Introduction

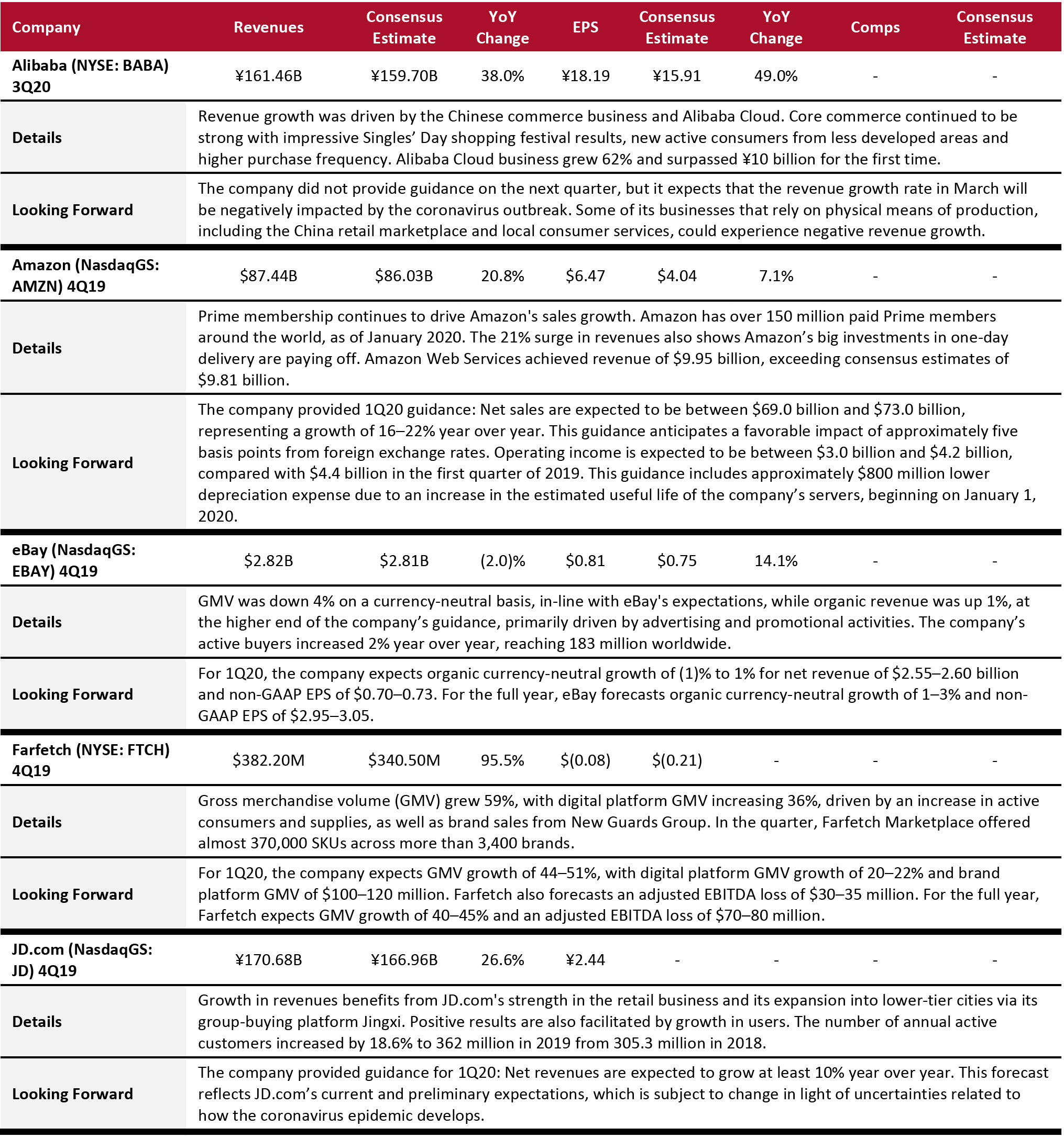

Our fourth-quarter 2019 (4Q19) wrap-up covers the quarterly earnings of 67 (mostly) US-based retailers, brands, e-commerce platforms and REITs in our Coresight 100.

- More than half (58% or 39 companies) beat revenue consensus estimates, 27% (18 companies) missed revenue consensus estimates and 15% (10 companies) reported revenues in line with the consensus.

- Apparel specialty retailers, beauty brands and retailers, luxury, e-commerce companies and REITs saw the most companies (over 70%) beat consensus revenue estimates. In terms of earnings, CPG, luxury, e-commerce, apparel specialty retail and beauty brands led.

- Despite most companies posting positive sales growth, the apparel and footwear sector was the worst-performing sector (versus expectations) in the quarter, with 63% (five companies) missing the consensus revenue estimates.

Company results in 4Q19, which ended January 31 for most companies in our coverage, will include limited impact from the

coronavirus. Some firms adjusted their guidance in view of the pandemic—but that guidance did not factor in the disruption to demand that is currently unfolding in the US market.

We assess the recent performance of retailers in more detail below.

