Nitheesh NH

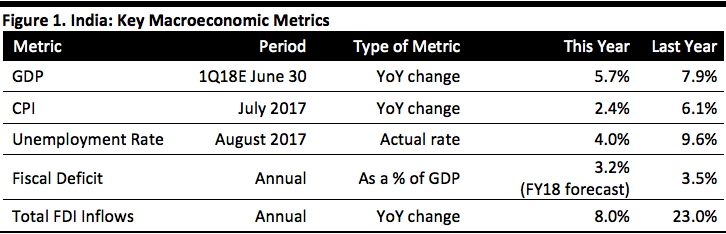

[caption id="attachment_86458" align="aligncenter" width="720"] Note: India’s financial year runs from April 1 to March 31.

Note: India’s financial year runs from April 1 to March 31.

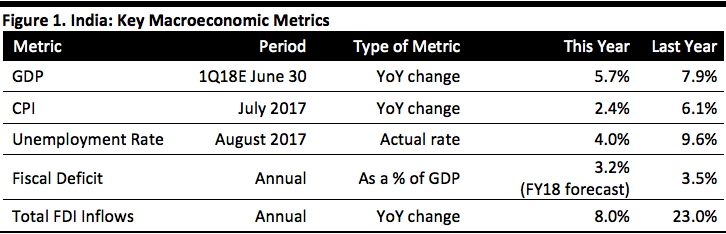

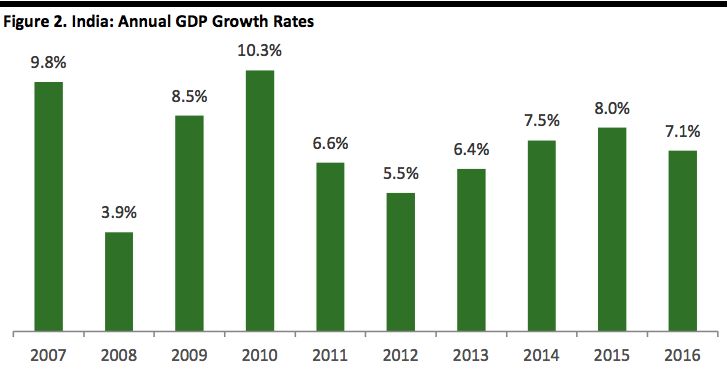

Source: MOSPI/Bombay Stock Exchange/Centre for Monitoring Indian Economy/Ministry of Finance: Department of Economic Affairs/Ministry of Commerce and Industry[/caption] An Overview of India’s Key Macroeconomic Data India has been garnering much global attention for the pace of its economic growth and has attracted billions of dollars in investments. India vies with China for the title of fastest-growing major emerging economy. India’s economy is more liberal than China’s, and in recent years India has been shedding its protectionist policies and growing faster than China. However, recently released numbers reveal that India’s GDP growth slipped back significantly, to 5.7%, in the first quarter, ended June 30, 2017. [caption id="attachment_86459" align="aligncenter" width="720"] Source: World Bank[/caption]

In this report, we scrutinize key data to understand the country’s macroeconomic health. In particular, we highlight two radical initiatives that the government of India has implemented in the past 12 months that have had a significant impact on the country’s economy:

Source: World Bank[/caption]

In this report, we scrutinize key data to understand the country’s macroeconomic health. In particular, we highlight two radical initiatives that the government of India has implemented in the past 12 months that have had a significant impact on the country’s economy:

Source: Central Board of Excise and Customs/The Economic Times[/caption]

