Introduction

Our fourth-quarter 2021 (4Q21) wrap-up covers the quarterly earnings of 61 (mostly) US-based retailers, brands, e-commerce platforms in the recently updated

Coresight 100.

- About 71% of companies beat revenue consensus estimates, while 26% missed revenue consensus estimates and 3% were in line with expectations. In terms of earnings, 77% of companies beat consensus estimates, while 16% missed consensus expectations and 7% were in line with expectations.

- Apparel and footwear, beauty brands and retailers, CPG companies, drugstores, food retailers, luxury companies and pet care retailers enjoyed a stronger quarter (versus expectations): More than 80% of covered companies beat consensus revenue estimates. Furthermore, 100% of covered beauty brand owners, department stores, drugstores, e-commerce players, electronics retailers, food retailers, mass merchandisers, pet care retailers and warehouse clubs beat consensus EPS estimates.

- Discount stores, e-commerce platforms, electronics retailers, home and home-improvement retailers, mass merchandisers and warehouse clubs were the worst-performing sectors (versus expectations) of the quarter, with 50% or more of covered companies in each sector missing consensus revenue estimates.

However, beating or meeting consensus does not necessarily indicate positive results. As retailers navigate the Covid-19 crisis and supply chain headwinds, pace of sales recovery is a much better indicator of the health of retailers than benchmarking versus consensus.

Company results in the latest completed fiscal quarter, which ended January 30, 2022, for most companies in our coverage, include key commentary and qualitative insights from major US retailers and brand owners on their recent performance, in terms of revenues and comps, and the impact of the coronavirus pandemic. Although we term the period under review “4Q21,” some companies in this report describe their latest quarter differently; some also have different quarter-end dates.

In October 2021, US retail sales saw a double-digit year-over-year increase, fueled by strong growth in several sectors, and sales increased by 23.2% on a two-year basis. In November 2021, US retail sales continued to see double-digit growth, with sales increasing by a strong revised 14.7% year over year and revised 24.7% on a two-year basis. In December 2021, US retail sales increased by 13.3% year over year and 22.3% on a two-year basis. However, sales growth slowed sequentially in December 2021, possibly reflecting some holiday season shopping being pulled forward into November 2021. In January 2022, US retail sales increased by a revised 9.4% year over year and 22.3% on a two-year basis, against strong 2021 comparatives, boosted by a strong month of job creation and continued average hourly wage growth.

In February 2022, US retail sales increased by 12.8% year over year and 21.0% on a two-year basis, boosted by another strong month of job creation as average hourly wages continue to rise within a still-tight labor market.

US retail traffic saw growth of 31.9% year over year in February 2022—higher than January’s growth of 26.9%, reflecting apparent deconsolidation of shopping trips, amid a decrease in Covid-19 cases and President’s Day holiday shopping.

Below, we assess the recent performance of retailers, brand owners and e-commerce platforms in detail.

Apparel and Footwear Brand Owners

Overall, apparel and footwear brand owners have reported solid sales growth in the latest quarter. All the covered companies in this sector posted strong positive sales growth year over year. By category, demand for outerwear and activewear remained strong in both the men’s and women’s segments.

|

|

| Carter’s, Inc. (NYSE: CRI) 4Q21 |

|

| Details |

The company’s total sales increased by 7.3% year over year, accelerating from 2.9% in the prior quarter. EPS increased by 2.0% versus 4Q20 but declined by 18.0% on a two-year basis.

Adjusted operating margin was down 170 basis points (bps) year over year to 13.0%, due to higher transportation costs.

By segment, US retail revenue increased by 3.0% year over year, driven by improved store traffic; US wholesale revenue increased by 9.0%, as a portion of sales volume moved into the fourth quarter from the third; and international revenue increased by 25.0%, driven by strong demand from Canada and Mexico.

The kids’ apparel segment registered over 10% year-over-year sales growth in both sleepwear and playwear products. Baby apparel sales increased by 8.0%.

During the quarter, the company invested in omnichannel capabilities in Canada, including same-day pickup and curbside pickup of online purchases—over 30% of Canada’s online purchases were picked up in stores. |

| Looking Forward |

For fiscal 2022, Carter’s expects net sales growth in the range of 2.0% to 3.0% year over year, and adjusted operating income growth in the range of 4.0% to 6.0%. The company expects adjusted EPS growth of 12.0%–14.0%, year over year.

For 1Q22, the company expects net sales of $740–750 million, down 4.7%–6.0% year over year. It expects an adjusted operating income of $85–90 million, down 29.9%–33.9% year over year. It expects adjusted EPS of $1.25–$1.35, a decline of 31.8%–36.9% year over year.

For the five-year period fiscal 2021–2026, the company expects low-single-digit sales growth and mid-single-digit adjusted operating income growth. It projects adjusted EPS growth in the high single digits. |

| Columbia Sportswear Company (NYSE: COLM) 4Q21 |

|

| Details |

Columbia Sportswear’s net sales in the fourth quarter increased by 23.0% year over year and by 18.3% on a two-year basis. EPS increased by 66.0% year over year.

Gross margin expanded by 160 bps year over year to 52.2%, from 50.6% in the comparable period in 2020. Gross margin expansion was primarily driven by lower direct-to-consumer (DTC) promotional levels, strong retail sell-through performance resulting in higher wholesale product margins, and a favorable channel sales mix, partially offset by higher inbound freight costs and year-over-year changes in inventory provision activity.

According to the company, Mountain Hardwear was its fastest-growing brand in 2021, with net year sales increasing by 33.0% year over year, followed by Columbia, which reported a sales increase of 28.0%. Growth was broad-based by channel, with its DTC business growing 33.0% and wholesale growing 18.0% year over year.

In 2021, the company’s global DTC business represented 47.0% of net sales, including its e-commerce business, which represented 18.0% of total net sales. The company worked with its factory partners to successfully expand footwear capacity in 2022 across both its SOREL and Columbia footwear businesses. However, even with the additional footwear capacity, the company will not be able to fulfill all demand in the marketplace during the year. It is continuing to work with factory partners to further expand capacity for 2023 and beyond. |

| Looking Forward |

The company expects net sales for full year 2022 to be in the range of $3.63–3.69 billion, representing net sales growth of 16.0%–18.0% year over year. The company expects diluted EPS of $5.50–$5.80, representing growth of 3.2%–8.8% from last year.

On the technology front, the company is investing in digital and analytics capabilities to leverage consumer data, enhance the consumer experience across platforms, and drive efficiencies across the organization. It is also investing in enhanced supply chain capabilities to expand distribution capacity, improve inventory management, and adapt to shifts in the sales mix. Additionally, the company is investing in the expansion of its DTC store fleet. In North America, the company’s current plans call for opening around 15 new stores. |

| Crocs, Inc. (NasdaqGS: CROX) 4Q21 |

|

| Details |

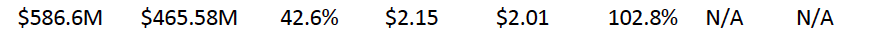

Crocs reported revenue growth of 42.6%, year over year, and 123.0% on a two-year basis, in 4Q21. Adjusted EPS increased by 102.8%, year over year.

By distribution channel, the direct-to-consumer (DTC) business, which includes retail and e-commerce, grew 44.5%, and wholesale revenues grew 40.3%.

By geography, Americas’ revenue increased by 51.2% versus 4Q20, wherein DTC revenue increased by 49.3% and wholesale revenue by 52.6%; EMEA (Europe, Middle East and Africa) revenue increased by 22.5% year over year, wherein DTC revenue increased by 18.5% and wholesale revenue by 24.6%; and Asia revenue increased by 10.3% year over year. Within Asia, South Korea and India grew strongly in the quarter.

In 4Q21, the company’s gross margin was up 770 bps to 63.4% year over year. Gross margin improved across all regions and channels, driven by increased prices and fewer promotions and discounts.

During the quarter, Crocs’ inventory increased by 21.9% year over year, with most of the increase driven by rising in-transit inventory due to extended transit times.

On January 11, 2022, Crocs filed a trademark application to get a non-fungible token (NFT)-based intellectual property for its new products, officially entering the metaverse. |

| Looking Forward |

The company reiterated its full-year 2022 guidance and expects its revenue growth (excluding the HEYDUDE brand) to be over 20.0% compared to 2021. The company expects the revenue for HEYDUDE to be in the range of $700–750 million in 2022. For the full-year 2022, Crocs expects adjusted EPS to be in the range of $9.70–$10.30, representing growth of 16.6%–23.2%, year over year.

For 1Q22, Crocs expects revenue growth of 31.0%–37.0%, year over year, assuming the HEYDUDE acquisition closes by the end of February 2022. The company has a plan to amplify the HEYDUDE brand through innovative marketing and leveraging Crocs’ strong wholesale relationships to extend distribution. The company believes that HEYDUDE will become a $1 billion brand by 2024.

