Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

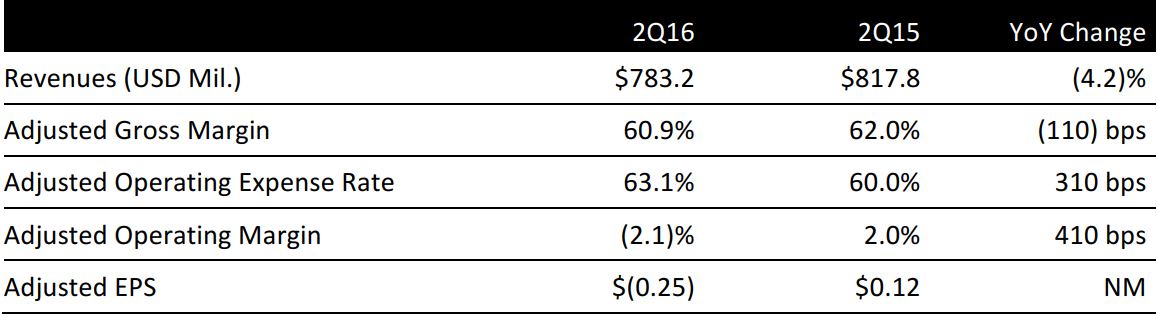

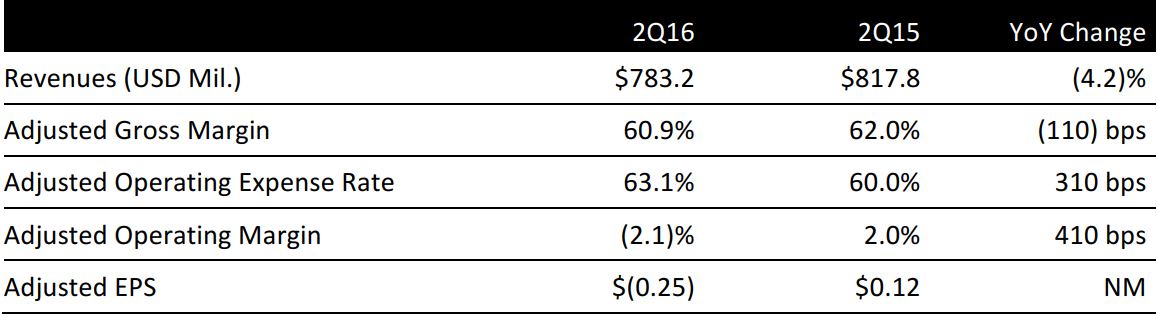

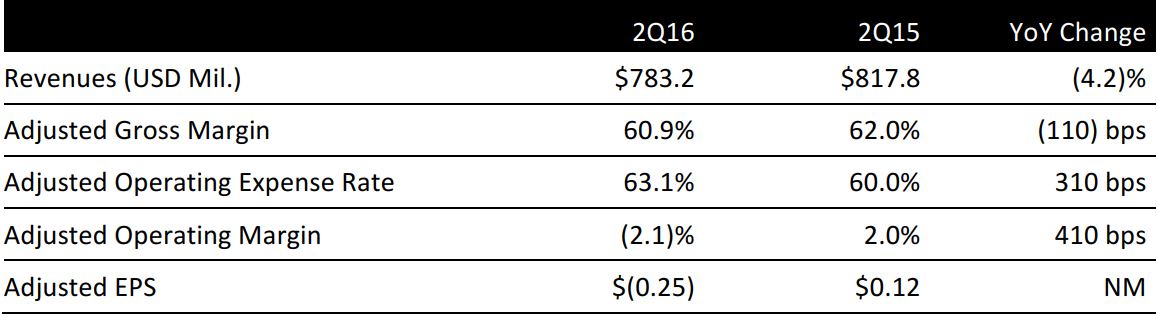

Abercrombie & Fitch reported adjusted 2Q16 EPS of $(0.25) versus consensus of ($0.20).

Total revenue was $783.2 million versus expectations of $782.6 million. Comps were down 4%, in-line with consensus. Abercrombie comps were (7)% versus consensus of (7.2)% and Hollister comps were (2)% versus consensus of (2.3)%.

Traffic remained a significant headwind in the quarter. The overall environment was also more promotional relative to the first quarter.

The company saw a sales recovery in the Hollister European business. In the US, softness versus 1Q16 was driven by fashion misses in the Hollister girls tops business; shorts were also weak at Hollister. The denim category was strong for both genders. At the Abercrombie brand, women’s outpaced the men’s category with swim, dresses and accessories performing well. Tops decelerated relative to the first quarter. In the men’s business, tops remain challenging.

By geography, comps were down 4% in both the US and international markets.

Direct-to-consumer sales grew to approximately 23% of total sales, compared to approximately 21% last year.

During the period, the company opened a Hollister store at Dolphin Mall in Miami, two Hollister stores in China, one in Beijing and one in Qingdao and an A&F outlet store in Deer Park, New York. The store count at the end of 2Q16 was 926 composed of 372 A&F stores and 554 Hollister stores. There were 744 stores in the US, 18 stores in Canada, 117 stores in Europe and 47 stores in the rest of the world.

2016 OUTLOOK

Comps are expected to remain challenging through the second half of the year with a disproportionate effect from flagship and tourist locations. Gross margins are expected to be flat compared to last year’s 61.9%, but down in 3Q16 due to a negative impact related to foreign exchange. Operating expenses are expected to be down on a dollar basis with investments in marketing skewed toward 3Q16, offset by savings related to expense reduction efforts.

Capital expenditures (Capex) are expected to be at the low end of the range of $150 to $175 million for the full year. The company plans to open 15 stores in the fiscal year including 10 stores in international markets, particularly China, and five stores in the US.