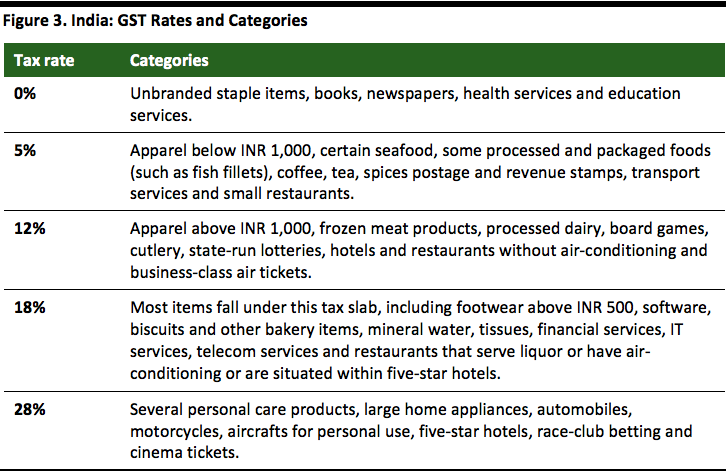

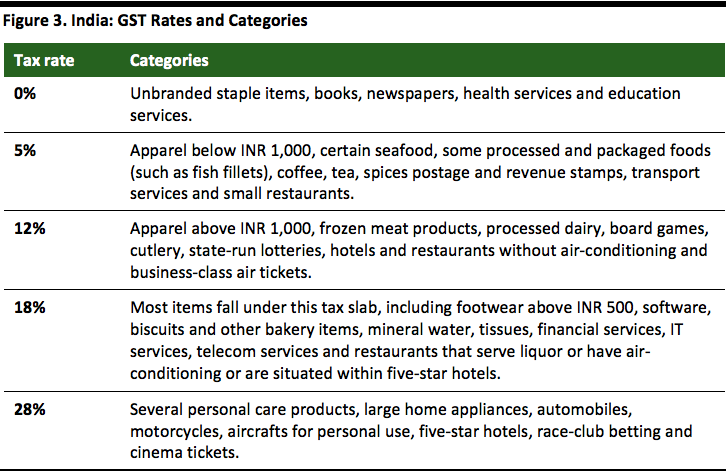

The government has even put into operation a new website and system to help businesses file taxes easily. As businesses were informed about the GST implementation months in advance, they had time to prepare their goods and services for sale under the new regime. Many retailers attempted to de-stock products with the old tax rates printed on price tags before July 1 and held “pre-GST” discount sales.

GDP: India’s Economic Growth Slows

Recently released numbers reveal that India’s GDP growth was 5.7% in the first quarter, ended June 30, 2017.

Source: Central Board of Excise and Customs/The Economic Times[/caption]

The government has even put into operation a new website and system to help businesses file taxes easily. As businesses were informed about the GST implementation months in advance, they had time to prepare their goods and services for sale under the new regime. Many retailers attempted to de-stock products with the old tax rates printed on price tags before July 1 and held “pre-GST” discount sales.

GDP: India’s Economic Growth Slows

Recently released numbers reveal that India’s GDP growth was 5.7% in the first quarter, ended June 30, 2017.

Source: MOSPI[/caption]