In 1H22, Crocs expects its gross margin to include an incremental $75 million of air freight.

To support sales growth, the company expects to invest $170–200 million in capital expenditure in 2022, primarily to continue to expand and automate its distribution capabilities. |

| Deckers Outdoor Corporation (NYSE: DECK) 3Q22 |

|

| Details |

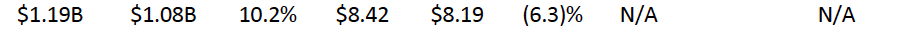

Deckers reported net sales growth of 10.2% year over year or 26.8% on a two-year basis. EPS decreased by 6.3% year over year, but increased by 17.9% on a two-year basis.

By brand, UGG’s sales increased by 7.9% year over year—the majority of its growth was driven by men’s and kids’ footwear, women’s slippers and fluffy shoes, as well as apparel and accessories; HOKA’s net sales increased by 30.3%; Teva’s net sales increased by 31.4% and Sanuk’s net sales decreased by 13.4%. Other brands, including Koolaburra, saw a decrease in net sales of 16.6%.

By channel, wholesale net sales increased by 7.3% and DTC sales increased by 13.4% year over year.

By geography, domestic net sales increased by 3.3% year over year and international net sales increased by 27.5%. The company stated that in its fiscal year-to-date, the most significant macro-level supply chain impact the company has seen is extended transit lead times and cost pressures related to container shortages, port congestion, and trucking scarcity—which have caused shipping delays and a higher usage of air freight. |

| Looking Forward |

For the full year 2022, the company expects its net sales to be in the range of $3.03–3.06 billion, representing growth of 21.2%–22.4% year over year. Its gross margin is expected to be at or slightly below 51.5% and its diluted EPS in the range of $14.50–$15.15, representing growth of 7.4%–12.6% year over year. The company stated that it continues to experience certain disruptions, delays and capacity constraints related to Covid-19. |

| Gildan Activewear Inc. (TSX: GIL) 4Q21 |

|

| Details |

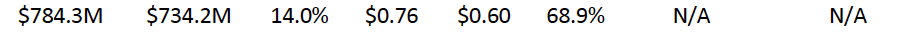

The company’s total sales increased by 14.0% year over year and by 19.0% on a two-year basis. EPS increased by 68.9% year over year and by 85.0% on a two-year basis.

Adjusted gross margin was up 480 basis points (bps) to 30.6% year over year, driven by higher net selling prices and manufacturing efficiencies. Adjusted operating margin was 20.4%, up 510 bps year over year.

By category, activewear sales increased by 16.6% year over year, while hosiery and underwear sales increased by 3.2% year over year.

By geography, US sales increased by 14.5% and Canada sales increased by 19.3%. International sales increased by 1.8%.

During the quarter, the company reinforced its vertically integrated supply chain model by broadening its existing yarn capabilities through the acquisition of Frontier Yarns, a producer of spun yarns—which will help the company to expand its business in Central America and the Caribbean. |

| Looking Forward |

The company’s sales CAGR outlook between 2021 and 2024 reflects net sales growth of 7.0%–10.0% and its operating margin is expected to be 18.0%–20.0%.

Gildan expects investments in capital expenditures as a percentage of sales to be in the range of 6.0% to 8.0% over the three-year period. |

| Guess?, Inc. (NYSE: GES) 4Q22 |

|

| Details |

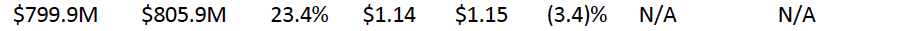

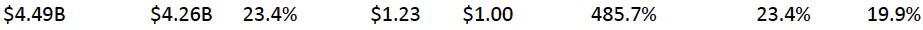

Guess? reported revenue growth of 23.4% year over year, accelerating from 13.0% growth in the prior quarter. Adjusted EPS decreased by 3.4% year over year.

The company’s adjusted operating margin increased by 430 bps year over year to 15.7%, driven by overall leveraging of expenses, lower markdowns and higher initial markups.

Guess? saw strength in both women’s and men’s outerwear, and, including its athleisure line. The company also stated that demand for handbags remained solid, but a lack of inventory due to supply chain delays in this category impacted the business in the fourth quarter.

By region, the Americas’ retail revenues increased by 26.0% year over year, and wholesale revenues increased by 32.0% year over year. Europe’s total revenues increased by 30.0% year over year. Asia’s total revenues declined by 4.0%, with more than half of the decline arising due to permanent store closures in some areas.

For fiscal 2023, Guess? remains confident that it will have the appropriate inventory, as the company ended the year with inventories up 19.0% year over year, has a higher portion of product in transit than last year and has placed orders earlier to mitigate inventory delay risk. |

| Looking Forward |

For full fiscal year 2023, the company expects revenues to be up in the low-single digits year over year and its operating margin to be 10.5%—which is less than fiscal 2022—due to expected cost pressures in production, logistics and wages. For the first quarter of 2023, Guess? expects revenues to be up in the low-teens year over year, driven by wholesale growth and positive store comps.

The company stated that the outlook for the full fiscal-year 2023 and its first quarter takes into account the significant disruptions in Russia. |

| Hanesbrands (NYSE: HBI) 4Q21 |

|

| Details |

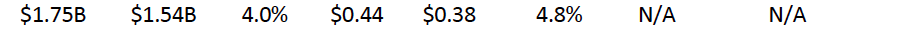

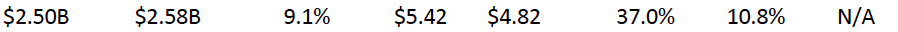

Hanesbrands reported net sales growth of 4.0% year over year and 15.0% on a two-year basis, driven by strong consumer demand and point-of-sale (POS) trends in the US, Europe, the Americas and certain Asia markets, including China, which more than offset lingering pandemic-related headwinds in Australia and Japan.

Its adjusted gross margin was 38.4%, decreasing by 195 bps compared to last year’s 40.3%—driven by increased expedite costs. The company obtained significant new retail space and decided to expedite additional product to ensure arrival in time for space sets at retail partners.

By segment, innerwear sales increased by 3.0% year over year, excluding PPE. Management stated that innerwear growth was mainly driven by increasing unit volumes. Activewear sales grew 11.0% year over year, driven by strong POS trends across its activewear brands. Champion sales increased by 21.0%. In terms of geography, international sales increased by 4.0%.

Inventory at the end of its fiscal year 2021 was $1.6 billion, an increase of 16.0% year over year, due to the combination of higher levels of in-transits and the strategic decision to invest in inventory in the quarter to capture increased consumer demand. |

| Looking Forward |

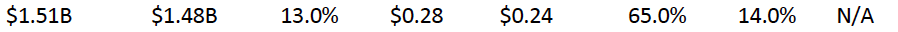

For its first quarter of 2022, Hanesbrands expects net sales between $1.51 billion and $1.57 billion. At the midpoint, this represents around 2.0% growth year over year. Adjusted EPS is expected to be in the range of $0.24–$0.31.

For the full year 2022, the company expects net sales of around $7.0–$7.15 billion. At the midpoint, this represents around 4.0% growth year over year. Adjusted EPS is expected to be in the range of $1.64–$1.81.

The company raised its 2024 full-year potential revenue targets to around $8 billion compared to its prior goal of $7.4 billion.

The company also made the decision to sell its US Sheer Hosiery business, focusing its portfolio on areas with the greatest potential for growth and returns. |

| Levi Strauss & Co (NYSE: LEVI) 4Q21 |

|

| Details |

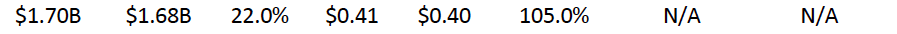

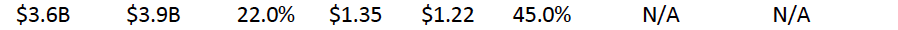

Levi’s reported revenue growth of 22.0% year over year or 7.0% versus the corresponding quarter in 2019. Adjusted EPS increased by 105.0% year over year and up 58.0% on a two-year basis.

Direct-to-consumer (DTC) net revenues increased by 25.0%, driven by growth in company-operated stores and e-commerce, which grew 28.0% and 22.0%, respectively. As a percentage of fourth-quarter company net revenues, sales from DTC stores and e-commerce comprised 30% and 8%, respectively.

By geography, Americas’ net revenues grew 12% on a constant-currency basis, driven by growth across all channels. Europe’s net revenues grew 3% and Asia’s net revenues declined 2% on a constant-currency basis.

The company continues to increase its share in women’s jeans in the US and has achieved significant traction engaging Gen Z consumers through programs such as Levi’s SecondHand recommerce initiative wherein customers can drop off their used clothing at designated stores to receive gift cards for future purchases. Through the “Buy Better Wear Longer” campaign, the company raised awareness regarding the responsibility on the environmental impacts of apparel production and consumption and encouraged customers to wear each item longer.

