Introduction

Our third-quarter 2021 (3Q21) wrap-up covers the quarterly earnings of 55 (mostly) US-based retailers, brands, e-commerce platforms and REITs in the

Coresight 100.

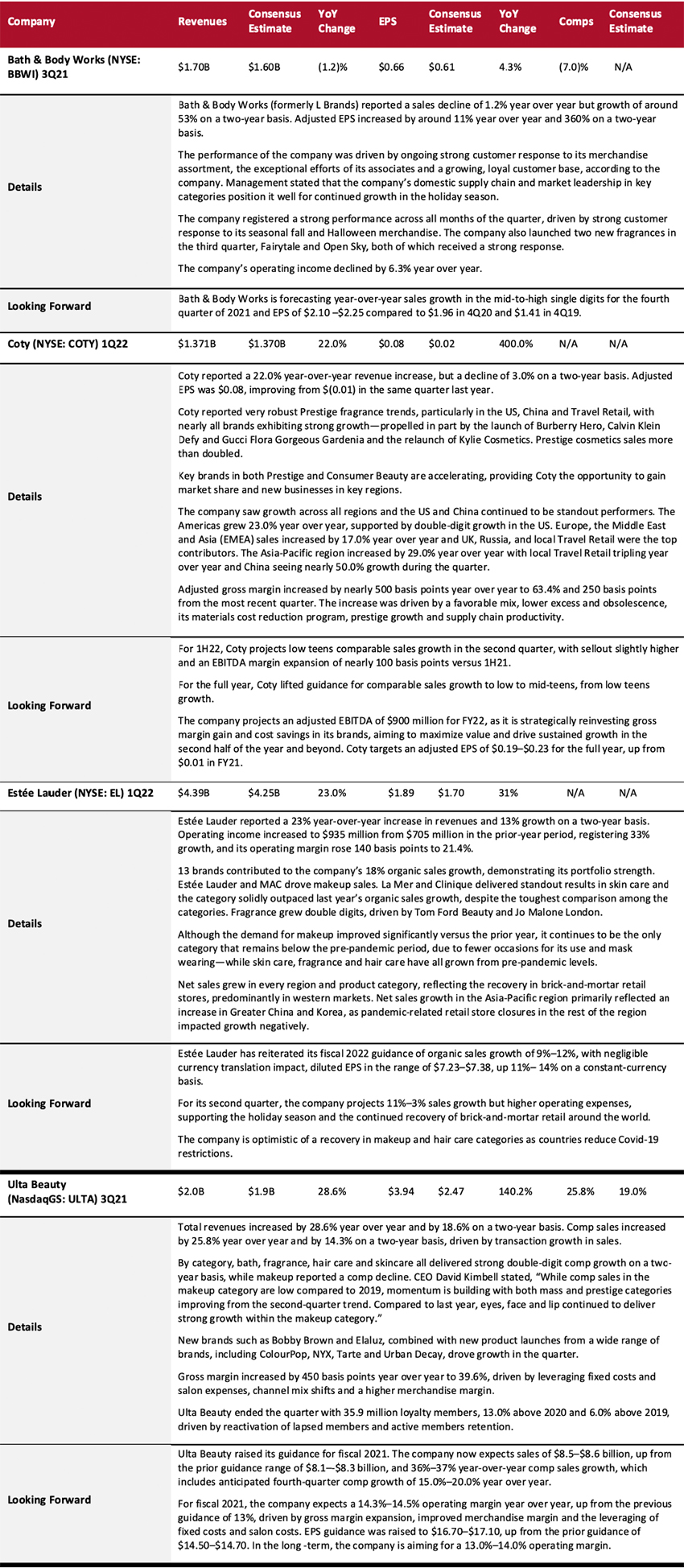

- About 78% of companies beat revenue consensus estimates, while 22% missed revenue consensus estimates. In terms of earnings, 86% of companies beat consensus estimates, while 12% missed consensus expectations and 2% were in line with the expectations.

