Introduction

Our fourth-quarter 2020 (4Q20) wrap-up covers the quarterly earnings of 58 (mostly) US-based retailers, brands, e-commerce platforms and REITs in the

Coresight 100.

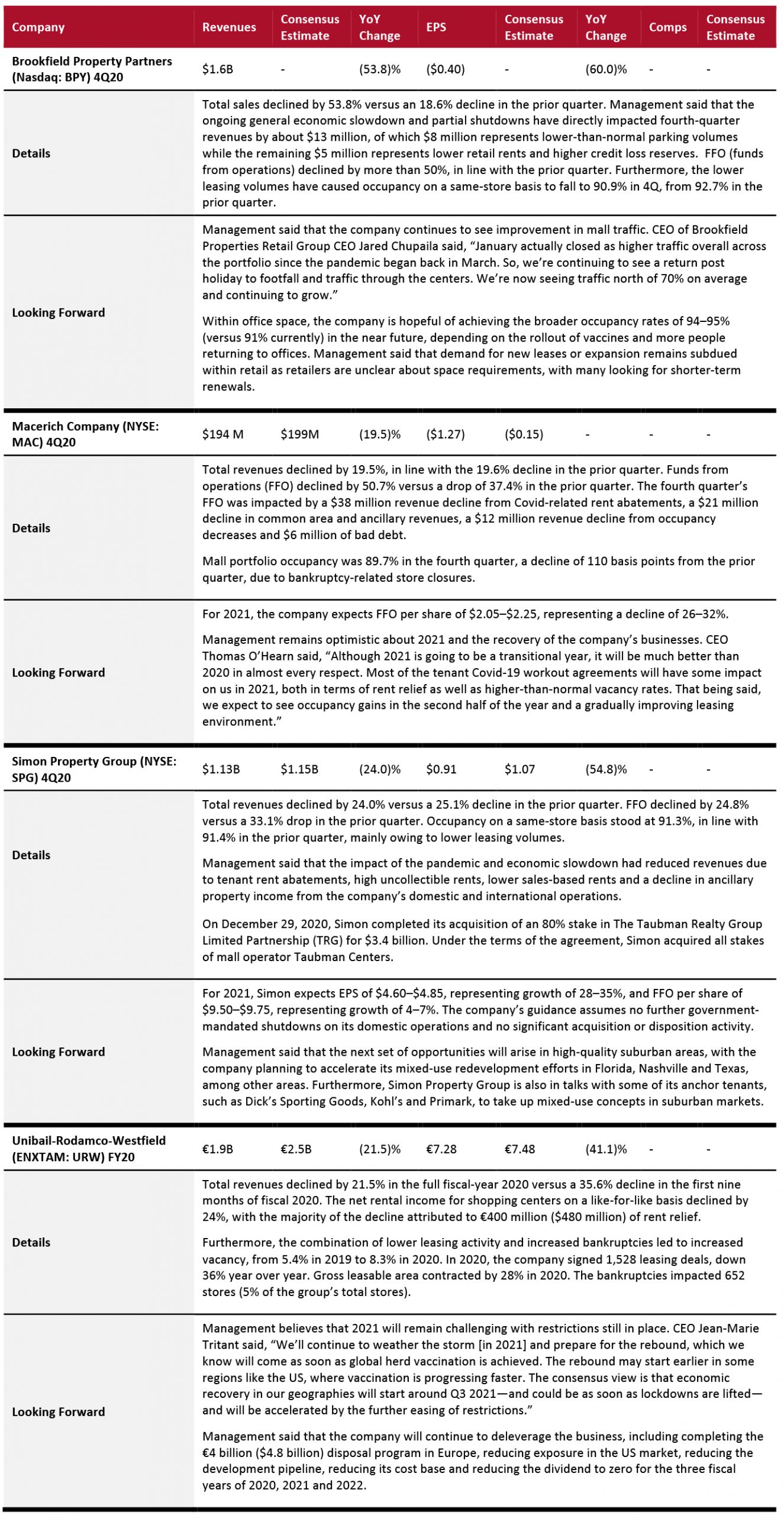

- About 56% of companies beat revenue consensus estimates, 40% missed revenue consensus estimates and 4% reported revenues in line with consensus.

- Home and home-improvement retailers, discount retailers, e-commerce companies and mass merchandisers enjoyed a stronger quarter, with more than 65% of covered companies beating consensus revenue estimates. Furthermore, we saw more than 75% of covered companies in these sectors beating consensus EPS estimates.

- Electronics retailers, food retailers and warehouse clubs comprised the worst-performing sector (versus expectations) in the quarter, with all covered companies missing consensus revenue estimates.

However, beating or meeting consensus does not mean the results were “good” in the context of retailers navigating through

the Covid-19 crisis. The pace of sales recovery is much more indicative of the health of retailers than benchmarking versus consensus.

Company results in 4Q20, which ended January 31 for most companies in our coverage, include key commentary and qualitative insights from major US retailers and brand owners on their recent performance, in terms of revenues and comps, and the impact of the coronavirus pandemic. Although we term the period under review 4Q20, some companies in this report describe their latest quarter differently; some have different quarter-end dates too.

In November 2020, US retail sales saw strong growth of 8.1%, despite several states reinstituting more restrictive mandates owing to the surge in new coronavirus cases. US retail sales continued to rebound strongly in December 2020, with consumers shifting spending away from services and experiences to retail goods. In January, US retail sales growth accelerated to a revised 13.0% as stimulus checks boosted consumer spending.

US retail sales growth slowed to a still-solid 7.2% in February as consumers continued to purchase goods rather than services but pulled back spending in a month that saw no stimulus checks and a nearly nationwide winter storm that kept millions inside their homes.

Below, we assess the recent performance of retailers, brand owners, e-commerce platforms and REITS in detail.

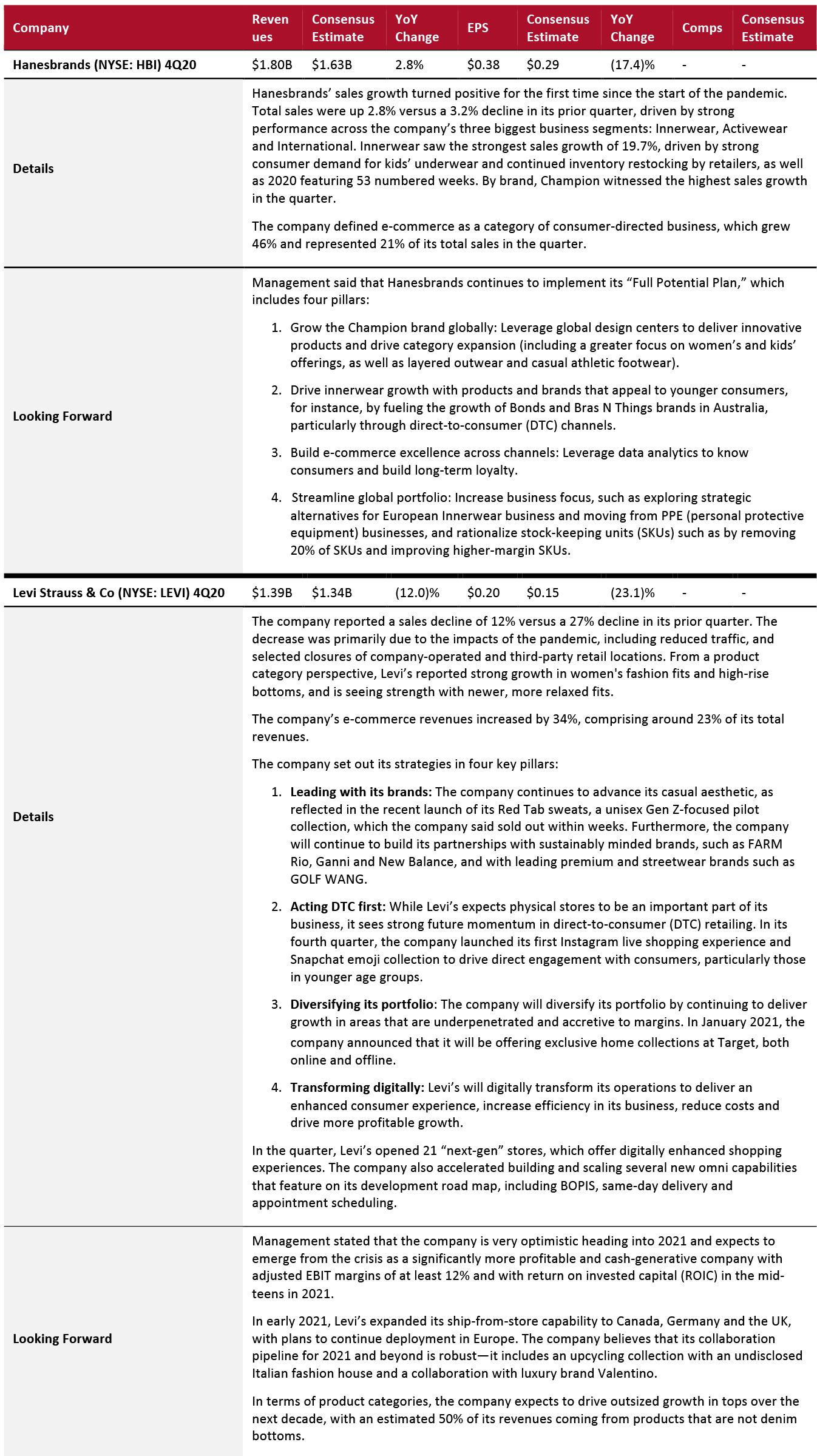

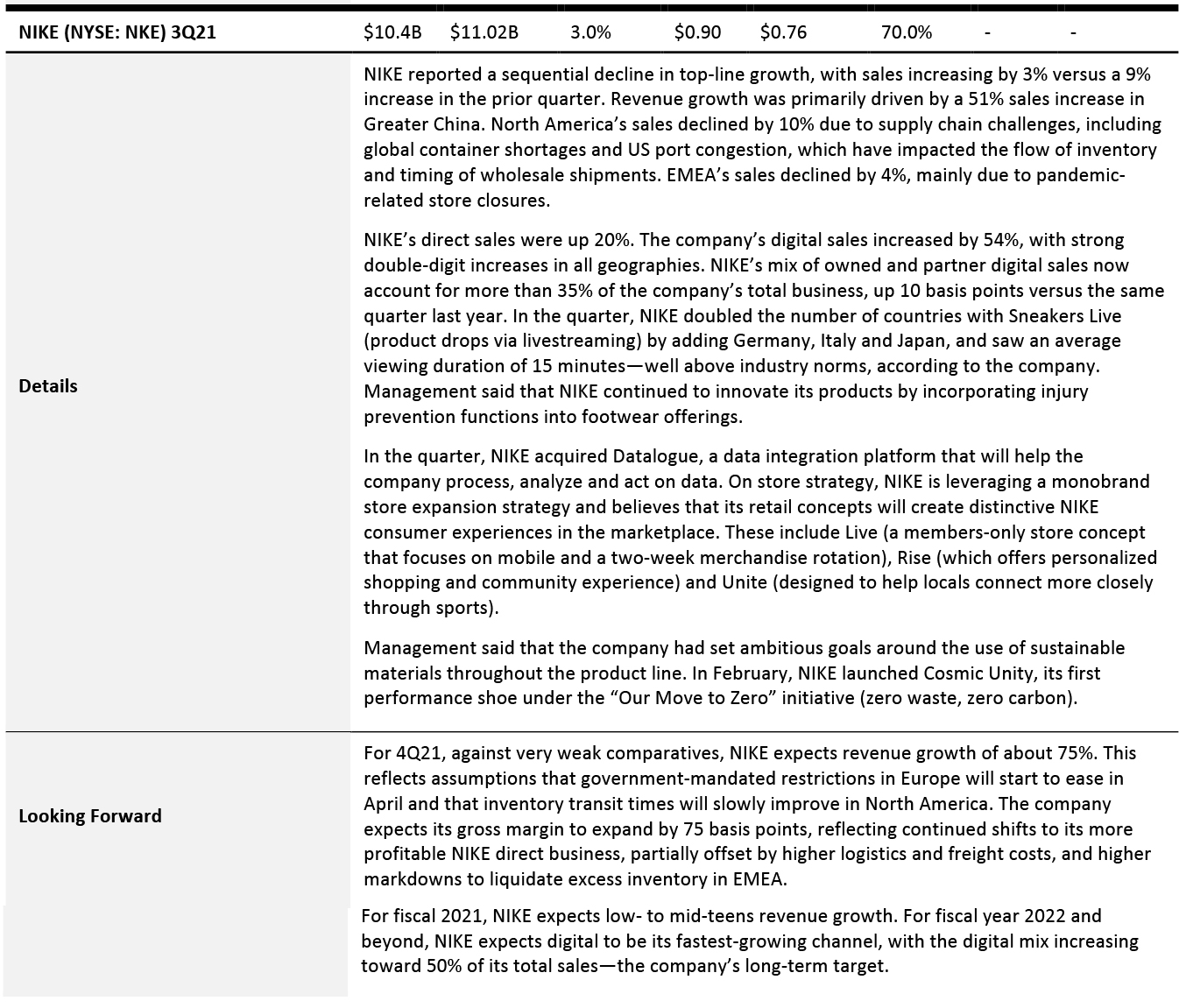

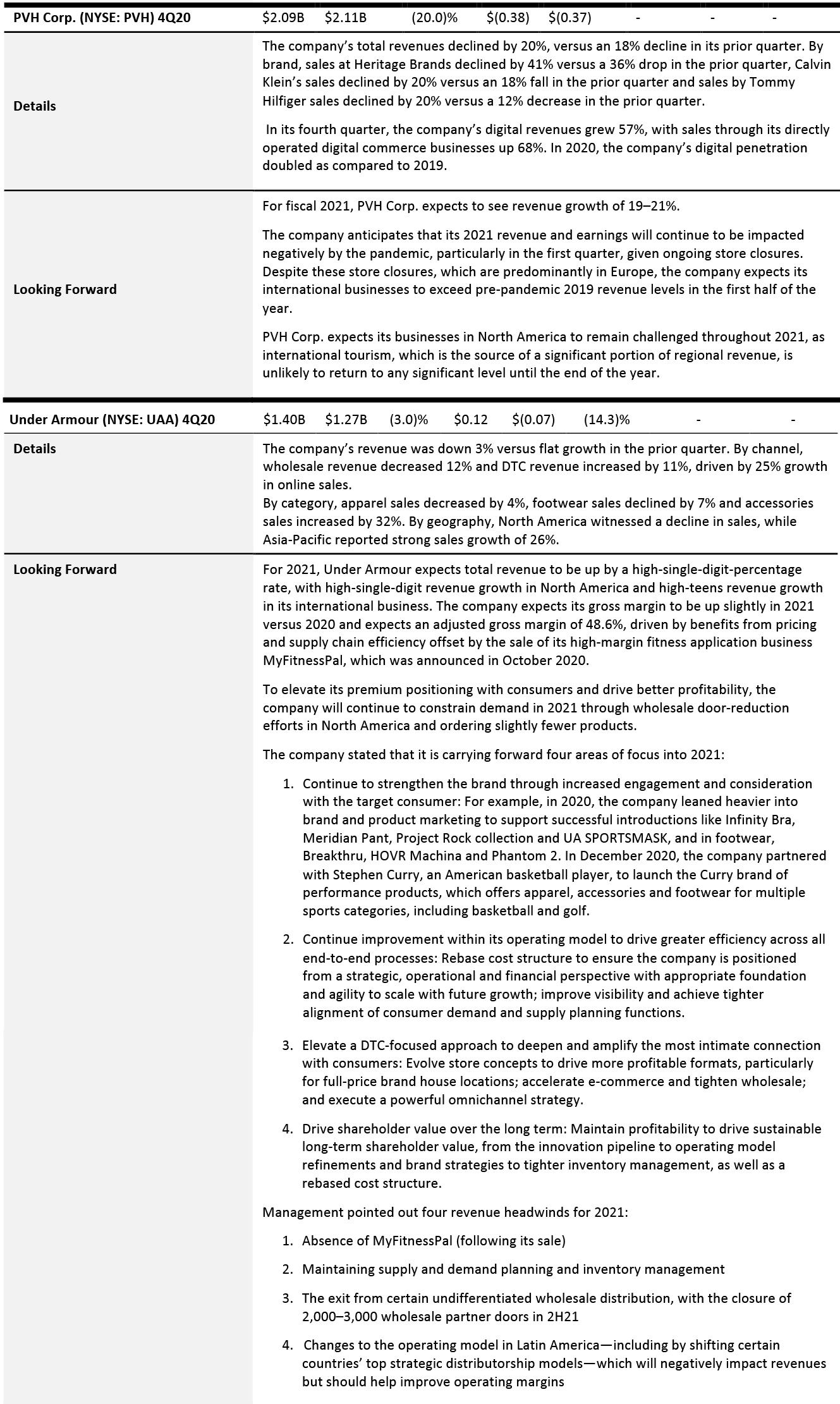

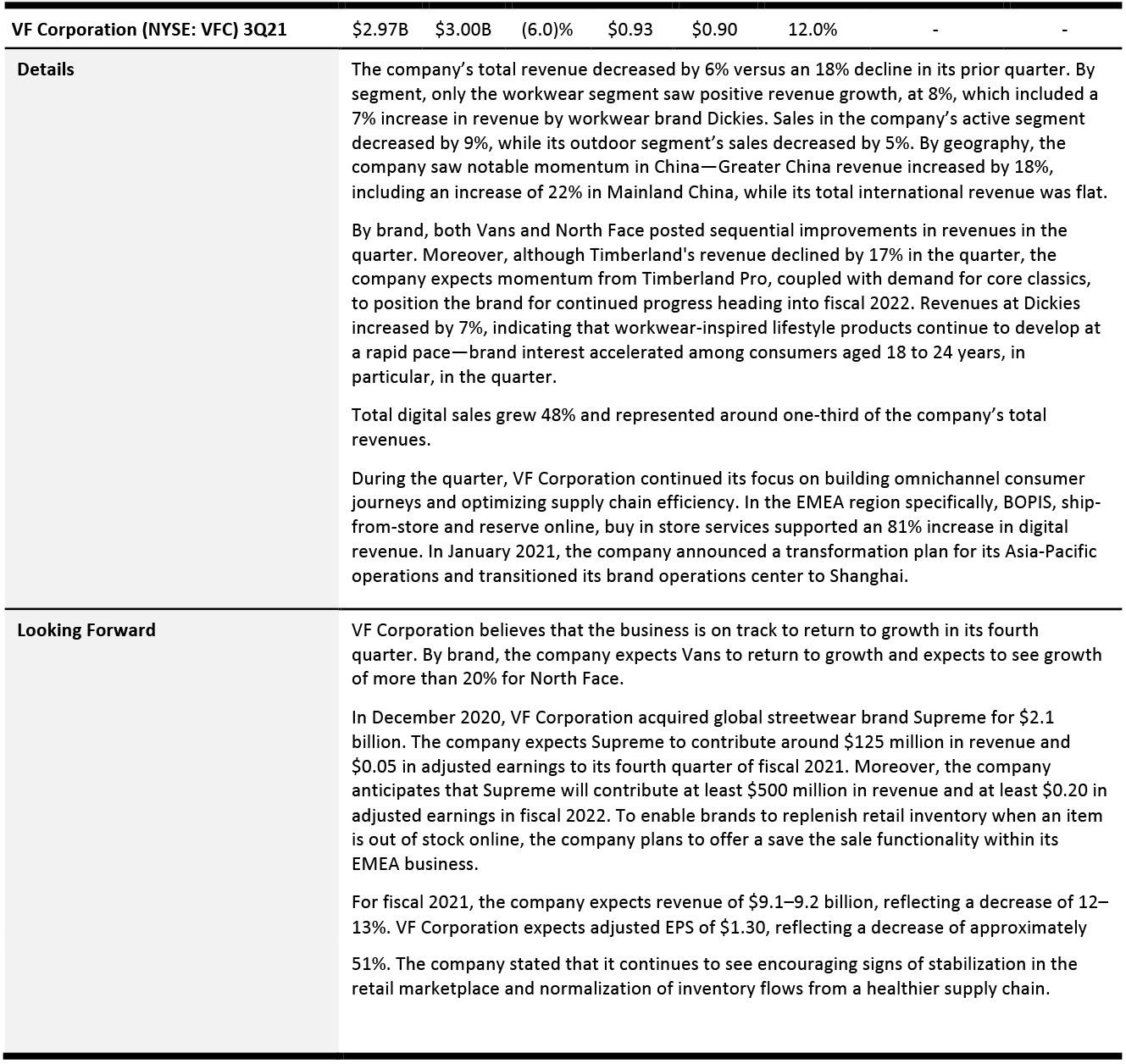

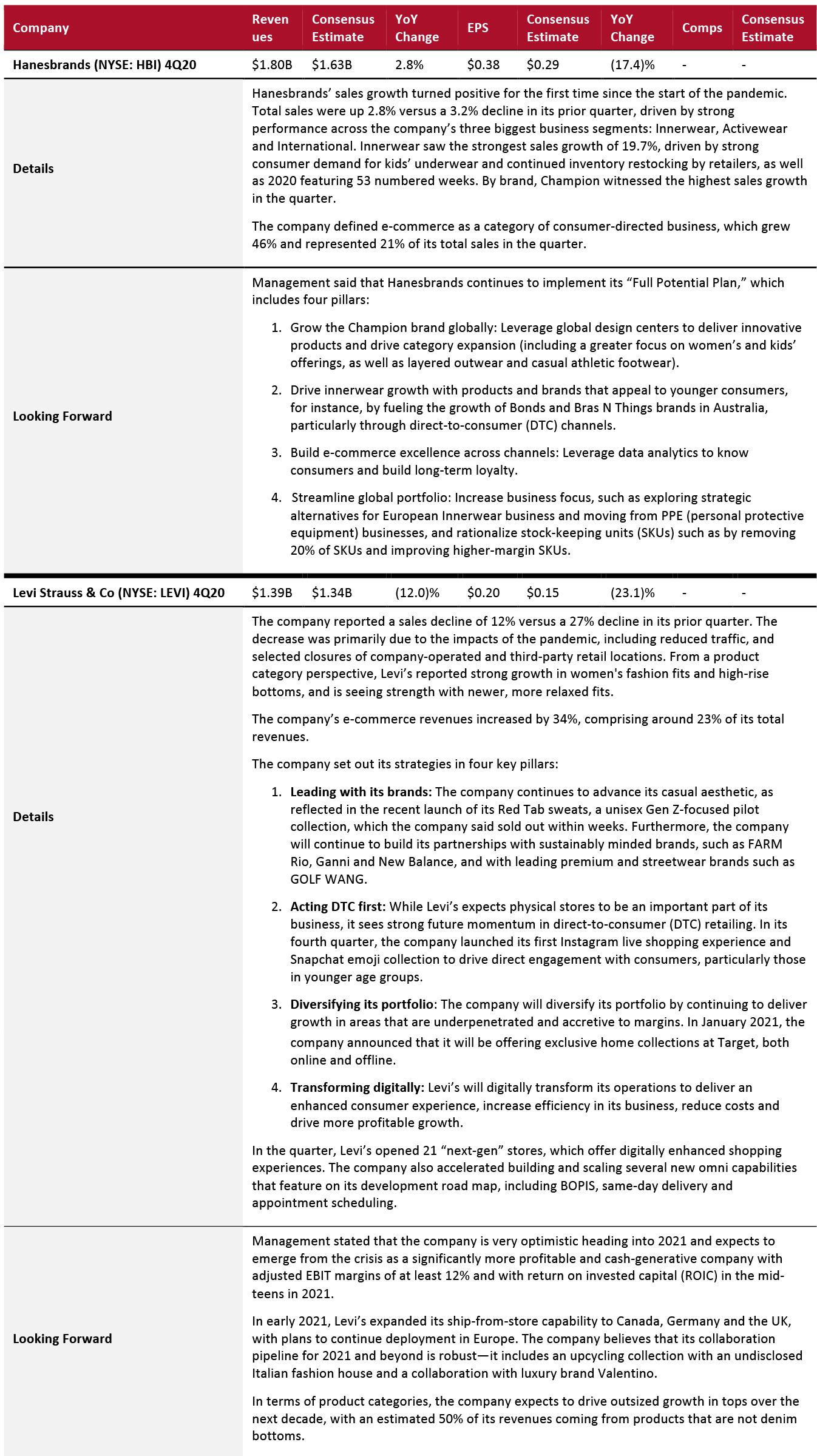

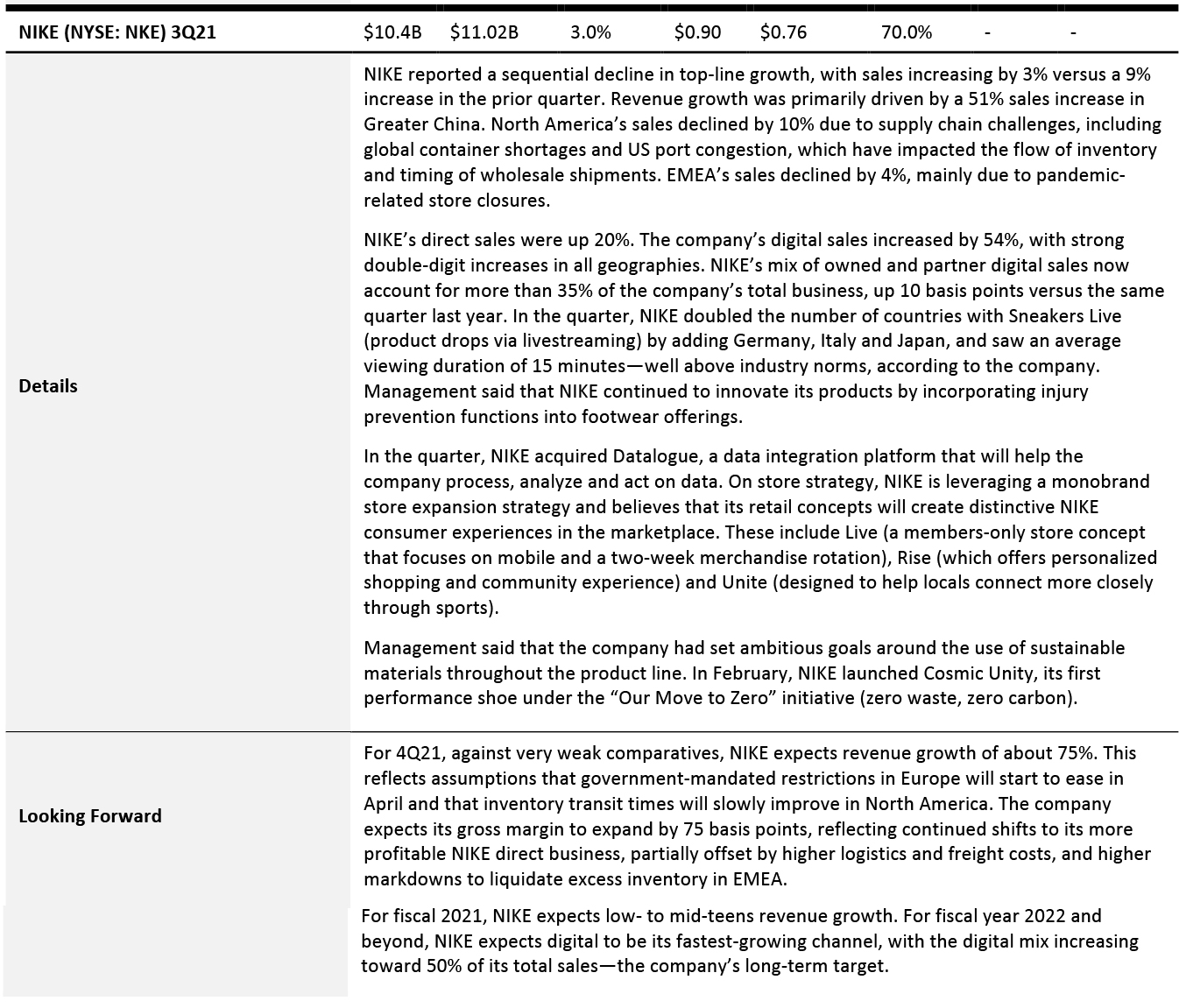

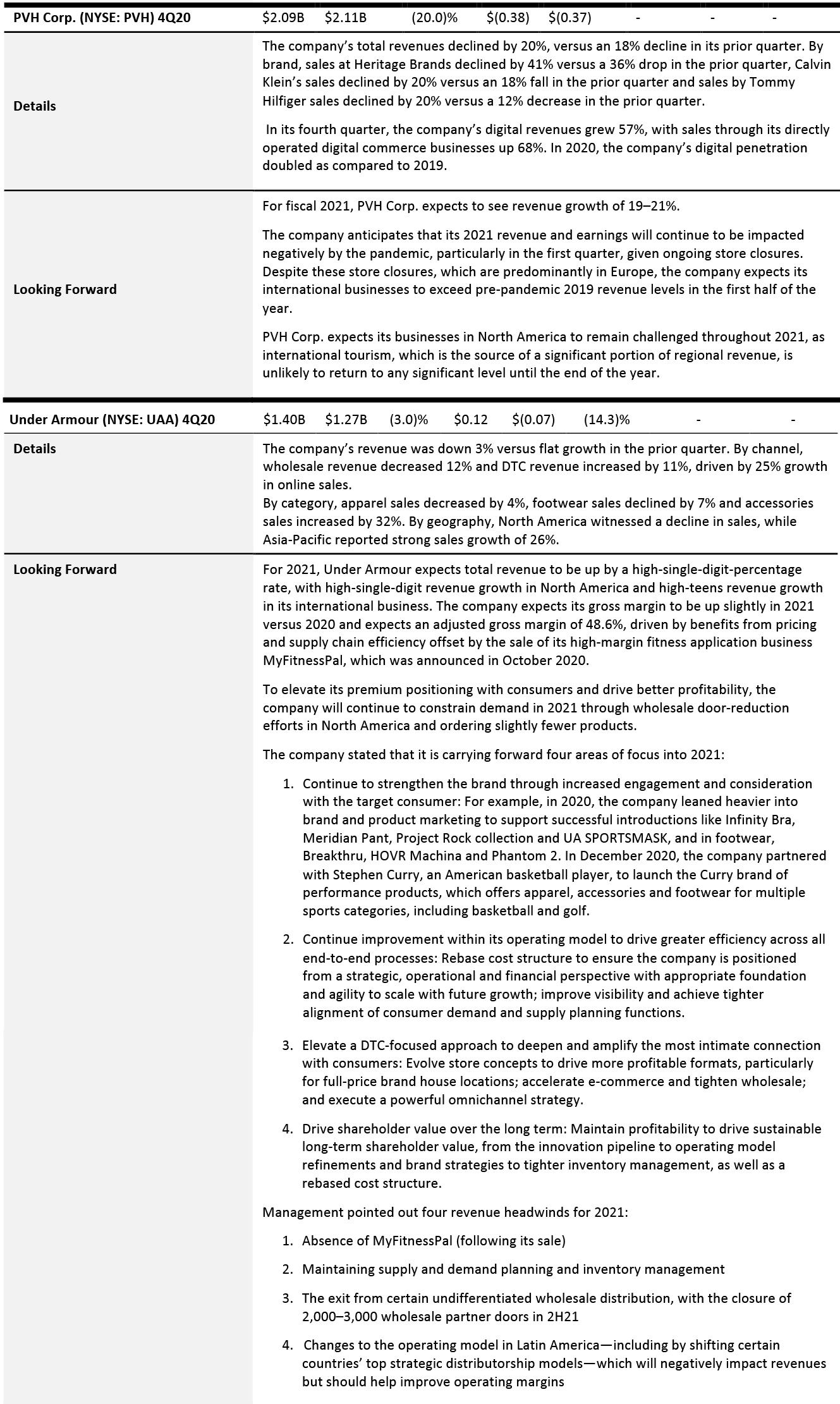

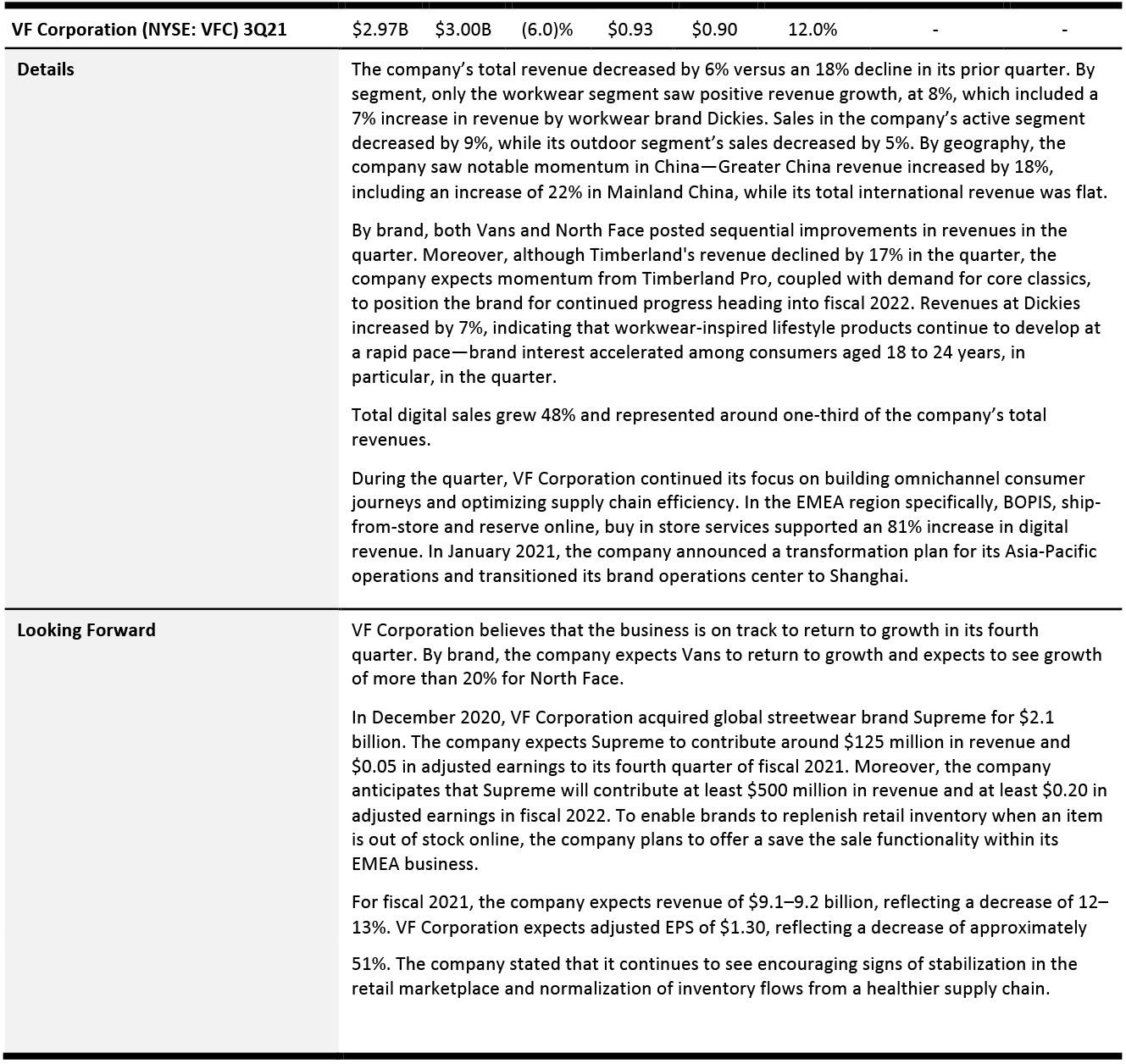

Apparel and Footwear Brand Owners

Apparel and footwear brand owners reported a mixed recovery: Although Hanesbrands’ sales growth turned positive for the first time since the start of the pandemic and VF Corp. saw sequential improvement in sales, NIKE reported a sequential decline in top-line growth, Under Armour reported a sales decline versus flat growth in the prior quarter PVH and Levi’s continued to report double-digit sales declines. By category, demand for intimates and activewear remained strong, while tailored clothing and footwear saw weaknesses.

Going forward, these brand owners will continue to expand their digital channels, target younger consumers and drive category expansion—including a greater focus on casual and athletic wear, kids’ wear, and layered clothing.

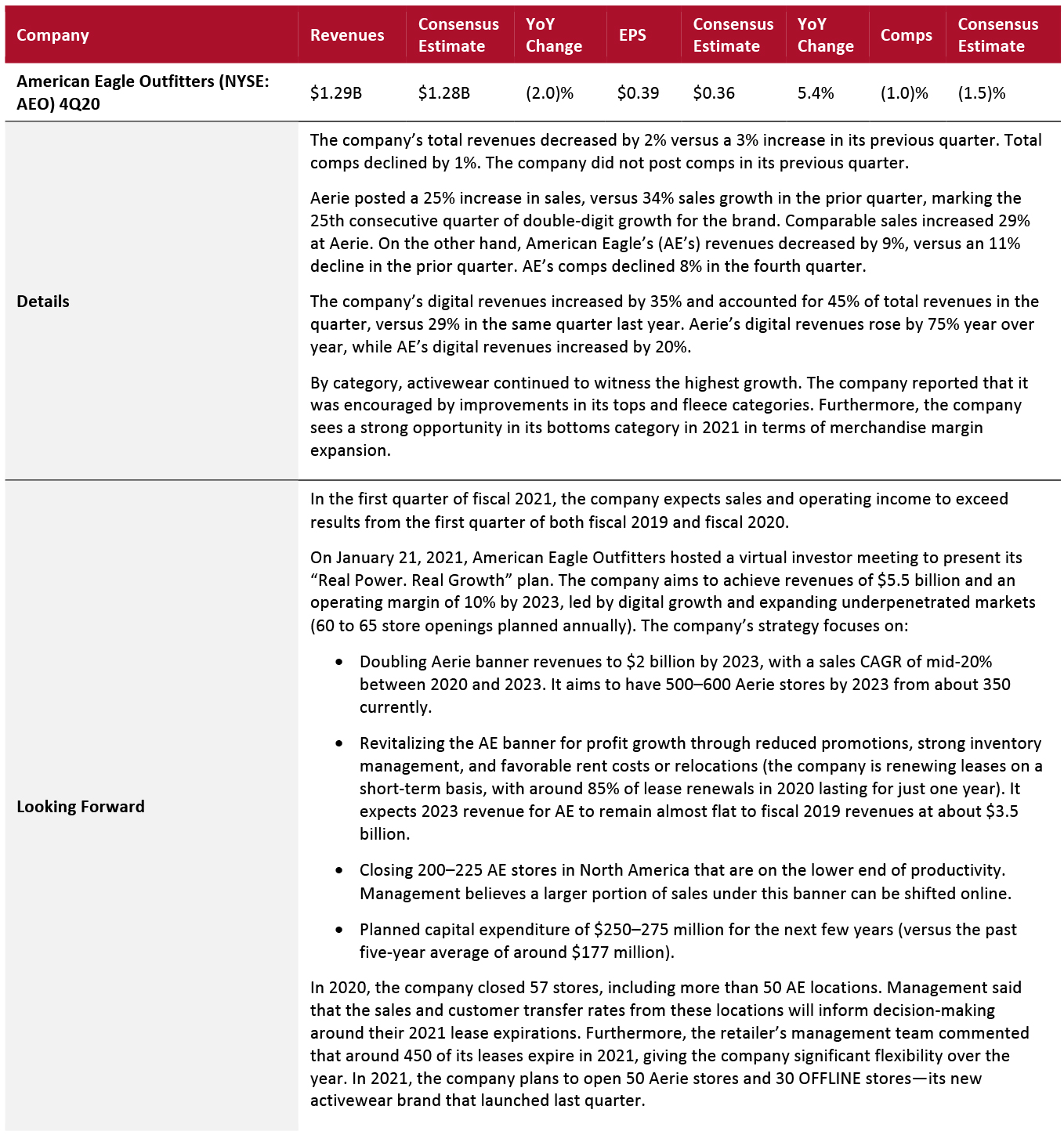

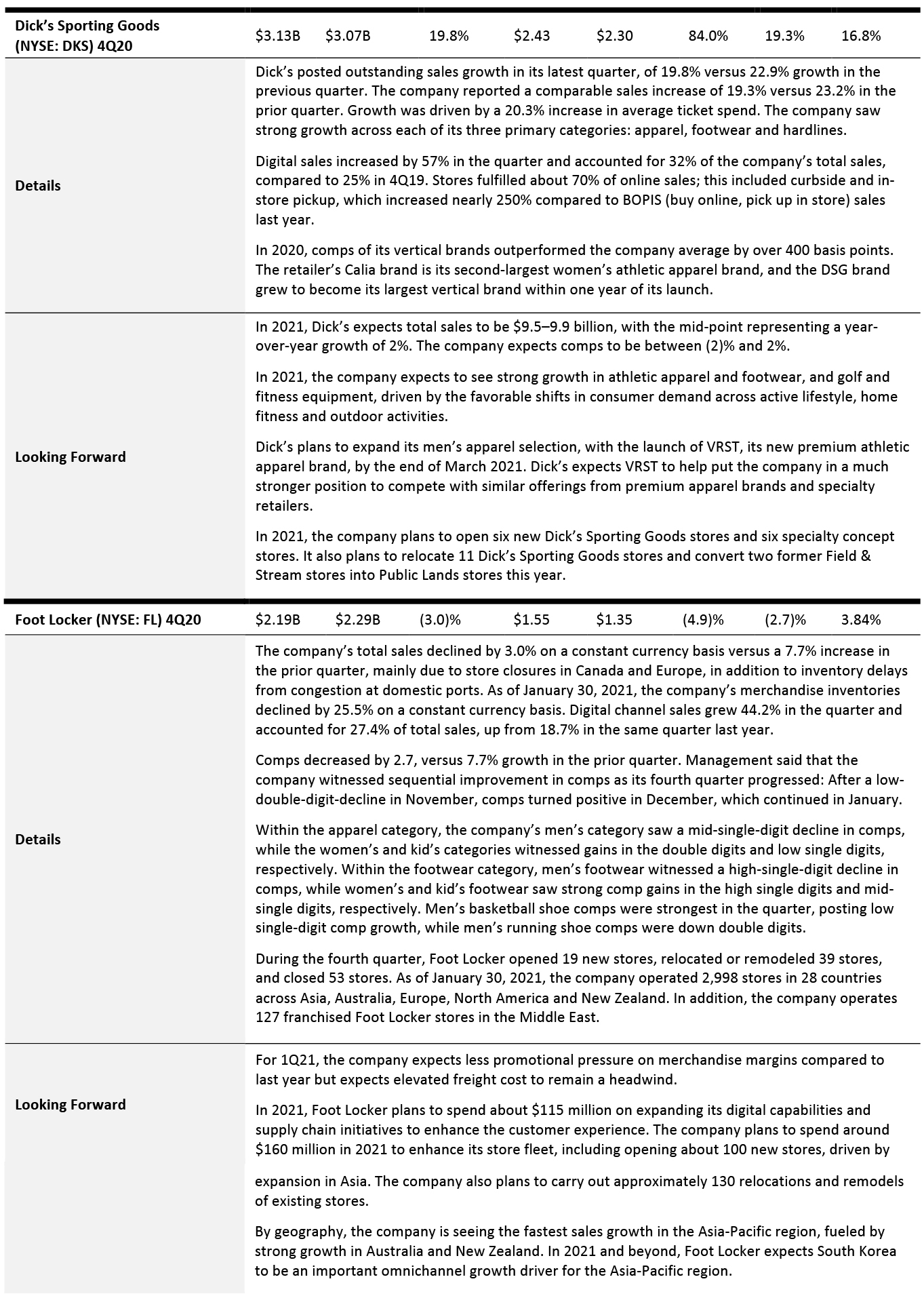

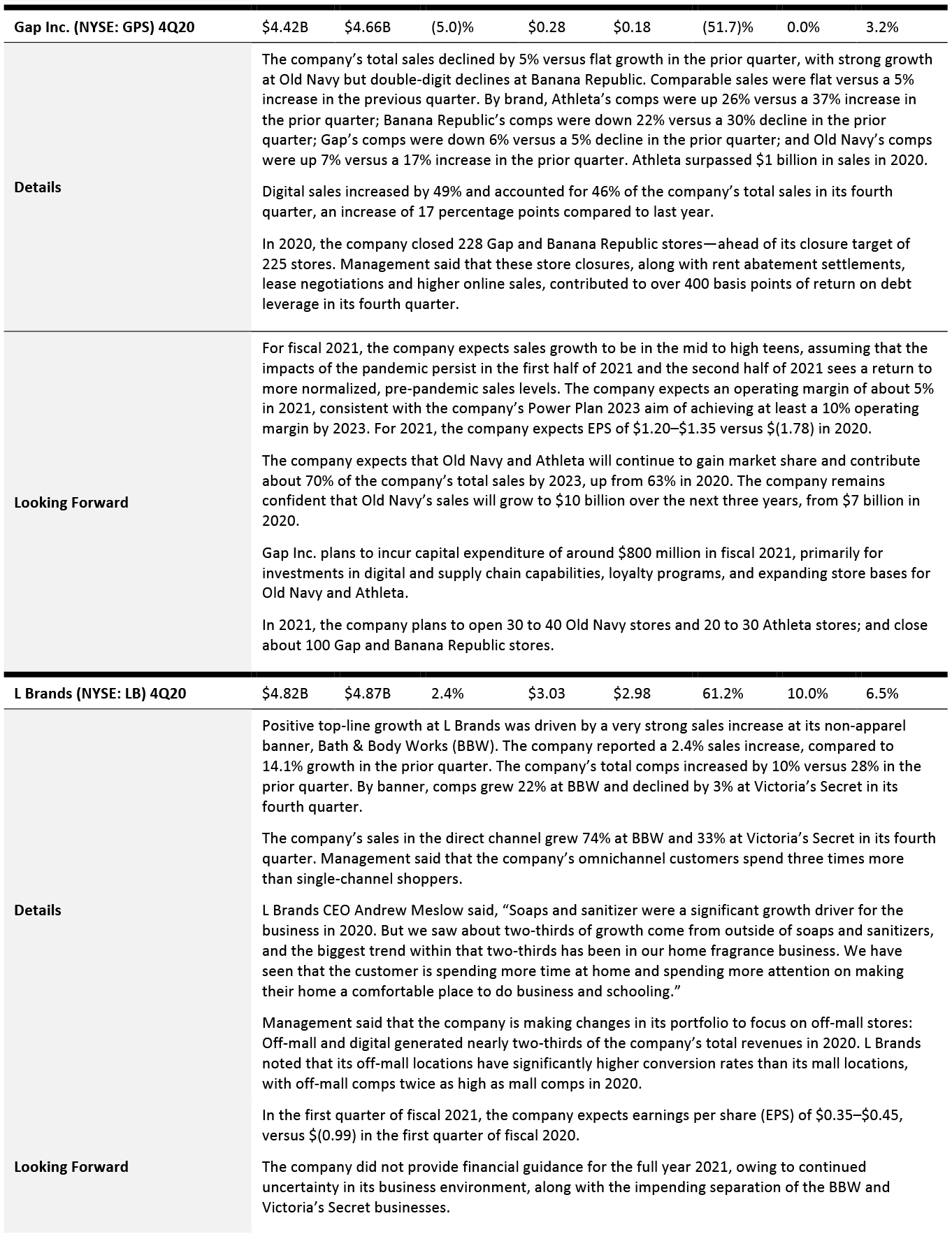

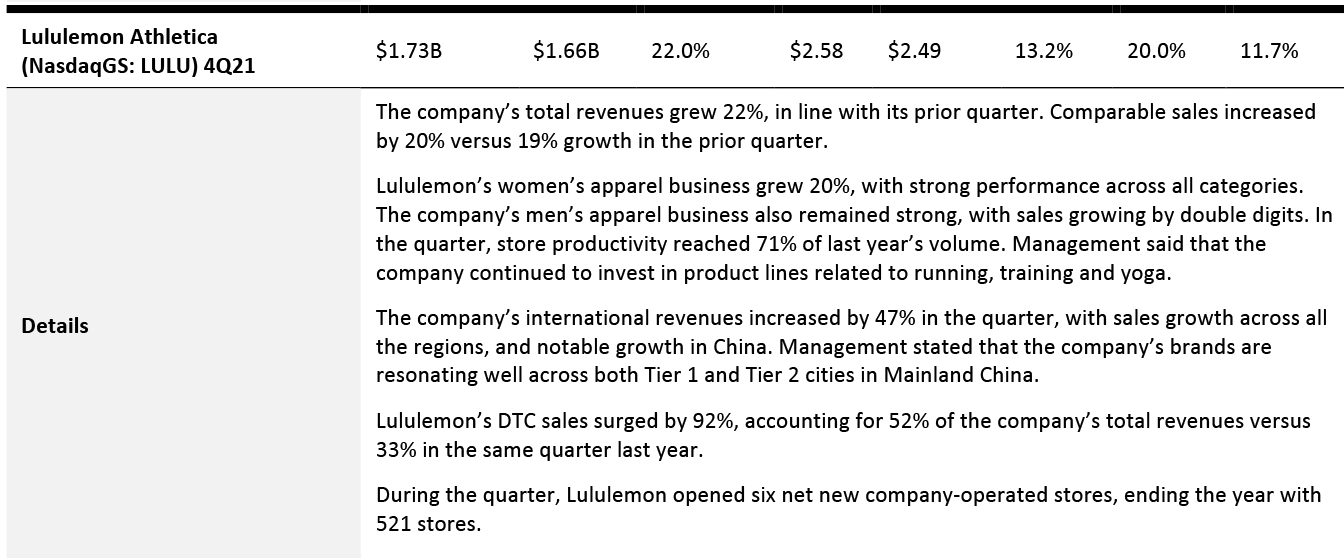

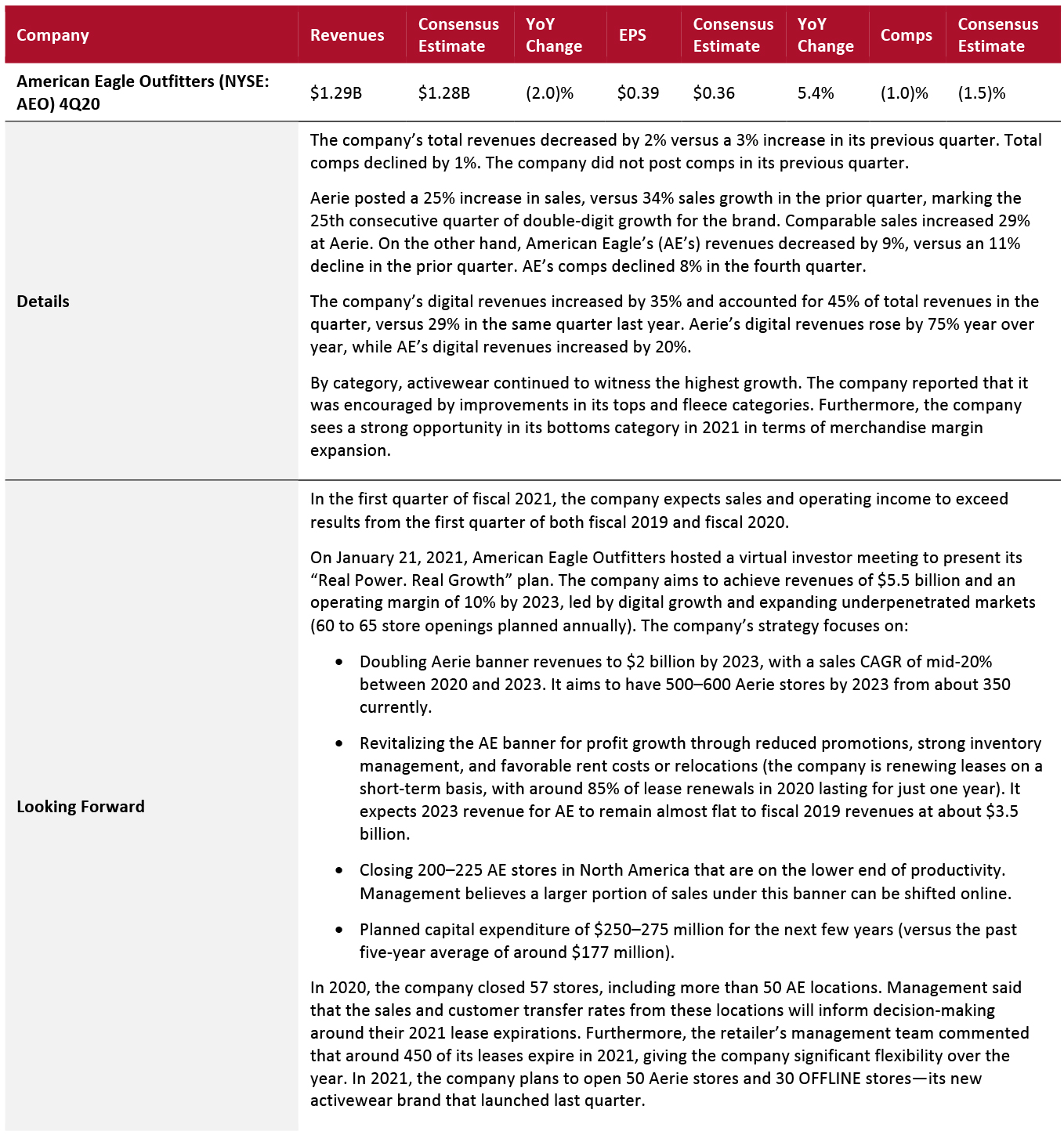

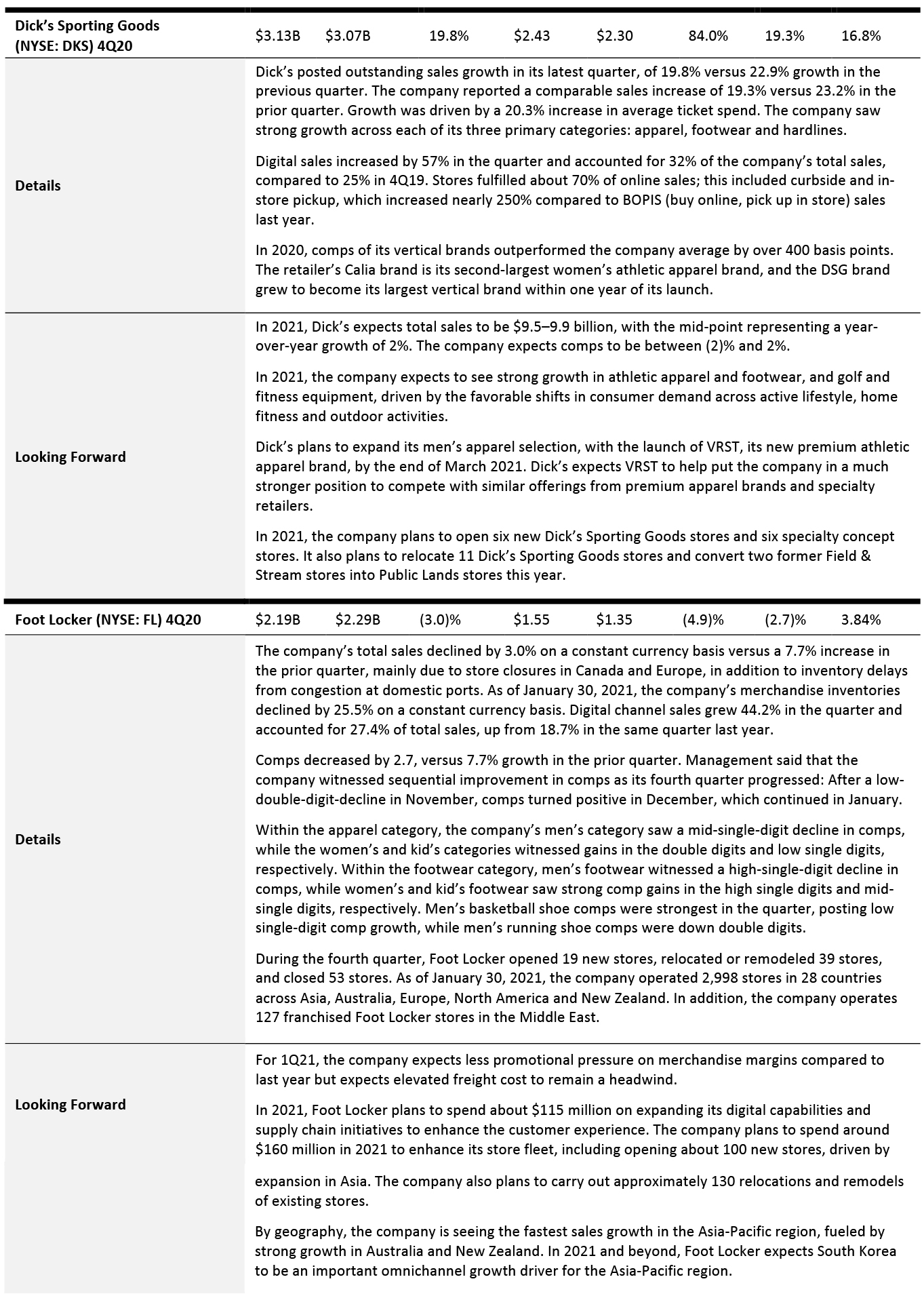

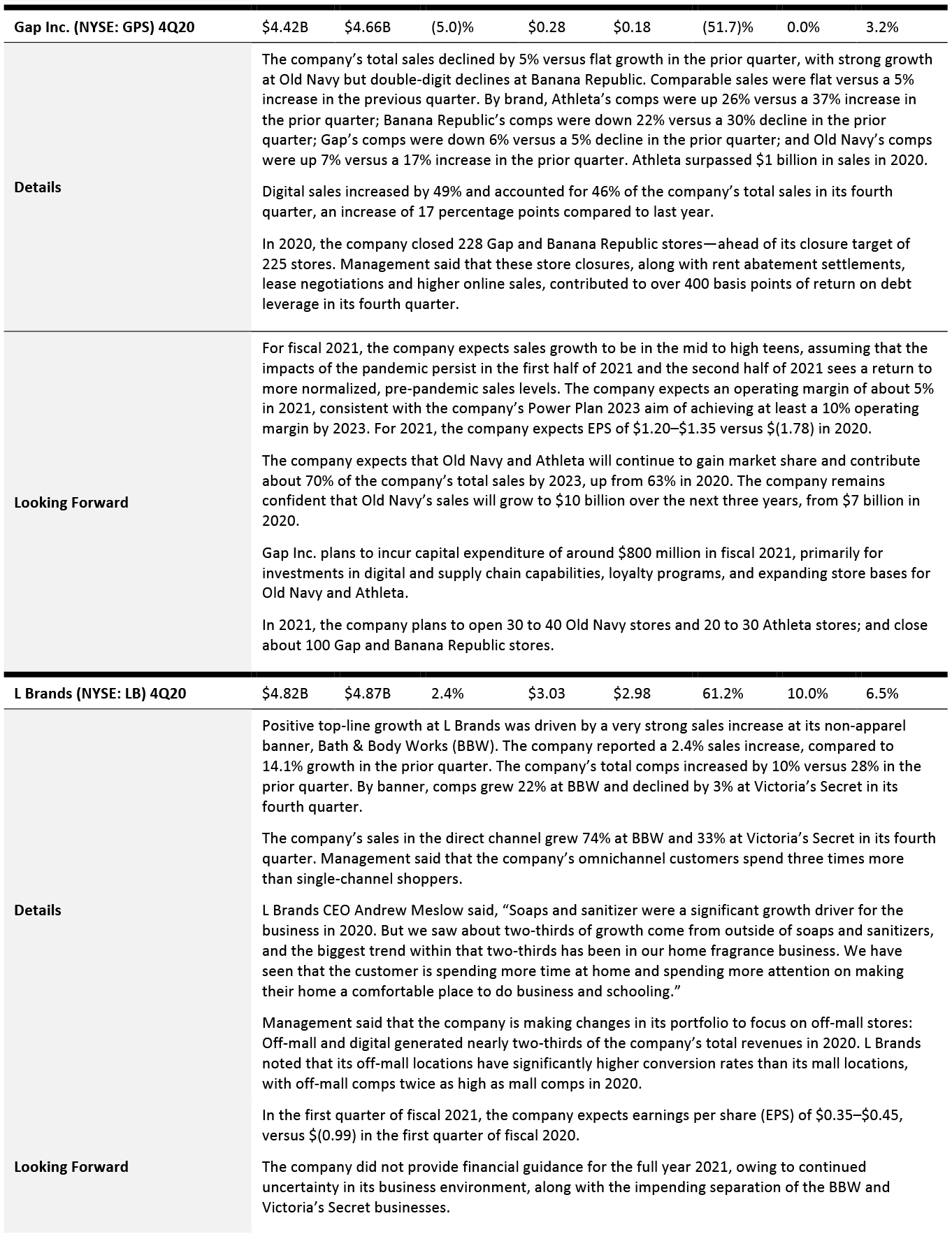

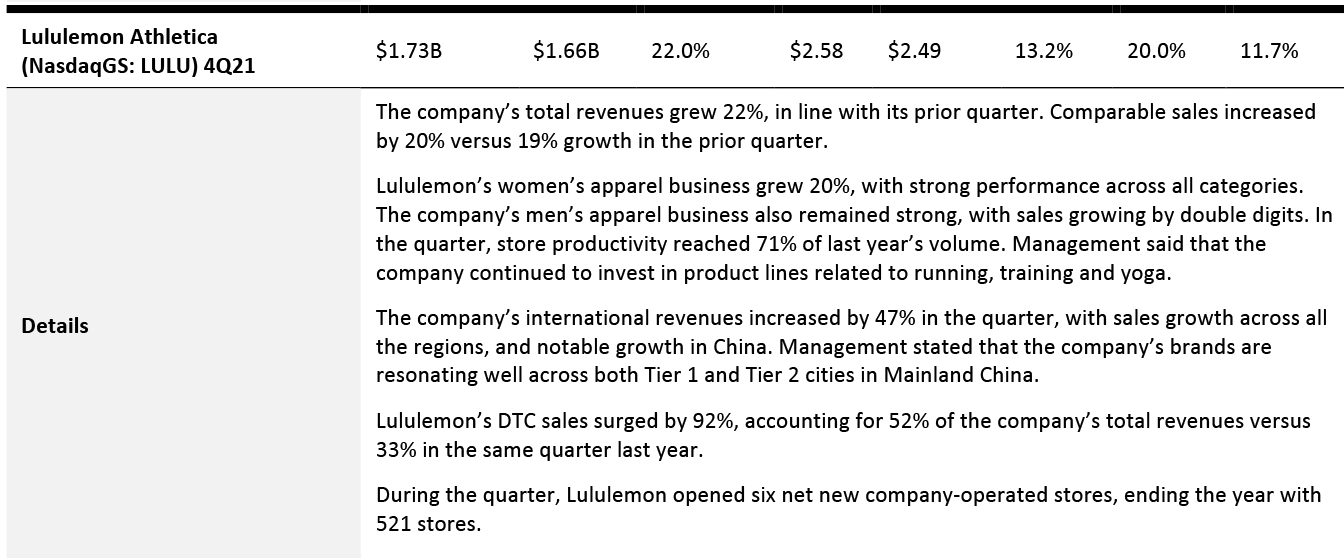

Apparel Specialty Retailers

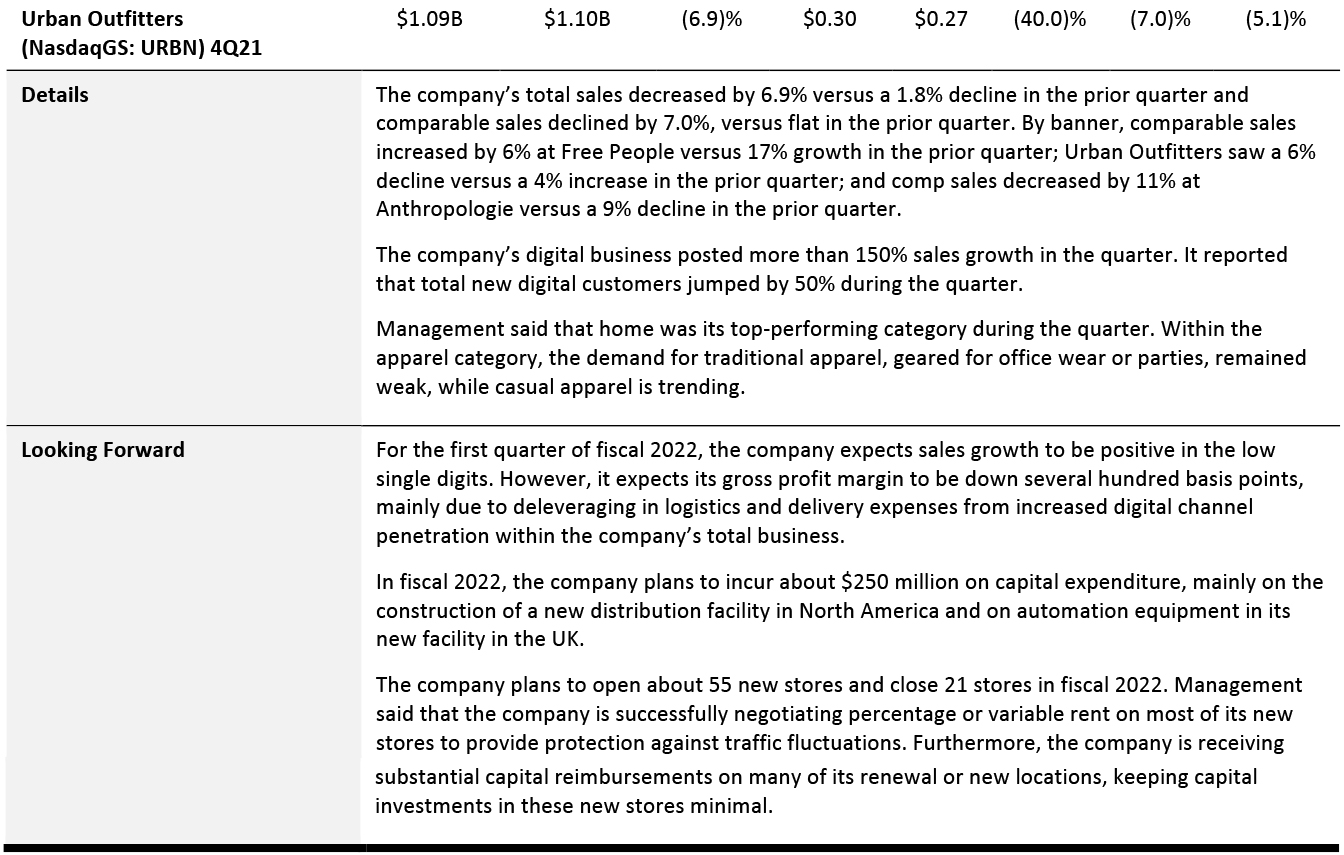

The apparel specialty retail sector is witnessing a mixed recovery. By category, the demand for athleisure, casualwear and intimate apparel remained strong, while traditional clothing for officewear and events continued to see weaknesses.

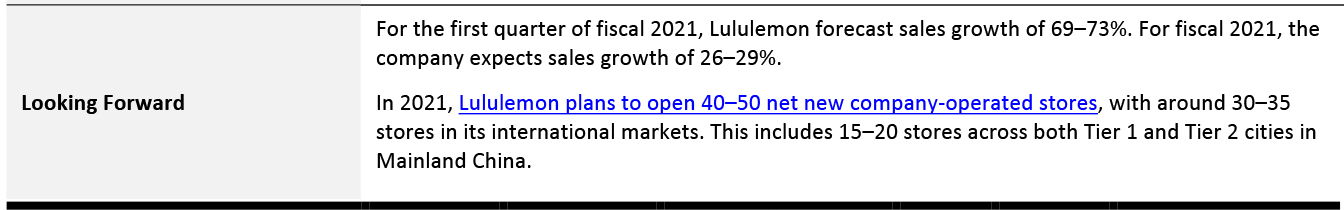

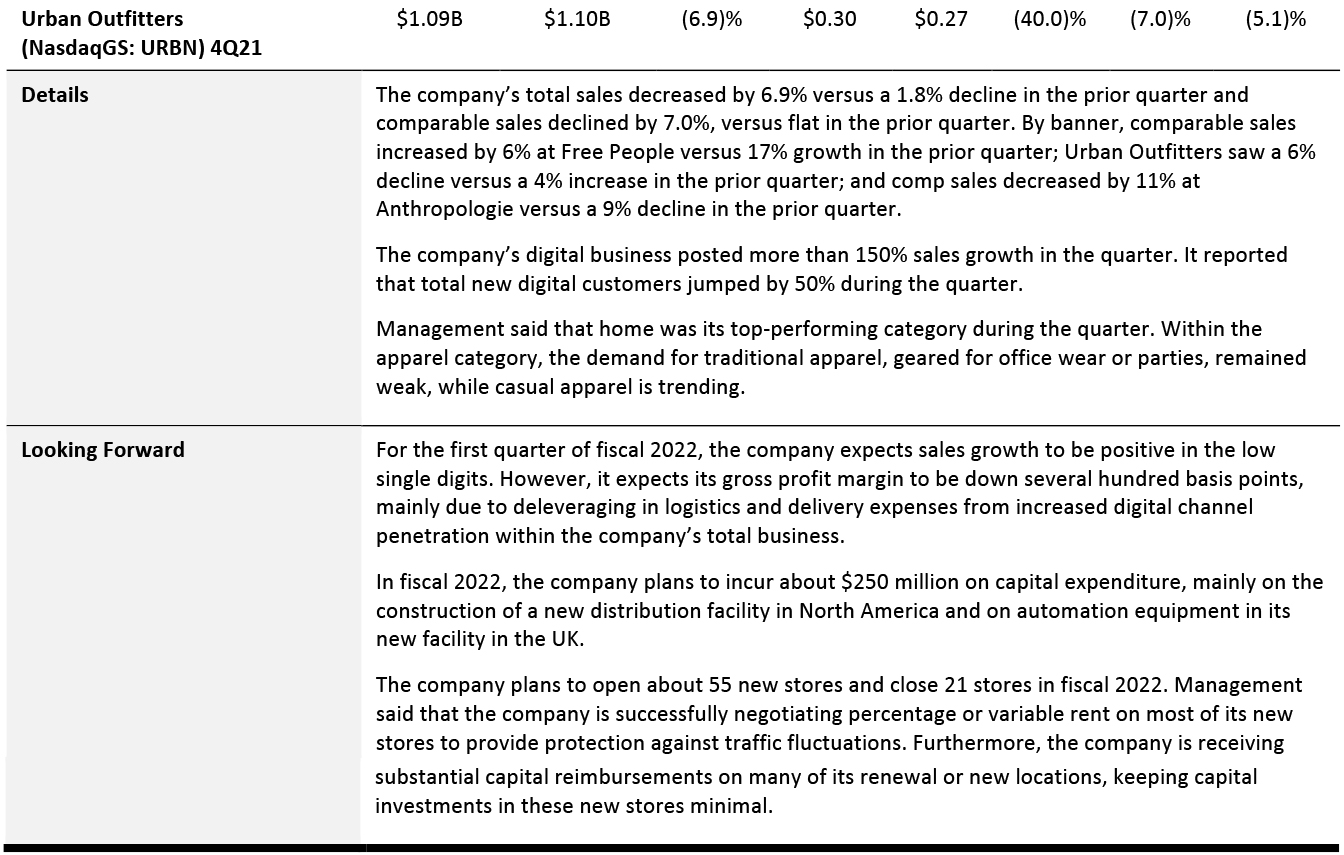

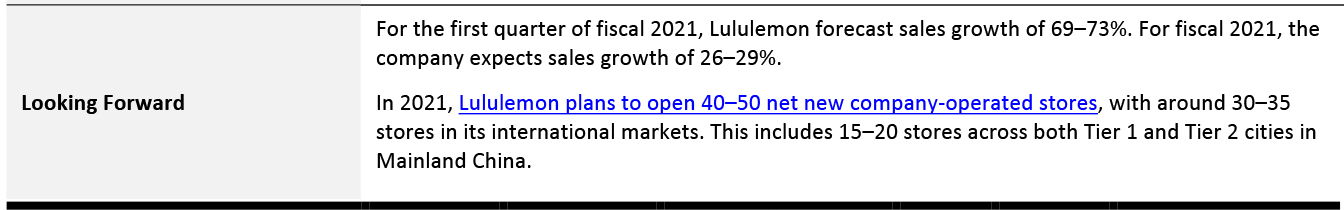

American Eagle Outfitters, Foot Locker, Gap Inc. and Urban Outfitters posted sequential declines in their toplines, with total sales declines of between 2% and 7%. On the other hand, athletic apparel retailer Lululemon posted double-digit comp growth in the quarter. For 2021, Lululemon expects to see double-digit revenue growth. Similarly, Dick’s Sporting Goods posted outstanding comp growth during the quarter.

Off-Price Retailers

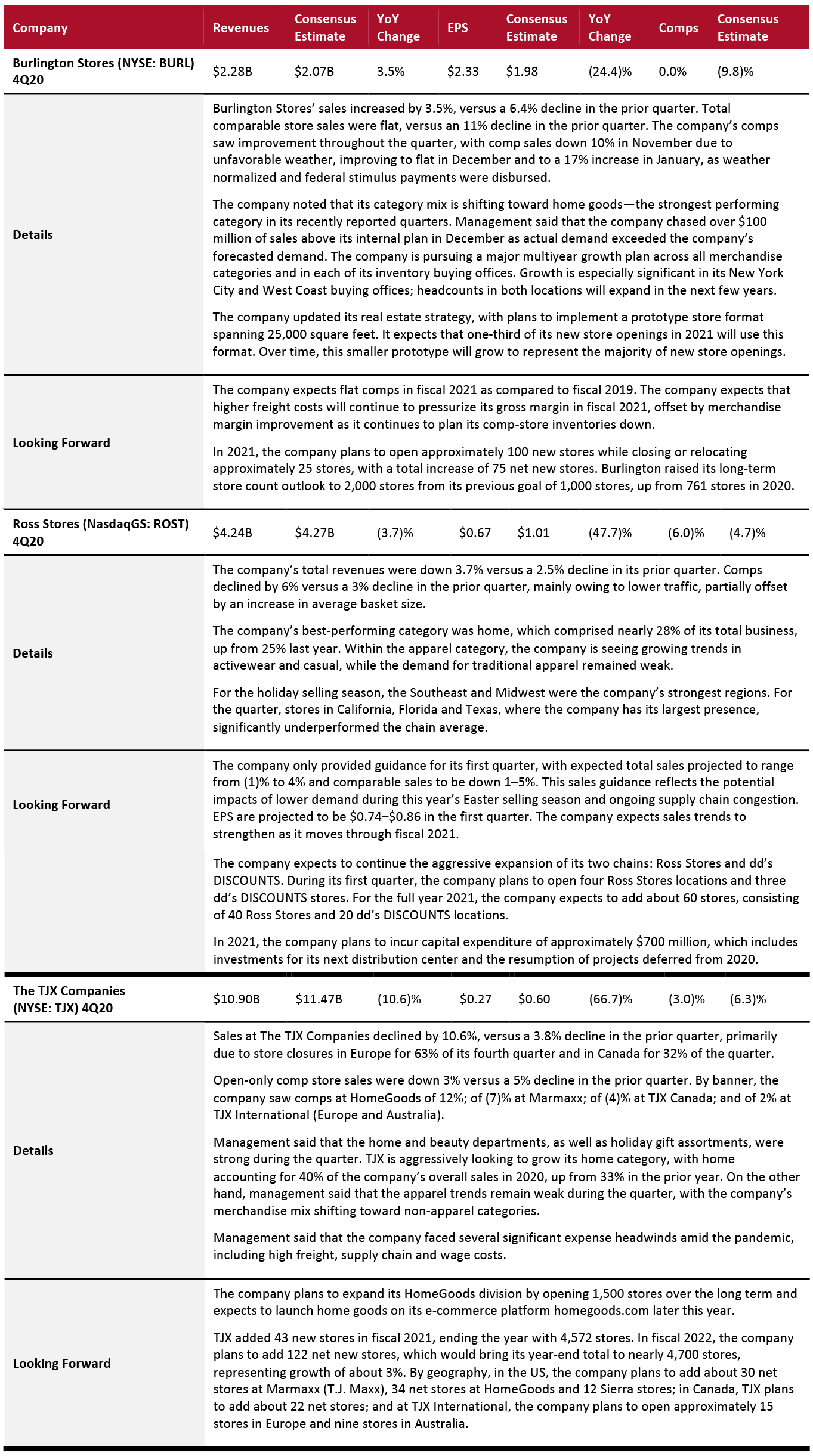

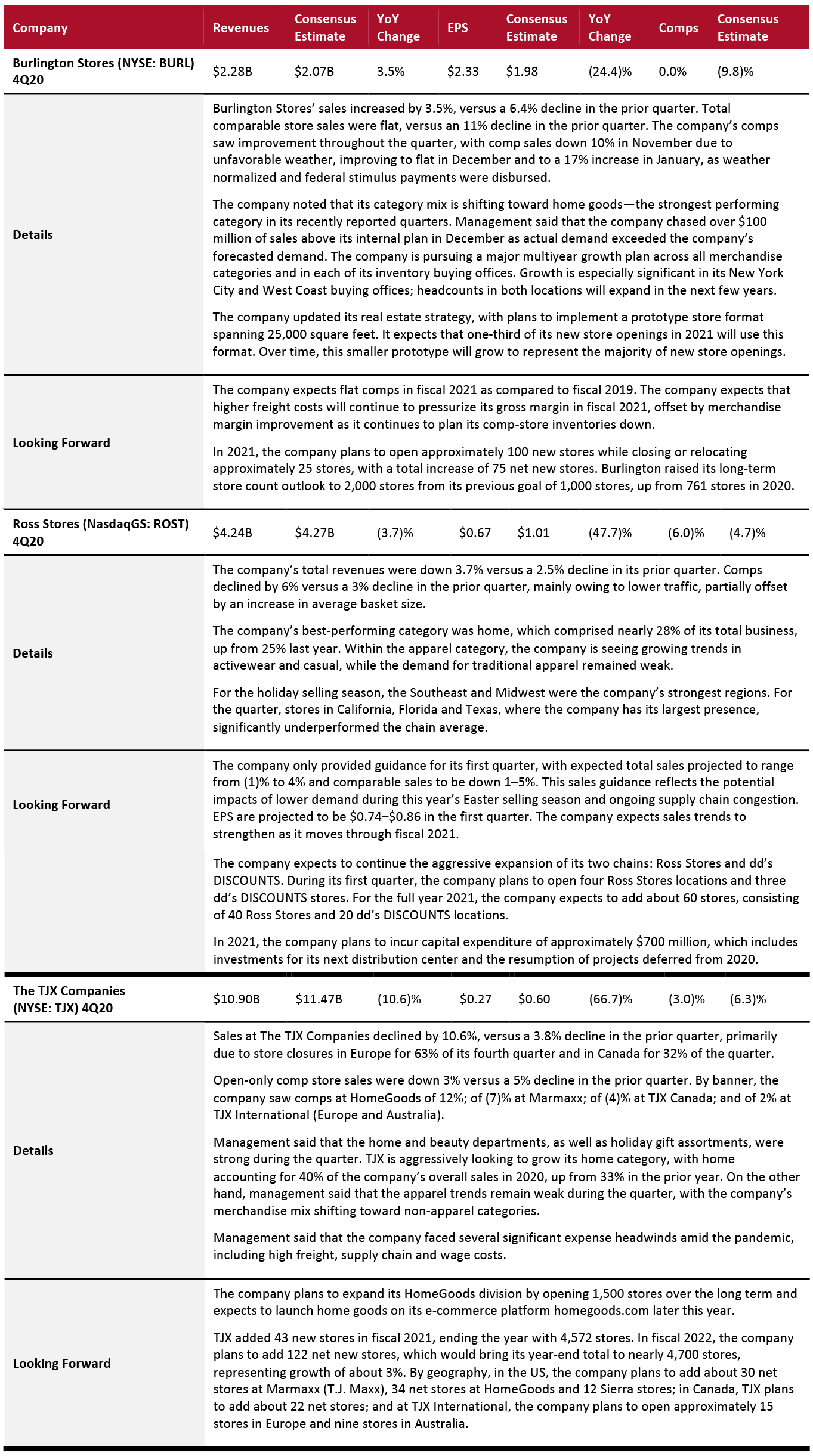

Like apparel specialists, off-pricers also posted mixed results. Burlington Stores’ sales growth turned positive in its latest quarter, while sales declines at Ross Stores and TJX accelerated during the quarter, mainly due to large-scale store closures. Off-price retailers are seeing strength in casual and athletic apparel categories and home goods.

Online Apparel Retailers

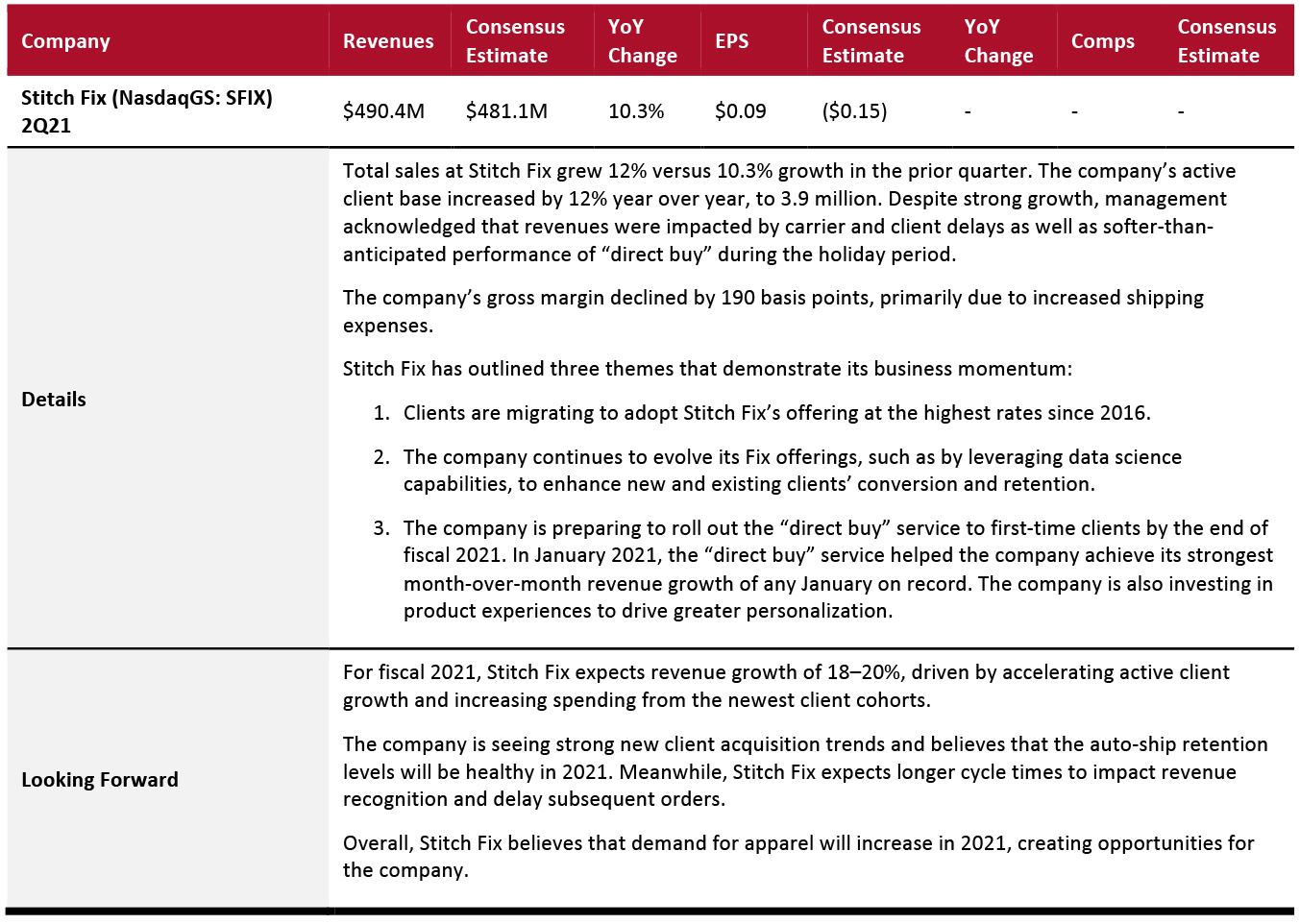

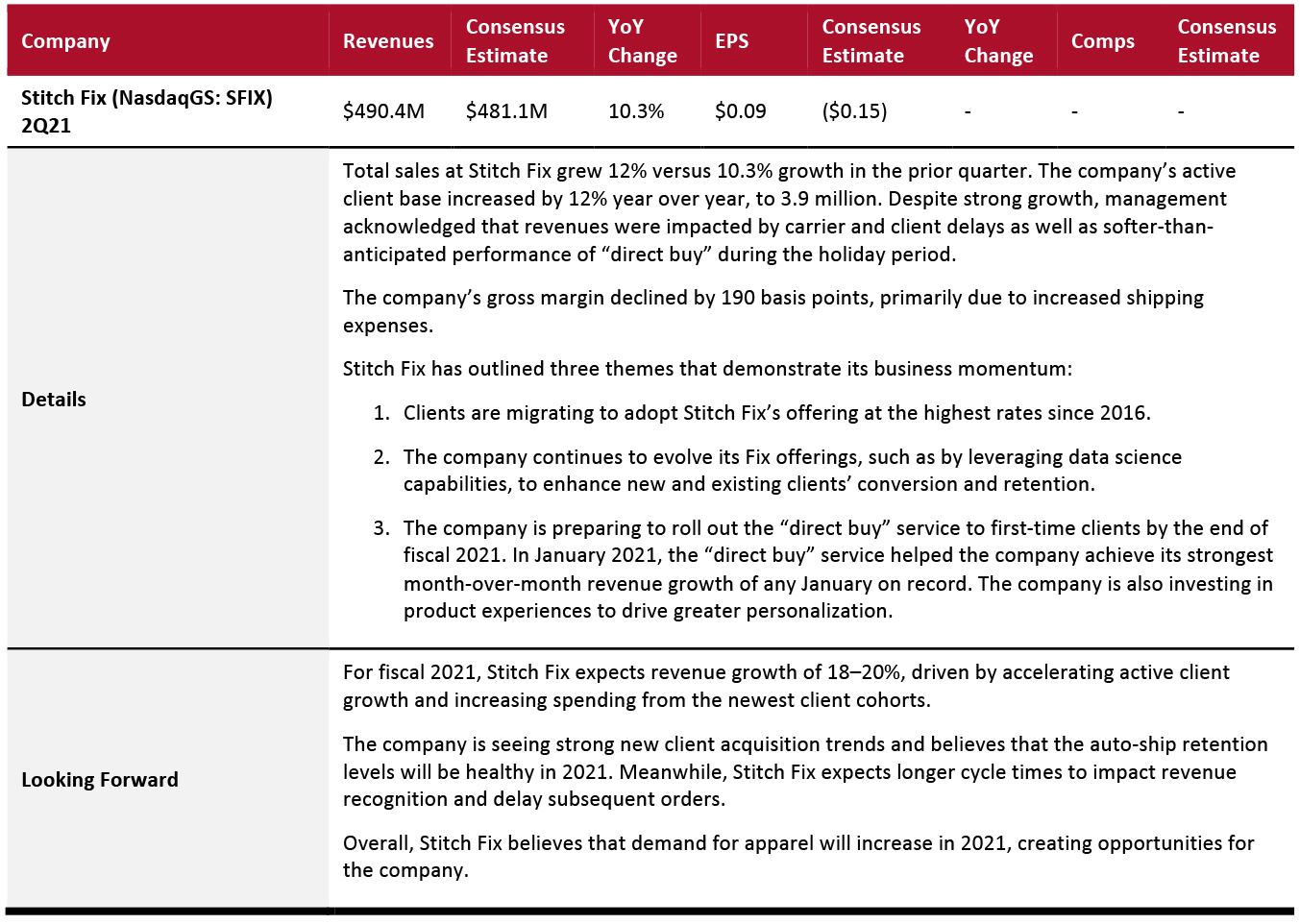

Stitch Fix reported double-digit sales growth in the quarter, driven by a 12% increase in its active client base. For fiscal 2021, the company expects sales growth of 18–20%.

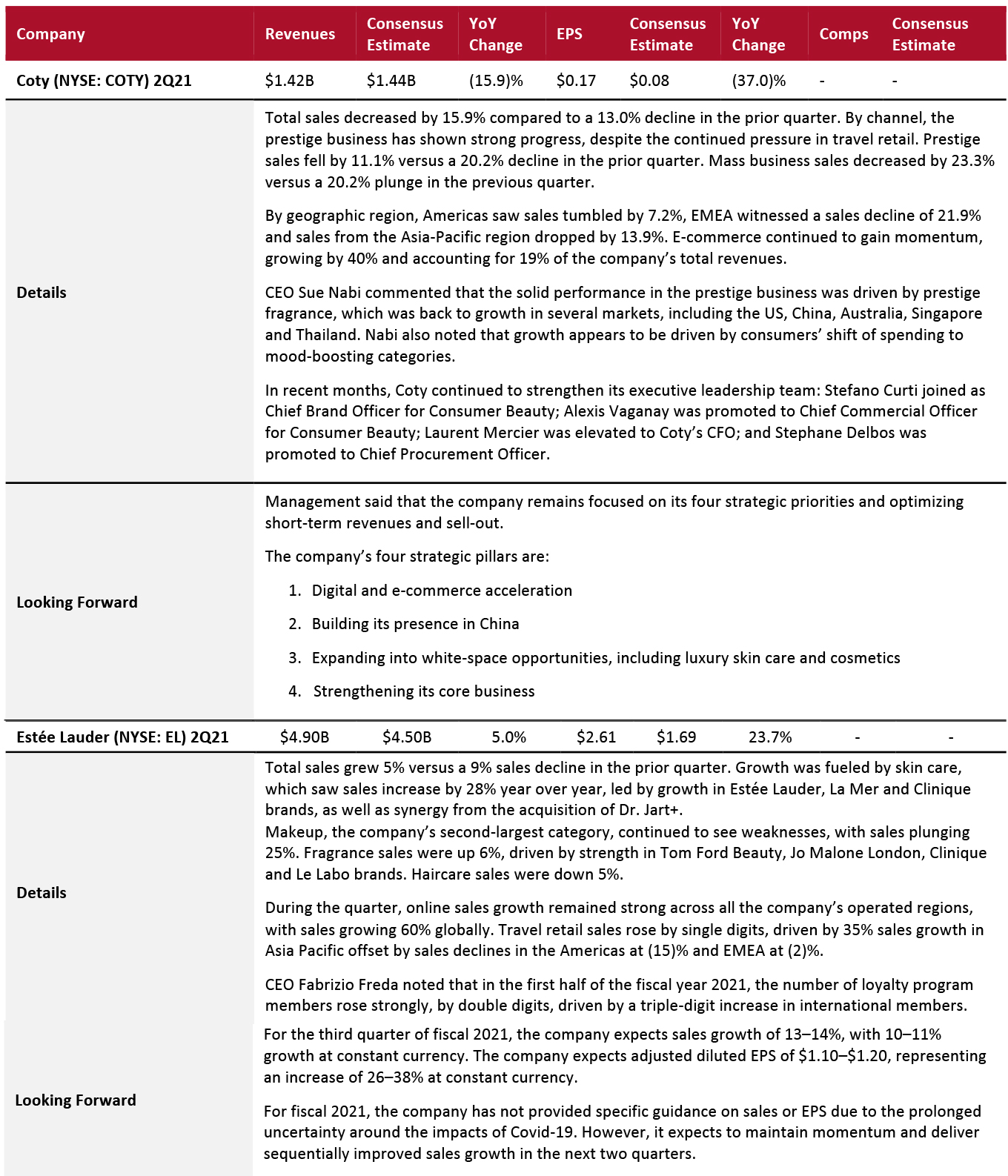

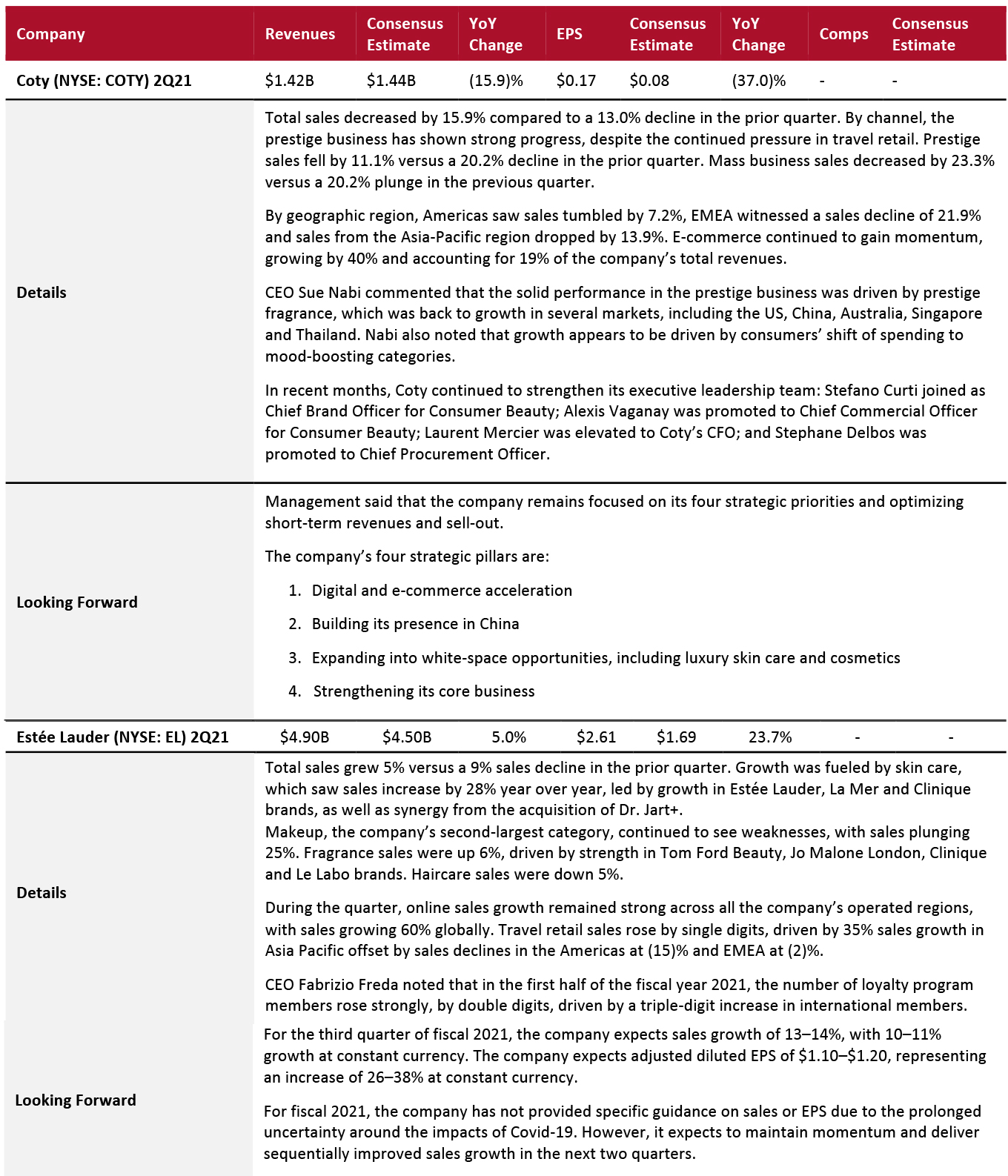

Beauty Brands and Retailers

The beauty category continues to see a strong recovery, with Ulta Beauty posting a substantial sequential improvement in its topline trajectory and L’Oréal reporting flat sales growth versus a decline in the prior quarter. Similarly, Estée Lauder’s sales growth turned positive in its latest quarter. On the other hand, Coty reported a double-digit decline in sales, with declines accelerating sequentially.

Among the beauty categories, skin care is trending, but demand for makeup remains weak. Coty is seeing a strong sales recovery in its prestige business, driven by demand for perfume.

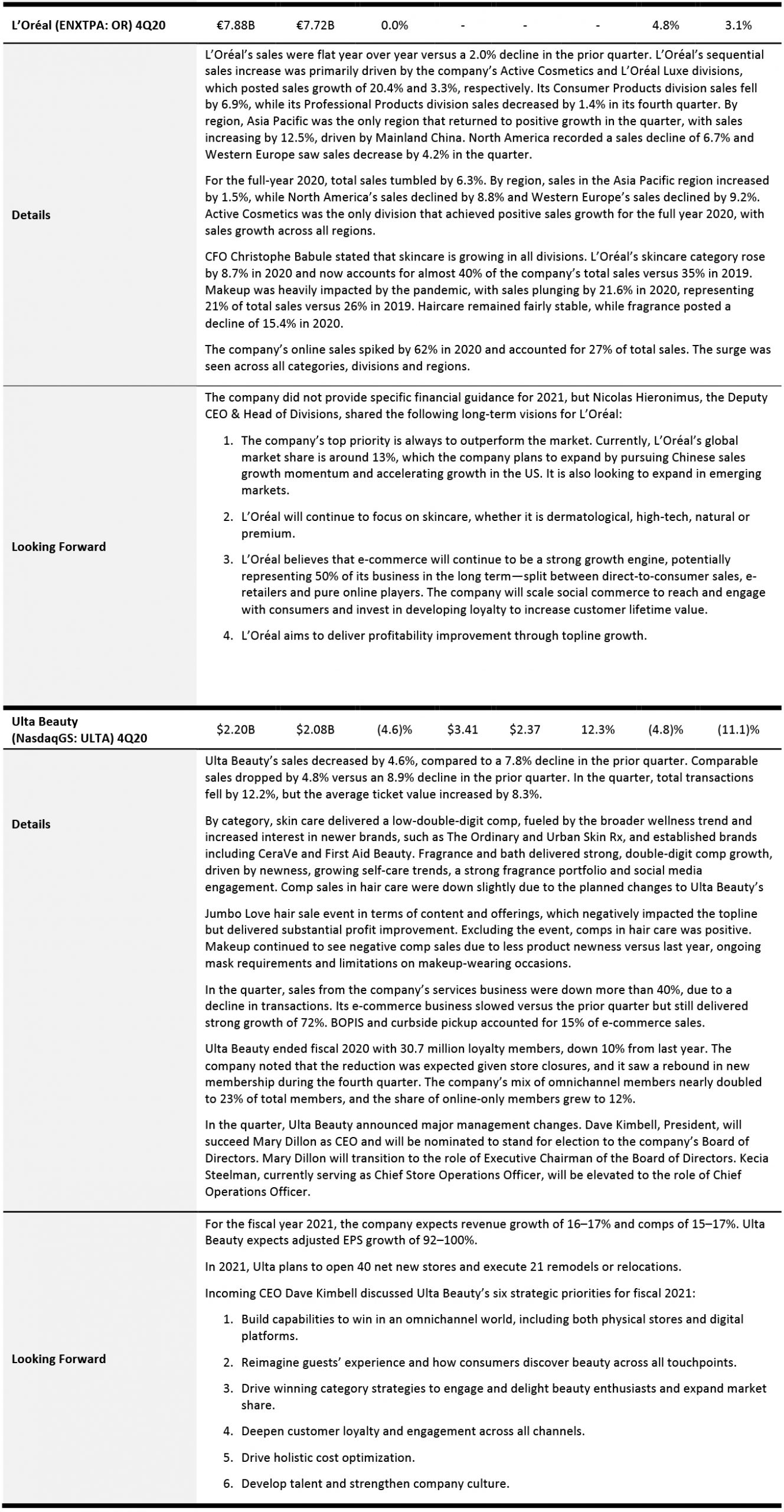

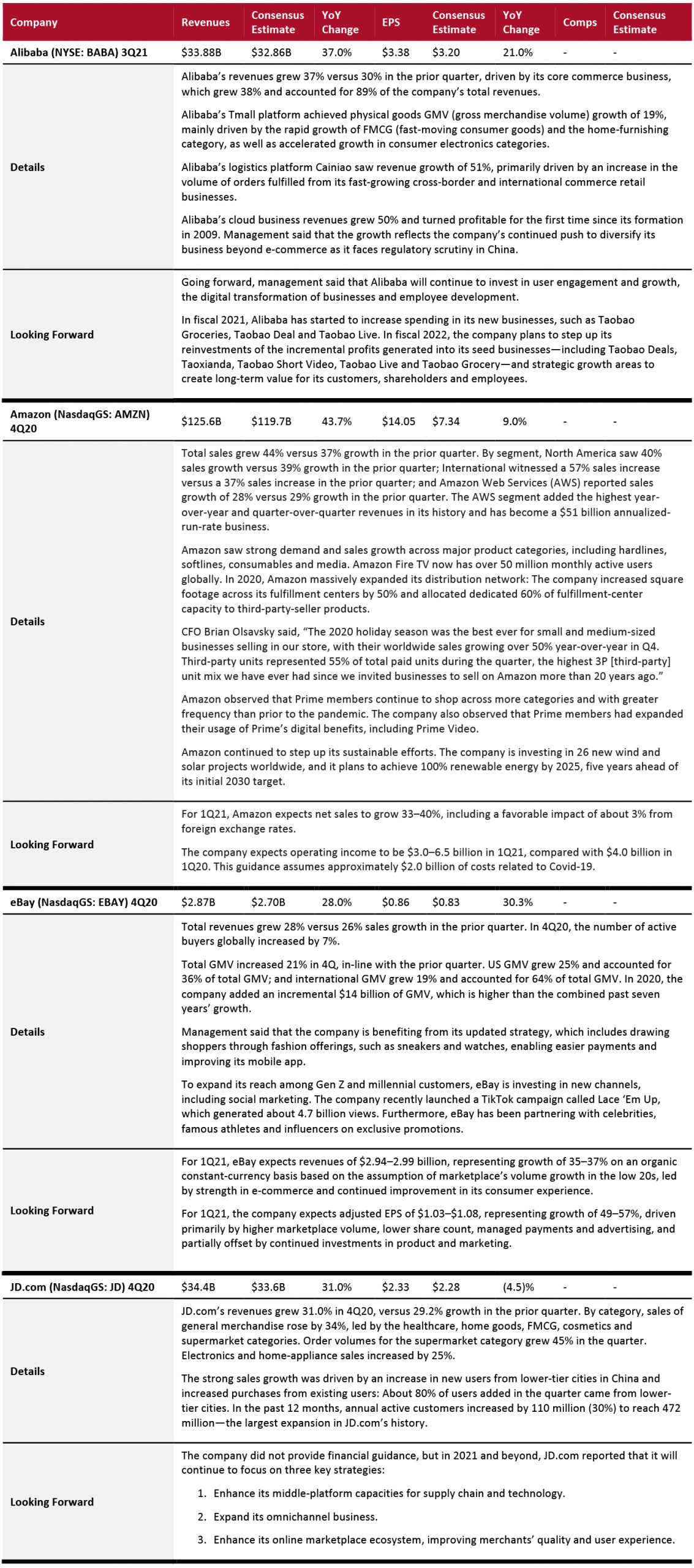

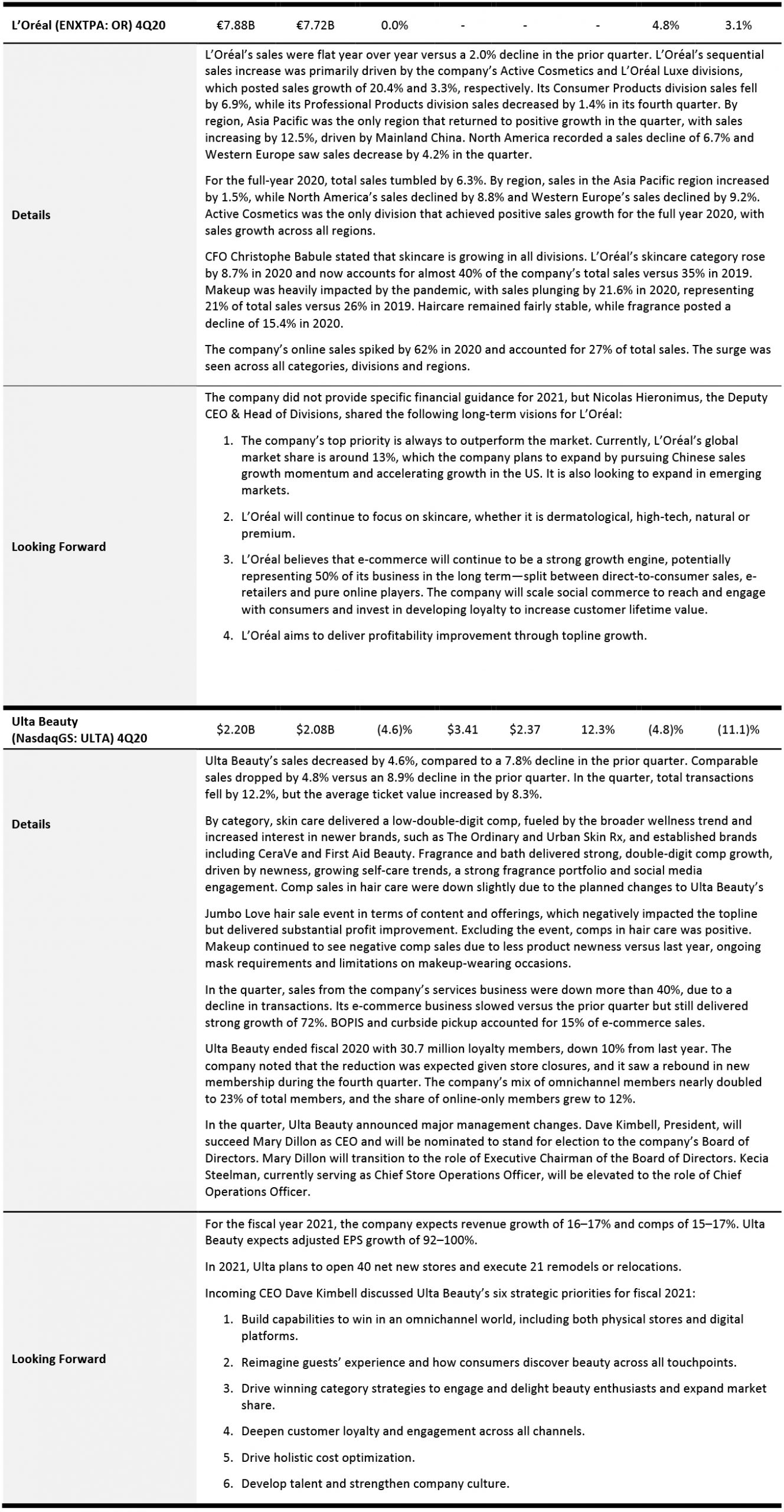

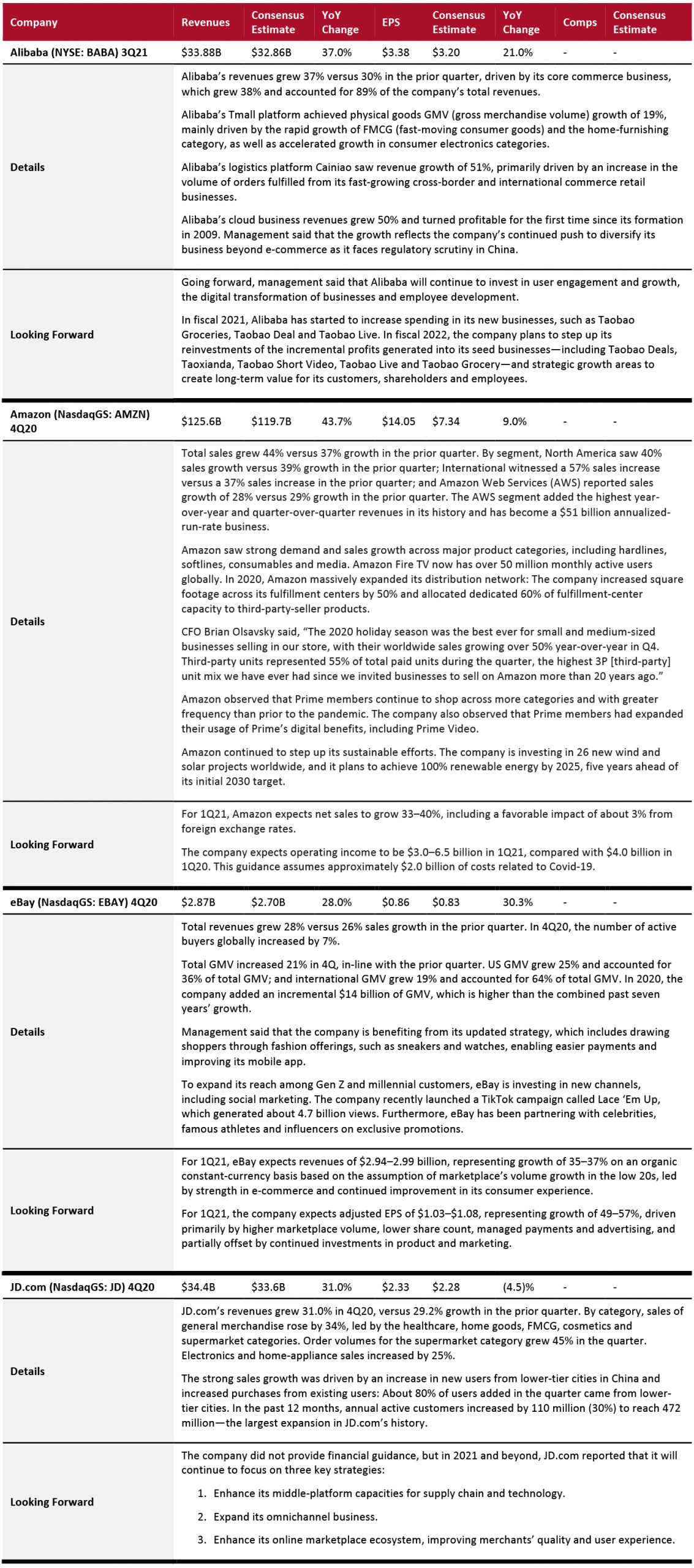

Department Stores

Department stores are seeing very weak recoveries from the crisis, with Kohl’s, Macy’s and Nordstrom reporting double-digit declines in sales. These department stores are looking to ramp up their digital businesses by investing substantially in technology transformation, supply chains and improving digital experiences over the next few years.

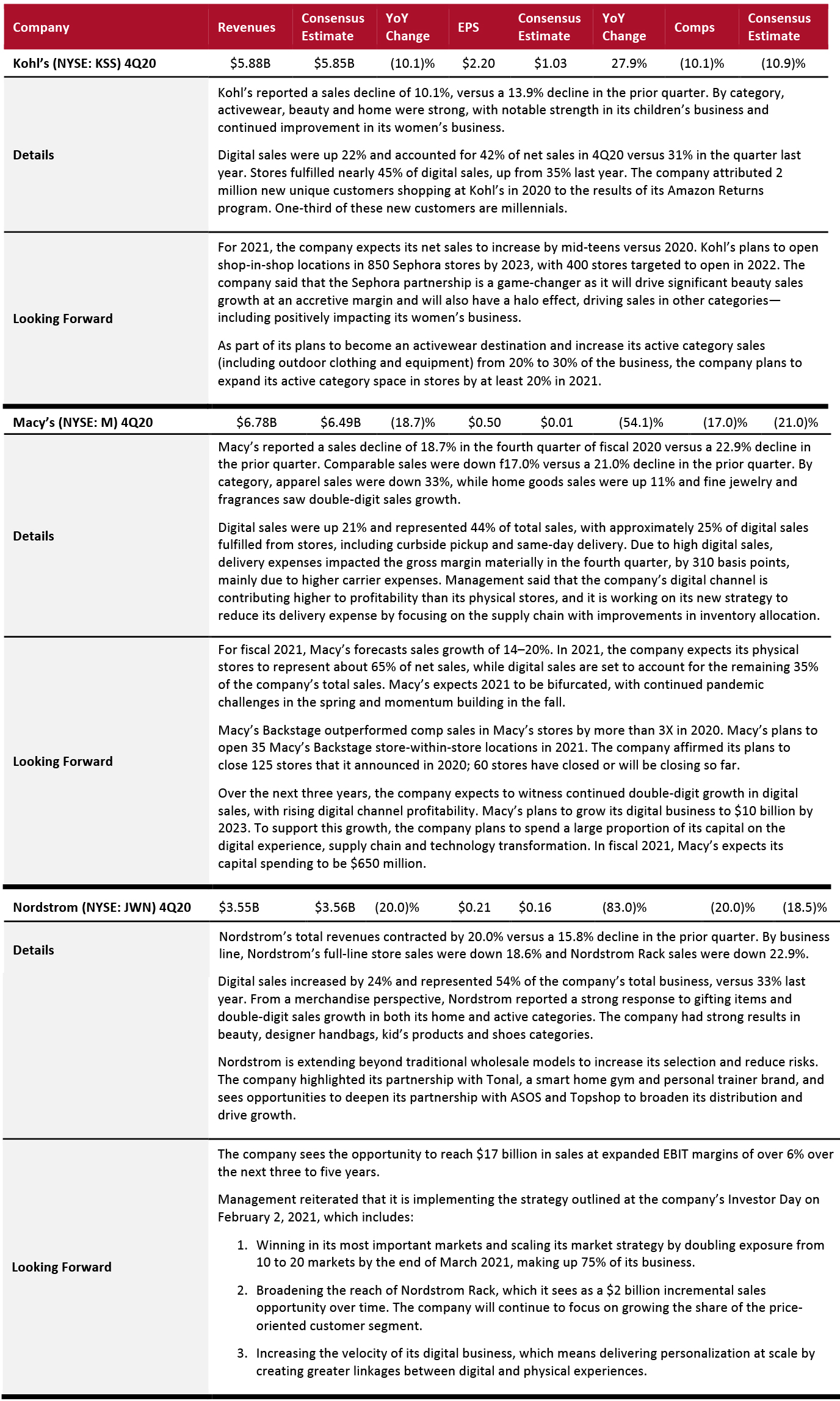

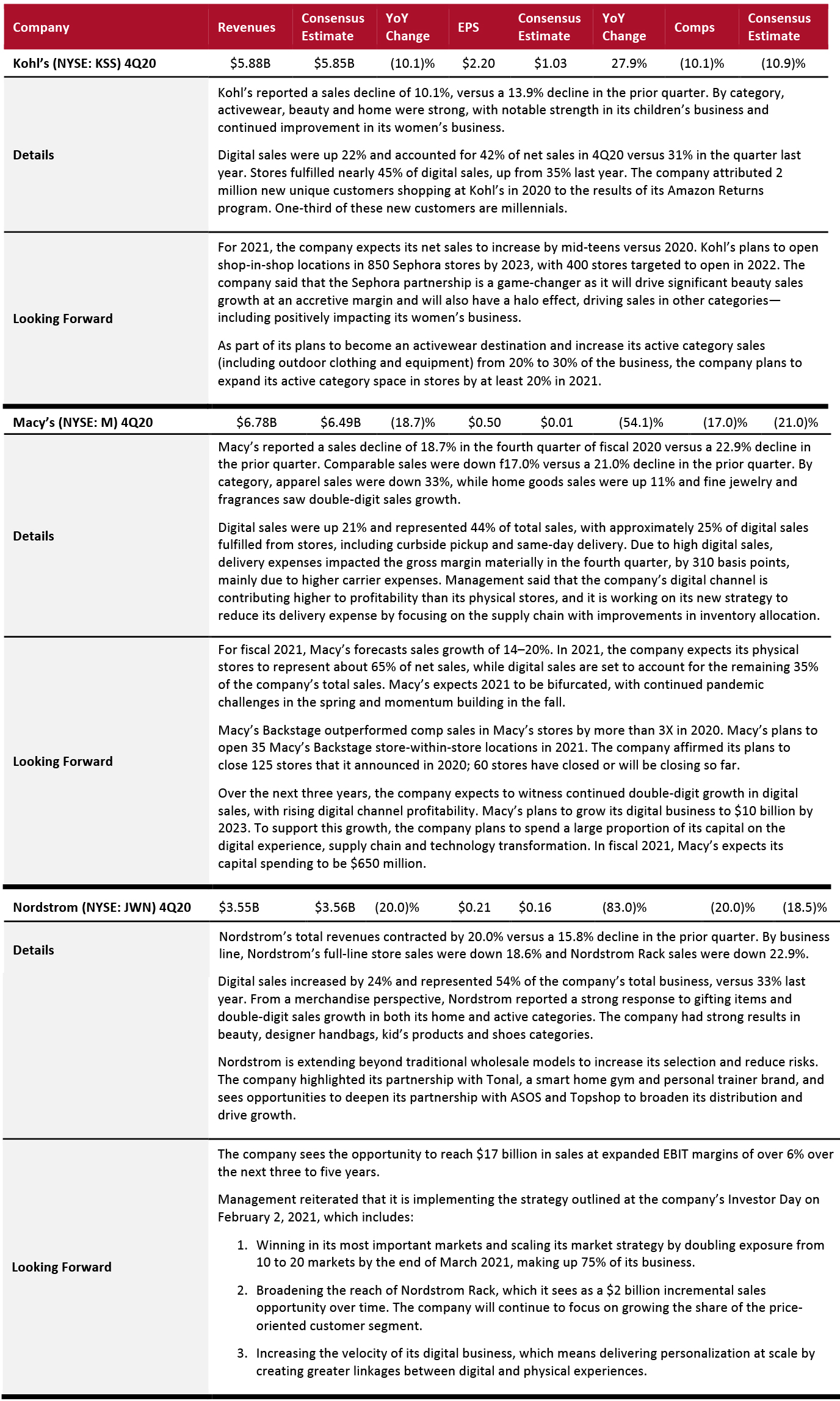

E-Commerce Platforms

The Covid-19 crisis continues to support e-commerce formats, with Alibaba, Amazon, eBay and JD.com reporting strong sales growth. For the next quarter, Amazon and eBay expect sales growth to exceed 30%.

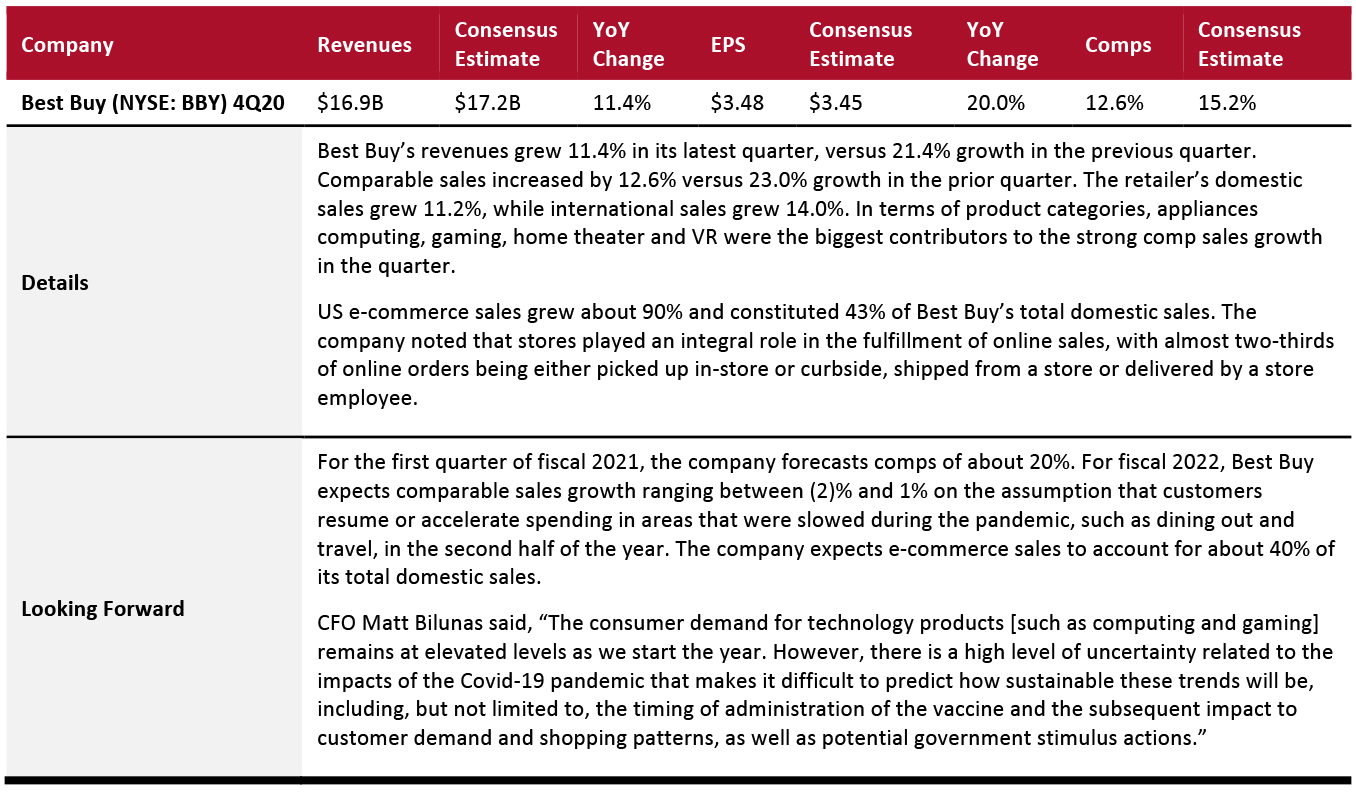

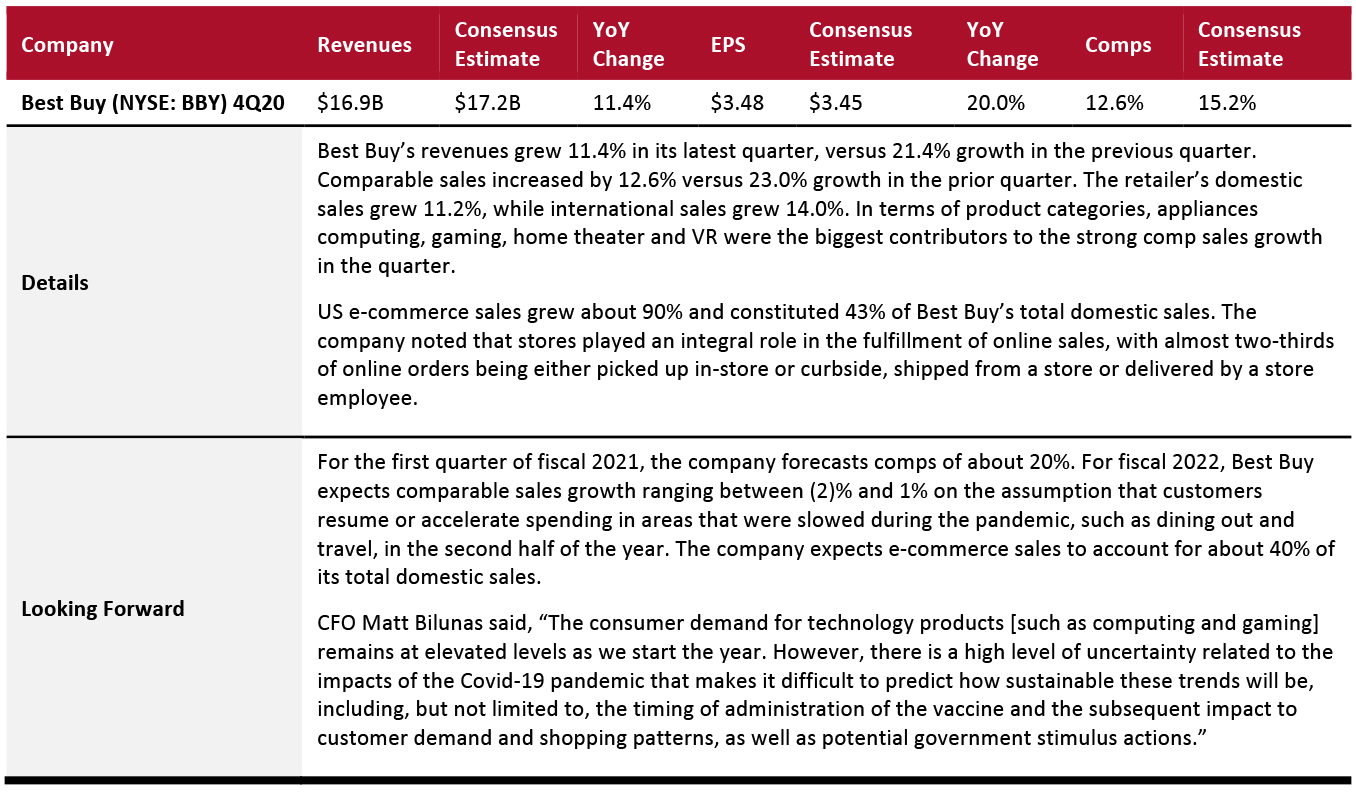

Electronics Retailers

Best Buy reported double-digit comps in its latest quarter, with its appliances, computing, gaming, home theater and virtual reality (VR) categories making the biggest contributions. The company forecasts comp growth of about 20% in its next quarter.

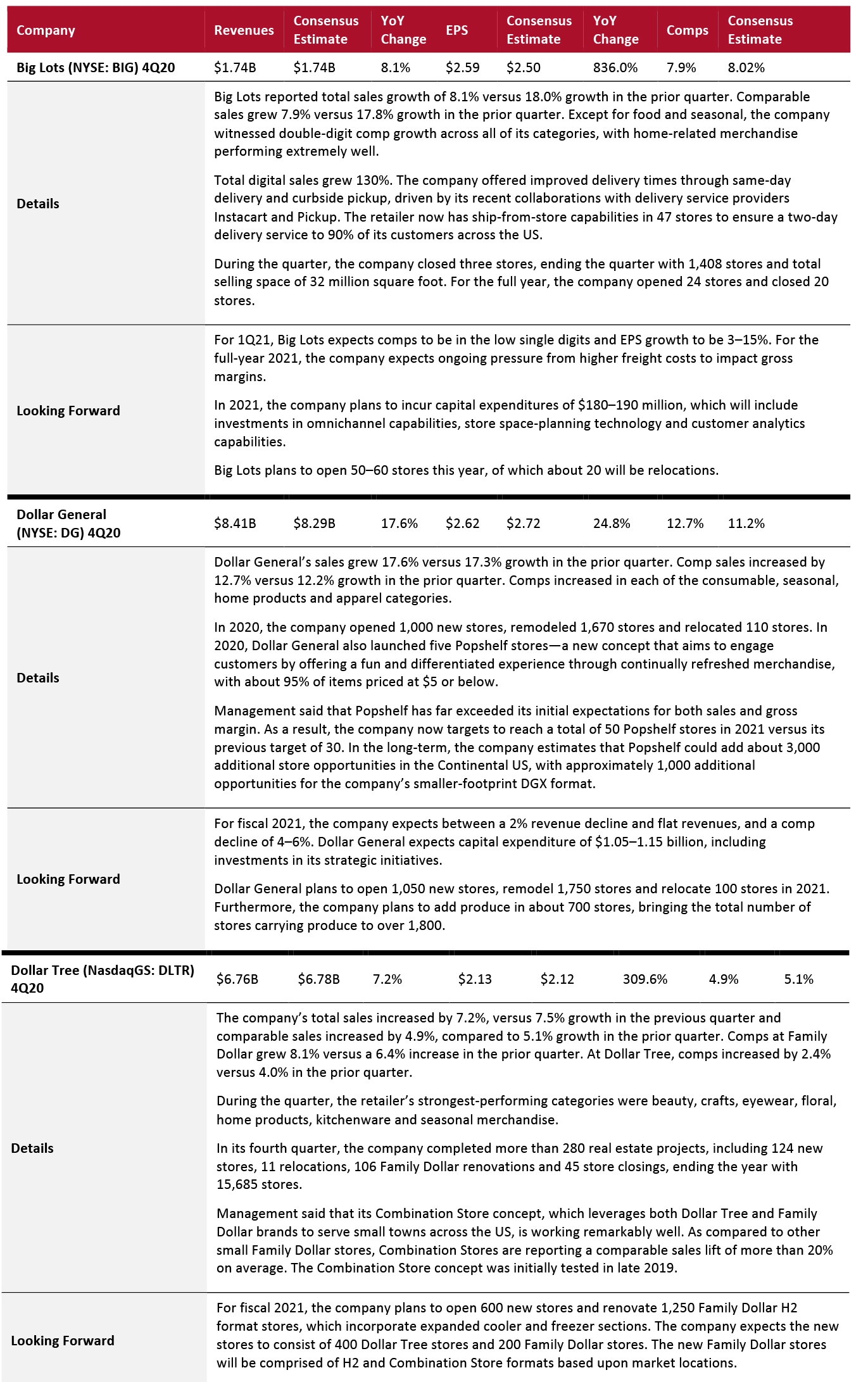

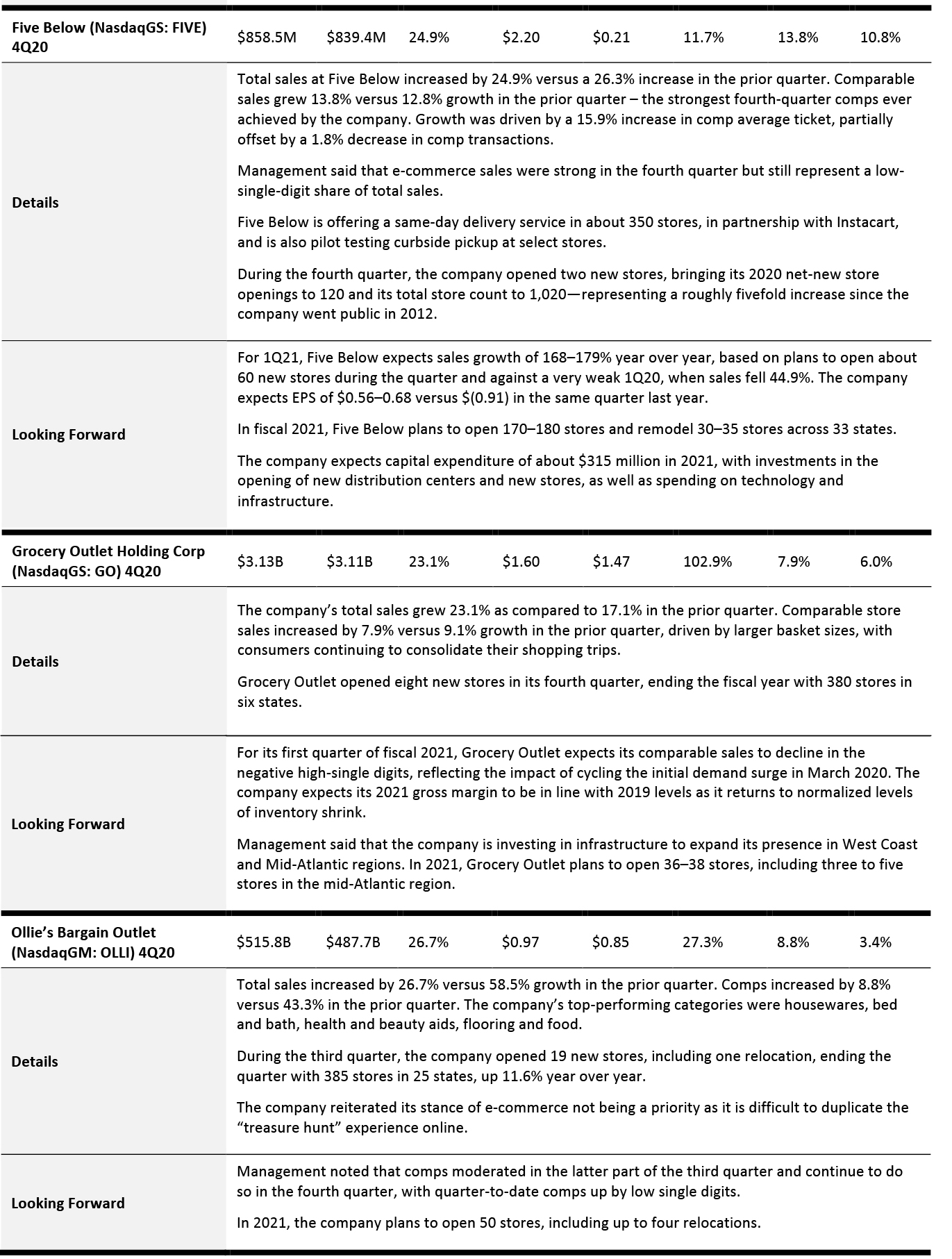

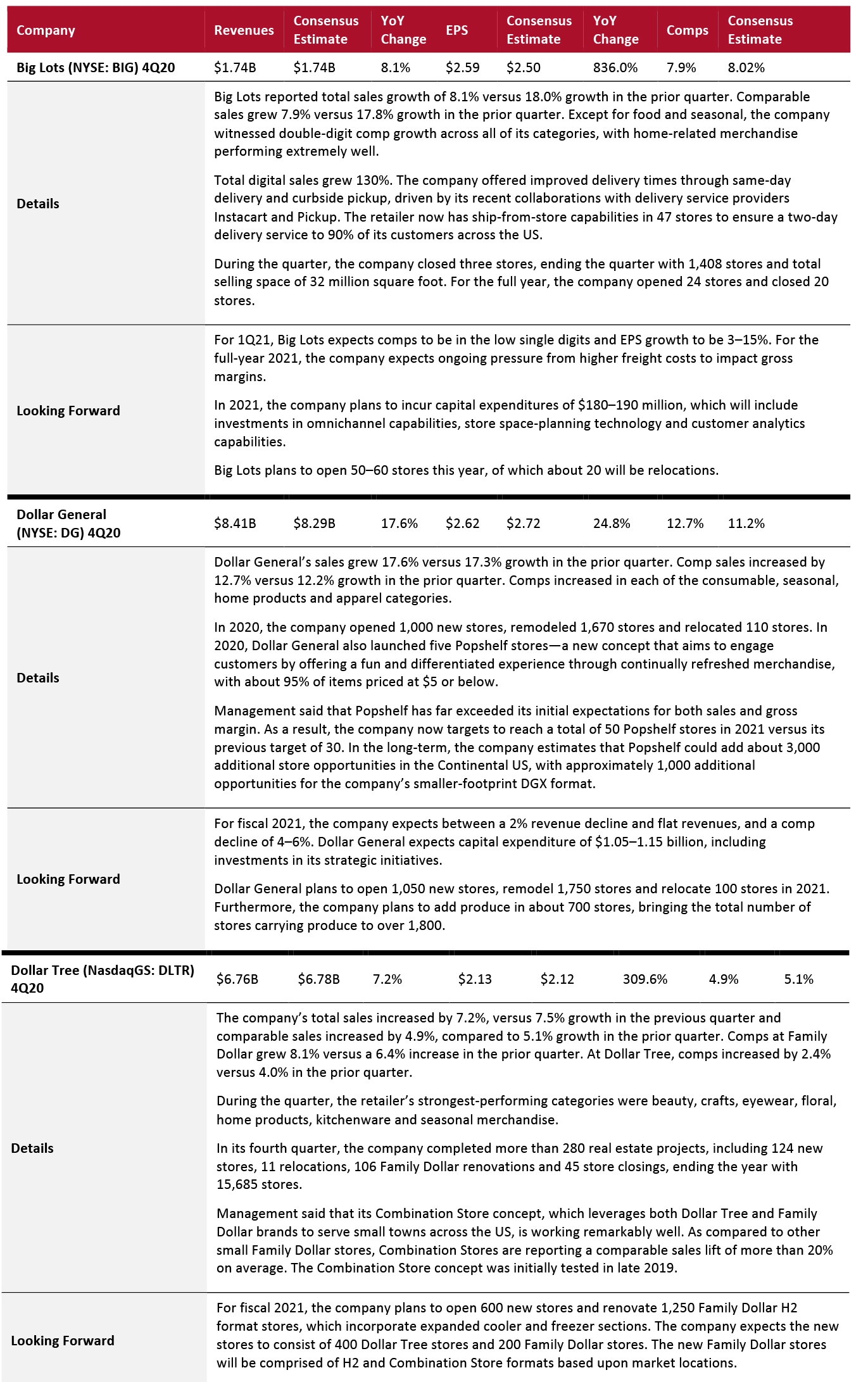

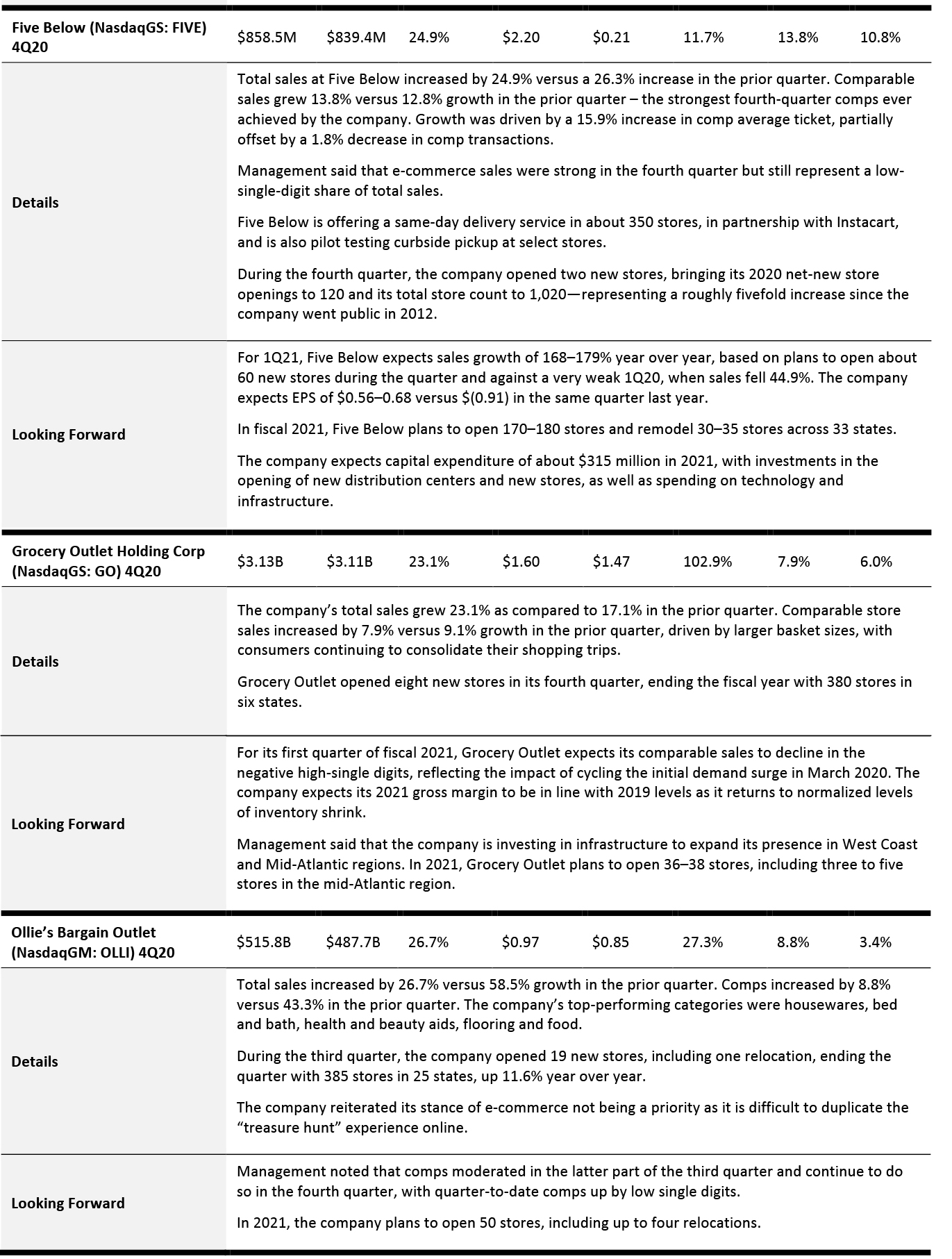

Food, Drug and Mass Retailers: Discount Stores

Discount stores continued their solid run in the quarter, attracting a broad base of budget-conscious customers. All of the companies covered noted strong discretionary momentum driven by seasonal and home products. Big Lots, Dollar General, Dollar Tree and Five Below are embracing omnichannel retailing and testing new e-commerce initiatives. Unlike most retailers, which are shrinking their physical footprints, discounters’ real estate plans remain firmly in place, including new store expansions.

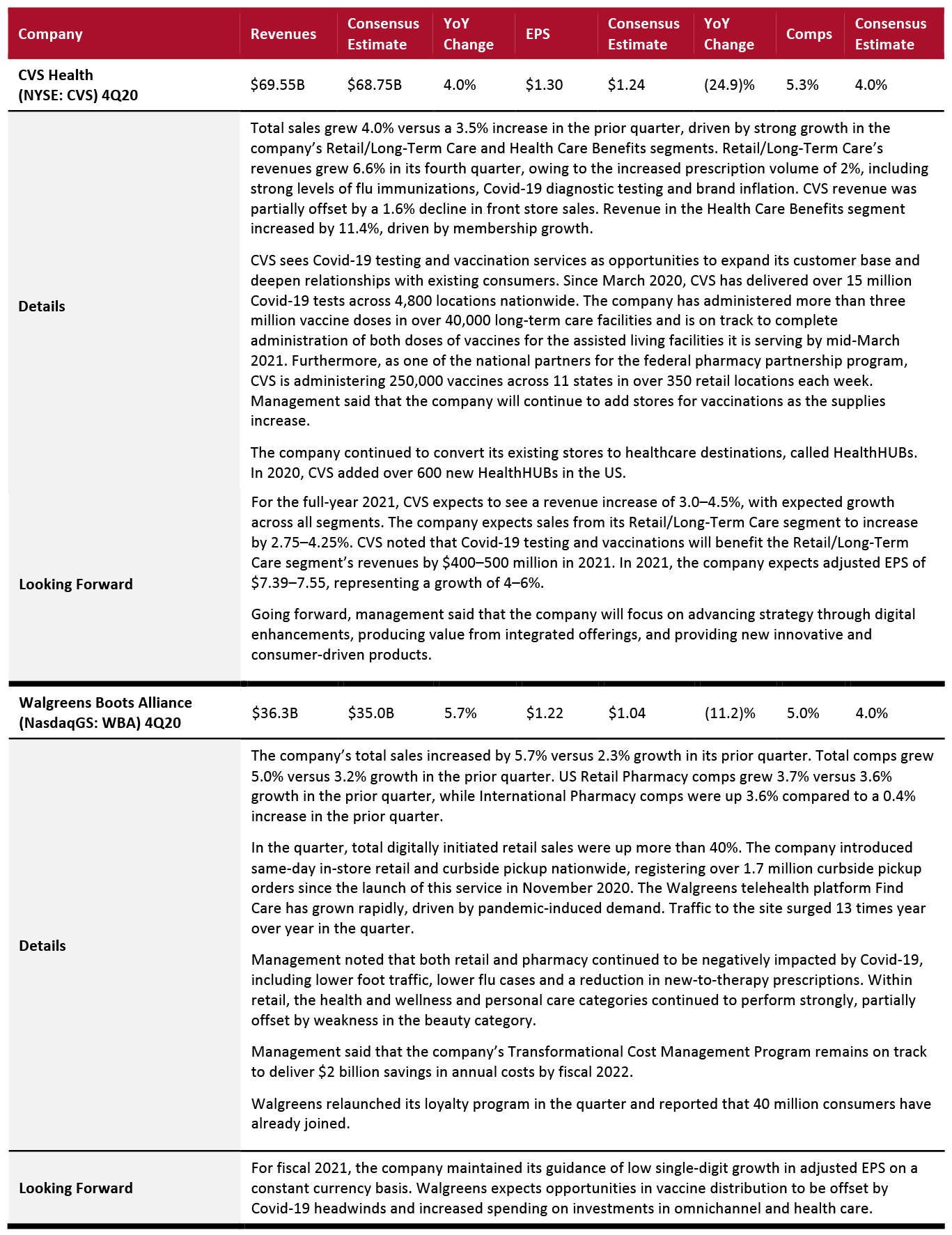

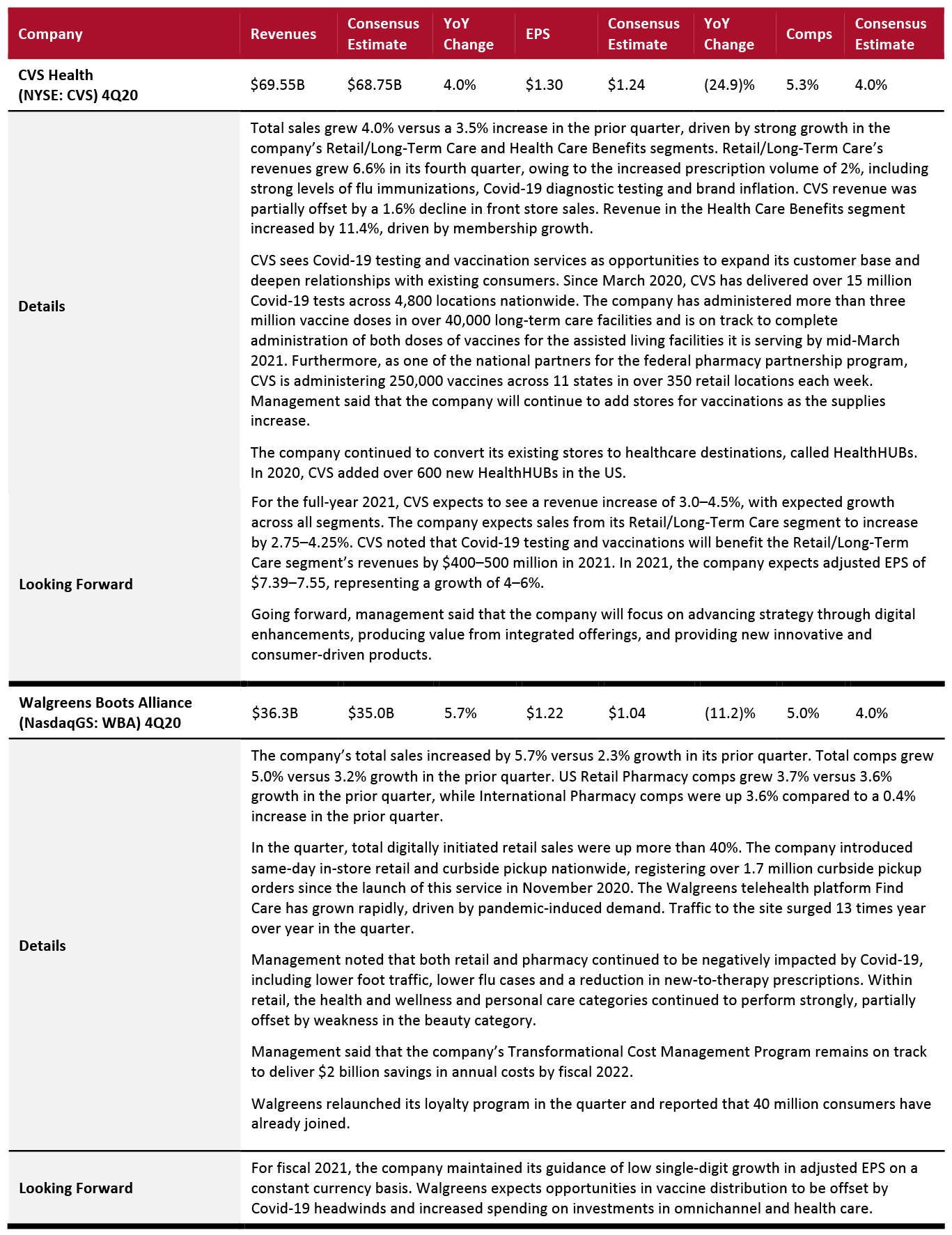

Food, Drug and Mass Retailers: Drugstores

CVS Health’s sales growth accelerated in its latest quarter, driven by increased prescription volumes and membership growth. CVS maintained its aggressive push into healthcare offerings by converting some of its stores into healthcare destinations.

Sales growth reported by Walgreens also accelerated in its latest quarter. In 2021, Walgreens expects opportunities in vaccine distribution to be offset by Covid-19 headwinds and increased spending on investments in omnichannel and health care.

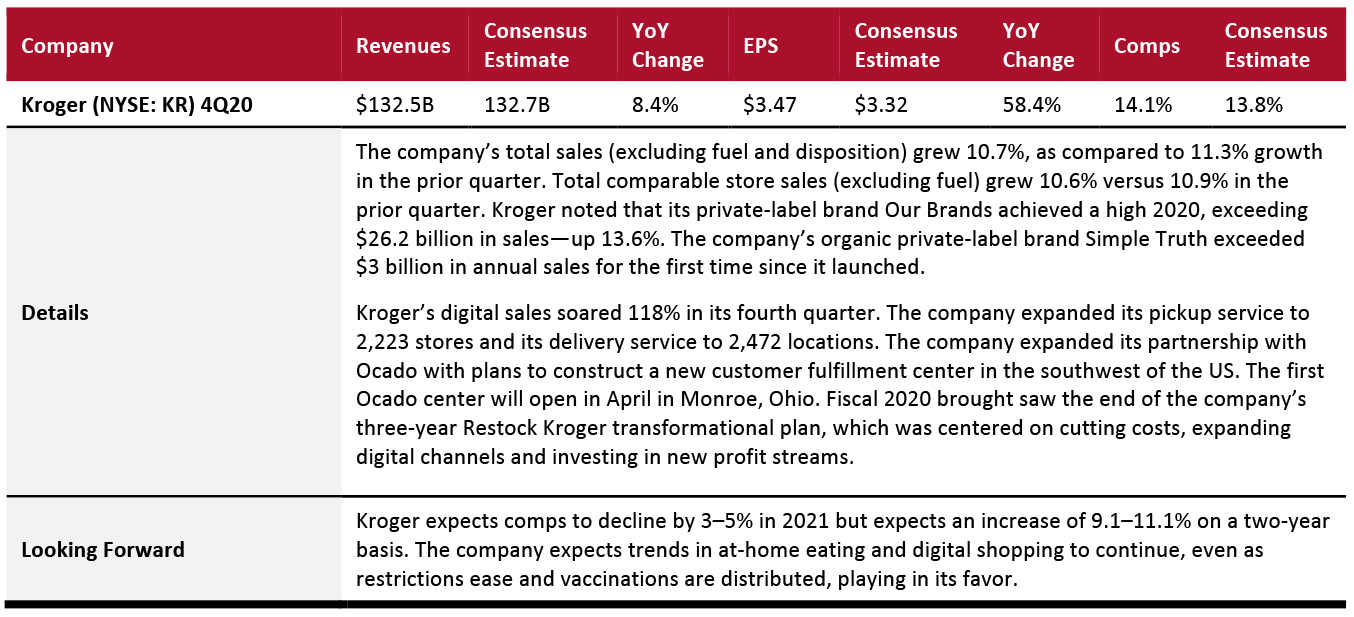

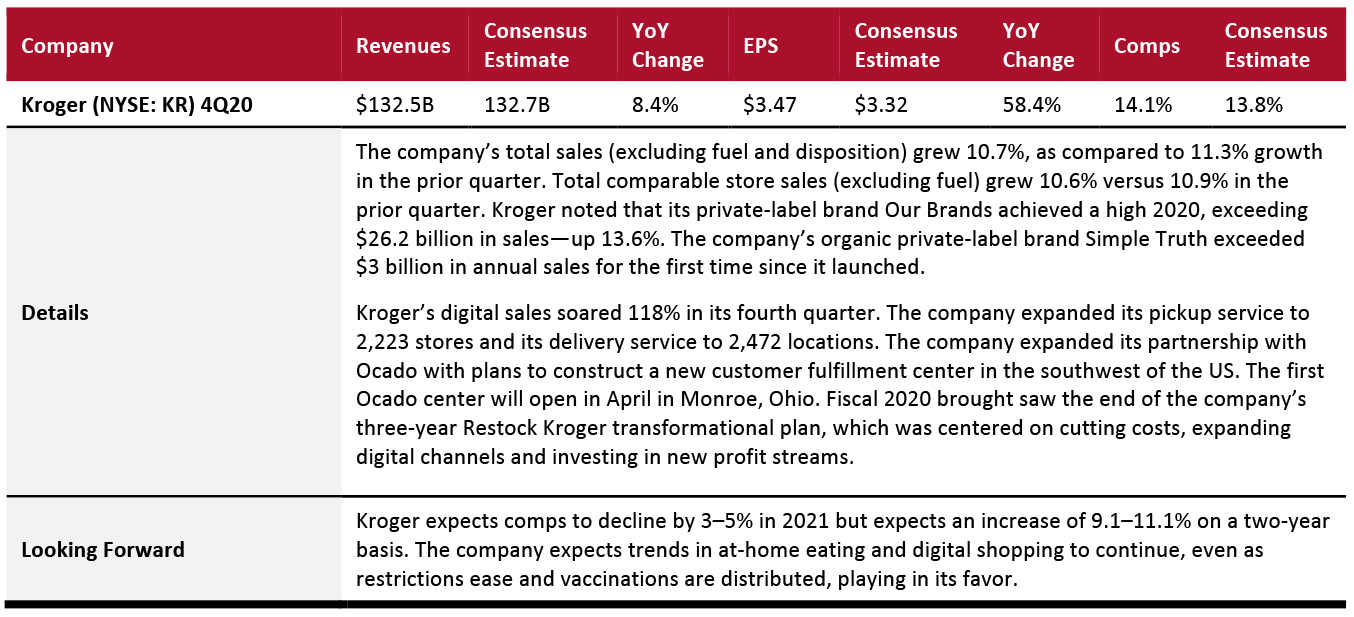

Food, Drug and Mass Retailers: Food Retailers

Kroger delivered robust results, with strong comps continuing from its third quarter into its fourth quarter. However, against strong comparatives, the company expects comps to decline by 3–5% in 2021. Kroger anticipates that trends in at-home eating and digital shopping will continue, even as restrictions ease and vaccinations are distributed, playing in its favor.

