Introduction

Our quarterly

US Retail Inventory Tracker reviews inventories held by US retailers in the

Coresight 100, our global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past nine quarters.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported results for the fourth quarter of fiscal 2021 (4Q21), ended January 31, 2022.

In October 2021, US retail sales saw a double-digit year-over-year increase, fueled by strong growth in several sectors, and sales increased by 23.2% on a two-year basis. US retail sales continued to see double-digit growth the following month, with sales increasing by a strong revised 14.7% year over year and revised 24.7% on a two-year basis. In December 2021, US retail sales increased by 13.3% year over year and 22.3% on a two-year basis.

However, sales growth slowed sequentially in December 2021, possibly reflecting some holiday season shopping being pulled forward to November 2021. Kicking off 2022, US retail sales increased by a revised 9.4% year over year in January and 22.3% on a two-year basis, against strong 2021 comparatives, boosted by a strong month of job creation and continued average hourly wage growth.

In February 2022, US retail sales increased by 12.8% year over year and 21.0% on a two-year basis, supported by another strong month of job creation as average hourly wages continue to rise within a still-tight labor market.

US retail traffic saw growth of 31.9% year over year in February 2022, coming in higher than January’s growth of 26.9%. We believe this reflects the deconsolidation of shopping trips, amid a decrease in Covid-19 cases and President’s Day holiday shopping.