- Apparel specialists, online apparel retailers, beauty brands and retailers, department stores, drugstores, electronics retailers, home improvement, luxury companies, mass merchandisers, off-pricers and warehouse clubs enjoyed a stronger quarter (versus expectations): More than 80% of covered companies beat consensus revenue estimates. Furthermore, 100% of covered beauty brand owners, online apparel retailers, department stores, drugstores, electronics retailers, luxury companies, mass merchandisers, off-pricers and warehouse clubs beat consensus EPS estimates.

- E-commerce platforms, food and grocery retailers, luxury e-commerce players and REITs were the worst-performing sectors (versus expectations) in the quarter, with 50% of covered companies missing consensus revenue estimates.

However, beating or meeting consensus does not necessarily indicate positive results: The pace of sales recovery is a much better indicator of the health of retailers than benchmarking versus consensus.

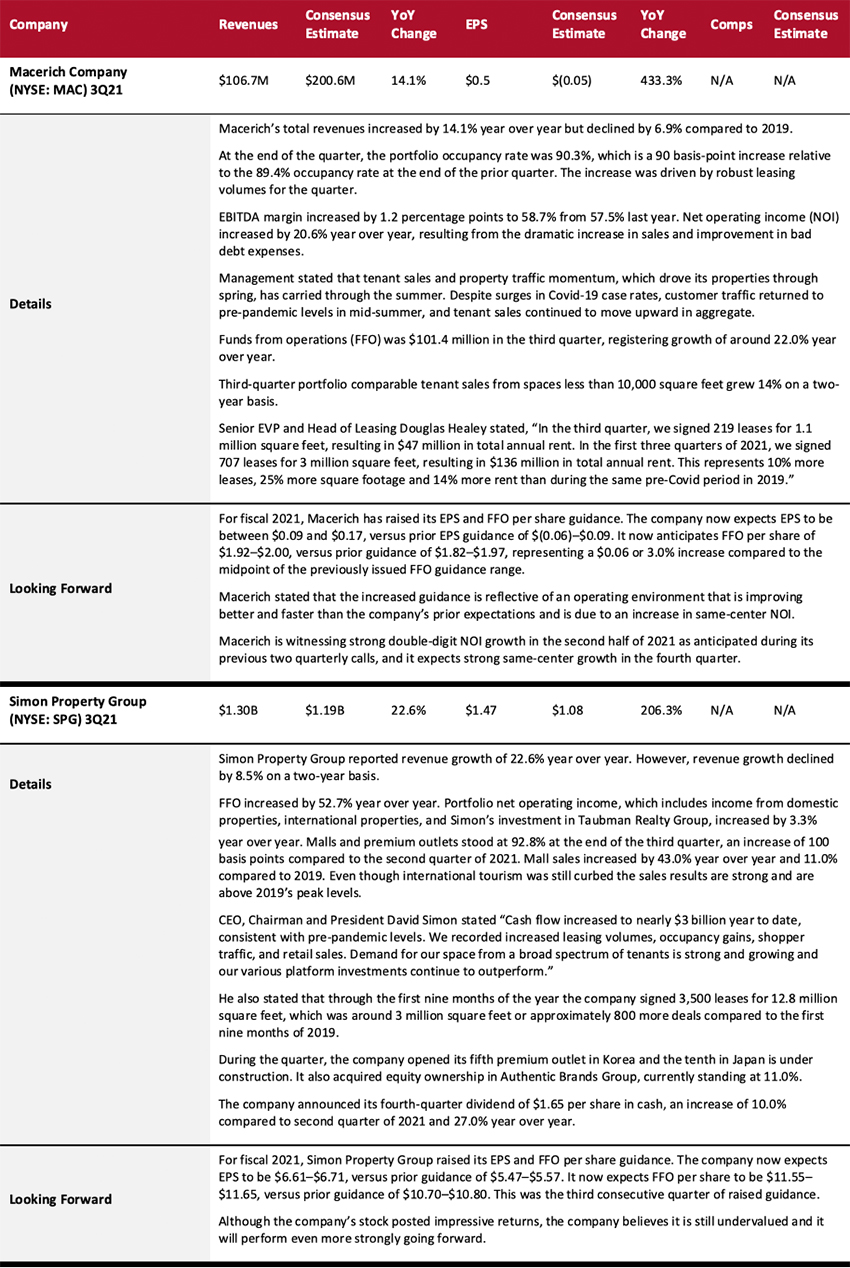

Company results in 3Q21, which ended September 30 for most companies in our coverage, include key commentary and qualitative insights from major US retailers and brand owners on their recent performance, in terms of revenues and comps, and the impact of the coronavirus pandemic. Although we term the period under review 3Q21, some companies in this report describe their latest quarter differently; some also have different quarter-end dates.

