Nitheesh NH

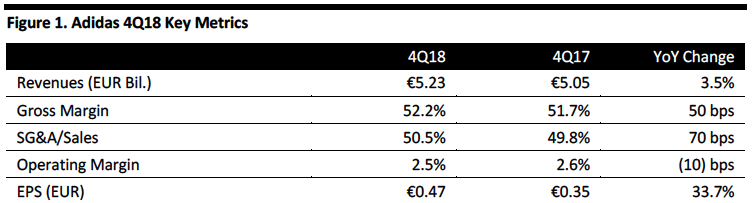

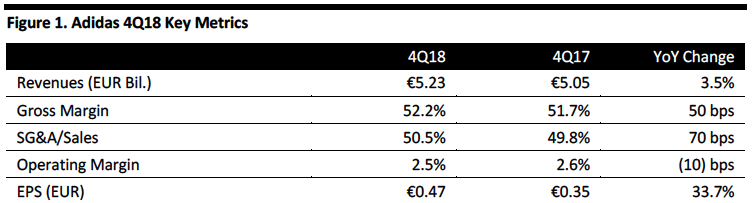

[caption id="attachment_80273" align="aligncenter" width="640"] Source: Company reports/Coresight Research [/caption]

4Q18 Results

Adidas reported 4Q18 EPS of €0.47, beating the consensus estimate of €0.38, and up 33.7% year over year.

Net sales increased 3.5% to €5.2 billion, or 5% on a currency-neutral basis, driven by double-digit gains in Asia Pacific (up 11%) and Greater China (up 13%). Sales in North America rose 9% on double-digit growth for the Adidas brand while sales in Latin America, Russia/CIS, emerging markets and Europe declined 1%, 2%, 5%, and 6% respectively, on a currency neutral basis. Adidas brand sales rose 5% globally and sales of Reebok branded product declined 1%.

Gross margin was 52.2%, up 50 bps year over year, reflecting an improved product and channel mix and lower input costs. Marketing and point-of-sale expenses increased 8.1% and represented 16.7% of sales (up 60bps), driving the 10-bps operating margin contraction, to 2.5% of sales.

Excluding a negative one-time tax charge in 4Q17, net income from continuing operations increased 29.3% to €93 million from €72 million. Basic EPS from continuing operations was up 33.7% to €0.47 from €0.35 in 2017.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research [/caption]

4Q18 Results

Adidas reported 4Q18 EPS of €0.47, beating the consensus estimate of €0.38, and up 33.7% year over year.

Net sales increased 3.5% to €5.2 billion, or 5% on a currency-neutral basis, driven by double-digit gains in Asia Pacific (up 11%) and Greater China (up 13%). Sales in North America rose 9% on double-digit growth for the Adidas brand while sales in Latin America, Russia/CIS, emerging markets and Europe declined 1%, 2%, 5%, and 6% respectively, on a currency neutral basis. Adidas brand sales rose 5% globally and sales of Reebok branded product declined 1%.

Gross margin was 52.2%, up 50 bps year over year, reflecting an improved product and channel mix and lower input costs. Marketing and point-of-sale expenses increased 8.1% and represented 16.7% of sales (up 60bps), driving the 10-bps operating margin contraction, to 2.5% of sales.

Excluding a negative one-time tax charge in 4Q17, net income from continuing operations increased 29.3% to €93 million from €72 million. Basic EPS from continuing operations was up 33.7% to €0.47 from €0.35 in 2017.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research [/caption]

4Q18 Results

Adidas reported 4Q18 EPS of €0.47, beating the consensus estimate of €0.38, and up 33.7% year over year.

Net sales increased 3.5% to €5.2 billion, or 5% on a currency-neutral basis, driven by double-digit gains in Asia Pacific (up 11%) and Greater China (up 13%). Sales in North America rose 9% on double-digit growth for the Adidas brand while sales in Latin America, Russia/CIS, emerging markets and Europe declined 1%, 2%, 5%, and 6% respectively, on a currency neutral basis. Adidas brand sales rose 5% globally and sales of Reebok branded product declined 1%.

Gross margin was 52.2%, up 50 bps year over year, reflecting an improved product and channel mix and lower input costs. Marketing and point-of-sale expenses increased 8.1% and represented 16.7% of sales (up 60bps), driving the 10-bps operating margin contraction, to 2.5% of sales.

Excluding a negative one-time tax charge in 4Q17, net income from continuing operations increased 29.3% to €93 million from €72 million. Basic EPS from continuing operations was up 33.7% to €0.47 from €0.35 in 2017.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research [/caption]

4Q18 Results

Adidas reported 4Q18 EPS of €0.47, beating the consensus estimate of €0.38, and up 33.7% year over year.

Net sales increased 3.5% to €5.2 billion, or 5% on a currency-neutral basis, driven by double-digit gains in Asia Pacific (up 11%) and Greater China (up 13%). Sales in North America rose 9% on double-digit growth for the Adidas brand while sales in Latin America, Russia/CIS, emerging markets and Europe declined 1%, 2%, 5%, and 6% respectively, on a currency neutral basis. Adidas brand sales rose 5% globally and sales of Reebok branded product declined 1%.

Gross margin was 52.2%, up 50 bps year over year, reflecting an improved product and channel mix and lower input costs. Marketing and point-of-sale expenses increased 8.1% and represented 16.7% of sales (up 60bps), driving the 10-bps operating margin contraction, to 2.5% of sales.

Excluding a negative one-time tax charge in 4Q17, net income from continuing operations increased 29.3% to €93 million from €72 million. Basic EPS from continuing operations was up 33.7% to €0.47 from €0.35 in 2017.

Outlook

The company provided the following guidance for 2019:

- Net sales growth of 5-8% on a currency-neutral basis. The company noted it was experiencing supply chain shortages and would be unable to keep up with strong demand in North America, impacting growth in the first half of 2019, and overall clipping 1-2 percentage points from consolidated 2019 sales growth.

- By region on a currency-neutral basis, revenues in Asia Pacific are projected to grow at a double-digit rate, in North America and emerging markets, high-single-digit growth rates are expected. Sales in Latin America and Russia/CIS are forecast to improve at a low-single-digit rate in currency-neutral terms and Europe is expected to return to growth during 2019 and a slight increase is forecasted for the full year.

- Gross margin is forecast to expand 20 bps 52.0%.

- The operating margin is expected to increase 50-70bps to 11.3-11.5%

- Net income from continuing operations is projected to increase 10-14% to €1.88-1.95 billion.