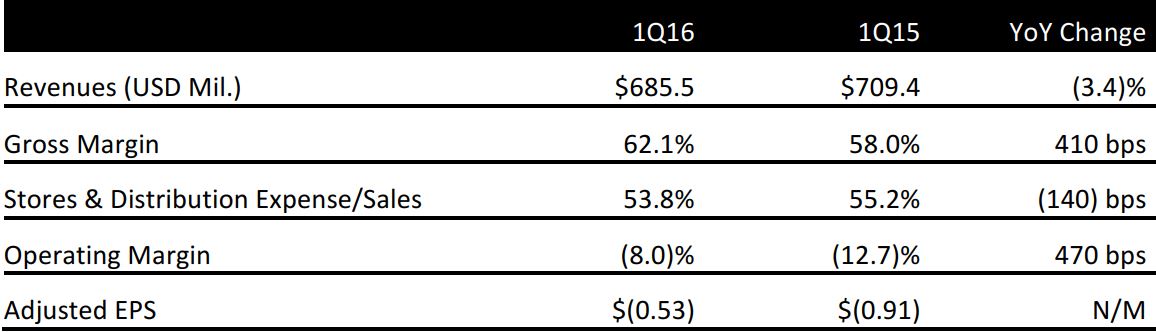

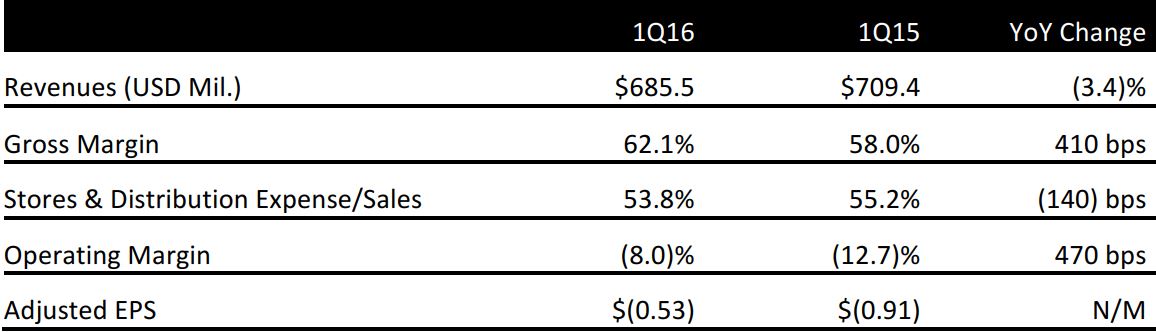

Source: Company reports

1Q16 RESULTS

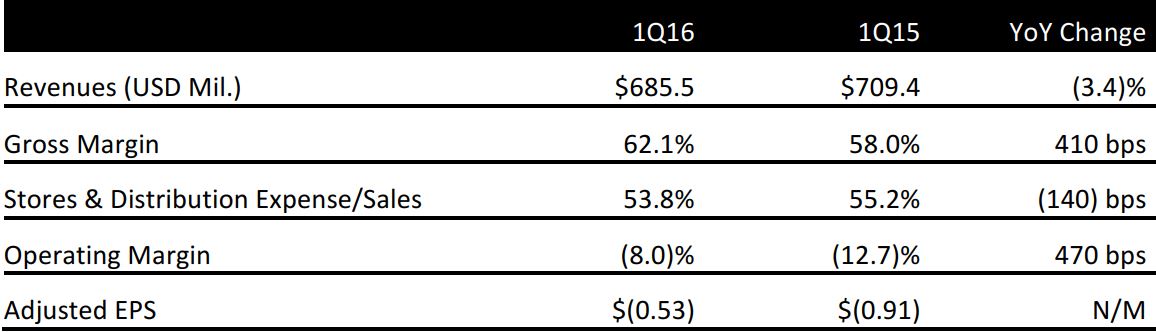

Abercrombie & Fitch reported adjusted 1Q16 EPS of $(0.53) versus the consensus estimate of $(0.51).

Total revenues were $685.5 million versus consensus of $709.5 million. Comps declined by 4% versus expectations of a 1.5% increase. By brand, comps at Abercrombie were down 8% versus consensus of a 0.7% decline and comps at Hollister were flat versus consensus of 3%. By region, US comps were down 2% and international comps were down 7%. Direct sales represented 24% of total sales versus 23% in the year-ago period.

The company experienced significant traffic headwinds in the quarter, particularly at international locations and domestic flagship and tourist stores.

Inventory was down 1.2% at the end of the quarter, compared to a sales decline of 3.4% during the period.

2016 OUTLOOK

Management expects 2Q16 to remain challenging overall and specifically in terms of comp results. Gross margins are expected to decline modestly in the quarter and operating expense dollars are expected to increase by 2%–3%.

For FY16, the company expects to see comps improve in the second half. Gross margins are expected to increase slightly over last year and operating expenses are expected to be flat year over year on a US-dollar basis.