INTRODUCTION

China’s scale makes it an attractive market for international brands and retailers: in 2017, the country’s population reached 1.4 billion and consumer spending totaled ¥31.8 trillion ($4.6 trillion), according to data from the National Bureau of Statistics of China. Foreign brands and retailers have flocked to China in recent years, but some have failed to expand effectively and have eventually had to exit the market.

When it comes to entering the Chinese market, cross-border e-commerce platforms are the obvious choice. However, the cross-border e-commerce space has become very crowded and it is hard for foreign companies to differentiate themselves on these platforms without incurring substantial marketing costs. In this report, the first in our series

A Guide to Entering China for Foreign Brands and Retailers, we introduce a new way for foreign brands and retailers to enter the Chinese market, a method that we call the Bonded + Retail Store model.

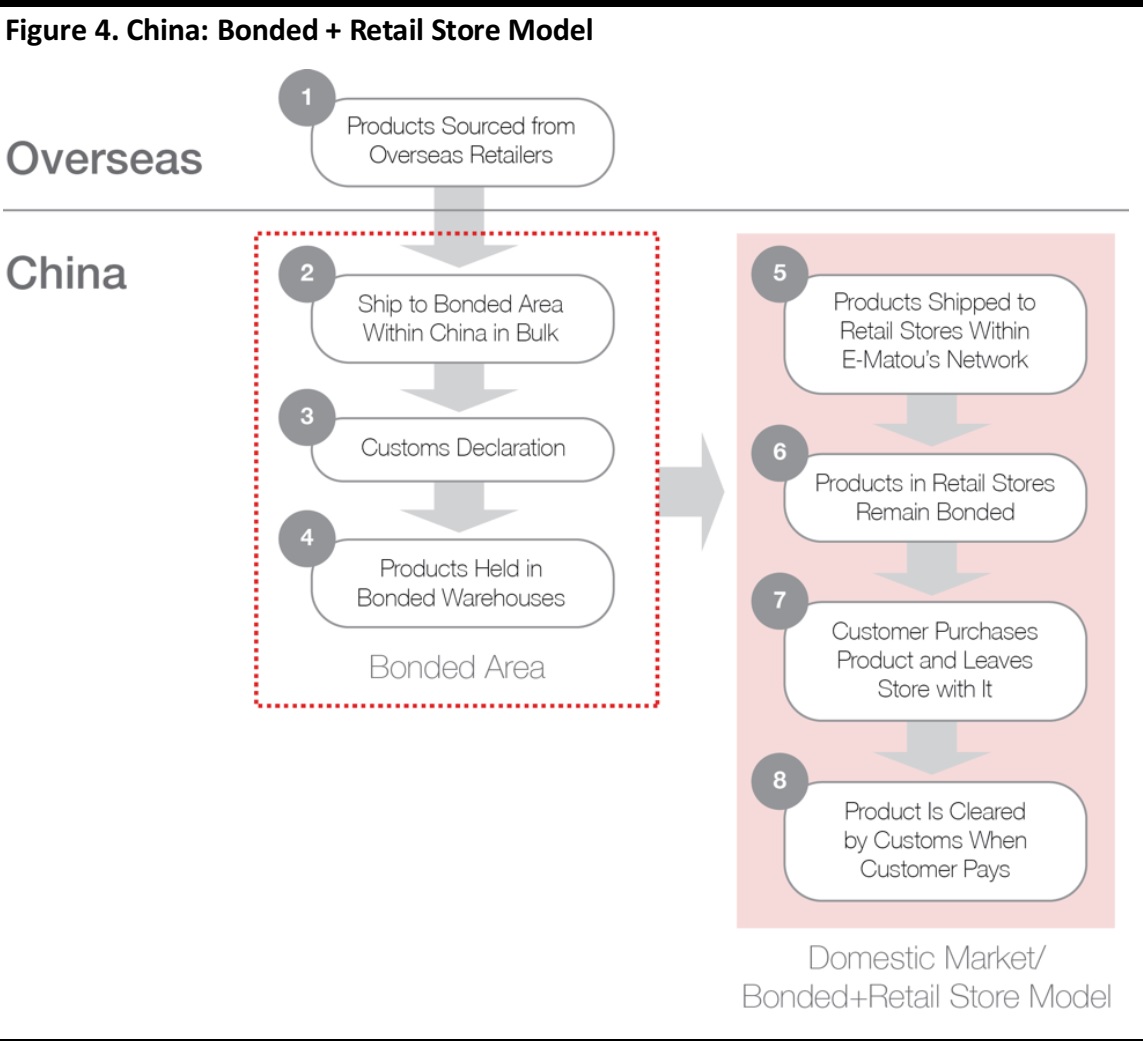

Under this model, foreign brands and retailers are allowed to ship products to authorized retail stores in China under the supervision of the country’s General Administration of Customs, in cooperation with two local supply chain companies, E-Matou and Red Star Supply Chain Technology. The products are bonded throughout the process, but they go through customs clearance only after consumers have purchased them.

Foreign brands and retailers selling in China benefit by being able to move unsold inventory from bonded warehouses in the country to retail stores, where the goods are likely to be sold. The model also benefits foreign companies in terms of marketing, as shoppers like to be able to see and touch products on shelves in physical stores. Consumers benefit by being able to examine products in person and walk out of a store with their purchase, rather than having to wait for delivery of an online order.

