Nitheesh NH

Academy Sports and Outdoors, Inc.

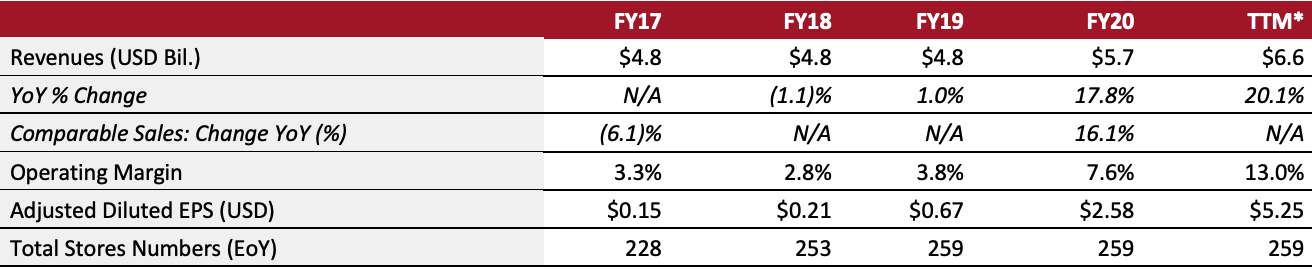

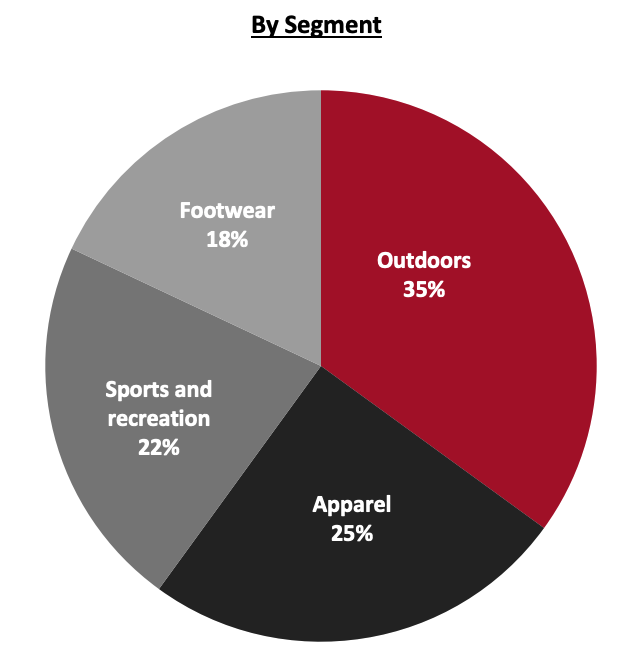

Sector: Apparel specialty retail Countries of operation: The US Key product categories: Sports accessories, apparel, equipment and footwear Annual Metrics [caption id="attachment_141467" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

Fiscal year ends on January 30 of the following calendar year*Trailing 12 months ended October 30, 2021[/caption] Summary Founded in 1938 and headquartered in Katy, Texas, Academy Sports and Outdoors offers an assortment of sports and outdoor accessories, apparel, equipment and footwear. The company offers both national brands and a portfolio of 19 private labels—Academy Sports + Outdoors, AGame, Austin Trading Co., BCG, Brava, FREELY, Game Winner, H2O Xpress, JumpZone, Love + Pineapples, Magellan Outdoors, Marine Raider, Monarch, Mosaic, O’Rageous, Outdoor Gourmet, Ozone 500, Tactical Performance and Yildiz. As of October 30, 2021, the company operates 259 stores. Company Analysis Coresight Research insight: Academy Sports and Outdoors benefits from its buying scale, size and ability to leverage strong relationships with key vendor partners—including leading brand owners, such as Adidas, Colombia, NIKE, The North Face and Under Armour. Its private-label brands (comprising nearly 20% of the company’s total revenues) help to drive strong sales growth—providing a margin benefit and differentiating the company from its competitors. In its third quarter of fiscal 2021 (ended October 30, 2021), the company’s comparable sales increased by 17.9% year over year, representing nine consecutive quarters of positive comp growth—driven by growth across each of its four primary categories of apparel, footwear, outdoors, and sports and recreation. The company stated that it remains optimistic about long-term demand trends in its key categories including athletic apparel, footwear and team sports. Additionally, the company’s Academy Credit Card program continues to grow—and cardholders buy products more frequently with a bigger basket than non-cardholding customers, according to the company’s management. We expect that Academy will continue to post positive comps in the fourth quarter of 2021 and in the full year 2022—as we expect that consumer perspectives concerning active lifestyles will remain unchanged even after the pandemic. New working-from-home set-ups will also continue to support the activewear and outdoor apparel market. In fact, Academy is continuing to expand its outdoor segment: In August 2021, the company, in collaboration with fast-food chain Whataburger, launched a co-branded outdoor apparel line, Magellan Outdoors x Whataburger. Additionally, Academy is aggressively ramping up its e-commerce business, which grew 26% year over year and 147% on a two-year basis in its third quarter of fiscal 2021. The company is also expanding its omnichannel operations, including its ship-from-store capabilities—a critical strategy across the retail landscape as e-commerce specialists continue to gain market share over brick-and-mortar retailers.