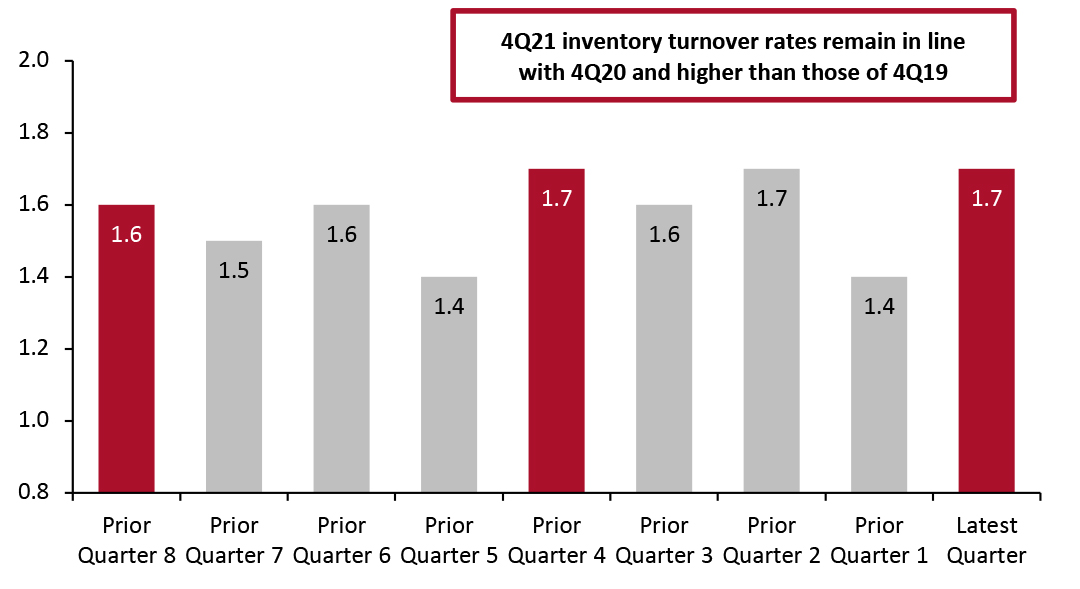

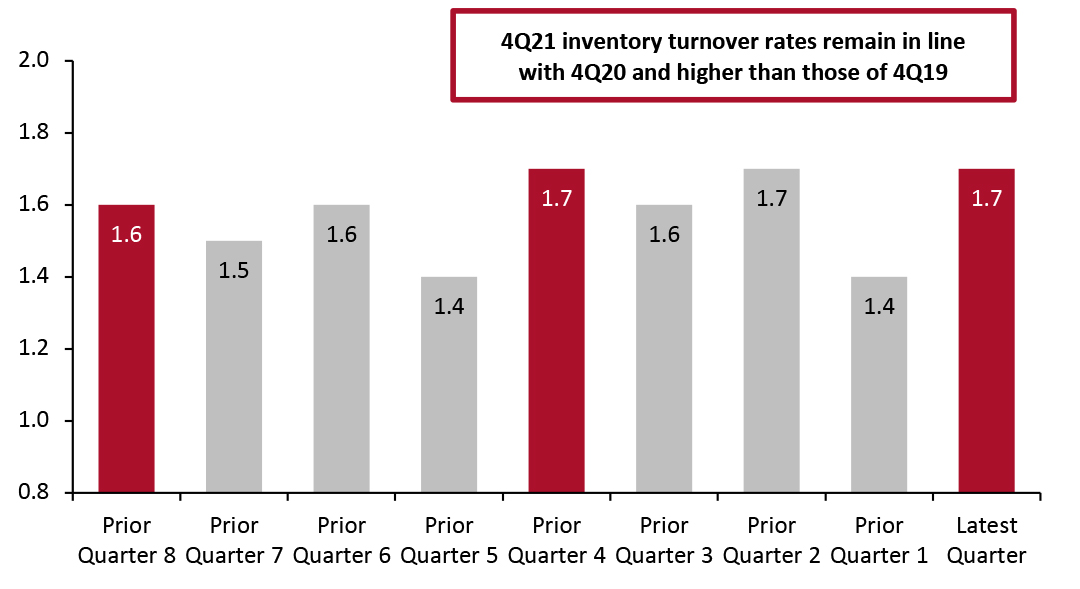

Overview: Inventory Turnover Rates Increase Year over Year and on a Two-Year Basis

Most retailers covered saw their inventory turnover rates remain in line with the previous year (4Q20) and increase on a two-year basis (pre-pandemic 4Q19).

Figure 1. Inventory Turnover Ratios by Quarter: All Retailers

[caption id="attachment_144860" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

The latest quarter continued to see positive growth in inventory turnover for most retailers, as consumers continue to spend strongly, as reflected in store traffic growth.

Apparel specialty retailers: Apparel specialists saw their inventory turnover ratios decline by 9.7% year over year and 2.7% on a two-year basis as supply chain issues continue. Global logistics challenges are resulting in much higher than anticipated inbound transportation costs.

Off-price retailers: Off-pricers maintained their growth momentum from the previous quarter, with inventory turnover ratios increasing by 14.4% year over year and 21.2% on a two-year basis. Apparel and home categories outperformed other categories for these retailers.

Beauty retailers: Beauty retailers saw inventory turnover ratios increase by 44.8% year over year and 32.7% on a two-year basis. The retailers saw robust demand for fragrance, haircare and skincare products in the quarter, plus demand for makeup is picking up substantially.

