Nitheesh NH

[caption id="attachment_94433" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

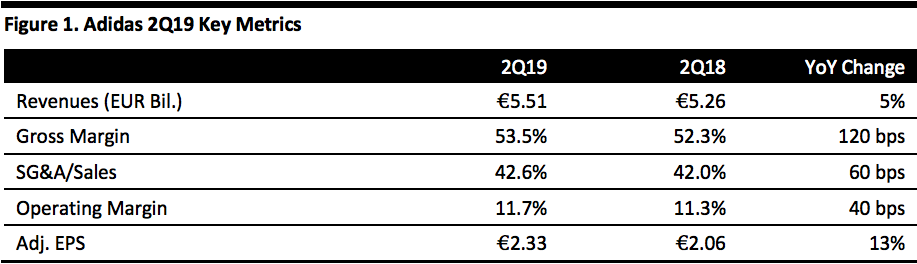

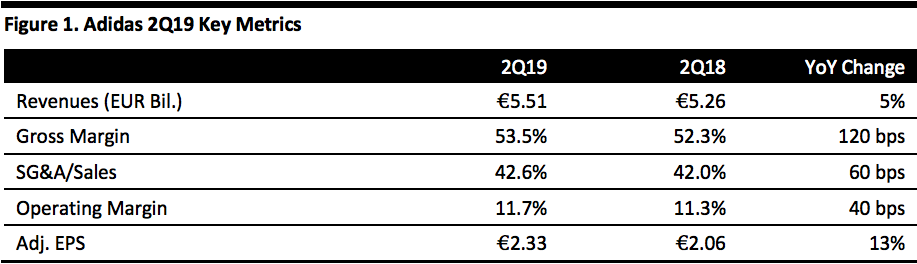

Adidas reported currency-neutral 2Q19 revenue growth of 4%, driven by a high-single-digit increase in the company’s “sport inspired” business. Revenues rose 5% to €5.51 billion, missing the consensus estimate of €5.52 billion. 2Q19 EPS rose 13% to €2.33, beating the consensus of €2.30.

For adidas and Reebok, the company saw a 12% currency-neutral sales increase in emerging markets and 8% in Asia Pacific, driven by 14% growth in greater China. Revenues in North America increased 6%, reflecting a 5% increase at the Adidas brand and 10% growth for Reebok. While sales in Latin America grew 5%, revenues in Europe were flat year-over-year. Sales in Russia declined 4% due to difficult prior year comparisons in relation to the 2018 FIFA World Cup.

Revenues for Adidas increased 4.0% currency neutral to €5.0 billion and for Reebok increased 3.1% currency neutral to €406 million.

Direct-to-consumer revenue increased 37%.

Gross margin expanded 120 basis points (bps) to 53.5%, driven by lower sourcing cost, positive foreign currency and a better product and channel mix.

As a percentage of sales, SG&A expenses expanded 60 bps to 42.6%.

Ending 2Q19, company inventory was €3.58 billion, up 5% year over year.

Net income from continuing operations grew 10% to €462 million. EPS from continuing operations increased 37.4% to €2.33.

The company continued to experience supply-chain shortages, with late arrivals hurting its overall margin in the US.

Outlook

The company reiterated FY19 guidance of:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Adidas reported currency-neutral 2Q19 revenue growth of 4%, driven by a high-single-digit increase in the company’s “sport inspired” business. Revenues rose 5% to €5.51 billion, missing the consensus estimate of €5.52 billion. 2Q19 EPS rose 13% to €2.33, beating the consensus of €2.30.

For adidas and Reebok, the company saw a 12% currency-neutral sales increase in emerging markets and 8% in Asia Pacific, driven by 14% growth in greater China. Revenues in North America increased 6%, reflecting a 5% increase at the Adidas brand and 10% growth for Reebok. While sales in Latin America grew 5%, revenues in Europe were flat year-over-year. Sales in Russia declined 4% due to difficult prior year comparisons in relation to the 2018 FIFA World Cup.

