Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

1Q18 Results

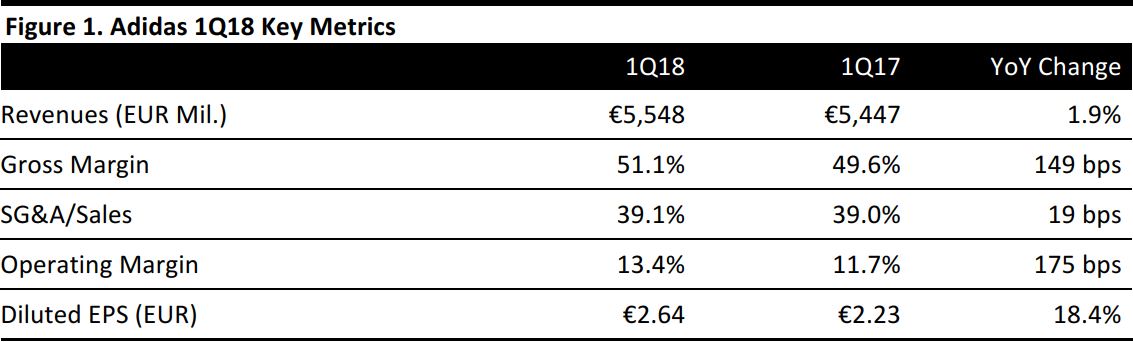

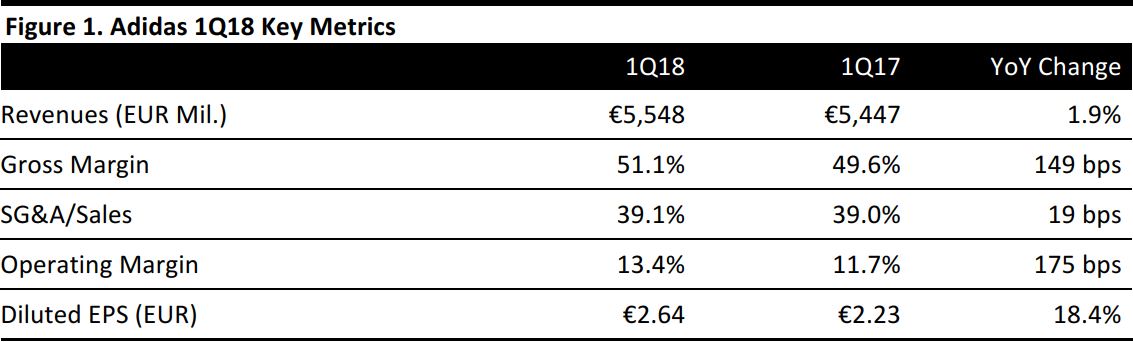

Adidas reported 1Q18 revenues of €5.55 billion, up just 1.9% year over year as reported and up 10% at constant currency, reflecting currency headwinds. The figure was slightly below consensus expectations of €5.63 billion and constant-currency growth slowed sequentially from a 19% increase in 4Q17and a 16% increase across FY17.

Operating profit of €746million came in ahead of analysts’ expectations of €713million. Operating profit was up 17.1% year over year.This yielded an operating margin of 13.4%, up 175basis points year over year. The company attributed this increase to better pricing and product mix.

Statutory net income of €540 million was up 18.6% year over year and was ahead of analysts’ expectations of €510.5million.

Adidas reported diluted EPS of €2.64 versus analysts’ expectations of €2.51.

Management Commentary

The Adidas brand grew constant-currency sales by 11% in the quarter, driven by double-digit increases in the running, football and training categories and the Adidas Originals line. Reebok revenues fell by 3% due to declines in the training and running categories.

At constant currency, the company grew revenues by 21% in North America and by 15% in the Asia-Pacific region, where26% growth in China underpinned regional revenue growth. Latin America sales were up 10% and Western Europe sales were up 5%.

Outlook

Management reiterated the guidance it issued when it published its FY17 results. That guidance calls for a 10% increase in sales at constant currency in FY18. Adidas expects to increase its gross margin by 0.3 percentage points, to 50.7%. The company expects a 9%–13% increase in operating profit, yielding an operating margin increase of 0.3–0.7 percentage points. Management expects net income from continuing operations to be €1.615–€1.675 billion.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research