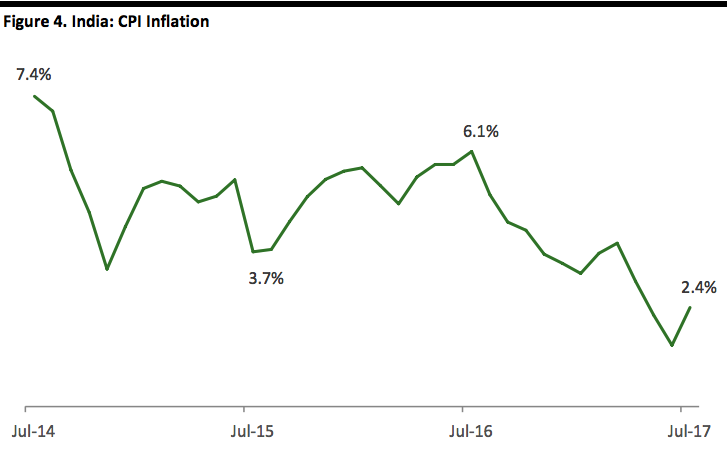

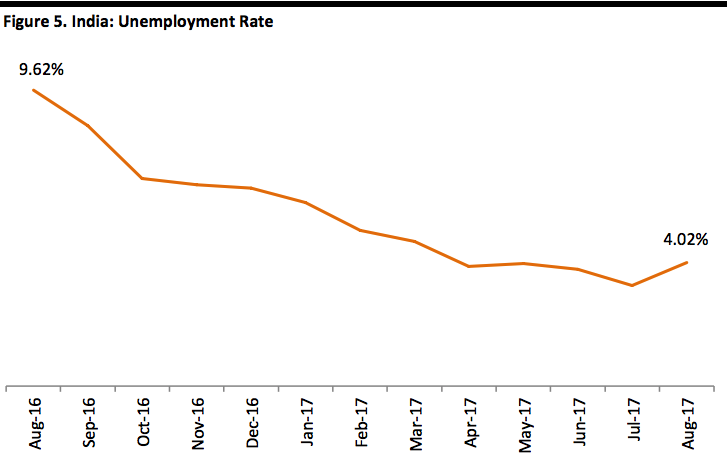

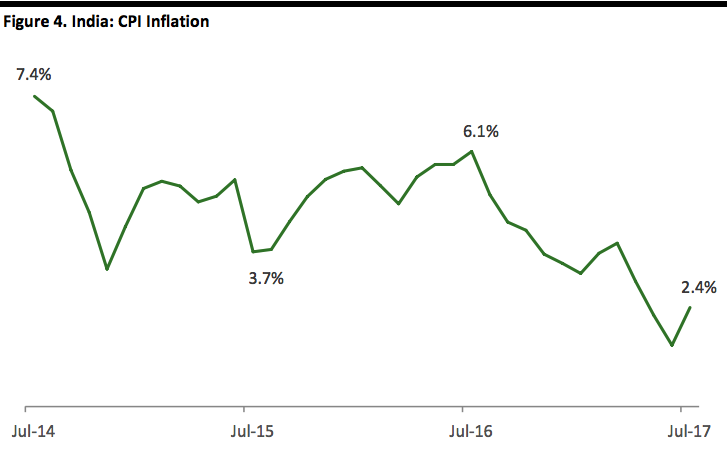

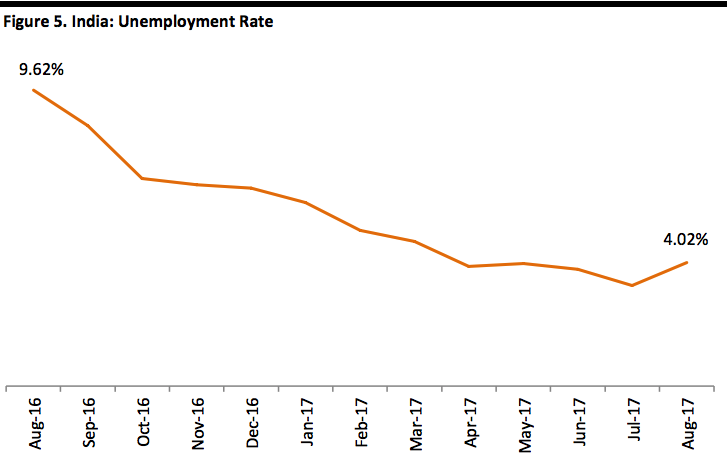

Unemployment Rate Falling

The unemployment rate in August 2017 was 4.0%, a fall from the 9.6% recorded in August 2016. A UN report released earlier this year forecasts the number of unemployed people in India will increase by 300,000 to 18 million by next year, but in terms of the unemployment rate, it is expected to fall further to 3.4%.

In an action plan released by the government in August 2017, it hopes to tackle underemployment where multiple workers are performing the role of a single worker, and intends to cut back investments on labor-intensive industries.

[caption id="attachment_86462" align="aligncenter" width="720"]

Source: MOSPI[/caption]

Unemployment Rate Falling

The unemployment rate in August 2017 was 4.0%, a fall from the 9.6% recorded in August 2016. A UN report released earlier this year forecasts the number of unemployed people in India will increase by 300,000 to 18 million by next year, but in terms of the unemployment rate, it is expected to fall further to 3.4%.

In an action plan released by the government in August 2017, it hopes to tackle underemployment where multiple workers are performing the role of a single worker, and intends to cut back investments on labor-intensive industries.