Looser fits continue to increase in penetration, representing roughly half of Levi’s women’s and men’s bottoms assortments. Levi’s is seeing growth in tops business, driven by solid performance in men’s wovens and sweatshirts and strong momentum across women’s wovens, dresses and outerwear. |

| Looking Forward |

Levi’s expects its net revenues to grow 11.0%–13.0% in fiscal 2022 compared to fiscal 2021, reaching net revenues of $6.4–6.5 billion. The company expects to achieve an adjusted EPS of $1.50–1.56 in fiscal 2022, representing growth of 2.0%–6.1% year over year. Gross margin is expected to expand by around 15–30 basis points year over year.

To drive e-commerce growth, the company has accelerated investments to evolve its distribution network with plans to open two new distribution centers in 2022. In 2021, the company successfully migrated its US West Coast e-commerce fulfillment to its owned and operated distribution center in Nevada and now has plans to build a new distribution center for digital on the East Coast. The company is also building a highly automated, highly sustainable, owned and operated omnichannel facility in Germany that will be operational by 2024. |

| NIKE (NYSE: NKE) 3Q22 |

|

| Details |

NIKE’s revenues increased by 5.0% year over year versus 1.0% growth in the prior quarter. NIKE Direct sales were up 15.0% year over year. Wholesale revenues declined by 1.0% year over year but increased by 1.0% on

Gross margin increased by 10year over year to 46.6%, driven by margin expansion in the NIKE Direct business due to lower markdowns and higher mix of full-price sales, partially offset by increased freight and logistics costs.

NIKE brand digital sales increased by 22.0% year over yea, driven by double-digit sales growth in North America, Asia Pacific and EMEA, partially offset by declines in Mainland China.

In the third quarter, the company launched ZoomX Streakfly, its lightest road-racing shoe, which performed well, according to NIKE. The ZoomX Streakfly offers an engineered knit upper and responsive NIKE foam , all designed for increased speed inmiddle-distance running. Another running shoe, the Pegasus 38, a lightweight and durable trainer designed for everyday use, saw strong sell-through in the quarter, the company reported.

In the third quarter, following the acquisition of RTFKT—a non-fungible token (NFT) studio that produces digital collectibles, including virtual sneakers—the company introduced the NIKE Virtual Studio division, which released the first official NIKE-branded NFT.

NIKE-owned inventory increased by 22.0% versus the prior year, with in-transit inventory representing 65.0% of total inventory at the end of the quarter, as transit times are now more than six weeks longer than pre-pandemic levels and two weeks longer than the same period in the prior year. |

| Looking Forward |

NIKE reiterated its prior sales growth guidance for fiscal 2022 and expects sales to grow by mid-single-digits year over year. Specifically, for the fourth quarter, in North America, NIKE expects a decline in revenue due to strong comparatives. In Mainland China, it expects to see The company expects its gross margin to expand by at least 150 bps year over year, as strong consumer demand continues to fuel high levels of full price realization, low markdown rates and low customer returns.

Management stated that the benefits of strategic pricing expected in the fourth quarter are being partially offset by elevated product costs, primarily due to higher macro input costs, supply chain costs and strategic actions to expedite delivery of product in North America. |

| Ralph Lauren (NYSE: RL) 3Q22 |

|

| Details |

In the third quarter, Ralph Lauren’s revenue increased by 27.0% year over year. Comparable store sales increased by 34.0% and adjusted EPS increased by 76.0% on a reported basis.

By geography, North America’s total revenues increased by 30.0% year over year and comparable store sales were up 38.0%, with a 40.0% increase in brick-and-mortar stores and a 32.0% increase in digital commerce. Europe’s revenues increased by 47.0% and comps grew 55.0%, with a 68.0% increase in brick-and-mortar stores and a 27.0% increase in digital commerce. In Asia, revenues grew 16.0% while comps increased by 14.0%, with 12.0% growth in brick-and-mortar stores and a 64.0% increase in digital commerce.

The company continues to leverage the following strategies and highlighted some achievements during the quarter.

- Win Over a New Generation of Consumers: The company continued to fuel strong consumer engagement, through diverse content, and accelerate marketing investments. The company also continued expanding leadership into the metaverse.

- Energize Core Products and Accelerate Under-Developed Categories: The company delivered a compelling Fall assortment, successfully capturing consumer interest in post-pandemic dressing, blending casual comfort with elevated looks.

- Drive Targeted Expansion in Regions and Channels: The company delivered strong growth across every region in the quarter.

- Lead With Digital: Total Ralph Lauren digital ecosystem revenues grew more than 40%.

- Operate With Discipline to Fuel Growth: The company’s third-quarter adjusted operating margin expanded 260 bps year over year, to 15.9%, with continued gross margin expansion and operating expense leverage on stronger revenues, including increased marketing investments.

Its adjusted gross margin was 66.0%, up 60 bps year over year, despite increased freight headwinds of around 150 bps. The company also made continued progress on environmental, social and governance issues—including launching its first product using Clarus, a first-to-market patented technology that uses high-performance recycled cotton, developed by the company’s partner, Natural Fiber Welding. |

| Looking Forward |

For fiscal 2022, the company raised its outlook and now expects revenue growth of 39.0%–41.0% compared to its previous outlook of 34.0%–36.0%. The company now expects its operating margin to be around 13.0%, compared to the prior expectation of 12.0%–12.5%. The gross margin is expected to increase by 70–90 bps year over year, up from its prior outlook of 50–70 bps, representing 65.7%–65.9% growth—with stronger average unit retail (AUR) growth and a favorable product mix more than offsetting increased freight headwinds.

For the fourth quarter of fiscal 2022, the company expects its revenues to increase by 17.0%–18.0%.

The company continues to comment on the uncertain and evolving situation surrounding Covid-19 impacting the timing and path of recovery in its market—and the potential for further outbreaks or resurgences across various markets, alongside the potential global supply chain disruptions. |

| Skechers U.S.A., Inc. (NYSE: SKX) 4Q21 |

|

| Details |

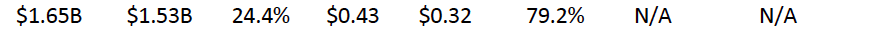

Fourth-quarter Skechers sales increased by 24.4%, caused by a 9.8% increase in domestic sales and a 34.0% increase in international sales.

Domestic and international sales growth was driven by increases in both wholesale and DTC, with the largest improvement in international wholesale. Improvements in domestic wholesale were the result of higher unit sales volume and higher average selling prices. International wholesale increases were driven by growth of 123.5% in distributor sales, 61.3% in Europe and 8.6% in China.

Gross margin was 48.6%, a decrease of 30 bps from last year’s 48.9%, primarily driven by higher freight costs. The company is seeing strong consumer demand for the Skechers brand. Consumers continue to stay outdoors for exercise, dining and many other activities—and seek out Skechers for comfort, innovation, quality and style at a reasonable price, according to the company. E-commerce achieved double-digit growth for the quarter. Its DTC average selling price per unit increased by 25.0%, reflecting of the company’s less promotional stance, higher-priced products and continued strong demand for innovative features in its comfort technology.

The company continued to invest in its DTC capabilities, upgrading its POS systems in North America and the UK. It is currently completing updates in Japan, with Europe to follow. The rollout of new e-commerce sites also continued in the fourth quarter, with the launch of new platforms in Austria, Germany, India and the UK. More markets are planned for 2022, including several in Europe, according to the company. Additionally, the company is finalizing plans to enter the metaverse, creating an entirely new opportunity for the Skechers brand. |

| Looking Forward |

For the first quarter of 2022, the company believes it will achieve sales of $1.68–1.73 billion, representing growth of 17.5%–20.9% year over year, and diluted EPS of $0.70–$0.75, representing 11.1%–19.0% year-over-year growth.

For the full year 2022, the company expects sales of $7.0–7.2 billion, representing growth of 11.1%–14.3% year over year. Diluted EPS is expected to be between $2.70 and $2.90, representing growth of (38.7)%–(42.9)%. Port congestion eased in January 2022 and more containers reached the company’s distribution centers. However, the company believes supply chain challenges will remain through the first half of 2022 and ease in the latter half of the year. |

| Under Armour (NYSE: UAA) 4Q21 |

|

| Details |

In 4Q21, Under Armour reported a 9.0% year-over-year increase in revenue—9.3% growth on a two-year basis (versus 4Q19). Adjusted EPS decreased by 83.5% year over year but increased by 133.3% on a two-year basis.

By distribution channel, wholesale revenue increased by 16.0%, year over year. DTC revenue increased by 10.0% versus 4Q20, driven by a solid performance in the company’s owned and operated retail stores and 4.0% year-over-year growth in e-commerce (an increase of more than 30% on a two-year basis), with online sales representing 42.0% of the total DTC business during the quarter.

By category, apparel revenue increased by 18.0%, year over year, driven by strength in the training and outdoor businesses; footwear revenue increased by 17.0%, driven by the running and training categories; accessories revenue decreased by 27.0% due to lower sales of sports masks compared to 4Q20.

