Web Developers

On March 14, 2017, Fung Global Retail & Technology attended the Adidas annual Investor Day event at its global headquarters in Herzogenaurach, Germany. The company’s new CEO, Kasper Rorsted, presented, as did its Head of Global Brands and CFO. We left the event with a favorable impression. In our view, Adidas is a forward-thinking, agile and innovative company. Here, we discuss the key topics covered during the day and our top takeaways from the event.

Rorsted strongly emphasized that Adidas has the right company strategy in place and that management will now overwhelmingly focus on executing the strategy for the next couple of years. Adidas has had a strong start in terms of accomplishing its 2020 goals, but still has a long way to go to achieve them in full.

CEO Transition Bodes Well

New CEO Kasper Rorsted joined Adidas on October 1, 2016, succeeding Herbert Hainer, who had led the company for 15 years, making him the longest-serving CEO of a major German company at the time. Rorsted is a highly regarded corporate executive who previously held the post of CEO at German consumer staples company Henkel. Rorsted has been widely lauded for Henkel’s 6% operating margin expansion from 2008 through 2014. The investor and analyst community is optimistic that, with Rorsted at the helm, Adidas will increase its profitability and margins, and make headway toward closing the operating margin gap with Nike. Adidas’s shares rose by 5.8% on news of Rorsted’s appointment, while Henkel’s declined by 4.5%. Many Investor Day attendees were keen to speak to and question Rorsted.Creating the New

