DIpil Das

[caption id="attachment_86522" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

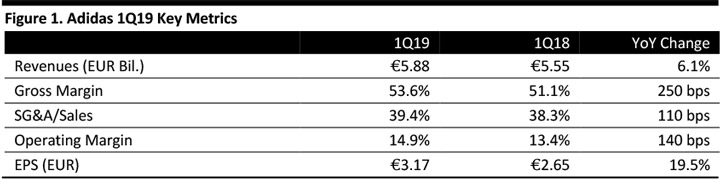

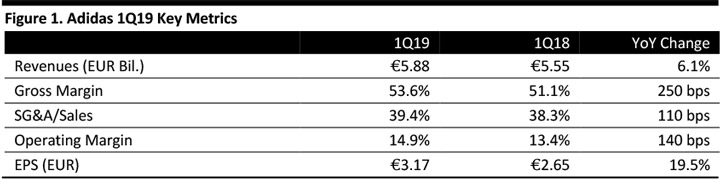

Adidas reported 4% currency-neutral 1Q19 revenue growth driven by 5.3% growth in the Adidas brand. Revenues rose 6.1% to €5.88 billion, beating the consensus estimate of €5.80 billion. 1Q19 EPS rose 19.5% to €3.17, beating the consensus of €2.80.

Asia Pacific, Adidas largest region with 38% of 1Q sales, grew sales 12% on a currency-neutral basis to €2.14 billion, driven by strong 16% pace set in greater China. Emerging markets and Russia/CIS also achieved double-digit currency-neutral growth, 10% and 22%, respectively. Sales in North America were constrained by supply chain shortages and rose 3% on a currency-neutral basis to €1.16 billion. Adidas brand sales rose 5% while Reebok brand sales declined 12% despite growth in Reebok’s Classics. Sales in Europe declined 3.2% to €1.55 billion

Gross margin expanded 250 bps to 53.6% reflecting a 610-bps gross margin improvement to 51.7% in Europe, and supported by lower sourcing costs, positive currency effects and a better channel mix; a 270-bps expansion in Greater China, to 58.7%; and, a 50-bps improvement in North America, to 38.3%.

Operating margin expanded 140 bps to 14.9%, reflecting operating leverage in North America where the operating margin widened 130 bps to 10.8%; a 260-bps improvement in greater China to 38.3%; and, a 460-bps operating margin improvement in Europe, to 26.2%.

Ending 1Q19, the company’s inventory was €3.3 billion, up 1.9% year over year.

Supply-chain shortages are expected to negatively impact revenues by roughly €200 to €400 million, mainly in North America, particularly in the second quarter and partially in the third quarter. Adidas has reviewed is supplier base and brought on new capacity. The company will use overtime and airfreight to remedy the situation near-term.

Outlook

Despite expected continued supply chain constraints through Q4, management reiterated FY19 guidance of:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Adidas reported 4% currency-neutral 1Q19 revenue growth driven by 5.3% growth in the Adidas brand. Revenues rose 6.1% to €5.88 billion, beating the consensus estimate of €5.80 billion. 1Q19 EPS rose 19.5% to €3.17, beating the consensus of €2.80.

Asia Pacific, Adidas largest region with 38% of 1Q sales, grew sales 12% on a currency-neutral basis to €2.14 billion, driven by strong 16% pace set in greater China. Emerging markets and Russia/CIS also achieved double-digit currency-neutral growth, 10% and 22%, respectively. Sales in North America were constrained by supply chain shortages and rose 3% on a currency-neutral basis to €1.16 billion. Adidas brand sales rose 5% while Reebok brand sales declined 12% despite growth in Reebok’s Classics. Sales in Europe declined 3.2% to €1.55 billion

Gross margin expanded 250 bps to 53.6% reflecting a 610-bps gross margin improvement to 51.7% in Europe, and supported by lower sourcing costs, positive currency effects and a better channel mix; a 270-bps expansion in Greater China, to 58.7%; and, a 50-bps improvement in North America, to 38.3%.

Operating margin expanded 140 bps to 14.9%, reflecting operating leverage in North America where the operating margin widened 130 bps to 10.8%; a 260-bps improvement in greater China to 38.3%; and, a 460-bps operating margin improvement in Europe, to 26.2%.

Ending 1Q19, the company’s inventory was €3.3 billion, up 1.9% year over year.

