DIpil Das

Introduction

What’s the Story? Kohl’s, Macy’s and Nordstrom are the leading US department stores. Despite being impacted heavily by the Covid-19 pandemic with a combined revenue decline of 26.8% in fiscal 2020, the major department stores nearly achieved pre-pandemic levels in fiscal 2021: The three retailers’ combined revenue totaled $58.3 billion, 2.3% below fiscal 2019. The department store sector is seeing a strong recovery from the impacts of the Covid-19 pandemic, as 65% of Americans are fully vaccinated as of March 18, 2022, according to the Center for Disease Control, and consumers are beginning to resume pre-pandemic activities. Coresight Research’s US Department Store Insights quarterly series covers the recent performance of Kohl’s, Macy’s and Nordstrom, highlighting trends in comparable sales, revenue, digital sales, product categories and areas of note by management. In this report, we compare the three major department stores’ fourth-quarter 2021 performance, ended January 30, 2022, (4Q21) to last year (4Q20) and the previous year (4Q19) to assess each retailer’s performance. Why It Matters As the department store sector has become smaller, the dominant players are becoming more competitive in terms of total revenue, categories and customers they serve. Digital sales have become increasingly important for department stores, which have traditionally been more focused on physical store channels than other sectors, especially prior to Covid-19. Now, the department stores are heavily investing in digital, and each is approaching digital integration differently. It will be instrumental to learn from all retailers, as increasing digital sales while maintaining physical sales is an industry-wide goal. Each department store has different growth strategies; tracking and monitoring these innovations is informative for the sector.4Q21 US Department Store Insights: Coresight Research Analysis

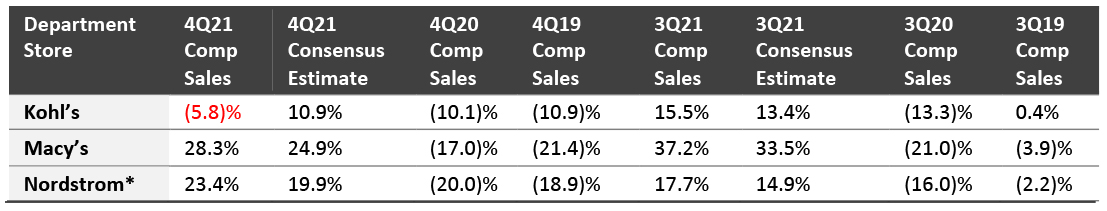

Comparable Sales: Positive Growth at Macy’s and Nordstrom Comparable sales at Macy’s and Nordstrom were strong in the fourth quarter, beating consensus estimates, with management teams reporting that store traffic was up. Macy’s store traffic was up 28.3% year over year, compared to a 17% decline in 4Q20; this is the highest increase of the three retailers, as shown in Figure 1.Figure 1. Comparable Sales at Kohl’s, Macy’s and Nordstrom [caption id="attachment_144565" align="aligncenter" width="698"]

*Nordstrom reports only changes in net sales, which are represented in the table as approximate to comparable sales

*Nordstrom reports only changes in net sales, which are represented in the table as approximate to comparable sales Source: Company reports/S&P Capital IQ [/caption] Sales Trends

- Kohl’s reported an inability to meet consumer demand due to inventory receipt delays during the holiday period and a softening in store traffic due to Omicron in January. Kohl’s had exited 3Q21 with inventory levels up 1.0% year over year but down 25.5% on a two-year basis.

- Macy’s reported strong November and December holiday sales that exceeded its expectations as well as softer sales in January, with the total company average unit retail (AUR) up 11.5% for the quarter.

- Nordstrom reported significant disparity in geographic performance. The Southern US, where 44% of its stores are located, outperformed the Northern Nordstrom banner stores by 7.0 percentage points and suburban locations outperformed urban locations by 10.0 percentage points.

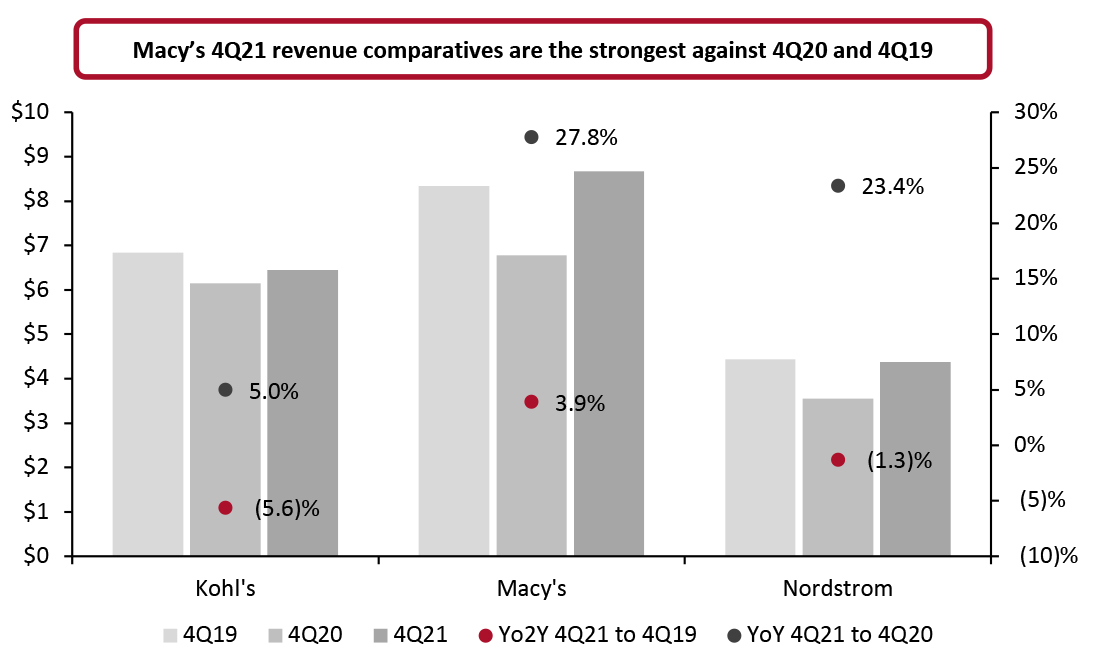

- Macy’s showed the most resilience across the three department stores again in the fourth quarter, as it did in the third and second quarters, compared to 2019 levels. The company revenues were up 3.9% in 4Q21 on a two-year basis.

- Kohl’s had the deepest year-over-two-year decline of the three department stores, at 5.6%.

- Macy’s had the largest year-over-year increase of the three department stores, of 27.8%.

- Kohl’s had the lowest year-over-year increase, of 5.0%.

Figure 2. Fourth-Quarter Revenue Comparatives (USD Bil.; Left Axis) and Revenue Growth (%; Right Axis) [caption id="attachment_144560" align="aligncenter" width="700"]

Source: Company reports[/caption]

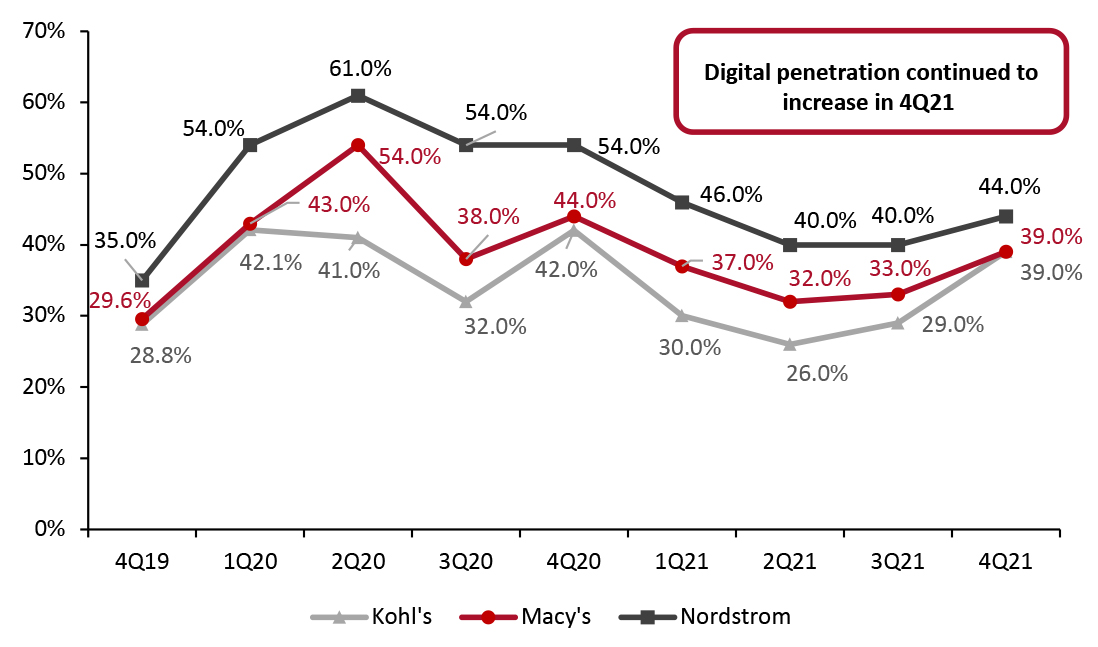

Digital Sales: Penetration Continues To Increase

E-commerce penetration levels ended the year strong at all three department stores. After slowing in the first two quarters of the fiscal year, e-commerce increased in the third and fourth quarters to the highest penetration rates for the year for Kohl’s and Macy’s (39% each), and the rate was very strong for Nordstrom (44%, down slightly from its 2021 high of 46% in the first quarter).

Total digital penetration across the three major department stores decreased by 5.3 percentage points in 4Q21 to 40.1%—compared to 45.4% in 4Q20.

Source: Company reports[/caption]

Digital Sales: Penetration Continues To Increase

E-commerce penetration levels ended the year strong at all three department stores. After slowing in the first two quarters of the fiscal year, e-commerce increased in the third and fourth quarters to the highest penetration rates for the year for Kohl’s and Macy’s (39% each), and the rate was very strong for Nordstrom (44%, down slightly from its 2021 high of 46% in the first quarter).

Total digital penetration across the three major department stores decreased by 5.3 percentage points in 4Q21 to 40.1%—compared to 45.4% in 4Q20.

- Kohl’s digital sales totaled 39% of total sales, at $2.5 billion, compared to 42% in 4Q20 ($2.6 billion).

- Macy’s reported 39% e-commerce penetration in 4Q21, at $3.4 billion, compared to 44% in 4Q20 ($3.0 billion).

- Nordstrom recorded 44% of its sales through e-commerce, totaling $1.9 billion. This is below the high level of 54% in 4Q20, but in value, online sales matched that high.

Figure 3. Digital Sales Penetration, 4Q19–4Q21 (Online Sales as a % of Total Revenue) [caption id="attachment_144561" align="aligncenter" width="700"]

Source: Company reports[/caption]

Digital Highlights from 4Q21

Below, we summarize digital highlights from 4Q21 as department stores continue to invest in e-commerce capabilities, underscoring the inter-connectedness of digital and physical. Highlights include BOPIS (buy online, pick up in-store), curbside pickup, store fulfillment and live shopping events.

Source: Company reports[/caption]

Digital Highlights from 4Q21

Below, we summarize digital highlights from 4Q21 as department stores continue to invest in e-commerce capabilities, underscoring the inter-connectedness of digital and physical. Highlights include BOPIS (buy online, pick up in-store), curbside pickup, store fulfillment and live shopping events.

- Kohl’s

- More than 40% of digital sales were fulfilled by stores during the quarter.

- The retailer continues to pilot self-returns, self-pickup and self-checkout in select stores.

- Macy’s

- The company added 7.2 million new customers in the fourth quarter, an 11% increase compared to 4Q19, with 58% coming in through digital.

- The company has redesigned its app experience, personalized homepages, curated sitelets and improved search function, to which it attributes a 4.2% conversion rate—a 13% increase over 2019.

- The Macy’s app saw an 81% increase in downloads compared to 3Q21.

- Macy’s has shifted its media mix toward digital marketing, with 66% of its total spend on digital versus 35% five years ago. Over this time, Macy’s has experienced a 25% improvement in its return on advertising spend.

- Macy’s launched a digital marketplace for third-party sellers’ merchandise.

- Nordstrom

- One-third of next-day Nordstrom.com orders were picked up at Nordstrom Rack stores.

- Nordstrom scaled order pickup and ship-to-store at all its Nordstrom banner and Rack stores; Nordstrom.com order pickup reached a record high in the quarter, totaling 11%.

- Customers utilizing in-store pickup have higher engagement and spend 3.5X more than customers who do not use the service, according to the company.

- Since launching order pickup at Nordstrom Rack last year, the retailer has seen 70% growth in the program.

- Nordstrom advanced its digital tools, including virtual style boards and style links, to allow salespeople to offer customers relevant recommendations, both in-store and digitally. In fiscal 2021, remote selling sales volume increased by 63% versus fiscal 2020; the average customer spend is over six times that of an average Nordstrom customer.

- Kohl’s ended fiscal 2021 with nearly 32% e-commerce penetration compared to 40% in fiscal 2020.

- Macy’s ended fiscal 2021 with 35% e-commerce penetration compared to 44% in fiscal 2020.

- Nordstrom’s e-commerce penetration was 42% for fiscal 2021 compared to 55% in fiscal 2020.

Figure 4. Category Highlights [wpdatatable id=1855]

Source: Company reports Areas of Note by Management Kohl’s: Sephora and Active/Casual Category Expansion Management reported on the strength of its 200 Sephora shop-in-shops, which launched in the third quarter. Kohl’s is seeing an incremental mid-single-digit sales lift to the overall store sales in the stores launched, and the partnership is bringing in new customers. More than 25% of Sephora at Kohl’s shoppers are new to Kohl’s and they are younger and more diverse. Customers are shopping across the store with approximately half of Sephora customers adding at least one other category in their purchase across other Kohl’s lines of business. Kohl’s is planning to add 400 Sephora at Kohl’s in spring 2022. Kohl’s seeks to be an active and casual destination for the family, a strategic goal that it set in October 2020, increasing its active sales from 20% to 30%. Kohl’s has dedicated more floor space in store for active and casual prominently displayed next to its Sephora shop-in-shops. Management reported it plans to continue to grow its active product assortment while repositioning its women’s casual portfolio.

- Read our insights from the Kohl’s Investor Day on March 7, 2022.

- In August 2021, Macy’s and Toys ”R” Us entered a partnership. The company reported that 25% of customers that shopped Toys “R” Us were new to Macy’s and 93% cross-shopped other categories. The company plans to have Toys “R” Us shop-in-shops in all locations in the second half of 2022.

- During the third quarter, Macy’s added Fanatics, offering customers licensed sports products. Management reported the merchandise is driving higher AUR increases in each of its categories.

- Macy’s added Pandora jewelry to five stores in November 2021; the merchandise assortment helped to drive younger customers, and Macy’s plans to add the assortment to 28 more stores in 2022.