albert Chan

Introduction

In China, Alibaba Group recorded record sales of US$30.8 billion on Singles’ Day 2018, a 27% increase over 2017. This shopping festival has become one of the most important retailing events in China.

In this third report in our A Guide to Entering China for Foreign Brands and Retailers series, we focus on what successful retailers did to leverage a retail event that has grown to be bigger than Black Friday. See the first instalment in our series Using the Bonded Retail Store Model and the second part Chinese E-commerce Calendar for 2019.

In this report, we turn our attention to Singles’ Day, which an increasing number of brands and retailers are using as a springboard to enter the China market. Here, we leverage our proprietary data sets from Singles’ Day 2018 to provide a detailed analysis of the competitive landscape of selected product categories on Tmall and what strategies successful brands used.

How We Got Our Data

The proprietary data in this report was collated in collaboration with DataWeave, a competitive intelligence platform. We reviewed lists of the top-selling products and their 30-day rolling sales unit sales volumes for products sold on Tmall (for sellers based in China) and for cross-border sales. We analysed sales volumes for the top 500 products in four key categories: womens’ wear, women’s skincare, snacks and diapers. Data was recorded weekly, on October 25, November 1, 8 and 14. The figures for November 14 include Singles’ Day sales. Our methodology is detailed at the end of this report.

Source: DataWeave/Coresight Research[/caption]

How Did Uniqlo and Othermix Do It?

Uniqlo offered multi-purchase discounts, such as cash coupons worth ¥50-150 off purchases over ¥400–1,000.

[caption id="attachment_79187" align="aligncenter" width="338"]

Source: DataWeave/Coresight Research[/caption]

How Did Uniqlo and Othermix Do It?

Uniqlo offered multi-purchase discounts, such as cash coupons worth ¥50-150 off purchases over ¥400–1,000.

[caption id="attachment_79187" align="aligncenter" width="338"] Uniqlo’s Singles’ Day promotions on Tmall

Uniqlo’s Singles’ Day promotions on Tmall

Source: Uniqlo/Tmall[/caption] Uniqlo also promoted its products ahead of Singles’ Day. The brand introduced a mini app on WeChat, which let users track product availability across channels. Uniqlo also posted regularly on Weibo to update customers about goods that were selling out quickly. These tactics helped Uniqlo drive awareness of promotions and underpin its online store traffic. [caption id="attachment_79188" align="aligncenter" width="530"] Uniqlo’s collect-at-store option (left) and post on Singles’ Day on Weibo (right)

Uniqlo’s collect-at-store option (left) and post on Singles’ Day on Weibo (right)

Source: Uniqlo/Weibo[/caption] Fast delivery is also a key success factor: China’s consumers have become accustomed to rapid product delivery, and slow delivery or mis-delivery can dramatically impact overall customer satisfaction. This can prove challenging when sales jump suddenly, as they did for Uniqlo when order volumes climbed 65 times in one day. Uniqlo managed this through effective pre-event planning and offering in-store pickup for online orders. Othermix started promoting its products well in advance of Single’s Day, encouraging customers to buy on social media and on Xiaohongshu, an online platform that showcases customer product reviews, where there was a link to the brand’s Tmall store in its Xiaohongshu posts. [caption id="attachment_79189" align="aligncenter" width="284"] Othermix promoting its products on Xiaohongshu platform