Supply-chain shortages are expected to negatively impact revenues by roughly €200 to €400 million, mainly in North America, particularly in the second quarter and partially in the third quarter. Adidas has reviewed is supplier base and brought on new capacity. The company will use overtime and airfreight to remedy the situation near-term.

Outlook

Despite expected continued supply chain constraints through Q4, management reiterated FY19 guidance of:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Adidas reported 4% currency-neutral 1Q19 revenue growth driven by 5.3% growth in the Adidas brand. Revenues rose 6.1% to €5.88 billion, beating the consensus estimate of €5.80 billion. 1Q19 EPS rose 19.5% to €3.17, beating the consensus of €2.80.

Asia Pacific, Adidas largest region with 38% of 1Q sales, grew sales 12% on a currency-neutral basis to €2.14 billion, driven by strong 16% pace set in greater China. Emerging markets and Russia/CIS also achieved double-digit currency-neutral growth, 10% and 22%, respectively. Sales in North America were constrained by supply chain shortages and rose 3% on a currency-neutral basis to €1.16 billion. Adidas brand sales rose 5% while Reebok brand sales declined 12% despite growth in Reebok’s Classics. Sales in Europe declined 3.2% to €1.55 billion

Gross margin expanded 250 bps to 53.6% reflecting a 610-bps gross margin improvement to 51.7% in Europe, and supported by lower sourcing costs, positive currency effects and a better channel mix; a 270-bps expansion in Greater China, to 58.7%; and, a 50-bps improvement in North America, to 38.3%.

Operating margin expanded 140 bps to 14.9%, reflecting operating leverage in North America where the operating margin widened 130 bps to 10.8%; a 260-bps improvement in greater China to 38.3%; and, a 460-bps operating margin improvement in Europe, to 26.2%.

Ending 1Q19, the company’s inventory was €3.3 billion, up 1.9% year over year.

Supply-chain shortages are expected to negatively impact revenues by roughly €200 to €400 million, mainly in North America, particularly in the second quarter and partially in the third quarter. Adidas has reviewed is supplier base and brought on new capacity. The company will use overtime and airfreight to remedy the situation near-term.

Outlook

Despite expected continued supply chain constraints through Q4, management reiterated FY19 guidance of:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Adidas reported 4% currency-neutral 1Q19 revenue growth driven by 5.3% growth in the Adidas brand. Revenues rose 6.1% to €5.88 billion, beating the consensus estimate of €5.80 billion. 1Q19 EPS rose 19.5% to €3.17, beating the consensus of €2.80.

Asia Pacific, Adidas largest region with 38% of 1Q sales, grew sales 12% on a currency-neutral basis to €2.14 billion, driven by strong 16% pace set in greater China. Emerging markets and Russia/CIS also achieved double-digit currency-neutral growth, 10% and 22%, respectively. Sales in North America were constrained by supply chain shortages and rose 3% on a currency-neutral basis to €1.16 billion. Adidas brand sales rose 5% while Reebok brand sales declined 12% despite growth in Reebok’s Classics. Sales in Europe declined 3.2% to €1.55 billion

Gross margin expanded 250 bps to 53.6% reflecting a 610-bps gross margin improvement to 51.7% in Europe, and supported by lower sourcing costs, positive currency effects and a better channel mix; a 270-bps expansion in Greater China, to 58.7%; and, a 50-bps improvement in North America, to 38.3%.

Operating margin expanded 140 bps to 14.9%, reflecting operating leverage in North America where the operating margin widened 130 bps to 10.8%; a 260-bps improvement in greater China to 38.3%; and, a 460-bps operating margin improvement in Europe, to 26.2%.

Ending 1Q19, the company’s inventory was €3.3 billion, up 1.9% year over year.

Supply-chain shortages are expected to negatively impact revenues by roughly €200 to €400 million, mainly in North America, particularly in the second quarter and partially in the third quarter. Adidas has reviewed is supplier base and brought on new capacity. The company will use overtime and airfreight to remedy the situation near-term.

Outlook

Despite expected continued supply chain constraints through Q4, management reiterated FY19 guidance of:

- Sales growth of 5%-8% on a currency-neutral basis.

- Gross margin of about 52%, up from 51.8%.

- Operating margin expansion of 50-70 bps to 11.3-11.5%, up from 10.8%.

- Net income from continuing operations of €1.88-1.95 billion, up 10-14% from €1.71 billion in 2018.