Source: Company reports/FGRT

Source: Company reports/FGRT

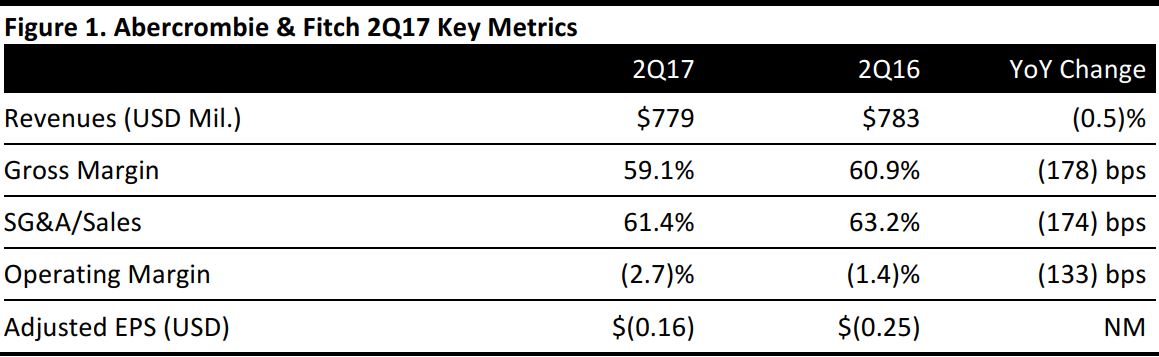

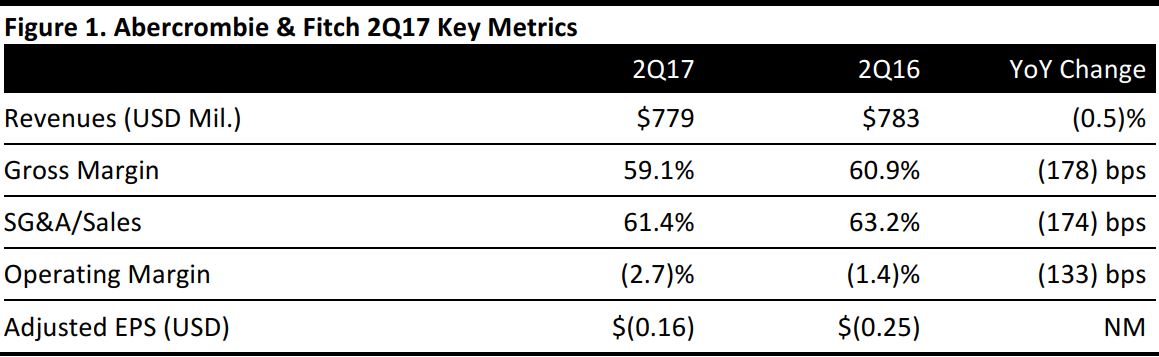

2Q17 Results

Abercrombie & Fitch reported 2Q17 revenues of $779 million, down 0.5% year over year but beating the consensus estimate of $759 million.

Comps decreased by 1%, ahead of the (2)% consensus estimate and up from (3)% in the first quarter. Hollister comps increased by 5%, while Abercrombie comps declined by 7%.

Adjusted EPS was $(0.16), up from $(0.25) in the year-ago quarter and beating the consensus estimate of $(0.33). GAAP EPS was $(0.23), compared with $(0.19) in the year-ago quarter.

Details from the Quarter

Management commented that 2Q17 represented the third consecutive quarter of comp improvement.

- Hollister leveraged higher levels of customer engagement and saw growth across all touch points.

- Abercrombie showed continued improvement in expected areas, as better balance was brought to the assortment throughout the quarter. Management noted that it continued to apply learnings from Hollister’s success.

Management commented further that it expects the environment to remain challenging and promotional in the second half, but that it expects to see benefits from continued improvements in product assortment, strategic investments in marketing and omnichannel, and its ongoing efforts to optimize productivity across all channels.

Outlook

For FY17, the company expects:

- Comparable sales to be approximately flat, and flat to up slightly in the second half of the year.

- Foreign currency to have a slightly positive effect on sales and operating income.

- Gross margin to be down from last year’s margin of 61.0%, and approximately flat in the second half.

- Operating expense to be down at least 3% from last year’s adjusted operating expense of $2.025 billion.

- Capital expenditure to be approximately $100 million.

- To open seven new stores, primarily in the US, in addition to two new outlet stores. The company also expects to close approximately 60 stores in the US through natural lease expirations.

Source: Company reports/FGRT

Source: Company reports/FGRT