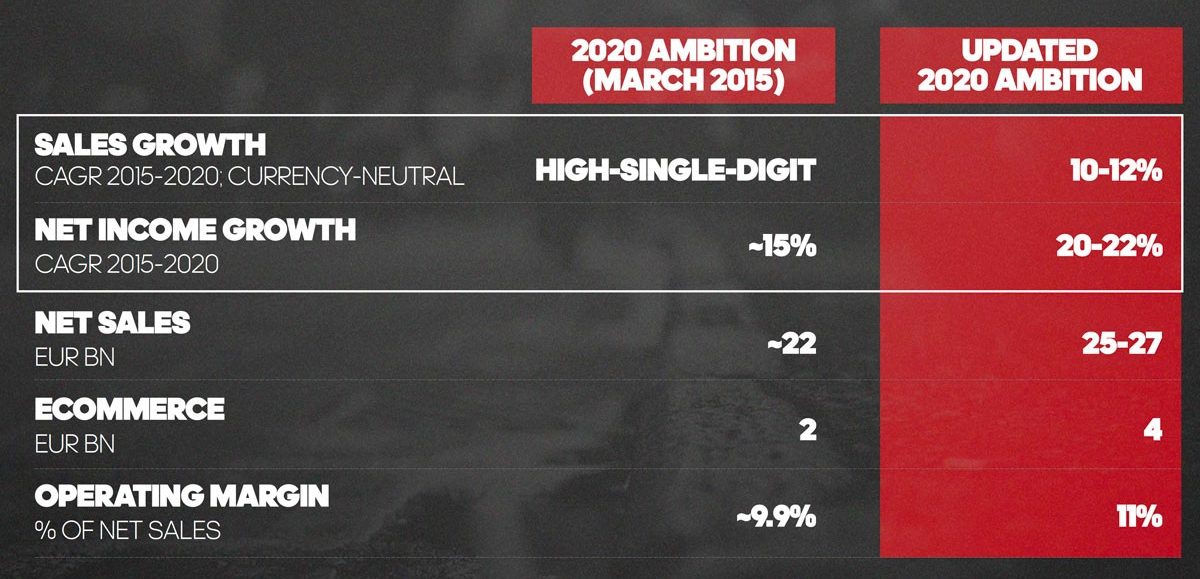

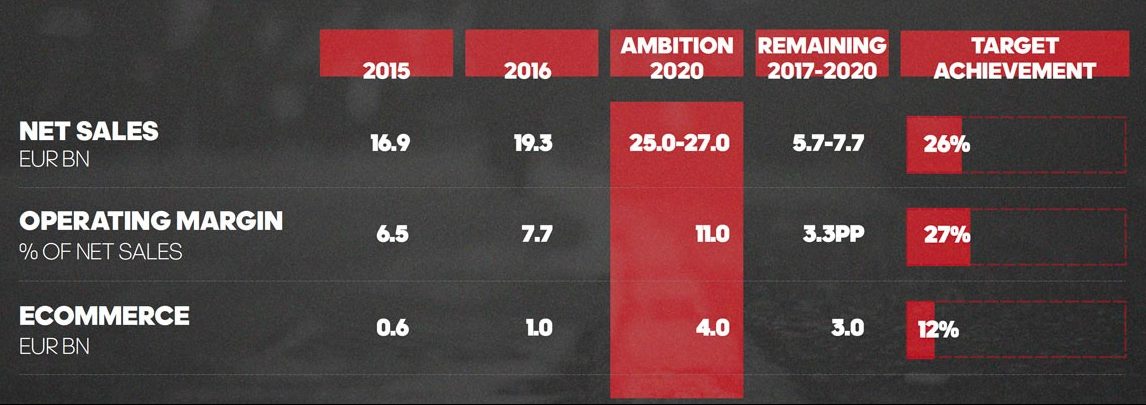

In March 2015, Adidas introduced a strategic business plan named “Creating the New,” which defines the company’s strategies and objectives through 2020. Following exceptional financial results in fiscal 2016, the company updated its corporate strategy and introduced an acceleration plan that outlines more ambitious growth targets than those initially set in 2015:- Adidas plans to grow total company sales to €25–€27 billion in 2020, up from €19.3 billion in 2016. The company expects sales growth to be higher than that of the global sporting goods industry, which means Adidas will take market share.

- The company also aims to reach a total operating margin of 11% in 2020, up from 7.7% in 2016. This would narrow the company’s margin gap with archrival Nike, which enjoys a 14% annual operating margin.

Source: Adidas

Source: Adidas

Rorsted strongly emphasized that Adidas has the right company strategy in place and that management will now overwhelmingly focus on executing the strategy for the next couple of years. Adidas has had a strong start in terms of accomplishing its 2020 goals, but still has a long way to go to achieve them in full.

Source: Adidas

Source: Adidas

2016: A Blowout Year

The company achieved stellar operating results in 2016 and increased its top- and bottom-line guidance several times throughout the year. In 2016:- Net sales increased by 18% year over year.

- Gross margin expanded by 30 basis points due to better product pricing and product and channel mix as well as lower input costs, all of which helped to offset severe currency headwinds.

- Operating margin expanded by 120 basis points on cost control and operating leverage.

- Net income increased by 41% year over year.

- The company’s share price surged by 67% over the year, and Adidas was the best-performing stock on the German DAX Index for a second year in a row.

Increased Guidance for 2017

Management expects 2017 to be another standout year. For the full year, the company has guided for:- A net sales increase of 11%–13% year over year.

- Operating expenses as a percentage of sales to decrease.

- Operating margin to expand by 60–80 basis points year over year, to 8.3%–8.5%.

- A net income increase of 18%–20% year over year.