STRONG DEMAND FOR FOREIGN PRODUCTS

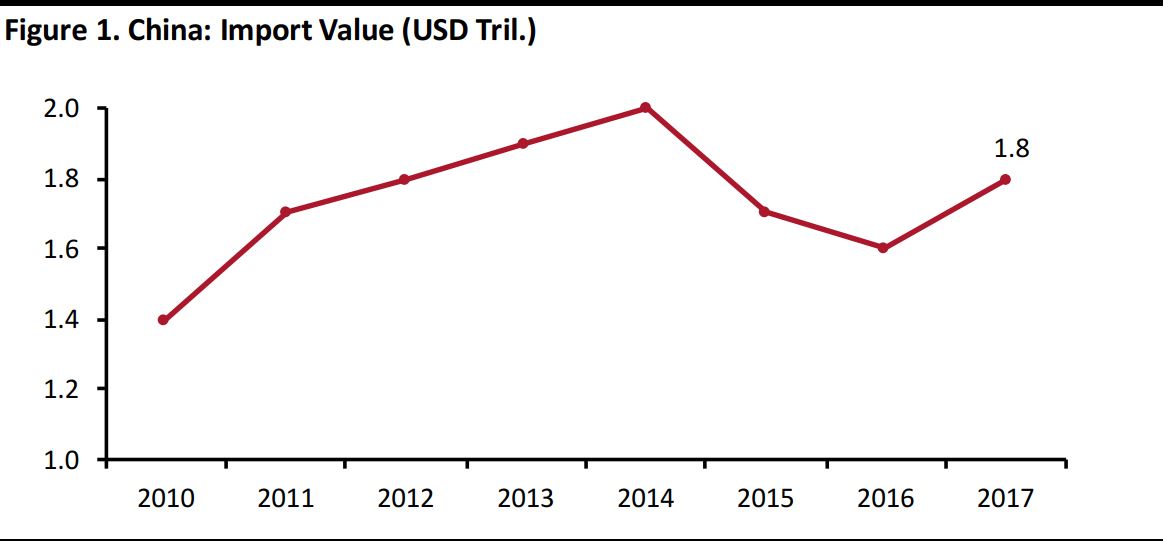

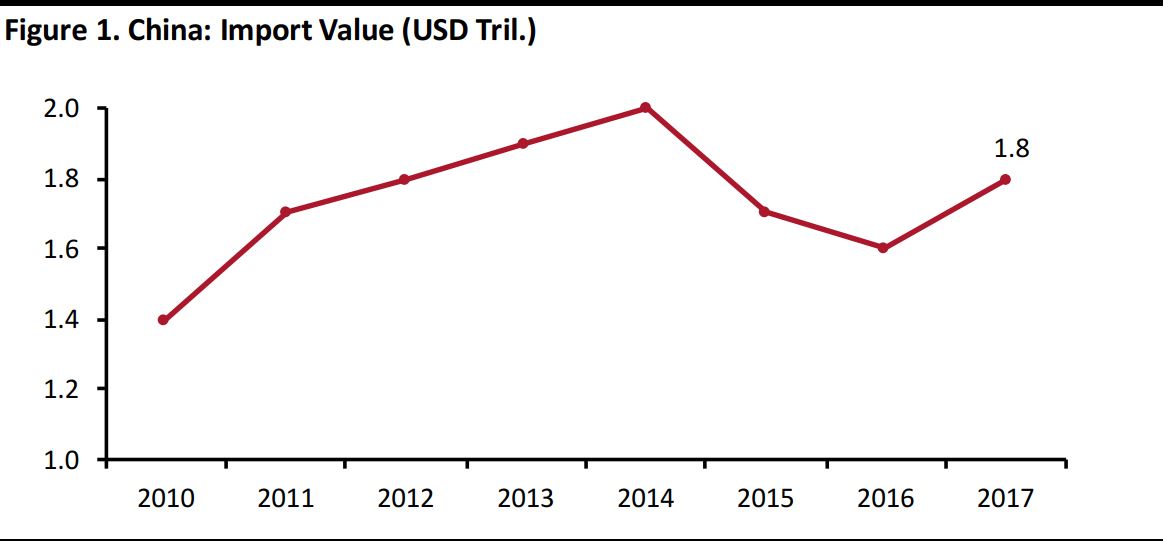

Chinese demand for foreign products is robust, and the country’s import value has shown an upward trend over the past eight years, despite a temporary drop from 2014 to 2016. According to China’s General Administration of Customs, the country’s import value rose by 32% between 2010 and 2017, to $1.8 trillion. This was fueled by China’s soaring disposable income per capita, which increased at a much faster rate of 90% in the same period, to ¥36,396 ($5,321), according to the National Bureau of Statistics of China.

