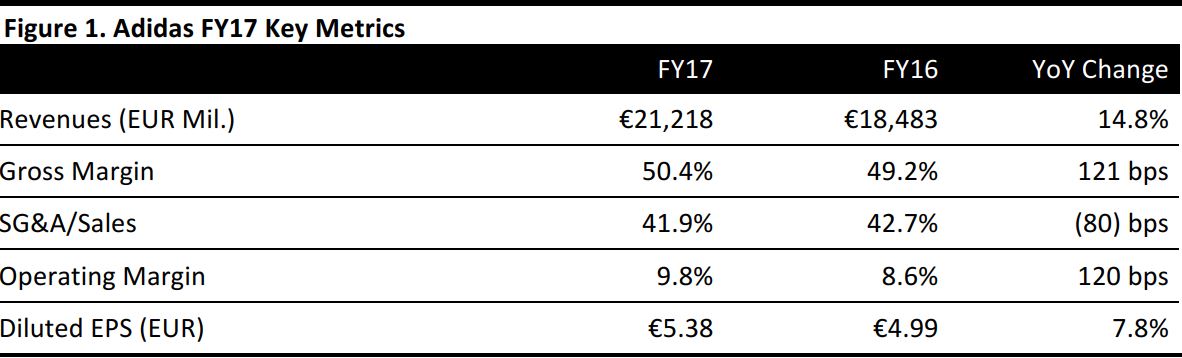

FY16 revenues restated to represent continuing operations only. EPS is from continuing and discontinued operations.

Source: Company reports/Coresight Research

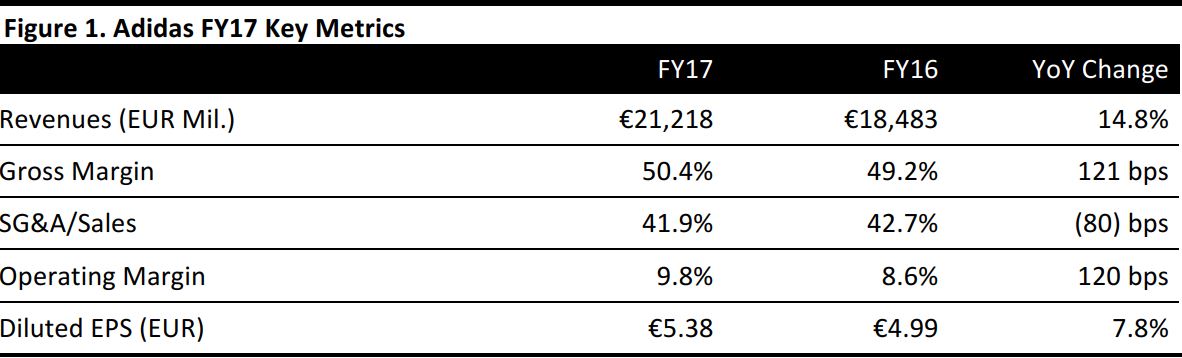

FY16 revenues restated to represent continuing operations only. EPS is from continuing and discontinued operations.

Source: Company reports/Coresight Research

FY17 Results

Adidas reported FY17 revenues of €21.2 billion, up 14.8% year over year as reported and up 16% at constant currency. The figure was slightly below consensus expectations of €21.3 billion.

Despite the top-line miss, operating profit of €2.1 billion came in ahead of analysts’ expectations of €2.0 billion. Operating profit was up 30.8% year over year.This yielded an operating margin of 9.8%, up 120 basis points year over year, which the company attributed to better pricing and product mix.

Statutory net income of €1.1.billion was up 7.9% year over year and was affected by onetime tax impacts. This total was below analysts’ expectations of €1.2 billion. The tax impact of €76 million arose from a revaluation of the company’s US deferred tax assets following the implementation of US tax reform.

Adidas reported diluted EPS of €5.38. Excluding the onetime tax impact, diluted EPS was €5.75, up 15.2% year over year. Normalized EPS, or diluted EPS from continuing operations excluding the tax impact, was €7.00, ahead of consensus expectations of €6.77. Discontinued operations include the Taylor Made, Adams Golf, Ashworth and CCM brands, all of which were sold in 2017.

Management Commentary

The Adidas brand grew constant-currency sales by 18% in the year. Reebok revenues increased by 4%. Management stated that, on a currency-neutral basis, the combined sales of the Adidas and Reebok brands grew at double-digit rates in nearly all regions. The company pointed to particularly strong growth in Greater China and North America, where sales at constant currency were up by 29% and 27%, respectively. Constant-currency sales were up 13% in Western Europe and up 12% in Latin America.

4Q17 Update

In the fourth quarter, the group grew revenues by 19% on a constant-currency basis, with sales at the Adidas brand up 22%. Excluding currency effects, combined Adidas and Reebok sales grew by 32% in Greater China, by 31% in North America and by 17% in Western Europe. The company expanded its gross margin by 2.2 percentage points and its operating margin by 1.7 percentage points.

Outlook

Management guided for a 10% increase in sales at constant currency in FY18. Adidas expects to increase its gross margin by 0.3 percentage points, to 50.7%. The company expects a 9%–13% increase in operating profit, yielding an operating margin increase of 0.3–0.7 percentage points. Management expects net income from continuing operations to be €1.615–€1.675 billion. CEO Kasper Rorsted said, “We expect quality growth, with over proportionate bottom-line improvements. This will enable an even stronger increase in profitability by 2020 and allow us to upgrade our long-term target yet again.”

FY16 revenues restated to represent continuing operations only. EPS is from continuing and discontinued operations.

Source: Company reports/Coresight Research

FY16 revenues restated to represent continuing operations only. EPS is from continuing and discontinued operations.

Source: Company reports/Coresight Research