Introduction

Our quarterly

US Retail Inventory Tracker reviews inventories held by US retailers in the

Coresight 100, our global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past nine quarters.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported results for the third quarter of fiscal 2021 (3Q21), ended September 30, 2021.

In recent months, strong US consumer demand has supply challenges due to bottlenecks in sourcing, shipping and domestic supply chains. In July 2021, US retail sales grew 9.6% year over year and 21.4% when compared to 2019 values. Similarly, in August 2021, US retail sales increased by a strong 12.0% year over year and by 19.7% from the corresponding quarter of 2019, reflecting consumers’ willingness to spend and a strong back-to-school season. September 2021 saw year-over-year retail sales growth decelerate to a still-strong 11.1%, with 25.8% growth on a two-year basis (compared to the corresponding quarter in 2019). In October, US retail sales continued to witness a double-digit year-over-year increase, fueled by strong growth in several sectors, and sales increased by 23.2% on a two-year basis. US retail traffic saw robust growth of 31.4% year-over-year, driven by early holiday shopping. In

November, US retail sales increased by a strong 14.8% year over year and 24.8% on a two-year basis, supported by the record-high inflation experienced during the month.

US retail traffic saw an improvement in traffic trends, with an increase of 39.3% year-over-year in November, driven by Black Friday sales.