Source: General Administration of Customs of China

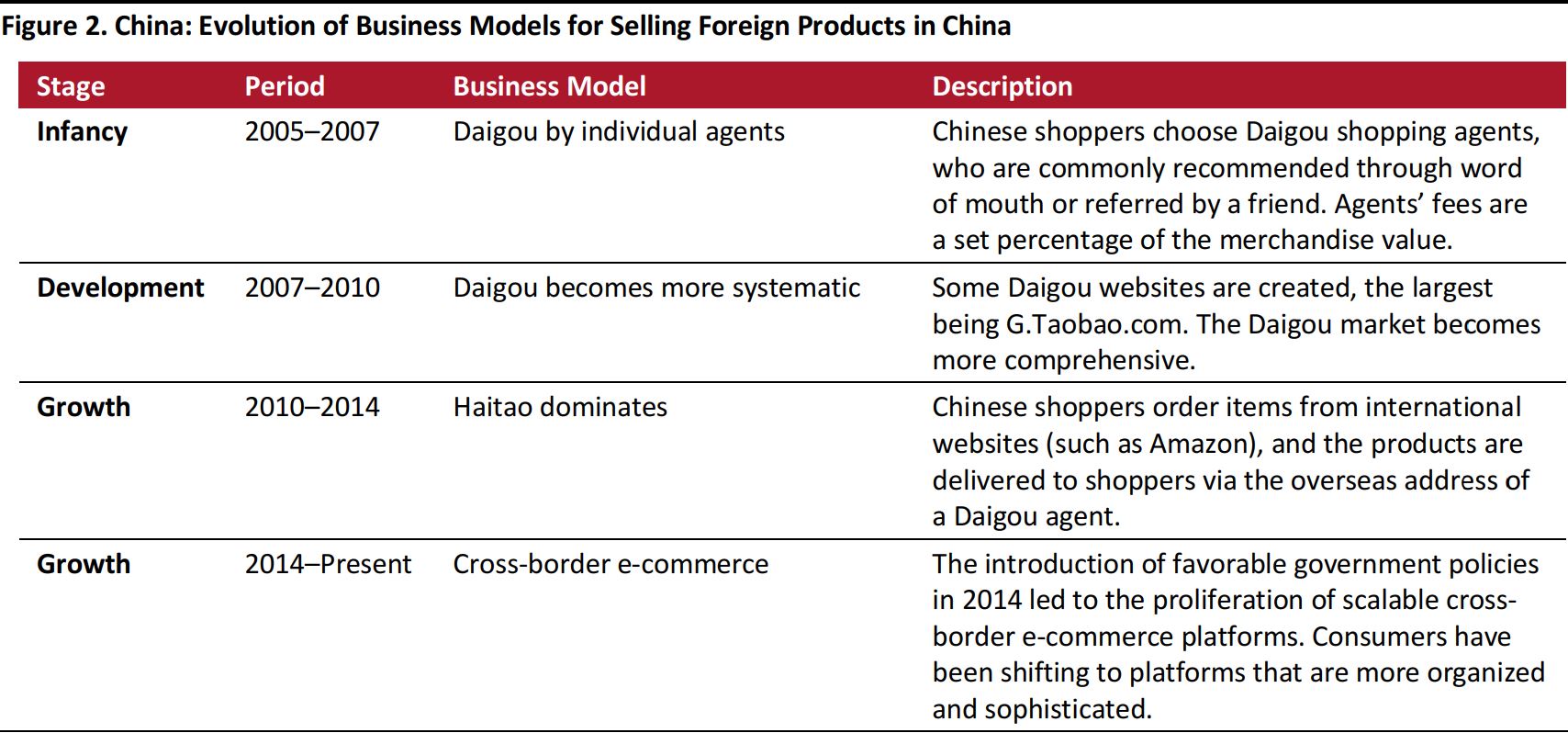

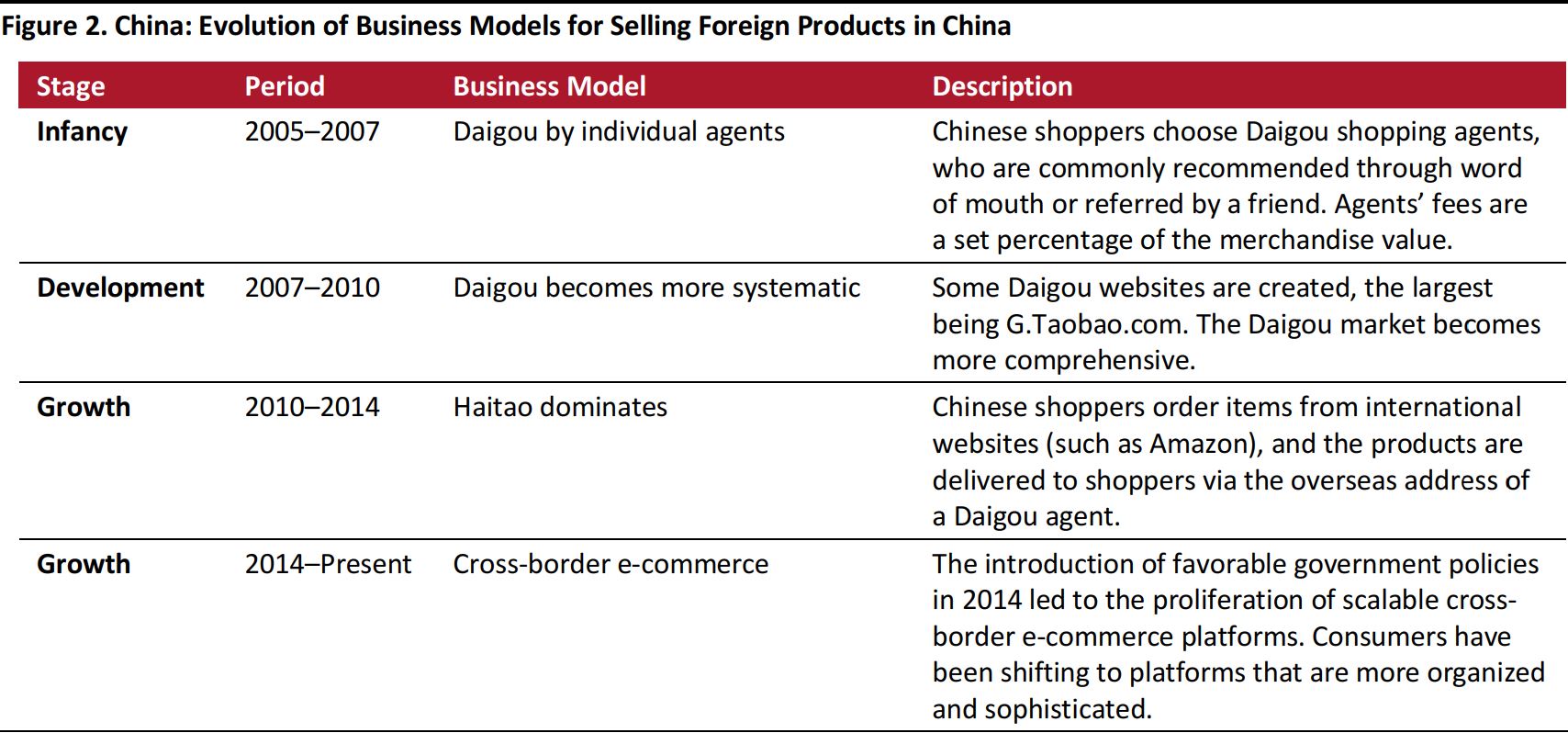

Business models for entering the Chinese market have evolved as consumer demand for foreign products has grown. Entry models have moved from Daigou, which refers to overseas shopping agents purchasing items abroad on behalf of Chinese consumers and shipping them to China, to Haitao, where Chinese consumers order directly from foreign websites, to cross-border e-commerce, where consumers buy foreign products from online marketplaces.

Source: iResearch/Coresight Research

Source: iResearch/Coresight Research

In our report

Chinese Demand for Cross-Border E-Commerce Booms, but Looming Tax Reforms Are a Cloud on the Horizon, we examined the size of the cross-border e-commerce market in China:

- China’s General Administration of Customs reported that e-commerce imports to the country grew by 116% year over year in 2017, to ¥56.6 billion ($8.4 billion). However, this absolute figure looks low relative to estimates published by a number of research firms and relative to the scale of total Chinese e-commerce.

- Given that the customs agency figure is based on imports of parcels for individual consumers, we assume that it excludes orders fulfilled from bonded warehouses in China, where goods are first imported in bulk.

- Other sources cite much higher cross-border e-commerce sales: eMarketer, for example, estimates that such sales will reach $115.5 billion in China this year.

However, we think that even these higher estimates do not fully reflect total Chinese demand for foreign products, as they do not account for the rampant parallel trading of foreign products across the borders of Hong Kong and Shenzhen, China, every day. Due to differences in the quality and price of products available in Hong Kong and in China, parallel traders carry consumables in bulk from Hong Kong to Shenzhen daily.

Demand for these parallel-traded goods remains sturdy, as Mainland China residents consider many items purchased from stores in Hong Kong to be safer and of higher quality than those sold at home. Some of the most popular items carried by parallel traders include baby formula, personal hygiene products and medicines.

The scope of parallel trading suggests that the current supply of foreign products procured through existing channels (including Daigou, Haitao, cross-border e-commerce and general trade) is not sufficient to fulfill demand from Chinese consumers.

Parallel traders gathering goods near Sheung Shui Station in Hong Kong, the metro station closest to the Lo Wu checkpoint, before departing for Shenzhen, China

Source: TheStandNews.com

Parallel traders gathering goods near Sheung Shui Station in Hong Kong, the metro station closest to the Lo Wu checkpoint, before departing for Shenzhen, China

Source: TheStandNews.com

E-Matou and Red Star Supply Chain Technology Lead a Transformative New Model to Fulfill Chinese Demand for Foreign Products

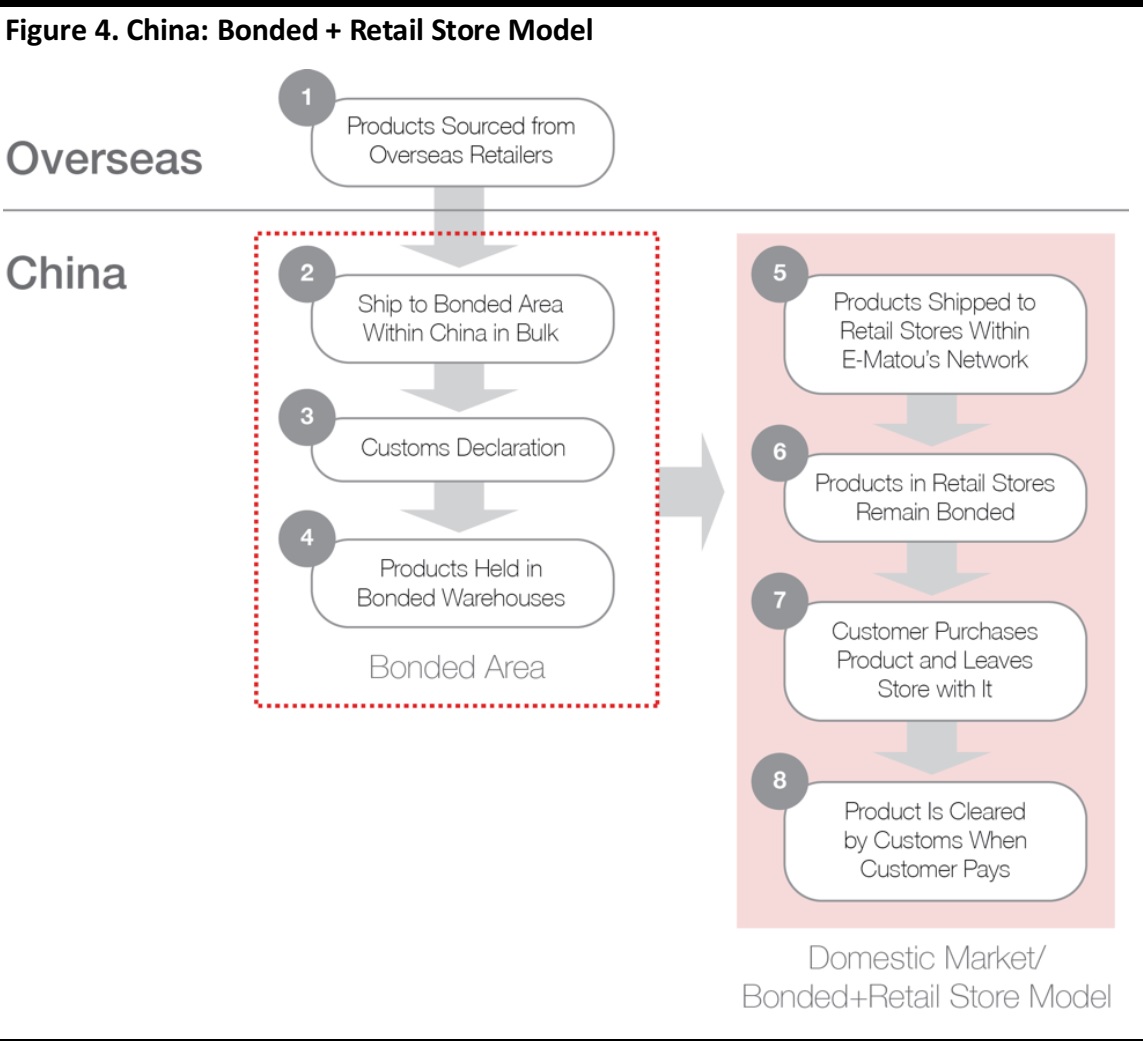

With existing import models unable to fulfill Chinese demand for foreign products, Shenzhen-based supply chain management companies E-Matou and Red Star Supply Chain Technology partnered to establish the Bonded + Retail Store model to help foreign brands and retailers enter the Chinese market. With this model, foreign products in a bonded warehouse in China can be put on the shelves of authorized local brick-and-mortar stores, but the products go through customs clearance only after they have been purchased.

On August 1, 2018, E-Matou and Red Star signed a joint venture agreement to bring products from Hong Kong and foreign companies to the Chinese market under the new model. The two supply chain management companies are willing to partner with all foreign brands, from well established, high-end names to emerging up-and-comers.

In China, bonded areas (geographic areas where multiple bonded warehouses are located) and pilot free trade zones (geographic areas where the government is testing freer trade policies) are typically located near ports and international hubs, far away from the communities where consumers live and shop. The Bonded + Retail Store model effectively expands the bonded area to retail locations in city centers, where footfall is considerable, maximizing the benefits of the free trade zones’ preferential policies.

Qiya Shen, President of E-Matou, and Gordon Lam, President of Red Star Supply Chain Technology

Source: Coresight Research

Qiya Shen, President of E-Matou, and Gordon Lam, President of Red Star Supply Chain Technology

Source: Coresight Research

The Bonded + Retail Store Model

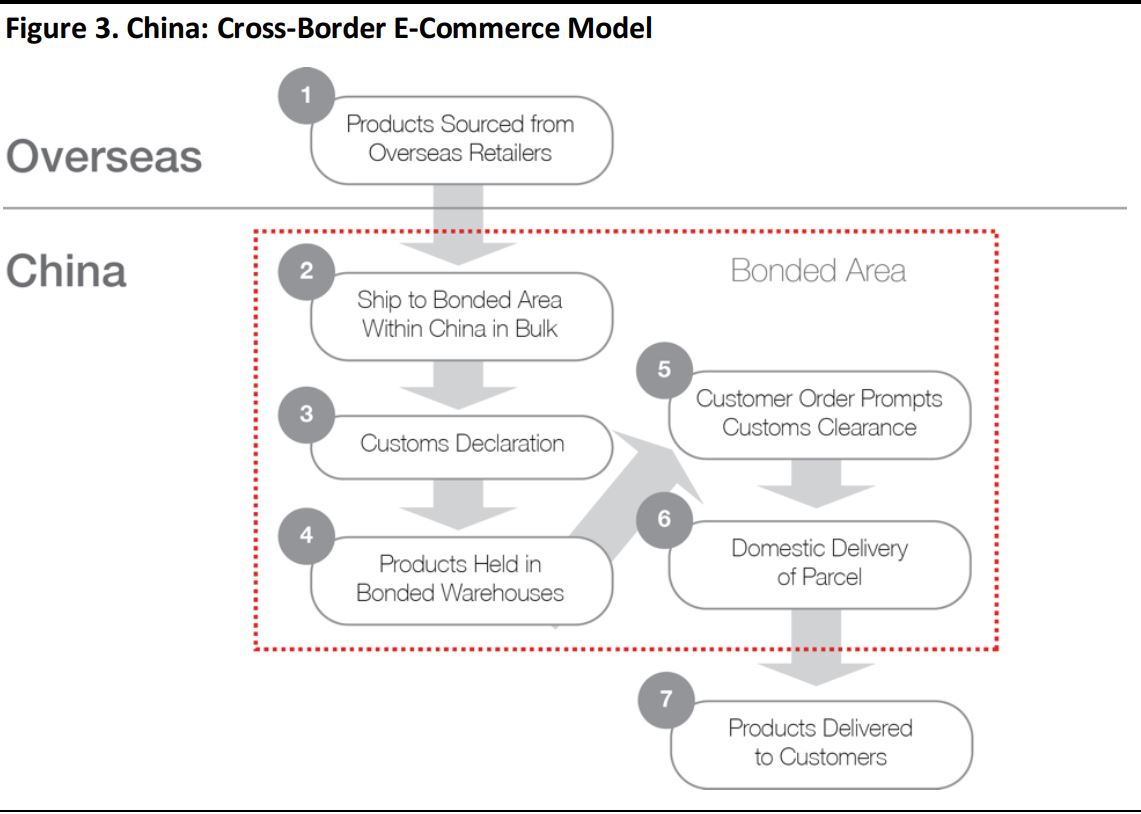

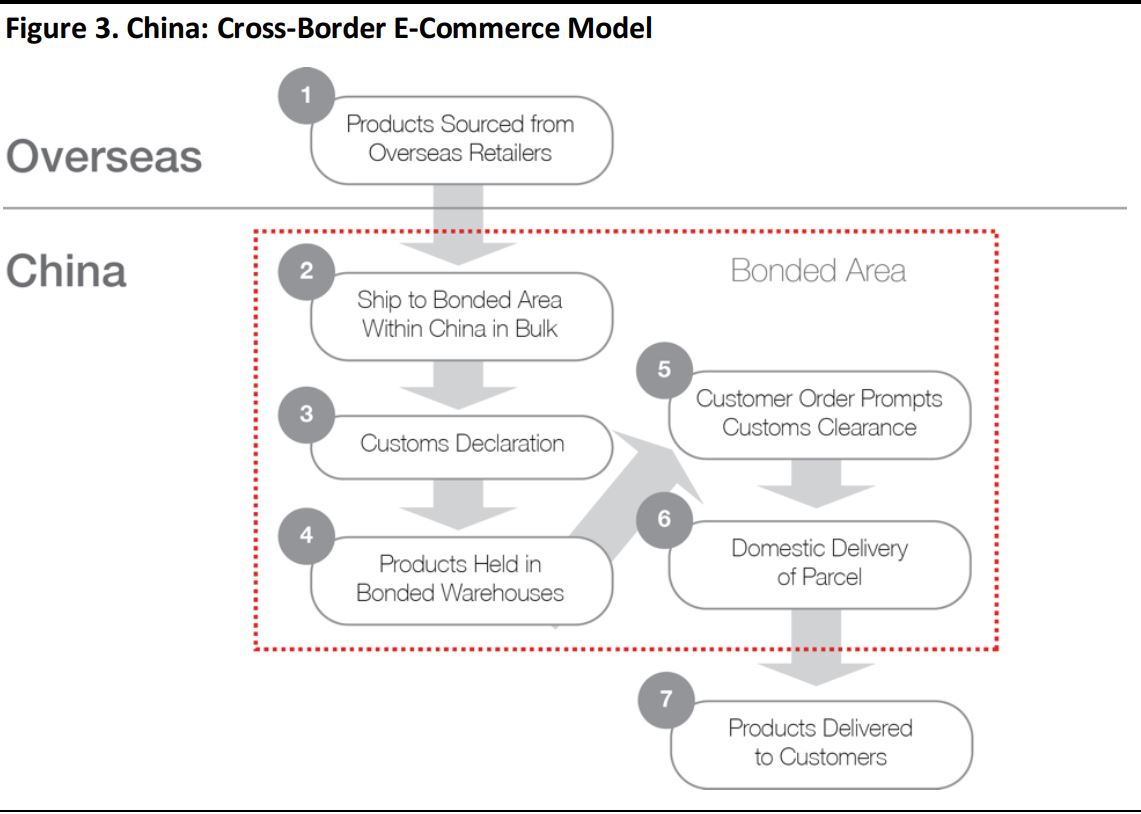

The Bonded + Retail Store model can be viewed as an evolution of the cross-border e-commerce model. With cross-border e-commerce, foreign products are shipped to China and stored in bonded warehouses. When a customer orders a product, the product goes through customs clearance before leaving the bonded warehouse and is then shipped to the customer’s home. With this model, foreign brands and retailers are able to sell only through e-commerce platforms, not through physical stores, and any unsold foreign products end up just sitting in bonded warehouses.

