Nitheesh NH

Introduction

Our quarterly US Retail Inventory Tracker reports review inventories held by US retailers in the Coresight 100, a global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past eight quarters. The inventory turnover ratio indicates how efficiently a retailer manages their inventory, showing how many times inventory turns over in a particular period, calculated as the cost of sales (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate challenges in inventory management. As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported 4Q19 results, which ended January 31 and included limited impacts of the coronavirus. The coronavirus crisis means that the recent metrics reported here will not be indicative of inventory trends as we continue through 2020. With consumer demand for discretionary items falling and thousands of stores temporarily closing as a result of the pandemic, retailers are likely to be faced with a glut of unsold products. For retailers whose ranges are based on seasonality—such as apparel retailers—this may prove disastrous: Fashion retailers will get no second chance at selling spring/summer 2020 collections. As we write, the crisis is prompting some global retailers (such as Primark) to place all orders on hold. Therefore, while we note some positive trends in this report, we make the obvious caution that the quarter under review will be no guide to 2020. Those retailers with cleaner stock levels, such as American Eagle Outfitters, Ascena Retail and Target, enjoy a head start over rivals.Overview: Retailers Witness Improvement in Their Inventory Turnover Rates

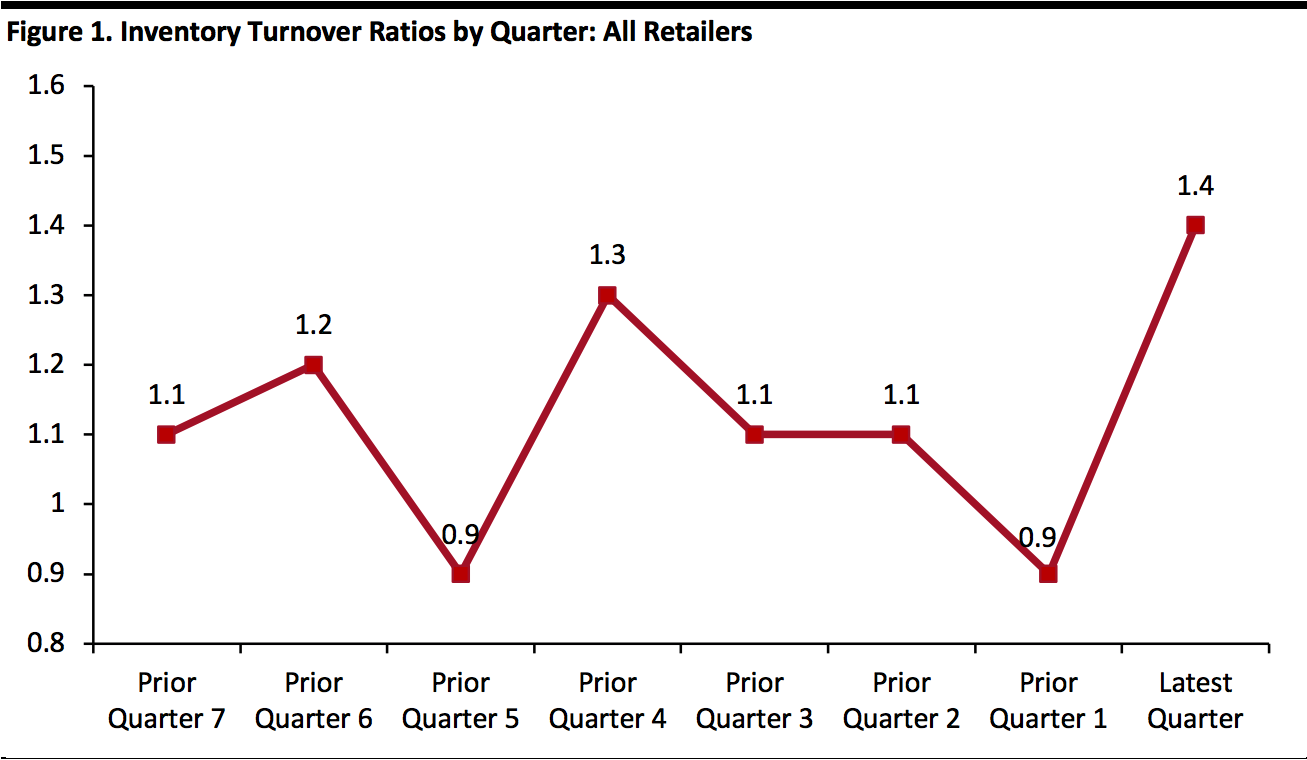

Most retailers covered here saw their inventory turnover rates improve compared to the same quarter in the previous year, as well as showing a strong sequential (quarter-over-quarter) increase, primarily due to the holiday season. The same quarter last year saw many retailers accumulate inventory to offset the impact of potential tariffs and support their expansion plans. [caption id="attachment_107012" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

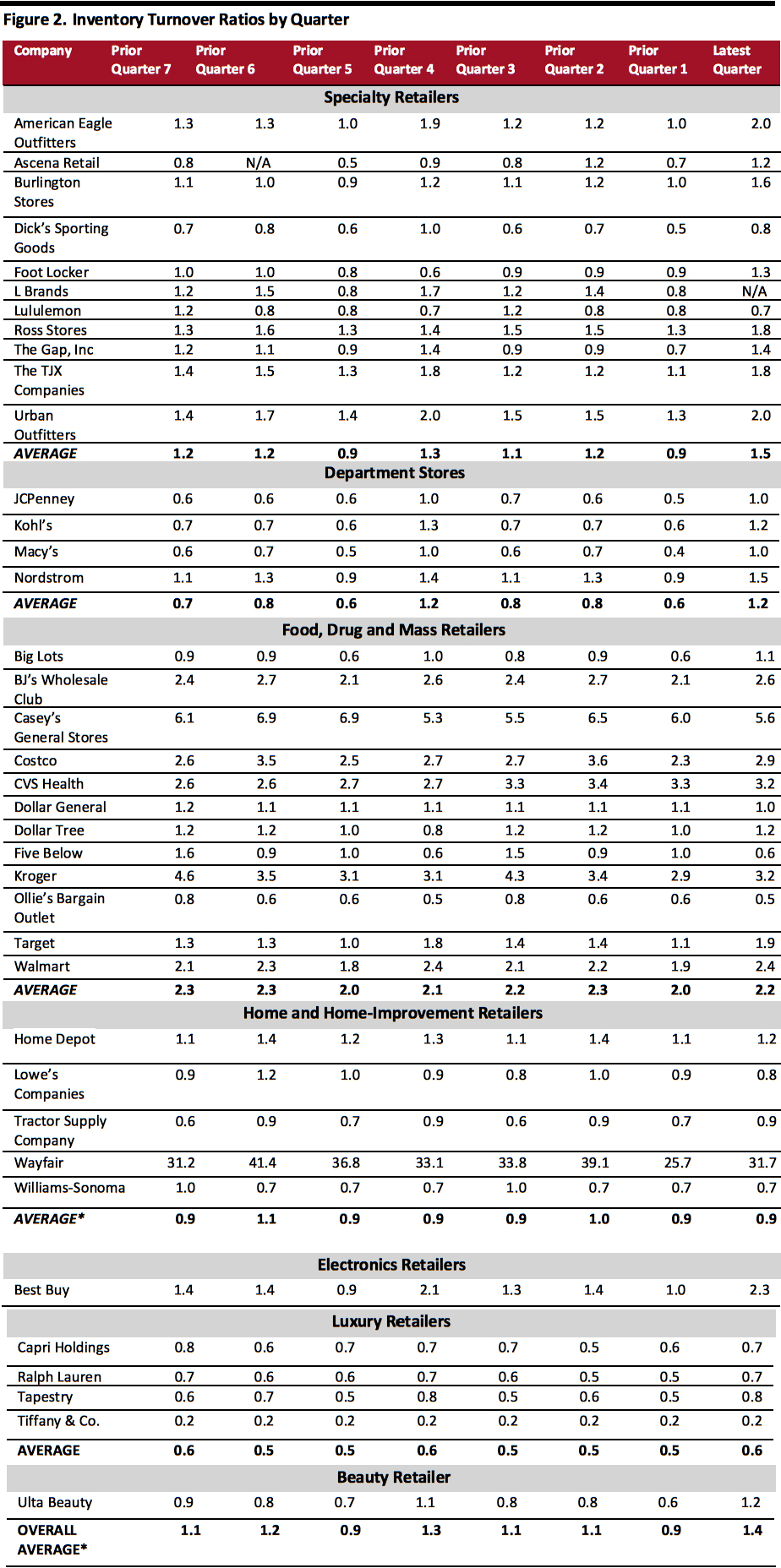

Most retail sectors—including specialty retail, food, drug and mass retail, electronics retail and beauty retail—witnessed a year-over-year improvement in their inventory turnover ratios. Department stores and home and home-improvement retailers saw their inventory turnover ratios unchanged from the same quarter last year. On a sequential basis, all retailers, except home and home-improvement retailers, witnessed strong improvement in their inventory turnover ratios. [caption id="attachment_107013" align="aligncenter" width="700"] Inventory turnover = Cost of sales for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

