albert Chan

What’s the Story?

The five-year plan is issued by the Chinese government every five years to provide guidance for the nation’s overall development. In this report, we explore China’s latest five-year plan and investigate its implications for retail.

Why It Matters

The National People’s Congress of China, the highest organ of state power and the national legislature of China, released “The Outline for the 14th Five-Year Plan (2021–2025) for National Economic and Social Development and Long-Range Objectives Through the Year 2035” on March 11, 2021. The preparation and formulation of the latest five-year plan involved several key government organizations, including the State Council (China’s highest administrative authority led by the premier) and the Central Committee of the Communist Party of China (a political body comprising top leaders).

The tradition of China’s five-year plan dates to the 1950s, when Chairman Mao Zedong led the drafting of the country’s first five-year plan that ran from 1953 to 1957. Since then, China has released and implemented 13 of these guidelines, which have been evolved beyond the initial functions of economic roadmaps. The official document now covers all important issues, from national security through to carbon emissions. Current Chairman Xi Jinping calls the plans “an important way… to govern the country.”

The five-year plan covers targets for economic indicators and domestic expenditure, so it has direct implications for the nation’s retail industry.

China’s Latest Five-Year Plan: In Detail

Major Targets of the 14th Five-Year Plan

Aiming to elevate the nation’s economic and technological strength in the next five years, China’s latest five-year plan places heavily emphasis on improving domestic economic conditions and promoting technological innovation and national security, while leaving sufficient room to cope with increasing risks and challenges.

There are six major targets of China’s latest five-year plan, which we outline below.

1. Keep major economic indicators “within an appropriate range”Instead of setting annual GDP growth targets for the next five years, the latest five-year plan lays out a new system of issuing “indicative economic growth targets” every year based on actual circumstances. For 2021, the government expects GDP growth to reach 6%. By comparison, GDP increased by only 2.3% in 2020, with growth restricted by the Covid-19 pandemic.

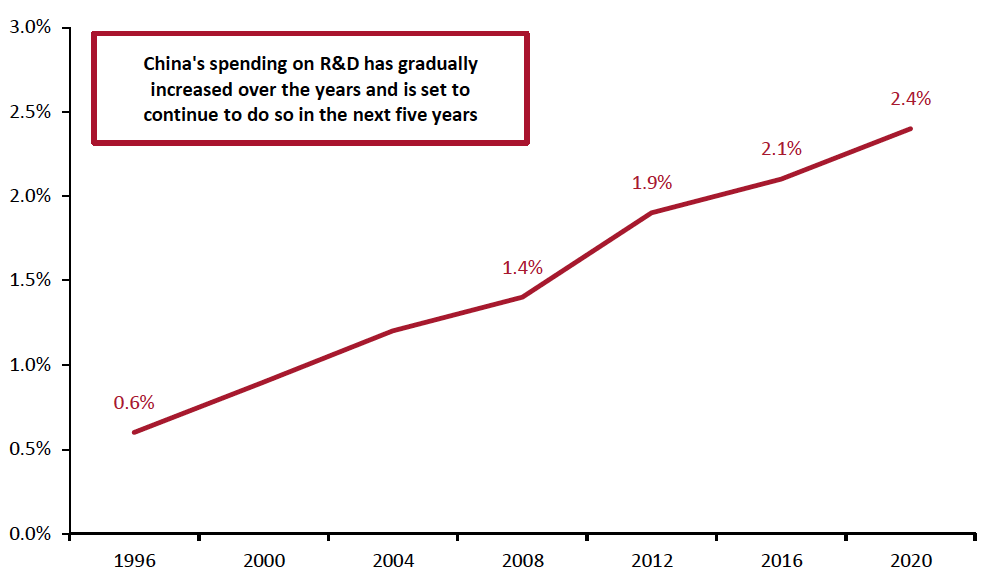

2. Grow R&D expenditure at an annual growth rate of above 7%China is a scientific powerhouse and has invested heavily in expanding its research and development (R&D) over recent decades. According to the government, China’s R&D expenditure has increased from ¥1.42 trillion ($218.5 billion) in 2016 to ¥2.21 trillion ($340.0 billion) in 2020, at a CAGR of 11.7%.