Source: Coresight Research

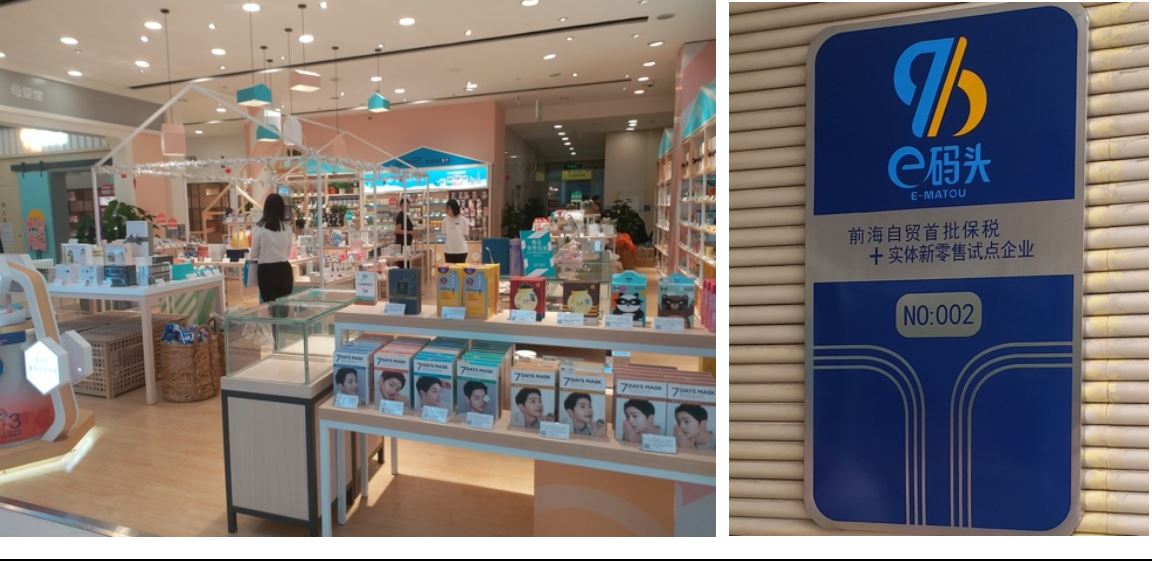

With the Bonded + Retail Store model, foreign products can be put on shelves in authorized retail stores in the E-Matou and Red Star network that are located outside a bonded area. The model’s main benefits are that products remain bonded before purchase and unsold products can be displayed and sold in local retail stores.

Source: Coresight Research

E-Matou and Red Star’s Partner Network Includes Brick-and-Mortar Retailers Rainbow Department Store, Well, SF Best and A.S. Watson and Will Expand to 1,000 Locations by 2020

E-Matou and Red Star have reached agreements with several Chinese retail chains, including Rainbow Department Store and its convenience store chain, Well (also known as TianhongWei’o), SF Best (owned by SF Express) and Watsons (owned by A.S. Watson). The Bonded + Retail Store model was first trialed with Rainbow Department Store. After a year of experimentation and exploration by E-Matou and authorities at the Shenzhen Shekou checkpoint, the model was expanded to SF Best stores in a number of communities in the Shenzhen area.

E-Matou and Red Star plan to grow their partner network to 200 retail locations in Shenzhen by the end of 2018 and to 1,000 locations across China by 2020. The two companies plan to add Easy Joy (a convenience store chain that operates in Sinopec gas stations), The Beast Shop (an up-and-coming design and décor chain) and Hive Box (a network of self-service package drop-off and pickup locations) to their retail network. Hive Box’s systems will be upgraded to allow vending of foreign products.

A Hive Box self-service package drop-off and pickup location

Source: FCBox.com

A Hive Box self-service package drop-off and pickup location

Source: FCBox.com

Rainbow Department Store

Rainbow Department Store operates department stores, shopping malls, supermarkets and convenience stores under the Tianhong and Jun Shang brand names in China. The company was founded in 1984 and is headquartered in Shenzhen. According to the China Chain Store & Franchise Association, Rainbow ranked second on the list of the “Top 10 Department Store Operators in China” and 23rd on the list of the “Top 100 Retail Chain Operators in China” in 2016.

A Tianhong Shopping Plaza in China

Source: Coresight Research

A Tianhong Shopping Plaza in China

Source: Coresight Research

SF Best

SF Best, owned by logistics services provider SF Express, operates almost 1,000 physical stores in China as well as an online platform. Launched in 2012 in Beijing, SF Best quickly expanded to other major cities, including Shanghai and Shenzhen. Its mission is to offer healthy and high-quality imported products along with the best shopping experience. SF Best’s core customers are middle-class households (85%), with the remainder represented by upper-middle-class households. Some 90% of the company’s customers come from cities in the first through third tiers.

An SF Best store in China

Source: Coresight Research

An SF Best store in China

Source: Coresight Research

A.S. Watson

Hong Kong–based health and beauty retailer A.S. Watson operates more than 14,300 retail stores across 25 markets under 13 brands, including Watsons, Kruidvat, Superdrug and ParknShop. The group’s product range includes health and beauty items, luxury perfume and cosmetics, food, electronics, and fine wine. As an established player in the beverage industry, the company also manufactures and distributes a wide range of nonalcoholic beverages, including bottled water, fruit juices, soft drinks and teas.

In Mainland China, A.S. Watson operates more than 3,000 Watsons stores across 353 cities. In April 2017, the group inaugurated its 3,000th Watsons store in the Super Brand Mall in Shanghai. The brand has more than 60 million loyalty subscription members. In partnership with E-Matou and Red Star, A.S. Watson plans to sell bonded goods in its stores in Shenzhen and Hainan.

A Watsons store in China

Source: ASWatson.com

A Watsons store in China

Source: ASWatson.com

Supply Chain System Breakthrough Streamlines Customs and Quarantine Process, Blending E-Commerce and Physical Stores

E-Matou and Red Star leverage supply chain technology to make their network of retail locations function as an extension of a bonded area. The companies integrate the customs monitoring system from Shenzhen Customs into warehouse management systems to ensure products are traceable by authorities. The Chinese government approved this new model because it ensures products are taxed before they leave a retail store, but products displayed in-store are not taxed until they are purchased.

The integration of systems streamlines the customs and quarantine process for both the government and foreign companies. It allows for goods to be inspected and then sold before taxes are levied, removing the need for authorities to conduct multiple inspections. The simplified procedure expedites the trade exchange and facilitates the convergence of cross-border e-commerce and physical retail. The model efficiently combines cross-border e-commerce, in-store shopping, the purchase of bonded goods and the in-store collection of those goods.

The Bonded + Retail Store Model Is Enabled by the Tracking of Goods

For the Bonded + Retail Store model to work, the movement of goods from their source must be tracked. Under the model, overseas sellers attach labels to their products before shipping them to China. Once the goods arrive in China, E-Matou and Red Star transport them to bonded warehouses. The China Certification & Inspection Group (CCIC), an independent third-party inspection and certification body monitoring the supply chain along with E-Matou and Red Star, attaches additional tracking stickers to the goods so that they can be traced after leaving the bonded warehouses. After those labels are attached, the goods are declared and then sent to authorized retail stores.

Labels are applied to goods by overseas sellers before shipment to China.

Source: Coresight Research

CCIC tracking stickers are applied to goods before they leave bonded warehouses.

Source: Coresight Research

CCIC tracking stickers are applied to goods before they leave bonded warehouses.

Source: Coresight Research

The joint venture of E-Matou and Red Star also ensures that the “three instant receipts clearance” (purchase order, payment and logistics) is performed correctly. When customers place an order at an authorized retail store, they must provide their name and ID number so the system can confirm their identity. Once that is complete, customers can proceed to payment, where the system again cross-checks that the purchase order information and payment information align. Only when the two accord can payment be accepted.

After paying, customers receive their product in a courier package. The packaging distinguishes the purchase from goods that are sold through general trade. E-Matou and Red Star receive automatic stock updates whenever purchases are made.

What Brands Are Participating?

