Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

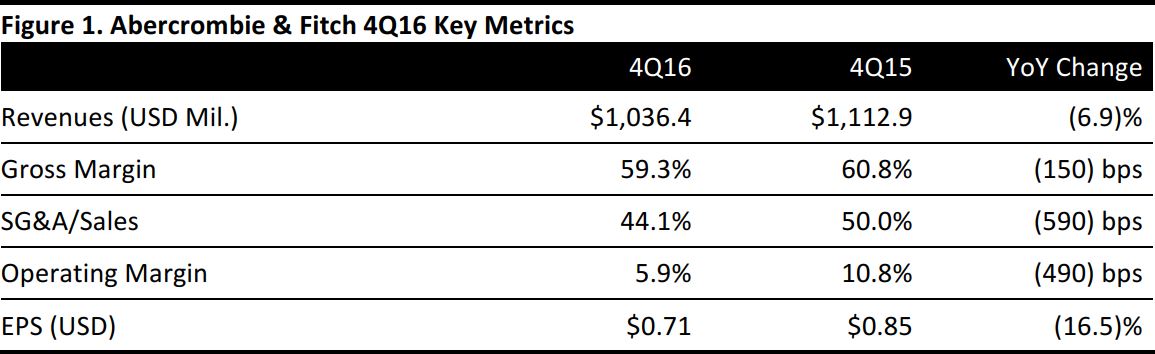

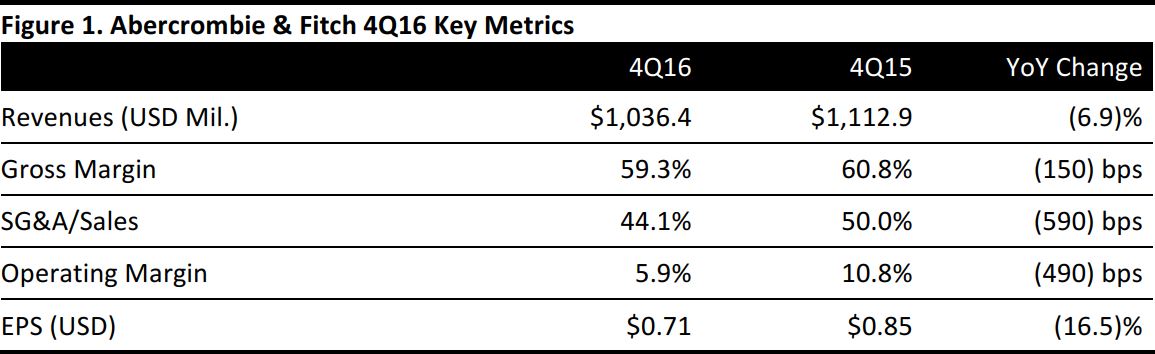

4Q16 Results

Abercrombie & Fitch reported 4Q16 EPS of $0.71, missing the consensus estimate of $0.75 and down from $0.85 in the year-ago period. Total comps were down 5%, beating the consensus estimate of a 5.4% decline. Total revenue was $1.04 billion, down 6.9% from the year-ago quarter and missing the consensus estimate of $1.05 billion.

By business segment, total net sales for the Abercrombie brand were down 13% for the quarter, to $442.4 million. Total comps for the Abercrombie brand were also down 13%, missing the consensus estimate of an 11.3% decline. Sales at Hollister were down 2%, to $594.0 million. Comps at Hollister were up 1%, beating the consensus estimate of a 0.5% decline.

The company’s gross margin decreased by 150 basis points, to 59.3%, primarily due to a lower average unit retail price, which was partially offset by a lower average unit cost. Sales from the direct-to-consumer channel grew to 31% of total sales, up from 28% in the year-ago quarter.

By geography, US sales were down 8%, to $688 million, and international sales were down 5%, to $594 million. International comps improved significantly from (10)% to (4)%.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology