Executive Summary

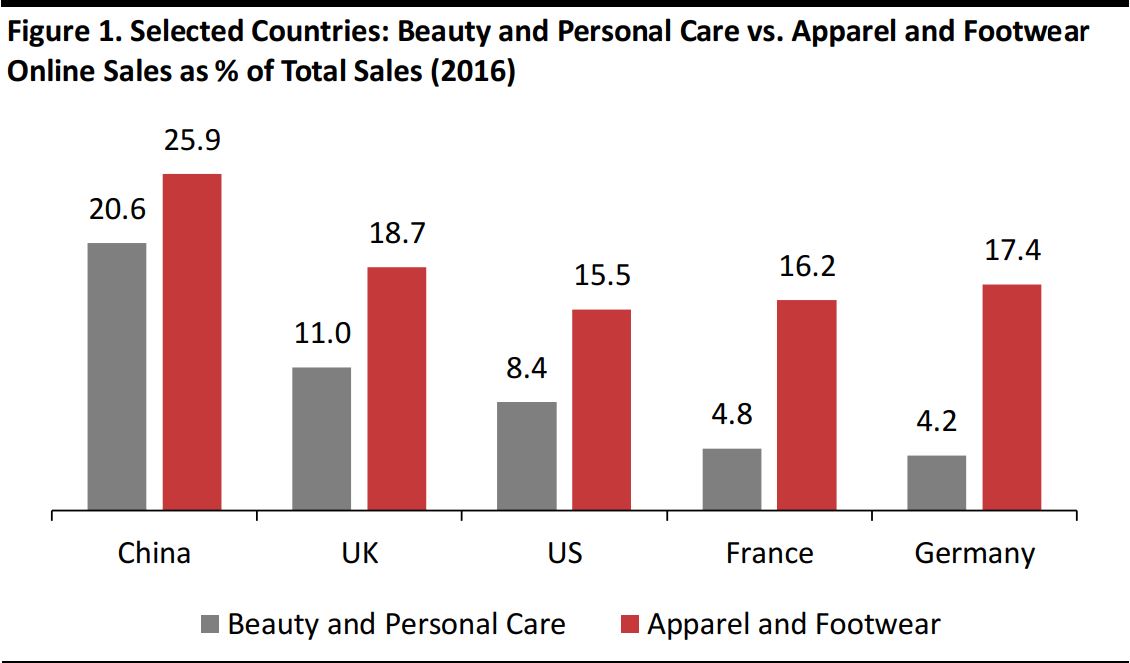

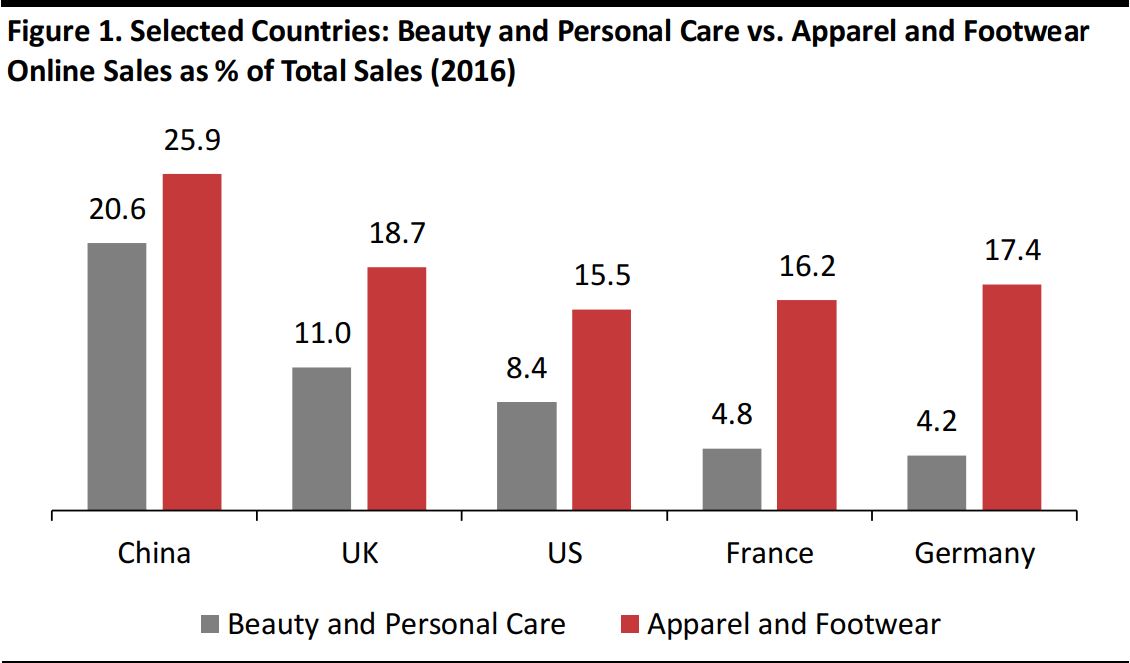

Beauty brands and retailers have moved into the online channel more slowly than sellers of other nonfood categories, such as apparel. In the US, for instance, the proportion of total apparel and footwear sales accounted for by e-commerce in 2016 was almost double the proportion for beauty and personal care items, according to Euromonitor International. However, the online beauty retail market is showing dynamism.

In this report, we feature takeaways from our interview with Joël Palix, CEO of beauty pure play retailer Feelunique, as well as our own analysis and brief descriptions of several major players in the online beauty space. Key details about the market include:

- Online beauty retail is a dynamic market that saw 20% growth year over year in 2016 in countries such as the UK and France, according to The NPD Group.

- Factors that previously depressed e-commerce penetration in the beauty category include consumers’ hesitancy to buy beauty products online (due to a lack of customer support provided through the channel) and beauty brands’ reluctance to venture into e-commerce (due to the risk of losing control of distribution).

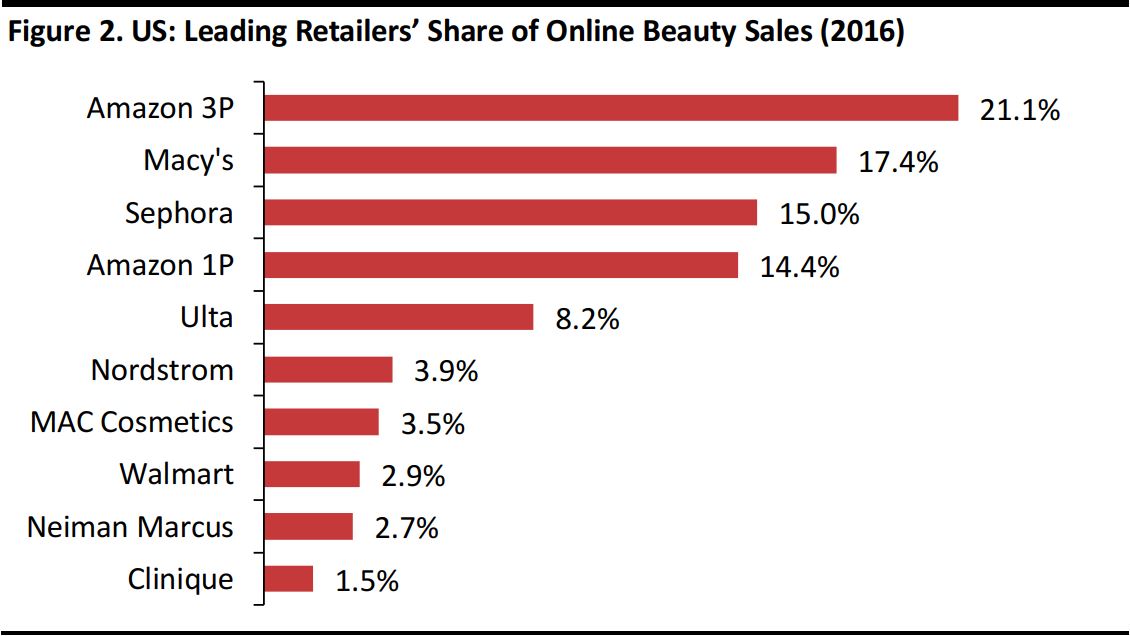

- The online beauty market in the US is dominated by Amazon and department stores. In China, it is dominated by generalist e-commerce marketplaces such as Tmall. In Europe, however, the market is more diverse and specialist beauty pure play retailers are more significant.

- Consumers in China tend to behave differently than shoppers in the US and Europe, according to Palix. While convenience and a wide range of products are the main drivers that attract American and European beauty shoppers to the online channel, Chinese beauty shoppers are mainly driven by price and brand authenticity.

There are opportunities for further expansion of the online beauty retail market. Beauty products are well suited to be sold online because they typically have reasonable unit prices and are compact in size. Young consumers have a propensity to buy beauty products online and the importance of e-commerce in beauty retail in emerging markets such as China should ensure future expansion of the market globally.

Introduction

This report provides an overview of the online beauty market, with a focus on Internet-only beauty retailers. We include the thoughts of Joël Palix, the CEO of beauty pure play Feelunique, who shared his view of the opportunities and challenges the market presents. In our interview with Palix, we discussed the growth of the online channel in beauty, the factors that have slowed online penetration, the main differences among the key regional markets and the opportunities for future expansion of the market. Finally, we profile selected beauty pure play retailers and include a case study on how Feelunique expanded into the Chinese market.

A Pure Play’s Perspective of the Online Beauty Retail Market: Interview with Joël Palix, CEO of Feelunique

In this section, we report the main insights that Feelunique CEO Joël Palix shared with us in an interview and provide further supporting research and analysis.

The Growth of the Online Channel in Beauty

The beauty category’s move into the online channel has been slower than that of other nonfood categories such as apparel, but beauty has been catching up in recent years. In countries such as the UK and France, online beauty sales grew by about 20% year over year in 2016, according to market research firm The NPD Group. In 2017, Feelunique grew revenues by around 20% in the UK and 100% in France. Across all markets, the company grew revenues by 40% in 2017, Palix said.

The graph below shows that the proportion of sales made online in beauty and personal care categories is still lower than the proportion made online in apparel and footwear. In the US, e-commerce’s share of total apparel and footwear sales was 15.5% in 2016, almost double the online channel’s share of beauty and personal care total sales, according to Euromonitor International.

Source: Euromonitor International/FGRT

Why Beauty Has Been Slower to Migrate Online than Other Categories

A number of factors have contributed to the relative underpenetration of e-commerce in beauty:

- Consumers have been reluctant to buy beauty products online in the past, preferring to shop at specialist stores, where they can receive advice from staff, or at supermarkets, where they can easily make repeat purchases of items they frequently buy.

- Beauty brands have been slow to venture into e-commerce because they risk losing control of distribution in the channel.

- Premium brands have perceived that selling online could downgrade their image, as many high-end brands have long been associated with luxury department stores or specialist retailers.

Regulations can also make it more difficult for international beauty pure plays to expand into new markets. The European Union (EU) requires non-EU retailers to have a physical presence in the EU in order to be able to sell in the market, Palix told us. In China, international beauty brands must be registered with Chinese health authorities in order to be able to import their products through domestic suppliers or retailers. This process of registration involves product testing that sometimes results in a company being required to change a product’s formula, which can be burdensome for companies aiming to enter the Chinese market, Palix noted.