South Korean beauty brand Saimdang Cosmetics, Japanese healthy food brand Uprise, Canadian skincare brand George’s and well-known milk powder brands such as The a2 Milk Company are among the foreign companies that have already partnered with E-Matou and Red Star to gain entry to supermarkets or convenience stores in China.

The Rainbow Department Store in the Tianhong Shopping Plaza sells foreign products under the Bonded + Retail Store model.

Source: Coresight Research

The Rainbow Department Store in the Tianhong Shopping Plaza sells foreign products under the Bonded + Retail Store model.

Source: Coresight Research

Coresight Research Store Visits: Seeing How It Works

The Coresight Research team visited the Rainbow Department Store in the Tianhong Shopping Plaza and an SF Best store in Shenzhen, the first stores piloted under the Bonded + Retail Store model, to see how the purchase process works. At these stores, we saw popular foreign brands being sold in cooperation with local distributors:

- Baby products: The a2 Milk Company, NUK, Nutrilon, Philips Avent, Sebamed

- Cosmetics: Chanel, Dior, Giorgio Armani, NARS, RMK, Tom Ford, YSL Beauty

- Fragrances: Bulgari, Chloe, Gucci, Marc Jacobs, Tiffany & Co.

- Haircare: Aussie, Ryo

- Healthcare: JustUme, US Clinicals

- Skincare: Clé de PeauBeauté, Lancôme, Laneige, SkinLife

Normally, any product sold in China must have product labeling in Chinese and undergo testing and quarantine prior to being sold. But with the Bonded + Retail Store model, products sold in brick-and-mortar stores do not need to have labels or product specifications in Chinese on the packaging.

Products sold in brick-and-mortar stores under the Bonded + Retail Store model are not required to have labeling in Chinese. We saw the above products for sale in the SF Best store we visited in Shenzhen.

Source: Coresight Research

Products sold in brick-and-mortar stores under the Bonded + Retail Store model are not required to have labeling in Chinese. We saw the above products for sale in the SF Best store we visited in Shenzhen.

Source: Coresight Research

Although products sold under the new model are not required to have Chinese-language labels, all information consumers may need is available to them via a small QR code attached to each product. This includes product specifications, description, quarantine reports and logistics information. Shoppers can scan the QR code to see all of the relevant information about the product presented in Chinese.

Product specifications, quarantine reports, logistics information and other data appear on a shopper’s smartphone once the shopper scans the QR code on a foreign product.

Source: CCIC/Coresight Research

Product specifications, quarantine reports, logistics information and other data appear on a shopper’s smartphone once the shopper scans the QR code on a foreign product.

Source: CCIC/Coresight Research

After choosing the items they want, shoppers can pay for them using Alipay, WeChat Pay or another mobile payment method by scanning the QR code. This makes the whole purchasing process under the Bonded + Retail Store model the same as with cross-border e-commerce, except that customers can go to an authorized physical store in their community to browse, so they can see and touch items, instead of only being able to browse online.

A shopper scans a QR code printed out by a store associate to purchase items using mobile payment.

Source: Coresight Research

A shopper scans a QR code printed out by a store associate to purchase items using mobile payment.

Source: Coresight Research

With the Bonded + Retail Store model, shoppers can also purchase products online through a cross-border e-commerce site and then collect their purchases from an authorized local retail store.

New Model Presents a Major Opportunity for Foreign Brands and Retailers

Although Chinese consumers’ demand for foreign products is strong, foreign brands and retailers may find it difficult to enter the Chinese market through cross-border e-commerce, given the fierce competition:

- Promotions and marketing on popular cross-border e-commerce and social media platforms can involve huge costs. The cost of hiring celebrity influencers or key opinion leaders to help sell products has risen significantly in recent years.

- Total costs, including platform, logistics and marketing costs, as well as the cost of hiring a local operator to manage e-commerce channels, can soak up a large portion of sales proceeds.

- Finding a suitable local operator can be difficult, especially for brands and retailers that do not have enough knowledge about the Chinese market.

- The costs associated with product returns can be high.

- Products that are stored in bonded warehouses for a long period of time can become obsolete.

Given the challenges of entering China through cross-border e-commerce, the new Bonded + Retail Store model represents a major opportunity for foreign brands and retailers:

- Companies with a presence in local retail stores in China have a strong marketing advantage. Consumers are able to familiarize themselves with products in stores, and they are more likely to try products that they can see and touch before buying.

- Consumers tend to shop at convenience stores for daily necessities, groceries and other fast-moving consumer goods rather than purchasing them online.

- Foreign brands and retailers can quickly move unsold products in bonded warehouses to stores within the authorized retail network.

- Putting products on shelves is a perfect opportunity to test new items in the Chinese market.

- The retail network can be used for product returns, too, reducing the cost of returns for foreign brands and retailers.

Models of Cooperation: Consignment and Direct Sourcing

Foreign brands and retailers can choose to use a consignment model or a direct sourcing model to work with E-Matou and Red Star to bring their products into China. Under the consignment model, brands and retailers need to first ship their products to a bonded warehouse in China or a warehouse in Hong Kong (as it is the closest to the Chinese border). From there, E-Matou and Red Star will distribute the products via their network. Brands and retailers pay no slotting fee up front.

Under the direct sourcing model, E-Matou and Red Star help local retail chains within their network source products directly from foreign brands and retailers. This provides an immediate boost to the top line, but allows brands and retailers less control over their sales and branding in China.

What Do Foreign Brands and Retailers Need?

Foreign brands and retailers that already have inventory in a bonded warehouse in China can immediately cooperate with E-Matou and Red Star. Companies without inventory in the country will need to ship their products to a bonded warehouse in China before cooperating with E-Matou and Red Star (and companies should know that foreign medical products are not accepted in Chinese bonded warehouses). Generally, foreign companies must provide the following information to the China Inspection & Quarantine agency to get inventory into a bonded warehouse:

