Introduction

What’s the Story?

The pandemic upset

supply chains the world over, prompting companies to consider how to protect their own from external shocks. Although 2020 should have been a wake-up call to revamp supply chain strategies, companies continued to experience increased disruptions through 2021.

In this report, we present five strategies for brands and retailers to make sourcing more responsive and less susceptible to external pressures. We also discuss companies with innovative solutions for ensuring resilient and agile supply chain ecosystems.

Why It Matters

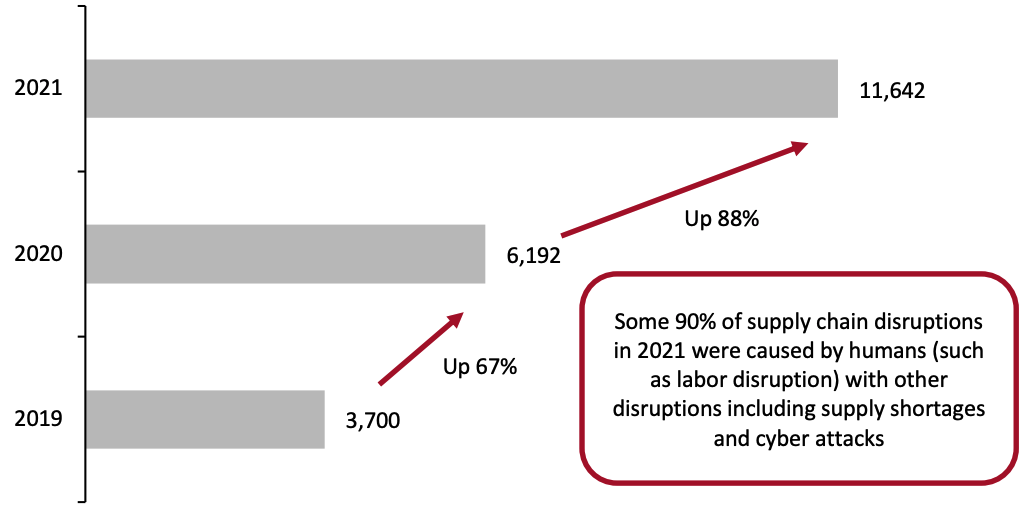

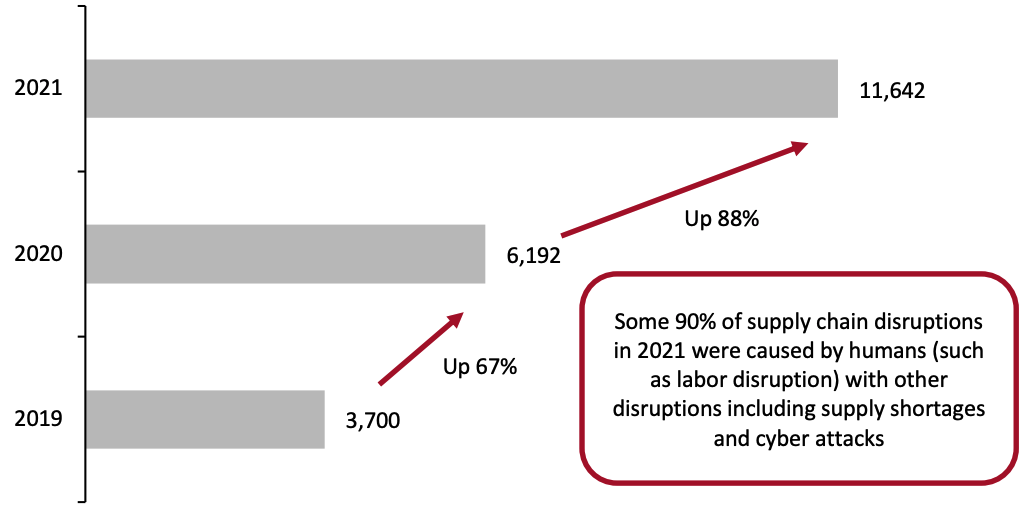

The events of 2020 warranted a close re-examination of sourcing strategies and prompted implementation of more robust supply chain approaches as consumer demand for some categories plunged while other categories saw a sharp increase. However, 2021 turned out to be markedly disruptive and challenges compounded: Global supply chain disruptions were up 88% year over year, according to data from supply chain risk-monitoring provider Resilinc—on top of a 67% increase in disruption in 2020 (see Figure 1).

These statistics underscore the need to build in further agility and resilience into supply chains and sourcing, to ensure businesses are as prepared as possible for impending uncertainties in 2022 and beyond.

