Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

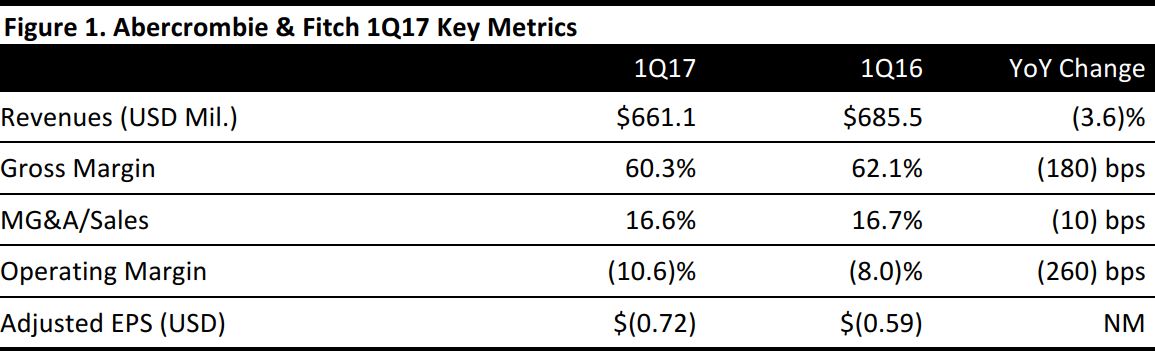

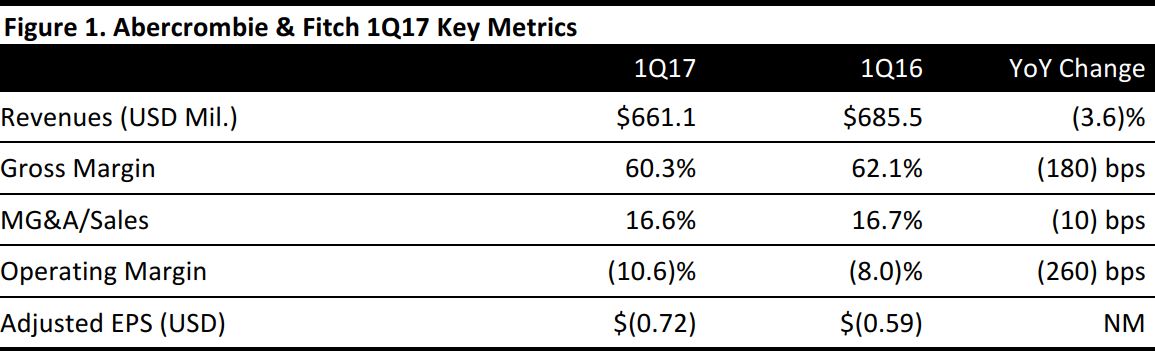

1Q17 Results

Abercrombie & Fitch reported 1Q17 adjusted EPS of $(0.72) compared with a loss of $0.59 in the year-ago quarter; the consensus estimate called for a loss of $0.70.

Total revenues were $661.1 million versus expectations of $651.5 million. Comps were down 3.0%, roughly in line with expectations of a 3.1% decline. Comps at the Abercrombie brand were down 10%, while comps at the Hollister brand (including Gilly Hicks) were up 3%. Geographically, comps were down 3% in the US and down 2% in international markets.

Management was pleased with quarterly results, particularly in March and April as the aggressively promotional environment continued. Abercrombie brand sales were in line with the company’s expectations and management was pleased with the performance at Hollister.

FY17 Outlook

Management expects comparable sales to remain challenging in 2Q17 and to see improvement in trends in the back half of the year. The company expects 2Q17 to remain promotional overall.

The company expects gross margins to continue to be pressured and to be down slightly in 2Q17 compared with 61.0% in 2Q16. The company expects operating expenses to be down at least 3% from the prior-year period’s $2.025 billion, and it expects approximately 65% of the full-year reduction to occur in the second half of the year. Foreign exchange is expected to negatively impact sales and operating income for the remainder of the year.

The company expects capital expenditure to be roughly $100 million for the year.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology