Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

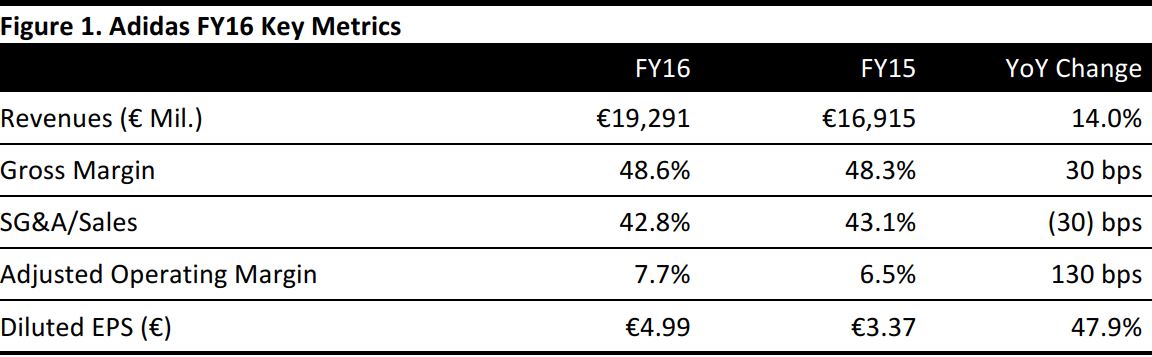

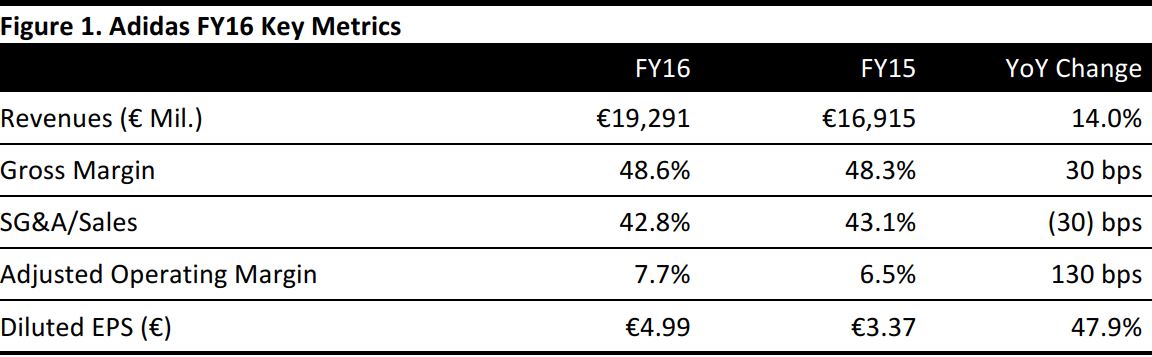

FY16 Results

Adidas reported FY16 revenue growth of 14.0% year over year to €19,291 million, slightly below the consensus estimate of €19,307 million. Constant-currency FY16 sales increased 18% year over year. The strong sales performance was driven by the Adidas brand, which increased-constant currency sales by 22% year over year.

FY16 gross margin expanded by 30 bps and SG&A margin contracted by 30 bps year over year. The adjusted operating profit margin expanded by 130 bps in FY16 to 7.7%, up from 6.5% in FY15. Diluted EPS from continuing operations increased by 47.9% to €4.99 year over year, broadly in line with analyst consensus forecasts.

Geographic Segments

The strong sales performance was driven by double-digit revenue growth in nearly all geographic markets. Constant-currency sales growth increased by 20% year over year in Western Europe, 24% in North America, 28% in Greater China, 16% in Latin America and 16% in Japan.

4Q16 Results

Adidas increased 4Q16 reported sales by 12.5% year over year to €4,687 million. Constant-currency 4Q16 sales increased 14% year over year. Sales growth during the quarter was driven by the running category, as well as strength at adidas Originals and adidas neo. 4Q16 gross margin expanded by 160 bps year over year to 48.8%.

Guidance

Adidas expects FY17 constant-currency sales to increase 11%–13% year over year. FY17 gross margin is expected to expand by 50 bps year over year to 49.1%. FY17 operating margin is expected to expand by 60–80 bps year over year to 8.3%–8.5%. Net income is expected to increase between 18% and 20% year over year.

Analysts expect the company to generate FY17 revenues up 9.5% year over year to €21,129 million, although estimates are likely to increase following this earnings release. FY17 consensus EBIT is estimated at €1,685 million, implying an EBIT margin of 8.0%. FY17 consensus normalized EPS is forecast at €5.65.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology