DIpil Das

Introduction

What’s the Story? China’s 6.18 shopping festival—called the 6.18 Grand Promotion by JD.com and also known as the 6.18 Mid-Year Shopping Festival—is a month-long event this year. With the sales periods having already begun, we highlight the marketing strategies that we are seeing from participating marketplace platforms, as well as consumer expectations and emerging trends. Why It Matters Launched by JD.com in 2014 to honor its anniversary on June 18, the 6.18 Grand Promotion has since attracted leading e-commerce platforms to participate in the mid-year event—such as Alibaba’s B2C (business-to-consumer) marketplaces Taobao and Tmall, as well as Douyin, Kuai and Pinduoduo—providing a significant opportunity for brands and retailers to boost sales. Retail demand in China has been decimated by restrictions related to Covid-19. In April, China’s total retail sales growth (excluding food service, including automobiles and gasoline) experienced the steepest decline since March 2020, of 9.7% year over year, as stringent Covid-19 Omicron lockdowns in Beijing and Shanghai took a heavy toll on consumer spending. The extended timeframe of this year’s 6.18 shopping festival provides additional sales and marketing opportunities to overcome challenges.6.18 Shopping Festival 2022: Coresight Research Analysis

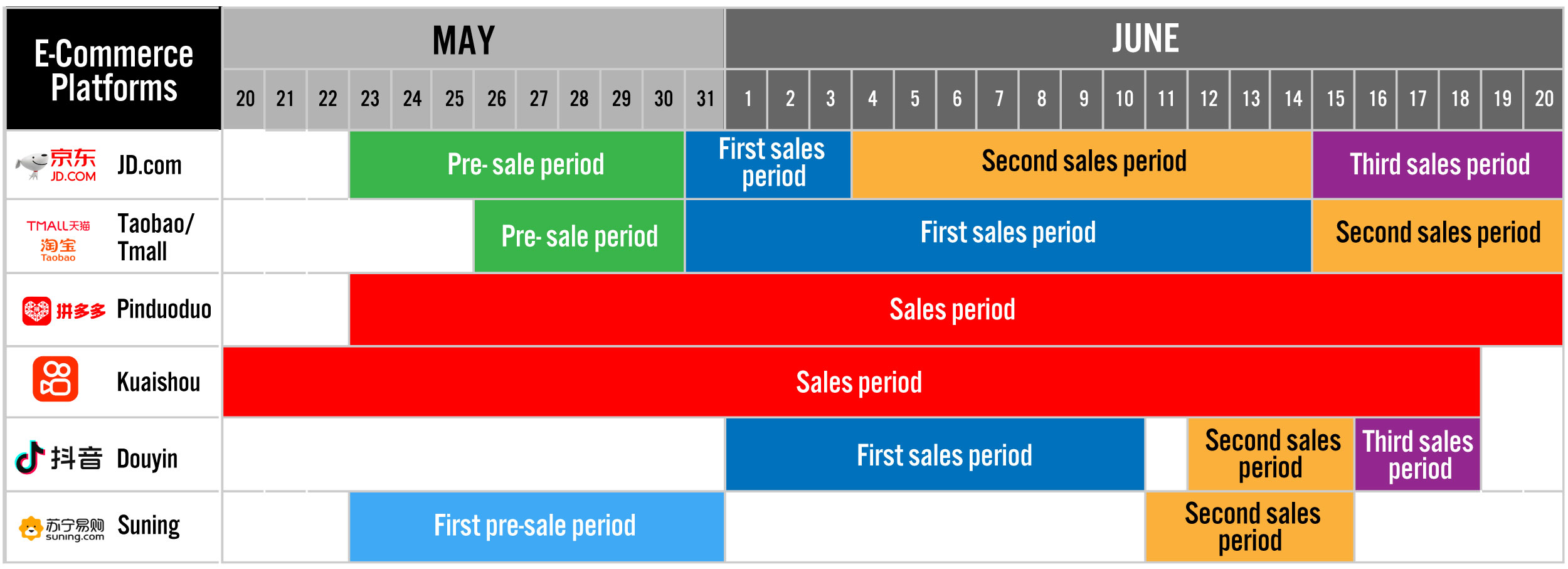

Key Dates The 6.18 Grand Promotion has extended to a month-long series of promotional activities, with a pre-sale period and several official sales periods, enabling consumers to make the most of the discounts and vouchers offered by thousands of brands. Against the backdrop of weak consumer spending, e-commerce platforms are aiming to boost sales volumes during the 6.18 festival by extending their pre-sale period and adding more discounts for consumers than in previous years. Pre-sales periods enable e-commerce platforms to drive interest in the festival’s new products and exclusive promotions. Shoppers are more likely to commit to a purchase early, as they can make a deposit on goods they want to buy to guarantee a low price ahead of the 6.18 official sales period. Dominant e-commerce companies JD.com, Pinduoduo and Suning began their 6.18 pre-sales period on May 23, 2022, while Alibaba marketplaces initiated pre-sales campaigns on May 26, 2022. In the past, 6.18 sales began at midnight, and consumers would stay up all night to