Differences Between the American, European and Chinese Beauty Markets

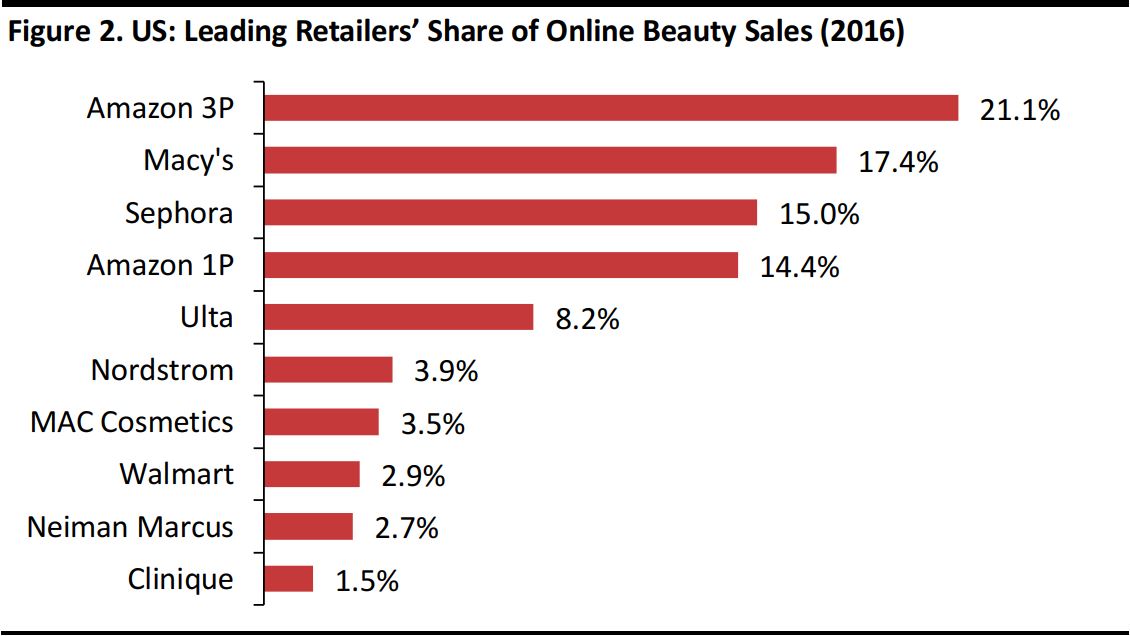

Online beauty retail markets differ in the US, Europe and China. There are no specialist beauty pure plays in the US that can keep up with the big players in the sector, Palix remarked. Amazon is the leading online beauty retailer in the US, providing wide choice, competitive prices and a convenient shopping experience. However, it does not offer the features that specialist online retailers provide, including expert product advice and all the factors that improve the customer journey by guiding shoppers through their purchase, such as storytelling, content and sampling, Palix said.

Aside from Amazon, department stores tend to be the main online distribution channel for beauty products in US, Palix told us. The graph below confirms his insight, and shows that Amazon accounted for 35.5% of total online beauty sales in 2016 when we consider third-party sales (Amazon 3P) and products sold directly by Amazon (Amazon 1P) together. Department store Macy’s held the second-largest share of online beauty sales in the US in 2016, with 17.4%.

Market share based on the fragrance, face makeup, eye makeup, lip makeup and nailcare