By geography, North America witnessed revenue growth of 15.0%, year over year, driven by growth in the wholesale and DTC businesses. International revenue increased by 3.0% versus 4Q20. Within the international business, EMEA’s revenue increased by 24.0% year over year, while the APAC region saw a decline in revenue of 6.0%, due to weak demand in the wholesale business, which more than offset DTC business growth. Latin America’s revenue declined by 22.0%, owing to changes in the company’s business model as the company transitioned certain countries in this region to a strategic distributor model.

In North America, Under Armour will continue to focus on three fundamentals to boost sales:

- Create more compelling in-store experiences and deliver best-in-class service (both online and offline)

- Continue to establish a premium positioning in wholesale price through inventory management

- Investing more smartly in marketing

In China, Under Armour noted that it will continue to invest in digital innovation, including working to deliver an improved end-to-end customer engagement platform and ensuring that store expansions are done at an appropriate pace.

In 4Q21, gross margin was up 130 bps, year over year, to 50.7%, driven by benefits from favorable pricing related to sales and lower restructuring charges. |

| Looking Forward |

Under Armour is changing its fiscal year end from December 31 to March 31. Following a three-month transition period (January 1 to March 31, 2022), the company’s fiscal 2023 will run from April 1, 2022, through March 31, 2023 (as such, there will be no fiscal 2022).

Under Armour believes that this change will provide greater alignment with its business cycle and financial reporting. Under Armour now expects its revenue for the transition quarter to increase at a mid-single-digit rate (in percentage terms) compared to the previous expectation of a low-single-digit increase. This expectation includes around 10 percentage points of headwinds related to a reduction in the company’s spring/summer 2022 order book due to supply constraints associated with the impacts of Covid-19.

In the transition quarter, Under Armour expects its gross margin to be down 200 bps to 48.0% compared to the year-ago period, due to higher freight expenses resulting from pandemic-related supply chain challenges.

Under Armour expects supply chain challenges to continue into fiscal 2023—until longer-than-usual transit times, backlogs and congestion find balance, associated freight and logistics costs normalize and inbound shipping delays subside. |

| V.F. Corporation (NYSE: VFC) 3Q22 |

|

| Details |

The company’s revenue from continuing operations increased by 22.0% year over year and by 5.9% on a two-year basis. Adjusted EPS increased by 45.0% year over year and by 9.8% on a two-year basis.

By segment, active’s revenue increased by 25.0% year over year, including an 8.0% increase in its brand Vans. Outdoor’s revenue increased by 23.0%, including a 28.0% increase in its brand The North Face. Work’s revenue increased by 6.0%, including a 4.0% increase in its Dickies brand.

Within The North Face, the company continues to see broad-based growth across categories, with logowear, sportswear and snow sports all growing over 20.0% year over year. On-mountain products grew strongly, particularly in products offering key technologies. Off-mountain lifestyle products also showed solid ongoing momentum, with its brand SELF nearly growing over 60.0%. Lifestyle footwear grew 30.0%. Vans increased by 8.0% year over year, representing modest growth compared to pre-pandemic levels. Apparel grew 29.0% year over year. The Supreme brand continues to see strong demand and sell-through, both online and in its stores. The brand delivered about $200 million in revenue in the quarter, despite closing doors globally at various stages due to pandemic surges. Timberland grew 11% year over year, led by a very strong sellout season.

By geography, the Americas’ revenue increased by 18.0% year over year. International revenue increased by 19.0%. Within international, Europe revenue increased by 26.0% and Greater China revenue decreased by 6.0% year over year.

By distribution channel, DTC revenue increased by 30.0% and digital revenue increased by 21.0%. VF’s total digital penetration was roughly 30.0% as compared to about 20.0% in same quarter of fiscal 2020, reflecting investments made in digital infrastructure and talent, enhanced merchandising capabilities and omnichannel services. |

| Looking Forward |

The company expects its full-year fiscal 2022 revenue to be approximately $11.85 billion, reflecting growth of around 28.0% year over year, including an approximate $600 million contribution from Supreme. In the fourth quarter, the company expects revenue growth of 10.0% year over year.

Full-year 2022 adjusted EPS guidance remains unchanged at around $3.20. The company expects the DTC ecosystem to deliver stronger margins, supported by the mix shift to digital, which the company believes will continue to be a structurally accretive profitability driver over the long term.

Pandemic-related manufacturing capacity constraints have continued during the third quarter, although the situation has improved. Additionally, continued port congestion, equipment availability and other logistics challenges have contributed to ongoing product delays. VF is working with its suppliers to minimize disruption and is employing expedited freight as needed. |

Apparel Specialty Retailers

Apparel specialists reported another strong quarter: American Eagle Outfitters and Urban Outfitters posted double-digit sales growth year over year, whereas Dick’s Sporting Goods, Foot Locker and Gap posted single-digit sales growth. Within apparel categories, athleisure, casualwear and intimates continued to perform strongly in the quarter.

|

|

| American Eagle Outfitters (NYSE: AEO) 4Q21 |

|

| Details |

Total revenues increased by 14.7% year over year, decelerating from 23.5% in the prior quarter. Comparable sales increased by 14.8%.

By banner, Aerie’s sales grew 27% year over year, on the top of 25% growth in 4Q20, and American Eagle’s sales increased by 11%, following a 9% decline last year.

The company’s digital revenues declined by 3% year over year, against strong comparatives. On a two-year basis, total digital revenues grew 31%.

The company’s gross margin contracted by 160 bps year over year to 32.4%, mainly caused by elevated freight costs amid Vietnam factory closings—but offset by strong product demand, higher full-priced sales, inventory optimization and lower promotions. Its operating margin was 5.3%, up from 0.3% in the year-ago quarter. Adjusted EPS declined by 10.3% year over year.

The company continued to expand its Aerie banner, opening 43 new stores in the quarter and bringing its full-year new store openings to 95.

Management stated that the company saw strong year-over-year growth across all product categories. President and Executive Creative Director Jennifer Foyle stated, “Demand was strong across core Aerie apparel and intimates as well as OFFLINE activewear, which is showing great momentum just one and a half years into the launch. We have this incredible opportunity in OFFLINE, rooted in leggings, which we’re going to continue to build on and grow.” |

| Looking Forward |

For 2022, the company expects year-over-year revenue growth to be in the mid-teens and operating income to be $550–600 million, compared to $603 million in 2021. The company expects a decline in operating income in the first half of fiscal 2022, followed by a recovery in the second half as it cycles elevated air freight prices in the second half of 2021, caused by factory closures and inventory challenges. |

| Dick’s Sporting Goods (NYSE: DKS) 4Q21 |

|

| Details |

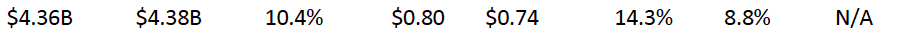

Total revenues increased by 7.3% year over year, a deceleration from 13.9% in the prior quarter.

Total comps grew 5.9% year over year, on the top of a 19.3% increase in the same period last year, driven by strong growth in apparel and footwear, and sporting equipment categories, along with a 4.8% increase in average ticket and 1.1% growth in transactions.

E-commerce penetration stood at 27.0%, down from 32.0% in 4Q20 but in line with 27.0% in 4Q19.

Management stated that its private-label brands have become a significant source of growth. In 2021, the company reported that these brands, including CALIA, DSG and VRST, saw more than $1.7 billion in sales, comprising about 14.0% of Dick’s total revenues. These private labels represent the company’s largest brands in fitness, golf, team sports and outdoor equipment categories.

The company’s adjusted EPS grew by 49.8% year over year, driven by strong sales and merchandise margin rate expansion. Executive Chairman Edward Stack stated, “2021 has been the most transformational year in our company’s history. Among our accomplishments, we drove strong growth in our core Dick’s business; launched Dick’s House of Sport, a completely new experiential destination that’s redefining sports retail; we reengineered Golf Galaxy and launched the Golf Galaxy Performance Center, a new immersive experience for golf enthusiasts of all levels; and finally, we unveiled Public Lands, a new omnichannel specialty concept, to better serve the outdoor athlete.” Furthermore, Dick’s noted that lifestyle trends beneficial to the company, including health and fitness, casualization of the workplace and greater participation in outdoor activities, remain elevated. |

| Looking Forward |

For the full year 2022, Dick’s expects adjusted EPS to be down by 16.6%–25.5% year over year and comp sales to be (4.0)% to flat year over year. It plans to spend $400–425 million on capital expenditure on a gross basis in 2022, compared to $308 million capital expenditure in 2021. |

| Foot Locker (NYSE: FL) 4Q21 |

|

| Details |

Total revenues increased by 6.9% year over year, accelerating from 3.9% in the prior quarter. Comparable sales increased by 0.8% year over year.

The company’s digital penetration stood at 21.6% at the end of 4Q21, compared to 27.4% in 2020 and 18.7% in 2019.