| Tailwinds | Headwinds |

|

|

- Cater to customers more effectively by improving understanding of their shopping trends

- Capitalize on data from nearly 40 million customers and over 80 million annual transactions in the company’s database, to make more informed and localized decisions on inventory, marketing and promotion

- Use customer relationship management tools, and create targeted consumer surveys to obtain customer data

- Increase targeted marketing and direct customer communication to yield higher conversion rates

- Invest in omnichannel and digital initiatives to enhance the online experience—with a focus on its mobile site and product information

- Expand “buy online, pickup in store” (BOPIS), curbside fulfilment and ship-to-store capabilities

- Enhance its website’s and app’s capabilities—both consumer-facing and back-end functionality—to create faster and more seamless transactions, which improve conversion

- Optimize merchandise presentation through store remodeling, improved visual storytelling and enhanced inventory management—by disciplined pricing markdowns and effective queuing

- Automate inventory re-ordering and labor scheduling, keeping stores and distribution centers in sync

- Improve store operations through personnel and technology investments, in order to increase their productivity and sales conversion

- Open eight to 10 new stores every year beginning in 2022

- Expand into surrounding metro areas and rural locations

Company Developments

Company Developments

| Date | Development |

| January 25, 2022 | Announces that it will open eight new stores in 2022, growing the company’s store count to 267 stores across 18 states. |

| October 28, 2021 | Contributes more than $100,000 to local communities, including 11 chapters of National Police Athletic/Activities Leagues, on National First Responders Day—the third consecutive year the company has contributed to the communities on National First Responders Day. |

| September 7, 2021 | Enters a multi-year partnership with National Police Athletic/Activities Leagues to bolster the relationship between communities and law enforcement, as well as create opportunities for children in underserved communities to enjoy sports and outdoor activities. |

| August 16, 2021 | Launches a co-branded outdoor apparel line, in collaboration with fast-food chain Whataburger: Magellan Outdoors x Whataburger. The new line includes boat shorts, caps, crew shorts and fishing shorts. |

| July 27, 2021 | Announces multi-year sponsorships for Texas Athletics and Austin FC. |

| July 7, 2021 | Announces a donation of $150,000 in cooling neck gaiters to youth fishing and outdoors organizations across the Southeast. |

| June 22, 2021 | Launches a new private-label activewear brand, FREELY, featuring a dress, skort and matching sets for outfits. About one-third of the items used in FREELY are made from recycled materials, promoting the company’s sustainable initiatives. Furthermore, FREELY is offered in sizes ranging from S-3X in order to support inclusivity. |

| October 20, 2020 | Collaborates with the Central Intercollegiate Athletic Association (CIAA), the black athletic conference, for deploying community initiatives, including youth outreach and mentoring programs. |

| October 20, 2020 | Collaborates with the Mid-Eastern Athletic Conference (MEAC), to gain exposure across men’s and women’s basketball and conference championship events. |

| October 13, 2020 | Collaborates with the Southern Intercollegiate Athletic Conference (SIAC), making Academy Sports the official outdoor and sporting goods retailer of the SIAC. |

| March 11, 2020 | Announces a new multi-year partnership with Big 12 conference, making Academy Sports the official outdoors and sporting goods retailer of the conference. |

- Ken Hicks—Chairman, President and CEO

- Steven Lawrence— Executive Vice President and Chief Merchandising Officer

- Michael Mullican—Executive Vice President and CFO

- Samuel Johnson—Executive Vice President, Retail Operations

- Sherry Harriman— Senior Vice President, Logistics and Supply Chain

- Manish Maini—Senior Vice President and Chief Information Officer

Source: Company reports/S&P Capital IQ