Attractive Industry

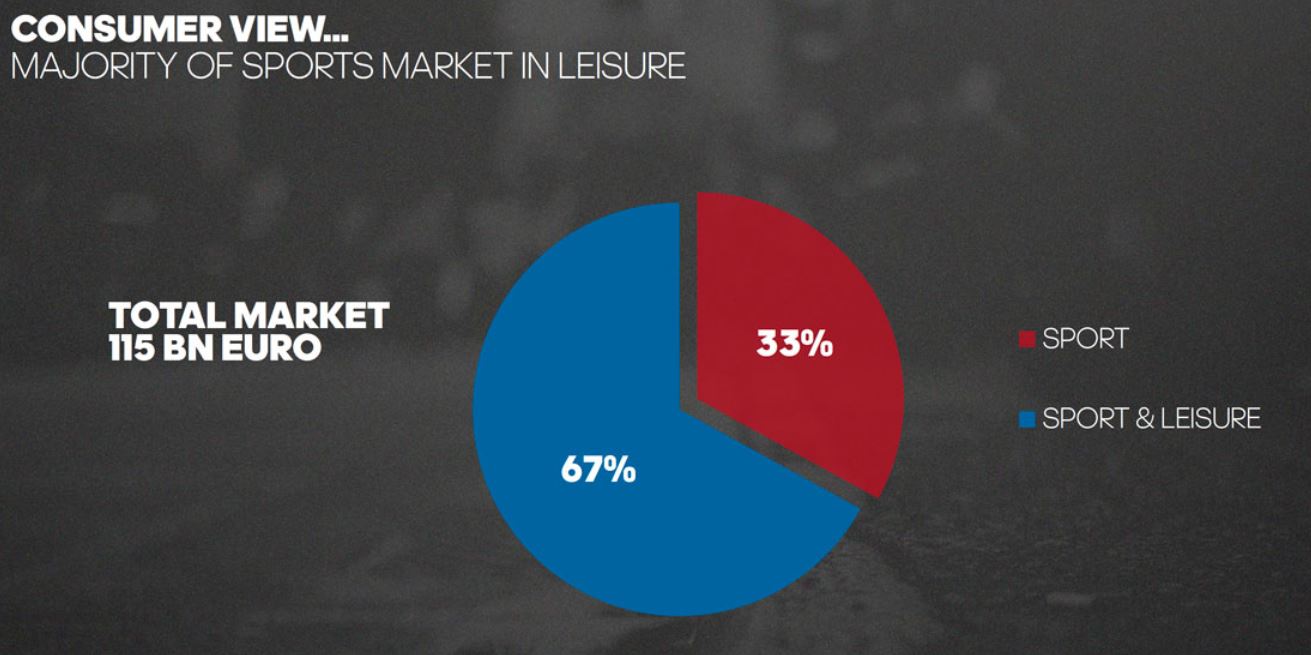

Sports footwear and apparel is a highly competitive industry dominated by large, global players that include Adidas, Nike and Under Armour. Numerous smaller players are also active in the industry. In 2016, Nike reported total company sales of $32.4 billion, and the company plans to increase its sales to $50 billion by 2020. Despite heavy competition, the industry is attractive due to robust growth trends, which have been propelled by the rise of athleisure, increasing global concerns regarding health and fitness, and higher sports participation rates. Market research firm The NPD Group forecasts that the global sporting goods industry will grow at a mid-single-digit rate in 2017, even though no major global sporting events are scheduled to occur this year. Consumer spending on sporting goods is expected to grow faster in developing economies than in developed markets. Source: Adidas

Source: Adidas

Athleisure and Streetwear

The casual athletic category continues to enjoy strong momentum, driven by retro running and tennis designs and silhouettes. According to Adidas, the athleisure trend will remain a strong structural driver for the sporting goods industry. Adidas will capitalize on these ongoing favorable trends by creating and driving demand for streetwear through sports-inspired lifestyle products. Source: Adidas

Source: Adidas

Mission: To Be the Best Sports Company in the World

The company’s mission is to be the best sports company in the world, and its strategy is to increase top-line growth and market share, expand gross margin and increase operating leverage. Source: Adidas

Source: Adidas

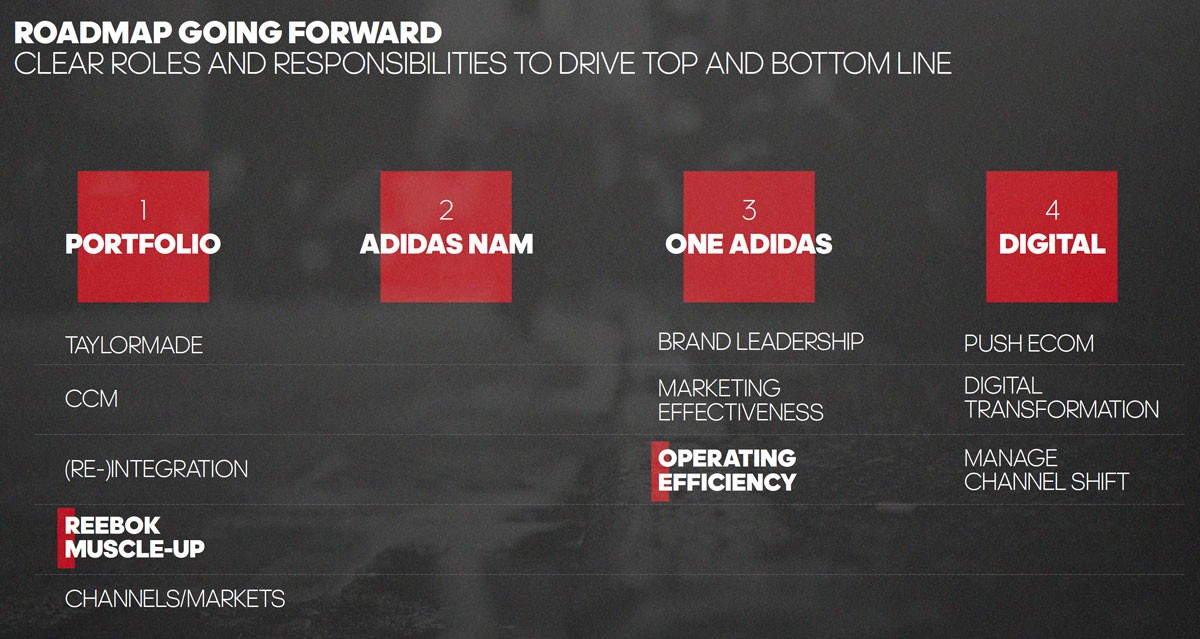

- Adidas plans to propel sales growth by driving brand desirability through product innovation, brand exits and turnarounds, as well as by focusing on e-commerce growth, greater penetration of the North American market and womenswear.