Department stores: Department stores’ inventory turnover ratios increased by 1.6% on a two-year basis but declined by 4.7% year over year, due to supply chain disruptions and high freight costs. While these stores are seeing strong sales in various accessories, apparel and footwear categories, including activewear, denim, fine jewelry and home décor, the inventory turnover ratio is still declining as the retailers are accumulating inventory to secure stock positions for the next quarter.

Discount stores: Discount retailers reported a 13.2% year-over-year decline in inventory turnover ratios. On a two-year basis, these retailers saw inventory turnover ratios decline by 8.0%.

Drugstores: Drugstore retailers’ inventory turnover ratios increased by 19.5% both year over year and on a two-year basis.

Electronics retailer: The one covered electronics retailer, Best Buy, saw an 8.4% year-over-year decline in its inventory turnover ratio and a 5.3% drop on a two-year basis, owing to constrained inventory and a temporary reduction in store opening hours in January 2022 amid Omicron-related restrictions.

Food and grocery retailers: Food and grocery retailers’ inventory turnover ratios increased 6.2% year over year and 20.7% compared to the fourth quarter of 2019.

Home-improvement retailers: Home-improvement retailers witnessed a 14.8% year-over-year decline in inventory turnover ratios, but 3.1% growth on a two-year basis.

Luxury retailers: The luxury category is seeing substantial recovery, with inventory turnover ratio growth of 6.1% year over year. However, on a two-year basis, the inventory turnover ratio declined by 0.5%.

