DIpil Das

What’s the Story?

Having begun as an anniversary promotion for Chinese e-commerce giant JD.com, the 6.18 Shopping Festival has grown into China’s second-largest annual online shopping event, behind Singles’ Day. The two shopping festivals serve as an important barometer of China’s retail health. Last year, 6.18 supported the rebound of domestic spending following the Covid-19 crisis in China. In this report, we take a look at Chinese consumer spending during the 2021 iteration of the festival, as China’s economy continues its recovery from the pandemic. We discuss new innovations and strategies implemented by major e-commerce and social platforms during this year’s mid-year shopping event.Why It Matters

In China, shopping festivals present massive opportunities for brands and retailers to increase brand awareness and drive sales. In recent years, we have seen more platforms, such as short-video platforms Douyin and Kuaishou, launch their own shopping festivals alongside 6.18 or Singles’ Day to capture a share of consumers’ wallet. The intense competition among different platforms pushes them to innovate to better serve consumers, providing lessons to learn for Western e-commerce platforms. For brands that have a presence in China, the 6.18 Shopping Festival is also a testing ground for Singles’ Day and long-term strategies in the China market.6.18 Shopping Festival Wrap-Up

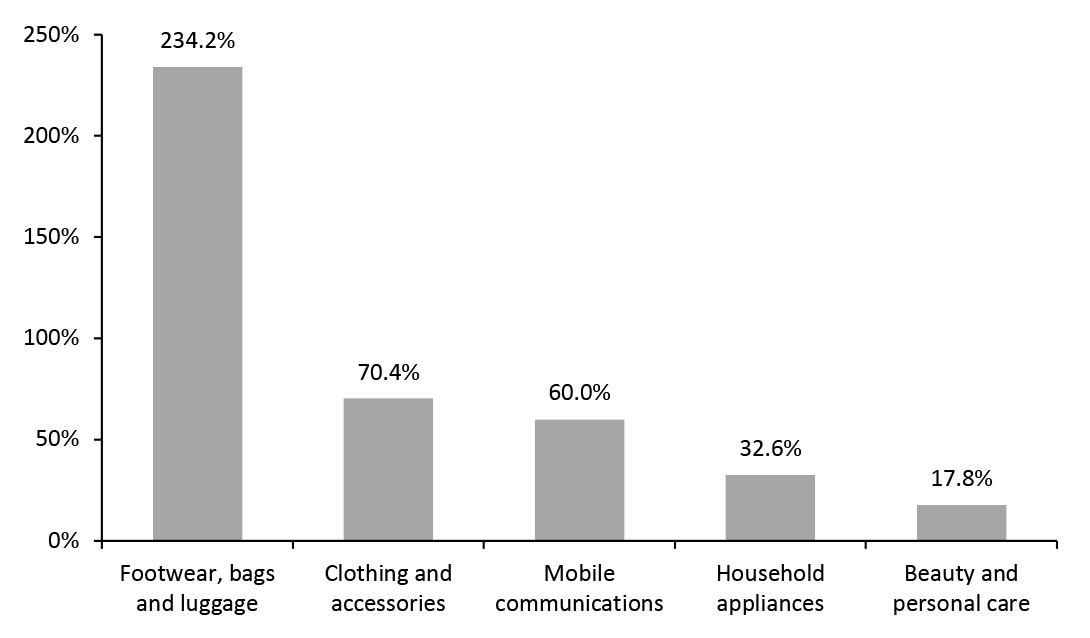

The 6.18 Shopping Festival kicked off at the end of May with pre-sale periods, when consumers could browse deals and pay deposits to secure discounted products. The official event was held on June 1–18, 2021 (or until June 20 on some platforms). Top Product Categories Household appliances comprised the bestselling category during 6.18, driven by sales on JD.com. Against relatively weak comparatives from last year, footwear, bags and luggage recorded the highest year-over-year GMV growth of 234.2% during 6.18, according to Chinese third-party data company Syntun.Figure 1. Top Five Bestselling Categories During the 6.18 Shopping Festival: YoY % Change [caption id="attachment_128995" align="aligncenter" width="724"]

Source: Syntun[/caption]