Food, Drug and Mass Retailers: Mass Merchandisers

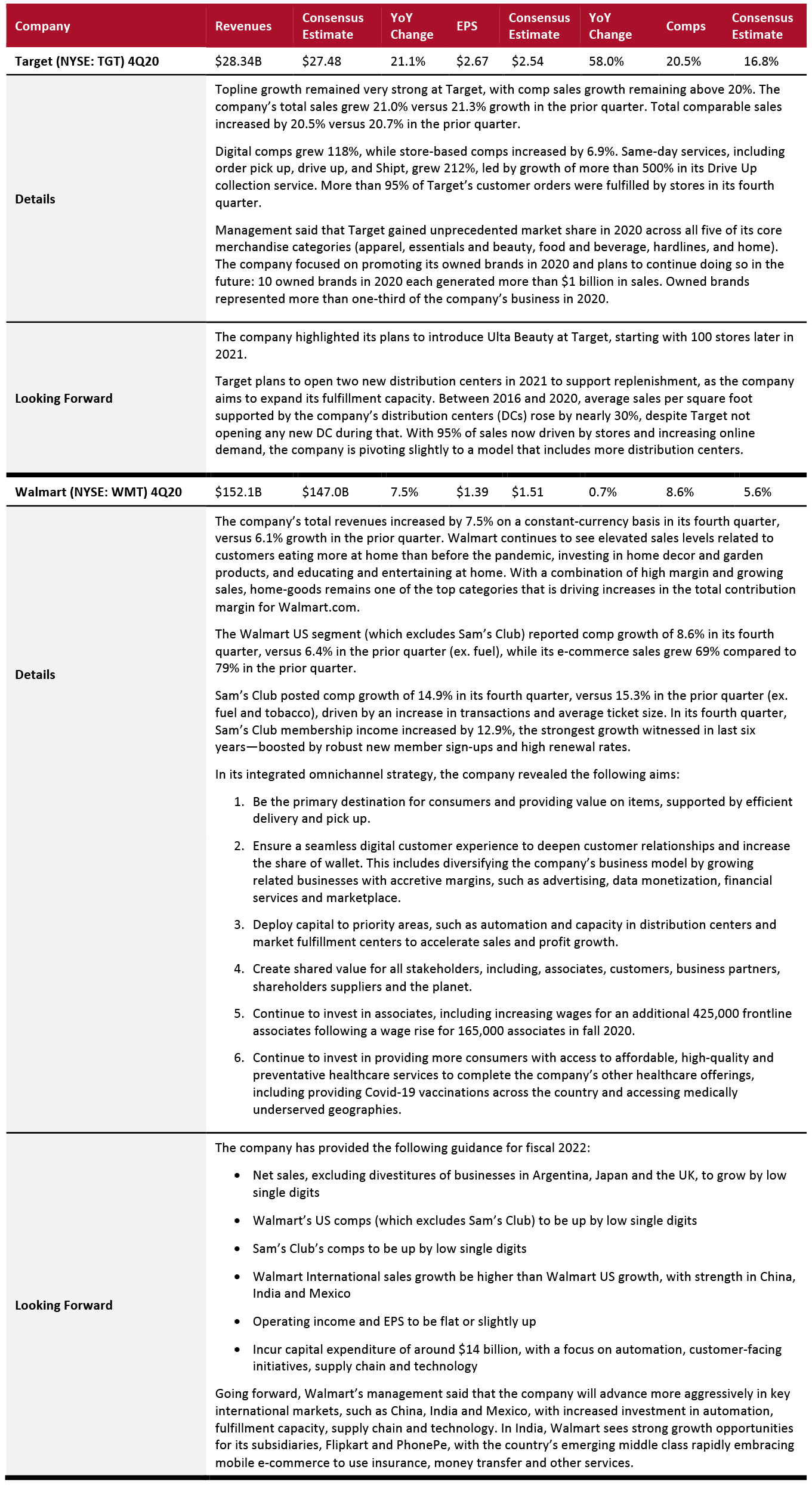

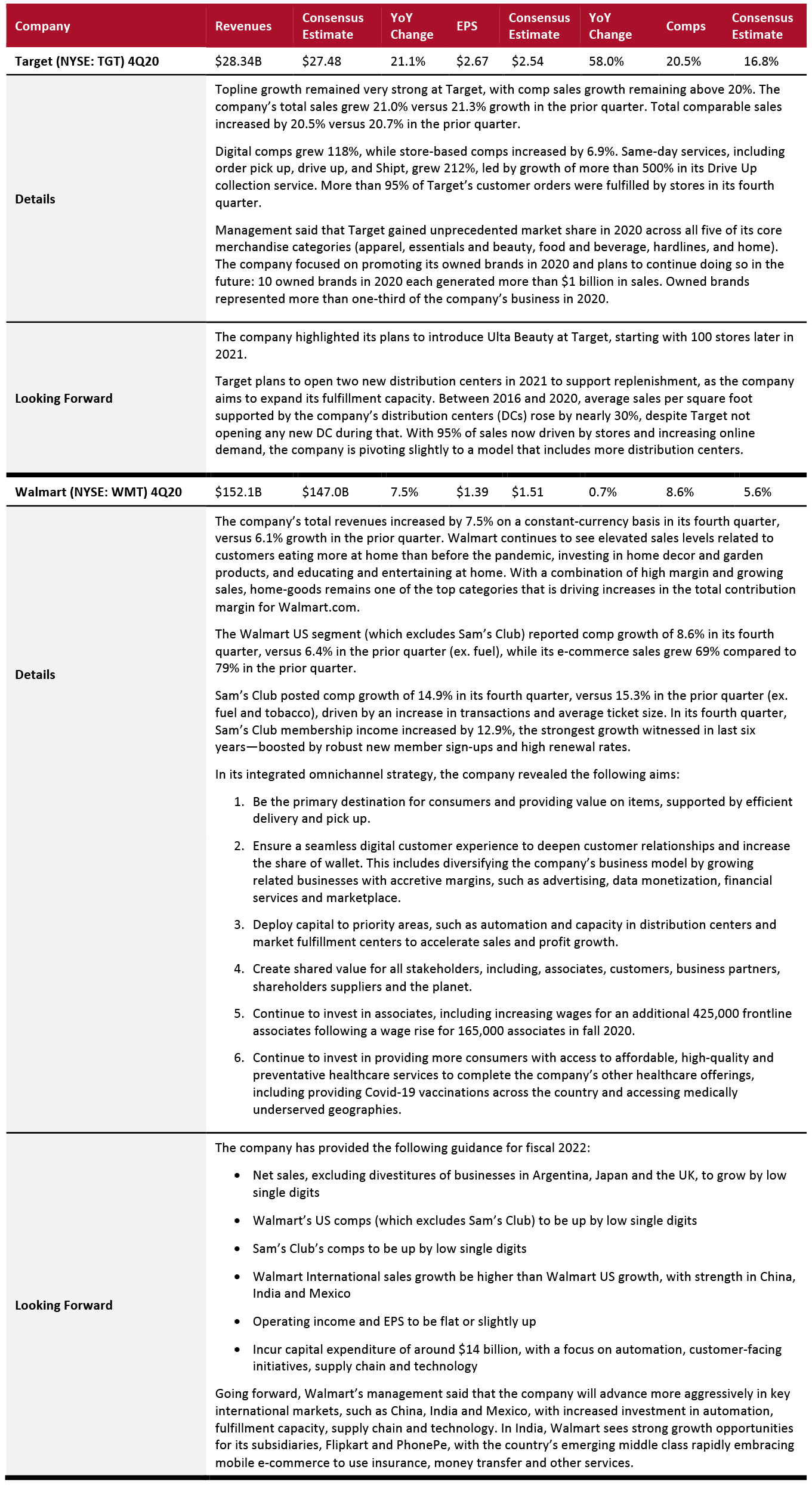

Mass merchandisers sustained their strong growth momentum in the fourth quarter, led by increased demand for merchandise categories including food and consumables, home-related merchandise, and health and wellness.

Target’s topline growth remained exceptionally strong, with comp sales growth above 20%, supported by very strong digital growth. Target noted that apparel, essentials and beauty, food and beverage, and home goods hardlines are performing well.

Walmart reported another strong quarter, with sales growth accelerating sequentially. The company continued to witness strength in its food and consumables, education and entertainment, and home-goods categories.

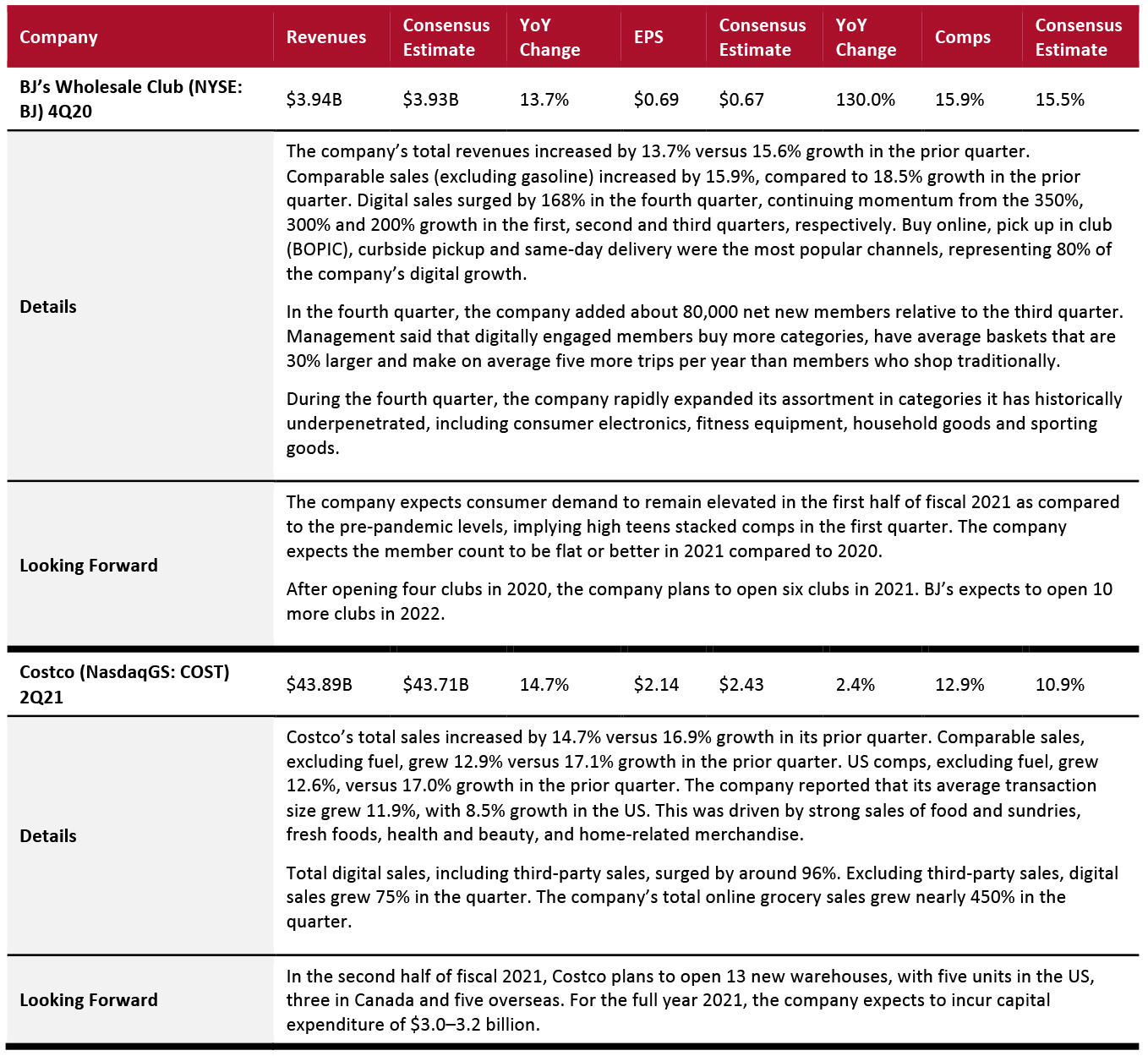

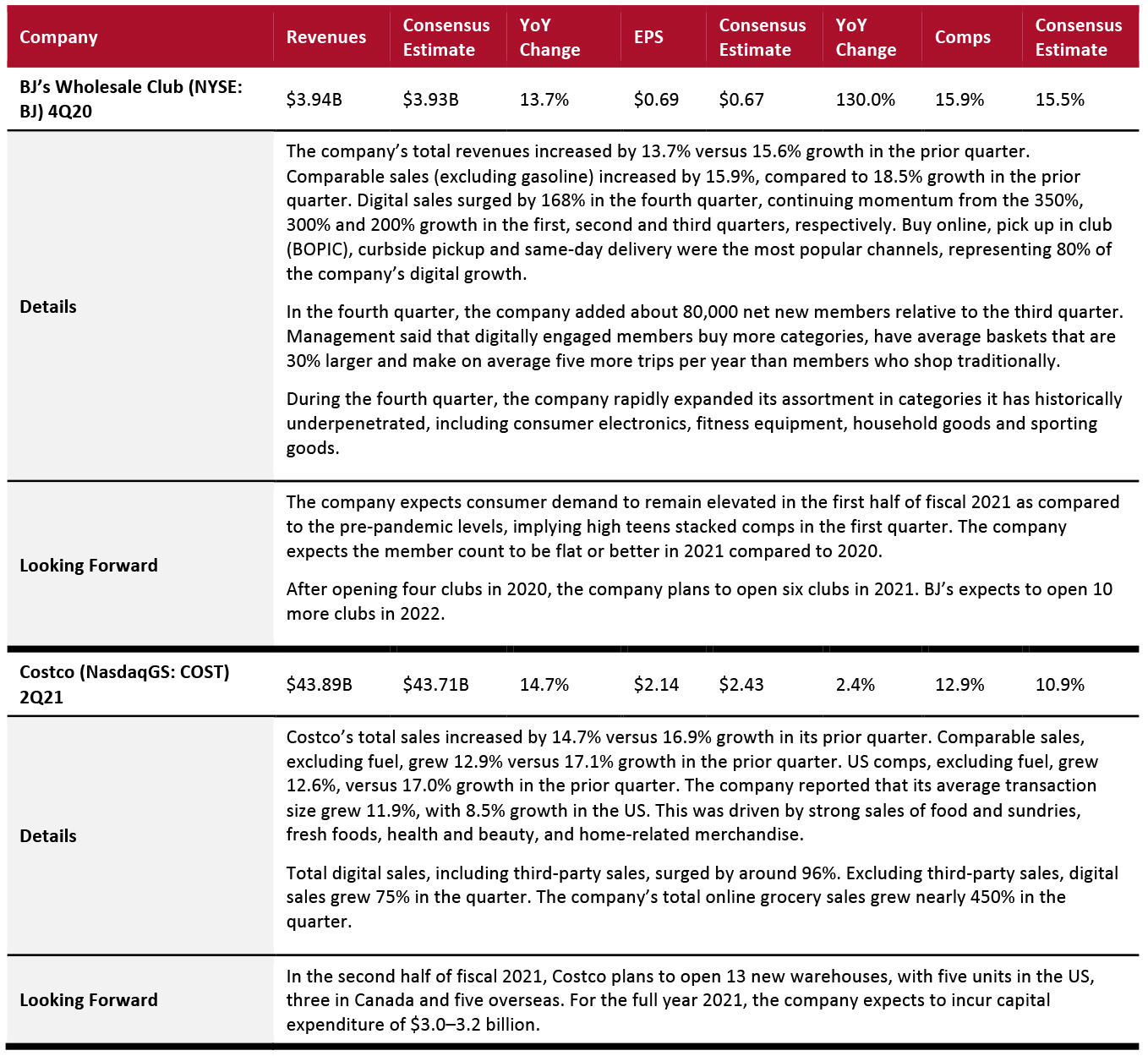

Food, Drug and Mass Retailers: Warehouse Clubs

Warehouse clubs continue to be a major beneficiary of the pandemic. Grocery goods at wholesale retailers were in high demand in the quarter while the home-related merchandise category also saw strong momentum. The continued emphasis on e-commerce and omnichannel capabilities among warehouse club retailers is driving customer engagement from both their core base as well as new members in the current environment.

Warehouse clubs are well-positioned for sustainable growth with new club openings, strong core member trends, new member opportunities and a growing e-commerce business.

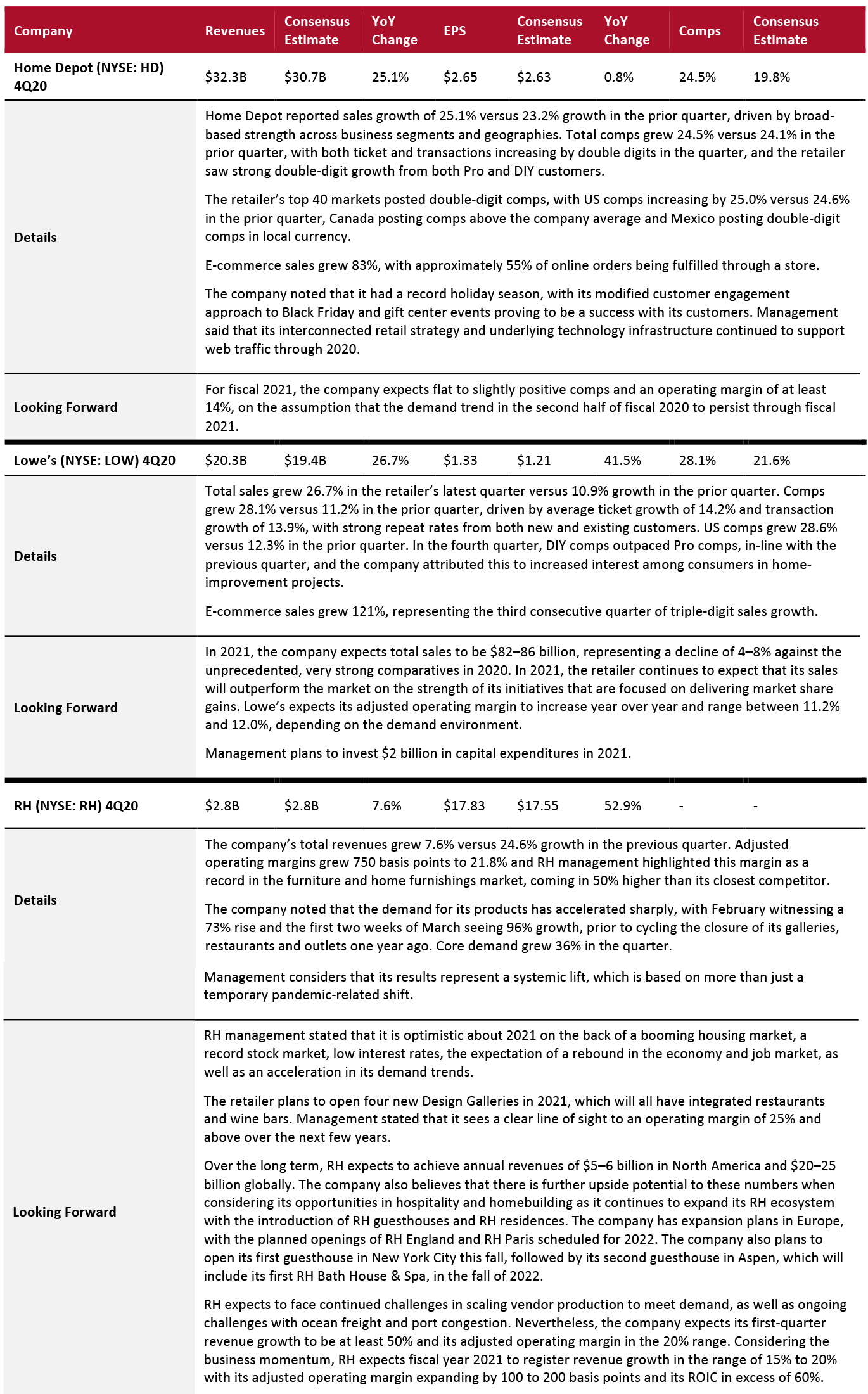

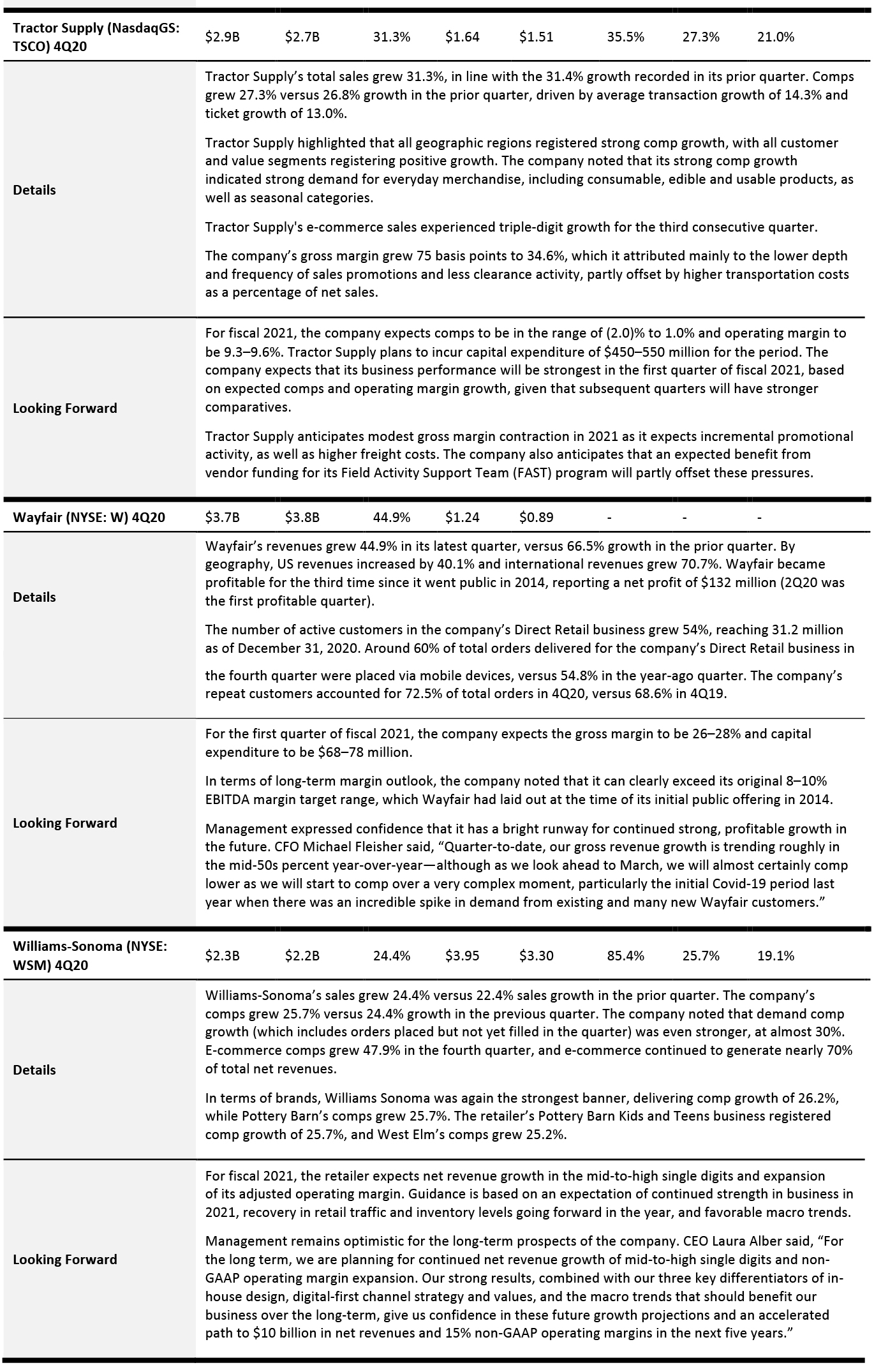

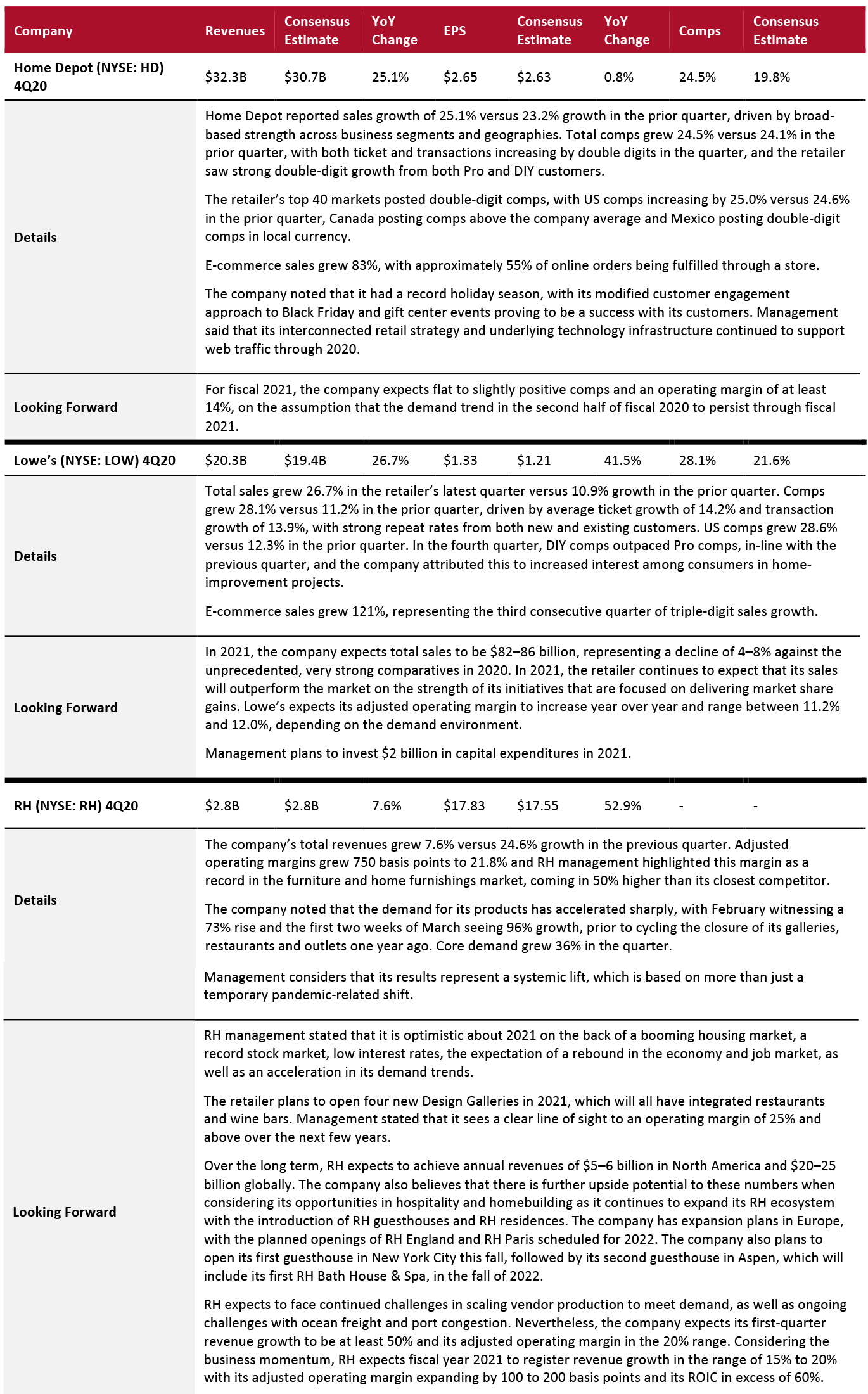

Home and Home-Improvement Retailers

The home and home-improvement sector had another strong quarter—unsurprising given the continued demand and consumer spending on home-improvement and home decor products as consumers spend more time at home.