Jewelry retailers: The one covered jewelry retailer, Signet Jewelers, saw 23.8% year-over-year growth in its inventory turnover ratio and a 47.1% increase on a two-year basis.

Mass merchandisers: Mass merchandisers reported a 17.5% year-over-year decline in their inventory turnover ratios and a 14.7% drop on a two-year basis.

Warehouse clubs: Warehouse club retailers saw an inventory turnover ratio increase of 2.9% year over year and 2.4% on a two-year basis.

Figure 2. Inventory Turnover Ratios by Quarter

[wpdatatable id=1867 table_view=regular]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

*Excludes Wayfair, an outlier

The absolute inventory turnover ratios have been rounded off to one decimal

Source: Company reports/Coresight Research

Sector and Company Overview

We look at the inventory levels of selected retailers across sectors and assess why inventory levels changed from the year-ago period and on a two-year basis.

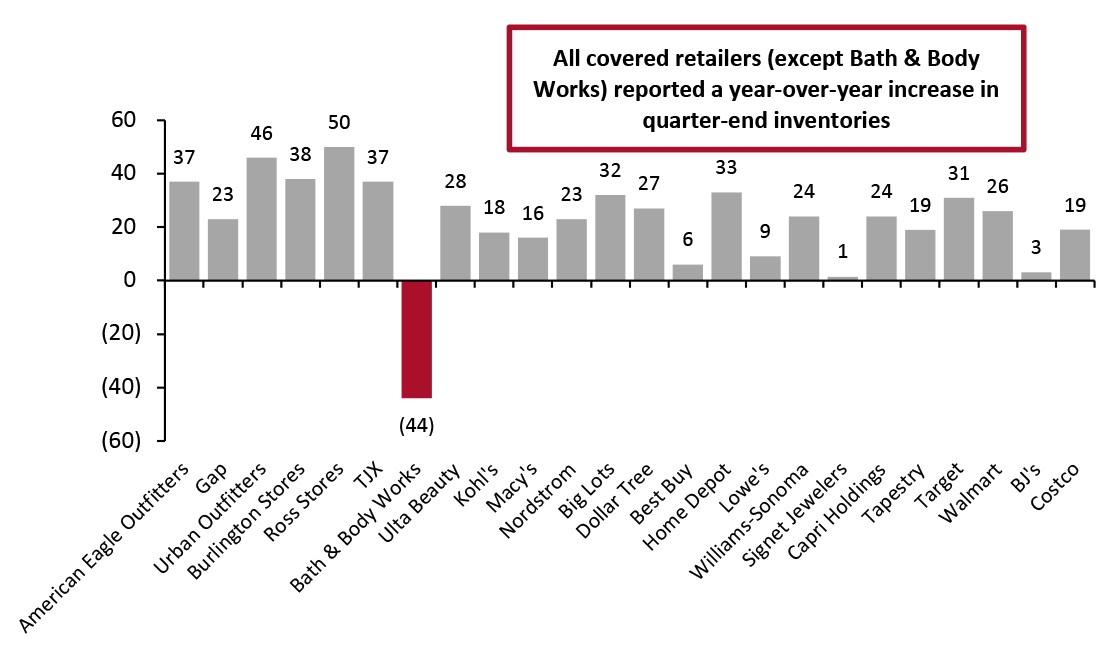

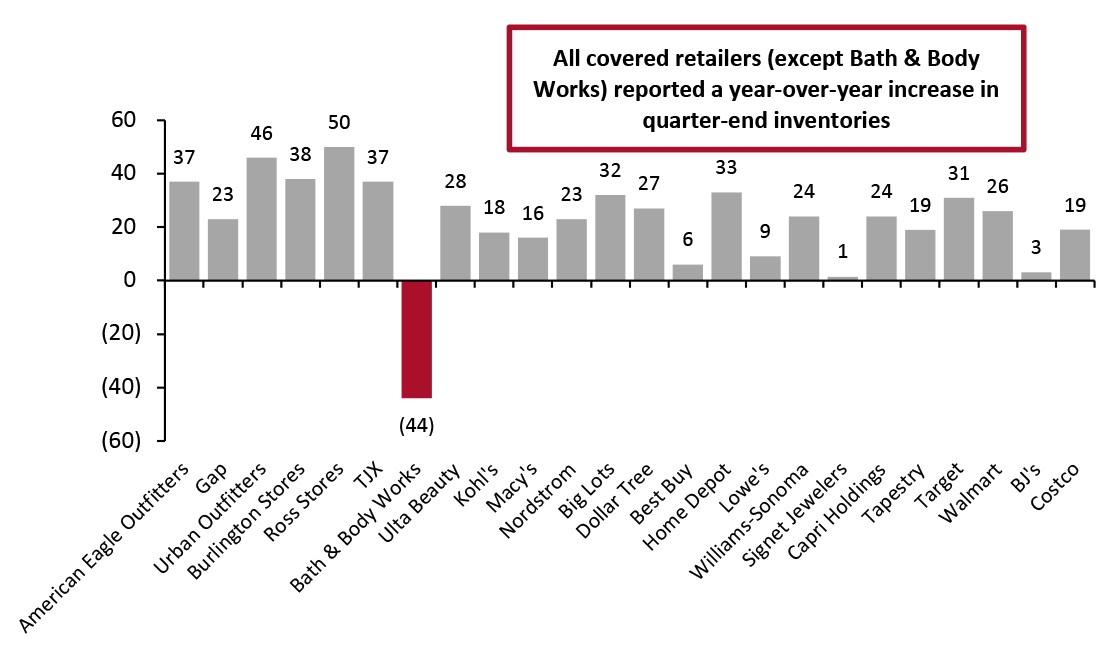

Figure 3. Latest-Quarter Inventory Values of Covered US Retailers: YoY % Change

[caption id="attachment_144861" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