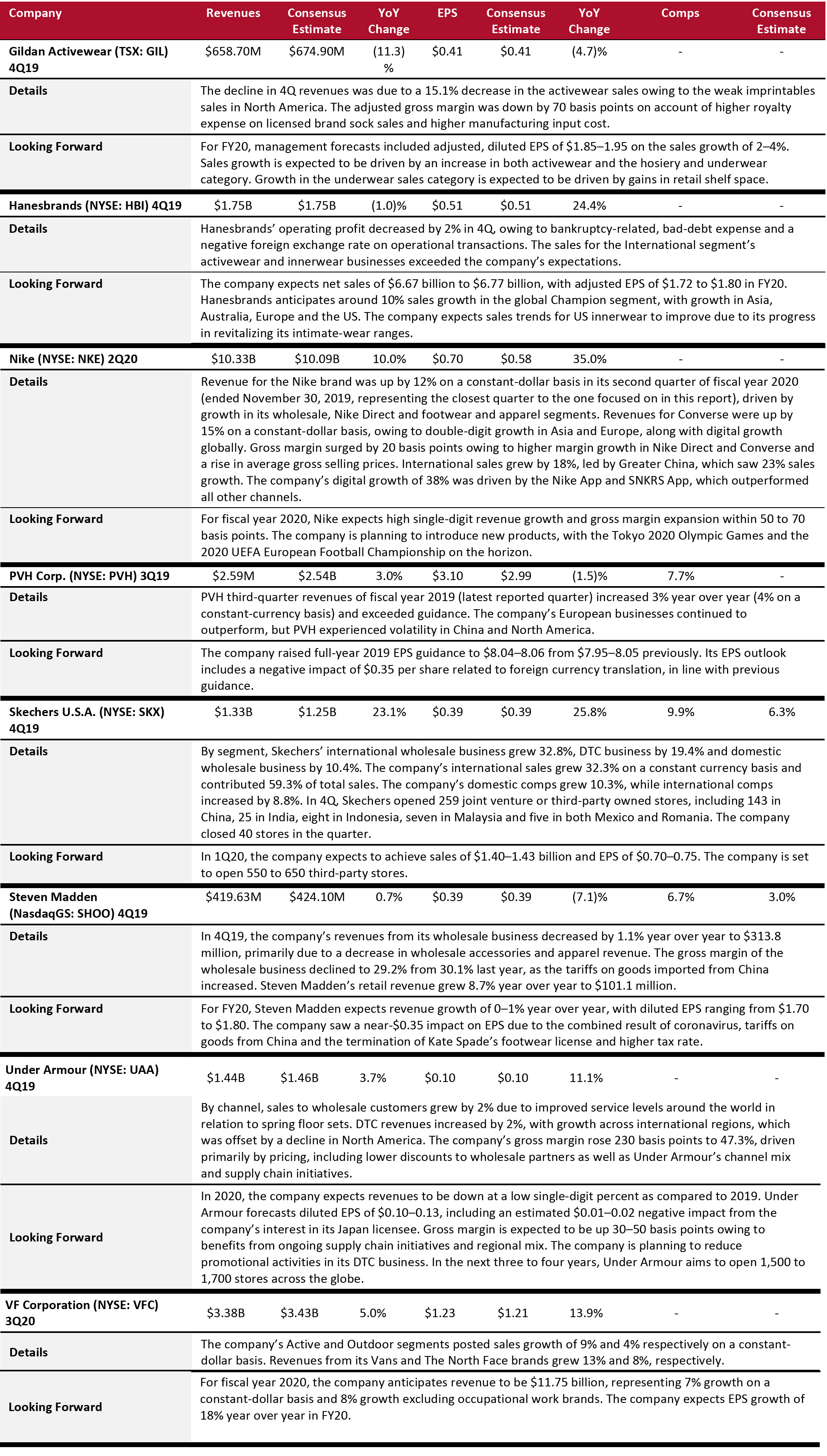

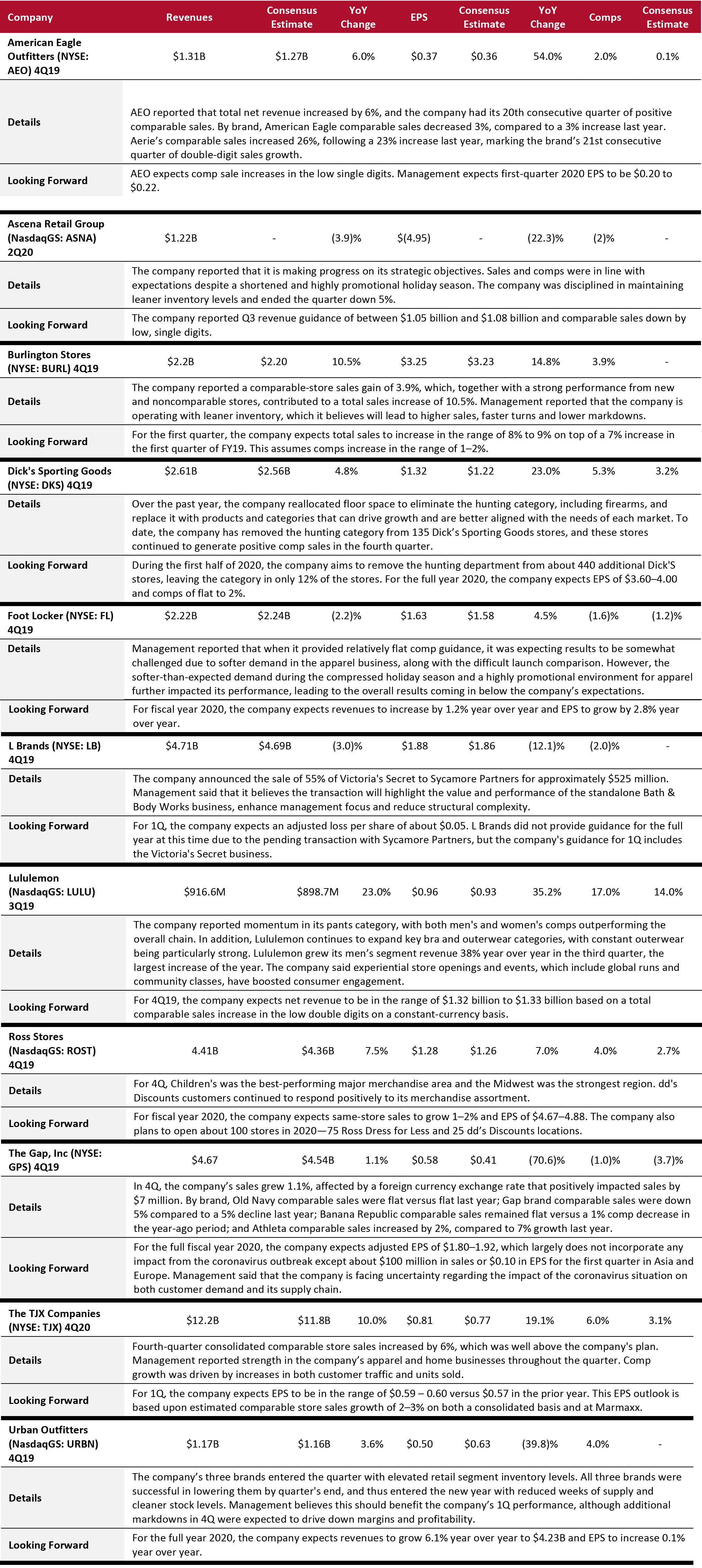

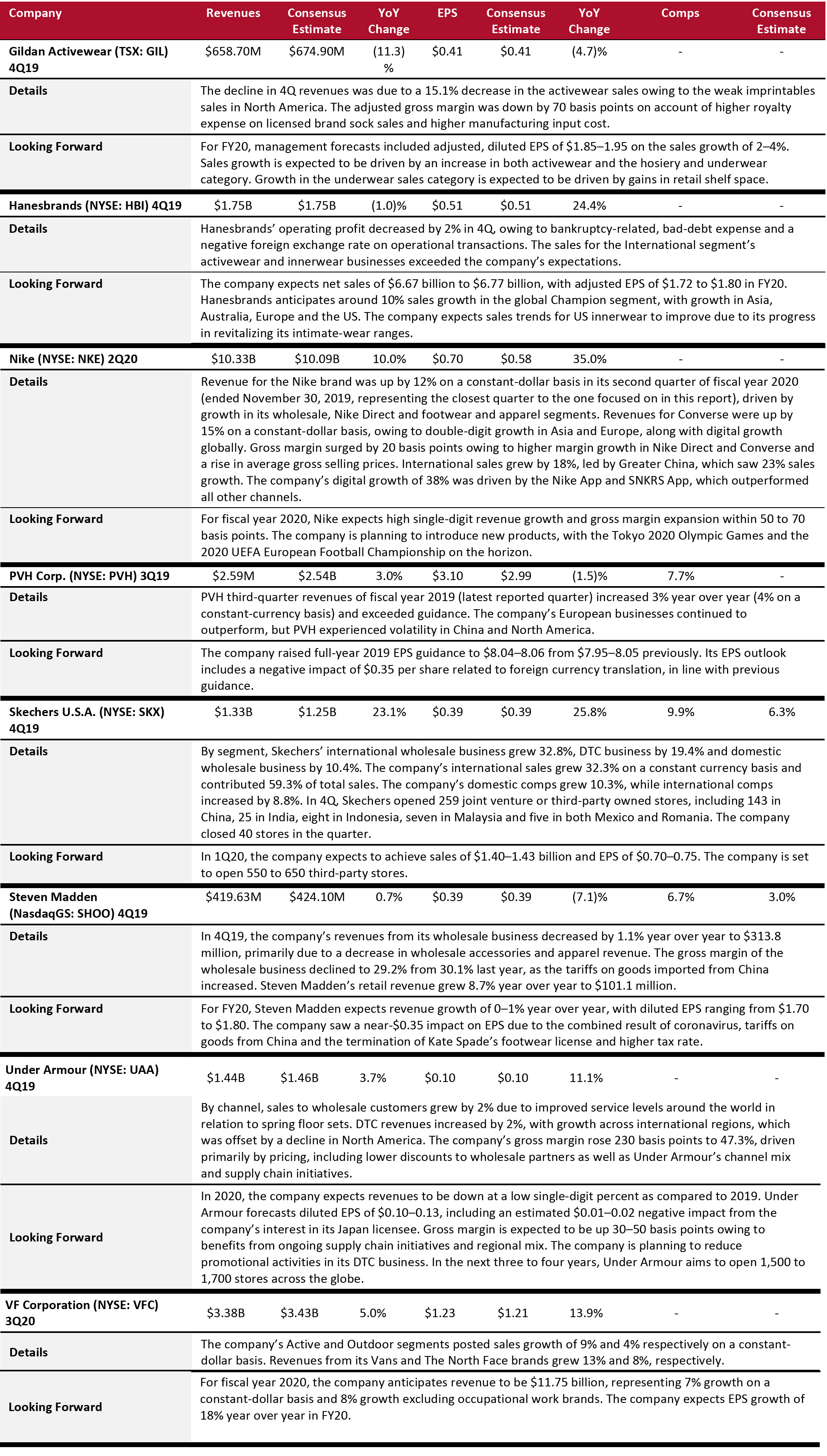

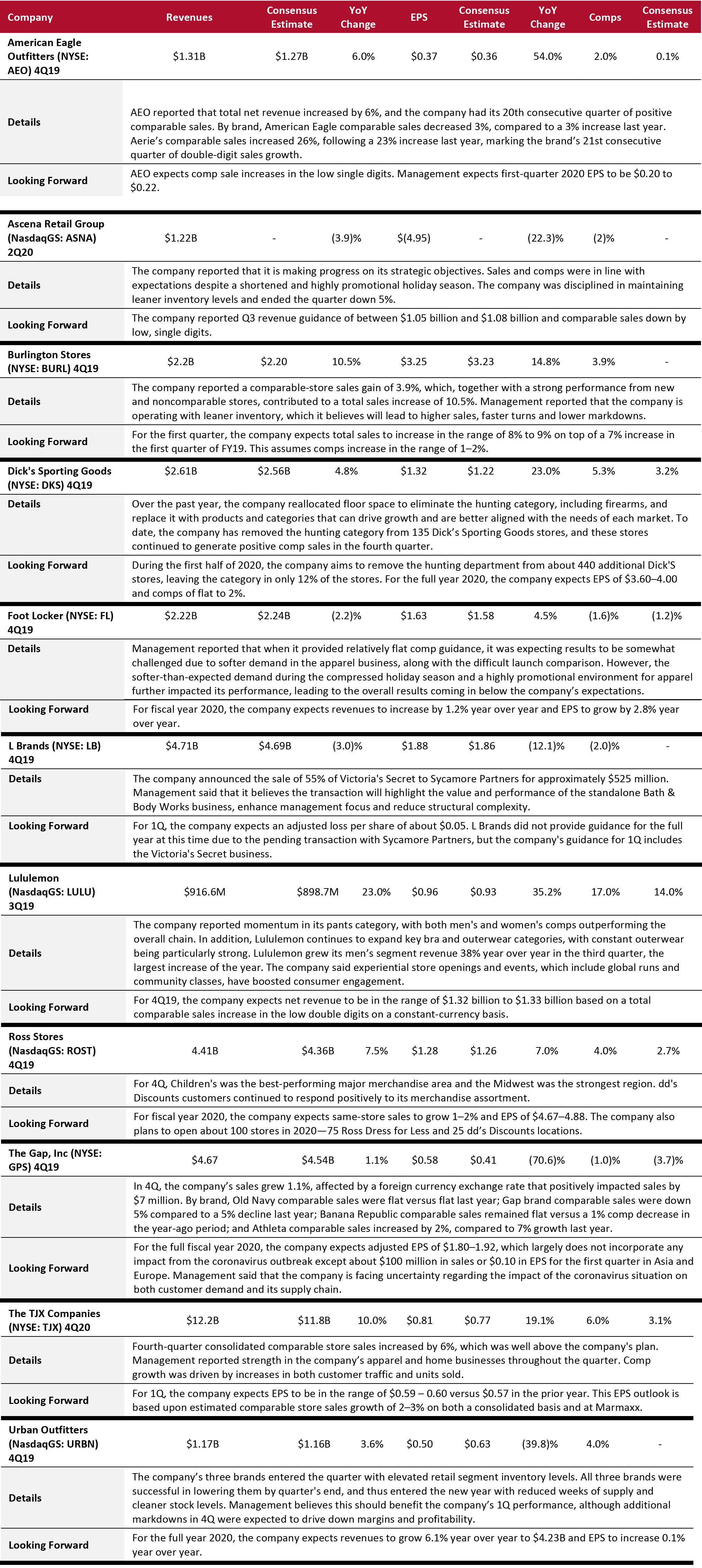

Apparel and Footwear

Most US apparel and footwear firms under our coverage reported revenues that were up from the year-ago period, driven by brand strength globally and the ability to leverage this strength in a direct-to-consumer (DTC) model. However, most of the revenues reported were below market expectations. A few brands, such as Steve Madden, continue to increase digital penetration and are seeing strong sell-through in subcategories such as intimates, footwear and private labels.

Overall, retail outperformers tend to be polarized, while middle-market brands are being squeezed by greater competition and a lack of innovation and differentiation. Lifestyle apparel brands such as Nike are growing quickly and further penetrating consumers’ closets as the athleisure trend continues and luxury brands begin to participate as well. The closing of 125 Macy’s stores will impact mid-market brands this year and drive further DTC efforts among apparel brands, as will cautious order trends from department stores.

Brands are also seeing shifts and delays in orders due to the coronavirus. Most companies with exposure to China have reduced sales projections for the current year based on the outbreak. Some have noted that the reduction in travel to international flagship cities would also impact results. As we noted above, the impact is now shifting to Western markets, including the US.

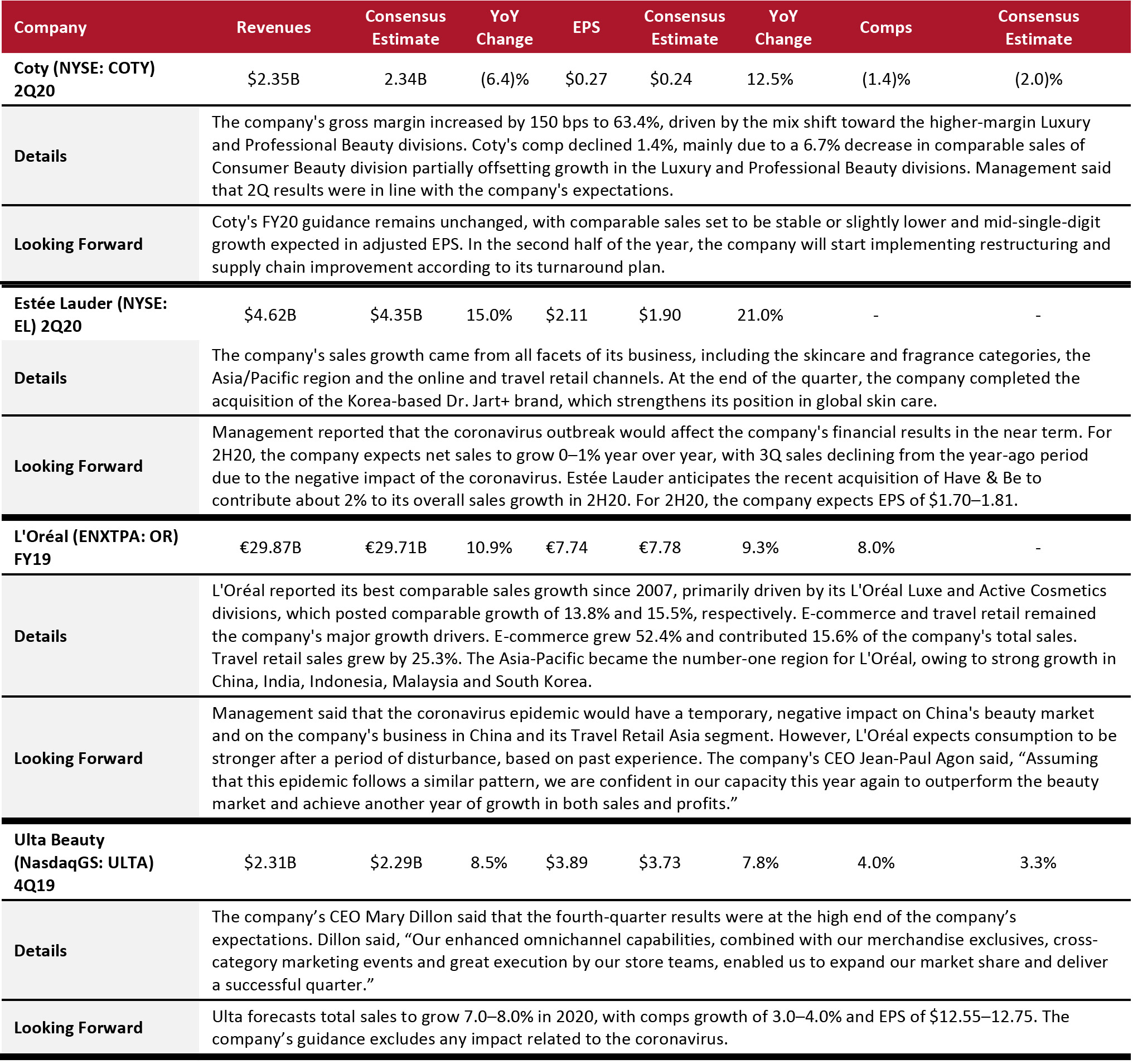

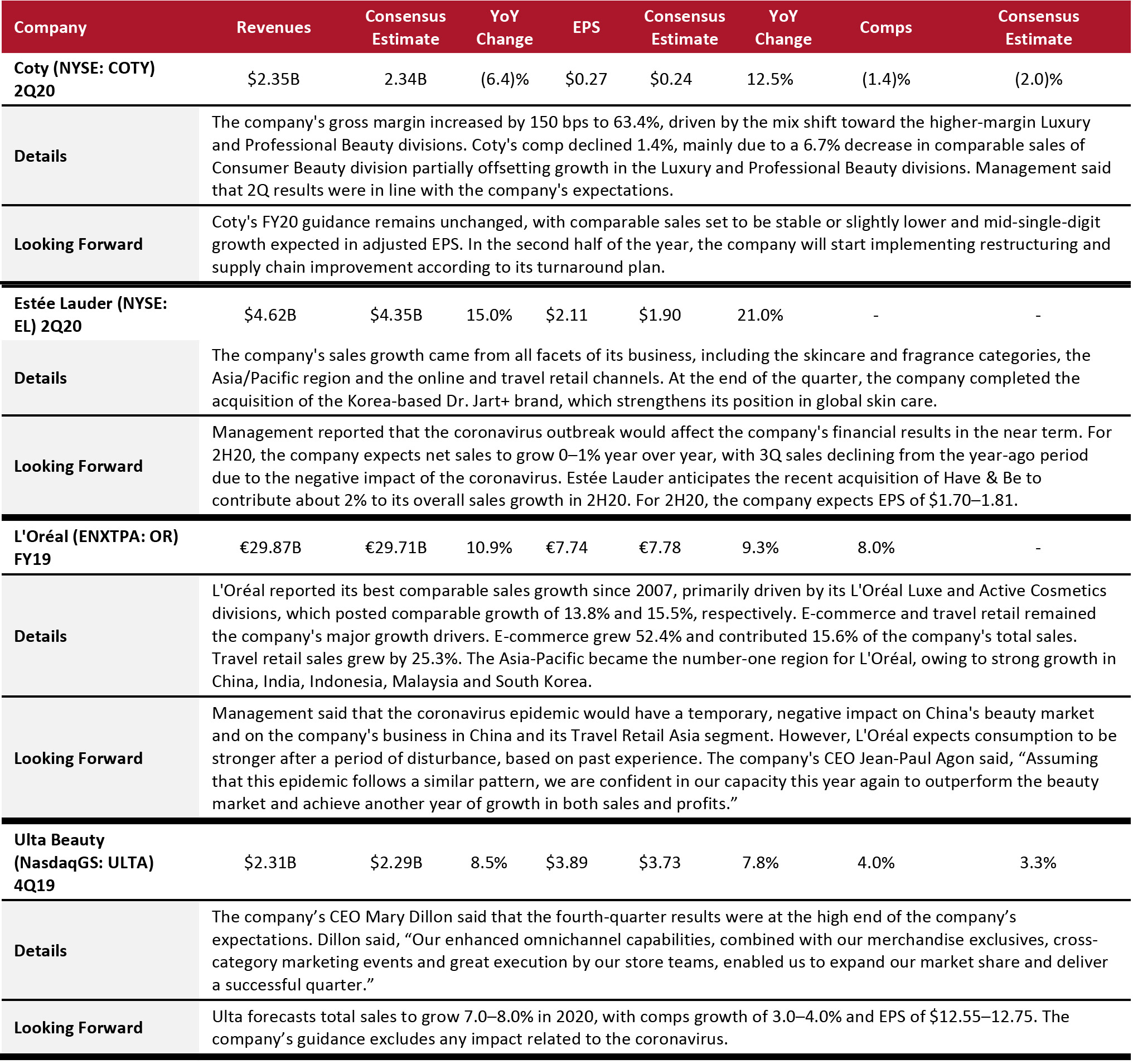

Beauty Brands and Retailers

Nearly 75% of the beauty sector saw strong revenue growth, ranging from 8.5% to 15.0% year over year. L’Oréal’s growth was driven by its Active Cosmetics division (products sold in healthcare outlets and pharmacies designed to solve problems), while Estée Lauder reported that its sales growth came from all facets of the business, including the skincare and fragrance categories, the Asia/Pacific region and the online and travel retail channels. Ulta Beauty’s revenues, EPS and comps all beat market expectations, which management attributed to the company’s enhanced omnichannel capabilities, combined with its merchandise exclusives and cross-category marketing events. Coty's comps declined by 1.4%, mainly due to a 6.7% decrease in comparable sales of the Consumer Beauty division partially offsetting growth in the Luxury and Professional Beauty divisions.