categories

Source: 1010data

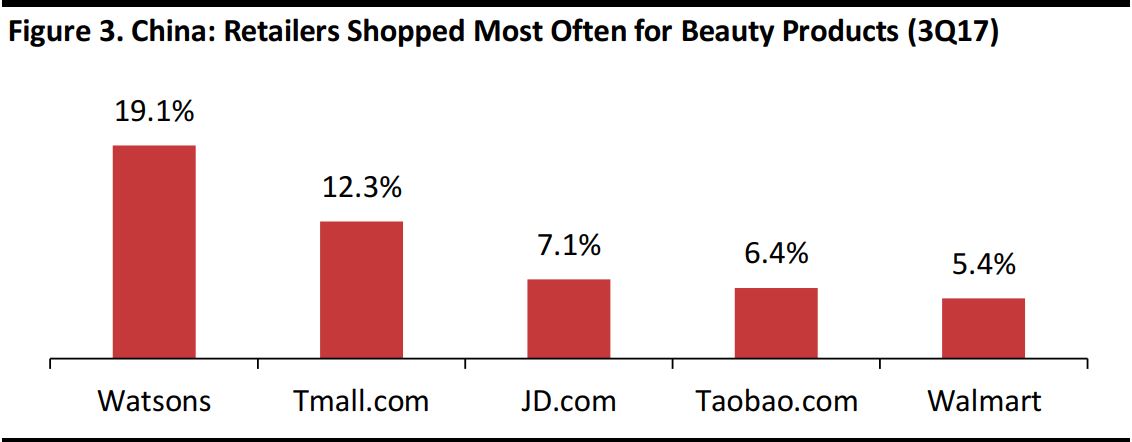

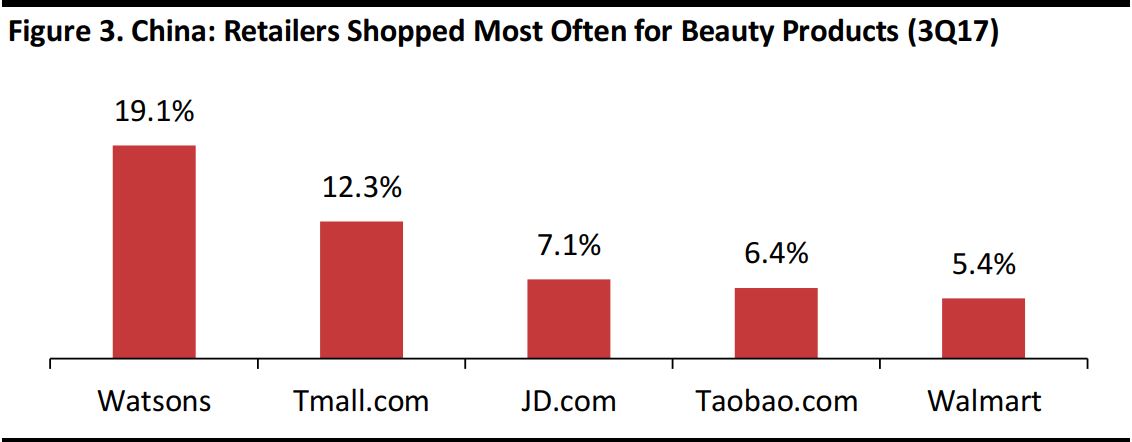

In Europe, the online beauty retail market is more diverse, with a greater number of specialist pure play retailers, Palix said. We profile five European beauty pure plays later in this report—Feelunique, Lookfantastic, Glossybox, MyShowcase and LoveLula—as well as US-based Birchbox. In China, generalist e-commerce platforms Tmall, Taobao and JD.com dominate the online beauty retail market, as shown below.

Base: 5,600 Chinese adults (ages 19–54) surveyed in the third quarter of 2017. Participants were asked, “Where do you buy your beauty products (like skincare, perfume and makeup) most often?”

Source: ProsperChina Quarterly Survey

Consumers in China tend to behave differently than shoppers in the US and Europe, Palix added. While American and European beauty shoppers are mainly attracted to the convenience and wide choice offered by the online channel, Chinese consumers are mainly driven to buy online by price and brand authenticity. These two drivers lead Chinese consumers to shop on platforms such as Taobao when looking for low prices and on specialist international beauty retailers’ websites when looking for international brands that can ensure the products sold are authentic and not counterfeited, Palix said.

Opportunities for Further Expansion of the Online Beauty Retail Market

There is scope for the online beauty retail market to expand. Beauty products are a good match for e-commerce, given the reasonable unit price and compact size of most beauty items. In addition, beauty shoppers do not face some of the issues that shoppers in other categories have to deal with, such as having to choose between different sizes (when buying apparel and footwear, for example) or having to adapt to specific market conditions (needing to buy the right power plug or adapt keyboards and operating systems based on country location when buying consumer electronics, for example).

Moreover, today’s young consumers, who are more inclined than older shoppers to buy beauty items online, will become a more prominent customer base as their incomes rise in the coming years, providing opportunities for further expansion of online beauty sales. According to a November 2017 Prosper Insights & Analytics survey of 12,300 US consumers, only 4.8% of respondents aged 55 or older buy between 26% and 50% of their beauty and personal care products online, versus 14.5% of millennial shoppers (which Prosper defines as those born between 1983 and 1998).

The growing importance of emerging consumer markets such as China—where a greater proportion of shoppers tend to buy beauty and personal care products online compared with the US or Europe—should also ensure further expansion of online beauty sales in the future. Online beauty and personal care sales in China grew by 17.4% year over year in local currency in 2016, versus 10% in the US, according to our analysis of Euromonitor International data.

Profiling Selected Beauty Pure Play Retailers

Below, we profile a selection of major beauty online pure plays. As we noted earlier, specialist beauty pure plays are more prominent in Europe than in the US or China, so our profiles include a number of European companies. For each company, we provide financial performance figures and a brief description of the company’s business model.