Inventory turnover = Cost of sales for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)*Excludes Wayfair, an outlier

Source: Company reports/Coresight Research[/caption]

Sector and Company Overview

We look at the inventory levels of various retailers and assess why inventory levels changed from the year-ago period. Apparel Specialty Retailers Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes or simply making misjudgements about the selection and design of products. Consequently, the need to make profit-denting markdowns to clear stock is an ever-present threat. Most of the apparel specialty retailers reported an improvement in their inventory turnover ratio compared to the year-ago period, as well as a strong sequential increase. Nearly every specialty retailer highlighted the impact of making more informed decisions about inventory. American Eagle Outfitters- The company saw inventory up 5% ($22 million) in the fourth quarter, of which 3% was driven by increased average unit costs and 2% by increased units. The bulk of the inventory increase was to fuel growth in its denim and Aerie businesses.

- Management said that the company cleared inventory through the holiday season and entered 2020 with carryover units down compared to last year.

- The company maintained leaner inventory levels and ended the fourth quarter with inventory down 5% year over year.

- Management said that the company took aggressive action during the quarter to clear its holiday inventory and ensure it is well positioned heading into spring.

- The company’s top store inventory turnover increased by 13% in the fourth quarter. Merchandise inventories declined to $777 million from $954 million last year. At the end of the fourth quarter, the company’s pack-and-hold inventory as a proportion of total inventory reduced to 26% from 30% at the end of the fourth quarter last year.

- At the start of February 2020, the company’s comparable-store inventory levels were down 15% year over. Management forecasts that average inventory levels will decline by low double digits throughout fiscal year 2020, and the company expects tighter inventory control to drive faster turnover and lower markdowns.

- The company’s year-end inventory levels grew 21% year over year. Management said that the improved inventory position has allowed the company to capitalize on the favorable warm-weather trends, offsetting the lost cold-weather business, and also position itself well going into the first quarter.

- For 2020, the company expects inventory levels to moderate and increase by a high single digit at the end of the first quarter, with further moderation in the second and third quarters.

- The company ended the fourth quarter with inventory down 4.0% year over year on a constant-currency basis versus a 2.2% decline in sales.

- Management said that the company’s disciplined approach to inventory management had helped it to increase inventory turnover for 2019 and to continue a flow of fresh assortments as it moves into fiscal year 2020.

- The company ended 2019 with inventory up 5% year over year, with its packaway levels at 46% of the total inventory, in line with last year. The company’s average in-store inventories were flat compared to 2018.

- In the fourth quarter, the company’s cost of goods sold rose 30 basis points (bps), primarily due to higher distribution costs of 45 bps owing to unfavorable timing of packaway-related expenses and higher wages.

- The company ended the fourth quarter with total inventory up 1% year over year. Excluding the impact of the Janie and Jack acquisition, net store openings (minus store closures) and tariffs, inventory was down about 1%, in line with the company’s previous guidance. In 2019, Gap, Inc said it had made good progress in reducing the cost of goods sold, tightening inventory and expanding margin.

- Management said that the company is making progress on conservative inventory buys, mainly due to challenging traffic trends. Management also commented that inventory productivity would remain a top priority for Gap, Inc in 2020, particularly in the context of uncertainty related to the coronavirus situation.

- The company’s inventory increased by 6% year over year at the end of the fourth quarter, mainly due to the opening of new stores: The TJX Companies added 223 net new stores in 2019.

- The company’s Anthropologie, Free People and Urban Outfitters brands entered the quarter with elevated inventory levels. All three brands were successful in lowering them by quarter's end, and thus entered the new year with reduced weeks’ worth of supply and cleaner stock levels.

- Management believes that the company’s reduced inventory should benefit the company’s first-quarter performance, although additional markdowns in the fourth quarter were expected to drive down margins and profitability.

- The company’s inventory was $2.17 billion at the end of the year, representing a decrease of $271 million or 11.1% year over year. The company’s in-store inventory has reduced by almost 23% since 2017.

- Management said that the company is reallocating inventory to areas where it is witnessing the most growth, such as denim and athletic apparel.

- The company’s inventory dollars were up 1.8%, while units were flat at the end of the year. This was higher than planned, as sales came in at the low end of the company’s expectations and increased inventory in the Women’s segment and key growth areas such as Active and Beauty.

- For fiscal year 2020, the company aims to address elevated levels of inventory, which may add margin pressure early in the year. Kohl's forecasts inventory to decrease by low, single digits for fiscal year 2020.

- The company’s comparable inventory was down 1.4% year over year at the end of the fourth quarter. Management said that the company’s Backstage locations—which have now been open for over 12 months—had improved both gross margin and inventory turn.

- Over the next three years, Macy’s is aiming to reduce its inventory by $200 million (cost price). With respect to the possible impact of the coronavirus outbreak on its supply chain, the company is working with its vendor partners to minimize disruption.

- The company ended the fourth quarter with inventory down 3%, marking four consecutive quarters of sales growing faster than inventory. The company’s off-price business saw increased profitability for the year and inventory turns for nine straight quarters.

- Management said that the company successfully executed plans to accelerate its sales trends, increase inventory turns and reduce its cost structure.

- The company ended the fourth quarter with inventory at $921 million, a decline of 5% compared to $970 million last year, where inventory levels were elevated due to tariff-mitigation activities. Excluding in-transit effects, the inventory on hand was in-line with the company’s expectations.

- In 2020, the company plans to roll out a new replenishment system to optimize inventory.

- In the fourth quarter, the company’s gross margin increased 60 bps to 31.8%, primarily driven by higher initial markups on inventory. At the end of the fiscal year, the company’s merchandise inventory was $4.7 billion, up 14.2% overall and 7.8% on a per-store basis.

- Management said that the company is maintaining inventory growth that is in line with, or below, its total sales growth.

- The company came out of the holiday season with very low levels of clearance inventory, which contributed to net profit, despite the shortfall in sales. In January, the company had very little clearance inventory, which led to some lost sales.

- In 2019, Target used machine learning to automate about 30% of its merchandise inventory and witnessed a drop of more than one-third in out-of-stock and backroom inventory.

- The company’s inventory level remained nearly flat year over year. Management said that inventory quantity and content are in good shape. During the quarter, the company managed to offer next-day delivery options, primarily by mirroring inventory in its warehouse.

- In the first quarter, Walmart is expecting a negative financial hit owing to the coronavirus epidemic, which we believe could impact the company’s inventory turnover.

- The company’s merchandise inventories increased $606 million to $14.5 billion at the end of the quarter. The growth in inventory is due to the company’s investments in accelerating merchandising resets and higher in-stock levels.

- The company ended 2019 with inventory at $13.2 billion, an increase of 4.9% year over year. This was driven by strategic investments in the first half of the year to drive sales, such as increased presentation minimums, CRAFTSMAN resets and investments in job-lot quantities for the Pro business. In the second half of the year, the company invested in inventory to maintain an earlier spring load-in for the Southern markets and capture initial seasonal demand for 2020.

- Management expects inventory levels to remain elevated in 2020 as the company continues to implement enhanced tools to drive long-term inventory productivity.

- The company ended the quarter with an inventory of $960 million, up from $765 million last year, reflecting the additional Versace inventory of $187 million. The company’s Jimmy Choo inventory grew 13% year over year to support its growing accessories category and new store expansion, while Michael Kors inventory declined 2% and is in line with sales trends.

- During the quarter, the company worked with its department-store partners in North America to bring inventory in earlier to help drive better sell-throughs.

- The company’s inventory was down 1% year over year (flat in constant currency) at the end of the quarter. Management said that the inventory positions for both its wholesale and direct-to-consumer businesses are well controlled coming out of the 2019 holiday season.

- In 2020, the company aims to follow a disciplined approach to inventory management and leverage its supply chain agility and responsiveness.

- The company ended the quarter with inventory up 2% year over year to $748 million, partially due to receipt timing shifts to the third quarter. During the typically markdown-heavy holiday period, the company moved through excess inventory by implementing higher levels of promotions.

- The company’s comparable sales declined 4% year over year, improved sequentially and beat its expectations; Tapestry moved through excess inventory and began to take key merchandising actions and products to optimize its assortment and enhance its novelty offering.

- The company built its inventory to support product launches in the second half of the year, in anticipation of a strong holiday season. Tiffany & Co also shifted its high jewelry assortment to mainland China to increase product availability in the country to partially offset lower sales abroad.

- The company’s total inventory grew 6.5% year over year in the quarter, driven by the opening of 80 new stores. Ulta Beauty’s inventory per store was roughly flat. The company said it continued to gain efficiencies from enhanced supply chain processes and merchandising.