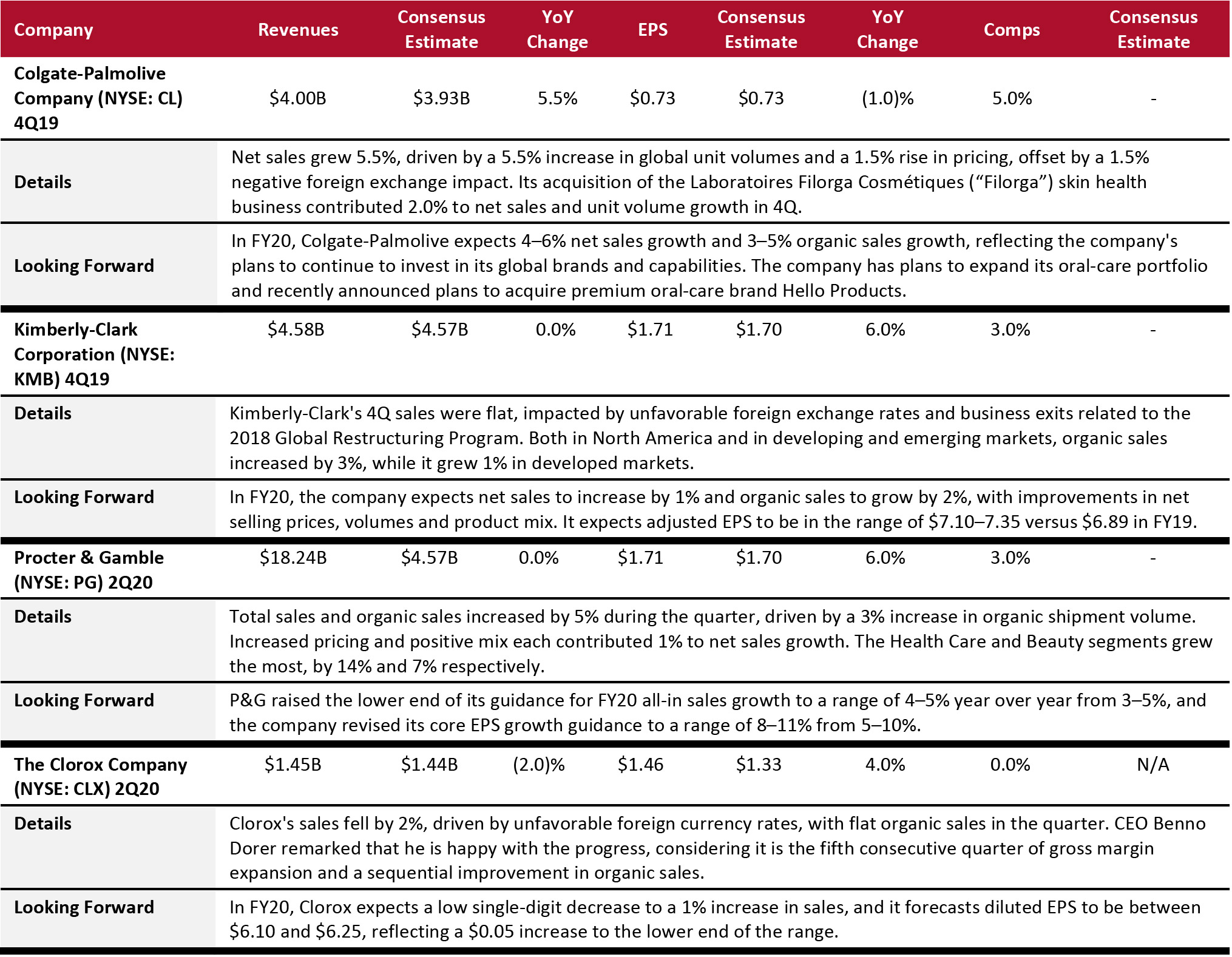

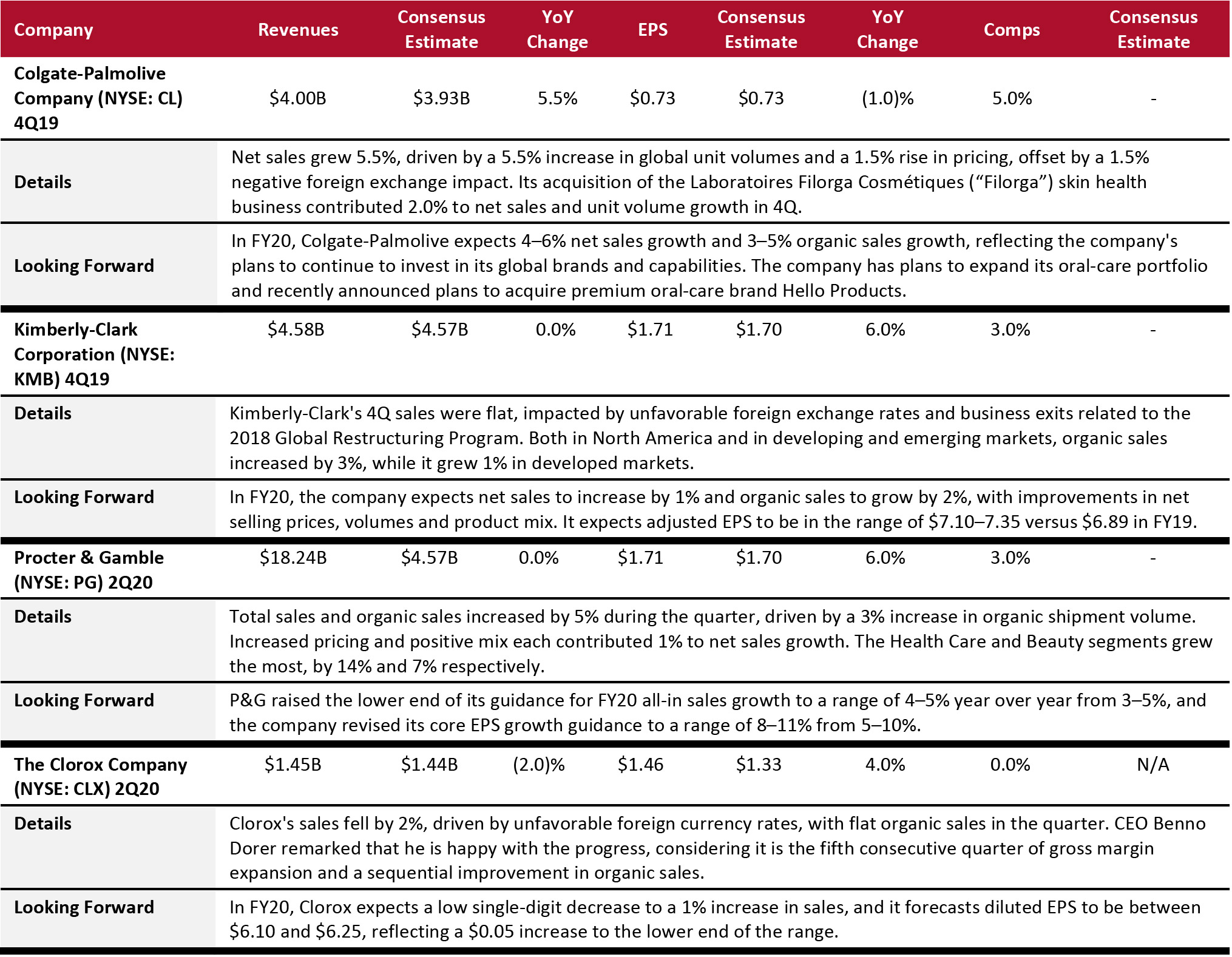

Consumer Packaged Goods (CPG)

CPG firms posted mixed results yet again. Procter & Gamble’s sales missed market expectations, while Colgate-Palmolive’s exceeded consensus estimates. Kimberly-Clark’s and Clorox’s sales were in line with expectations. Foreign-currency fluctuations and global economic volatilities impacted performance across the sector, yet the firms posted solid organic growth, with the exception of Clorox, where organic growth was flat.

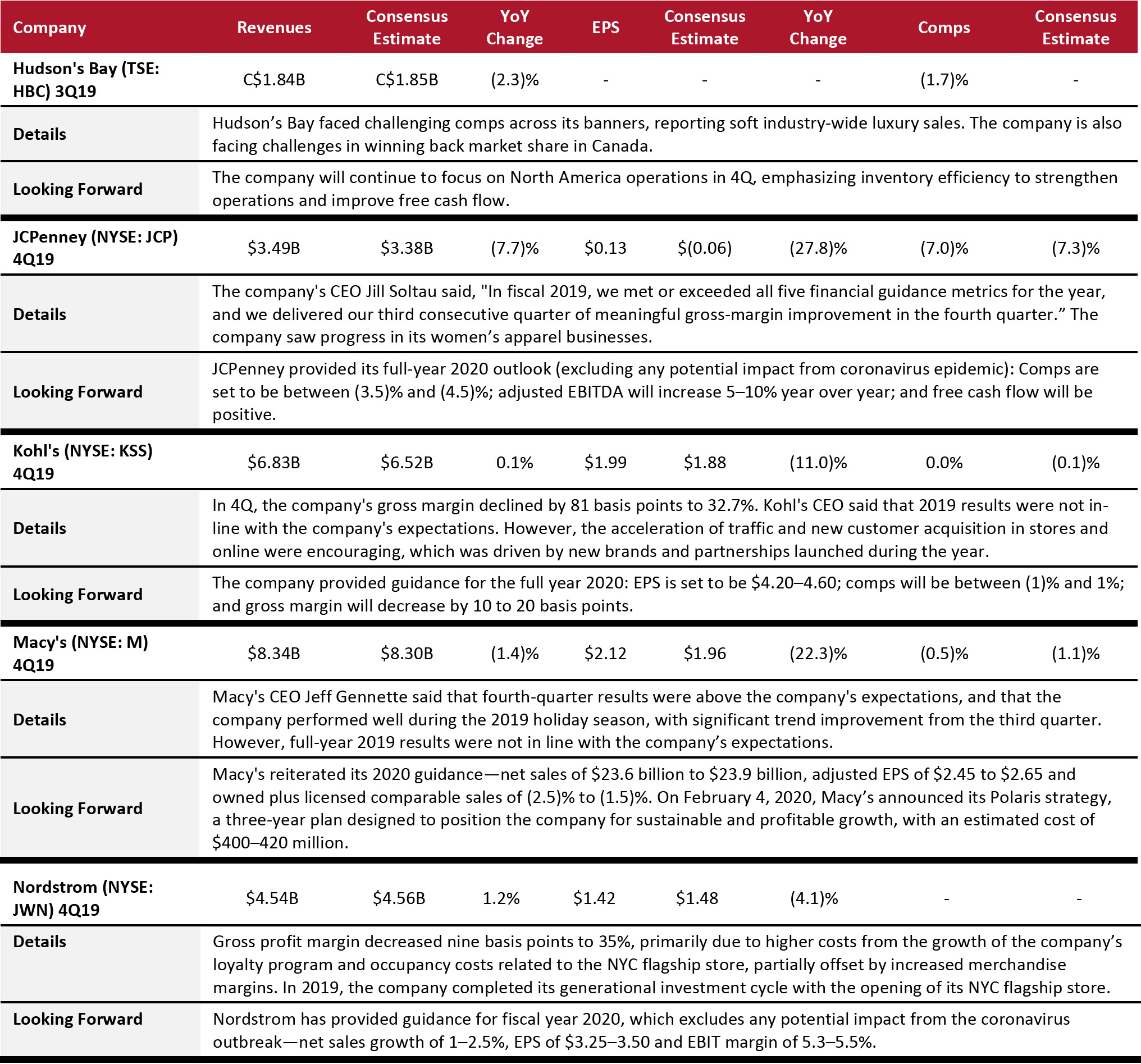

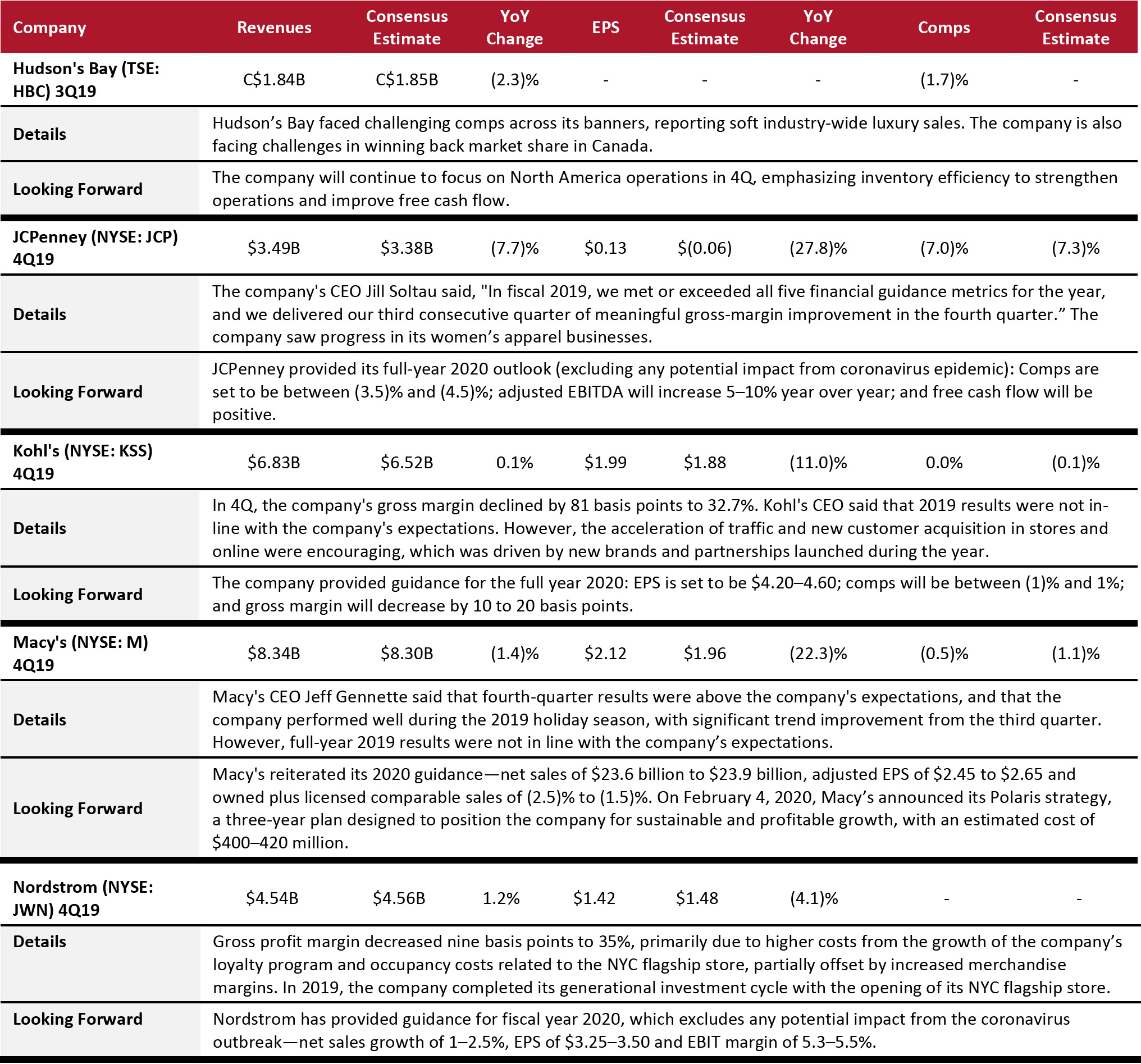

Department Stores

The department-store sector continued to struggle in the fourth quarter, despite showing some improvement since the previous quarter: Half of the four covered retailers had revenue down from the year-ago period, with three posting revenues above consensus and one below. Two of the three stores that reported comps were negative, and one was flat. JCPenney’s revenue, while beating consensus, was down by 7.7% from the year-ago period, with comps at (7)%. The company reported that it delivered its third consecutive quarter of meaningful gross-margin improvement in the fourth quarter. JCPenney saw progress in its women's apparel businesses. Macy's fourth-quarter results were above the company's expectation, and it performed well during the 2019 holiday season, with significant trend improvement over the third quarter.

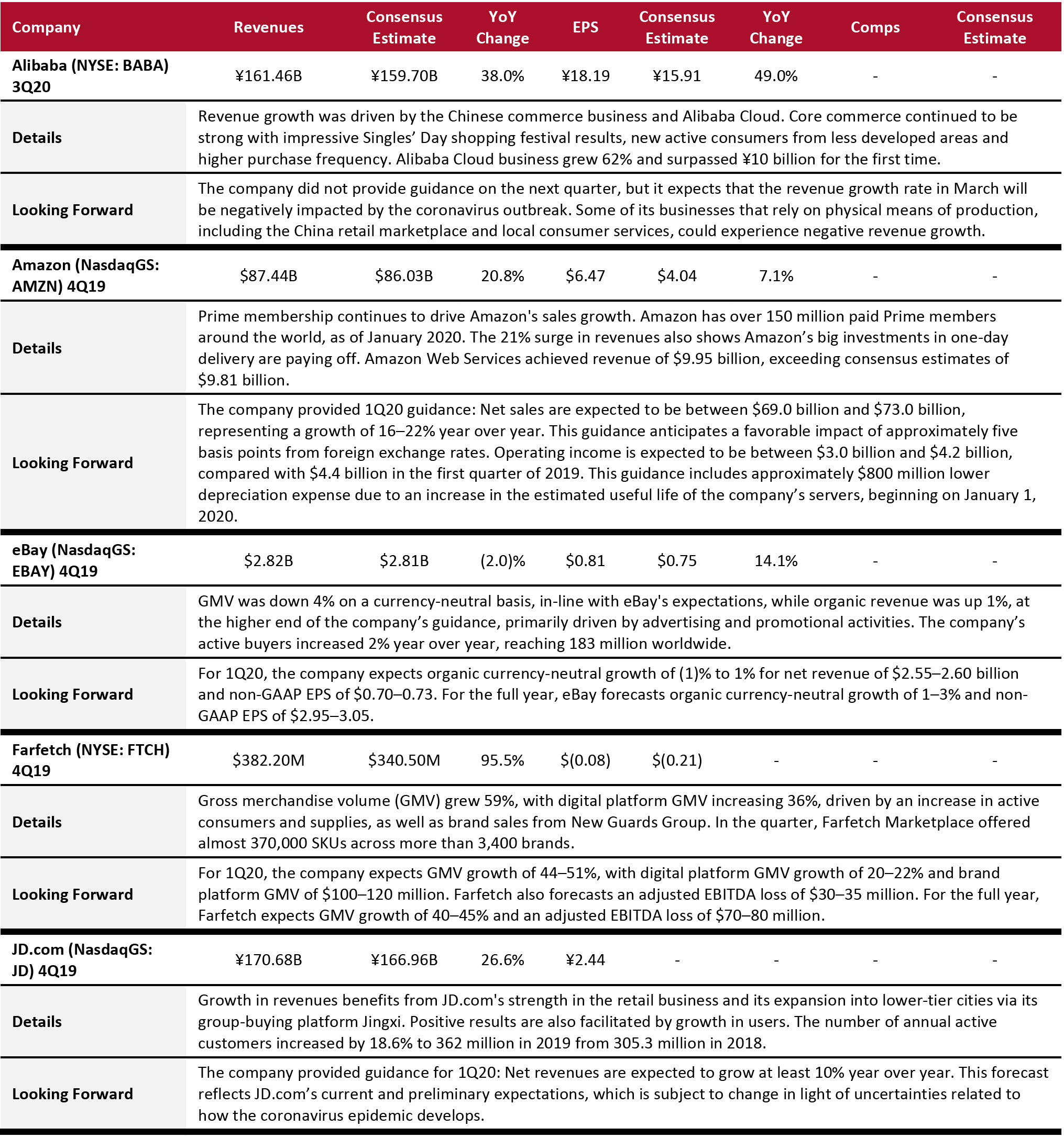

E-Commerce

Amazon reported strong sales growth, driven by solid holiday-season sales and an increase in Prime memberships. eBay also delivered better-than-expected revenue in the quarter. However, its marketplace platform was negatively impacted by an Internet sales tax, which became effective in more US states, as well as reduced marketing spend. Chinese e-commerce giants continued to see solid sales growth thanks to a successful Singles' Day shopping festival and gain from lower-tier markets. In 2019, the China Ministry of Commerce reported retail sales growth of 8.0% and e-commerce growth of 19.5% year over year.

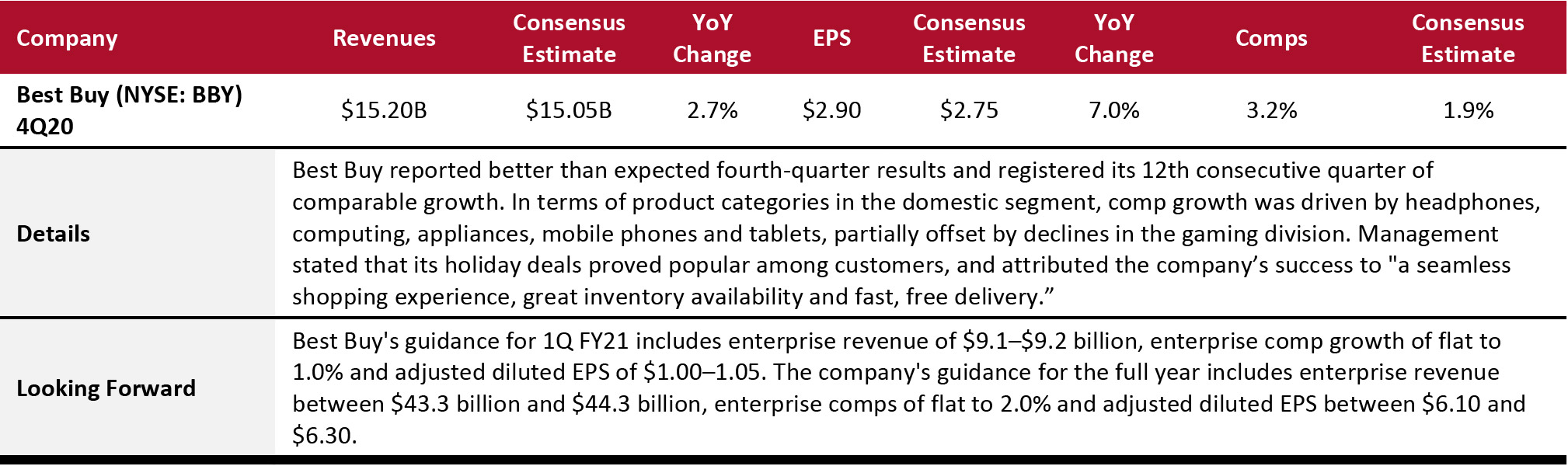

Electronics Retail

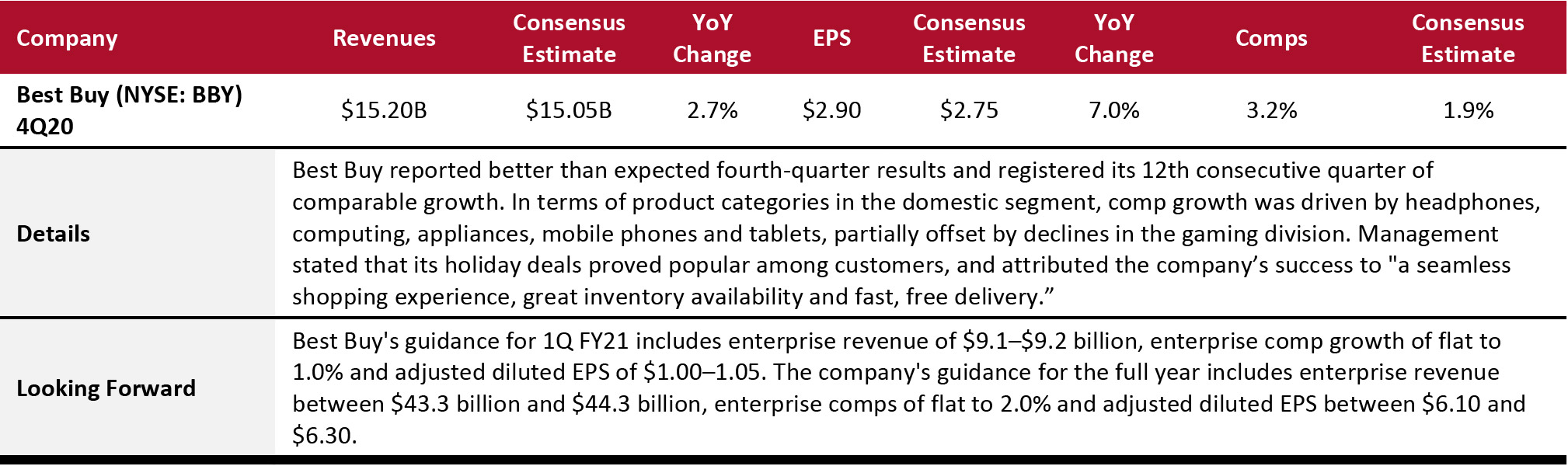

Best Buy reported strong 4Q19 results and beat consensus on revenues, EPS and comps. The largest comp growth product drivers were headphones, computing, appliances, mobile phones and tablets. Management stated that there was continued progress in its “Building the New Blue” strategy, under which it is enhancing its digital shopping platform with new functionality and adapting its marketing strategies to boost customer engagement, with a special emphasis on its mobile app. The company’s initiatives toward improving its digital capabilities focus on catering to customer needs across both online and offline channels.

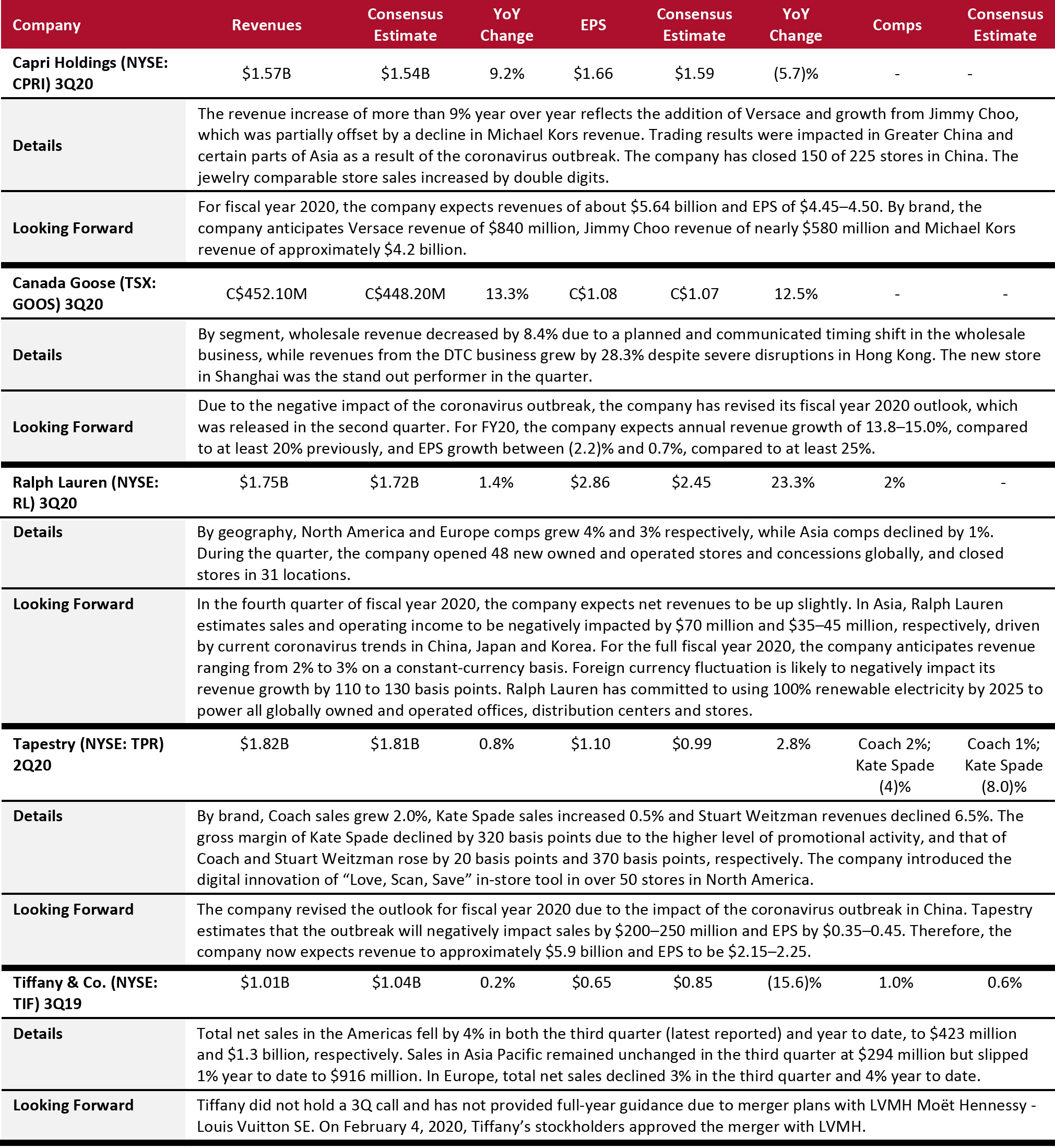

Luxury

The luxury sector had a strong fourth quarter, with 80% of the companies beating revenue consensus estimates. Canada Goose reported double-digit revenue growth, mainly driven by its DTC business. For Capri Holdings, the addition of Versace and growth from Jimmy Choo boosted sales. Ralph Lauren and Tapestry posted low-single-digit revenue growth in the quarter.

Brands are seeing shifts and delays in orders due to the coronavirus. Luxury brands began to see sales impacted by the coronavirus in early February, and with Chinese consumers driving the bulk of industry growth and accounting for 30–40% of some brand sales, the 2020 outlook is muted. Owing to the coronavirus impact, most luxury companies with exposure to China reduced their sales projections for fiscal year 2020.