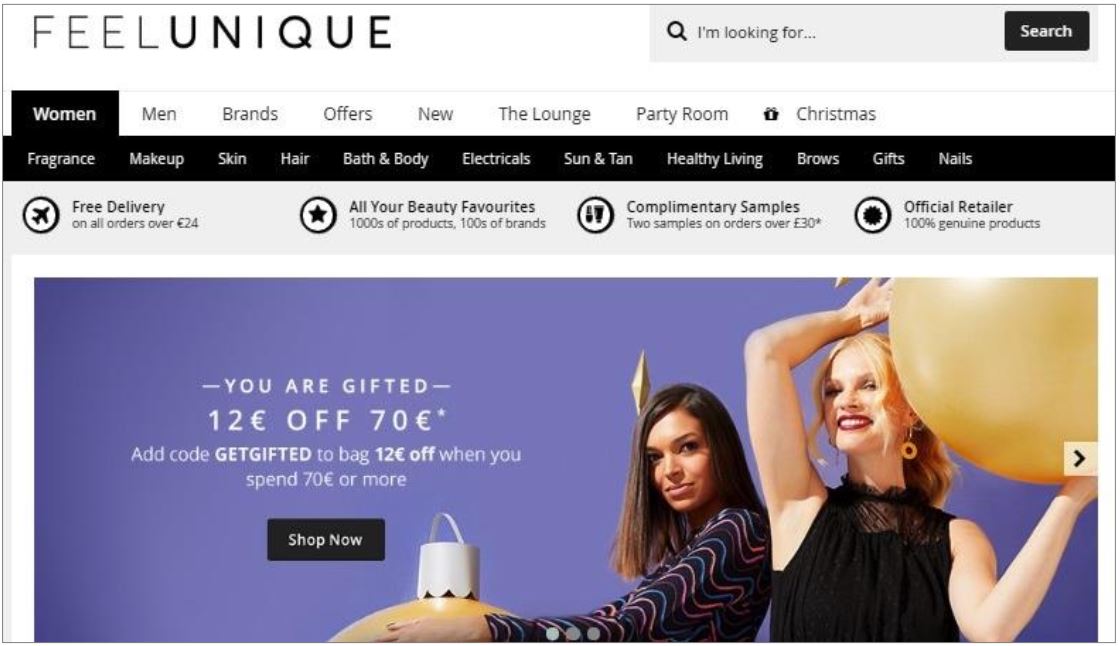

Feelunique

Feelunique is one of Europe’s largest online premium beauty retailers. The company was founded in 2005 and is based in London. Feelunique was acquired by two private equity funds, Palamon Capital Partners and Sirius Equity, in December 2012. The company generated £65.4 million ($87.6 million) in revenue in the year ended March 31, 2017,

Feelunique offers more than 20,000 products from more than 400 beauty brands. The retailer’s portal offers many services aimed at delivering a personalized shopping experience and guiding customers through their shopping journey, including complimentary samples; MyFeelunique, a portal that is personalized for each customer based on the customer’s browsing and shopping history; and The Lounge, a section of the website that features video tutorials.

Source: Azoya International/Feelunique

Lookfantastic

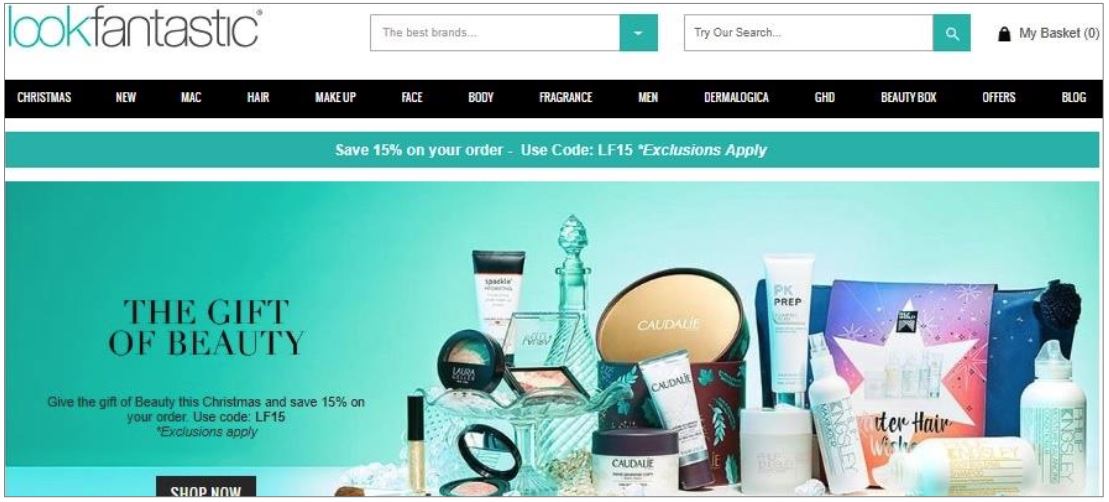

Founded in 1996, online beauty boutique Lookfantastic is a pioneer in online beauty retailing. The company, based in the UK, has grown to become one of the largest online beauty retailers in Europe. Lookfantastic attracts more than half a million unique visitors each month and generated sales of £80 million ($107 million) in 2015, according to the company’s website. The retailer was acquired by British e-commerce firm The Hut Group in 2010 for £19.4 million ($25.9 million).

Source: Lookfantastic.com

Customers can shop for more than 14,000 products from more than 350 beauty brands on Lookfantastic’s site. The retailer offers beauty advice on its blog page, where visitors can access video tutorials and other content. Lookfantastic also offers Beauty Box, a subscription service through which subscribers receive regular deliveries of products.