place orders. However, this year, JD.com, Taobao and Tmall launched the first sale period on May 31 at 8.00 p.m. (China Standard Time) and the second wave at 8.00 p.m. on June 4 on JD.com (the second sales period is set to start at 8.00 p.m. on June 15 on Taobao and Tmall). In addition to the leading e-commerce players, short-video apps Douyin and Kuaishou have taken part in 6.18 in the past and are making significant inroads. We present the event’s key dates by participating platform in Figure 1.Figure 1. Major E-Commerce Platforms in China: The 6.18 Grand Promotion 2022 Timeline [caption id="attachment_148969" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Key Performance Data So Far

With the full resumption of work and production in Shanghai and with the Covid-19 outbreak under control in Beijing, this year's 6.18 Grand Promotion is a key window to boost consumer spending and pave the way for an economic rebound in the second half of 2022.

JD.com

Source: Company reports/Coresight Research[/caption]

Key Performance Data So Far

With the full resumption of work and production in Shanghai and with the Covid-19 outbreak under control in Beijing, this year's 6.18 Grand Promotion is a key window to boost consumer spending and pave the way for an economic rebound in the second half of 2022.

JD.com

- During pre-sales from 8.00 p.m. on May 23 to midnight of May 29, sales of a number of popular consumer brands such as Haier, Huawei, Lenovo, Midea and Xiaomi exceeded ¥100 million ($15 million) on JD.com, according to the company. Over that six-day period, pre-order sales among Gen Zers rose 75% year over year, JD.com reported, signaling the spending power of younger consumers.

- On May 31, only 10 minutes after the launch of 6.18, the number of brick-and-mortar retailers that generated orders on JD.com increased by 170% year over year, according to the e-commerce platform.

- Data from Alibaba showed that its delivery arm, Cainiao, saw a 35% increase in the number of direct signed orders compared with the same period last year as of 12.00 p.m. on June 1.

- More than 29,000 overseas brands from 87 countries and regions are participating in the shopping festival on Tmall, including more than 3,000 new overseas brands, according to Alibaba.

- Alibaba data show that on Taobao and Tmall, more than 200 luxury brands are participating in 6.18, launching over 20,000 new products overall.