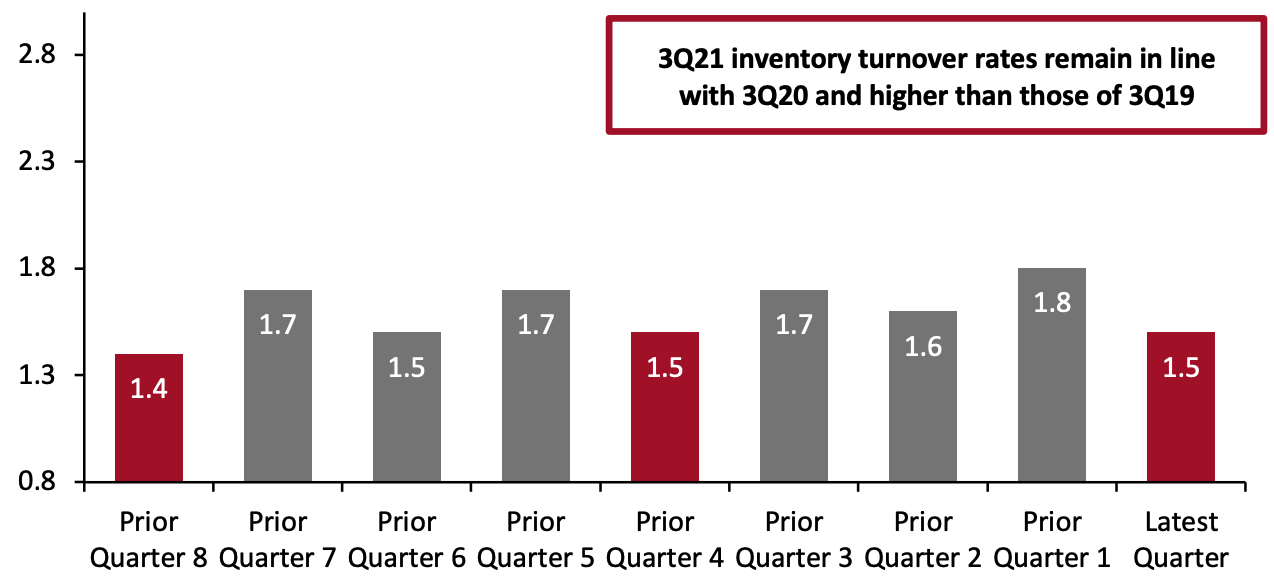

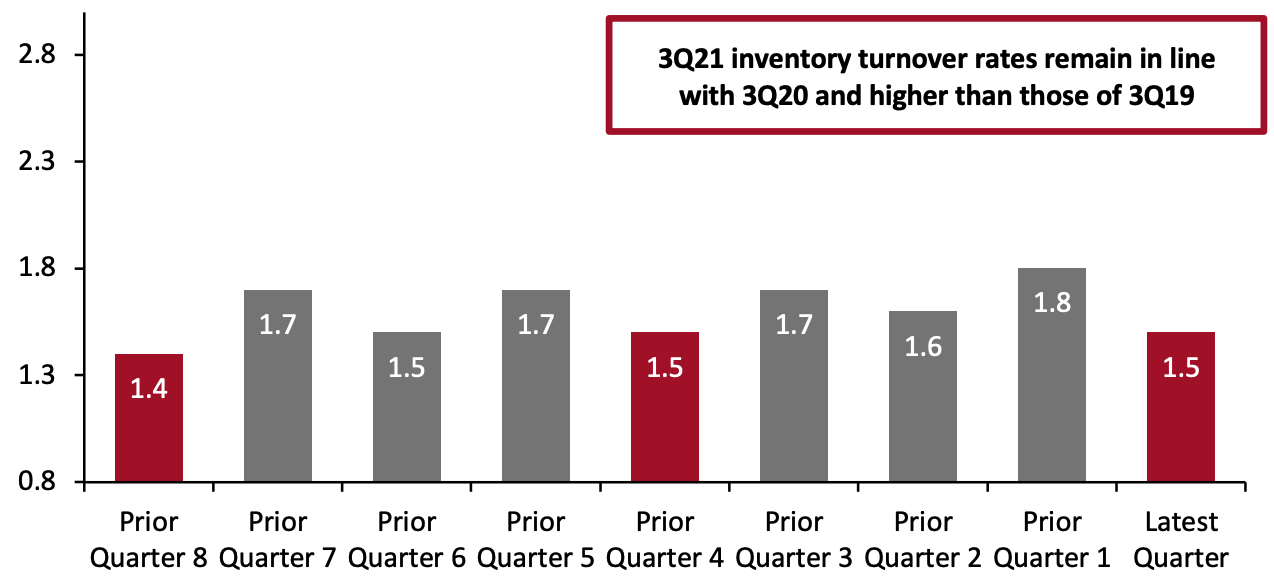

Overview: Inventory Turnover Rates Increase Year over Year and on a Two-Year Basis

Most retailers covered here saw their inventory turnover rates remain in-line with the previous year (3Q20) and increase on a two-year basis (pre-pandemic 3Q19).

Figure 1. Inventory Turnover Ratios by Quarter: All Retailers

[caption id="attachment_138683" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

The latest quarter continued to see a strong rebound in inventory turnover, with buoyant consumer demand reflecting in a store traffic recovery as well as still-elevated digital sales.

Apparel specialty retailers: Apparel specialists’ inventory turnover ratios increased by 0.9% on a two-year basis but declined by 7.6% year over year. While athleisure, casualwear and intimates remained strong catalysts for these retailers, they are also witnessing a rebound in demand for dresswear as consumers return to socializing outside of their homes.

Off-price retailers: Off-pricers maintained their growth momentum from the previous quarter, with inventory turnover ratios increasing by 17.7% on a two-year basis. However, these retailers saw a decline of 0.9% year over year.

Beauty retailers: Beauty retailers saw their inventory turnover ratio decline by 1.5% year over year or by 6.6% on a two-year basis. The retailers saw increased demand for fragrance, haircare and skincare products, but weak demand in the overall makeup category.

Department stores: Department stores’ inventory turnover ratios increased by 6.6% on a two-year basis but declined by 9.4% year over year. These retailers are witnessing strong trends in apparel and footwear categories including activewear, denim and dresses, and see these categories as a key part of their strategy going forward.

Discount stores: Discount retailers reported an 8.8% year-over-year decline in inventory turnover ratios. However, on a two-year basis, these retailers saw inventory turnover ratio growth of 8.3%.

Drugstores: Drugstore retailers’ inventory turnover ratios increased by 9.5% year over year or by 9.7% on a two-year basis.

Electronics retailer: The one covered electronics retailer, Best Buy, saw a 12.0% year-over-year decline in its inventory turnover ratio. However, compared to 3Q19, Best Buy’s inventory turnover ratio grew 8.9%. The company saw demand spike in appliances, home theater and mobile phones categories.

Food and grocery retailers: Food and grocery retailers’ inventory turnover ratios increased by 3.1% year over year or by 7.4% compared to 3Q19.

Home-improvement retailers: Home-improvement retailers witnessed 30.0% year-over-year decline in inventory turnover ratios, but 27.2% growth on a two-year basis.

Luxury retailers: The luxury category is seeing a substantial recovery, with luxury retailers reporting an inventory turnover ratio of 15.5% year over year. However, on a two-year basis, it declined by 4.3%.

Mass merchandisers: Mass merchandisers reported a 3.5% year-over-year decline in their inventory turnover ratios but an increase of 1.6% on a two-year basis.

Warehouse clubs: Wholesale Clubs’ inventory turnover ratio increased by 9.9% year over year or by 22.2% on a two-year basis.

Figure 2. Inventory Turnover Ratios by Quarter

[wpdatatable id=1576]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

*Excludes Wayfair, an outlier

The absolute inventory turnover ratios have been rounded off to one decimal

Source: Company reports/Coresight Research

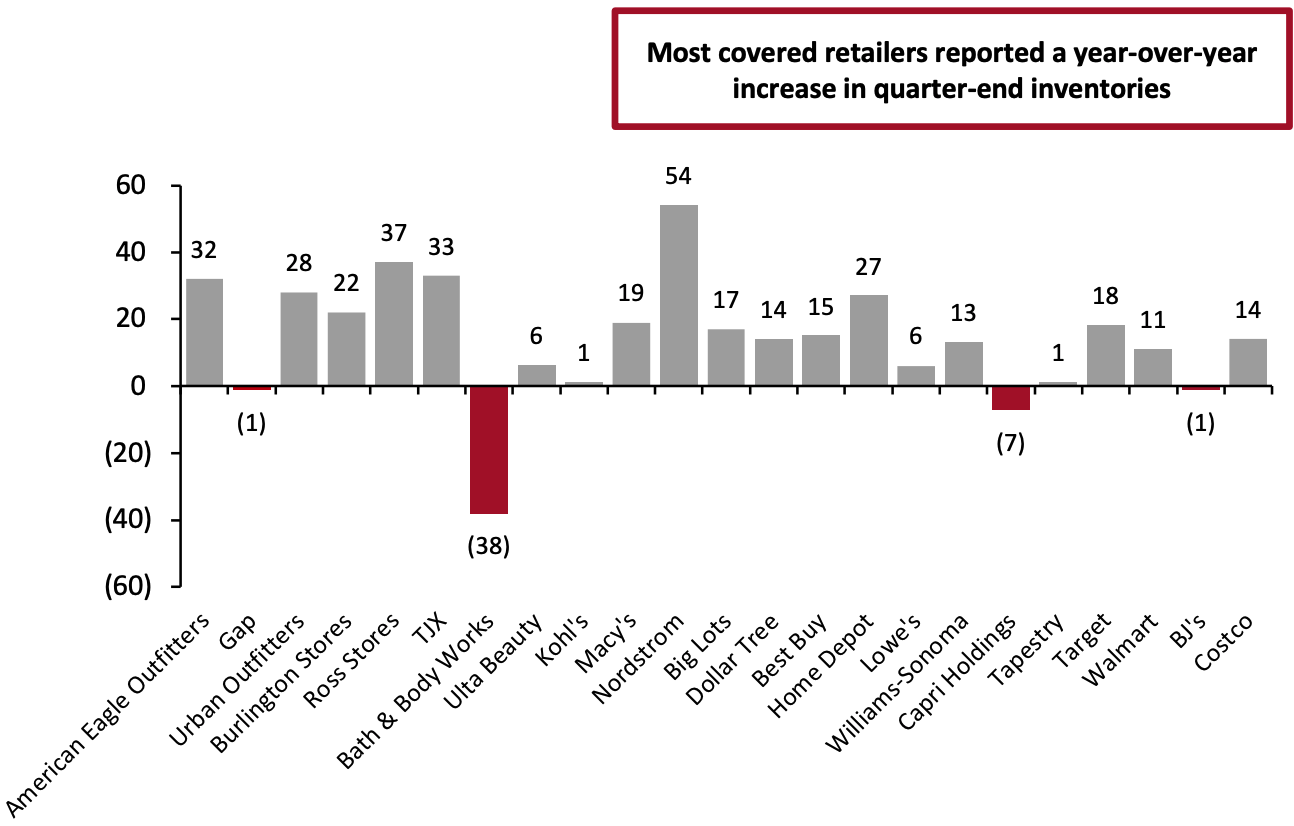

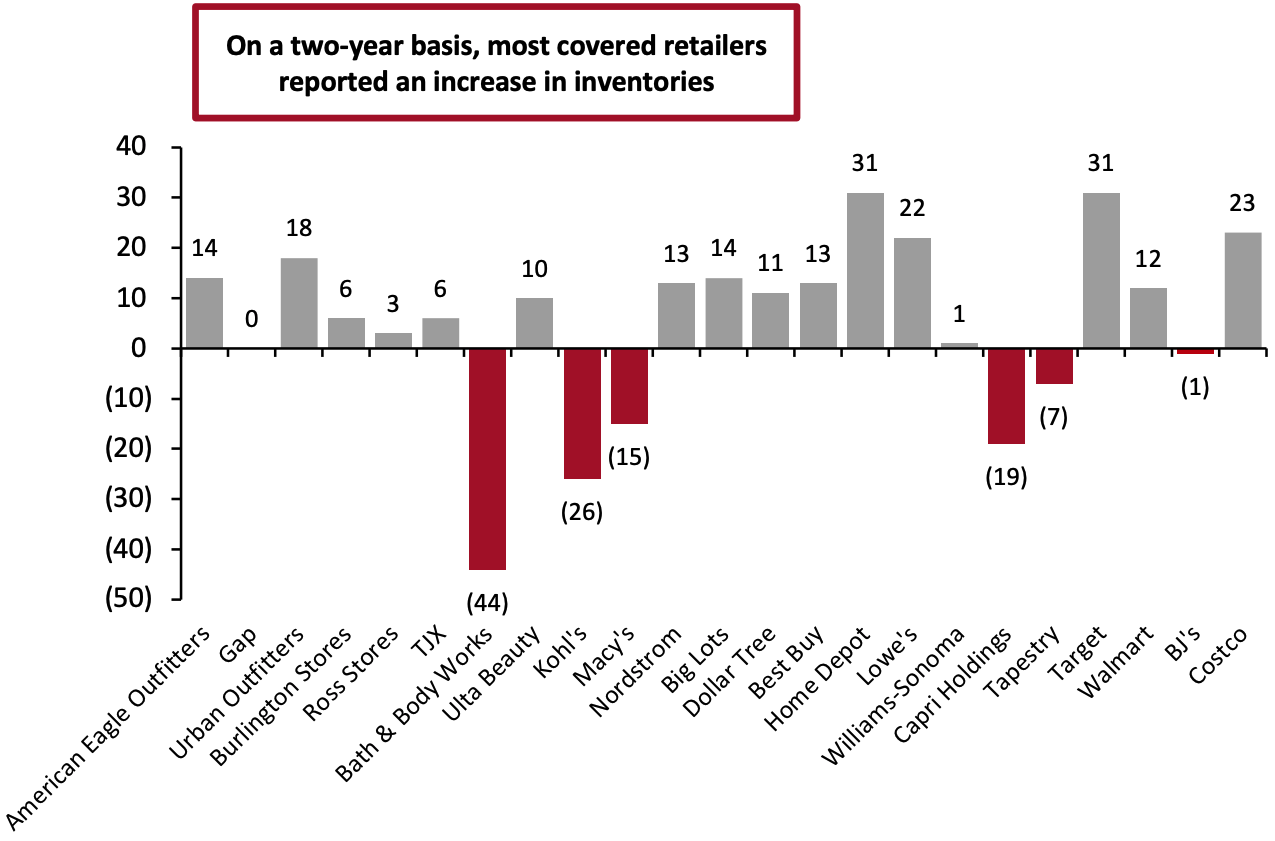

Sector and Company Overview

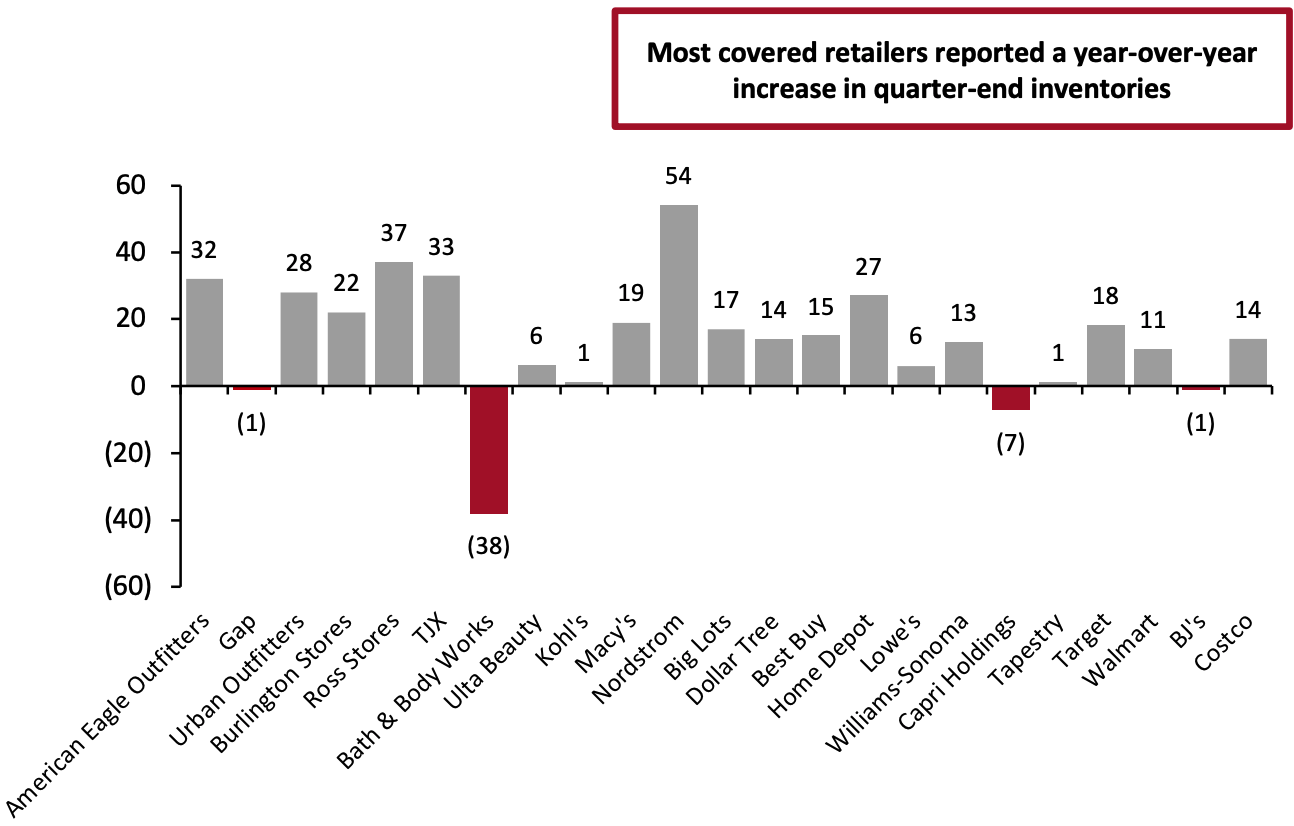

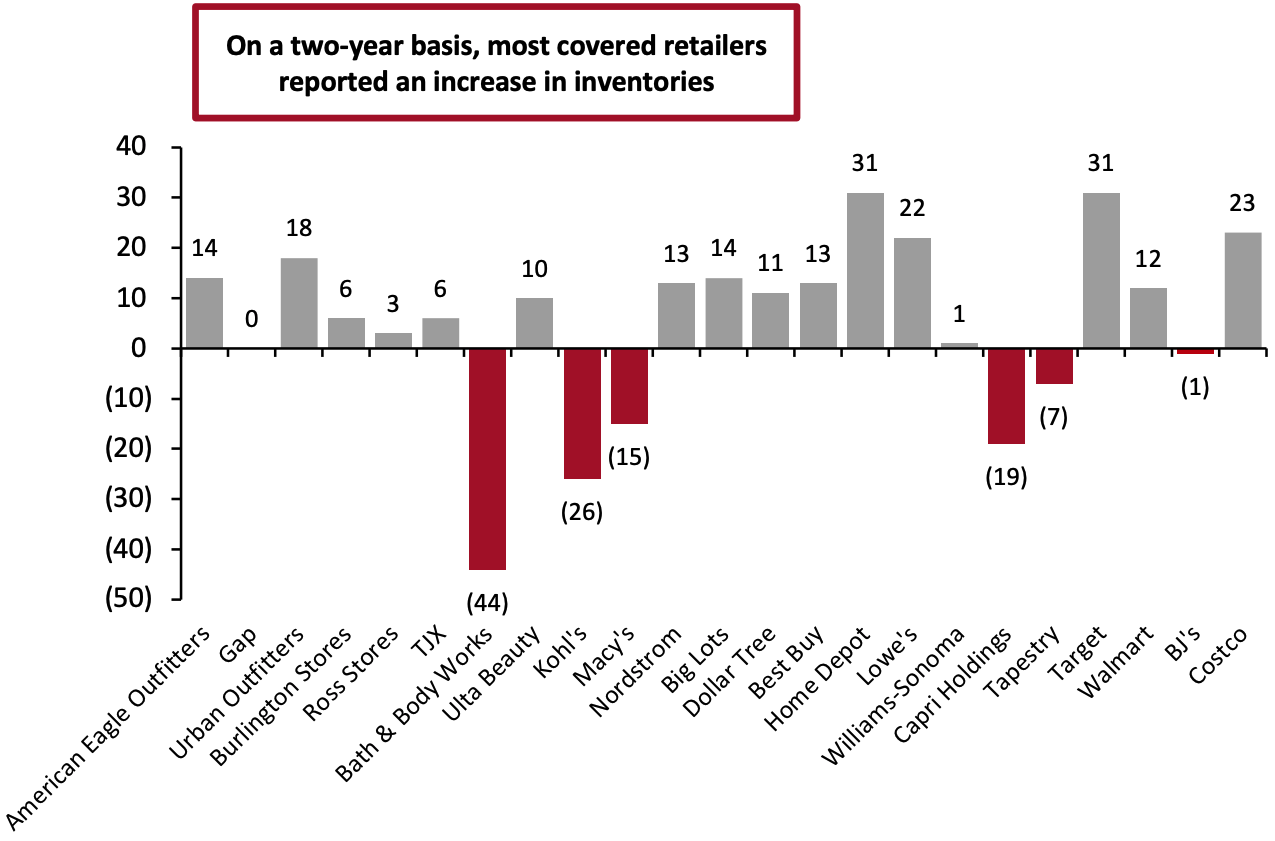

Despite recent supply chain challenges, most of our covered retailers had hiked inventories both year over year and versus two years earlier, as of the end of the latest quarter. We look at the inventory levels of selected retailers across sectors and assess why inventory levels changed from the year-ago period and on a two-year basis.

Figure 3. Latest-Quarter Inventory Values of Covered US Retailers: YoY % Change

[caption id="attachment_138663" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Figure 4. Latest-Quarter Inventory Values of Covered US Retailers: % Change from Two Years Prior

[caption id="attachment_138664" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

On a year-over-year basis, all covered apparel specialists witnessed an increase in quarter-end inventories, except Gap. However, on a two-year basis, Dick’s Sporting Goods and Foot Locker witnessed single-digit declines in inventories as they continue to ramp up their sourcing optimization efforts.

|

Commentary |

| American Eagle Outfitters |

The company ended 3Q21 with inventory up 32.1% year over year or up 14.3% on a two-year basis.

COO Michael Rempell said, “With greater control over inventory placement, shipments per order were down dramatically. This gives us the ability to drive substantially greater sales and margin on far less inventory, create more precision in our inventory allocation decisions and deliver products to customers both faster and at a lower cost.”

Management said that the American Eagle (AE) brand essentially had no disruption. However, Aerie's leggings category experienced uneven inventory flows when factory closures in Vietnam created product delays. As a result, the company chose to air freight the product to ensure sufficient stock for the holidays. |

| Gap

|

At quarter-end, the company’s inventory was down 0.9% year over year and was flat compared to fiscal 2019.

Management said that the backlog at US ports deteriorated meaningfully from the first half of the year, resulting in up to three continuous weeks of unanticipated delays to fall product deliveries throughout the quarter.

CFO Katrina O’Connell said, “Our production capacity is largely globally diversified, approximately 30% of our product is produced in Vietnam, where factory closures extended to over 2.5 months, significantly longer than initially anticipated. So, despite strong sell-through trends, we lost volume as a result of limited inventory.”

For the next quarter, Gap expects year-over-year inventory growth to be in the high-single-digits in anticipation of volatility related to pandemic-related supply chain disruptions. |

| Urban Outfitters

|

The company’s inventory was up 28.2% year over year or up 18.0% on a two-year basis.

Management said that a lack of inventory in the first half of the quarter negatively impacted store sales. In North America, the company saw tight inventory levels, especially in apparel, accessories and shoes due to supply-chain challenges. In Europe, Urban Outfitters experienced fewer delays in inventory receipt.

CFO Melanie Marein-Efron said, “The current supply chain challenges brought on by disruptions in production and the global transportation network have resulted in delayed inventory receipt flow. As a result, we are continuing to strategically place earlier inventory positions in areas with lower fashion risks such as the home category. We believe these factors may elevate our inventory position at the end of the fourth quarter versus two years ago.” |

Off-Price Retailers

All covered off-price retailers reported higher inventory turnover ratios than in the year-ago period and on a two-year basis. Most of these retailers used reserve or packaway inventory to chase high demand during the quarter.

| |

Commentary |

| Burlington Stores |

The company’s total inventory was up 22.2% year over year at the end of the quarter or grew 5.5% on a two-year basis.

On a comparable store basis, the company’s in-store inventory turnover fell by 24%. Reserve inventory, which includes stock that is being stored for later release (either later in the season or in a subsequent season), comprised 30% of total inventory versus 21% in the 2019 period.

At the end of the fourth quarter, the company expects in-store inventories to decrease by mid-30%. Over the coming months, Burlington Stores expects a very favorable buying environment as other retailers cancel late deliveries. |

| Ross Stores

|

The company’s total inventory was up 36.8% year over year or grew 2.9% on a two-year basis. Average store inventory declined by 1% relative to 3Q19.

Packaway inventory levels were 31% of total inventory versus 3Q19’s 39%, as the company uses packaway inventory to support ahead-of-planned sales. |

| The TJX Companies

|

The company ended the quarter with inventory up 32.7% year over year or up 5.7% on a two-year basis.

The company noted that the inventory levels on a per-store basis improved in

the third quarter versus both the first and second quarters. Management said that the company is in an excellent inventory position to flow goods to its stores and it is confident that its associates are in place to meet sales demand. |

Beauty Retailer

Bath & Body Works witnessed a decline in inventory levels both year over year and on a two-year basis, while Ulta Beauty reported higher inventories year over year and on a two-year basis.

| |

Commentary |

| Bath & Body Works |

The company’s total inventory was down 38.4% year over year or down 43.5% on a two-year basis.

CEO Andrew Meslow said, “We are satisfied with our inventory position as we head into holiday. While we are better positioned than most retailers due to our primarily domestic supply chain, we are not immune to challenges. We have proactively managed production and promotions throughout the third quarter and did not experience significant out-of-stocks. And we do expect our assortments to be full and abundant for holiday. We are partnering closely with our vendors to support production needs in order to continue to meet customer demand.” |

| Ulta Beauty |

The company’s total inventory increased by 5.5% year over year or by 9.7% on a two-year basis, reflecting the impact of the opening of 40 new stores as well as proactive efforts by the company to mitigate holiday sales risk due to anticipated supply chain disruptions. |

Department Stores

On a two-year basis, most covered department stores witnessed a decline in inventory levels at the end of the quarter. These retailers expect to improve inventory levels in the next quarter.

| |

Commentary |

| Kohl’s

|

The company’s inventory level increased by 1.0% year over year but remained down 25.5% on a two-year basis due to extended transit times. It reported a 10-year high in inventory turnover for the third consecutive quarter due to tighter inventory management.

CEO Michelle Gass said, “While we planned inventory to be down this year as compared to 2019 aligned with our strategy to drive margins and turnover, our levels remain below that original plan. We have aggressively implemented a number of measures throughout the supply chain to mitigate and minimize production and transit delays. We also made sure that we protected new brand receipts and inventory tied to key promotional events.”

Management said that industry-wide supply chain challenges continue to impact the ability of the company to rebuild inventory to desired levels. |

| Macy’s

|

The company ended the quarter with inventory up 19.4% year over year but down 15.4% on a two-year basis.

The company’s sales-to-stock ratio remains healthy, and the inventory turnover rate has improved by 18% in the trailing 12-month period versus the same period in 2019, while for the trailing 6-month period, inventory turnover increased by 22%.

Management said that given the macro challenges facing the retail industry, it is staying ahead by making further shifts in its inventory management practices and implementing a number of initiatives. The company expects inventory levels to become healthier than they were before the pandemic in mid-to-late 2022 in order to sustain margin benefits. |

| Nordstrom

|

The company’s inventory increased by 53.9% year over year. On a two-year basis, inventory increased by 12.6%.

The management noted that Nordstrom Rack has been challenged by low inventory levels in premium brands in key categories such as women's apparel and shoes. The company is undertaking a comprehensive set of actions to increase inventory levels and improve merchandise flow for the Rack.

To minimize supply gaps, the company is increasing opportunistic use of pack-and-hold inventory, allowing it to buy larger quantities of relevant items when available then hold a portion to deploy in periods with high demand, tight supply or system constraints.

With these actions, Nordstrom anticipates improvement in 4Q21 with more significant improvement to follow in the first half of fiscal 2022. |

Discount Stores

All covered discount stores are witnessing an increase in inventory levels, both year over year and on a two-year basis.

| |

Commentary |

| Big Lots

|

The company’s total inventory was up 17.3% year over year or by 14.3% on a two-year basis. This year-over-year increase was a purposeful heavy-up of inventory to support holiday as well as to right-set furniture depth and to support incremental inventory for The Lot and apparel.

CEO Bruce Thorn said, “We have line of sight to ending the fourth quarter with a strong inventory position to meet spring demand and deliver strong 1Q22 sales, and we know that we left sales on the table in each of the past two years.”

The company expects comps to be up by high-single-digits in the fourth quarter due to stronger underlying trends and improved inventory availability. |

| Dollar Tree |

The company’s total inventory increased by 13.8% year over year or by 11.2% on a two-year basis.

At Dollar Tree, inventory increased by 15.2% year over year, while comp store inventories were down by 6.4% year over year. At Family Dollar, inventory increased by 12.4% year over year, while comp store inventories were up by 7.2% year over year. |

Electronics Retailer

| |

Commentary |

| Best Buy |

The company ended the quarter with inventory up 14.7% year over year and up 13.0% compared to the corresponding period in 2019, reflecting its plans to support the current demand for technology as well as last year’s unusually low inventory balance.

CEO Corie Barry said, “For many of our vendors, we use our considerable supply chain expertise to transport their product often from the country of origin to our distribution centers. In addition to helping our vendors, it allows us to increase our level of visibility into incoming inventory and to garner greater scale.” |

Home and Home-Improvement Retailers

All covered home and home-improvement retailers reported higher inventory turnover ratios compared to the year-ago period. On a two-year basis all companies except Wayfair reported higher inventory levels.

| |

Commentary |

| Home Depot |

The company’s inventory increased by 27.4% year over year or by 31.0% on a two-year basis.

COO Edward Decker said, “Beginning in the second quarter of last year, our merchant inventory and supply chain teams leveraged tools and analytics to work with our vendor partners to adjust our assortments, and in some cases, introduced alternative products. The teams also built depth in job lot quantities and high-demand products. We improved our in-stock levels in the back half of last year, and we've been able to sustain, and in some cases, improve our levels, even as home improvement demand remains elevated.” |

| Lowe’s

|

The company’s inventory was up 6.2% year over year and up 21.6% on a two-year basis. Inflation did not have a material impact on inventory levels. Deflation in lumber was largely offset by inflation in other categories, including copper.

