DIpil Das

Introduction

What’s the Story?

The 6.18 Shopping Festival, which lasted from May 31 to June 18, is the second-largest annual e-commerce shopping holiday in China. Although founded to celebrate the anniversary of JD.com, the event has been adopted by other major e-commerce platforms, including Taobao and Pinduoduo, as well as social platforms such as Douyin and Kuaishou. In this year’s report, we explore how platforms are adapting to the new normal and how consumption patterns are shifting amid persistent lockdowns and supply chain disruptions in China.

Why It Matters

Major shopping holidays, such as the 6.18 Shopping Festival, offer important opportunities in the China market for brands, allowing them to market themselves to Chinese consumers and gain brand recognition. Holidays are also significant for e-commerce platforms, which offer major discounts and deals to generate a substantial portion of yearly revenue through 6.18 sales. As consumer confidence has hit record lows amid prolonged lockdowns in China, the 2022 6.18 Shopping Festival also enabled brands and retailers to test the appetite of Chinese shoppers.

6.18 Shopping Festival: Coresight Research Analysis

1. Performance of Major E-Commerce Platforms

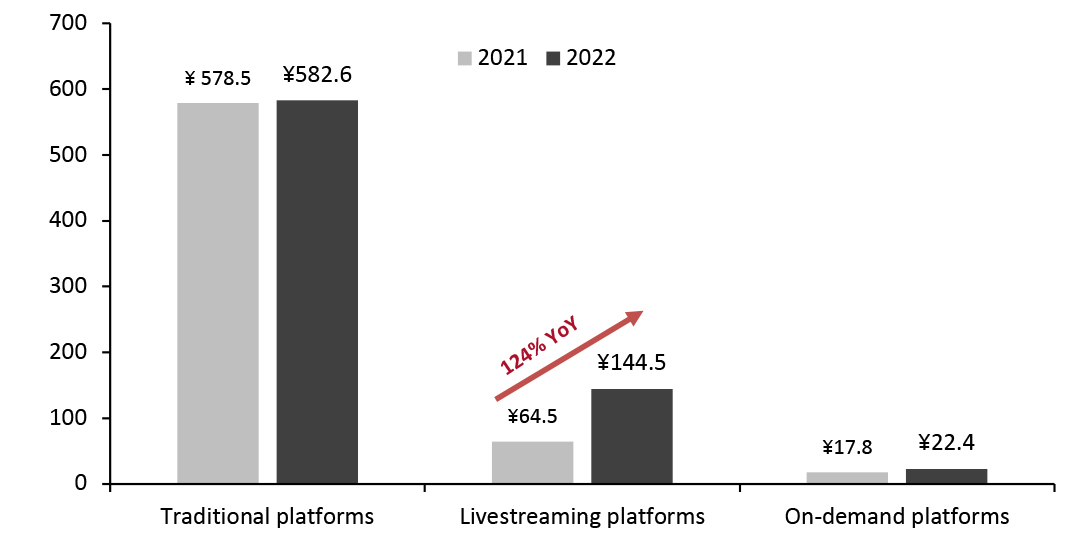

Traditional e-commerce platforms, such as JD.com and Alibaba’s Tmall, generated an estimated ¥582.6 billion ($87.0 billion) during the 6.18 Shopping Festival this year, representing 0.71% year-over-year growth, according to data services company Syntun (Figure 1, below), which records e-commerce site usage by consumers. Meanwhile, livestreaming platforms, including Douyin and Kuaishou, generated an estimated ¥144.5 billion ($21.6 billion), with growth of 124% year over year. Finally, on-demand retail platforms, such as JD Shop Now and Meituan Shangou, generated an estimated ¥22.4 billion ($3.3 billion), an estimated increase of 25.8% from 2021.

Figure 1. Estimated GMV Generated by E-Commerce Platforms During the 6.18 Shopping Festival (RMB Bil.) [caption id="attachment_150579" align="aligncenter" width="700"]

Source: Syntun[/caption]

Source: Syntun[/caption]