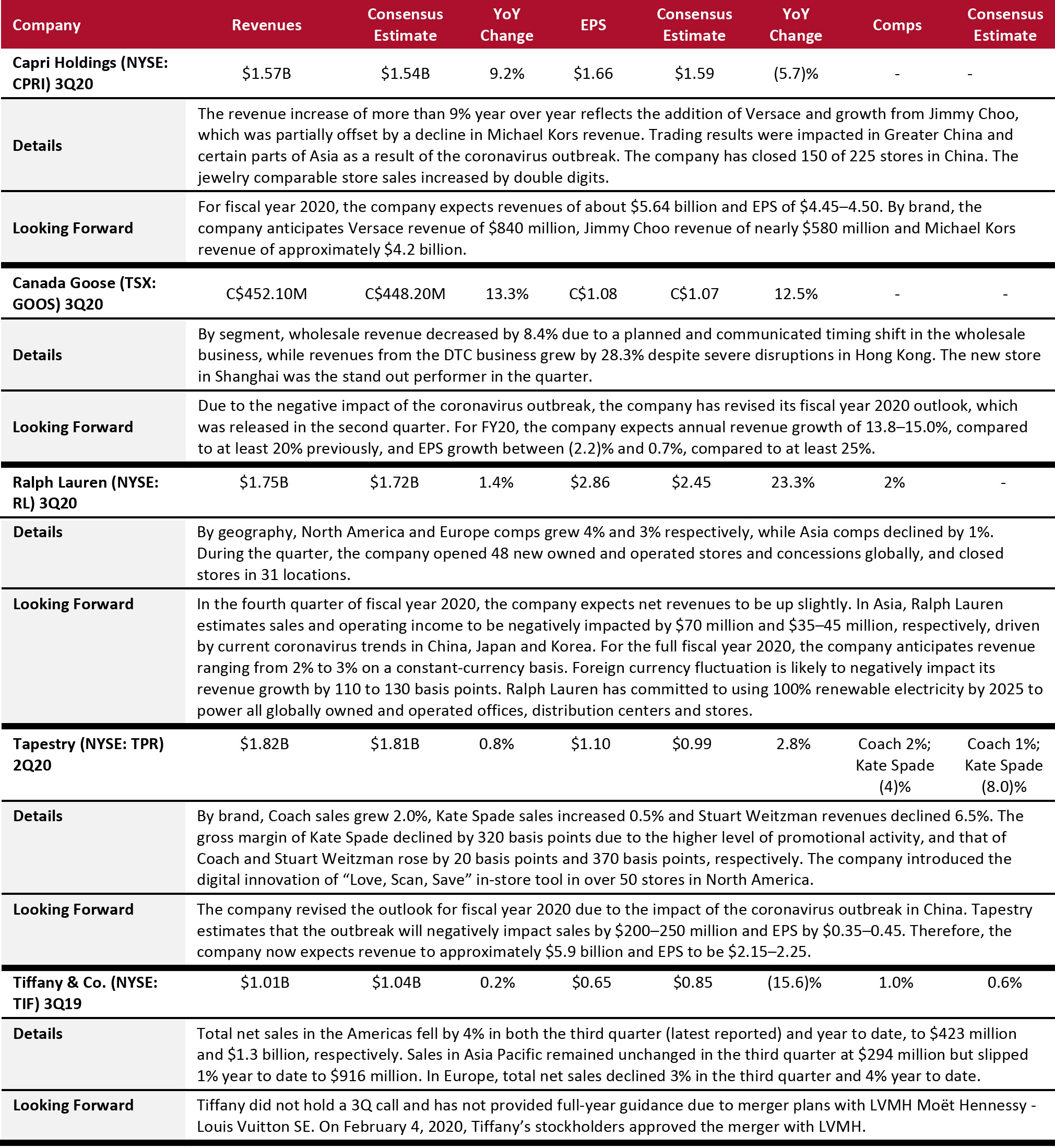

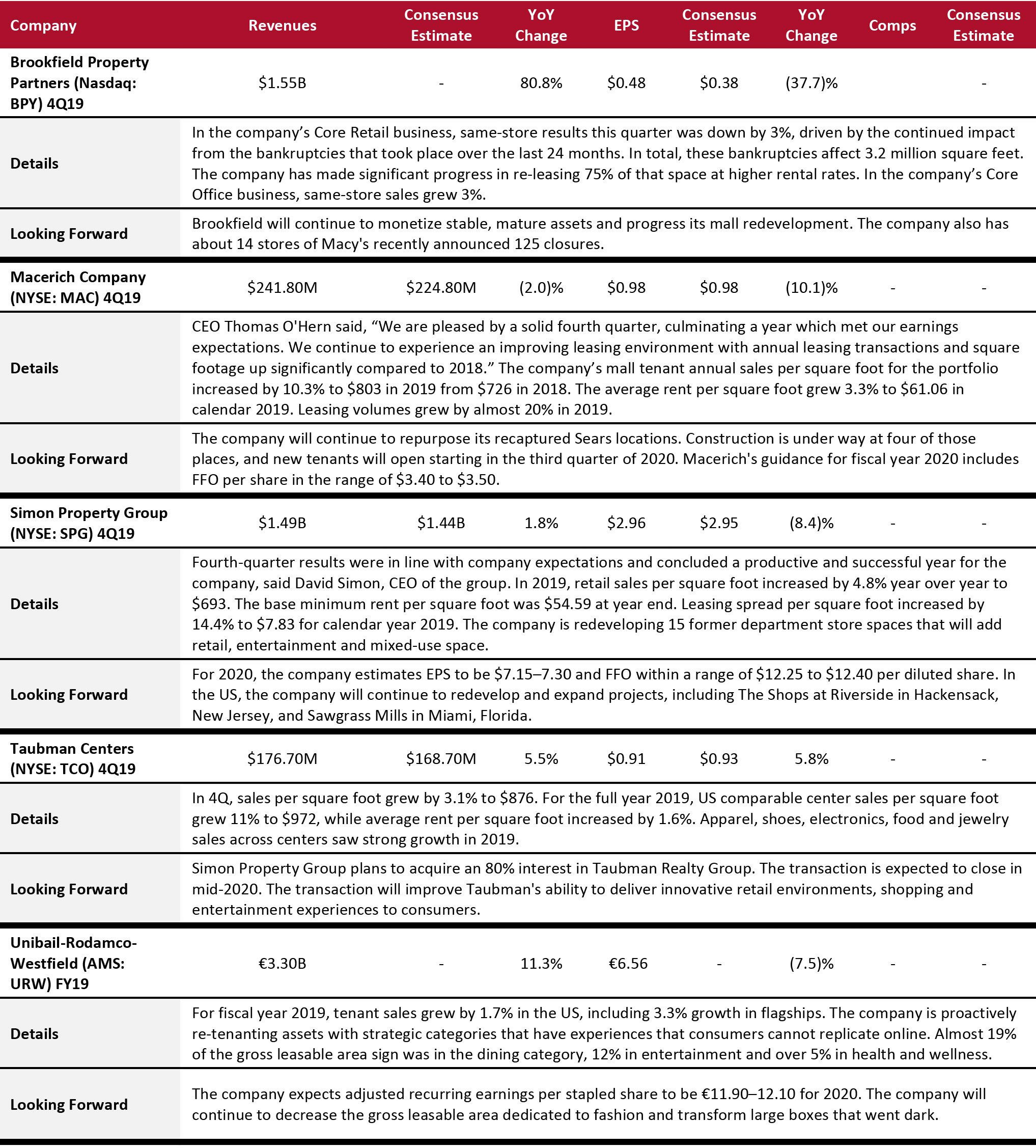

REITs

Overall, the REITs sector witnessed sales-per-square-foot growth in 2019. Developers are reporting higher rental rates for vacant places, but retail bankruptcies negatively impacted same-store sales. Mixed-use properties are on the rise. Real estate companies have redeveloped a number of former big boxes, adding entertainment, dining and other elements to shopping centers, and we believe they will continue to do so in the future.

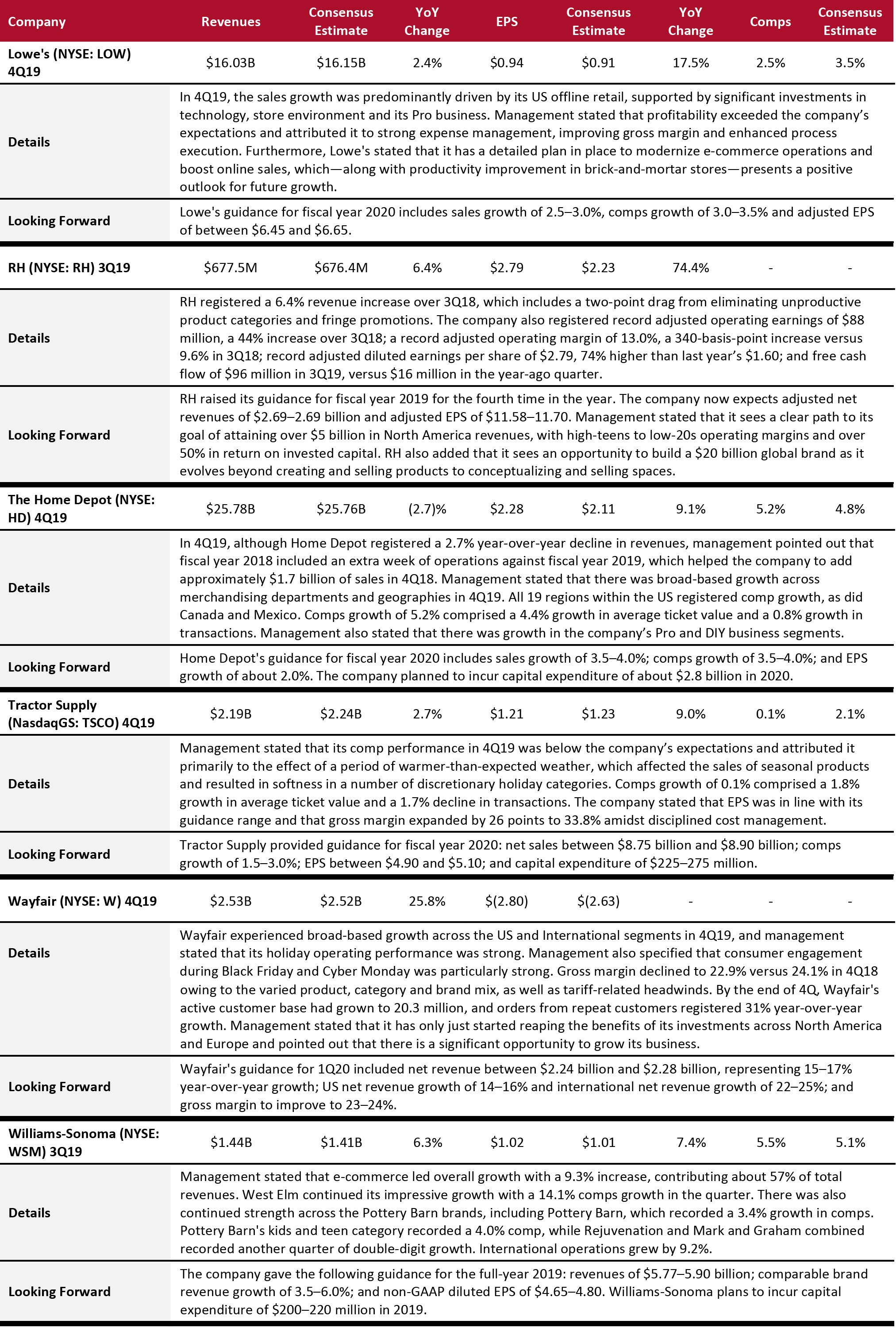

Specialty Retail

Specialty apparel had a strong fourth quarter with more than 80% of the companies covered beating revenue and comp consensus estimates. Nearly every specialty retailer highlighted that making more informed decisions about inventory contributed to growth. Off-price was particularly strong in the fourth quarter. Burlington Stores, Ross Stores and TJX all reported double-digit or high-single-digit revenue growth from the year-ago period, coupled with comparable sales of 3.9%, 4.0% and 6.0%, respectively. Another standout was American Eagle's Aerie brand, which saw comps of 26%. Gap revenues were up and beat consensus, but comps were down 1% overall. Management said that the company saw stabilization in the fourth quarter.

Specialty retailers that reported negative revenues and comps during the period include Ascena, Foot Locker and L Brands. L Brands announced the sale of 55% of its Victoria's Secret business during the quarter, and Foot Locker and Ascena both reported softer-than-expected demand due to a compressed holiday season.

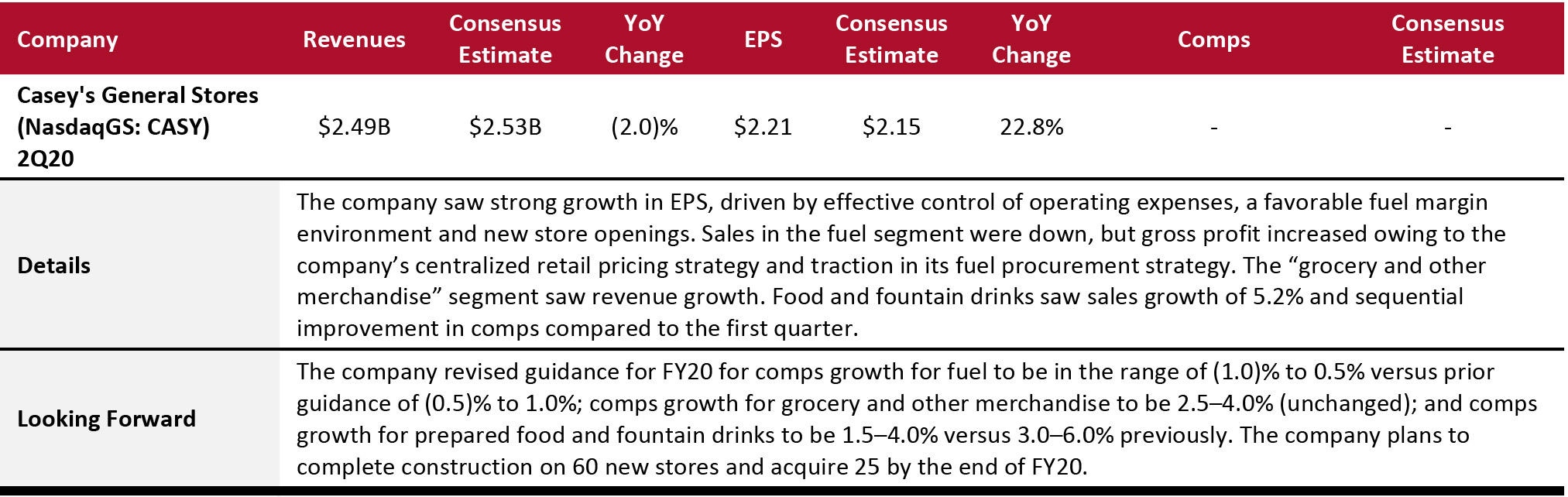

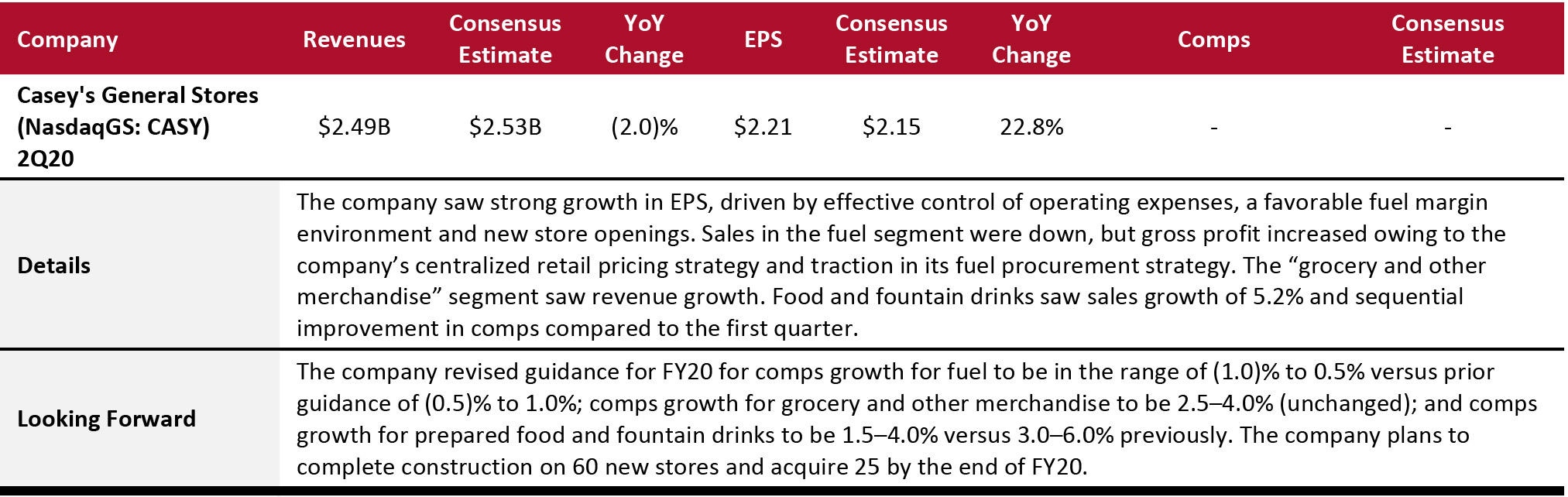

Food, Drug and Mass Retailers: Convenience Stores

Casey's saw its sales increase among all three categories—fuel, grocery and prepared food. Management said that the company is aware of the competitive pricing environment, especially for fuel, and is adopting price optimization and procurement programs to tackle this. Casey's launched a new customer reward system in January and is hoping to see it bring positive results. The company reported that its customer base has increased to 6.2 million as of the second quarter of fiscal year 2020.

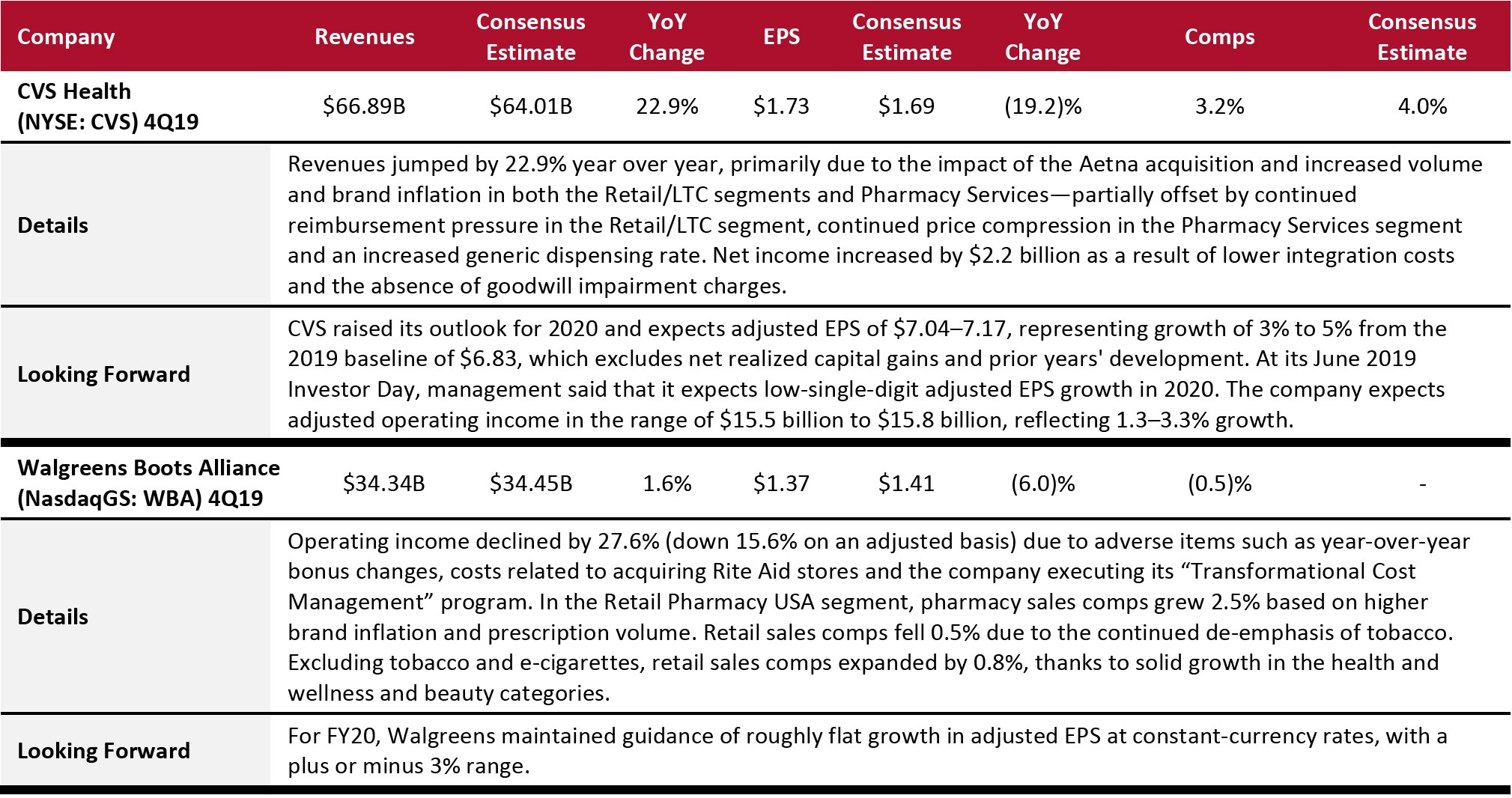

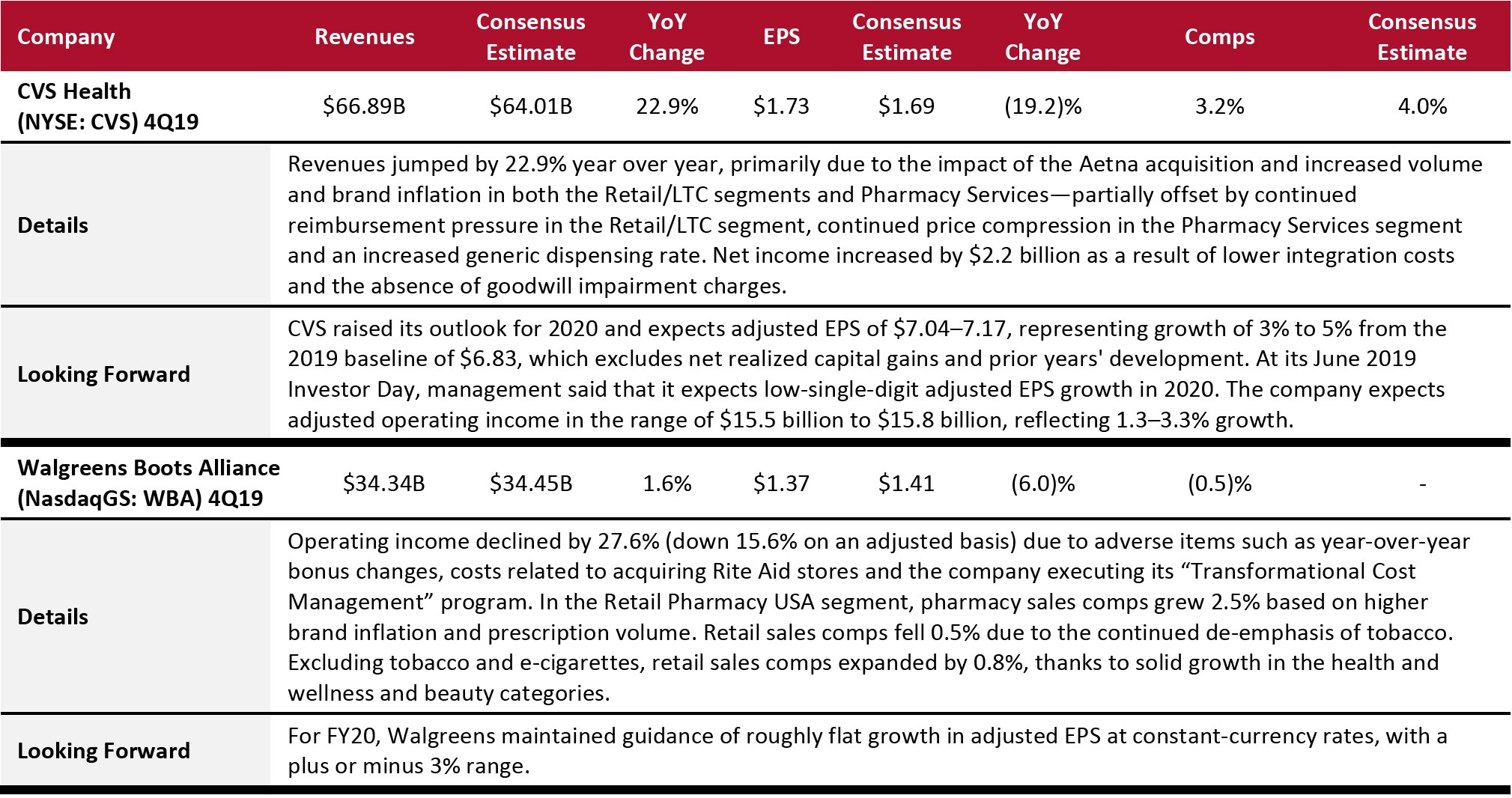

Food, Drug and Mass Retailers: Drugstores

CVS and Walgreens both saw sales growth during the quarter, with CVS posting a 22.9% increase driven by the Aetna acquisition. CVS plans to expand its healthcare initiative with the opening of 600 HealthHUBs in FY20 versus 50 at the end of FY19, and this may help dissipate the regular headwinds that the company faces across its segments in terms of pricing and reimbursement pressures.

During the quarter, Walgreens’ sales performance was softer as the company continues to cut costs as part of its “Transformational Cost Management program” and incur costs related to the Rite Aid acquisition. The company also continues with its strategy to tap into the health and wellness segment: Walgreens offered Jenny Craig weight-loss program services at 100 store locations by the end of January and opened two of a planned five VillageMD primary care clinics during the quarter.

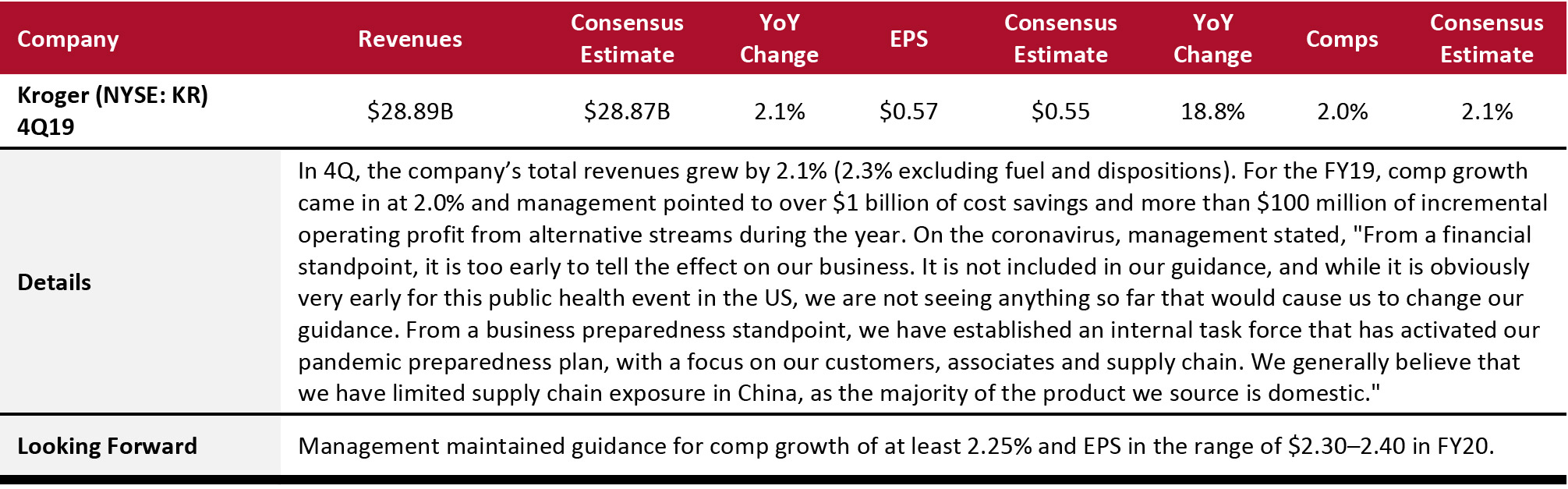

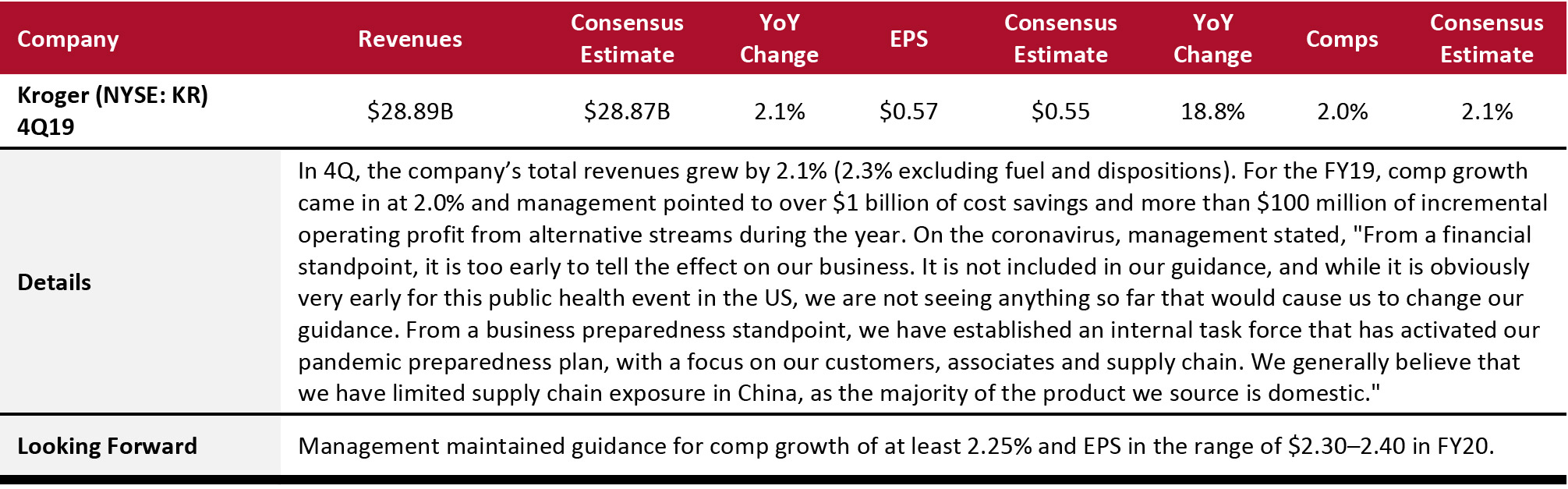

Food, Drug and Mass Retailers: Food Retailers

Excluding fuel and dispositions, Kroger saw a 2.3% rise in total revenues, with comp growth accelerated again, to 2.0%. Digital sales were up 22%. Management said that the company’s 2019 performance is consistent with its long-term financial model. Kroger is seeing improving trends in its supermarket business. Management said that its strategic framework program “Restock Kroger” will continue to enhance the core business, deliver strong shareholder return and achieve sustainable growth in the future.

