Source: Company reports/FGRT

Source: Company reports/FGRT

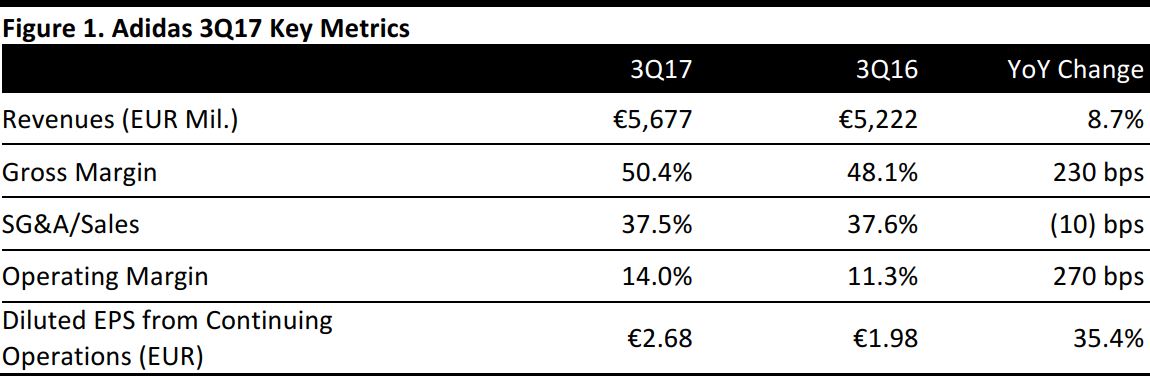

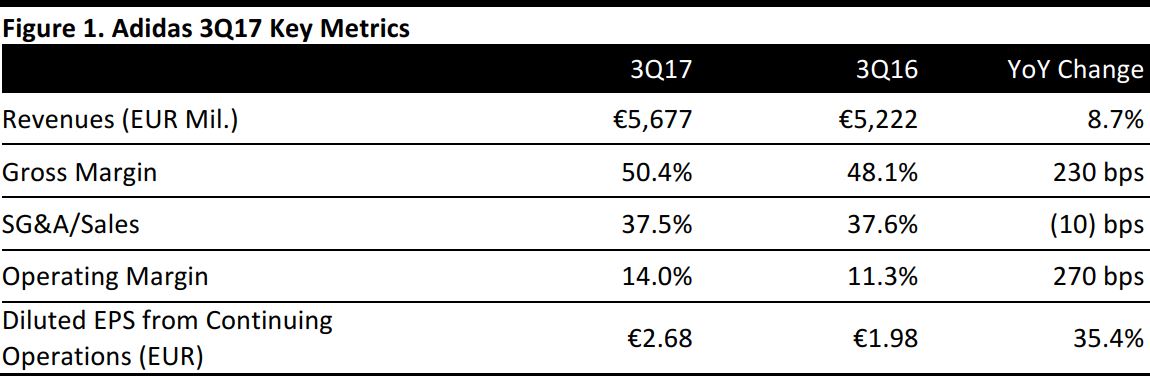

3Q17 Results

For 3Q17, Adidas reported that revenue was up 12.0% year over year on a currency-neutral basis and up 8.7% year over year in euro terms, to €5,677 million, which was below the consensus estimate of €5,910 million. Operating profit grew by 34.6% year over year, to €795 million, above the consensus estimate of €755 million. Net income from continuing operations grew by 34.8%, to €549 million, above the consensus estimate of €513 million. Better pricing and product mix reflected positively on profitability and offset higher input costs and unfavorable currency developments.

Sales for the Adidas and Reebok brands increased by 13.0% and 1.0%, respectively, during the quarter. Adidas brand revenue was driven by strong performances in the running and outdoor categories and the Adidas Originals and Adidas Neo lines. Reebok’s performance was negatively affected by planned efforts to clean up the brand’s distribution in the US market.

Performance by Region

On a currency-neutral basis, revenue in all regions except Russia/CIS grew during 3Q17: revenue grew by 28.0% in Greater China, by 23.0% in North America and by 7.0% in Western Europe. In Russia/CIS, sales declined by 17.0% due to challenging consumer sentiment and additional store closures during the quarter.

9M17 Results

For the first nine months of FY17, the company’s revenue increased by 15.6% year over year on a currency-neutral basis and in euro terms, to €16.2 billion. Operating profit grew by 25.8%, to €1.9 billion, and net income from continuing operations grew by 26.0%, to €1.4 billion.

Outlook

Adidas confirmed its guidance for FY17 following its strong financial performance in the first nine months of 2017. The company expects its currency-neutral sales to grow by 17%–19% and its operating profit to increase by 24%–26%. The company expects net income from continuing operations to grow by 26%–28% in FY17, to €1.36–€1.39 billion.

The FY17 revenue consensus estimate stands at €21,716 million, implying annual reported year-over-year growth of 12.6%. Consensus expects operating profit of €1,963 million, implying year-over-year growth of 31.6%, and EPS of €6.66, implying year-over-year growth of 31.1%.

Source: Company reports/FGRT

Source: Company reports/FGRT