Othermix promoting its products on Xiaohongshu platform

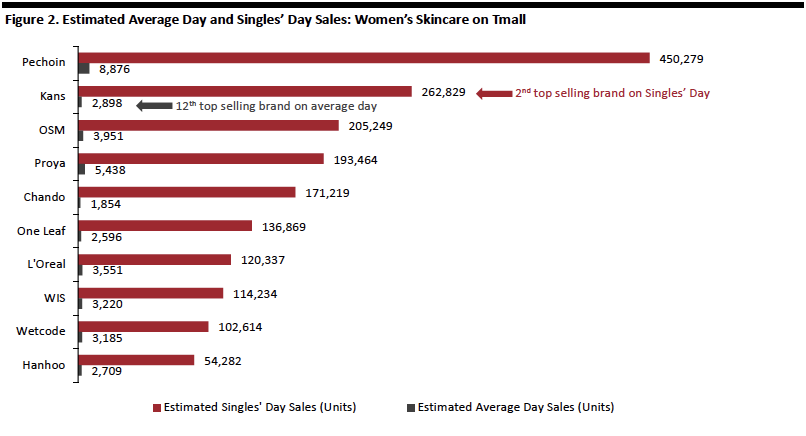

Source: Othermix/Xiaohongshu[/caption] Women’s Skincare on Tmall: How Kans Boosted Its Sales 90-Fold on Singles’ Day Pechoin was the top-selling women’s skincare brand, and we estimate it sold 50 times more compared to an average day. Kans was another top brand, which ranks as 12th best-selling brand by unit sales on an average day – but jumped to 2nd place on Singles’ Day. We estimate Kans sold 90 times more units on Single’s Day than on an average day. [caption id="attachment_79190" align="aligncenter" width="806"] Source: DataWeave/Coresight Research[/caption]

How Did Pechoin and Kans Do It?

Women’s skincare brands on Tmall generally offered cash coupons, discounts for multiple purchases and freebies during Singles’ Day 2018. Pechoin offered freebies for the first 1,000 customers buying select products on Singles’ Day.

[caption id="attachment_79191" align="aligncenter" width="206"]

Source: DataWeave/Coresight Research[/caption]

How Did Pechoin and Kans Do It?

Women’s skincare brands on Tmall generally offered cash coupons, discounts for multiple purchases and freebies during Singles’ Day 2018. Pechoin offered freebies for the first 1,000 customers buying select products on Singles’ Day.

[caption id="attachment_79191" align="aligncenter" width="206"] Pechoin’s promotions on Singles’ Day on Tmall

Pechoin’s promotions on Singles’ Day on Tmall

Source: Pechoin/Tmall[/caption] However, brands must also boost consumer awareness through social media and incorporate Chinese cultural elements into offerings. Pechoin launched a campaign named “crazy shopping cart” on WeChat before Singles’ Day, which consisted of a series of pictures containing a virtual shopping cart that included Pechoin products. The campaign quickly attracted customers’ attention as it contained Chinese cultural elements including dragons and buildings from the Qing dynasty, and WeChat users could easily share the campaign via the app’s “moments” feature that lets users post images, links etc that their contacts can see. This helped Pechoin quickly build a large following on WeChat. Pechoin also offered gifts that appealed to consumers who like watching Chinese historical dramas. To promote its best-selling Aqua Energy Skin Care and Cosmetics Set, Pechoin included customer reviews on its product page, highlighting product benefits. [caption id="attachment_79192" align="aligncenter" width="520"] Pechoin’s Singles’ Day promotions on Tmall

Pechoin’s Singles’ Day promotions on Tmall

Source: Pechoin/Tmall[/caption] Kans leapt from 12th position on an average day to 2nd place on Singles’ Day, selling 90 times more units. Kans supported its Singles’ Day promotions by posting a list of must-buy items on Xiaohongshu prior to Singles’ Day. [caption id="attachment_79193" align="aligncenter" width="548"] Kans showcasing its must-buy items on Singles’ Day

Kans showcasing its must-buy items on Singles’ Day

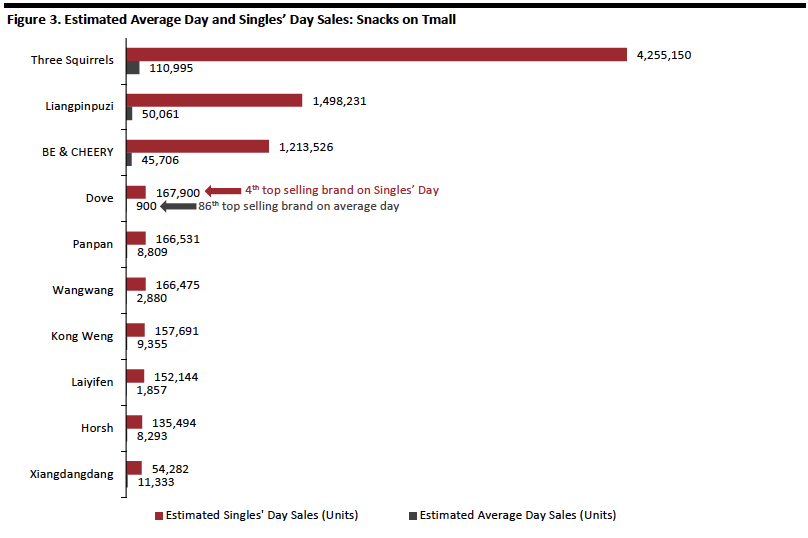

Source: Kans/Xiaohongshu[/caption] Snacks on Tmall: How Three Squirrels and Dove Gained Big on Singles’ Day Three Squirrels was the top snacks brand with estimated Singles’ Day sales of 4.255 million units, 37 times more than the 110,995 we estimate the company sells on an average day. Chocolate brand Dove leapt from 86th position on an average day to 4th place among snack brands, by unit sales, on Singles’ Day. We estimate the brand sold 186 times more on Singles’ Day than on an average day. [caption id="attachment_79194" align="aligncenter" width="808"] Source: DataWeave/Coresight Research[/caption]