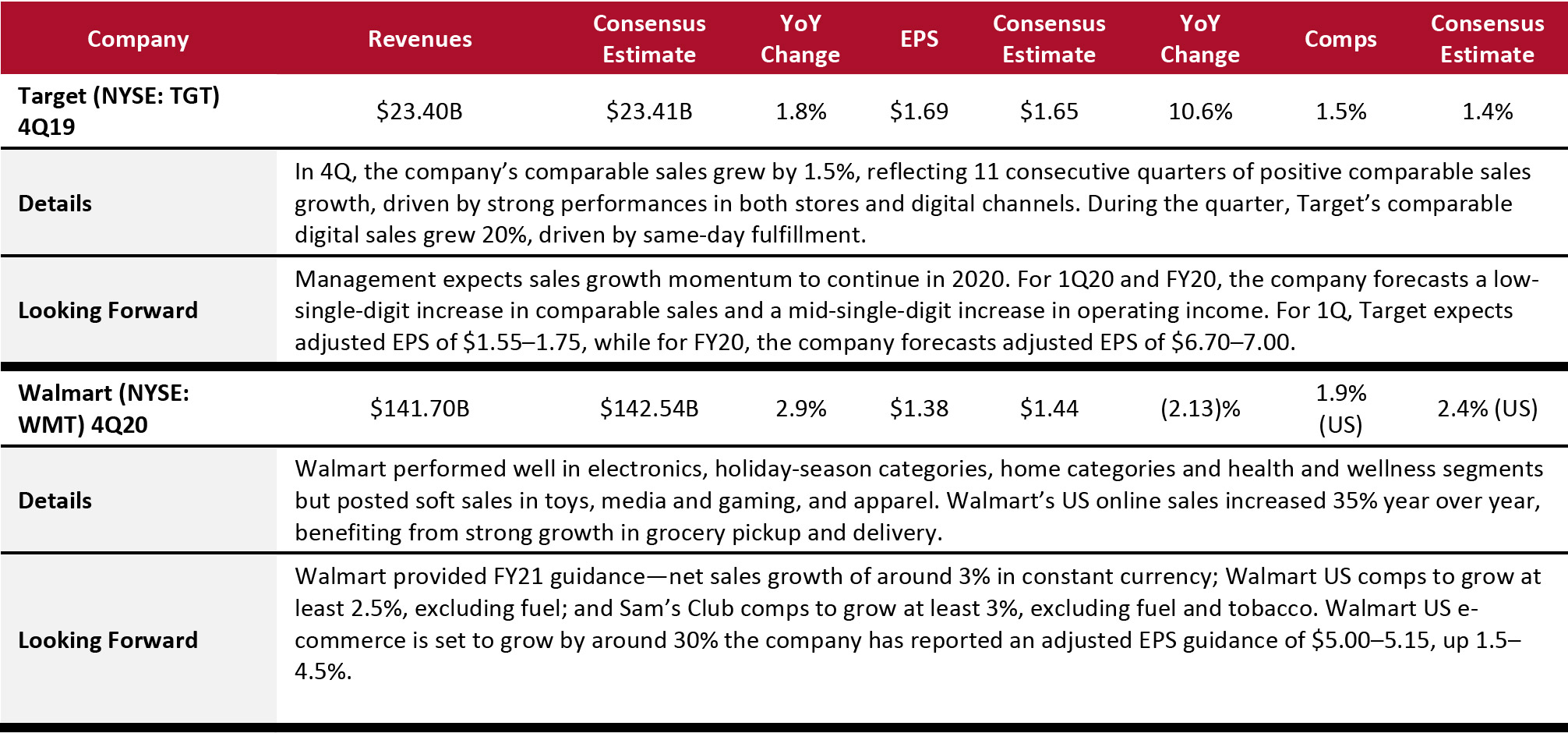

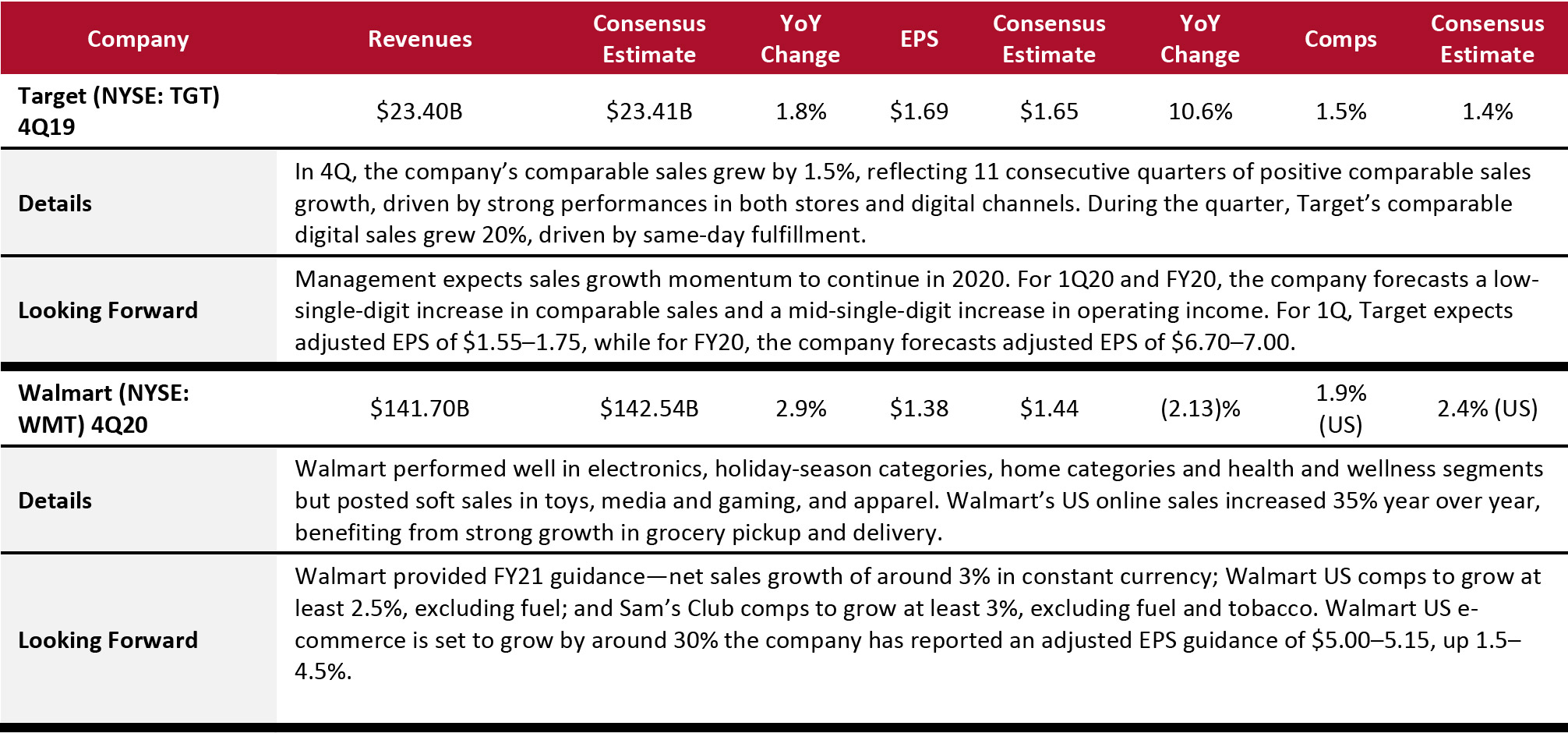

Food, Drug and Mass Retailers: Mass Merchandisers

Target and Walmart both saw sales growth in e-commerce, driven by faster fulfillment offerings. In 4Q19, Target’s same-day services (Order Pick Up, Drive Up and Shipt) accounted for more than 80% of comparable digital sales growth. As of March 2020, Target had more than 100,000 customers signed up to Shipt and had signed on almost 100 other retail brands. Management believes that growing Shipt inside and outside Target represents a big opportunity.

Walmart’s US online sales increased by 35%, benefiting from strong growth in grocery pickup and delivery. US comps increased 1.9% (equating to 6.0% on a two-year stacked basis) with continued strength in food and consumables. Walmart experienced some softness in Chile, Canada and the UK.

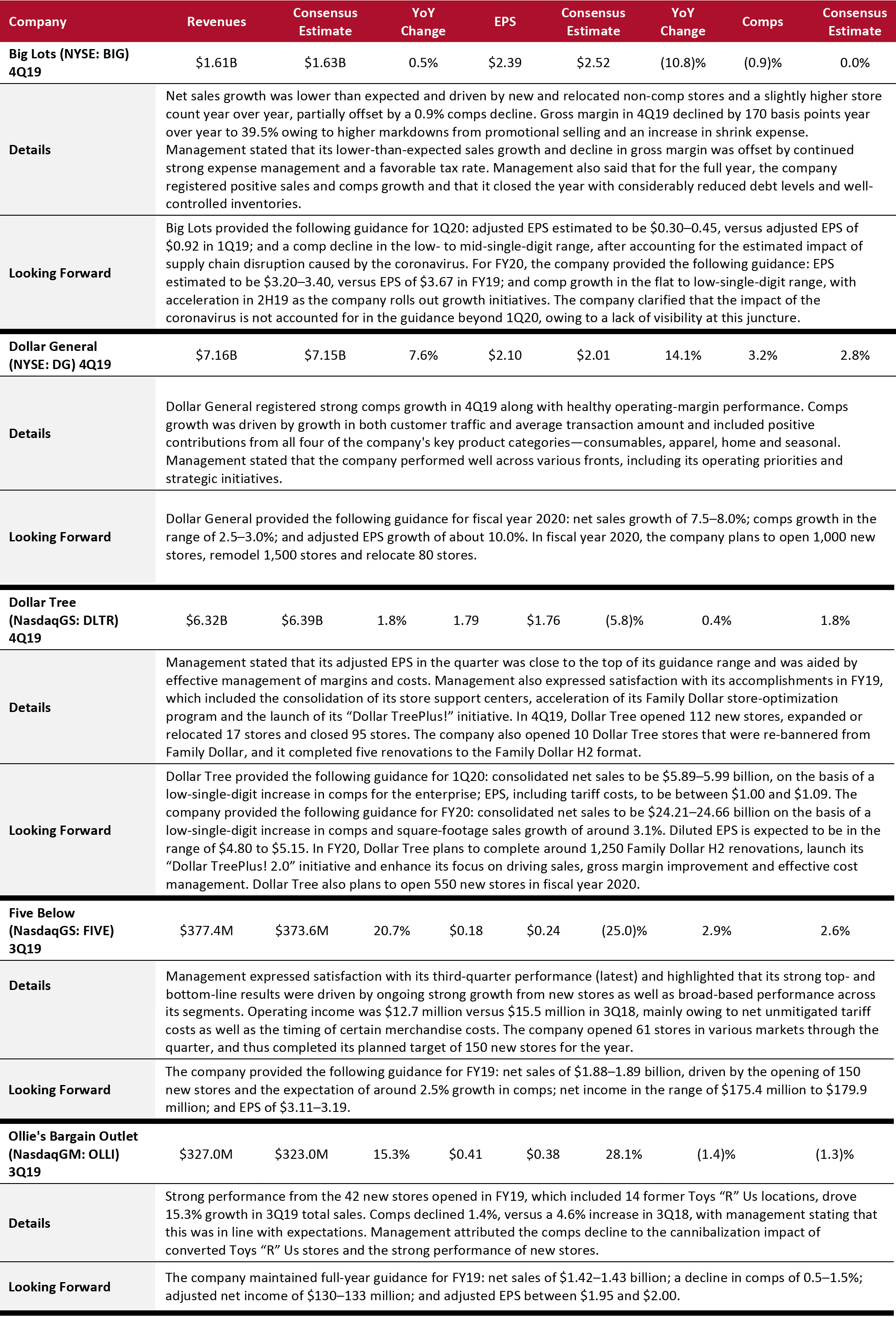

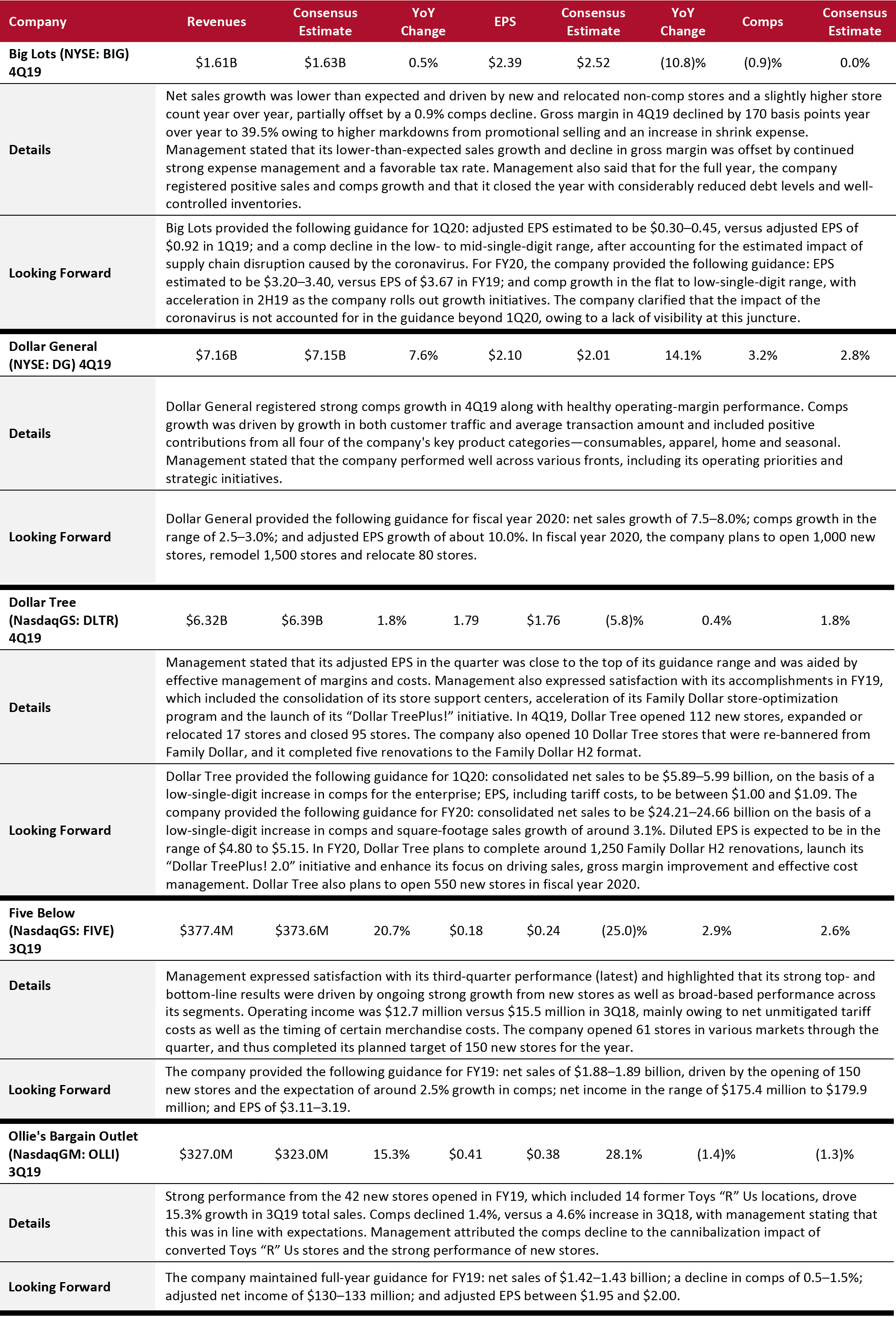

Food, Drug and Mass Retailers: Discount Stores

Dollar General was the star performer among discount stores, beating consensus on revenue, EPS and comps. Dollar Tree missed consensus on revenues and comps, but beat on EPS. Big Lots missed consensus on revenues, comps and EPS. Dollar stores overall had a strong quarter with both Dollar General and Dollar Tree reporting positive sales and comps growth. Both companies opened a number of stores during the quarter and are set to continue their store expansion in fiscal year 2020. Dollar Tree has been making significant progress in its Family Dollar store-optimization program.

Food, Drug and Mass Retailers: Warehouse Clubs

Warehouse clubs experienced a relatively solid quarter, with Costco beating consensus on revenues and EPS, whereas BJ's matched consensus on revenues and EPS. However, BJ's comps growth of 0.3% fell short of consensus.