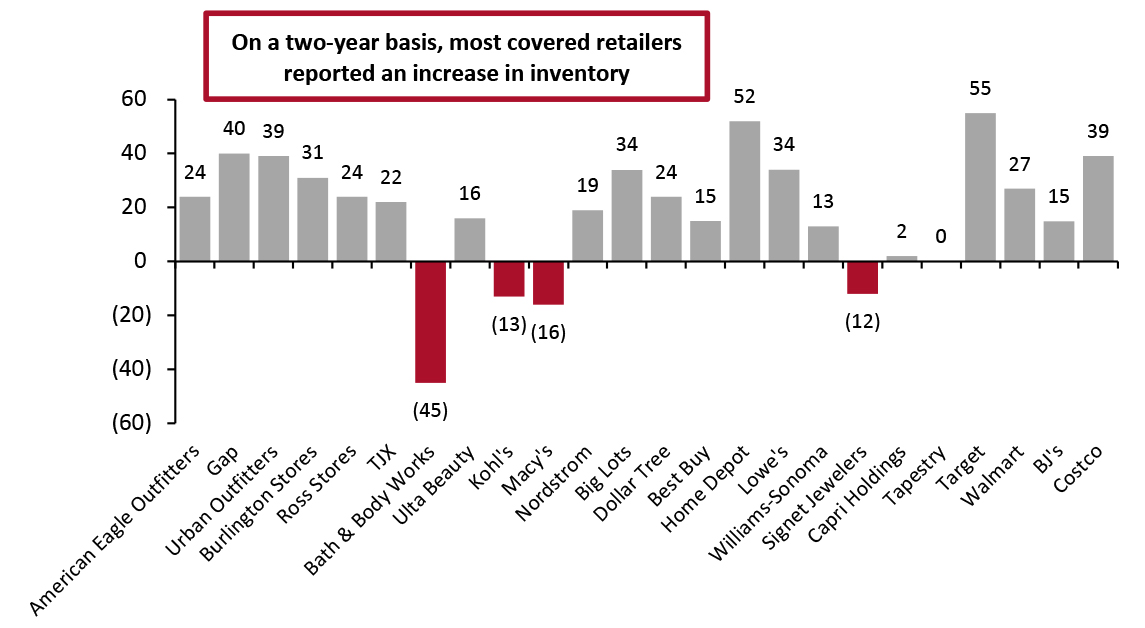

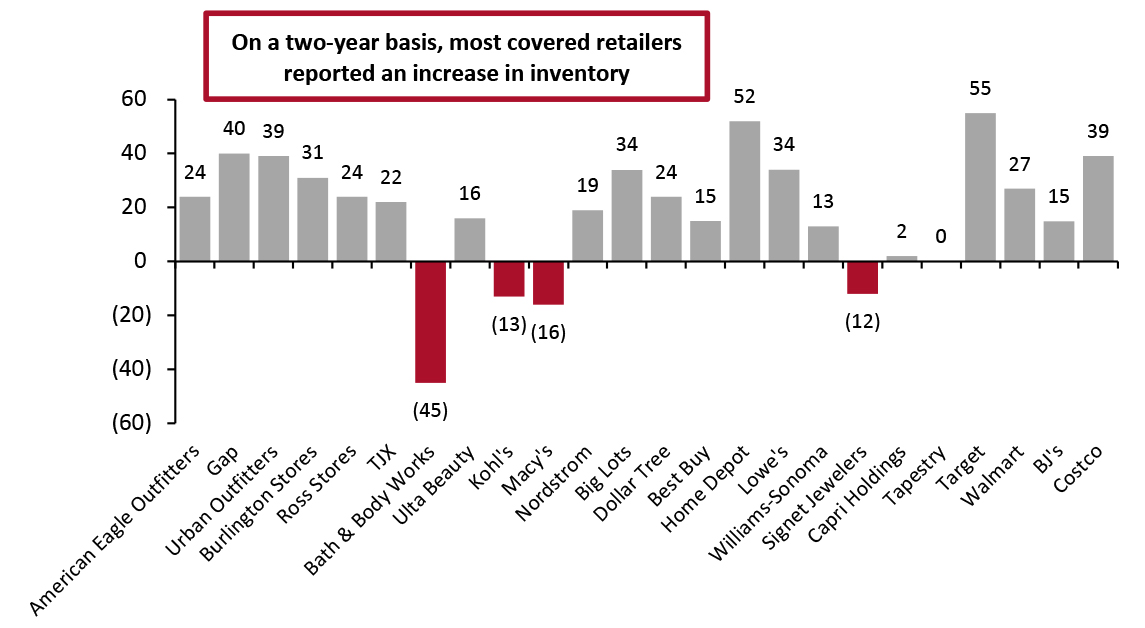

Figure 4. Latest-Quarter Inventory Values of Covered US Retailers: % Change from Two Years Prior

[caption id="attachment_144862" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

All covered apparel specialists witnessed an increase in quarter-end inventories both year over year and on a two-year basis.

|

Commentary |

| American Eagle Outfitters |

The company ended 4Q21 with inventory up 36.5% year over year or up 24.0% on a two-year basis.

COO Michael Rempell said, “As delivery and fulfillment costs rose across the industry, our in-market fulfillment model with Quiet Logistics continued to fuel savings. Delivery costs leveraged 190 basis points (bps) this quarter, driven by a significant reduction in shipments per order. We also shipped orders faster with an approximately 35% reduction in delivery times.”

Management said that Aerie's legging category experienced uneven inventory flows due to industry-wide supply chain disruptions in South Vietnam. As a result, the company took a higher-cost air freight route and transported the products to ensure sufficient stock, which constrained profit margins for Aerie. |

| Gap

|

At quarter-end, the company’s inventory was up 23.1% year over year or up 40.0% on a two-year basis.

Management said that the company is looking at end-to-end supply chain transformation to improve processes, drive efficiency and eliminate waste. This includes digital product creation to trim time from the development cycle and save on overhead and sample costs. It is also looking to optimize shipping logistics to reduce split shipments and implement automated returns in its distribution centers to get product back to inventory in under an hour.

For the first quarter of fiscal 2022, Gap expects year-over-year inventory growth to be up in the mid-20.0% range, due to early inventory bookings to offset longer transit times. |

| Urban Outfitters

|

The company’s inventory was up 46.2% year over year or up 39.1% on a two-year basis.

Management said that due to supply chain disruptions, the company prioritized inventory deliveries during the holiday season which resulted in much higher than anticipated inbound transportation costs.

CFO Melanie Marein-Efron said, “As a result of the much talked about supply chain delays and increased costs, we have extended our lead times and continue to bring product in earlier than normal. As a result of the earlier receipts, increased costs and constrained prior year inventory levels, our inventory varies currently exceeds our sales growth. We believe that our inventory levels will remain somewhat elevated this year versus our sales growth.” |

Off-Price Retailers

All covered off-price retailers reported higher inventory turnover ratios than in the year-ago period and on a two-year basis. Most of these retailers used reserve or packaway inventory to chase high demand during the quarter.

| |

Commentary |

| Burlington Stores |

The company’s total inventory was up 37.8% or up 31.4% on a two-year basis, driven by an increase in in-transit merchandise due to longer lead times caused by industry-wide supply chain bottlenecks.

On a comparable store basis, the company’s in-store inventories were down 30.0% year over year. Reserve inventory, which includes stock that is being stored for later release (either later in the season or in a subsequent season), grew 62.0% versus the same quarter of 2019.

Burlington Stores expects freight and supply chain expenses to remain at elevated levels through the middle of the year and then begin to abate. |

| Ross Stores

|

The company’s total inventories were up 49.9% year over year or up 23.5% on a two-year basis.

Average store inventories were down slightly versus 2019, while packaway merchandise represented 40.0% of the company’s total inventory, versus 46.0% two years ago. |

| The TJX Companies

|

The company ended the quarter with inventory up 37.4% year over year or up 22.3% on a two-year basis, primarily driven by higher in-transit inventory.

The company noted that its inventory levels on a per-store basis improved sequentially in its fourth quarter. Management said that the company is in an excellent inventory position to flow goods to its stores. |

Beauty Retailers

Bath & Body Works saw a decline in inventory levels year over year as well as on a two-year basis, while Ulta Beauty reported higher inventories both year over year and on a two-year basis.

| |

Commentary |

| Bath & Body Works |

The company’s total inventory declined by 44.3% year over year or by 44.9% on a two-year basis. CEO Andrew Meslow said, “We demonstrated agility to replan the business in the midst of strong customer demand while also experiencing inflationary pressures and production constraints. Our primarily North American, vertically integrated supply chain provides us with agility to present full merchandise assortments to our customers in all time frames.” |

| Ulta Beauty |

The company’s total inventory increased by 28.3% year over year or by 15.9% on a two-year basis, reflecting the company’s opening of 44 new stores as well as proactive efforts by Ulta Beauty to mitigate sales risk amid supply chain disruptions. CEO David Kimbell said, “Our decision to proactively manage inventory flow resulted in strong sell-through of holiday merchandise and core product.” |

Department Stores

On a year-over-year basis, all the covered department stores witnessed double-digit growth in inventory levels at the end of the quarter. However, Kohl’s and Macy’s saw a double-digit decline on a two-year basis.

| |

Commentary |

| Kohl’s

|

The company’s inventory level was up 18.4% year over year but declined by 13.3% on a two-year basis. Kohl’s delivered strong inventory turnover in the fourth quarter, resulting in a 4.1x turn for the year.

CEO Michelle Gass said, “Following a strong sales start to the quarter, we experienced significant additional inventory receipt delays and were unable to fulfill all of the customer demand during this critical holiday time. We estimate that our sales growth was impacted by approximately 400 bps as a result of worsening of supply chain disruption to our business.” |

| Macy’s

|

The company ended the quarter with inventory up 16.1% year over year but recorded a decline of 15.5% on a two-year basis.

Management said that the company expects a healthy level of inventory productivity in 2022 and beyond and noted that data science will play a key part in that. Using innovative data technology, the company will be able to better forecast not just sales demand but also the necessary receipts, all the way down to an item level. |

| Nordstrom

|

The company’s inventory increased by 22.9% year over year or by 19.2% on a two-year basis, with approximately half of its reported inventory increase due to planned investments to ensure in-stock merchandise availability.

Management stated that as the company raised inventory levels and improved average price points in its stores, it posted a sequential sales improvement of 320 bps in the fourth quarter.