The company’s gross margin declined by 10 bps year over year to 33.0%, due to occupancy deleveraging and higher supply chain costs. Foot Locker’s adjusted EPS increased by 7.7% year over year.

During 4Q21, Foot Locker recorded substantial vendor diversity, with the majority of its top 20 vendors reporting gains in their respective categories—comp growth from non-NIKE vendors was over 30%. Management stated that the momentum of brands including Adidas, Crocs, New Balance, PUMA, Timberland and UGG during 2021 showcased the expanding breadth of its consumer sneaker offerings, covering athletic, outdoor and seasonal categories.

Foot Locker continued to expand its apparel category. CEO Richard Johnson stated, “Our push into apparel continues to yield strong results, with the category growing 30% in the fourth quarter and reaching $1.4 billion in annual sales for the first time in the company’s history.” |

| Looking Forward |

For fiscal 2022, Foot Locker expects total sales to be down 4%–6% and comparable sales to decline by 8%–10%. The company forecasts gross margin of 30.1%–30.3% and adjusted EPS of $4.30–$4.60, down 40.8%–44.7% year over year.

In fiscal 2022, the company plans to open about 100 new stores, including 40 power and community stores, 27 WSS stores (a US-based apparel and footwear company acquired by Foot Locker in 2021) and nine Atmos stores (a Japan-based apparel and footwear company acquired in 2021), while closing a total of 190 stores. Foot Locker stated that it expects to increase WSS’s sales to $1 billion by 2024, supported by accelerated store openings and strong same-store sales growth. Foot Locker also expects to expand Atmos’s sales by about 50% annually to nearly $300 million by 2024, by expanding internationally and scaling up in the company’s existing markets. |

| Gap Inc. (NYSE: GPS) 4Q21 |

|

| Details |

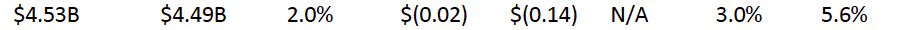

Total revenues grew 2.0% year over year, compared to a 1.3% decline in the prior quarter. Comparable sales increased by 3.0% year over year. On a two-year basis, fourth-quarter sales declined by 3.0%, while comparable sales increased by 3.0%.

By brand, Athleta’s sales increased by 52% on a two-year basis, Banana Republic’s sales declined by 11%, Gap’s sales decreased by 13%, and Old Navy’s sales rose by 2%. In terms of comps, Athleta reported a 42% increase versus 2019, Banana Republic reported a 2% decline, Gap saw an increase of 3% and Old Navy reported almost flat growth.

Digital sales were up 44% on a two-year basis and represented 43% of the total business.

The company’s adjusted operating margin stood at 0.4%, down 550 bps from 2019 levels.

CEO Sonia Syngal stated, “With customers returning to pre-Covid-19 purchasing behaviors, we are pivoting to a more versatile fashion, offering on-trend product across a range of used occasions, while playing to our market leadership in Denim, Active, and Kids and Baby. We saw these trends play out in the rise of Old Navy’s classic workhorse staple, the pixie pants and Athleta’s bestselling elation tight, both now in flare-leg shape.” |

| Looking Forward |

For fiscal 2022, Gap expects low-single-digit year-over-year sales growth and a mid-to-high-single-digit decline in first-quarter net sales. The company issued adjusted operating margin guidance of 6.0%–6.5% and forecasts adjusted EPS to be $1.85–$2.05.

For fiscal 2022, Gap expects capital expenditure of about $700 million, primarily to support growth investments, including digital and supply chain capacity projects, along with investment in store growth for its Athleta and Old Navy banners.

CFO Katrina Connell stated, “While we spent an estimated $430 million in air freight in fiscal 2021, we plan to spend about 20%–25% less in 2022. A little more than half of the full-year 2022 air expense is expected to be realized in Q1, as we sell through product we expedited for fourth- and first-quarter flows. Improvements we’ve made to our planning cycle, which we expect to fully come to bear in summer, should reduce air usage beginning in Q2 and through the back half of the year.” |

| Urban Outfitters (NasdaqGS: URBN) 3Q21 |

|

| Details |

Urban Outfitters reported a revenue increase of 22.4% year over year, accelerating from the previous quarter’s growth of 16.7%.

Comparable sales increased by 14% year over year, in line with the prior quarter. By brand, Free People led the way, with comps of 49% year over year—followed by Anthropologie and Urban Outfitters, which posted comp growth of 14% and 3%, respectively. By segment, retail saw total sales growth of 15% year over year, while wholesale’s net sales declined by 22%.

Gross margin declined by 97 bps year over year to 27.5%, decelerating from 34.5% in the prior quarter, primarily due to lower initial merchandise markups led by higher inbound transportation costs, and an increase in delivery and logistics expenses. The company’s adjusted EPS declined by 18% year over year, down from a 14.1% increase in the prior quarter.

During the fourth quarter, the company witnessed strong demand across all categories, with women’s apparel and home furniture performing strongest. Urban Outfitters stated that demand for dresses and occasion wear is growing substantially as weddings and events are once again being planned. |

| Looking Forward |

The company did not provide financial guidance, but management remains optimistic for the first quarter. CFO Melanie Marein-Efron stated, “Our URBN first-quarter-to-date comp sales rate is ahead of our fourth-quarter rate. We believe first-quarter total company sales could come in up mid-teens versus fiscal 2019 [prior to the pandemic]. We believe that the Retail segment’s sales could land in the mid- to high teens, while the Wholesale segment’s sales could be approximately flat.”

Furthermore, the company stated that gross margins for the first quarter will be down by over 100 bps year over year, owing to ongoing supply chain challenges, which led to the increase in inbound product transportation costs. |

Off-Price Retailers

Off-price retailers saw a solid quarter, with all covered companies posting strong double-digit sales growth year over year. The apparel and home categories continued to outperform other categories for these retailers.

|

|

| Burlington Stores (NYSE: BURL) 4Q21 |

|

| Details |

Total revenues increased by 14.3% year over year, decelerating from 38.1% growth in the prior quarter. Adjusted EPS increased by 3.7% year over year. Comparable sales increased by 6.0% on a two-year basis. Management attributed the 6.0% comp slowdown to lower store traffic, late delivery of inventory and lower consumer spending per transaction.

The gross margin rate declined by 270 bps year over year to 39.8%, due to higher supply chain costs, including freight expenses and product sourcing costs.

The company stated that the impact of inflation is both an opportunity and a risk for off-price retailers. The risk is that consumers, particularly lower income consumers, may be more affected as stimulus payments have ended and essential prices of food and gas are rising; the opportunity is that higher inflation affects all consumers and management believes it will benefit from customers trading down, seeking value.

At the end of the quarter, in-store inventories were down about 30% on a comp-store basis. Management stated that holiday-sensitive businesses, such as food, holiday decor, gifts and toys, missed critical receipts, which impacted its inventory. However, the company noted that supply chain disruptions have created a strong buying environment for off-price during the quarter. Reserve inventory, which the company holds back in anticipation that it will not be able to be sold, increased by 62.0% versus 2019.

During the quarter, Burlington opened net eight new stores, bringing its store count at the end of 2021 to 840. |

| Looking Forward |

The company did not provide financial guidance for fiscal 2022, due to the continued uncertainty surrounding the pace of consumer demand recovery and the ongoing Covid-19 pandemic; however, the company is projecting a mid-teen comp sales decline in 1Q22. Management stated that the off-price industry will continue to be reshaped by powerful consumer need for value, which should drive further significant growth and market share gains for the sector.

Burlington plans to open 120 new stores during 2022, adding 90 net new stores to its fleet. The retailer expects that 80 of those stores will be in its smaller format, spanning 30,000 square foot or under. Over the next five years, 75.0% of the stores that Burlington opens will be in its small format. Management sees productivity gains with the smaller stores, which are easier to operate and more efficient—and also as an opportunity, as the company relocates existing stores to smaller formats. |

| Ross Stores (NasdaqGS: ROST) 4Q21 |

|

| Details |

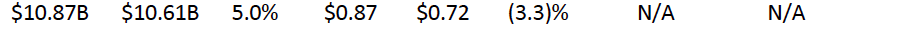

Total sales increased by 18.1% year over year, decelerating from 22.0% in the prior quarter. The company’s comparable store sales increased by 9.0% on a two-year basis, driven by growth in average basket size, partially offset by a decline in transactions. Diluted EPS increased by 55.2% year over year.

Children’s and men’s clothing were the company’s best-performing categories, while the Midwest and Southeast were the top-performing regions.

Its operating margin was down 350 bps on a two-year basis to 9.8%, which the company attributed to an increase in domestic and ocean freight, higher wages and pandemic-related expenses.

At quarter-end, inventories were up 23.0% on a two-year basis, caused by an increase in in-transit merchandise due to longer lead times from supply chain bottlenecks. Packaway merchandise, which includes apparel, represented 40.0% of total inventories compared to 46.0% for the same period in 2019.