- Product name in Chinese

- Net weight and shipping weight

- Photos of product from all six dimensions

- Price and quantity

- A list of ingredients and their percentages

- Country of origin

- Manufacturing date

- Expiration date

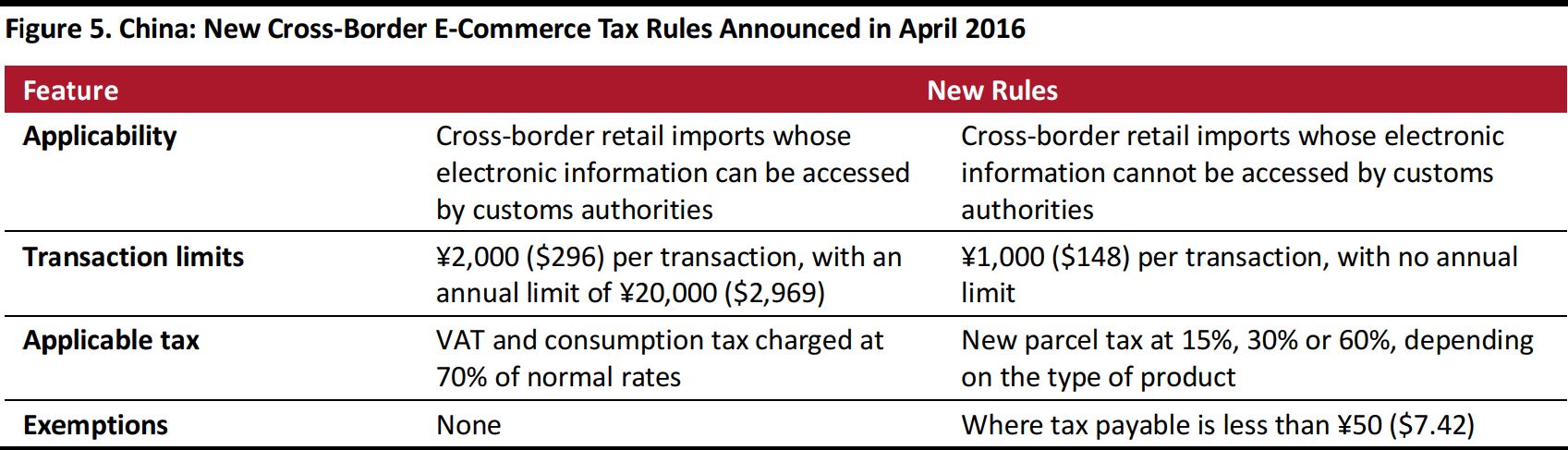

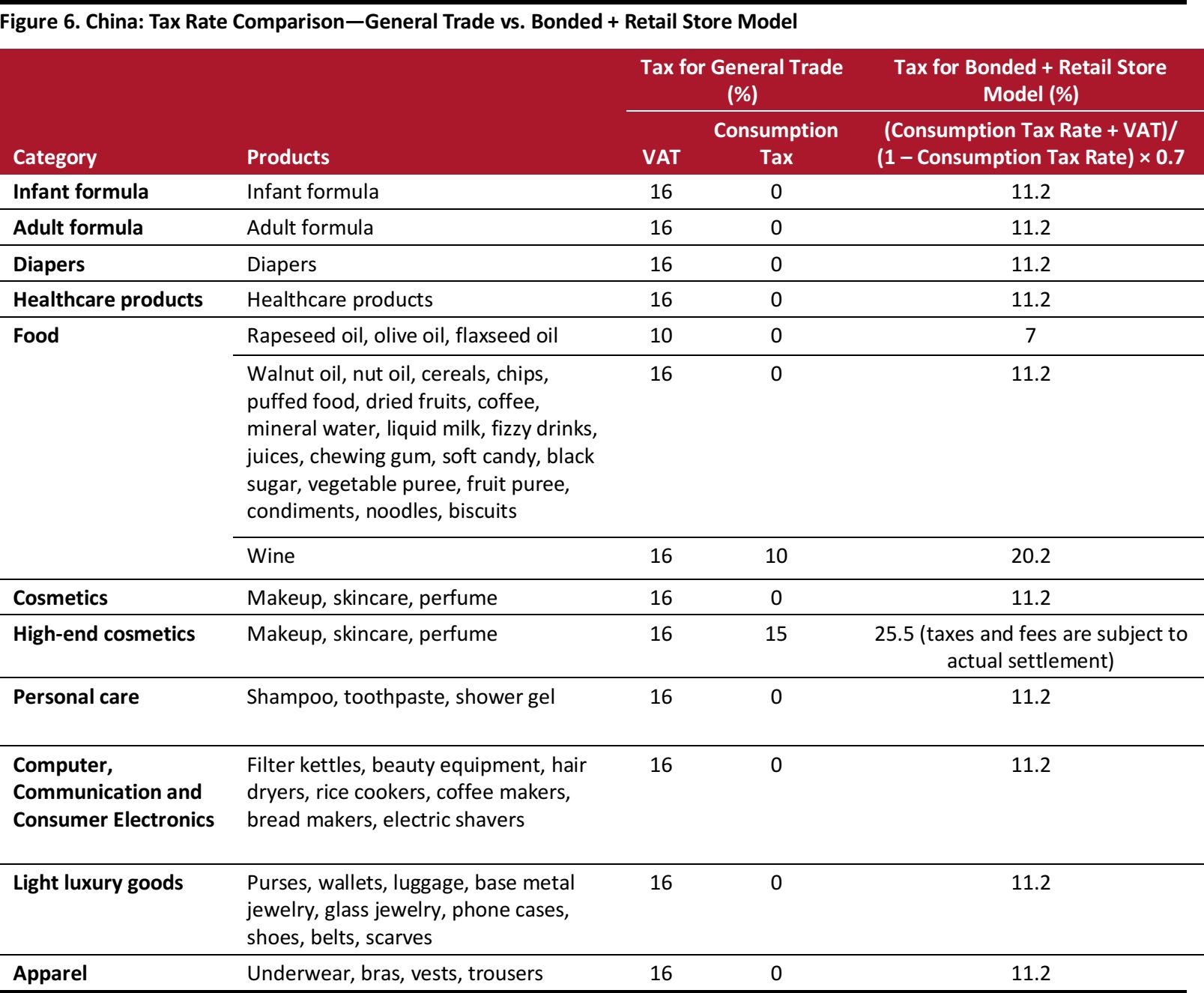

Tax Rates for the Bonded + Retail Store Model

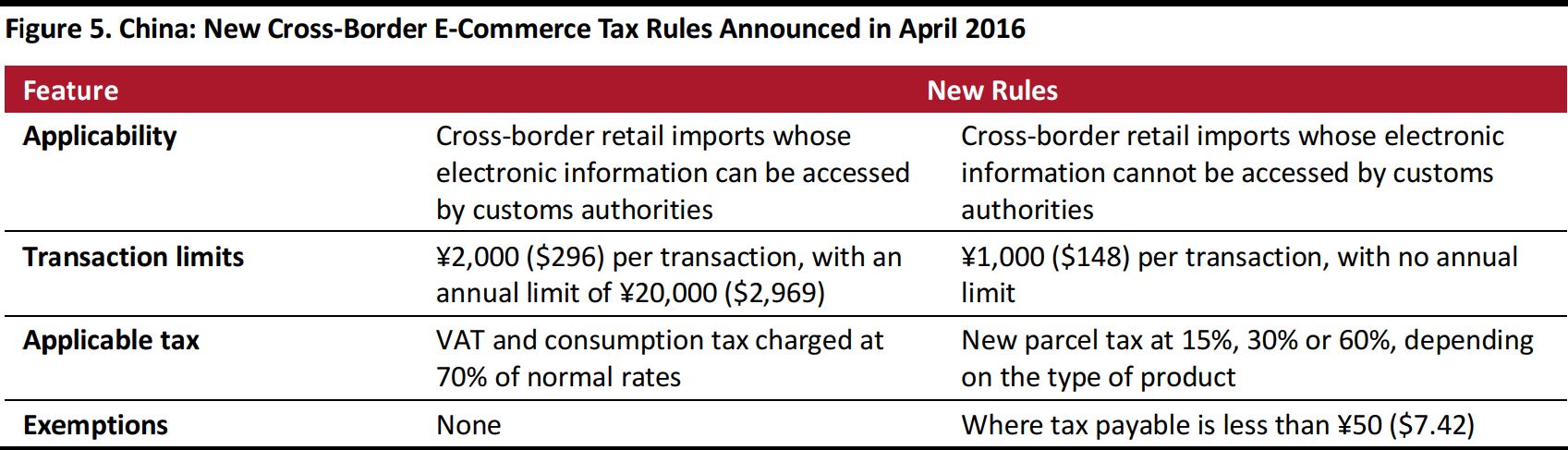

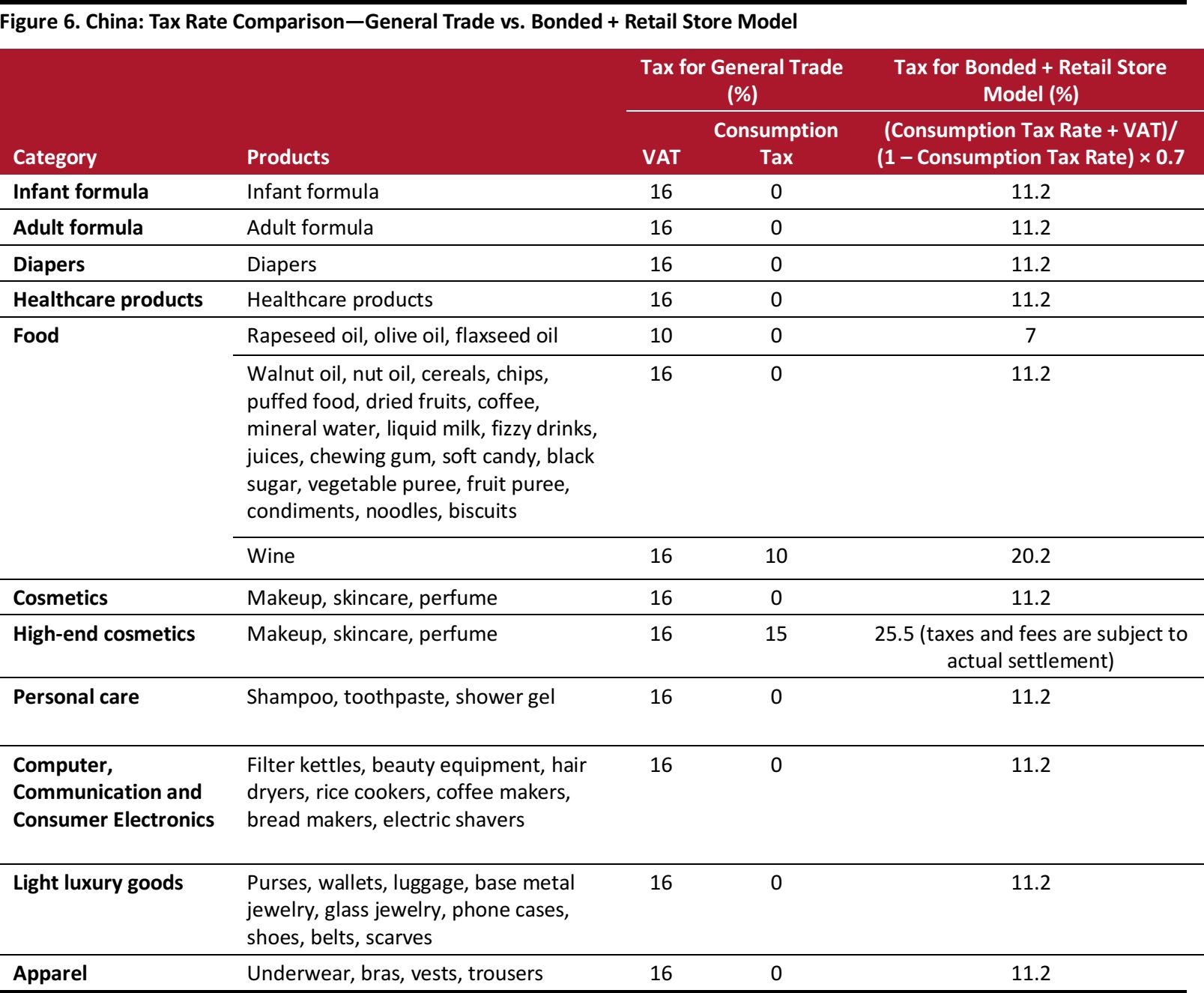

The tax rate for goods imported to China under this new model is the same as for goods imported under the cross-border e-commerce model. Following the announcement of new tax rules for cross-border e-commerce in April 2016, the tax advantages for certain products have changed, but most products imported under cross-border e-commerce remain advantaged relative to general imports.

Under the new tax rule, the value-added tax (VAT) and consumption tax are charged at 70% of normal rates. The transaction value must be under ¥2,000 ($296) per transaction and there is an annual limit of ¥20,000 ($2,969).

Source: AsiaBriefing.com

Source: AsiaBriefing.com

Source: Kaola.com/Coresight Research

Source: Kaola.com/Coresight Research

Product Categories Suitable for the Bonded + Retail Store Model

Certain foreign products are more suitable than others for this new retail model. These include:

- Products subject to widely differing tax rates depending on whether they are imported through general trade or cross-border e-commerce.

- Products for which consumers perceive quality as very important (for example, mother and baby care products and milk powder).

- Products that are priced below ¥2,000 ($296).

- Daily necessities that consumers tend to buy in their local convenience store instead of online.

- Products that require a lengthy or difficult approval process to enter China.

- Products that do not have a very long shelf life and cannot be stored in a bonded warehouse for a long period of time.

Chinese demand for imported goods is driven by consumers’ belief that foreign goods are safer and of higher quality than domestic ones. According to a May 2018 consumer survey on major consumables conducted by the Ministry of Commerce, more than 90% of the 1,397 respondents said that safety is the main reason they purchase foreign foodstuffs and maternal and baby products, and more than 70% of respondents said that they believe that imported cosmetics products are of higher quality. Some 20% of the survey respondents said that more than 30% of the products they consume are imported goods. Another survey, conducted by Mintel in 2017 among Chinese cross-border e-commerce shoppers, found that 68% of respondents consider proof of product quality the most important factor when determining whether to buy imported products.

We see daily necessities, health supplements, and mother and baby care products as the most suitable for the Bonded + Retail Store model. Chinese consumers tend to consider the quality of these products as highly important, and the approval process for general trade and local distribution in China can be lengthy and difficult with these items.

KEY TAKEAWAYS