How Did Three Squirrels and Dove Do It?

Snack brands generally offered price and multi-purchase discounts. On Singles’ Day 2018, Three Squirrels offered cash coupons worth ¥20–130 on purchases of ¥200–400. However, we think brands need to create innovative offerings on social media, too.

[caption id="attachment_79195" align="aligncenter" width="300"]

Source: DataWeave/Coresight Research[/caption]

How Did Three Squirrels and Dove Do It?

Snack brands generally offered price and multi-purchase discounts. On Singles’ Day 2018, Three Squirrels offered cash coupons worth ¥20–130 on purchases of ¥200–400. However, we think brands need to create innovative offerings on social media, too.

[caption id="attachment_79195" align="aligncenter" width="300"] Three Squirrels’ Singles’ Day promotions on Tmall

Three Squirrels’ Singles’ Day promotions on Tmall

Source: Three Squirrels/Tmall[/caption] Three Squirrels introduced 11 new products and promoted them in the “Squirrel Made 2018” event in Nanjing prior to Singles’ Day. In the event, Three Squirrels invited five endorsers to showcase new products with innovative names and packaging, driving pre-Single’s Day awareness. On another occasion, Three Squirrels featured selected products on Taobao’s live streaming platform with the help of Chinese girl group SNH48. Customers who logged onto Taobao to view the live stream had a chance to win prizes. [caption id="attachment_79196" align="aligncenter" width="486"] Three Squirrels’ ”Squirrel Made 2018” event held in Nanjing (left) and influencer marketing on the Taobao live streaming platform (right)

Three Squirrels’ ”Squirrel Made 2018” event held in Nanjing (left) and influencer marketing on the Taobao live streaming platform (right)

Source: Company website[/caption] In 2018, chocolate brand Dove introduced new products for Singles’ Day, such as chocolates shaped like the Tmall cat logo. Dove’s initiative is a prime example of a retailer generating shopper interest with novelty and innovation rather than simply relying on price promotions. [caption id="attachment_79197" align="aligncenter" width="306"] Dove Chocolates’ new product exclusive to Singles’ Day

Dove Chocolates’ new product exclusive to Singles’ Day

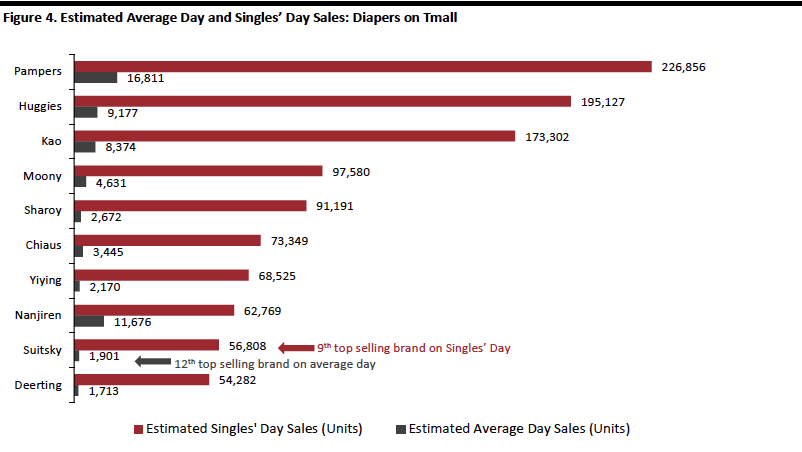

Source: Dove/Tmall[/caption] Diapers on Tmall: Pampers and Suitsky Enjoy Major Sales Boosts on Singles’ Day 2018 The fourth and final category we reviewed was diapers. Our research found Pampers is the best-selling brand on Tmall, on Singles’ Day and on an average day – but sales jumped 12 times on Single’s Day. Suitsky was another brand that saw a strong lift in unit sales on Singles’ Day, as shown below. [caption id="attachment_79198" align="aligncenter" width="802"] Source: DataWeave/Coresight Research[/caption]

How Did Pampers and Suitsky Do It?