There are seven frontier fields listed as national projects: artificial intelligence; quantum information; integrated circuits; brain science; genetic and biological technologies; clinical medicine and health; and the exploration of outer space, underground, deep seas and polar regions.

Last year, the Chinese government designated several scientific parks in Beijing, Shanghai, Shenzhen and Hefei as “national centers for science.” These will become incubators for technology enterprises, the latest five-year plan states.

With the government’s plans to keep the annual growth rate above 7%, R&D expenditure is likely to continue to increase as a proportion of China’s GDP, as it has for the past two decades (see Figure 1).

Figure 1. China’s Spending on R&D as a Proportion of GDP (%)

[caption id="attachment_126576" align="aligncenter" width="700"] Source: OECD/National Bureau of Statistics of China/Coresight Research[/caption]

3. Increase the proportion of urban residents to 65% of the population

Source: OECD/National Bureau of Statistics of China/Coresight Research[/caption]

3. Increase the proportion of urban residents to 65% of the population

China is aiming to accelerate urbanization and expand urban agglomerations and metropolitan areas. The country expects to increase the proportion of urban residents to 65% of the population by 2025.

4. Respond to the aging of the populationThe life expectancy of Chinese citizens is expected to increase by one year in the 14th five-year-plan period, according to the government. In response to the aging of the population, China is aiming to promote an appropriate birth rate and gradually delay the legal retirement age. The country is also set to improve its social security system and increase the basic pension insurance participation rate to 95%, according to the five-year plan.

5. Promote green developmentThis target includes goals such as increasing forest coverage rate to 24.1% by 2025 (from 23.2% in 2020) and the ratio of days with good air quality in prefectural-level cities and above reaching 87.5% (from 87% in 2020).

6. Ensure grain production capacity remains above 1.3 trillion cattiesChina is planning to maintain its annual grain output of 1.3 trillion catties (around 650 million tons) over the next five years. It is the first time that China has included the implementation of a food-security strategy in the five-year plan. According to the government, from a medium- to long-term perspective, China’s food supply and demand will remain in a tight balance, especially in the face of the complex international situation and other potential risks.

Directions of Development and the Implications for Retail

In addition to the six major targets of the plan (above), the National People’s Congress also laid out directions of development for consumption and technology. Local governments will need to follow these directions and formulate corresponding plans based on their specific situations. In this section, we discuss the directions of development and their impacts on retail.

Consumption Upgrade Will Bring New Opportunities

The plan gives clear directions to stabilize and expand domestic spending, including cultivating new types of consumption, expanding holiday spending and improving urban-rural integration.

- Cultivate new types of consumption; develop digital commerce

Following the outbreak of Covid-19, new forms of consumption that are centered around digitalization have shown strong growth momentum, such as livestreaming e-commerce and community group buying.

With the continuous improvement of digital infrastructure, the acceleration of online and offline integration and the changing spending habits of domestic consumers, new types of consumption will continue to inject vitality into the consumer market.

- Improve the policies on duty-free shopping inside cities, and build a batch of duty-free shops inside cities

As the global pandemic is still severe, the number of tourists traveling abroad has dropped sharply and much of the spending, especially on luxury goods, has shifted to the domestic market. Hainan’s duty-free shopping has been a hot topic in 2020 and continues its popularity in 2021.

[caption id="attachment_126577" align="aligncenter" width="550"] Chinese tourists shop at the Sanya International Duty-Free Shopping Complex in Hainan

Chinese tourists shop at the Sanya International Duty-Free Shopping Complex in HainanSource: Weibo[/caption]

There is a lot of room to develop duty-free shopping in China, especially in-city downtown duty-free shops, a concept that is still in its infancy. With the relaxation of the tax-exemption policy, China’s in-city duty-free market will grow. The overall Chinese duty-free market will more than double to $16.5 billion in 2025, representing a CAGR of 13.8% between 2019 and 2025, according to Morgan Stanley. Cities including Chengdu, Shanghai and Shenzhen are planning the construction of in-city downtown duty-free shops.