[caption id="attachment_86462" align="aligncenter" width="720"] Source: Centre for Monitoring India Economy[/caption]

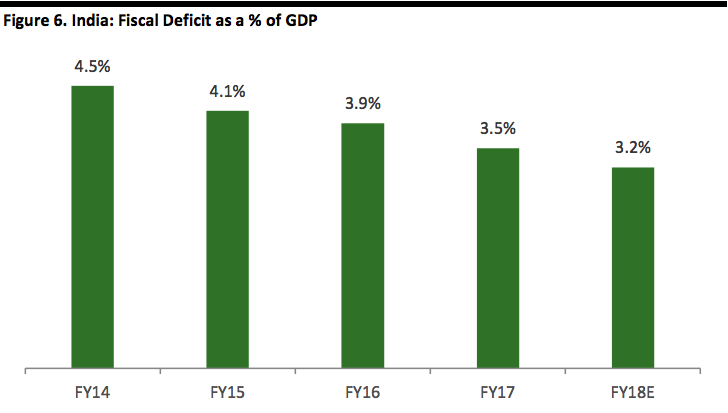

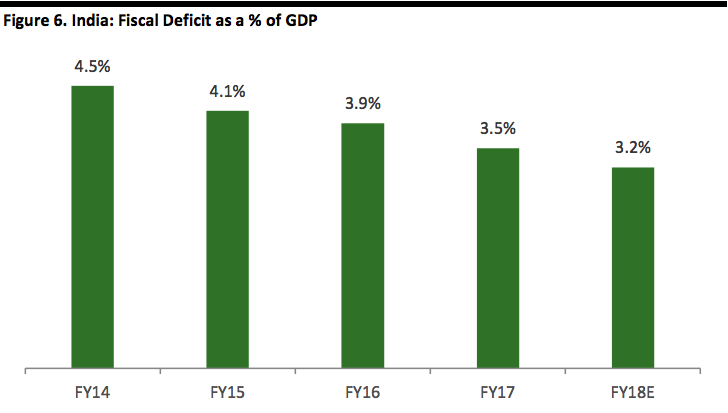

Fiscal Deficit Narrows

India’s fiscal deficit has been narrowing over the years, denoting a recovering exchequer. The Indian government has forecast the fiscal deficit for FY18 to be 3.2% of GDP, a narrowing from 3.5% last year. It hopes to reduce it further, to 3.0% of GDP, by FY19.

The two initiatives outlined earlier seem likely to help move the economy toward this goal. Demonetization, which will help reduce the shadow economy and increase the visibility of taxable income, should help bring in more tax revenues. As the hiccups in implementing the new GST subside and businesses are expected to file taxes seamlessly, tax revenues seem set to grow.

[caption id="attachment_86463" align="aligncenter" width="720"]

Source: Centre for Monitoring India Economy[/caption]

Fiscal Deficit Narrows

India’s fiscal deficit has been narrowing over the years, denoting a recovering exchequer. The Indian government has forecast the fiscal deficit for FY18 to be 3.2% of GDP, a narrowing from 3.5% last year. It hopes to reduce it further, to 3.0% of GDP, by FY19.

The two initiatives outlined earlier seem likely to help move the economy toward this goal. Demonetization, which will help reduce the shadow economy and increase the visibility of taxable income, should help bring in more tax revenues. As the hiccups in implementing the new GST subside and businesses are expected to file taxes seamlessly, tax revenues seem set to grow.

[caption id="attachment_86463" align="aligncenter" width="720"] Source: Ministry of Finance: Department of Economic Affairs[/caption]