Diaper brands on Tmall generally used coupons: Pampers offered coupons worth ¥250-300 off purchases of ¥600-800.

[caption id="attachment_79199" align="aligncenter" width="366"]

Source: DataWeave/Coresight Research[/caption]

How Did Pampers and Suitsky Do It?

Diaper brands on Tmall generally used coupons: Pampers offered coupons worth ¥250-300 off purchases of ¥600-800.

[caption id="attachment_79199" align="aligncenter" width="366"] Pampers’ promotions on Tmall on Singles’ Day

Pampers’ promotions on Tmall on Singles’ Day

Source: Pampers/Tmall[/caption] Pampers also leveraged its relationship with Tmall to feature selected products during the Tmall Baby Products Day event (before Single’s Day), which was broadcast via Taobao and Mangguohuyu live streaming platforms. This helped drive consumer awareness prior to Singles’ Day. [caption id="attachment_79200" align="aligncenter" width="480"] Pampers’ Doraemon-themed booth in Beijing (Left) and Pampers’ presence on Tmall Baby Products Day

Pampers’ Doraemon-themed booth in Beijing (Left) and Pampers’ presence on Tmall Baby Products Day

Source: Pampers/Tmall[/caption] Pampers also offered free product samples and live displays to engage potential customers. The Pampers booth used a Doraemon theme (a popular Japanese comic character) in Beijing on Singles’ Day. Parents could try pampers using fake babies, get expert advice on baby care and free diaper samples. Suitsky, which leapt from 12th position on an average day to ninth position on Singles’ Day, leveraged Chinese actress Yao Chen as brand endorser to showcase products on Tmall’s live streaming platform ahead of Single’s Day. Tapping Singles’ Day Singles’ Day is about more than just slashing prices. Winning brands use a combination of social media campaigns, influencer marketing, product launches and special events to build consumer excitement and drive sales on Singles’ Day.

Methodology in More Detail To estimate Singles’ Day sales for each category and brand, we calculated additional sales generated on Singles’ Day by deducting the 30-day rolling sales at November 8 (representing a typical shopping period) with that on November 14 (which includes Singles’ Day). We then added in the underlying sales generated on a typical day on Tmall to get a Singles’ Day estimate. 30-day rolling sales volume at November 14 (30-day sales volume including Singles’ Day). - 30-day rolling sales volume at November 8 (30-day sales volume excluding Singles’ Day). + [(30-day rolling sales volume at November 8)/30] (Average 1-day sales volume) The methodology used in this report was consistent with that used in our previous reports Singles’ Day 2018: Proprietary Coresight Research Data Reveal the Scale of Growth by Category for Tmall Global and Singles’ Day 2018: Proprietary Coresight Research Data Reveal the Scale of Growth by Category – Part 2 for Tmall. About DataWeave Powered by proprietary artificial intelligence (AI), DataWeave provides actionable competitive-intelligence-as-a-service to retailers and consumer brands in near real time by aggregating and analyzing data from the web. While retailers use DataWeave’s Retail Intelligence product to make smarter pricing and merchandising decisions and drive profitable growth, consumer brands use DataWeave’s Brand Analytics product to protect their brand equity online and optimize the experience delivered to shoppers on e-commerce websites. For more information, visit the DataWeave website.