Major E-Commerce Platforms’ Performance

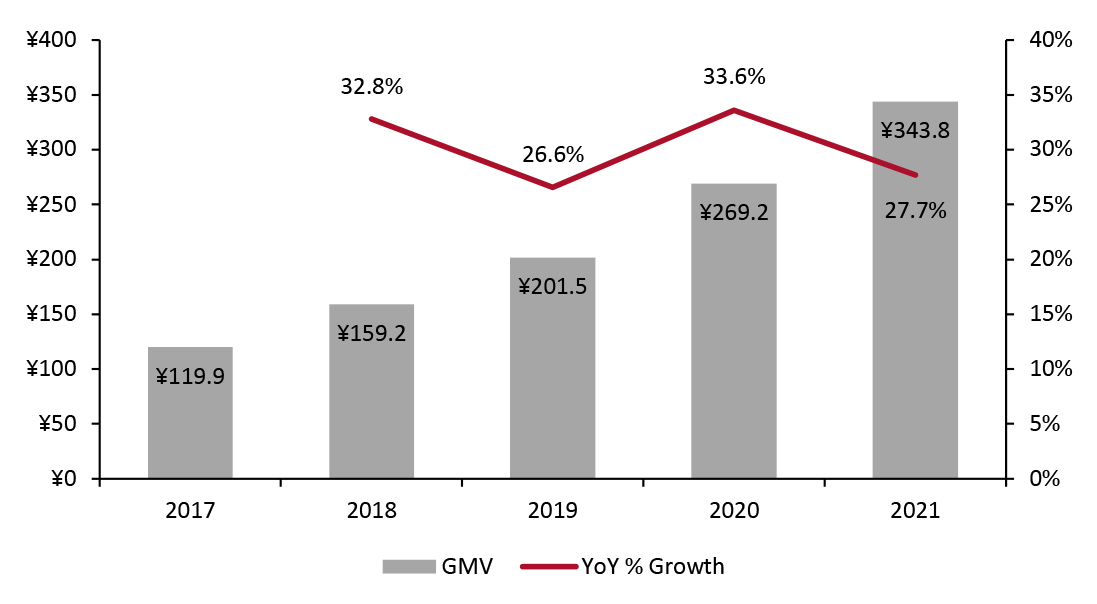

JD.com reported total GMV of ¥343.8 billion ($53 billion) during the 6.18 Shopping Festival (June 1–18), representing year-over-year growth of 27.7%, which is lower than the 33.6% growth of the 2020 event. JD.com shared some highlights of its performance during 6.18:

Source: Syntun[/caption]

Major E-Commerce Platforms’ Performance

JD.com reported total GMV of ¥343.8 billion ($53 billion) during the 6.18 Shopping Festival (June 1–18), representing year-over-year growth of 27.7%, which is lower than the 33.6% growth of the 2020 event. JD.com shared some highlights of its performance during 6.18:

- The top three bestselling product categories in terms of GMV were mobile phones, laptops and air conditioners. More than 263 brands reached GMV of ¥100 million ($15 million) during 6.18 this year.

- The supermarket category, including fresh and FMCG (fast-moving consumer goods) products was a key highlight. JD Super, JD.com’s online supermarket, saw sales surge 10 times in the first three minutes on June 18. In the first hour on June 18, sales of fresh products increased by 70% year over year.

- International products continued to witness strong demand from Chinese consumers. More than 20,000 international brands from over 100 countries participated in 6.18 promotions. Among them, sales of nearly 700 brands more than doubled year over year.

- The luxury category also performed well. Sales of Salvatore Ferragamo (an Italian luxury goods company) skyrocketed 209% year over year. Burberry saw sales increase 10 times compared to 6.18 in 2020.

Figure 2. The 6.18 Shopping Festival: GMV on JD.com, 2017–2021 (Left Axis; RMB Bil.) and YoY % Growth (Right Axis) [caption id="attachment_128959" align="aligncenter" width="725"]

Source: Company reports[/caption]

This year, Alibaba’s Tmall platform extended its 6.18 Shopping Festival by two more days for Father’s Day. The company did not report total GMV data this year, but disclosed some impressive figures:

Source: Company reports[/caption]

This year, Alibaba’s Tmall platform extended its 6.18 Shopping Festival by two more days for Father’s Day. The company did not report total GMV data this year, but disclosed some impressive figures:

- As in 2020, there were two official sales periods on Tmall this year: June 1–3 and June 18–20. In the first hour on June 1, over 1,700 brands equaled the GMV they generated on the full day last year. On June 18, sales in the first hour were up 100% year over year.

- Livestreaming extended its momentum during the event: In the first hour on June 1, livestreaming GMV exceeded full-day GMV from 2020. More merchants hosted their own livestreaming sessions on Taobao Live, too. GMV from merchant-run session rose more than 100% year over year in the first hour on June 1.