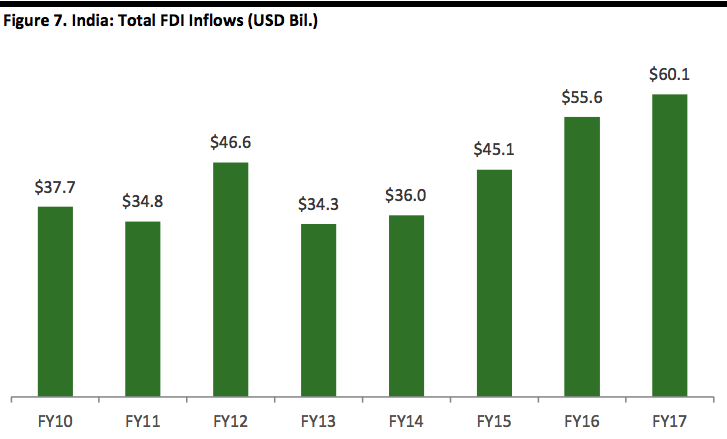

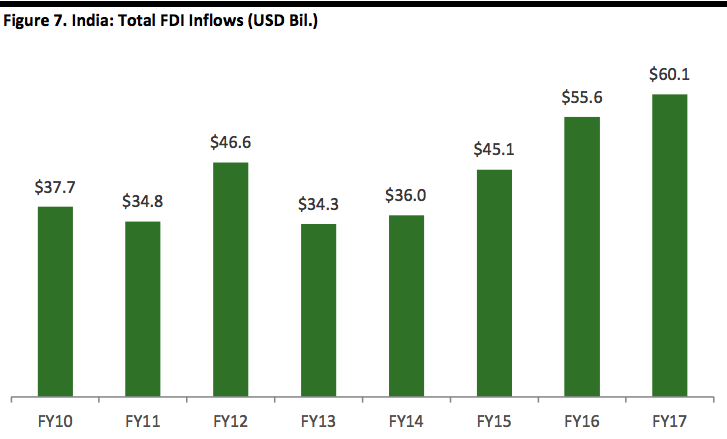

Total FDI Inflows

India has been receiving a steady stream of foreign direct investment (FDI), but in terms of growth, FY16 saw a higher increase (23% growth) than FY17 (8% growth). In the current fiscal year up to June 2017, India has received $14.5 billion in total FDI inflows, reflecting 23.8% year-over-year growth for the quarter, according to RBI data.

India operated a somewhat closed economy until 1991, after which it brought in a wave of reforms to open various sectors to foreign investment. We discussed these reforms in detail in our earlier report International Apparel Retailers in India—Jumping the Hurdles in Pursuit of Growth. As the government continues to ease restrictions on foreign investment in India, particularly in retail, more international funds are expected to flow into India.

[caption id="attachment_86464" align="aligncenter" width="720"]

Source: Ministry of Finance: Department of Economic Affairs[/caption]

Total FDI Inflows

India has been receiving a steady stream of foreign direct investment (FDI), but in terms of growth, FY16 saw a higher increase (23% growth) than FY17 (8% growth). In the current fiscal year up to June 2017, India has received $14.5 billion in total FDI inflows, reflecting 23.8% year-over-year growth for the quarter, according to RBI data.

India operated a somewhat closed economy until 1991, after which it brought in a wave of reforms to open various sectors to foreign investment. We discussed these reforms in detail in our earlier report International Apparel Retailers in India—Jumping the Hurdles in Pursuit of Growth. As the government continues to ease restrictions on foreign investment in India, particularly in retail, more international funds are expected to flow into India.

[caption id="attachment_86464" align="aligncenter" width="720"] Source: RBI[/caption]

What We Think

With India being portrayed as one of the fastest-growing large economies in the world, the GDP growth rate is a closely watched figure. While demonetization and the GST implementation have impacted the most recent quarter’s figures, the economy will eventually stabilize as market forces come into play, unless there are further economic shocks in the coming quarters.

As other economic indicators seem to tell a more positive story, and with the government claiming to work toward cushioning the impact of both moves, it is possible India will regain its strong growth trajectory, however, it may not reach those ambitious levels in the immediate quarters that were forecast prior to these economic shocks.

Source: RBI[/caption]

What We Think

With India being portrayed as one of the fastest-growing large economies in the world, the GDP growth rate is a closely watched figure. While demonetization and the GST implementation have impacted the most recent quarter’s figures, the economy will eventually stabilize as market forces come into play, unless there are further economic shocks in the coming quarters.

As other economic indicators seem to tell a more positive story, and with the government claiming to work toward cushioning the impact of both moves, it is possible India will regain its strong growth trajectory, however, it may not reach those ambitious levels in the immediate quarters that were forecast prior to these economic shocks.

Note: India’s financial year runs from April 1 to March 31.

Note: India’s financial year runs from April 1 to March 31. Source: MOSPI/Bombay Stock Exchange/Centre for Monitoring Indian Economy/Ministry of Finance: Department of Economic Affairs/Ministry of Commerce and Industry[/caption] An Overview of India’s Key Macroeconomic Data India has been garnering much global attention for the pace of its economic growth and has attracted billions of dollars in investments. India vies with China for the title of fastest-growing major emerging economy. India’s economy is more liberal than China’s, and in recent years India has been shedding its protectionist policies and growing faster than China. However, recently released numbers reveal that India’s GDP growth slipped back significantly, to 5.7%, in the first quarter, ended June 30, 2017. [caption id="attachment_86459" align="aligncenter" width="720"]

Source: World Bank[/caption]

In this report, we scrutinize key data to understand the country’s macroeconomic health. In particular, we highlight two radical initiatives that the government of India has implemented in the past 12 months that have had a significant impact on the country’s economy:

Source: World Bank[/caption]

In this report, we scrutinize key data to understand the country’s macroeconomic health. In particular, we highlight two radical initiatives that the government of India has implemented in the past 12 months that have had a significant impact on the country’s economy:

- Demonetization of high-value bank notes.

