Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

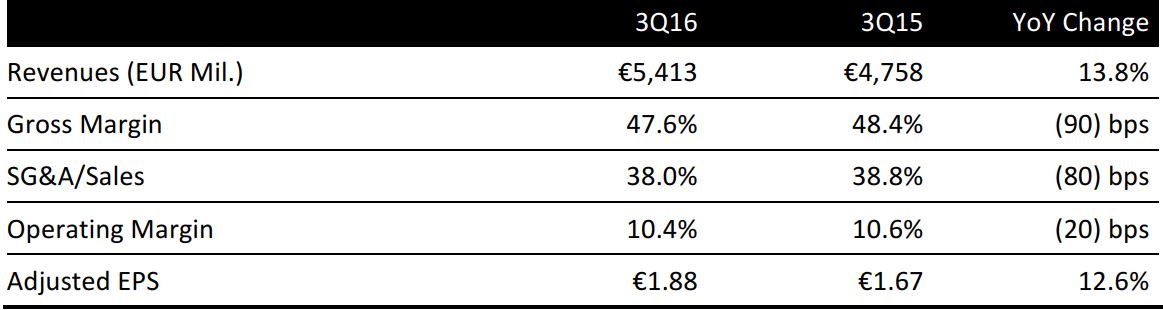

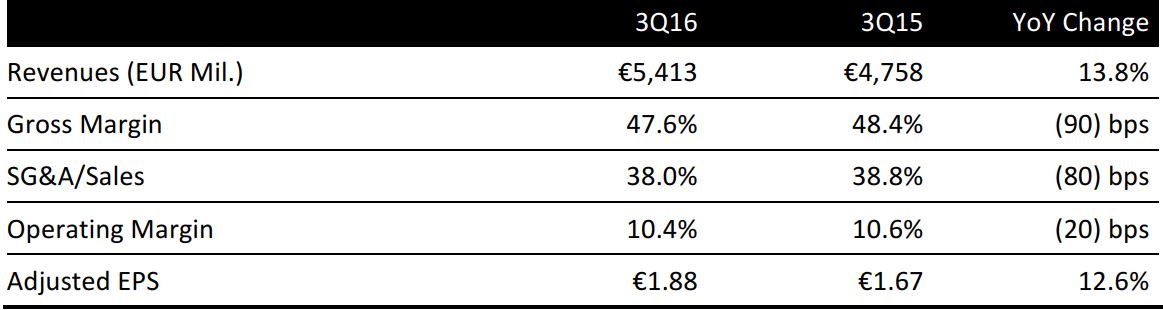

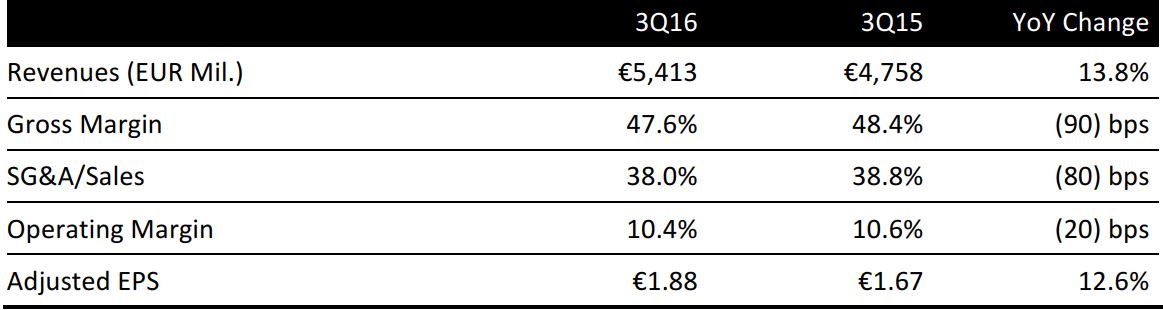

German athletic and sportswear company Adidas Group reported 3Q16 net sales of €5,413 million, up 13.8% on a reported basis and up 17.0% on a constant-currency basis. Net sales for the quarter were above the consensus estimate of £5,368 million.

3Q16 gross margin contracted by 90bps year over year to 47.6%, due to foreign-exchange headwinds. 3Q16 operating margin declined 20bps year over year to 10.4%. Underlying EPS of €1.88 expanded 12.6% year over year, in line with the analyst consensus estimate.

SALES BY BRAND

In terms of brands, Adidas showed the strongest sales growth, with sales up 19.5% at constant-currency to €4,640 million. Reebok sales grew by 7.2% year over year on a constant-currency basis and Taylor Made-adidas Golf revenues increased 6.0% year over year. CCM hockey brand revenues declined 7.3% year over year at constant currency, reflecting the challenging market conditions in the US hockey market.

SALES BY REGION

Across the group’s regions of operation, Greater China exhibited the strongest sales growth in the quarter, at 25.3% at constant currency, followed by North America at 20.2%. Western Europe constant currency sales increased 14.5% year over year. All regions exhibited double-digit constant-currency sales growth except Russia, which posted growth of 7.4% year over year.

9M16 RESULTS

Revenues for the first nine months of 2016 increased by 14.6% on a reported basis and by 20.0% at constant currency to €14,604 million. 9M16 gross margin contracted 10bps to 48.6%, due to negative currency effects. SG&A expenses as a percentage of sales declined 80bps to 40.5%, and adjusted operating margin expanded 140bps year over year to 10.0%.

GUIDANCE

For FY16, the company confirmed its guidance outlook for group sales to increase in the high teens rate at constant currency. FY16 gross margin is expected to be in the range of 48–48.3%, compared to 48.3% in FY15. The operating margin is expected to reach 7.5%, marking 100bps expansion year over year from 6.5% in FY15. Net income is expected to improve to a range of €975 million to €1 billion, up 35–39% year over year.

The FY16 revenue consensus estimate stands at €19,165 million, implying annual reported year-over-year growth of 13.3%. Consensus expects operating profit of €1,448 million, implying year-over-year growth of 32.4%. Consensus EPS for FY16 is €4.90, implying reported growth of 38.0% year over year.