- Boost rural consumption

China has nearly 600 million rural residents, presenting significant opportunity to expand domestic spending in this demographic.

The current Internet and logistics infrastructure in rural areas is relatively backward, making it difficult for high-quality supplies to fully reach the rural market. However, China’s five-year plan aims to “expand the coverage of e-commerce in rural areas,” and we have seen some e-commerce companies are also making efforts to capture the rural market. We expect rural spending, especially via online retail in rural areas, to grow in the future. According to the Ministry of Commerce, online retail sales in rural areas reached ¥1.79 trillion ($270 billion) in 2020—having increased by 8.9% year-over-year—and accounted for 18.3% of total online retail sales.

A Focus on Technology Will Accelerate the Reformation of Retail

As China has been increasing its spending on R&D, and is set to continue this growth moving forward, we can expect to see new technologies and applications emerge in the retail sector. China’s five-year plan provides clear directions regarding the development of technology:

- Build 5G-based application scenarios and industrial ecosystem, carrying out pilot projects in key areas including smart logistics

Integrated with other technologies such as the Internet of Things (IoT), big data, cloud computing and artificial intelligence, 5G is becoming a driving force for economic growth. The China Academy of Information and Communications Technology estimates that by 2025, 5G could drive total investment in telecom operators’ networks to about ¥1.2 trillion ($183.4 billion).

In smart logistics, the development of 5G can bring fundamental changes to the industry. For example, the combination of 5G and IoT technology make it possible for automated facilities to communicate with each other. We discuss more about the application of 5G in the supply chain in a separate report.

- Participate in the formulation of international rules and digital technology standards such as data security and digital currency

To enhance data security, China plans to ban apps from collecting excessive user data, starting May 1, 2021, according to a document jointly released by a group of the country’s top regulators, including the Cyberspace Administration, the Ministry of Industry and Information Technology, the Ministry of Public Security and the State Administration for Market Regulation.

Currently, some apps ask users to provide sensitive personal information and deny access to those who decline to share such information. With the new rules, if users refuse to provide personal information other than basic information (that which ensures the normal operation of the basic functional service), apps must provide users with basic services and cannot reduce the quality of service.

China’s current roadmap singles out its drive to create a national digital currency, which has undergone testing in major cities including Changsha, Shanghai, Shenzhen and Suzhou. In December 2020, for the 12.12 shopping festival, the government of Suzhou and People’s Bank of China launched a digital currency pilot program, distributing ¥20 million ($3 million) in digital currency to residents via a lottery. JD.com became the first e-commerce platform to accept the digital currency. Since March 2021, China’s six major state-owned banks, including the Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications and the Postal Savings Bank of China, have begun promoting digital currency wallets in Shanghai, where people can apply for a trial use of the wallets at the banks’ outlets.

[caption id="attachment_126578" align="aligncenter" width="350"] China’s digital currency

China’s digital currencySource: China Construction Bank[/caption]

What We Think

The five-year plan is issued by the Chinese government every five years to provide guidance for the nation’s overall development. The latest plan covers the government’s intentions to prepare for a post-pandemic environment and gives development directions regarding domestic spending and technology.

Implications for Brands/Retailers

- Duty-free shopping will continue to be popular, supported by the government’s policies. Brands and retailers can look to expand their business into duty-free shopping, which would capitalize on spending by domestic travelers.

- Brands and retailers can consider exploring new opportunities in rural areas with the support of upgraded logistics networks. Even with the government’s goal of increasing the urban population to 65%, the absolute number of residents in rural areas is still large. In addition, there are opportunities in the e-commerce market in rural areas, as this is still developing.

- Brands and retailers need to follow the new regulations around data privacy when collecting customer data.

- Brands and retailers should update their payment methods to accept digital currency, as this is likely to become widely used in China, driven by the government.