- The introduction of a new GST regime.

- Curb the shadow economy, which includes undeclared, unaccounted, taxable income. Many reports estimated this to have been in the range of 15%–30% of India’s GDP.

- Deter counterfeit currency that was in circulation and was being used to fund terrorist activities.

- Push digitalization of the economy, as most transactions in India are paid for in cash.

Source: Central Board of Excise and Customs/The Economic Times[/caption]

The government has even put into operation a new website and system to help businesses file taxes easily. As businesses were informed about the GST implementation months in advance, they had time to prepare their goods and services for sale under the new regime. Many retailers attempted to de-stock products with the old tax rates printed on price tags before July 1 and held “pre-GST” discount sales.

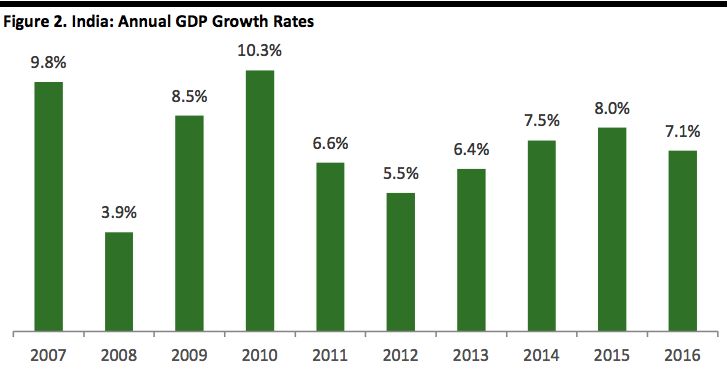

GDP: India’s Economic Growth Slows

Recently released numbers reveal that India’s GDP growth was 5.7% in the first quarter, ended June 30, 2017.

Source: Central Board of Excise and Customs/The Economic Times[/caption]

The government has even put into operation a new website and system to help businesses file taxes easily. As businesses were informed about the GST implementation months in advance, they had time to prepare their goods and services for sale under the new regime. Many retailers attempted to de-stock products with the old tax rates printed on price tags before July 1 and held “pre-GST” discount sales.

GDP: India’s Economic Growth Slows

Recently released numbers reveal that India’s GDP growth was 5.7% in the first quarter, ended June 30, 2017.

- This is the slowest pace of growth in 13 quarters, or just over three years.

- Growth in the corresponding quarter of the previous year was 7.9%, and in the last full fiscal year was 7.1%.

- Earlier this year, the International Monetary Fund (IMF) forecast India’s GDP would expand by 7.2% at the end of this fiscal year, and the UN had initially forecast 7.7%, which it revised to 7.3% in May 2017.

Source: MOSPI[/caption]

Unemployment Rate Falling

The unemployment rate in August 2017 was 4.0%, a fall from the 9.6% recorded in August 2016. A UN report released earlier this year forecasts the number of unemployed people in India will increase by 300,000 to 18 million by next year, but in terms of the unemployment rate, it is expected to fall further to 3.4%.

In an action plan released by the government in August 2017, it hopes to tackle underemployment where multiple workers are performing the role of a single worker, and intends to cut back investments on labor-intensive industries.

[caption id="attachment_86462" align="aligncenter" width="720"]

Source: MOSPI[/caption]

Unemployment Rate Falling

The unemployment rate in August 2017 was 4.0%, a fall from the 9.6% recorded in August 2016. A UN report released earlier this year forecasts the number of unemployed people in India will increase by 300,000 to 18 million by next year, but in terms of the unemployment rate, it is expected to fall further to 3.4%.

In an action plan released by the government in August 2017, it hopes to tackle underemployment where multiple workers are performing the role of a single worker, and intends to cut back investments on labor-intensive industries.