Figure 1. Global Supply Chain Disruptions Across Sectors

[caption id="attachment_142937" align="aligncenter" width="700"]

Source: Resilinc

Source: Resilinc[/caption]

Achieving Agility and Resilience in Sourcing: Coresight Research Analysis

While agility and resilience have long been at the heart of sourcing strategies, the pandemic exposed vulnerabilities in even the most well-planned supply chains.

For many companies, the disruptions that arose demanded companies to deal with several challenges at once, including the following:

- Shutdowns of manufacturing/vendor facilities

- Inventory pile-ups in stores, warehouses and distribution centers

- Clogging of routes to market

- Mass employee absenteeism—In 2021, labor events that disrupted supply chains globally were up 156% year over year, according to Resilinc.

- Seesawing in consumer demand

Below, we present five ways that companies can build stronger sourcing processes, with examples from major retail players.

1. Consider Costs and Speed to Market at Each Stage of Sourcing

Companies are often focused on achieving cost savings through isolated sourcing proposals and speed to market by simply considering proximity of sourcing locations. However, by optimizing time across each stage of the sourcing chain, companies could reap incremental speed-to-market benefits.

Gap Inc. stated on its November 24, 2021, earnings call that it is factoring longer delays at ports when planning its product booking deadlines for 2022 so that it can ship most of its goods through ocean freight and receive them on time. It has also accelerated the use of digital product creation for Old Navy’s fall orders adding further speed and efficiency to sourcing.

Macy’s underwent a significant supply chain overhaul through 2019. Its supply chain teams previously worked in brand silos specific to brands rather than product categories, with separate end-to-end processes for each brand, including transport and technology. For a retailer such scale, centralizing operations was not only economical but also helped design teams to work more cohesively. For example, developing common fabrics and samples across brands can cut down approval times in the product development and innovation stage and save on shipping them together. Macy’s achieved a 6% uplift in the cost of goods in pilot programs under the new centralized strategy and aims to achieve a 6%–8% decrease in the cost of goods by 2023.

2. Increase Control Over the Supply Chain

Acquiring vendors or facilities at various stages of the supply chain helps brands and retailers to grow control over sourcing, gain improved visibility and have a greater say in operations of that stage.

Ahold Delhaize announced a supply chain overhaul in December 2019, which included creating an integrated self-distribution model, warehouse design innovations and an expansion of facility locations. As the pandemic elevated demand for essentials, the company recognized its supply chain transformation as more important than ever—matching investments on the demand forecasting and replenishment sides, too.

At the outbreak of the pandemic in 2020, Ahold Delhaize faced challenges in keeping up with the demand surge and had to shift from one main supplier to secondary and tertiary suppliers. The company even had to source products from vendors that specialized in bulk supply to business consumers, and break product down for retail consumer use, according to Chris Lewis, EVP of Ahold Delhaize’s Retail Business Services (which is responsible for back-end innovation).

Lewis stated in an August 2020 interview that “having control of inventory across 18 distribution centers and 2,000 stores means that [Ahold Delhaize will] be better prepared for any spike in sales, from a hurricane or other natural disaster, for example.”

The luxury group is a firm believer in vertical integration. It believes that its control over its factories and supply chain has given the company a competitive advantage over its industry cohorts amid pandemic-led disruptions. At its Investor Day call on November 18, 2021, group management remarked that the company owns 23 manufacturing sites and has long-term relationships with strategic suppliers. Prada’s acquisition of 40% of an Italian yarn supplier in June 2021 is likely part of its long-term strategy to continually tighten its supply chain control.

3. Reassess Supply Chains and Invest in Technologies

The pandemic and resulting disruptions have underscored the significant need for investment in supply chain technologies. Moving forward, retailers should turn to innovative technologies to grow visibility and improve efficiency.

UK-based online retailer Ocado has developed technology that can help to better predict inventory replenishment rates, achieve shorter supply chains and provide greater control over the sourcing process.

In 2019, Ocado invested in vertical farming startup Jones Foods and partnered with 80 Acres Farms, an indoor farming company, that could eventually help Ocado grow produce closer to customer locations, cutting down sourcing efforts and transport times, as well as increasing product freshness.

Ocado stated on its February 11, 2020, earnings call that having larger scale automation and predictability across its warehouses has helped it to remain efficient. Its robotic picking warehouses, automated vehicle routing and scalable

last-mile technology have supplemented its efforts in sourcing, too.