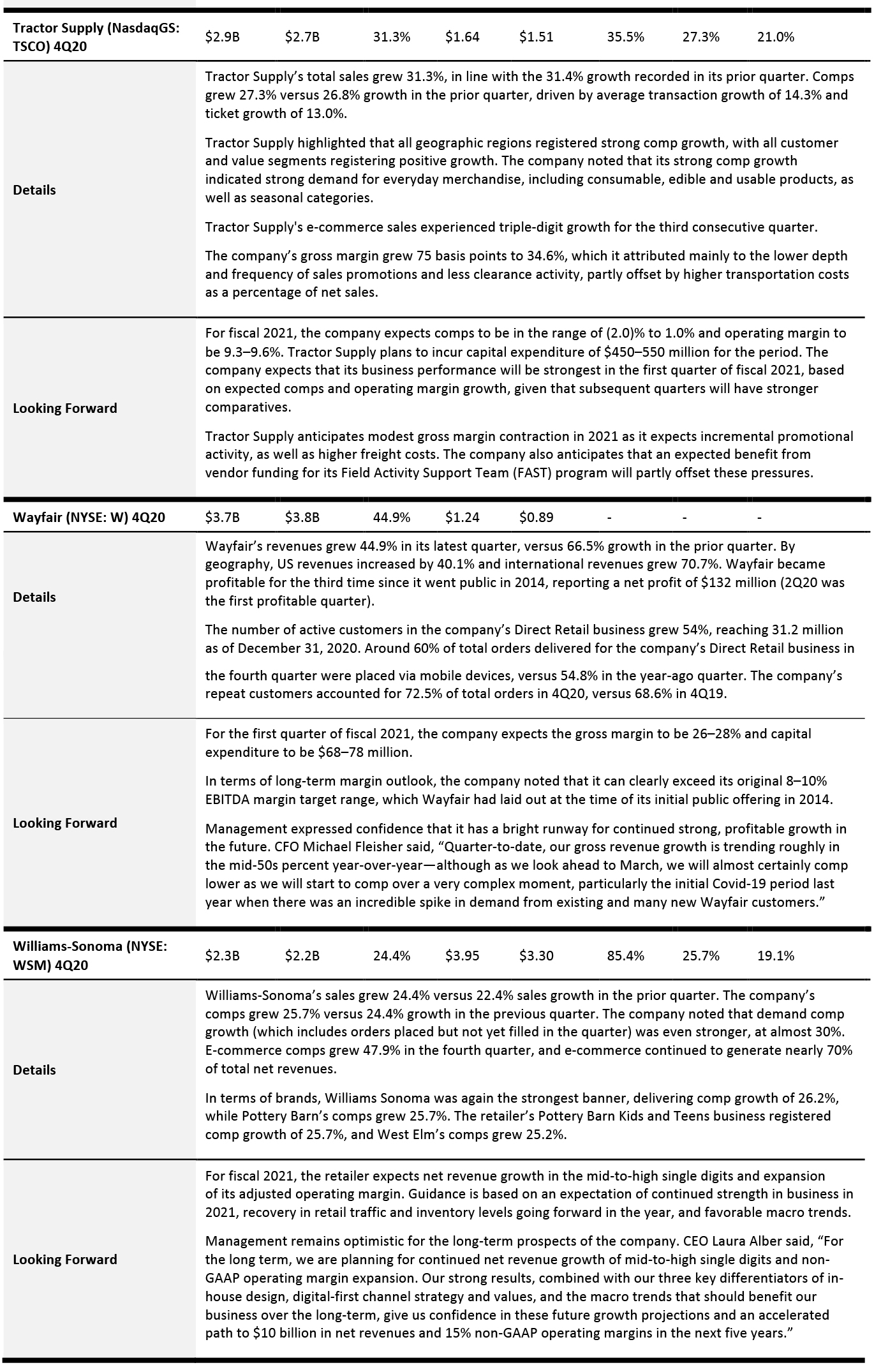

Home-improvement retailers Home Depot and Lowe’s continued to see outsized demand from both Pro and DIY customers. Wayfair and Williams-Sonoma continued to capitalize on accelerated e-commerce adoption among consumers, with Wayfair reporting a profit for the third time since it went public in 2014.

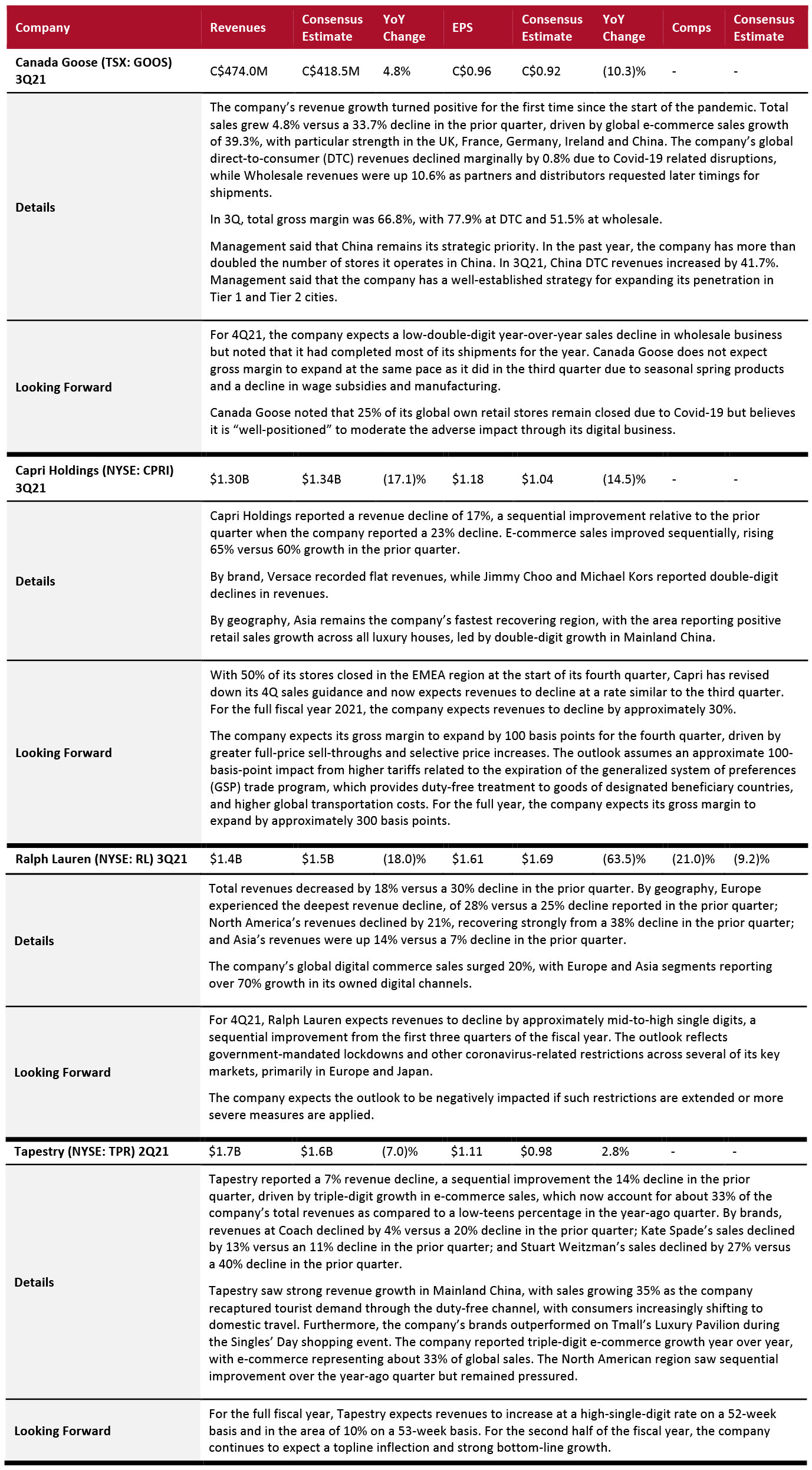

Luxury Companies

The luxury sector has been heavily impacted by the pandemic as travel and tourism—two important drivers of spending in the sector—have come to a virtual standstill.

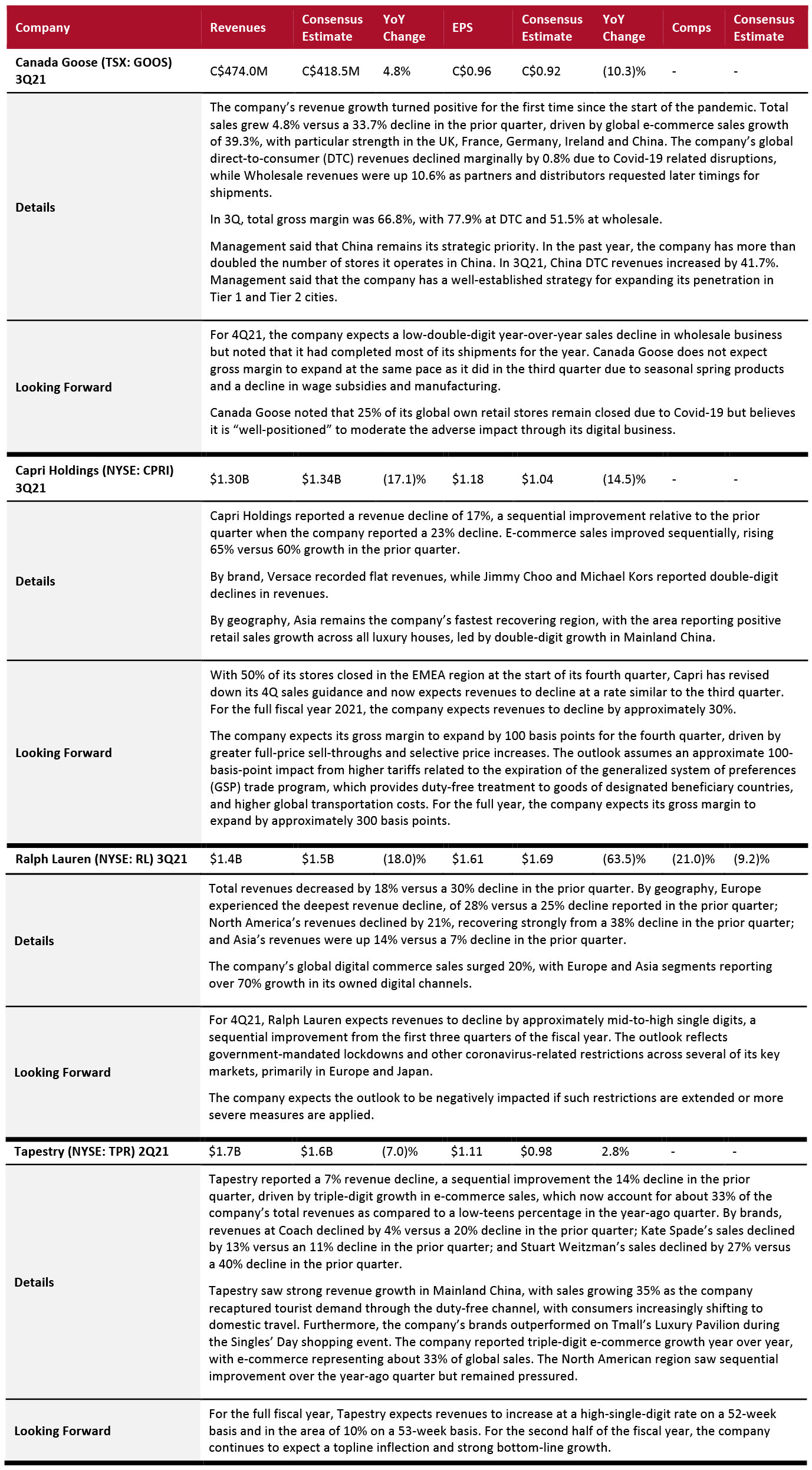

As the easing of pandemic-related restrictions varied around the world, the latest quarter has seen mixed recovery compared to the previous quarter. Canada Goose’s revenue growth turned positive for the first time since the start of the pandemic, while Tapestry’s sales declined by only a single-digit percentage. On the other hand, Capri Holdings and Ralph Lauren continued to witness double-digit declines in sales.

Luxury E-commerce

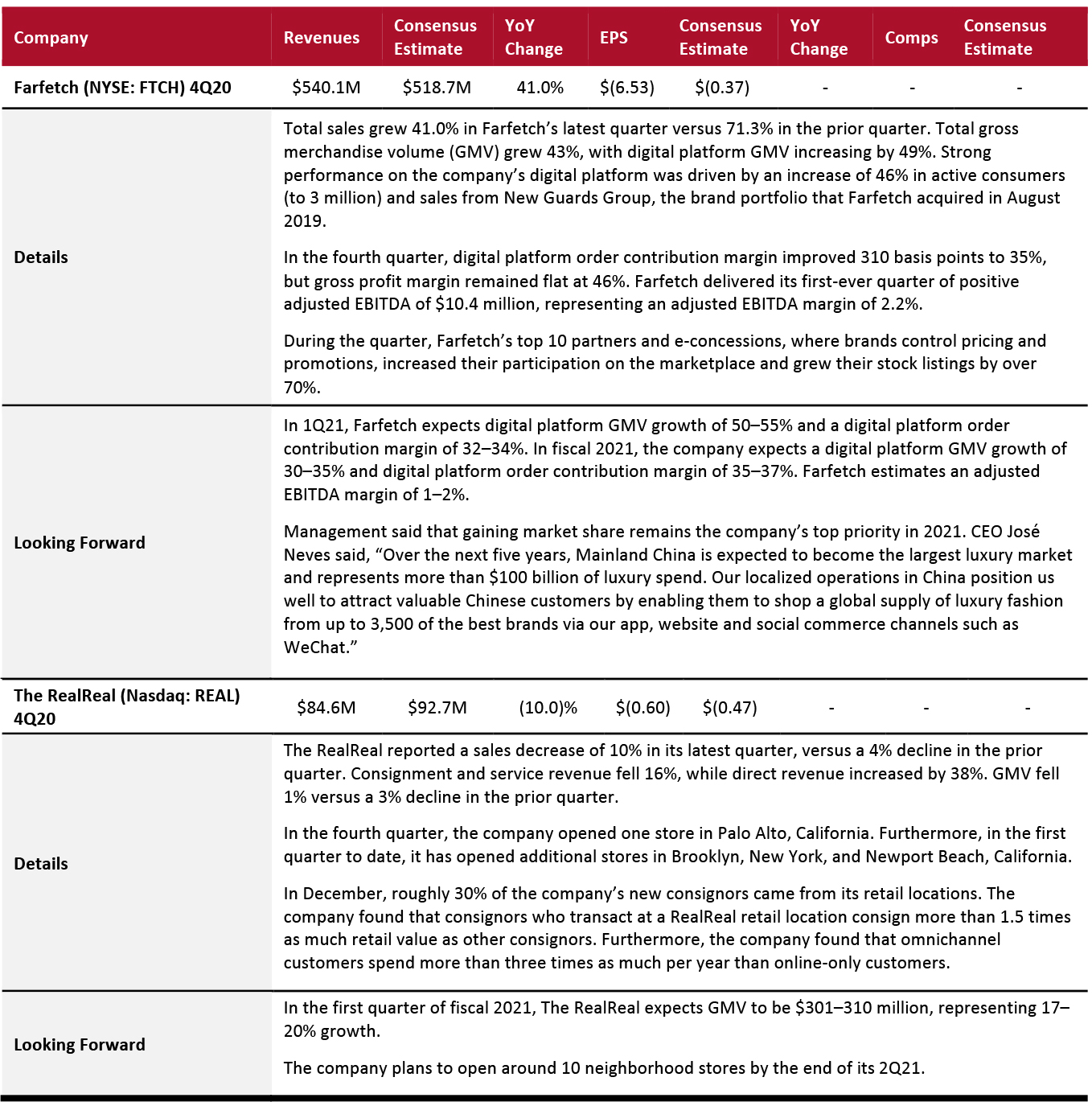

Luxury e-commerce platforms are witnessing a mixed recovery. Farfetch posted outstanding sales growth in its latest quarter, and the company sees strong growth opportunities in China in the near future. The RealReal remains badly hit, with its sales decline accelerating in its latest quarter. However, the company continued to expand its store base in the quarter.

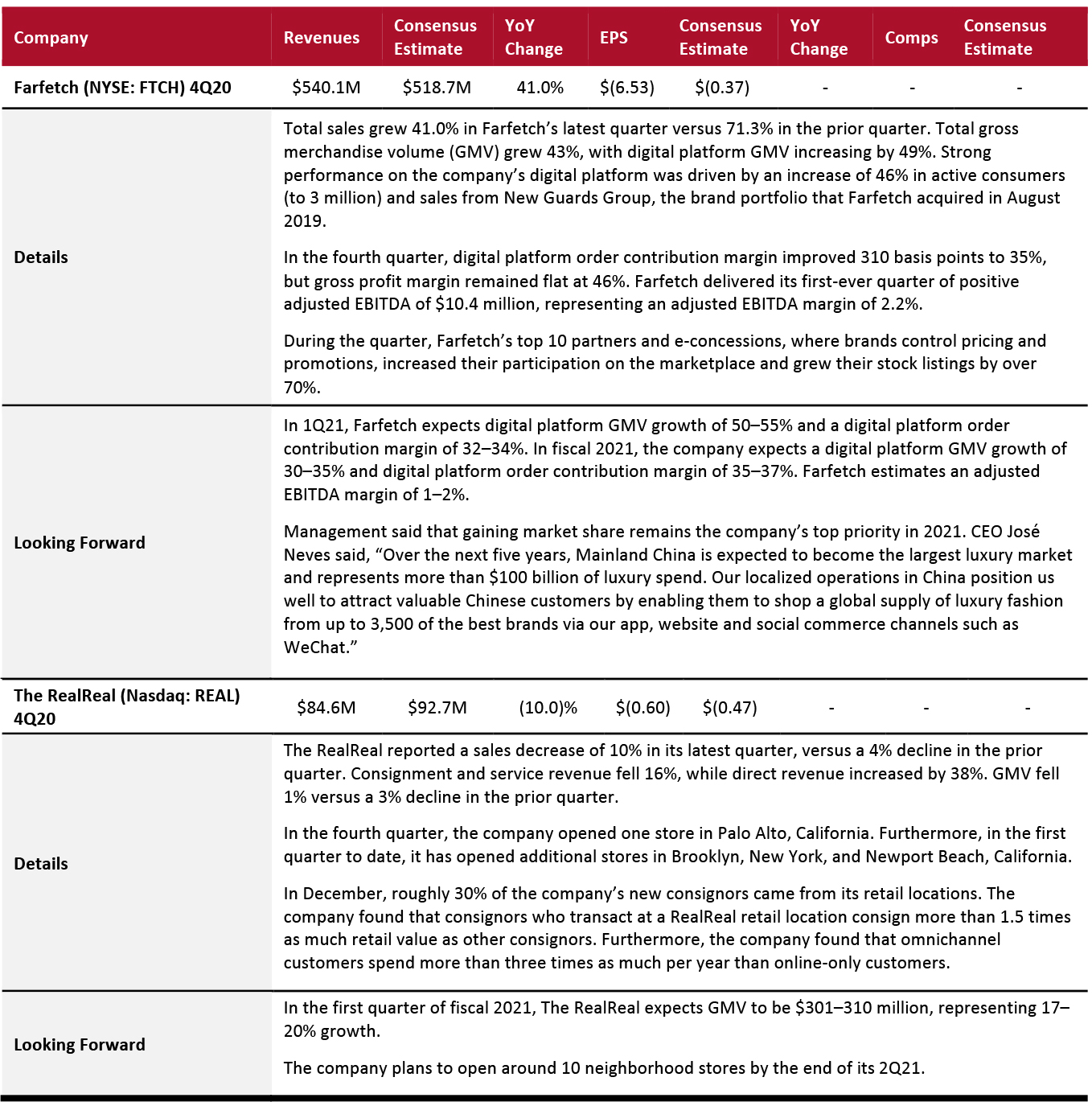

REITs

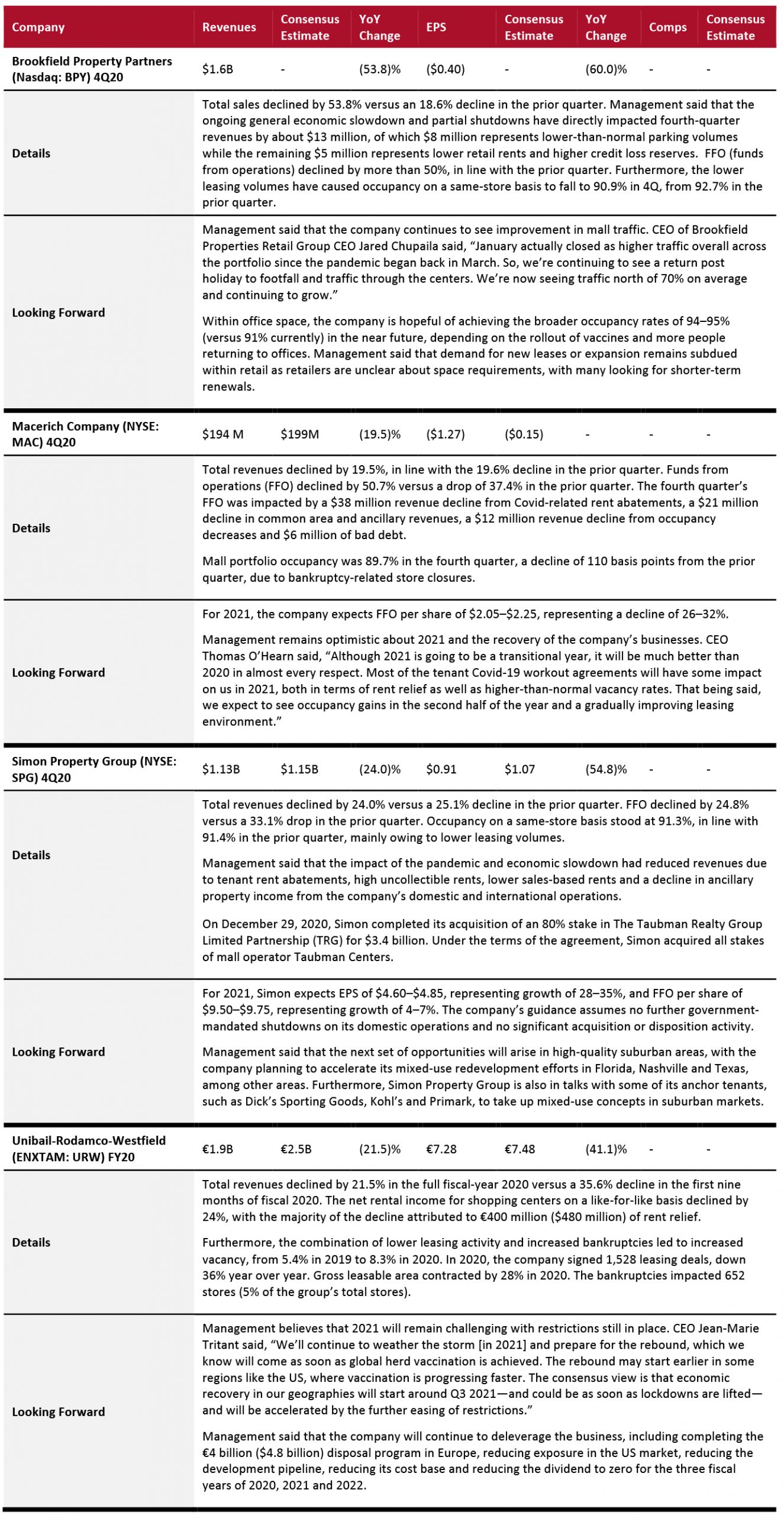

The sector continues to suffer amid the coronavirus crisis, as many reopened centers face closures again. All companies under our coverage reported a double-digit decline in revenues.

Most REITs remain optimistic about business recovery in 2021. Simon Property Group noted that the next set of opportunities will arise in high-quality suburban areas, with the company planning to accelerate its mixed-use redevelopment efforts in Florida, Nashville and Texas, among other areas.

Looking Forward

Retailers and brand owners saw a mixed fourth quarter. With consumers still spending more time indoors, we continue to see strength in home-related merchandise. This is benefiting more than home and home-improvement retailers, with a number of companies across sectors each calling out home categories as outperformers–including Burlington Stores, TJX and Ross Stores (off-pricers); Big Lots, Dollar Tree and Dollar General (discounters); Costco (warehouse club); Kohl’s, Macy’s and Nordstrom (department stores); Target and Walmart (mass merchandisers); and Urban Outfitters (specialty retailer). We believe that the home category will continue to see strong growth in the next quarter, and many retailers will adjust their assortment in that direction.

In the discretionary category, beauty continues to see a strong recovery. However, while skin care continues to trend well, the demand for makeup remains weak. In the apparel and footwear categories, demand for casualwear and athleisure remains strong, while tailored clothing is seeing weakness.

This quarter, we continued to see evidence that the crisis will support, and likely accelerate, structural changes in US retail, such as store expansion among discount retailers—all discounters reported outstanding topline growth. We expect discount stores’ comps to slightly decline in the next quarter, reflecting the impact of cycling the initial demand surge in March 2020. Like discounters, warehouse clubs continued to benefit from the crisis, with Costco and BJ’s reporting strong double-digit comps. These retailers are continuing to expand their store estates.

Department stores are seeing very weak recoveries from the crisis, with sales continuing to decline by double digits. These stores are looking to ramp up their digital businesses by investing substantially in digital experiences, supply chains and technology transformation over the next couple of years.