- All P&L items are expected to contribute to profitability and margin improvement.

- Adidas plans to improve gross margin by minimizing clearance activities, increasing share of full-price sales, speeding up sourcing and improving manufacturing efficiencies

- The company aims to increase operating margins through gross margin expansion, cost control, more efficient marketing procurement and greater return on marketing investment.

Source: Adidas

Source: Adidas

New Product Launches Are Key

The importance of maintaining a pipeline of new products, especially in footwear, cannot be underestimated. In 2016, newly launched products accounted for 77% of Adidas brand sales and 73% of Reebok footwear sales. New products have higher gross margins than do those that have been on the market for more than one season. The company’s new product designs have been based on:- Design collaboration partnerships with athletes, performing artists, designers, models, celebrities and digital influencers such as Kanye West, Pharrell Williams and Stella McCartney.

- The relaunch of historic designs and styles with modern silhouettes and detailing, using new materials and fabrics. For example, Adidas has leveraged some of its iconic franchises, such as Stan Smith and Gazelle, to capitalize on retro and nostalgia consumer trends.

- The use of innovative materials such as recycled polyester and biodegradable fabrics in order to leverage consumer concerns regarding sustainability and environmentalism. For example, Adidas unveiled the first mass-produced running shoe created with recycled ocean plastic; the 7,000 pairs of limited-edition shoes sold out in 24 hours.

Marketing and Distribution Strategy

Marketing spending constitutes a sizable portion of the company’s operating expenses and represents an important mechanism for driving brand desirability. The company is committed to improving marketing efficiency by focusing communication efforts and brand initiatives on the most impactful partnerships with sports teams, events, athletes and artists.- Adidas will focus marketing spending, product introductions and retail store investment on six key cities that influence global consumer trends: New York, Los Angeles, London, Paris, Shanghai and Tokyo.

- The company plans to expand its controlled space, which is retail space where Adidas is able to manage the way brands and products are presented. These spaces include own retail stores and franchises, and shops-in-shops at certain wholesale accounts. The company aims to generate 60% of revenues in controlled spaces by 2020.

- The company recently opened its largest global flagship store in New York City, on Fifth Avenue and 46th Street. The store features an innovative high school sports stadium concept.

Streamlining and Revamping the Brand Portfolio

Adidas has announced that it will exit low-growth, noncore and low-profitability businesses such as the TaylorMade golf and CCM hockey businesses, as these are dilutive to overall top-line and profitability trends. If the divestitures occur in 2017, annual sales, margins and earnings would increase even more than outlined in the company’s full-year guidance. Source: Adidas

Source: Adidas

- The golf and hockey businesses contributed 6% to total company revenues in 2016, but constant currency sales declined by 1% in the golf business and by 13% in the hockey segment.

- The company is also implementing a turnaround plan for Reebok, whose sales growth and margins are lower than those of the Adidas brand. Reebok’s sales growth is also lower than that of the overall sporting goods industry, and its margins and operating profits are lower than those of its main competitors. As a result, Reebok’s performance is dilutive to total company earnings.

- Management has chosen to revamp the Reebok brand instead of divest it, as Reebok has already made some operational headway. The brand has posted double-digit revenue growth outside the US for the last three years.

- The key is to now increase growth in the US market, especially given Reebok’s historic roots in the US. Reebok North America’s constant currency sales declined by 1% year over year in 2016. Management and organizational changes have been made at the brand’s headquarters in Boston. The number of Reebok US factory outlet stores has been reduced and more brand stores will be closed in 2017.

Opportunities for Growth

E-Commerce to Quadruple

Adidas plans to increase its top line and market share by growing e-commerce revenue from €1 billion in 2016 to €4 billion in 2020. In 2016, e-commerce constant currency sales grew by 59% year over year.Womenswear

One of the company’s targeted growth areas is womenswear (both the footwear and athletic apparel categories). Management stated that it is not happy with the company’s current position in the womenswear market and that it seeks to double its share of the segment by 2020. Womenswear represented 23% of Adidas’s revenues in 2016, and the company wants that figure to reach 28% by 2020.- Adidas is forming collaborations with female influencers, leaders, athletes and models. The company’s current team of 25 female influencers includes former Lululemon Athletica CEO Christine Day.