[caption id="attachment_86462" align="aligncenter" width="720"] Source: Centre for Monitoring India Economy[/caption]

Fiscal Deficit Narrows

India’s fiscal deficit has been narrowing over the years, denoting a recovering exchequer. The Indian government has forecast the fiscal deficit for FY18 to be 3.2% of GDP, a narrowing from 3.5% last year. It hopes to reduce it further, to 3.0% of GDP, by FY19.

The two initiatives outlined earlier seem likely to help move the economy toward this goal. Demonetization, which will help reduce the shadow economy and increase the visibility of taxable income, should help bring in more tax revenues. As the hiccups in implementing the new GST subside and businesses are expected to file taxes seamlessly, tax revenues seem set to grow.

[caption id="attachment_86463" align="aligncenter" width="720"]

Source: Centre for Monitoring India Economy[/caption]

Fiscal Deficit Narrows

India’s fiscal deficit has been narrowing over the years, denoting a recovering exchequer. The Indian government has forecast the fiscal deficit for FY18 to be 3.2% of GDP, a narrowing from 3.5% last year. It hopes to reduce it further, to 3.0% of GDP, by FY19.

The two initiatives outlined earlier seem likely to help move the economy toward this goal. Demonetization, which will help reduce the shadow economy and increase the visibility of taxable income, should help bring in more tax revenues. As the hiccups in implementing the new GST subside and businesses are expected to file taxes seamlessly, tax revenues seem set to grow.

[caption id="attachment_86463" align="aligncenter" width="720"] Source: Ministry of Finance: Department of Economic Affairs[/caption]

Total FDI Inflows

India has been receiving a steady stream of foreign direct investment (FDI), but in terms of growth, FY16 saw a higher increase (23% growth) than FY17 (8% growth). In the current fiscal year up to June 2017, India has received $14.5 billion in total FDI inflows, reflecting 23.8% year-over-year growth for the quarter, according to RBI data.

India operated a somewhat closed economy until 1991, after which it brought in a wave of reforms to open various sectors to foreign investment. We discussed these reforms in detail in our earlier report International Apparel Retailers in India—Jumping the Hurdles in Pursuit of Growth. As the government continues to ease restrictions on foreign investment in India, particularly in retail, more international funds are expected to flow into India.

[caption id="attachment_86464" align="aligncenter" width="720"]

Source: Ministry of Finance: Department of Economic Affairs[/caption]

Total FDI Inflows

India has been receiving a steady stream of foreign direct investment (FDI), but in terms of growth, FY16 saw a higher increase (23% growth) than FY17 (8% growth). In the current fiscal year up to June 2017, India has received $14.5 billion in total FDI inflows, reflecting 23.8% year-over-year growth for the quarter, according to RBI data.

India operated a somewhat closed economy until 1991, after which it brought in a wave of reforms to open various sectors to foreign investment. We discussed these reforms in detail in our earlier report International Apparel Retailers in India—Jumping the Hurdles in Pursuit of Growth. As the government continues to ease restrictions on foreign investment in India, particularly in retail, more international funds are expected to flow into India.

[caption id="attachment_86464" align="aligncenter" width="720"] Source: RBI[/caption]

What We Think

With India being portrayed as one of the fastest-growing large economies in the world, the GDP growth rate is a closely watched figure. While demonetization and the GST implementation have impacted the most recent quarter’s figures, the economy will eventually stabilize as market forces come into play, unless there are further economic shocks in the coming quarters.

As other economic indicators seem to tell a more positive story, and with the government claiming to work toward cushioning the impact of both moves, it is possible India will regain its strong growth trajectory, however, it may not reach those ambitious levels in the immediate quarters that were forecast prior to these economic shocks.

Source: RBI[/caption]

What We Think

With India being portrayed as one of the fastest-growing large economies in the world, the GDP growth rate is a closely watched figure. While demonetization and the GST implementation have impacted the most recent quarter’s figures, the economy will eventually stabilize as market forces come into play, unless there are further economic shocks in the coming quarters.

As other economic indicators seem to tell a more positive story, and with the government claiming to work toward cushioning the impact of both moves, it is possible India will regain its strong growth trajectory, however, it may not reach those ambitious levels in the immediate quarters that were forecast prior to these economic shocks.