Category-Level Analysis

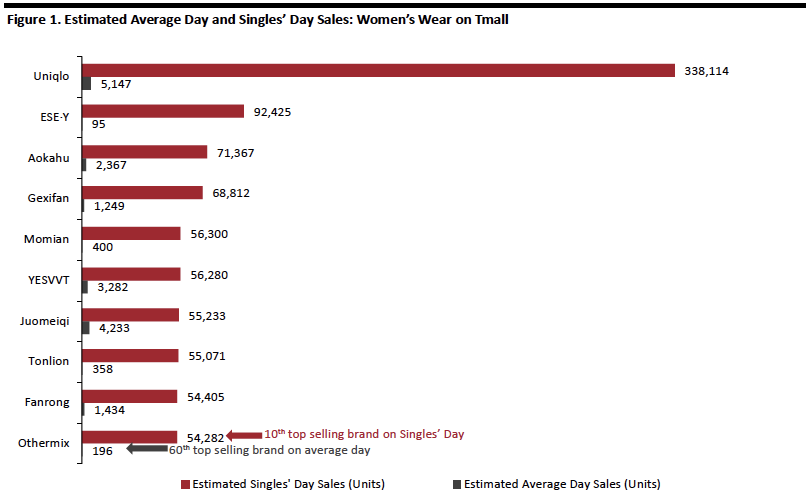

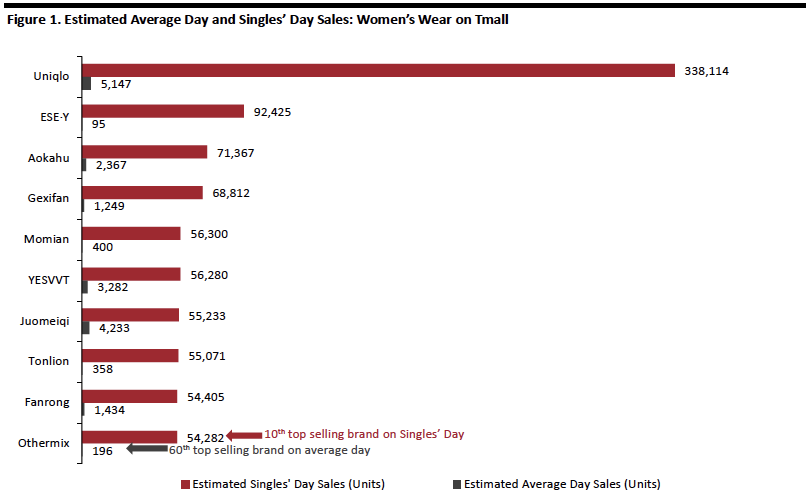

Women’s Wear on Tmall: How Uniqlo and Othermix Gained Big on Singles’ Day Uniqlo was the top apparel brand, with estimated Singles’ Day sales of 338,114 units – compared to its estimated average non-Single’s Day sales of 5,147 units – 65 times more than on an average day. Othermix also saw particular success: It is the 60th best-selling brand by unit sales on an average day – but rose to 10th place on Singles’ Day. [caption id="attachment_79186" align="aligncenter" width="808"] Source: DataWeave/Coresight Research[/caption]

How Did Uniqlo and Othermix Do It?

Uniqlo offered multi-purchase discounts, such as cash coupons worth ¥50-150 off purchases over ¥400–1,000.

[caption id="attachment_79187" align="aligncenter" width="338"]

Source: DataWeave/Coresight Research[/caption]

How Did Uniqlo and Othermix Do It?

Uniqlo offered multi-purchase discounts, such as cash coupons worth ¥50-150 off purchases over ¥400–1,000.

[caption id="attachment_79187" align="aligncenter" width="338"] Uniqlo’s Singles’ Day promotions on Tmall

Uniqlo’s Singles’ Day promotions on TmallSource: Uniqlo/Tmall[/caption] Uniqlo also promoted its products ahead of Singles’ Day. The brand introduced a mini app on WeChat, which let users track product availability across channels. Uniqlo also posted regularly on Weibo to update customers about goods that were selling out quickly. These tactics helped Uniqlo drive awareness of promotions and underpin its online store traffic. [caption id="attachment_79188" align="aligncenter" width="530"]

Uniqlo’s collect-at-store option (left) and post on Singles’ Day on Weibo (right)

Uniqlo’s collect-at-store option (left) and post on Singles’ Day on Weibo (right)Source: Uniqlo/Weibo[/caption] Fast delivery is also a key success factor: China’s consumers have become accustomed to rapid product delivery, and slow delivery or mis-delivery can dramatically impact overall customer satisfaction. This can prove challenging when sales jump suddenly, as they did for Uniqlo when order volumes climbed 65 times in one day. Uniqlo managed this through effective pre-event planning and offering in-store pickup for online orders. Othermix started promoting its products well in advance of Single’s Day, encouraging customers to buy on social media and on Xiaohongshu, an online platform that showcases customer product reviews, where there was a link to the brand’s Tmall store in its Xiaohongshu posts. [caption id="attachment_79189" align="aligncenter" width="284"]