- As of 12.00 p.m. on June 1, GMV on Tmall Global, Alibaba’s cross-border platform, grew 61% year over year, driven by imported wine, pet health products, fragrance and baby skincare products.

- On June 1, 755 new brands (that have been on Tmall for less than three years) each reached GMV of ¥1 million ($155,000).

Source: Alizila[/caption]

JD.com also witnessed consumer hunger for new and customized products. JD Super launched over 30,000 new brands and storefronts during 6.18, with over 2.4 million products, according to JD.com. The platform reported that GMV of total new products grew 314% year over year. Consumer-to-manufacturer (C2M) products, which are tailormade products based on consumers’ needs, also gained traction among shoppers. During the 6.18 promotion, sales of C2M computers increased by 100% year over year on JD.com, as reported by Chinese media firm Xinhua.

2. Upgraded Logistics Services

In today’s retail environment, it is critical for e-commerce platforms to provide efficient logistics services, as shoppers are increasingly looking for faster delivery of their orders. We have seen e-commerce platforms continue to step up their fulfillment networks.

Alibaba’s delivery and logistics arm, Cainiao, upgraded its express-delivery service just before the 6.18 event this year. During the pre-sale period, Cainiao delivered 95% of its orders on the same day or the next day. Moreover, throughout June, Cainiao had been setting up 5,000 parcel pickup stations in China’s remote villages to expedite deliveries for customers.

JD.com also boosted its logistics network, JD Logistics, during 6.18 to fulfill consumer demand. The company utilized 30 new autonomous delivery vehicles in Changshu, Jiangsu province, to fulfill 1.5 times as many orders daily as it achieved last year. JD Logistics has upgraded the autonomous vehicles to allow customers to choose a designated time for the vehicle to come to their doorsteps. These vehicles were also used to transfer products among JD.com’s delivery stations and fulfill on-demand delivery for stores. According to the company, consumers in 92% of districts and counties and 84% of villages nationwide enjoyed same-day or next-day delivery.

[caption id="attachment_128961" align="aligncenter" width="725"]

Source: Alizila[/caption]

JD.com also witnessed consumer hunger for new and customized products. JD Super launched over 30,000 new brands and storefronts during 6.18, with over 2.4 million products, according to JD.com. The platform reported that GMV of total new products grew 314% year over year. Consumer-to-manufacturer (C2M) products, which are tailormade products based on consumers’ needs, also gained traction among shoppers. During the 6.18 promotion, sales of C2M computers increased by 100% year over year on JD.com, as reported by Chinese media firm Xinhua.

2. Upgraded Logistics Services

In today’s retail environment, it is critical for e-commerce platforms to provide efficient logistics services, as shoppers are increasingly looking for faster delivery of their orders. We have seen e-commerce platforms continue to step up their fulfillment networks.

Alibaba’s delivery and logistics arm, Cainiao, upgraded its express-delivery service just before the 6.18 event this year. During the pre-sale period, Cainiao delivered 95% of its orders on the same day or the next day. Moreover, throughout June, Cainiao had been setting up 5,000 parcel pickup stations in China’s remote villages to expedite deliveries for customers.

JD.com also boosted its logistics network, JD Logistics, during 6.18 to fulfill consumer demand. The company utilized 30 new autonomous delivery vehicles in Changshu, Jiangsu province, to fulfill 1.5 times as many orders daily as it achieved last year. JD Logistics has upgraded the autonomous vehicles to allow customers to choose a designated time for the vehicle to come to their doorsteps. These vehicles were also used to transfer products among JD.com’s delivery stations and fulfill on-demand delivery for stores. According to the company, consumers in 92% of districts and counties and 84% of villages nationwide enjoyed same-day or next-day delivery.

[caption id="attachment_128961" align="aligncenter" width="725"] Source: JD.com[/caption]

3. Improved Shopping Experiences Through Membership Engagement and Integration of Online and Offline Retail

Alibaba and JD.com took slightly different approaches to enhance the shopping experience for 6.18 this year.

Alibaba aimed to leverage members’ engagement to drive spending. During 6.18, 2,000 brands unveiled member-exclusive discounts. For example, luxury skincare brand La Mer gifted its members a gift package valued at ¥2,566 (nearly $400) if they spent over ¥5,000 ($770). Other perks included members-only samples and products. These incentives have become growth drivers for brands. On June 1, 25 brands on Tmall recorded over ¥100 million ($15 million) in GMV generated by their members. As of June 4, over 20 merchants on Tmall had over 10 million members. Alibaba also offered additional discounts for its 88VIP customers. 88VIP is Alibaba’s paid loyalty program that offers members a variety of benefits across the entire Alibaba ecosystem. For this year’s 6.18, 88VIP customers were eligible for additional 5% discounts on top of existing promotions and could redeem up to ¥520 ($80) in shopping coupons.