Management said that the company’s push to land spring product earlier than normal has increased its inventory position modestly. However, this approach limits the company’s ability to significantly improve inventory turnover in the near term. |

| Williams-Sonoma |

The company’s inventory was up 13.0% year over year or by 1.1% on a two-year basis.

CEO Laura Alber said, “We sourced a sizable amount of inventory out of Vietnam, which was recently shut down for three months. This country has since reopened but is experiencing a significant backlog across factories as they ramp up. As a result, we are experiencing some inventory delays, particularly in our home furnishings businesses. Given the ongoing strong demand we are seeing across our business and the impact of the Vietnam delays, we do not expect full recovery of our inventory levels until the middle of 2022. |

Luxury Retailers

Both tracked luxury retailers reported declines in inventory on a two-year basis, which they attributed to Covid-induced lockdowns in factories in Vietnam. However, the retailers are rebuilding inventory to support expected strong sales growth in the next quarter.

| |

Commentary |

| Capri Holdings |

The company’s inventory declined by 6.9% year over year or dropped 19.3% on a two-year basis, reflecting greater-than-anticipated supply chain delays and extended factory closures.

Management said that while factories have reopened in Vietnam, it will still take time to return to full capacity. Going forward, the company expects to build inventory to support sales growth over the remainder of the year. |

| Tapestry |

Tapestry’s inventory increased by 0.9% year over year but declined by 7.0% on a two-year basis.

The company expects inventory levels to be up substantially in the next quarter as it pulls forward receipts to match strong demand and faces elongated lead times from supply chain pressures due to Covid disruptions. Management said that they are taking deliberate steps to accelerate inventory growth and feel comfortable in their inventory positioning to meet demand. |

Mass Merchandisers

Both Target and Walmart reported lower inventory turnover ratios compared to the year-ago period, but only Target reported a higher inventory turnover ratio compared to 2019 levels. Both retailers reported an increase in inventory year over year as well as on a two-year basis. For the next quarter, these retailers are planning for full shelves and better in-store stocks to fulfill customer demand quickly.

| |

Commentary |

| Target

|

The company ended the quarter with inventory up 17.7% year over year or up 31.3% on a two-year basis.

EVP Christina Hennington said, “With a strong inventory position and a great value proposition, we're able to lean into our Target assortment to build upon great gifting ideas and easy gathering solutions, like even more creative Gingerbread House making kits, Bullseye's top toys and gift sets for any budget.” |

| Walmart

|

Total inventory increased by 10.9% year over year or by 11.5% on a two-year basis.

Management said that the various steps taken to mitigate transit and port delays such as chartering vessels for Walmart goods, rerouting deliveries to less congested ports and expanding overnight hours for key US ports helped the company to position itself well in terms of inventory. |

Warehouse Clubs

Our covered retailers reported an increase in inventory turnover ratios compared to the year-ago period as well as on a two-year basis. These retailers continue to accumulate inventory aggressively to support the business going forward.

| |

Commentary |

| BJ’s Wholesale Club |

The company ended the quarter with inventory down 0.7% year over year and down 1.2% on a two-year basis as the company is used to running inventory leaner than the pre-Covid period.

Management noted that the company’s general merchandise sales in the third quarter were impacted by inventory unavailability in certain seasonal categories. |

| Costco

|

Total inventory increased by 13.7% year over year or by 22.6% on a two-year basis.

CFO Richard Galanti said, “About 79% of our import containers are late by an average of 51 days, a small percentage of those are actually a few days early, and many of them are a few days more than 51 late.” |

Looking Forward

In 3Q21, most retailers reported an increase in their inventory turnover ratios compared to the corresponding quarter in pre-pandemic 2019. Inventory was in line with the same quarter last year.

In the next quarter, we expect to see an improvement in inventory turnover ratios for most covered retailers, driven by the holiday season and improving in-store traffic trends so far (although Omicron could put the brakes on that).

Retailers including Bath & Body Works, Best Buy, Big Lots, Target and TJX reported that they are well positioned for the now-current quarter in terms of inventory. Nordstrom, Ross Stores and Tapestry said that they were planning to capitalize on scale advantages and bring inventory in earlier than normal to match strong sales demand. Similarly, Urban Outfitters planned to receive home products early to elevate its inventory position at the end of the fourth quarter.

The crisis-related US port congestion and impacts on shipping lanes continue to contribute to higher in-transit inventory levels. To reduce the risk of supply chain disruptions, retailers should strategically use air freight, diversify sourcing options and work with a variety of suppliers and manufacturers. Some retailers, such as Walmart, are

navigating supply chain challenges by chartering vessels, rerouting deliveries to less congested ports and expanding overnight hours for key US ports.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]