Othermix promoting its products on Xiaohongshu platform

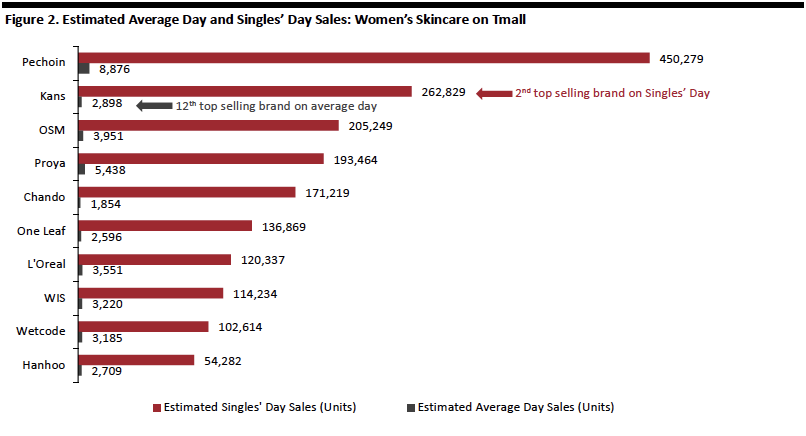

Othermix promoting its products on Xiaohongshu platformSource: Othermix/Xiaohongshu[/caption] Women’s Skincare on Tmall: How Kans Boosted Its Sales 90-Fold on Singles’ Day Pechoin was the top-selling women’s skincare brand, and we estimate it sold 50 times more compared to an average day. Kans was another top brand, which ranks as 12th best-selling brand by unit sales on an average day – but jumped to 2nd place on Singles’ Day. We estimate Kans sold 90 times more units on Single’s Day than on an average day. [caption id="attachment_79190" align="aligncenter" width="806"]

Source: DataWeave/Coresight Research[/caption]

How Did Pechoin and Kans Do It?

Women’s skincare brands on Tmall generally offered cash coupons, discounts for multiple purchases and freebies during Singles’ Day 2018. Pechoin offered freebies for the first 1,000 customers buying select products on Singles’ Day.

[caption id="attachment_79191" align="aligncenter" width="206"]

Source: DataWeave/Coresight Research[/caption]

How Did Pechoin and Kans Do It?

Women’s skincare brands on Tmall generally offered cash coupons, discounts for multiple purchases and freebies during Singles’ Day 2018. Pechoin offered freebies for the first 1,000 customers buying select products on Singles’ Day.

[caption id="attachment_79191" align="aligncenter" width="206"] Pechoin’s promotions on Singles’ Day on Tmall

Pechoin’s promotions on Singles’ Day on TmallSource: Pechoin/Tmall[/caption] However, brands must also boost consumer awareness through social media and incorporate Chinese cultural elements into offerings. Pechoin launched a campaign named “crazy shopping cart” on WeChat before Singles’ Day, which consisted of a series of pictures containing a virtual shopping cart that included Pechoin products. The campaign quickly attracted customers’ attention as it contained Chinese cultural elements including dragons and buildings from the Qing dynasty, and WeChat users could easily share the campaign via the app’s “moments” feature that lets users post images, links etc that their contacts can see. This helped Pechoin quickly build a large following on WeChat. Pechoin also offered gifts that appealed to consumers who like watching Chinese historical dramas. To promote its best-selling Aqua Energy Skin Care and Cosmetics Set, Pechoin included customer reviews on its product page, highlighting product benefits. [caption id="attachment_79192" align="aligncenter" width="520"]

Pechoin’s Singles’ Day promotions on Tmall

Pechoin’s Singles’ Day promotions on TmallSource: Pechoin/Tmall[/caption] Kans leapt from 12th position on an average day to 2nd place on Singles’ Day, selling 90 times more units. Kans supported its Singles’ Day promotions by posting a list of must-buy items on Xiaohongshu prior to Singles’ Day. [caption id="attachment_79193" align="aligncenter" width="548"]