Management stated that there is sufficient merchandise availability in the market, and that it sees more opportunistic buys from closeouts going forward. |

| Looking Forward |

For 1Q22, Ross forecasts comps to be (2.0)%–(4.0)% year over year, and EPS to be $0.93–$0.99, down 26.1%–30.6% year over year—as management expects larger headwinds from higher freight and wage costs in 2022.

For fiscal 2022, the company expects year-over-year comps to be flat to up 3.0% and EPS to be $4.71–$5.12, representing growth of (3.3)%–5.1%, year over year. Ross expects total sales for fiscal 2022 to grow by 2.0%–6.0% year over year.

The guidance reflects the company’s expectation for sales and profitability to improve as the year continues. Ross plans to return to its regular store opening cadence of 100 new store openings in 2022, comprising 75 Ross locations and 25 dd’s Discounts. The company also expects to close around 10 older stores. |

| The TJX Companies (NYSE: TJX) 4Q22 |

|

| Details |

The company’s total sales increased by 28.6% year over year and by 13.5% on a two-year basis. EPS increased by 188.7% year over year but declined by 3.7% on a two-year basis.

The company’s overall open-only comp sales grew by 10.0% on a two-year basis, supported by strong holiday season in November and December, offsetting softer sales in January due to Covid-19 restrictions.

By banner, Marmaxx (US Marshalls and US T.J. Maxx) comps increased by 10.0% on a two-year basis, HomeGoods comps increased significantly by 22.0%, TJX Canada comps increased by 1.0%; however, TJX International comps decreased by 2.0%, due to government-mandated shopping restrictions throughout the quarter in Europe and Australia.

In the fourth quarter, the company saw a strong increase in its average basket across all divisions, as customers purchased more items per shop. The company also saw consistent strength across all major categories and geographic regions for HomeGoods and HomeSense.

Total inventories were up 22.4% compared to fiscal 2020, due to higher in-transit inventory. Management stated that per store inventory levels improved sequentially and were up versus fiscal 2020.

During the quarter, the company increased its store count by five for a total of 4,689 stores. |

| Looking Forward |

For the first quarter of 2023, the company expects US comp store sales to be up 1.0%–3.0% year over year. It expects total sales to be $11.5–$11.7 billion, representing a growth of 13.9%–15.8% year over year, and its gross margin to be 8.1%–8.5%. However, the company expects elevated expense headwinds compared to fiscal 2022. The TJX Companies currently expects that the level of incremental freight expense in fiscal 2023 will be the highest in the first quarter, at around 220 bps. The company expects its diluted EPS to be in the range of $0.58–$0.61, representing growth of 31.8%–38.6% year over year.

For the full fiscal year 2023, the company expects US comp store sales to be up 3.0%–4.0% year over year. It expects total sales to be $52.6–53.1 billion, representing growth of 8.2%–9.3% year over year. It forecasts its gross margin to be close to fiscal 2022’s adjusted gross margin of 9.6%.

The company plans to add about 170 new stores in its fiscal year 2023, which will bring its year-end total to 4,850 stores, representing store growth of around 3.0%. The company plans to remodel 400-plus stores and relocate 50-plus stores during the year. In the long term, it plans to grow its current store base to 6,275 stores, adding 1,600 more stores. |

Beauty Brands and Retailers

The beauty category continued to recover strongly, with all covered beauty brands and retailers posting strong double-digit year-over-year sales growth. By category, bath, fragrance, haircare and skincare trended best while demand for makeup picked up substantially—reflecting the continued progression toward recovery in Western markets and increased usage.

|

|

| Bath & Body Works (NYSE: BBWI) 4Q21 |

|

| Details |

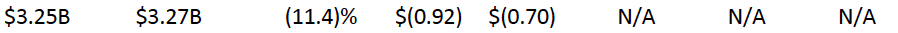

Bath & Body Works (formerly L Brands) reported sales growth of 11.4% year over year and 35.7% on a two-year basis. Adjusted EPS increased by 17.0% year over year and its company’s operating income increased by 1.2%.

According to the company, its performance was driven by strong customer response to its merchandise assortment, solid vertically integrated supply chain and a growing loyal customer base.

CEO Andrew Meslow stated, “We demonstrated agility to read, react and replan the business in the midst of strong customer demand while also experiencing inflationary pressures and production constraints. Our primarily North American, vertically integrated supply chain provides us agility, and we were able to present full merchandise assortments to our customers in all time frames. We had adjusted to continuous Covid-19 protocol changes to keep our associates and our customers safe. We started planning and constructing a new company-run fulfillment center to support the future growth of our digital business.” |

| Looking Forward |

For the first quarter of fiscal 2022, Bath & Body Works is forecasting a low-to-mid-single-digit decrease in year-over-year sales and its EPS to be $0.47–$0.55, compared to $0.60 in 1Q21.

For full year 2022, the company expects sales to be flat to up 4.0% year over year. EPS is expected to be in the range of $4.3–$4.7, compared to $4.5 in first quarter of 2021, representing growth of (4.4)%–4.4% year over year. Gross margin is expected to contract 300–400 bps from 49.0% in fiscal 2021, primarily reflecting contracting merchandise margins due to inflationary costs. |

| Coty (NYSE: COTY) 2Q22 |

|

| Details |

Coty reported a 12.0% year-over-year revenue increase, but a decline of 5.9% on a two-year basis. Comparable store sales increased by 13.0% year over year. Adjusted EPS increased by 30.8% year over year and by 240.0% on a two-year basis.

By segment, prestige reported 12.0% year-over-year growth in both revenues and comparable store sales. Prestige fragrance sales continued to grow at a double-digit pace in the second quarter, with nearly all brands particularly Burberry, Chloe, Gucci and Hugo Boss. Prestige cosmetics sales nearly doubled in the first half of fiscal 2022, led by global momentum in and the continued expansion of Kylie Cosmetics. The consumer beauty segment saw 11.0% year-over-year sales growth and comparable store sales growth of 12.0% in the second quarter.

By geography, the company saw growth across all regions and travel retail—with the US and China continuing to be standout performers. The Americas’ sales grew 9.0% year over year, supported by strength in Canada, Mexico and the US. Sales in Europe, the Middle East and Africa (EMEA) increased by 13.0% year over year, recording growth in all key markets, alongside local travel retail. Asia-Pacific sales increased by 16.0% year over year, .

Adjusted gross margin increased by nearly 590 basis points year over year to 64.6% and 120 basis points from the last quarter. The increase was driven by a favorable product and category mix, pricing and higher absorption. |

| Looking Forward |

For fiscal year 2022, Coty raised its comparable sales guidance, now expecting growth at the upper end of the previously guided

The company continues to expect adjusted EBITDA of $900 million for fiscal 2022, as it navigates the inflationary environment, while intentionally reinvesting gross margin gains and costs savings in its brands to maximize value and fuel sustained topline sales growth.

Coty raised fiscal 2022 adjusted EPS guidance and now expects it to be between $0.22 and $0.26, up from previous guided range of $0.20–$0.2 |

| Estée Lauder (NYSE: EL) 2Q22 |

|

| Details |

Estée Lauder reported a 14.2% year-over-year increase in net sales and organic net sales grew 11.0%. Net sales increased in every region and product category, reflecting early stages of recovery in brick-and-mortar retail stores, primarily in Western markets and strength in online. Adjusted EPS increased by 15.0%.

The company’s operating income increased by 22.0% year over year and its operating margin rose by 160 bps to 25.9%.

By geography, organic net sales in the Americas increased by 19.0% year over year as holiday shoppers return to brick-and-mortar retail. Online also grew solidly in the Americas, with online representing more than one-third of sales in the region. In Europe, the Middle East and Africa (EMEA), organic net sales increased by 13% as growth was diverse and broad-based. In Asia Pacific, organic net sales increased by 5.0% as most of the markets in the region grew, led by Mainland China and Australia.

By category, fragrance’s organic net sales grew 30.0% year over year with double-digit growth in every region and across all brands that sell fragrances. Hair care’s organic net sales rose 18.0%, reflecting increases from both Aveda and Bumble and bumble as brick-and-mortar salons and retail stores recover. Makeup’s organic net sales increased by 12.0%, reflecting the continued progression toward recovery in western markets and increased usage occasions. Skincare organic net sales grew 7.0% in every region, led by strong double-digit sales growth from Bobbi Brown, Clinique and La Mer. |

| Looking Forward |

The company raised its sales guidance for the full year 2022. Organic net sales are forecasted to grow 10.0%–13.0%, up from the previous guidance of 9.0%–12.0%. Diluted EPS is expected to range between $7.43 and $7.58, compared to prior guidance of $7.23–$7.38.

Inflation and transportation and procurement are expected to impact the company’s cost of goods in the second half. However, the benefit of pricing and cost-mitigation efforts are helping to offset some inflation impacts for the fiscal year, according to the company.