CEO Erik Nordstrom said, “In the fourth quarter, we improved our in-stock position at the Rack by increasing the flow of inventory, making more frequent deliveries to our stores, partnering with brands to prioritize Rack deliveries and focusing our sourcing efforts on core categories that matter most to customers such as shoes and apparel.” |

Discount Stores

All covered discount stores witnessed an increase in inventory levels, both year over year and on a two-year basis.

| |

Commentary |

| Big Lots

|

The company’s total inventory was up 31.6% year over year or up 34.4% on a two-year basis, due to higher in-transit inventory. Management stated that despite continued supply chain disruptions, the company was able to end the quarter in a strong position on inventory for the start of 2022.

For the first quarter of fiscal 2022, the company expects inventory to increase by the mid-20% range versus the same quarter of 2019, reflecting strong progress in rebuilding inventory to support lawn and garden and summer sales and improve in-stock positions in key furniture items. |

| Dollar Tree |

The company’s total inventory increased by 27.4% year over year or by 24.0% on a two-year basis.

At Dollar Tree, inventory increased by 39.0% year over year, and at Family Dollar, inventory increased by 17.0% year over year. The higher levels of inventory are comprised of significant increases in in-transit goods year over year, as the company rebuilds inventory levels. |

Electronics Retailer

| |

Commentary |

| Best Buy |

The company ended the quarter with inventory up 6.3% year over year or up 15.3% on a two-year basis.

Management stated that the year-over-year decline in the company’s revenue was due to inventory shortages. The company expects to have pockets of inventory constraints up to mid-2022. |

Home and Home-Improvement Retailers

All covered home and home-improvement retailers reported an increase in inventory levels, both year over year and on a two-year basis.

| |

Commentary |

| Home Depot |

The company’s inventory increased by 32.7% year over year or by 51.9% on a two-year basis. Merchandise inventory increased by 32.3% year over year and inventory turns were 5.2x, down from 5.8x for the same period last year.

The company stated that demand for homes remains strong, and existing home inventory available for sale is at near-record lows, resulting in support for continued home price appreciation. Management said that the company is working to bring goods in early to make sure that it is ready for the spring season. |

| Lowe’s

|

The company’s inventory was up 8.7% year over year or up 33.6% on a two-year basis, in line with seasonal trends and consistent with the company’s efforts to land spring products earlier.

Management said that the company has recently launched a new store inventory management system (SIMs) across all of its stores. This platform gives store associates real-time visibility into inventory in their stores. This includes inventory in the home bay location as well as product in the top stock and cap, off-shelf and back stock room. |

| Williams-Sonoma |

The company’s inventory was up 23.9% year over year or up 13.3% on a two-year basis. Merchandise inventory increased by 24.0% year over year and inventory on hand increased by 14.8%.

Management stated that given the significant macro supply chain disruptions throughout the year and strong ongoing customer demand, the company is still below optimal inventory levels. CEO Laura Alber said, “The shutdown in related backlogs from Vietnam had a larger impact on our children's home furnishings business, which ran a negative 6.1% comp for the quarter.” |

Jewelry Retailer

| |

Commentary |

| Signet Jewelers Limited |

The company’s inventory increased by 1.4% year over year but declined by 11.6% on a two-year basis. Signet’s inventory turn improved by 56.0% year over year, driven by continued progress in inventory life cycle management as well as the positive impact of fulfillment options such as ship from store.

Management said that in the latest quarter, the company’s largest banner, Kay, reported inventory turn of around 2x, the fastest turn in its history. In terms of the company’s inventory health, the clearance and sell-down penetration declined by 10 bps year over year. |

Luxury Retailers

Both luxury retailers reported an increase in inventory both year over year and on a two-year basis, as they rebuilt stock to support strong expectations for sales growth in the holiday season.

| |

Commentary |

| Capri Holdings |

The company’s inventory increased by 24.0% year over year or by 1.9% on a two-year basis. Capri stated that sales revenue would have been even greater without inventory constraints, estimating that inventory constraints had a mid-single-digit impact on Michael Kors' third-quarter growth rate.