Kans showcasing its must-buy items on Singles’ Day

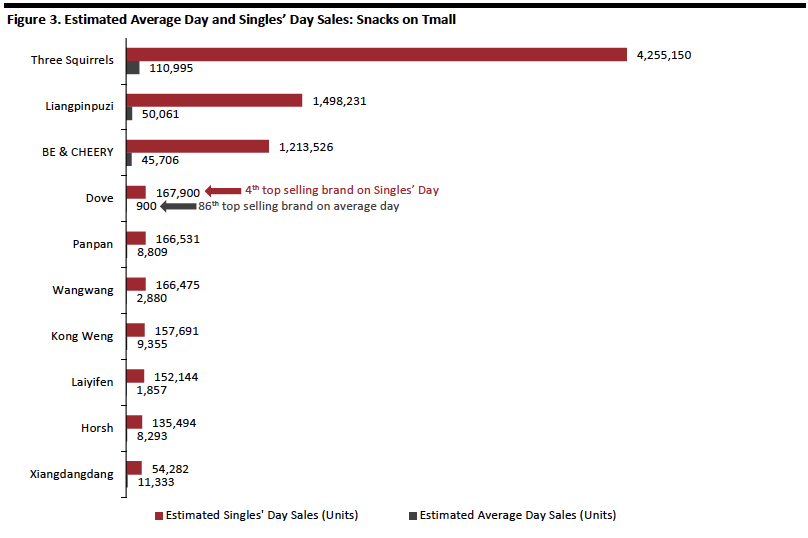

Kans showcasing its must-buy items on Singles’ DaySource: Kans/Xiaohongshu[/caption] Snacks on Tmall: How Three Squirrels and Dove Gained Big on Singles’ Day Three Squirrels was the top snacks brand with estimated Singles’ Day sales of 4.255 million units, 37 times more than the 110,995 we estimate the company sells on an average day. Chocolate brand Dove leapt from 86th position on an average day to 4th place among snack brands, by unit sales, on Singles’ Day. We estimate the brand sold 186 times more on Singles’ Day than on an average day. [caption id="attachment_79194" align="aligncenter" width="808"]

Source: DataWeave/Coresight Research[/caption]

How Did Three Squirrels and Dove Do It?

Snack brands generally offered price and multi-purchase discounts. On Singles’ Day 2018, Three Squirrels offered cash coupons worth ¥20–130 on purchases of ¥200–400. However, we think brands need to create innovative offerings on social media, too.

[caption id="attachment_79195" align="aligncenter" width="300"]

Source: DataWeave/Coresight Research[/caption]

How Did Three Squirrels and Dove Do It?

Snack brands generally offered price and multi-purchase discounts. On Singles’ Day 2018, Three Squirrels offered cash coupons worth ¥20–130 on purchases of ¥200–400. However, we think brands need to create innovative offerings on social media, too.

[caption id="attachment_79195" align="aligncenter" width="300"] Three Squirrels’ Singles’ Day promotions on Tmall

Three Squirrels’ Singles’ Day promotions on TmallSource: Three Squirrels/Tmall[/caption] Three Squirrels introduced 11 new products and promoted them in the “Squirrel Made 2018” event in Nanjing prior to Singles’ Day. In the event, Three Squirrels invited five endorsers to showcase new products with innovative names and packaging, driving pre-Single’s Day awareness. On another occasion, Three Squirrels featured selected products on Taobao’s live streaming platform with the help of Chinese girl group SNH48. Customers who logged onto Taobao to view the live stream had a chance to win prizes. [caption id="attachment_79196" align="aligncenter" width="486"]

Three Squirrels’ ”Squirrel Made 2018” event held in Nanjing (left) and influencer marketing on the Taobao live streaming platform (right)

Three Squirrels’ ”Squirrel Made 2018” event held in Nanjing (left) and influencer marketing on the Taobao live streaming platform (right)Source: Company website[/caption] In 2018, chocolate brand Dove introduced new products for Singles’ Day, such as chocolates shaped like the Tmall cat logo. Dove’s initiative is a prime example of a retailer generating shopper interest with novelty and innovation rather than simply relying on price promotions. [caption id="attachment_79197" align="aligncenter" width="306"]