For its third quarter, Estée Lauder projects 8.0%–10.0% organic net sales growth. The company stated that the net incremental sales from acquisitions, divestitures and brand closures are expected to add about 3 percentage points to reported growth. |

| L'Oréal S.A (ENXTPA: OR) H2 2021 |

|

| Details |

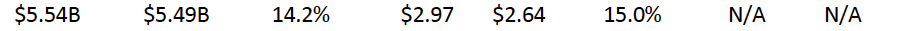

L’Oréal reported a 15.4% year-over-year increase in revenues and 13.5% growth on a two-year basis. EPS increased by 20.1% year over year and by 59.9% on a two-year basis.

All divisions posted strong double-digit year-over-year. The professional products division recorded 18.5% year-over-year sales. Consumer products’ sales were up 10.0%. L’Oréal Luxe’s sales increased by 16.5% and active cosmetics’ sales grew 28.4%.

By geography, North America witnessed very strong momentum throughout the year and recorded the strongest year-over-year sales growth of 25.1%. Europe saw sales growth of 11.5%, with strong growth in Italy, Russia, Spain and the UK. Sales in the South Asia Pacific, the Middle East, North Africa and Sub-Saharan Africa region were up by 14.2%, with strong performance in India, the Middle East and South Africa. Latin America saw 16.2% sales growth, which was broad-based across all countries, with the exception of Argentina. North Asia recorded year-over-year sales growth of 12.9%, led by Mainland China. |

| Looking Forward |

L’Oréal did not provide specific guidance for 2022, but is optimistic stated that desire among the rising upper middle-class worldwide is still extremely strong. The company expects L’Oréal Luxe to outperform as it continues investing in the division, aiming to make the most desirable, creative and admired products, according to the company.

The company stated that it aims for continuous investment in maintaining its digital edge, and that its brands are already exploring the new frontiers of gaming and the metaverse. |

| Ulta Beauty (NasdaqGS: ULTA) 4Q21 |

|

| Details |

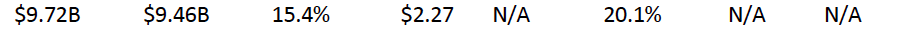

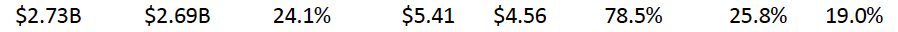

Total revenues increased by 24.1% year over year, a deceleration from 28.6% in the prior quarter. Comp sales increased by 21.4% year over year, driven by EPS increased by 78.5% year over year.

Gross margin increased by 250 basis points (bps) year over year to 37.6%, driven by leveraging fixed costs and a higher merchandise margin.

By category, bath, fragrance, haircare, makeup and skincare all delivered strong double-digit comp growth year over year, which the company attributes to strong execution of holiday plans and inventory management.

The company’s beauty services business accelerated in the quarter, increasing by more than 30.0% year over year, driven by growth in sales transactions. During the quarter, the company expanded its salon capacity to 100% in all its salons and Benefit Brow Bars, a brow shaping and waxing store. It also launched salon services such as Express Color and OLAPLEX Repair & Protect, which continue to bring in new members to Ulta Beauty salons, according to the company.

During the quarter, the company launched four new brands such as prestige haircare brand OLAPLEX, makeup brand N°1 DE CHANEL, skincare brand Supergoop! and fragrance brand Billie Eilish. Management stated that the company has so far experienced a strong sales response for these new brands.

The company opened six new stores, relocated three and remodeled one during the quarter. |

| Looking Forward |

For fiscal 2022, Ulta Beauty expects sales of $9.05–9.15 billion, representing growth of 5.2%–6.5% year over year. It expects year-over-year comp sales growth of 3.0%–4.0% and operating margin of 13.7%–14.0% of sales versus 15.0% in fiscal 2021. The company expects diluted EPS of $18.20–$18.70, representing growth of 1.2%-4.0% year over year.

In fiscal 2022, Ulta Beauty plans to open 50 new stores and remodel or relocate 35. |

CPG

CPG companies witnessed a mixed recovery. In the latest quarter, Colgate-Palmolive, Kimberly-Clark and Procter & Gamble posted positive sales growth year over year, while Clorox and Herbalife Nutrition registered single-digit year-over-year sales declines.

|

|

| Clorox Company (NYSE: CLX) 2Q22 |

|

| Details |

The company reported a net sales decline of 8.0% year over year but a 19.0% increase on a two-year stack, reflecting a 10-percentage-point decline in volume and two points of favorable price mix. Adjusted EPS declined by 72.0% year over year.

Gross margin decreased by 1,240 bps to 33.0%, primarily driven by higher manufacturing and logistics costs and commodity costs.

By segment, health and wellness’s net sales decreased by 21.0%, due to a decline of 18 percentage points in volume from lower shipments in cleaning and professional products, and three percentage points of unfavorable price mix. Household net sales increased by 3.0%, driven by five percentage points of favorable price mix and a two-percentage-point decline in volume from lower shipments in cat litter. Lifestyle net sales increases by 2.0%, driven by a one percentage point increase in volume and one percentage point of favorable price mix. International sales were flat due to eight percentage points of favorable price mix, a five-percentage-point decline in volume and three percentage points of unfavorable foreign exchange.

Clorox stated that it has added Alaska Airlines to its out-of-home, multi-year partnerships. Under the terms of the alliance, Clorox will supply hand sanitizer and disinfecting wipes for most airports where the airline operates and all its lounges. |

| Looking Forward |

Clorox raised its sales guidance for the full year 2022 and now expects a net sales decline of 1.0%–4.0%, increasing from its prior guidance of a 2.0%–6.0% decline. By the fourth quarter of fiscal 2022, the company expects sales growth to return to its long-term sales growth target of 3.0%–5.0%.

For the full year 2022, the gross margin is expected to decline about 750 bps, primarily due to commodity and manufacturing and logistics costs, which were higher than previously anticipated—with the assumption of a return to gross margin expansion in the fourth quarter of fiscal 2022. Adjusted EPS is expected to be between $4.25 and $4.50, representing a decrease of 38%–41% year over year. |

| Colgate-Palmolive Company (NYSE: CL) 4Q21 |

|

| Details |

In the fourth quarter, Colgate-Palmolive reported organic sales growth of 3.0% year over year, driven by pet nutrition and oral care segments. EPS increased by 3.0% on a base-business basis.

The company’s gross profit margin was down 300 bps in the quarter to 58.1%, due to a 670-bps headwind from raw materials offsetting 120 bps pricing benefit and 250 bps of favorable productivity.

By geography, North America’s organic net sales decreased by 1.5% year over year as North America lapped high-single-digit growth in the prior year, with liquid hand soap providing a headwind of more than 3 percentage point in the quarter. Latin America’s organic net sales increased by 6.0%; Brazil led growth, with strong pricing and premium innovation across whitening and natural products. Europe’s organic net sales decreased by 3.5%, lapping 4.5% growth in in the prior year, with a 2.5% foreign-exchange headwind. Asia Pacific’s organic net sales grew 1.5%, with volume and pricing increasing slightly but a modest negative impact from foreign exchange.

The company stated that its digital transformation is paying off, seeing e-commerce market shares growing in key markets and strong e-commerce sales growth across all categories, including pet nutrition and within personal care, premium skin. |

| Looking Forward |

Colgate-Palmolive expects organic net sales growth in 2022 to be within the company’s long-term target range of 3.0%–5.0%, driven by continued growth in oral care and pet nutrition segments. It expects gross profit margin expansion and low-to-mid-single-digit EPS growth.

The company plans to streamline its supply chain to reduce structural costs through its 2022 Global Productivity Initiative. The program aims to reallocate resources toward the company’s strategic priorities and faster growth businesses, as well as drive efficiencies in its operations. The company expects to see benefits from the program in the second half of 2022, accelerating into 2023. |

| Herbalife Nutrition Ltd. (NYSE: HLF) 4Q21 |

|

| Details |

Herbalife’s total sales decreased by 6.6% year over year, mainly due to strong comparatives. On a two-year stack, sales increased by 8.0%. Adjusted EPS decreased by 19.7% year over year and by 23.0% on a two-year stack.

The gross margin for the fourth quarter was 77.5%, down 60 bps year over year, due to increased costs as supply chain challenges persisted.

By geography, North America’s sales decreased by 2.6% year over year but increased by 29.0% on a two-year stack. EMEA’s sales decreased by 7.4% year over year but increased by 21.0% on a two-year basis. South and Central America’s sales decreased by 14.3% year over year, while Asia Pacific’s sales increased by 5.1% year over year, led by continued strength in India, which grew 33.0% year over year.

During the quarter, the company opened a new facility in a suburb of Bangalore, spanning 150,000 square feet. The new center will allow the company to accommodate planned growth in India, and will be home to a new local product research and development facility designed to accelerate new product launches. It will also contain a quality-control lab, a distributor meeting facility and a global business services center. |

| Looking Forward |

For full year 2022, the company expects sales growth to be in the range of flat to 6.0% year over year and adjusted EPS to be in the range of $4.25 to $4.75, down from $4.79 in 2021.