Walmart announced its investment in indoor farming company Plenty on January 25, 2022. Plenty’s proprietary farming technology allows the cultivation of multiple crops on a single platform, in a shorter timeframe and with lower consumption of water and land compared to traditional farming, according to the company’s press release. Walmart aims to cut time to market with its investment in Plenty.

4. Expedite Communication and Transparency

When the pandemic hit, companies had to respond quickly, internally and externally, to understand and act on surges in demand and shortages in supply. Expedited communication and greater transparency will be beneficial for retailers in improving response times and take corrective action quickly in the future.

Tractor Supply has been re-evaluating its sourcing strategy over the past few years, according to Colin Yankee, the company’s EVP and Chief Supply Chain Officer. This reassessment has been driven by internal strategies, such as switching to a total landed cost model (final product costs plus associated shipping and logistics costs incurred in delivering goods to their final destination) from a total cost of ownership model (total landed cost plus costs to own the product, such as storage).

External factors have also had an impact—including tariff changes in 2018 prompting a switch from Chinese imports to making goods in the US or importing from Mexico. The company applied learnings from these changes to manage pandemic-driven disruptions. Tractor Supply is using a mix of structured and unstructured data to coordinate activities in its sourcing chain. One area of focus for the company has been to get earlier visibility into supplier production and transport, so it can be more reactive in case of disturbances and take corrective action across the rest of the supply chain.

5. Explore New Supplier Partnerships

While long-standing relationships with suppliers provide immense cost benefits to retailers, companies should maintain agility by establishing new relationships, too. Finding new suppliers helps companies be apprised of untapped resources for their products and maintain a directory they can leverage when necessary.

As trade fairs were canceled globally in 2020 and much of part of 2021, several companies hosted digital events for supplier or vendor pitches to still be able to explore new partnerships.

- Meijer held a “Localization Summit” on April 1, 2021, to find suppliers of baby, beauty, grocery and personal care products in the US states that it operates in.

- Lowe’s, Staples and Walmart held virtual pitch events in 2020 for small businesses and entrepreneurs to supply specific product categories.

Innovators

Brands and retailers should look to digital partners to help make their sourcing resistant to shocks yet flexible enough to respond quickly and effectively. We discuss companies with innovative solutions for ensuring resilient and agile supply chain ecosystems.

- Community Marketplace is a business-to-business marketplace launched by wholesale organic foods distributor United Natural Foods Inc. (UNFI). Suppliers can use this platform to sell to UNFI’s retailer clients and ship products directly to them. Retailers are able to identify local suppliers quickly and suppliers can find retailers to sell to without having to attend a physical trade fair—cutting the time it takes to source and vet suppliers.

- Fashwire is a global marketplace for fashion designers that offers insights into consumer buying patterns, allowing them to make better and quicker design and production decisions. Having up-to-date, actionable insights is key to developing resilient supply chains in a fast-changing market, such as apparel.

- Everstream Analytics is a supply chain risk analytics company. It uses predictive analytics to help supply chain and logistics specialists have better visibility across their supply chains and make informed decisions on potential disruptions.

What We Think

Retail players are likely to continue facing disruptions to their supply chain, with factors such as port congestion, inflation and the ongoing Russia-Ukraine conflict presenting major challenges. With the vaccine rollout at inconsistent stages across the world, retailers with international sourcing locations need to be prepared for hiccups in supply as well as fluctuations in demand.

Implications for Brands/Retailers

- Retailers should consider cost savings and speed to market through each stage of sourcing and not reserve the decisions to the end segments of the sourcing processes. Large firms will benefit from centralizing decisions while smaller firms should look to decentralization in their supply chain.

- Retailers should expand control over sourcing to be able to respond to demand variabilities quickly. Vertical integration and localizing supply are two ways they can achieve this.

- Retailers and brands should invest in technologies and digitalize the sourcing segment of their supply chains to be at par with the last-mile delivery aspect of their supply chain.

- Previous disruptions to sourcing will give retailers a journal of learnings that they can leverage. They should be quick to sift out relevant lessons and communicate swiftly with concerned parties to minimize ongoing disruptions.

- In times of interruption to supply chains, brands and retailers need to work evermore closely with suppliers and stress the importance of communication. Constant communication and partnership are key to creating win-win situations, even amid adversity.

Implications for Technology Vendors

- Brands and retailers are likely to look for technology that will assist them with identifying areas of risk and how to prepare for them. Technology that provides cost savings, speed, transparency and visibility across the sourcing and supply chain will stand to benefit in the ongoing reassessment of sourcing strategies.

Source: Resilinc[/caption]

Source: Resilinc[/caption]