JD.com partnered with over 3 million offline stores (both JD-owned and non-JD-owned stores) to create an omnichannel shopping experience. JD.com provided resources worth ¥500 million (around $77 million) to drive traffic to physical stores. Over 1,000 of JD’s offline computer and digital stores support one-hour delivery, and during 6.18, sales generated from these stores saw a 300% increase, year over year. JD.com’s two JD E-Space electronics experiential stores (located in Chongqing and Hefei) leveraged livestreaming to boost sales online and hosted interactive activities and events in-store to draw traffic offline. The two stores saw sales increase four times during 6.18, attracting over 5.6 million omnichannel shoppers, according to JD.com.

[caption id="attachment_128962" align="aligncenter" width="725"]

Source: JD.com[/caption]

3. Improved Shopping Experiences Through Membership Engagement and Integration of Online and Offline Retail

Alibaba and JD.com took slightly different approaches to enhance the shopping experience for 6.18 this year.

Alibaba aimed to leverage members’ engagement to drive spending. During 6.18, 2,000 brands unveiled member-exclusive discounts. For example, luxury skincare brand La Mer gifted its members a gift package valued at ¥2,566 (nearly $400) if they spent over ¥5,000 ($770). Other perks included members-only samples and products. These incentives have become growth drivers for brands. On June 1, 25 brands on Tmall recorded over ¥100 million ($15 million) in GMV generated by their members. As of June 4, over 20 merchants on Tmall had over 10 million members. Alibaba also offered additional discounts for its 88VIP customers. 88VIP is Alibaba’s paid loyalty program that offers members a variety of benefits across the entire Alibaba ecosystem. For this year’s 6.18, 88VIP customers were eligible for additional 5% discounts on top of existing promotions and could redeem up to ¥520 ($80) in shopping coupons.

JD.com partnered with over 3 million offline stores (both JD-owned and non-JD-owned stores) to create an omnichannel shopping experience. JD.com provided resources worth ¥500 million (around $77 million) to drive traffic to physical stores. Over 1,000 of JD’s offline computer and digital stores support one-hour delivery, and during 6.18, sales generated from these stores saw a 300% increase, year over year. JD.com’s two JD E-Space electronics experiential stores (located in Chongqing and Hefei) leveraged livestreaming to boost sales online and hosted interactive activities and events in-store to draw traffic offline. The two stores saw sales increase four times during 6.18, attracting over 5.6 million omnichannel shoppers, according to JD.com.

[caption id="attachment_128962" align="aligncenter" width="725"] JD E-Space store in Hefei, Anhui province

JD E-Space store in Hefei, Anhui province Source: JD.com [/caption]

What We Think

This year’s 6.18 Shopping Festival again demonstrated the steady recovery of Chinese consumer confidence and spending power following the Covid-19 crisis. Shopping festivals play a significant role in boosting spending and help brands and retailers to attract new customers and improve brand awareness. The mid-year timing of the 6.18 Shopping Festival also makes it a precursor to Singles’ Day, the largest online shopping festival globally. Implications for Brands/Retailers- Last year, brands and retailers focused more on selling products at discounted prices to boost sales amid Covid-19. As the economy gradually recovers, consumers have shown renewed interest in new products. Learning from this, Western brands and retailers should think beyond discounts to offer merchandise that appeals to consumers’ interests. For example, limited-edition and customized products can make brands stand out during shopping festivals. C2M products can meet specific consumer demand.

- Faster last-mile delivery is one of the key success factors for Chinese e-commerce giants. Both Alibaba and JD.com continue to advance their logistics capabilities to meet consumers’ high expectations. Brands and retailers can deploy the latest technologies such as autonomous vehicles to enable efficient parcel delivery.

- Loyalty programs have proved to be a winning tool for brands and retailers to drive growth and retain customers. Shopping festivals provide opportunities for brands and retailers to acquire new members and engage with existing members. They should offer exclusive benefits and perks to foster membership sign-ups or re-engage with inactive members. To maintain active engagement, merchants can even invite members to chat groups to directly communicate with them.

- With shoppers beginning to flock back to brick-and-mortar stores, brands and retailers should adopt an omnichannel strategy to boost both online and offline channels. This could include using stores to fulfill online orders or encouraging online consumers to visit physical stores through interesting events or coupons.