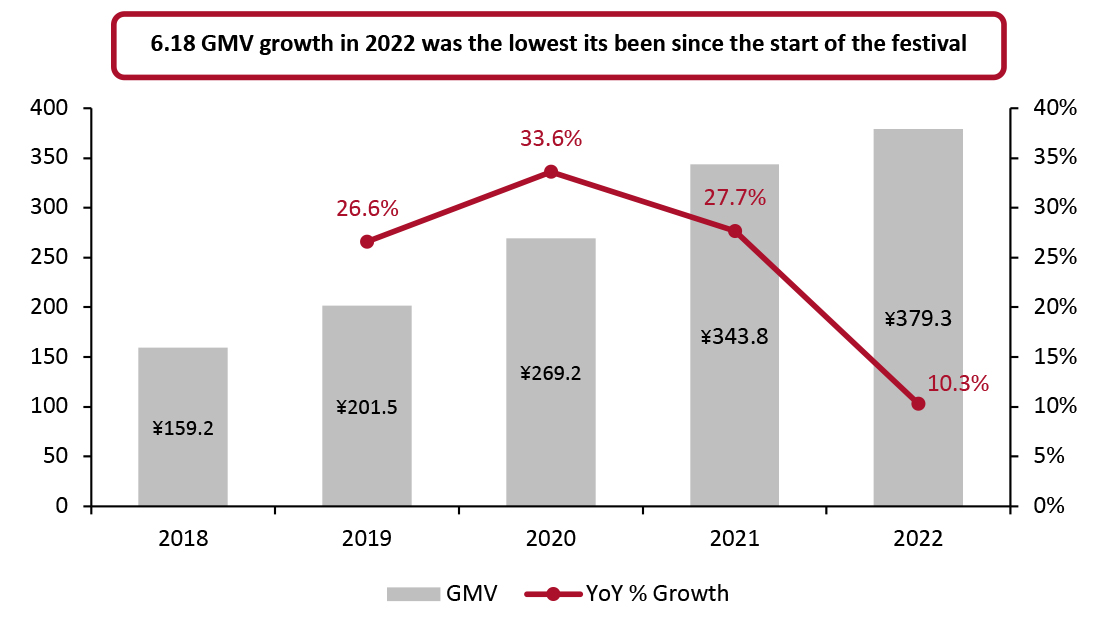

JD.com reported total GMV of ¥379.3 billion ($56.5 billion) during the main festival period, representing year-over-year growth of 10.3%, down from 27.7% in 2021. In a livestreamed presentation after the festival, JD.com shared the following 6.18 highlights:

- For newly launched products, the top categories for 2022 were food & beverage (28% of sales), 3C home appliances (19%) and smartphones (19%).

- JD.com enhanced its omnichannel offerings through partnerships with over 150,000 brick-and-mortar stores across 1,700 cities and counties in China. JD empowered these stores with marketing strategies and one-hour delivery services for customers within a three- to five-kilometer radius.

- Before the festival, the company emphasized its commitment to sustainability by launching its “Green Impact Initiative.” As a result, over 11.57 million green-labeled products were sold during the festival. Meanwhile, 6.18 searches for “environmental protection” increased 19% year over year and searches for “environmental protection education” increased 72%.

- JD Logistics, the platform’s logistical services arm, connected rural agricultural regions to consumers throughout China as part of the company’s “rural revitalization initiatives.” The top agricultural products sold by volume were Shandong large cherries, hairy crab gift boxes and sliced beef tendon.

Figure 2. GMV on JD.com (Left Axis; RMB Bil.) and YoY % Change (Right Axis) [caption id="attachment_150580" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Alibaba does not release total sales figures for 6.18; however, despite tough year-over-year comparisons due to Covid-19-related lockdowns and supply chain issues, total GMV growth for the festival was positive. Alibaba’s International Corporate Affairs team mentioned the following 6.18 Shopping Festival highs to Coresight Research:

- Amid lockdowns in China, Alibaba noted a renaissance of 2020 trends, including increased purchases of camping and sports equipment, such as fishing gear and skateboards which saw year-over-year growth of 50% and 290% during the first period of sales (May 31–June 3), respectively.

- There is growing demand in the pet products category, particularly smart pet products—such as self-cleaning litter boxes and automatic feeders—which increased 150% year over year.

- 20,000 new products, including digital collectibles and limited-edition items, were launched on the Tmall Luxury Pavilion, which hosts nearly 200 luxury brands. Products ranged from digital collectibles to limited edition items. Among the newcomers, Max Mara, an Italian fashion brand, generated ¥1 million ($149,437) in sales in two minutes during its 6.18 presale on May 31.

Livestreaming e-commerce platforms, such as Kuaishou and Douyin, generated impressive sales during 6.18, with total estimated GMV of ¥144.5 billion ($21.6 billion), according to data services company Syntun. Douyin’s livestreamed 6.18 content totaled 40.45 million hours, and videos with links to purchase products were played 115.1 billion times. Meanwhile, the number of participating merchants on Douyin grew 159% year over year.

Overall, domestic and time-honored brands were particularly popular among younger consumers. While sales of time-honored brands on Douyin increased 176% year over year, searches for domestic brands on Baidu, a Chinese search engine, increased 27%.