The Chinese market presents numerous opportunities for foreign brands and retailers, which no longer have to rely solely on cross-border e-commerce platforms to sell their products in China. The Bonded + Retail Store model presents a new way for foreign companies to enter the country, and it enables them to easily move unsold inventory stored in bonded warehouses to store shelves in local communities. Displaying products in stores is superb marketing in itself, and foreign brands and retailers that adopt this new model will likely have an edge over those that operate only through cross-border e-commerce.

Source: iResearch/Coresight Research

Source: iResearch/Coresight Research Parallel traders gathering goods near Sheung Shui Station in Hong Kong, the metro station closest to the Lo Wu checkpoint, before departing for Shenzhen, China

Source: TheStandNews.com

Parallel traders gathering goods near Sheung Shui Station in Hong Kong, the metro station closest to the Lo Wu checkpoint, before departing for Shenzhen, China

Source: TheStandNews.com Qiya Shen, President of E-Matou, and Gordon Lam, President of Red Star Supply Chain Technology

Source: Coresight Research

Qiya Shen, President of E-Matou, and Gordon Lam, President of Red Star Supply Chain Technology

Source: Coresight Research

A Hive Box self-service package drop-off and pickup location

Source: FCBox.com

A Hive Box self-service package drop-off and pickup location

Source: FCBox.com A Tianhong Shopping Plaza in China

Source: Coresight Research

A Tianhong Shopping Plaza in China

Source: Coresight Research An SF Best store in China

Source: Coresight Research

An SF Best store in China

Source: Coresight Research A Watsons store in China

Source: ASWatson.com

A Watsons store in China

Source: ASWatson.com

CCIC tracking stickers are applied to goods before they leave bonded warehouses.

Source: Coresight Research

CCIC tracking stickers are applied to goods before they leave bonded warehouses.

Source: Coresight Research The Rainbow Department Store in the Tianhong Shopping Plaza sells foreign products under the Bonded + Retail Store model.

Source: Coresight Research

The Rainbow Department Store in the Tianhong Shopping Plaza sells foreign products under the Bonded + Retail Store model.

Source: Coresight Research Products sold in brick-and-mortar stores under the Bonded + Retail Store model are not required to have labeling in Chinese. We saw the above products for sale in the SF Best store we visited in Shenzhen.

Source: Coresight Research

Products sold in brick-and-mortar stores under the Bonded + Retail Store model are not required to have labeling in Chinese. We saw the above products for sale in the SF Best store we visited in Shenzhen.

Source: Coresight Research Product specifications, quarantine reports, logistics information and other data appear on a shopper’s smartphone once the shopper scans the QR code on a foreign product.

Source: CCIC/Coresight Research

Product specifications, quarantine reports, logistics information and other data appear on a shopper’s smartphone once the shopper scans the QR code on a foreign product.

Source: CCIC/Coresight Research A shopper scans a QR code printed out by a store associate to purchase items using mobile payment.

Source: Coresight Research

A shopper scans a QR code printed out by a store associate to purchase items using mobile payment.

Source: Coresight Research Source: AsiaBriefing.com

Source: AsiaBriefing.com Source: Kaola.com/Coresight Research

Source: Kaola.com/Coresight Research