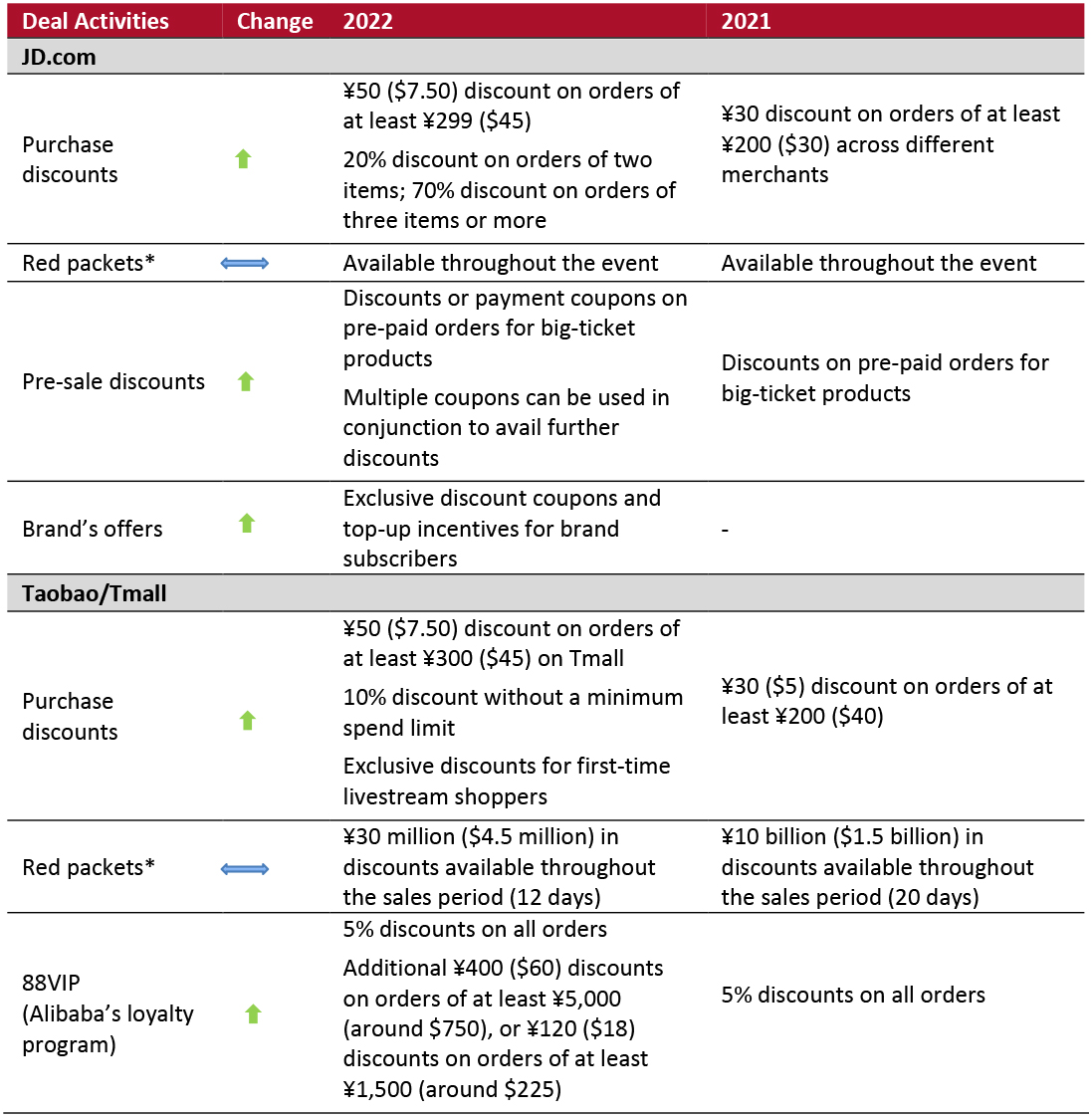

Figure 3. JD.com and Alibaba’s Taobao and Tmall: 6.18 Sales Offers—2022 vs. 2021 [caption id="attachment_148968" align="aligncenter" width="700"]

*Discounts that can be unlocked when an order is placed

*Discounts that can be unlocked when an order is placed Source: Company reports/Coresight Research [/caption] 2. E-Commerce Platforms Take Measures To Empower SMEs In the shadow of Covid-19, supply chain instability continues to impact retail performance: Both Alibaba Group and JD Retail reported heavy losses in the first quarter of 2022. The two companies, as well as smaller players in China’s e-commerce sector, have taken measures to alleviate pressure for merchants and sellers on their marketplaces, especially small and medium-size businesses (SMEs). Below, we discuss these measures under three key goals: boost liquidity, increase online traffic and improve logistics efficiency. Boost Liquidity In China’s competitive e-commerce sector, large retail companies’ key strategies often lean on their ability to quickly attract and retain huge numbers of online shoppers—leading to the risk of SMEs falling behind as they have less capital to invest in expensive customer acquisition. JD.com and Alibaba have launched initiatives to boost liquidity for small businesses, making it less expensive for them to participate in 6.18 so they can capitalize on the high online traffic that the festival attracts.

- JD Retail pledged to reduce the operating burdens for its merchants—particularly small businesses— by lowering services fees across its platforms during the sales period to boost merchants’ return on investment by at least 20% during the 6.18 sales period.

- JD Small Loan, JD.com’s financial business arm, has a reinsurance pool of ¥2 billion ($150 million) for merchants participating in the event. The company expects this to provide a 75% discount on loan interest rates.

- Alibaba will waive service fees from May 26 to June 20.

- Taobao and Tmall estimated that merchants would receive roughly ¥10 billion ($1.5 billion) in deposits made by consumers to secure their orders. Once the first sales period began on June 1, the remaining balance of ¥100 billion would be delivered to businesses.