For the coming months, the company expects inventory to increase as it continues to tightly manage inventory and is initiating a new program to receive core product earlier. As a result, it expects inventory growth to outpace sales growth for the next 12 months. |

| Tapestry |

Tapestry’s inventory increased by 18.7% year over year or by 0.2% on a two-year basis.

CFO Scott Roe said, “While our actions to aggressively secure goods positioned us well for the holiday period, top line sales in excess of our expectations, notably at Kate Spade, resulted in lower than projected inventory balances.”

The company anticipates low on-hand inventory for the coming months due to sales outperformance in the first half of 2022 amid strong demand and higher levels of in-transit inventory. |

Mass Merchandisers

Both Target and Walmart reported lower inventory turnover ratios compared to the year-ago period as well as on a two-year basis. Both retailers reported an increase in inventory year over year as well as on a two-year basis.

| |

Commentary |

| Target

|

The company ended the quarter with inventory up 30.5% year over year or up 54.6% on a two-year basis.

CEO Brian Cornell said, “We see supply chain constraints that are steadily working themselves out but will likely take more time, which is made more uncertain by the crisis in Ukraine.”

Management said that the company is working closely with supply chain partners and investing in capacity building and supply chain innovation to deliver on the growing inventory need in its stores. |

| Walmart

|

Total inventory increased by 25.7% year over year or by 27.2% on a two-year basis, reflecting continued efforts to improve in-stocks.

CEO Douglas Mcmillon said, “In the fourth quarter, our inventory position improved, and we delivered high sell-throughs in seasonal categories across markets.”

Management said its good inventory position contributed to the company’s strong growth in international sales. |

Warehouse Clubs

Our covered retailers reported an increase in inventory compared to the year-ago period as well as on a two-year basis. These retailers continue to accumulate inventory aggressively to support their businesses going forward.

| |

Commentary |

| BJ’s Wholesale Club |

The company ended the quarter with inventory up 3.1% year over year or up 14.9% on a two-year basis. Management stated that the company’s general merchandise sales in the fourth quarter were impacted by inventory unavailability in certain holiday categories.

CEO Robert Eddy said, “Key fourth-quarter categories such as TVs, electronics and seasonal suffered from some supply chain challenges. We had plenty of big expensive TVs and not enough smaller value TVs and that seems to be what the consumer wanted from us in the quarter.” |

| Costco

|

Total inventory increased by 18.9% year over year or by 39.1% on a two-year basis.

Management stated that factors pressuring supply chains and inflation include port delays, container shortages, Covid-19 disruptions, as well as shortages of components, raw materials, ingredients and supplies.

However, despite supply chain challenges, the company managed to post strong sales growth. While it expects continued delay in container arrivals for the next quarter, Costco has made advanced orders to have its shelves full for driving sales. |

Looking Forward

In 4Q21, most retailers reported an increase in their inventory turnover ratios year over year and on a two-year basis.

However, in the next quarter, we expect to see slow growth in inventory turnover ratios for most covered retailers, due to supply chain constraints driven by the latest Covid-19 lockdowns in China and the

ongoing Russia-Ukraine war.

Retailers including Big Lots, Capri Holdings, Costco, Gap, Macy’s, Target and TJX stated that they are well positioned for the next quarter in terms of inventory. On the other hand, Home Depot, Kohl’s, Nordstrom and Urban Outfitters are planning to capitalize on scale advantages and bring inventory in earlier than normal to match strong sales demand. Similarly, Lowe’s has recently launched a new store inventory management system across all of its stores, which gives store associates real-time visibility into inventory in their store to better forecast sales demand.

Retailers need to reassess their usual assortment and accumulate more stock in some categories and less in others, given the fluctuations in consumer demand. An efficient inventory management system could reroute in-store stock that has low demand in some areas to locations where demand is high.

The supply chain crisis-related US

port congestion and impacts on shipping lanes continue to contribute to higher in-transit inventory levels. To reduce the risk of supply chain disruptions, retailers should strategically use air freight, diversify sourcing options and work with a variety of suppliers and manufacturers.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

All covered apparel specialists witnessed an increase in quarter-end inventories both year over year and on a two-year basis.

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

All covered apparel specialists witnessed an increase in quarter-end inventories both year over year and on a two-year basis.