Source: Company reports/Coresight Research

3Q18 Results

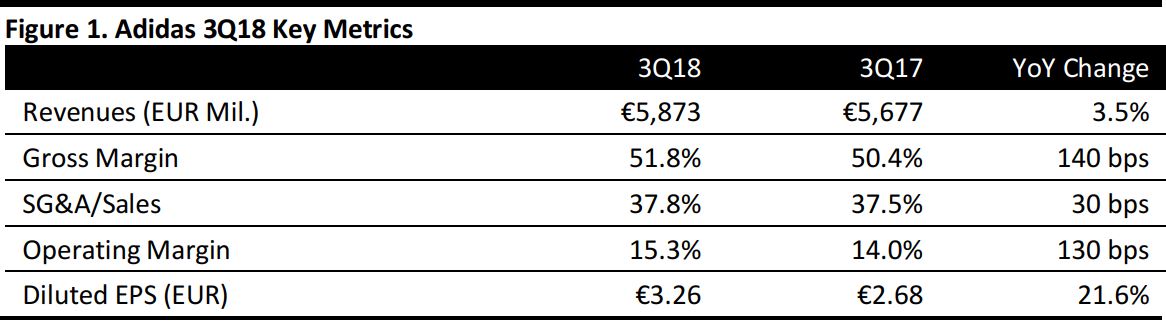

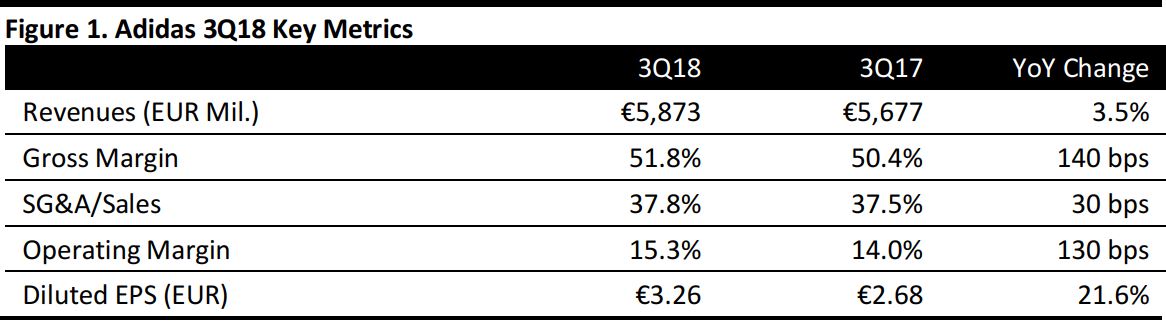

Adidas grew 3Q18 revenues by 8% at constant currency, lower than the 10% constant-currency growth reported in 2Q18. As reported, Adidas grew revenues by 3.5% to €5.87 billion and missed the consensus estimate of €5.97 billion. The company stated that it applied hyperinflation accounting to its Argentina business for the first time and this negatively impacted reported revenues by a high-double-digit million euro amount.

- Gross margin improved by 140 bps driven by improved pricing and channel and category mix as Adidas focuses “on the quality of its top-line growth, as well as lower(ing) sourcing costs.”

- SG&A as a percentage of sales grew by 30 bps. Adidas said that a 7% increase in marketing expenses and a 3% increase in overhead costs to improve the scalability of the business led to a rise in operating expenses.

- Operating margin expanded by 130 bps as EBIT was up fully 13% to €901 million and ahead of consensus.

- Statutory net income of €658 million was also ahead of the consensus estimate of €605 million.

Management Commentary

The Adidas brand grew sales by 9.8% at constant currency during the quarter, driven by a double-digit increase the Sports Inspired category and a high-single-digit growth in the Sport Performance segment. Reebok revenues fell by 5%, as growth in its Classics segment was offset by declines in the Training and Running segments.

At constant currency, Adidas grew revenues by 16% in North America. Strong 26% growth in China boosted revenue growth in the Asia-Pacific region by 15%. Latin America sales were flat, Western Europe sales fell 1% and Emerging Market sales fell 2% year over year.

Outlook

Management lowered FY18 guidance for sales growth to 8%–9% from the previous target of 10% at constant currency “due to lower-than-initially-expected growth in Western Europe.” In light of the company’s overall strong financial performance, management raised its profitability outlook for the year. This guidance calls for:

- net income growth of 16%–20% versus the 13%–17% range it had stated previously;

- gross margin growth of 1 percentage point to 51.4% versus 0.3 percentage points to 50.7%; and,

- operating margin growth of 1 percentage point to 10.8% versus 0.5–0.7 percentage points to a range of 10.3%–10.5%.