Revenues for Adidas increased 4.0% currency neutral to €5.0 billion and for Reebok increased 3.1% currency neutral to €406 million.

Direct-to-consumer revenue increased 37%.

Gross margin expanded 120 basis points (bps) to 53.5%, driven by lower sourcing cost, positive foreign currency and a better product and channel mix.

As a percentage of sales, SG&A expenses expanded 60 bps to 42.6%.

Ending 2Q19, company inventory was €3.58 billion, up 5% year over year.

Net income from continuing operations grew 10% to €462 million. EPS from continuing operations increased 37.4% to €2.33.

The company continued to experience supply-chain shortages, with late arrivals hurting its overall margin in the US.

Outlook

The company reiterated FY19 guidance of:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Adidas reported currency-neutral 2Q19 revenue growth of 4%, driven by a high-single-digit increase in the company’s “sport inspired” business. Revenues rose 5% to €5.51 billion, missing the consensus estimate of €5.52 billion. 2Q19 EPS rose 13% to €2.33, beating the consensus of €2.30.

For adidas and Reebok, the company saw a 12% currency-neutral sales increase in emerging markets and 8% in Asia Pacific, driven by 14% growth in greater China. Revenues in North America increased 6%, reflecting a 5% increase at the Adidas brand and 10% growth for Reebok. While sales in Latin America grew 5%, revenues in Europe were flat year-over-year. Sales in Russia declined 4% due to difficult prior year comparisons in relation to the 2018 FIFA World Cup.

Revenues for Adidas increased 4.0% currency neutral to €5.0 billion and for Reebok increased 3.1% currency neutral to €406 million.

Direct-to-consumer revenue increased 37%.

Gross margin expanded 120 basis points (bps) to 53.5%, driven by lower sourcing cost, positive foreign currency and a better product and channel mix.

As a percentage of sales, SG&A expenses expanded 60 bps to 42.6%.

Ending 2Q19, company inventory was €3.58 billion, up 5% year over year.

Net income from continuing operations grew 10% to €462 million. EPS from continuing operations increased 37.4% to €2.33.

The company continued to experience supply-chain shortages, with late arrivals hurting its overall margin in the US.

Outlook

The company reiterated FY19 guidance of:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Adidas reported currency-neutral 2Q19 revenue growth of 4%, driven by a high-single-digit increase in the company’s “sport inspired” business. Revenues rose 5% to €5.51 billion, missing the consensus estimate of €5.52 billion. 2Q19 EPS rose 13% to €2.33, beating the consensus of €2.30.

For adidas and Reebok, the company saw a 12% currency-neutral sales increase in emerging markets and 8% in Asia Pacific, driven by 14% growth in greater China. Revenues in North America increased 6%, reflecting a 5% increase at the Adidas brand and 10% growth for Reebok. While sales in Latin America grew 5%, revenues in Europe were flat year-over-year. Sales in Russia declined 4% due to difficult prior year comparisons in relation to the 2018 FIFA World Cup.

Revenues for Adidas increased 4.0% currency neutral to €5.0 billion and for Reebok increased 3.1% currency neutral to €406 million.

Direct-to-consumer revenue increased 37%.

Gross margin expanded 120 basis points (bps) to 53.5%, driven by lower sourcing cost, positive foreign currency and a better product and channel mix.

As a percentage of sales, SG&A expenses expanded 60 bps to 42.6%.

Ending 2Q19, company inventory was €3.58 billion, up 5% year over year.

Net income from continuing operations grew 10% to €462 million. EPS from continuing operations increased 37.4% to €2.33.

The company continued to experience supply-chain shortages, with late arrivals hurting its overall margin in the US.

Outlook

The company reiterated FY19 guidance of:

- Sales growth of 5-8% on a currency-neutral basis.

- Gross margin of about 52.0%, up from 51.8%.

- Operating margin expansion of 50-70 bps to 11.3-11.5%, up from 10.8%.

- Net income from continuing operations of €1.88-1.95 billion, up 10-14% from €1.71 billion in 2018.