Dove Chocolates’ new product exclusive to Singles’ Day

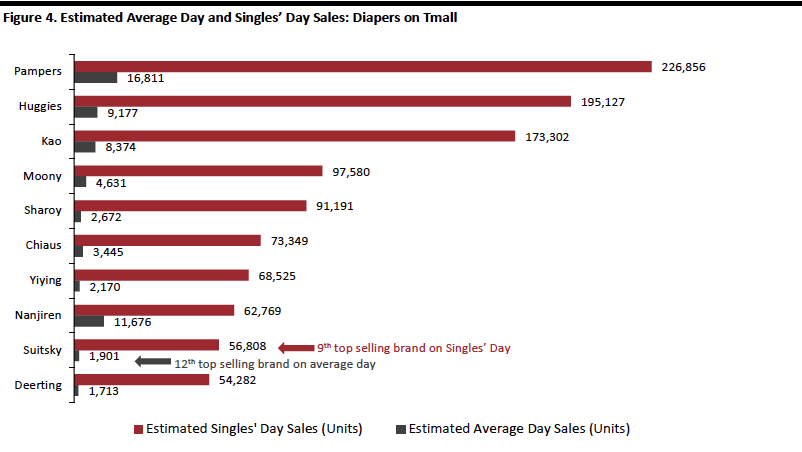

Dove Chocolates’ new product exclusive to Singles’ DaySource: Dove/Tmall[/caption] Diapers on Tmall: Pampers and Suitsky Enjoy Major Sales Boosts on Singles’ Day 2018 The fourth and final category we reviewed was diapers. Our research found Pampers is the best-selling brand on Tmall, on Singles’ Day and on an average day – but sales jumped 12 times on Single’s Day. Suitsky was another brand that saw a strong lift in unit sales on Singles’ Day, as shown below. [caption id="attachment_79198" align="aligncenter" width="802"]

Source: DataWeave/Coresight Research[/caption]

How Did Pampers and Suitsky Do It?

Diaper brands on Tmall generally used coupons: Pampers offered coupons worth ¥250-300 off purchases of ¥600-800.

[caption id="attachment_79199" align="aligncenter" width="366"]

Source: DataWeave/Coresight Research[/caption]

How Did Pampers and Suitsky Do It?

Diaper brands on Tmall generally used coupons: Pampers offered coupons worth ¥250-300 off purchases of ¥600-800.

[caption id="attachment_79199" align="aligncenter" width="366"] Pampers’ promotions on Tmall on Singles’ Day

Pampers’ promotions on Tmall on Singles’ DaySource: Pampers/Tmall[/caption] Pampers also leveraged its relationship with Tmall to feature selected products during the Tmall Baby Products Day event (before Single’s Day), which was broadcast via Taobao and Mangguohuyu live streaming platforms. This helped drive consumer awareness prior to Singles’ Day. [caption id="attachment_79200" align="aligncenter" width="480"]

Pampers’ Doraemon-themed booth in Beijing (Left) and Pampers’ presence on Tmall Baby Products Day

Pampers’ Doraemon-themed booth in Beijing (Left) and Pampers’ presence on Tmall Baby Products DaySource: Pampers/Tmall[/caption] Pampers also offered free product samples and live displays to engage potential customers. The Pampers booth used a Doraemon theme (a popular Japanese comic character) in Beijing on Singles’ Day. Parents could try pampers using fake babies, get expert advice on baby care and free diaper samples. Suitsky, which leapt from 12th position on an average day to ninth position on Singles’ Day, leveraged Chinese actress Yao Chen as brand endorser to showcase products on Tmall’s live streaming platform ahead of Single’s Day. Tapping Singles’ Day Singles’ Day is about more than just slashing prices. Winning brands use a combination of social media campaigns, influencer marketing, product launches and special events to build consumer excitement and drive sales on Singles’ Day.

Methodology in More Detail To estimate Singles’ Day sales for each category and brand, we calculated additional sales generated on Singles’ Day by deducting the 30-day rolling sales at November 8 (representing a typical shopping period) with that on November 14 (which includes Singles’ Day). We then added in the underlying sales generated on a typical day on Tmall to get a Singles’ Day estimate. 30-day rolling sales volume at November 14 (30-day sales volume including Singles’ Day). - 30-day rolling sales volume at November 8 (30-day sales volume excluding Singles’ Day). + [(30-day rolling sales volume at November 8)/30] (Average 1-day sales volume) The methodology used in this report was consistent with that used in our previous reports Singles’ Day 2018: Proprietary Coresight Research Data Reveal the Scale of Growth by Category for Tmall Global and Singles’ Day 2018: Proprietary Coresight Research Data Reveal the Scale of Growth by Category – Part 2 for Tmall. About DataWeave Powered by proprietary artificial intelligence (AI), DataWeave provides actionable competitive-intelligence-as-a-service to retailers and consumer brands in near real time by aggregating and analyzing data from the web. While retailers use DataWeave’s Retail Intelligence product to make smarter pricing and merchandising decisions and drive profitable growth, consumer brands use DataWeave’s Brand Analytics product to protect their brand equity online and optimize the experience delivered to shoppers on e-commerce websites. For more information, visit the DataWeave website.