2022 6.18 Festival Trends

1. Optimization of online shopping services for merchants and consumers

Given China’s prolonged lockdowns, platforms focused on innovative, supportive measures to encourage both merchants and consumers to participate in the 6.18 Shopping Festival. For instance, JD.com produced 30 supportive measures for small and mid-size enterprises (SMEs) to help drive sales, including extreme flash sales, promotional discounts and “super subsidies.” JD promised SMEs that their ROI would increase no less than 20%, a promise they delivered on. The company also launched a new version of its app prior to the festival, enabling a more transparent and seamless experience for consumers and better risk protection for merchants.

Similarly, Alibaba released a list of 25 supportive measures for merchants to assist with delivery services, efficiency, and growth. Its Taobao and Tmall platforms provided liquidity for merchants during the pre-sale period to assist with capital turnover, extensions for refund transactions, and free business education to help improve merchants’ strategy and capability.

JD.com’s improved after-sales service offerings were popular this year: cracked phone screen insurance increased 300% year over year and over 80% of those who bought insurance opted for unlimited repair guarantees. Additionally, sales of robot vacuums and air purifiers with a 30-day free trial period and “replacement over repair” guarantee increased by 200%.

2. Shifts in consumption patterns across consumer groups

E-commerce platforms reported that consumption patterns appear to be breaking away from traditional Chinese social norms. According to Alibaba, searches for male skincare and grooming products increased 20% year over year. Cultural aesthetics are also changing among women, with Alibaba noting increasing sales of fitness and gym-related products.

The increase in fitness and health sales also reflects sticky, pandemic-led behaviors and an increase in average living standards over the past several years. On JD.com, sales of preventative health products rose 35% year over year, while early screenings for serious illnesses through JDHealth increased by “50 times [year over year].” Meanwhile, purchases of health products and health beverages skyrocketed by 1988% and 379%, respectively, during the festival on JD.com.

Searches for healthy food trended during the festival, with searches for organic food increasing 382% on JD.com. Douyin saw interest in domestic food goods grow impressively, selling 1.4 million products from the Hubei region in just eight days. Best-sellers included Qianjiang crayfish, Tujia smoked bacon, and Laifeng tea, among others.

In addition to shifts in consumption patterns, a generational shift is also happening: Gen Zers now account for over 30% of online shoppers in China, according to Alibaba. “Consumers of imported goods are getting much younger, with the fastest growth from Gen Z consumers, [so] their huge consumption potential is important to brands,” explained the president of Alibaba B2C Retail, Alvin Liu, during an online presentation earlier this year.

3. Enhanced logistics infrastructure

Given ongoing global supply chain disruptions, major e-commerce platforms hoped to leverage their capabilities to support merchants’ operations and deliver goods quickly. According to a survey by the Southern Metropolis Daily, delivery times and adequate inventory have become major concerns for Chinese shoppers—54% of respondents indicated orders had been delayed in the past year.

As such, with its “Responsible Supply Chain” theme, JD.com used its logistical capabilities and emerging technologies, like autonomous delivery vehicles, to facilitate same- or next-day deliveries to 92% of districts and counties and 84% of villages, according to its presentation. Cainiao, Alibaba’s logistics company, also utilized its autonomous delivery fleet of 350 vehicles—the largest fleet in China—for the festival. Each of Alibaba’s vehicles can deliver 50 parcels an hour.

Taobao, on the other hand, aimed to address festival fulfillment issues by moving inventory into domestic warehouses nationwide prior to the festival and identifying alternative routes for cargo flights to avoid delays.

[caption id="attachment_150581" align="aligncenter" width="701"] One of JD.com’s autonomous delivery vehicles

One of JD.com’s autonomous delivery vehicles Source: Company website [/caption]

What We Think

This year’s 6.18 Shopping Festival fell at an interesting time, when major Chinese cities were just beginning to lift lockdown restrictions. This year, e-commerce platforms and brands needed to recover from suspended manufacturing and supply chain delays quickly. They also needed to attract consumers when many had been unable to go to work for several months and lacked spendable income. Given China’s zero-tolerance Covid-19 policy, brands and retailers operating in the region must develop strategies to overcome supply chain and inventory issues, and carter to consumers with impacted savings.

Omnichannel services offer excellent additional opportunities for partnership with major e-commerce platforms. Companies like JD.com and Alibaba are continuously developing and improving their logistics networks and brands should take advantage of these opportunities to avoid operation delays.

In November, we will head into Singles’ Day, the largest Chinese shopping holiday annually. Brands and retailers should pay special attention to trends and lessons learned from the 2022 6.18 Shopping Festival. Strong trends in fitness and health are unlikely to disappear in the short term, given the ongoing generational and cultural shifts. Brands must keep on top of these trends and cater their products to consumers to provide new and intimate experiences.