Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

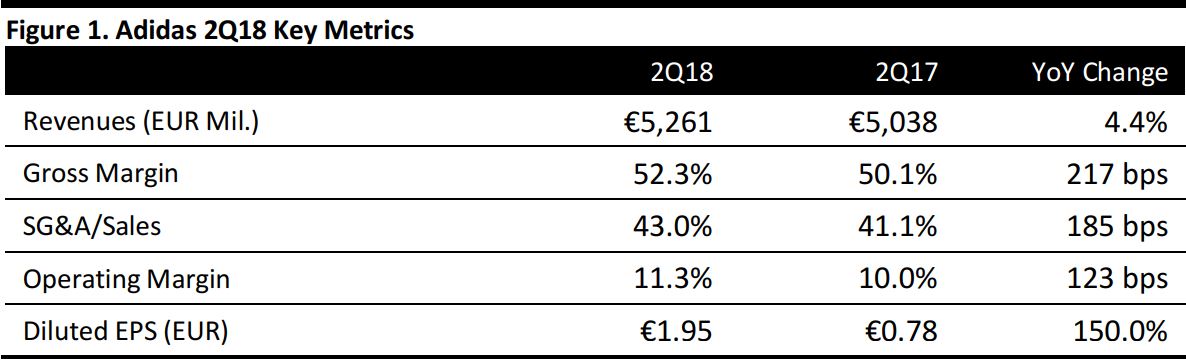

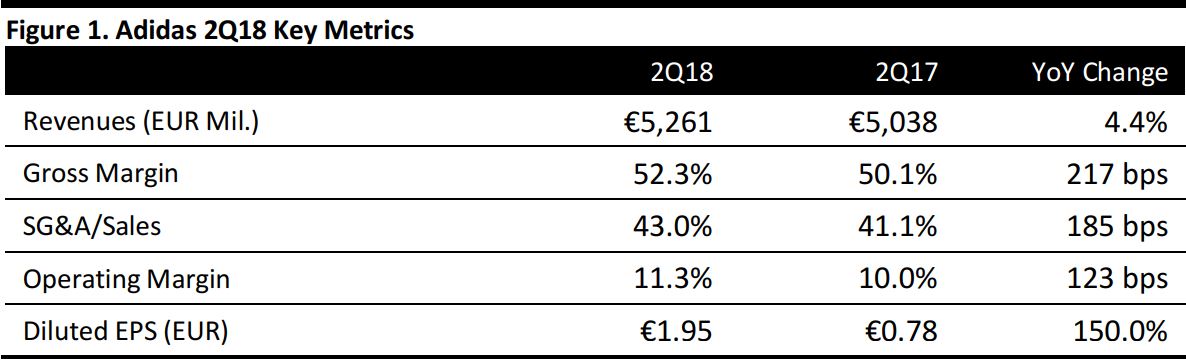

2Q18 Results

Adidas reported 2Q18 revenues up 10% at constant currency, level with the constant-currency growth reported in the prior quarter. As reported, Adidas grew revenues by 4.4% to €5.26 billion, comfortably ahead of consensus expectations of €5.18 billion.

- The gross margin saw an uplift in excess of two full percentage points on the back of beneficial pricing and channel mixes, which the company said reflected its “focus on the quality of its top-line growth.”

- EBIT of €592 million was up fully 17.2% year over year and was ahead of consensus of €546 million.

- Statutory net income of €396 million was also ahead of analyst expectations, of €385 million.

Management Commentary

The Adidas brand grew constant-currency sales by 12% in the quarter, driven by double-digit increases in the running, football and training categories, and high-single-digit growth in the Sports Inspired category. Reebok revenues fell by 3%, as the training and running categories declined.

At constant currency, the company grew revenues by 16% in North America and by 19% in the Asia-Pacific region, where 27% growth in China supported regional revenue growth. Latin America sales were up 15% and Western Europe sales were flat year over year.

Outlook

Management reiterated the FY18 guidance it had given when it published its FY17 results. That guidance calls for a 10% increase in sales at constant currency in FY18, with double-digit growth in North America and Asia Pacific. Adidas expects to increase its gross margin by 0.3 percentage points, to 50.7%. The company expects to report an operating margin increase of 0.5–0.7 percentage points. Management expects net income from continuing operations to be €1.615–€1.675 billion.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research