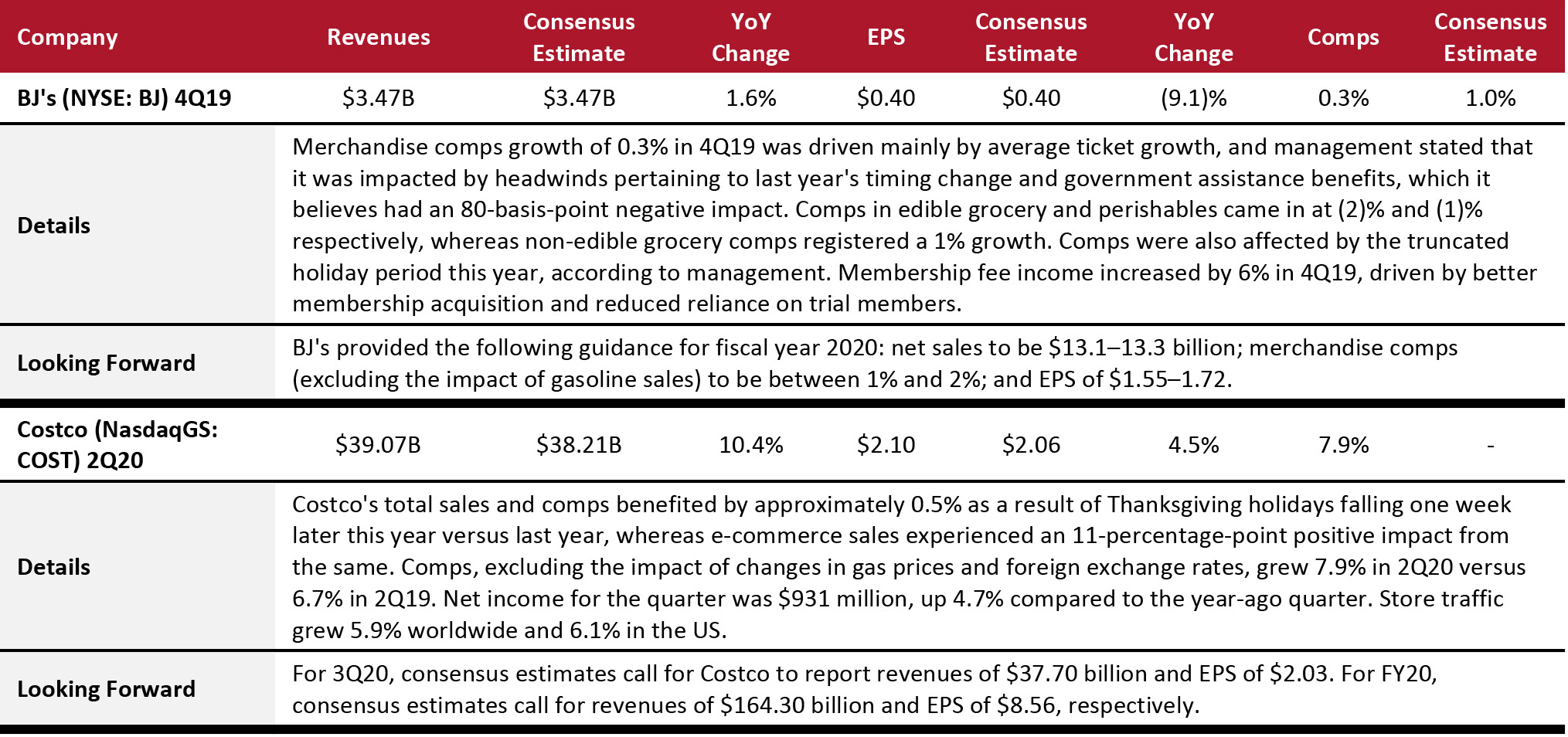

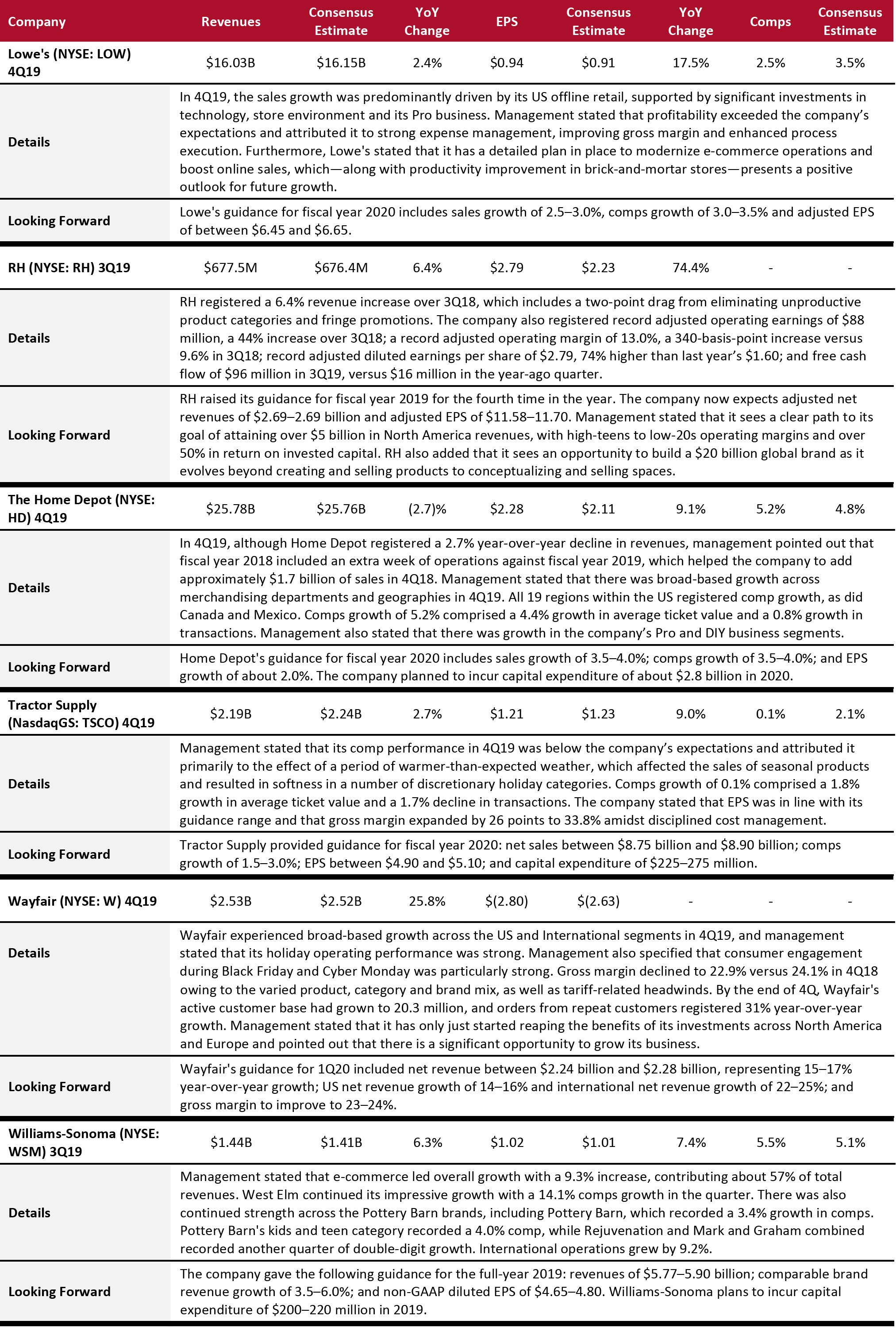

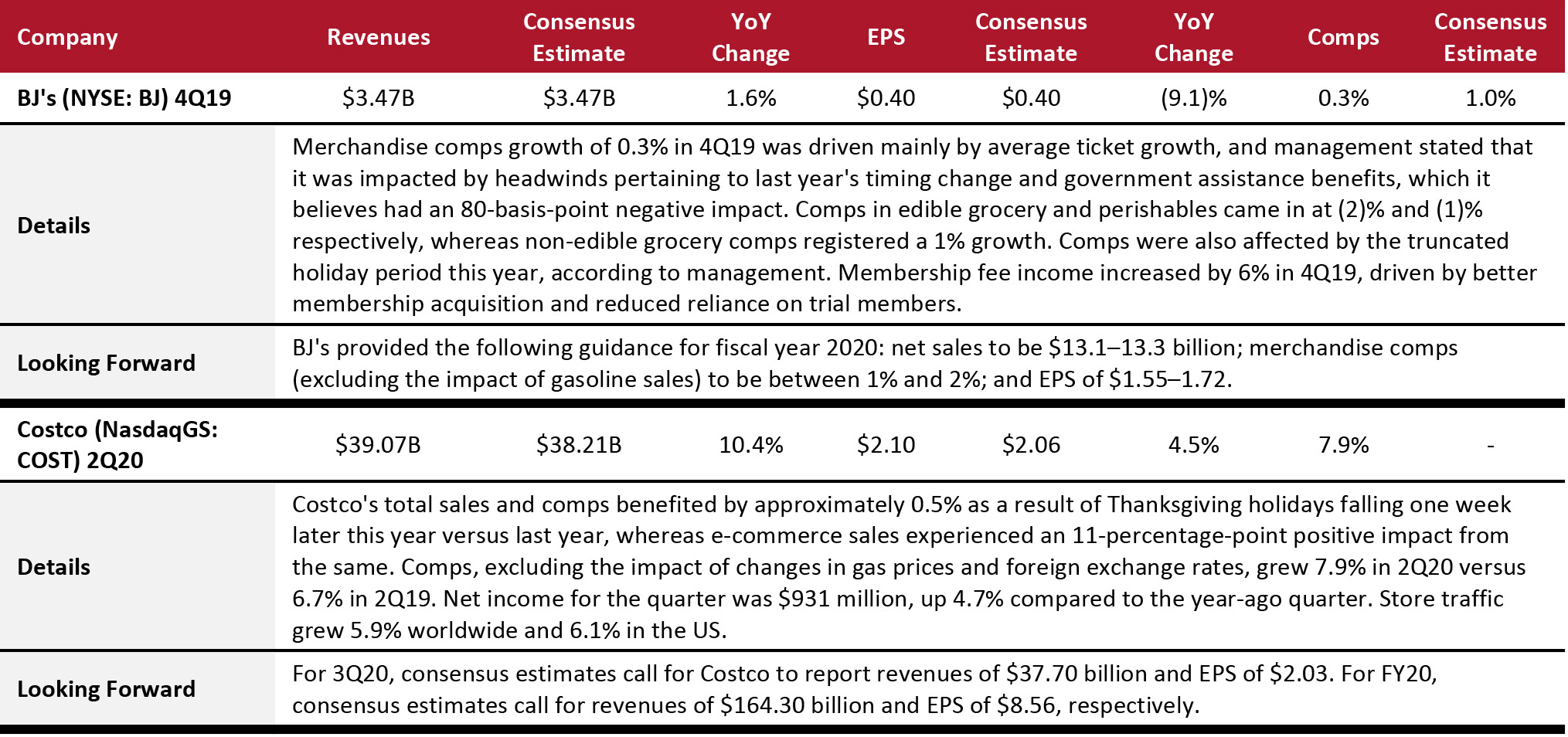

Home and Home-Improvement Retailers

The home and home-improvement sector experienced another mixed quarter, with two of the four companies covered beating consensus on revenues. Home Depot is the only retailer that beat consensus on revenues, comps and EPS.

Although Lowe's missed consensus on revenue growth, its recent strategy to enhance its focus on growing the Pro (professional contractor) business is helping to boost the company’s US sales growth—Pro comps beat that of DIY in 4Q19. Home Depot has also grown its Pro business and announced that it had onboarded 1 million Pro customers by the end of 4Q19. Tractor Supply missed consensus on revenues, comps and EPS.

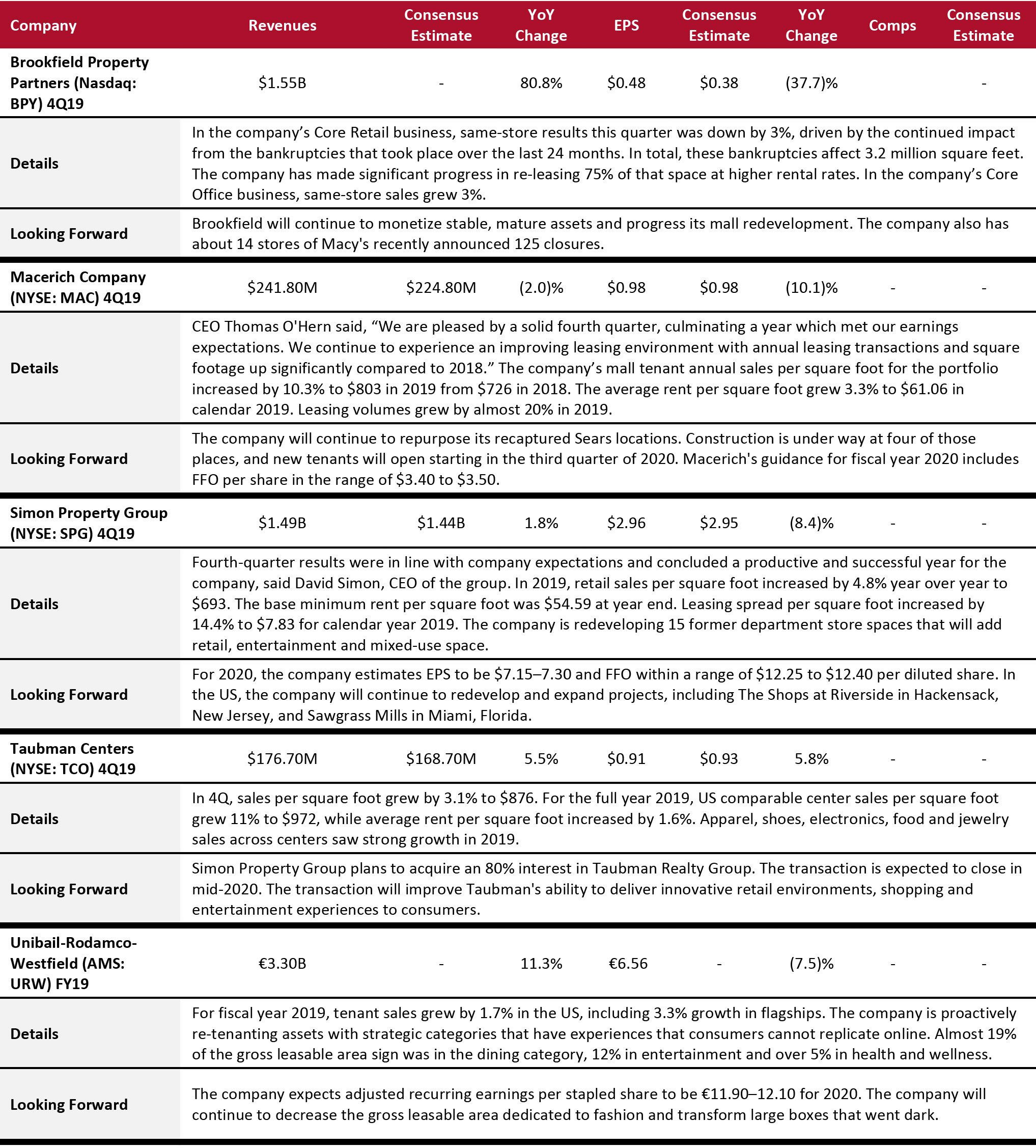

Key Insights

Most retail sectors posted strong results in the fourth quarter of 2019. Brands and retailers are improving their digital and omnichannel capabilities, and some are leveraging DTC models and private labels. Exchange-rate fluctuations and volatility in the macroeconomic environment continued to impact companies across sectors.

From February, brands and retailers began to see negative impacts on sales due to the coronavirus outbreak. US retailers have witnessed supply chain disruptions, such as orders shifting and being delayed. Most US retail companies with exposure to China reduced sales projections for the current year; some noted reduced travel trends to international flagship cities would impact results as well. Moreover, we are seeing Western markets, including the US, move closer to lockdown mode, which will shift the negative impacts from supply chains and demand in Asia to demand in domestic markets. So far, none of the US retailers’ and brands’ guidance updates have factored in such substantial disruption. We expect the coronavirus outbreak to have a significant impact on the next-quarter earnings for many of these companies.