- In 2016, after teaming up with global female athletes to study the female foot and how it moves during running, Adidas created the first running shoe designed specifically for women. Traditionally, running shoes for women were adaptations of men’s shoes.

Focus on North America

The company has identified the North American market as a strategic growth driver.- North America sales represented 21% of total company sales in 2016. The company plans to grow the Adidas brand in North America to €5 billion in sales by 2020, up from €3.4 billion in 2016. Nike currently dominates the North American market, and saw US sales of $14.8 billion in 2016.

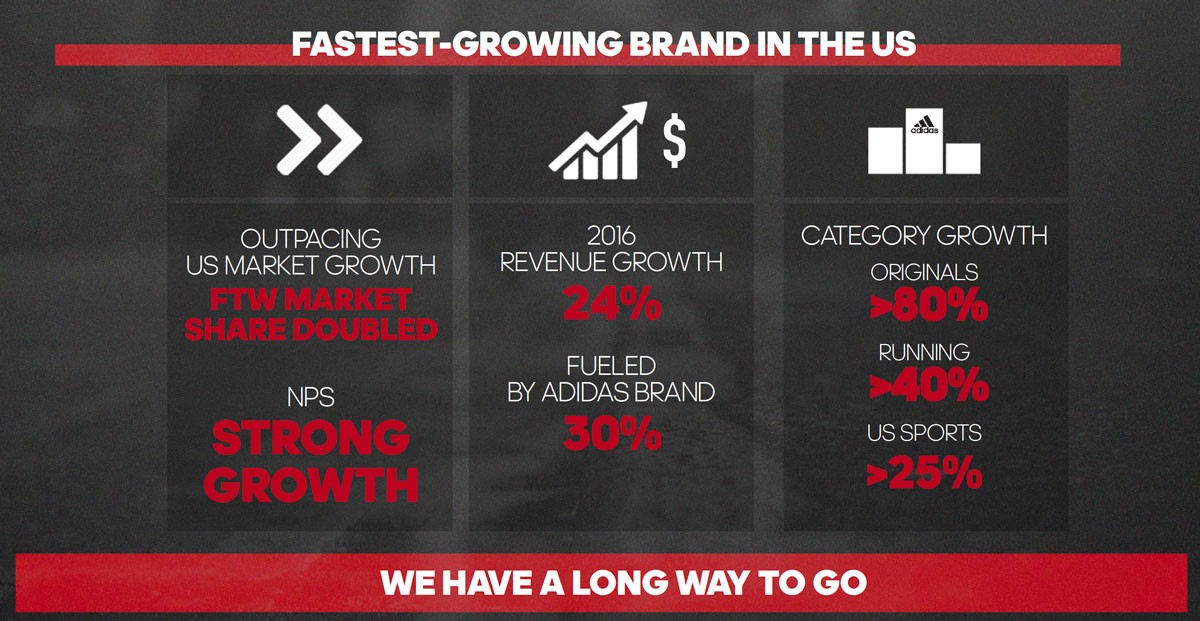

- Adidas’s momentum in the North American market accelerated considerably in 2016 following organizational setup improvements and new product launches. Sales in the region increased by 24% year over year, vastly outpacing total sporting goods market growth.

Source: Adidas

Source: Adidas

Sourcing

Adidas is focusing on improving sourcing and logistics and increasing speed to market. The company stated that the futures business model, with retailers booking orders six to nine months in advance, is antiquated and not representative of current dynamic world trends. Continued innovations in the supply chain and advances in production techniques will speed the design and manufacturing processes, enabling the company to get products to consumers faster.Speed Programs

Adidas will move away from mainly developing product ranges in advance of seasonal merchandising calendars and toward in-season production processes and rapid replenishment manufacturing. Improve product availability: The company seeks to enable constant product availability and ensure faster delivery of products. Decrease risk: Adidas is looking to reduce the risk of overbuying and decrease end-season cleanup by creating more relevant product propositions. Create additional net sales: Adidas aims to capture higher demand with shorter lead-time production and avoid seasonal product successes going out of stock. Generate more contribution: The company plans to reduce markdowns on articles sold by increasing the share of volumes sold at full price. Adidas is striving for quick replenishment capabilities for fast-selling items. Currently, about 15% of sales are generated on speed programs, but the company plans to increase the share of speed-enabled products to at least 50% of net sales by 2020. Adidas expects this to help it achieve 20% higher share of full-price sales.- Some 80% of the apparel volumes for the fall/winter 2017 season were produced with 60 days’ lead time.

- The majority of footwear volumes are already produced with lead times of 60 days or less.