Birchbox

Birchbox is a beauty box subscription service and online retailer that was founded in 2010. Based in New York, the company operates in the US, the UK, France, Spain and Belgium. Birchbox generated more than $200 million in sales in 2016, according to business magazine

Inc. The company raised $86.9 million in funding in four investment rounds in the period from 2014 to 2016, according to Crunchbase.

Source: Birchbox.com

Subscribers to Birchbox’s subscription service receive a beauty box containing five product samples for $10 a month. Shoppers complete a profile with their beauty preferences, so that Birchbox can tailor the contents of each beauty box to the individual. Shoppers can purchase the full-size version of the products at a discount of $1 off for every $10 spent on beauty boxes. In 2017, the company introduced a more premium box that offers enhanced customization, which is available for $14 a month to existing subscribers only.

Glossybox

Glossybox was founded in Berlin in 2011 and has become one of the leading beauty box subscription services. The company operates in nine markets and has offices in the UK, Germany, France, Sweden and the US. Glossybox raised $72 million from private equity investors, including venture capital firm Rocket Internet, between 2011 and 2016, according to Crunchbase. The company was acquired in 2017 by The Hut Group.

Source: Glossybox.com

Glossybox customers pay $21 a month to subscribe to a monthly or three-, six- or 12-month plan that entitles them to receive a monthly beauty box containing five products. The items are selected by beauty experts according to the preferences that the customer indicated during the sign-up process.

MyShowcase

MyShowcase was founded in 2012 in the UK with the aim of helping shoppers discover high-quality, independent beauty brands that have little exposure to the traditional high-street distribution channels. The company raised £2.2 million ($2.9 million) from investors in two equity funding rounds in 2015 and 2017, according to Crunchbase. MyShowcase’s turnover rose from £0.5 million ($0.7 million) in 2014 to £3 million ($4 million) in 2015, according to news portal Private Equity Wire.

Source: MyShowcase.com

MyShowcase combines e-commerce with direct selling. Customers can buy directly on the company’s website, but MyShowcase also employs stylists and self-employed distributors (who are typically also customers of the company) who wish to build their sales network. Stylists pay £199 ($266) for a starter pack that contains £400 ($544) worth of product samples, and they can earn up to 30% commission on sales.

LoveLula

LoveLula is an online organic beauty brand owned by UK-based firm Amarya, which was founded in 2008. Amarya owns a portfolio of pure play beauty brands, including organic skincare retailer Balm Balm and ManOrganic, which makes organic grooming products for men. LoveLula’s gross annual turnover grew from £37,000 ($49,473) to close to £1 million ($1.3 million) in the six years ended 2015, according to specialist information website Crowdfund Insider.

Source: LoveLula.com

LoveLula specializes in natural and organic beauty products that are not tested on animals. The retailer sells products from more than 200 brands. LoveLula also offers a beauty box subscription service though which customers can receive product samples. Subscription fees start at £13.95 ($18.65) per month.

Key Takeaways

Online beauty retail is a dynamic market that grew by 20% year over year in 2016 in countries such as the UK and France, according to The NPD Group. However, some beauty brands have been reluctant to venture in e-commerce because they risk losing control of distribution.

According to Joël Palix, CEO of Feelunique, the online beauty market in the US is dominated by Amazon and department stores. In China, generalist e-commerce platforms such as Tmall, Taobao and JD.com dominate, but in Europe, the market is more diverse and specialist beauty pure play retailers such as Feelunique are more significant.

There are opportunities for the online beauty retail market to expand further. Many beauty products are well suited to be sold online thanks to their reasonable unit prices and compact size. Young consumers’ propensity to buy beauty products online and the importance of e-commerce in beauty retail in emerging markets such as China should ensure future expansion of the market globally.

Feelunique offers more than 20,000 products from more than 400 beauty brands. The retailer’s portal offers many services aimed at delivering a personalized shopping experience and guiding customers through their shopping journey, including complimentary samples; MyFeelunique, a portal that is personalized for each customer based on the customer’s browsing and shopping history; and The Lounge, a section of the website that features video tutorials.

Feelunique offers more than 20,000 products from more than 400 beauty brands. The retailer’s portal offers many services aimed at delivering a personalized shopping experience and guiding customers through their shopping journey, including complimentary samples; MyFeelunique, a portal that is personalized for each customer based on the customer’s browsing and shopping history; and The Lounge, a section of the website that features video tutorials.