- Suning.com is charging lower fees on merchants for advertising coverage and data flow to help brands reach more customers.

- JD.com has optimized its marketing, livestreaming and advertising policies for sellers through a simplified mechanism for merchants to grow and monetize user traffic. Through the upgrade, the company aims for the system to better handle the entire shopping process, from pre-sales to after sales.

- Alibaba has developed incentives for merchants to unlock the core resources on Taobao and Tmall, such as coupons and financial subsidies for broadcasting livestreaming.

- Responding to Chinese government expectations for Internet platform operators to provide support for small businesses and help stabilize the country’s economy, JD.com is leveraging its intelligent logistics and warehouses offerings to help speed up the digital transformation of SMEs and brick-and-mortar stores. The company estimated that its peak transport volume will exceed 60 million items a day during the 6.18 campaign. To boost its transportation capacity, JD Logistics has opened more than 50,000 transportation lines with nearly 70,000 daily truck departures.

- Cainiao Network, the smart logistics arm of Alibaba, has a 350-strong fleet of autonomous logistics delivery vehicles, each capable of delivering up to 50 parcels per hour to provide on-time package delivery services to consumers across more than 70 cities. Additionally, the company has 1 million square meters of warehouse space and another 5 million square meters of peripheral storage facilities to support merchants.

- JD.com continues to strengthen its omnichannel business. The company opened four new J Shops ahead of the sales event. The 335-square-meter stores in Chengdu, Shenzhen, Xi’an and Yinchuan feature 300 brands, covering 150 categories of goods including cosmetics, kitchenware and home. In-store shoppers can scan electronic labels on the products to learn more information or place an order for same- or next-day delivery on JD.com. In addition, J Shop has a livestreaming studio, so visitors can watch the session in-store while remote consumers can watch the livestream online and shop the featured products via the company’s e-commerce site or app.

J Shop on JD.com’s app, with curated shopping themes (left); on-site livestreaming studio in a J Shop store (right)

J Shop on JD.com’s app, with curated shopping themes (left); on-site livestreaming studio in a J Shop store (right) Source: JD.com [/caption]

- As part of its omnichannel strategy, Alibaba-owned department store Intime is offering online coupons, livestreaming and flash sales during 6.18. Other perks are available at the point of checkout online to encourage bigger basket sizes and future orders, as well as to drive visits to brick-and-mortar stores.

Taobao 6.18 shopping festival in the metaverse

Taobao 6.18 shopping festival in the metaverse Source: Alibaba [/caption] 5. Sustainability Is Front and Center Sustainability is a key consideration for the modern consumer, driving huge potential for sales of “green” (environmentally friendly) products. Implementing sustainability initiatives and communicating these to consumers will be key for e-commerce companies to capture demand and boost sales.

- JD.com launched its “Green Impact Initiative” on May 31, featuring around 1 million products as green-labeled items on its marketplace, from global consumer brands such as Abbott, CHERY, JOMOO, L'Oréal, Nestlé, Panasonic, Procter & Gamble (P&G) and PurCotton. Through the newly established green account system integrated into JD.com’s app, shoppers can collect green credits that they can redeem for green products, which may use reduced packaging or sustainable materials, or may be delivered via low-carbon transportation, for example. Green products include sustainable fashion and furnishing products as well as energy-efficient appliances.

The home page of the Green Impact Initiative on JD.com’s app

The home page of the Green Impact Initiative on JD.com’s app Source: JD.com [/caption]

- Taobao has launched a dedicated page for more than 1 million renewable and sustainable “green” products. Consumers can collect points and purchase green products at discounted prices.

Taobao’s green products on its app

Taobao’s green products on its app Source: Alibaba [/caption]

What We Think

The 6.18 shopping festival is likely to help support recovery in the China retail market following pandemic-led lockdowns. However, for those participating in the festival, the backdrop remains unusually challenging. Implications for Brands/Retailers- The measures taken by e-commerce platforms are set to boost liquidity and ease supply chain pressures for SMEs, driving revenue.

- Leading companies are competing to offer experiential and convenient shopping experiences for customers through upgraded omnichannel approaches, livestreaming and the metaverse. Such experiences will generate huge consumer interest and high online traffic for brands and retailers participating in 6.18.

- Environmental concerns are top of mind for e-commerce companies in China. Viewing sustainability issues as a key factor in strategic planning will enable retail companies to determine how sustainability can be used as a differentiator to attract consumer interest and drive growth.