For first quarter of 2022, Herbalife expects sales growth to decline by 4.0%–10.0% year over year; however, the company anticipates that the sales decline will ease in the second quarter of fiscal 2022. Herbalife expects adjusted EPS to be in the range of $0.8 to $1.0, compared to $1.42 in 1Q21. |

| Kimberly-Clark Corporation (NYSE: KMB) 4Q21 |

|

| Details |

Total revenues increased by 2.7% year over year, versus 7.0% growth in the prior quarter. Comparable sales increased by 3.0% year over year, driven by an increase in net selling price. Adjusted EPS decreased by 23.1% year over year.

The company stated that the sales growth results were impacted by $530 million of higher input costs, led by an increase in pulp and polymer-based materials, distribution and energy costs. These factors escalated input costs and the company's ability to fully meet growing consumer demand.

By region, North America’s comp sales were in-line with the year-ago quarter in the consumer products segment and increased by 2.0% year over year in the K-C professional (KCP) segment. Outside North America, comp sales increased by 8.0% in developing and emerging (D&E) markets and 2.0% in developed markets.

By segment, personal care sales increased by 12.0% year over year, but consumer tissue sales decreased by 10.0% year over year. KCP sales increased by 2.0% year over year. |

| Looking Forward |

For full year 2022, the company expects net sales growth to be 1.0%–2.0% year over year and comp growth to be 3.0%–4.0% year over year. Kimberly-Clark expects operating profits to be down low- to mid-single digit year over year. It expects EPS to be in the range of $5.60–$6.00, representing growth of 4.1%–11.5% year over year.

Kimberly-Clark plans to spend $1.0–1.1 billion in capital expenditures in 2022. The company expects inflation and supply chain disruptions to persist in 2022. It anticipates that approximately half of the inflation for 2022 is expected to come from elevated costs of distribution and energy, with the rest attributed to raw material components, which will be led by polymer-based purchase materials (superabsorbent, nonwovens and pulp). |

| Procter & Gamble Company (NYSE: PG) 2Q22 |

|

| Details |

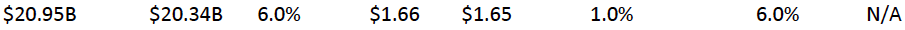

Procter & Gamble’s total revenues increased by 6.0% year over year, accelerating from 5.0% growth in the prior quarter. Comparable sales increased by 6.0% year over year, driven by an increase in shipment volumes. Adjusted EPS increased by 1.0% year over year.

The company’s gross margin dropped down 400 bps year over year to 49.1%, due to high commodity costs and freight costs. Likewise, its operating margin went down 250 bps year over year to 24.7%.

By segment, beauty’s comp sales increased by 2.0% year over year. Within the beauty segment, both skin and personal care and haircare comp sales increased by low-single-digits year over year. Grooming’s comp sales increased by 5.0% year over year. Within grooming, both shave care and appliances comp sales increased by mid-single-digits year over year. Health care’s comp sales increased by 8.0% year over year. Within health care, oral care comp sales increased by low-single-digit year over year and personal health comp sales increased by over 20.0% year over year, driven by an increase in respiratory products sales due to a more intense flu season. Fabric and home care comp sales increased by 8.0% year over year. Within this category, fabric care comps saw a double-digit increase, led by strong sales growth of unit dose detergents and fabric enhancers. Meanwhile, home care comp sales registered a low-single-digit increase. Baby, feminine and family care comp sales increased by 5.0% year over year; specifically, baby care comp sales saw a high-single-digit increase, feminine care comp sales increased by double-digits and family care comp sales were in-line with the prior year.

By region, Europe comp sales increased by 5.0% year over year, Latin America comp sales increased by 15.0% year over year, Mainland China comp sales were in-line with prior year, and US comp sales increased by 9.0% year over year. |

| Looking Forward |

The company raised its sales and comps guidance for fiscal 2022 and now expects sales growth in the range of 3.0%–4.0% year over year, up from 2.0%–4.0% in its prior guidance. It now expects comp growth of 4.0%–5.0% year over year, up from the prior guidance of 2.0%–4.0%. The company also reiterated its adjusted EPS growth of 3.0%–6.0% year over year.

The company has announced price increases in each of its 10 product categories in the US in 2022, which include baby care, feminine care, adult incontinence, family care, home care, hair care, grooming, oral care, skincare, and mid-tier liquid and powder detergents. It began these increases by raising the prices of its fabric care portfolio on February 28 and will increase the prices of certain personal health care brands in mid-April. |

Department Stores

Major department stores witnessed robust recovery in the latest quarter. Macy’s and Nordstrom reported strong double-digit sales growth year over year, while Kohl’s reported single-digit year-over-year sales growth. These department stores are seeing strong sales in various accessories, apparel and footwear categories, such as activewear, denim, fine jewelry and home decor.

|

|

| Kohl’s (NYSE: KSS) 4Q21 |

|

| Details |

Total revenues increased by 5.8% year over year, versus 15.5% growth in the prior quarter. Adjusted EPS decreased by 1.0% year over year, and gross margin increased by 124 bps to 33.2%.

Digital sales declined by 1% year over year, but increased by 21.0% on a two-year basis. Online sales accounted for 39.0% of the company’s total sales.

By category, activewear continues to be a key growth driver of the company’s business, with sales increasing by more than 25.0% year over year. The company saw strong sales growth in men’s and children’s apparel, as well as in the footwear category. Women’s apparel sales growth was affected as its average inventory was down around 45.0% compared to 4Q19. Active national brands Adidas, Champion, NIKE and Under Armour all experienced exceptional sales growth. Additionally, national brands Hurley, Koolaburra by UGG, LEGO, Levi’s, Ninja and Vans also performed well in terms of sales.

The shop-in-shop concept, Sephora at Kohl’s, drove significant beauty sales in its first holiday season during the quarter. The company witnessed increased levels of traffic and a mid-single-digit sales lift in the first 200 stores that opened Sephora at Kohl’s locations, compared to the balance of the chain. Additionally, over 25% of customers shopping at Sephora at Kohl’s are new to Kohl’s.

Management stated that the company experienced significant additional inventory receipt delays during the quarter, and it was unable to fulfill all the customer demand during the holiday period. The company estimated that sales growth was impacted by around 400 bps due to supply chain disruption. |

| Looking Forward |

For the full-year 2022, the company expects net sales to increase by 2.0%–3.0% year over year and its operating margin to be in the range of 7.2%–7.5%. Kohl’s expects EPS in the range of $7.00–$7.50, representing growth of (4.5)%–2.3% year over year. The company expects around $850 million in capital expenditures, including the expansion of Sephora at Kohl’s and store-refreshing activity.

In 2022, Kohl’s plans to open 400 Sephora at Kohl’s locations and, in 2023, it plans to open another 250. The company also plans to expand clothing brand Eddie Bauer from its current 500 stores to all 1,162 Kohl’s locations by the end of 2022. |

| Macy’s (NYSE: M) 4Q21 |

|

| Details |

Macy’s reported total sales growth of 27.8% year over year—driven by strong November and December holiday sales that exceeded the company’s expectations, but offset by softer sales in January. On a two-year basis, sales increased by 3.4%. Comparable sales increased by 27.8% year over year and by 6.1% on a two-year basis. Adjusted EPS increased by 206.3% year over year and by 15.6% on a two-year basis.

Gross margin for the quarter was 36.5%, up 280 bps from the fourth quarter of 2020 and down 30 bps from the fourth quarter of 2019.

Digital sales increased by 12.0% year over year and by 36.0% on a two-year basis. Digital penetration was 39% of net sales, a five-percentage point decline from 4Q20, but a 10-percentage point improvement on a two-year basis.

By banner, comp sales at Macy’s were up 27.8% year over year and increased by 5.2% on a two-year basis. Bloomingdale’s comp sales increased by 37.6% year over year and by 13.0% on a two-year basis, and Bluemercury comp sales were up 30.9% year over year and increased by 3.1% on a two-year basis.

Trending categories at Macy’s included: Fragrances, fine jewelry, home decor, men’s outerwear, toys, sleepwear and watches. Luxury clothing was a strength at Bloomingdale’s, along with strong performances in fragrances, fine jewelry, handbags, home décor and men’s shoes.

Inventory was up 16.0% year over year and down 16.0% on a two-year basis. The company attributed its inventory productivity improvements to scaling its data science into its working teams, which has improved its decision-making process.

In the quarter, the company added 7.2 million new customers, an 11.0% improvement on a two-year basis, with 58.0% coming in through its digital platform. Around 30% of these new customers were dormant over the past 12 months and have now re-engaged.

Management announced that it will not be separating its e-commerce business, which had been under review for several months. |

| Looking Forward |