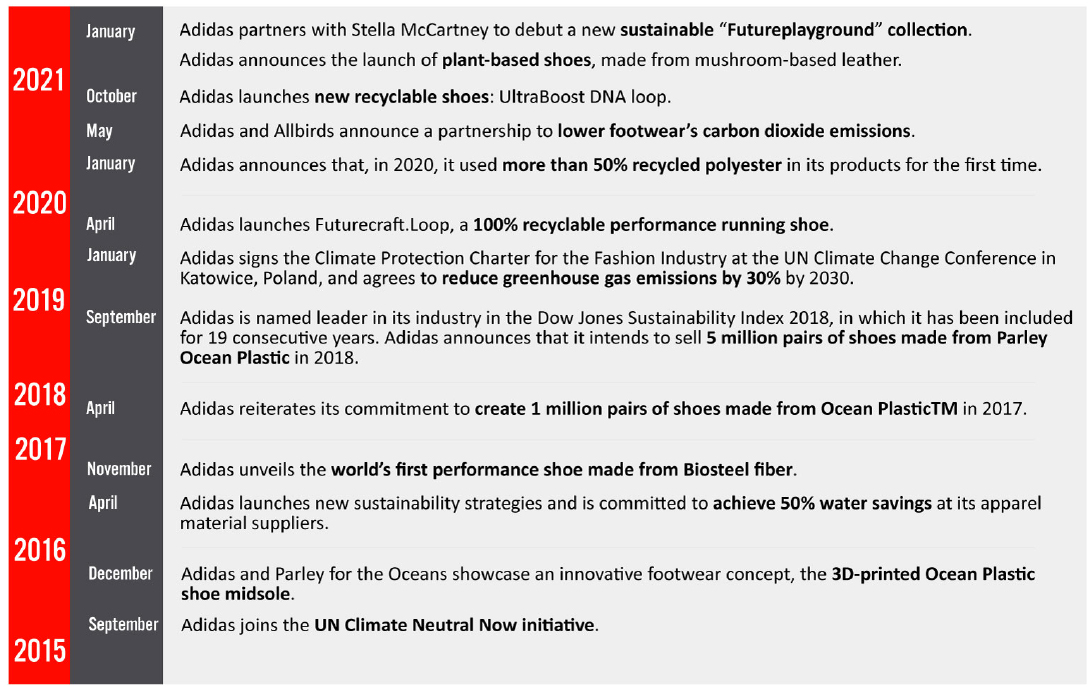

Adidas plans to focus more on Greater China, EMEA and North America Source: Adidas [/caption] 3. Expanding the Company’s Activities in Sustainability Martin Shankland, Executive Board Member of Global Operations at Adidas, presented more details on the company’s third initiative: sustainability. Adidas plans to expand its activities in sustainability and move to a comprehensive consumer-facing program with a sustainable offering. The company expects that “nine out of 10 articles will be sustainable” by 2025, compared to six in 10 currently. Adidas intends to innovate through “three loops”: the recycled loop (made from recycled materials), the circular loop (made to be remade) and the regenerative loop (made with natural and renewable materials). Adidas announced that it will launch a new vegan, fully recyclable and biodegradable version of its popular lifestyle shoe, Stan Smith, in 2022.

Figure 1. Adidas: A Timeline of Sustainability Initiatives Since 2015 [caption id="attachment_124613" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]