In July 2021, US retail sales grew a strong 9.6% year over year and by 21.4% when compared to 2019 values. Similarly, in August 2021, US retail sales grew by a very strong 12.0% year over year and by 19.7% from the corresponding quarter of 2019 values.

September 2021 saw year-over-year retail sales growth decelerate to a still-strong 11.1% and rose by 25.8% on a two-year basis (compared to the corresponding quarter in 2019).

In October, US retail sales continued to see a double-digit year-over-year increase, fueled by strong growth in several sectors, and sales increased by 23.2% on a two-year basis.

US retail traffic saw robust growth of 31.4% year over year, driven by early holiday shopping.

Below, we assess the recent performance of retailers, brand owners, e-commerce platforms and REITS in detail.

Apparel and Footwear Brand Owners

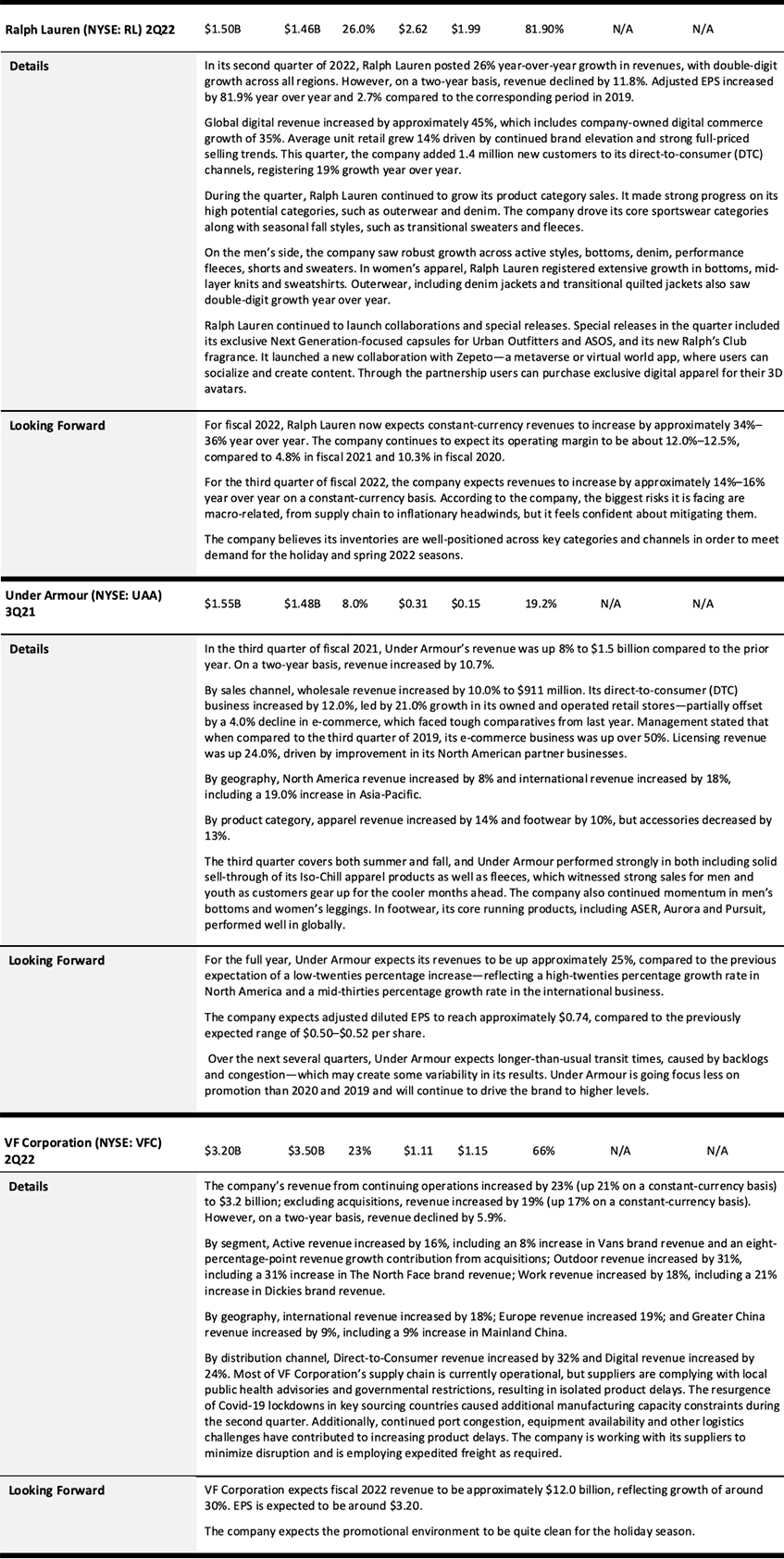

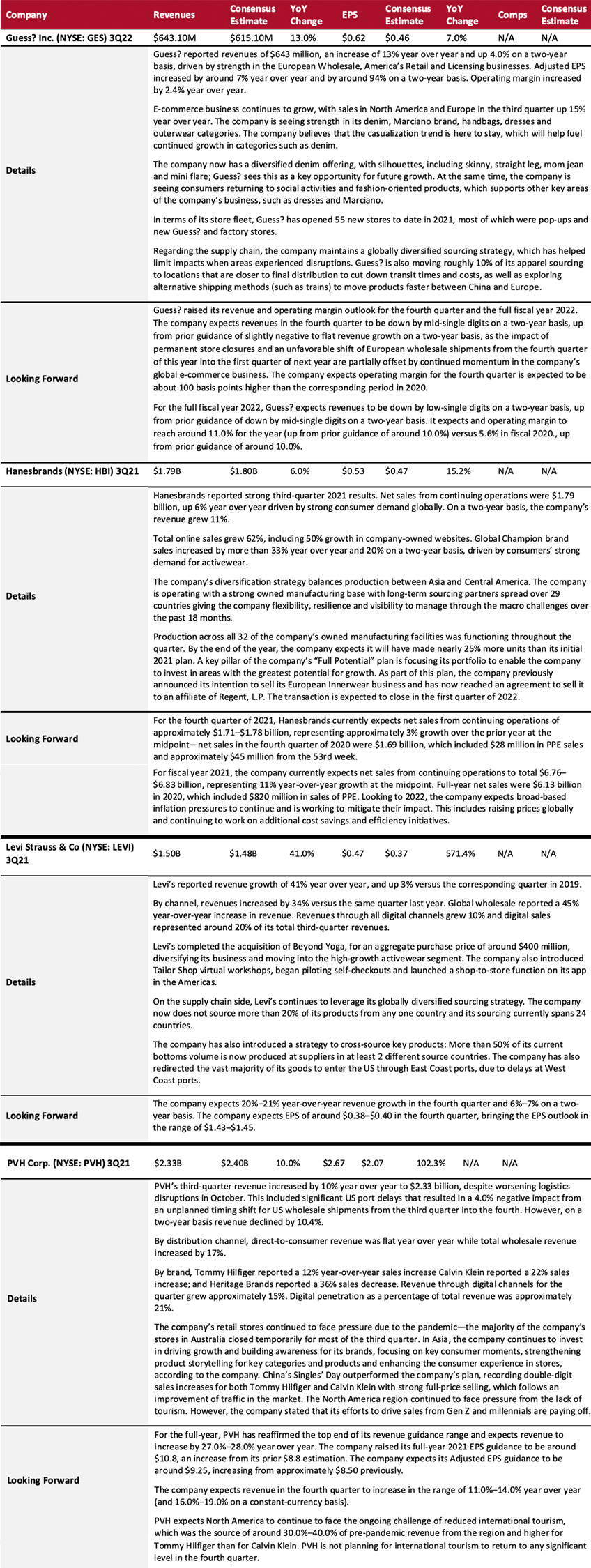

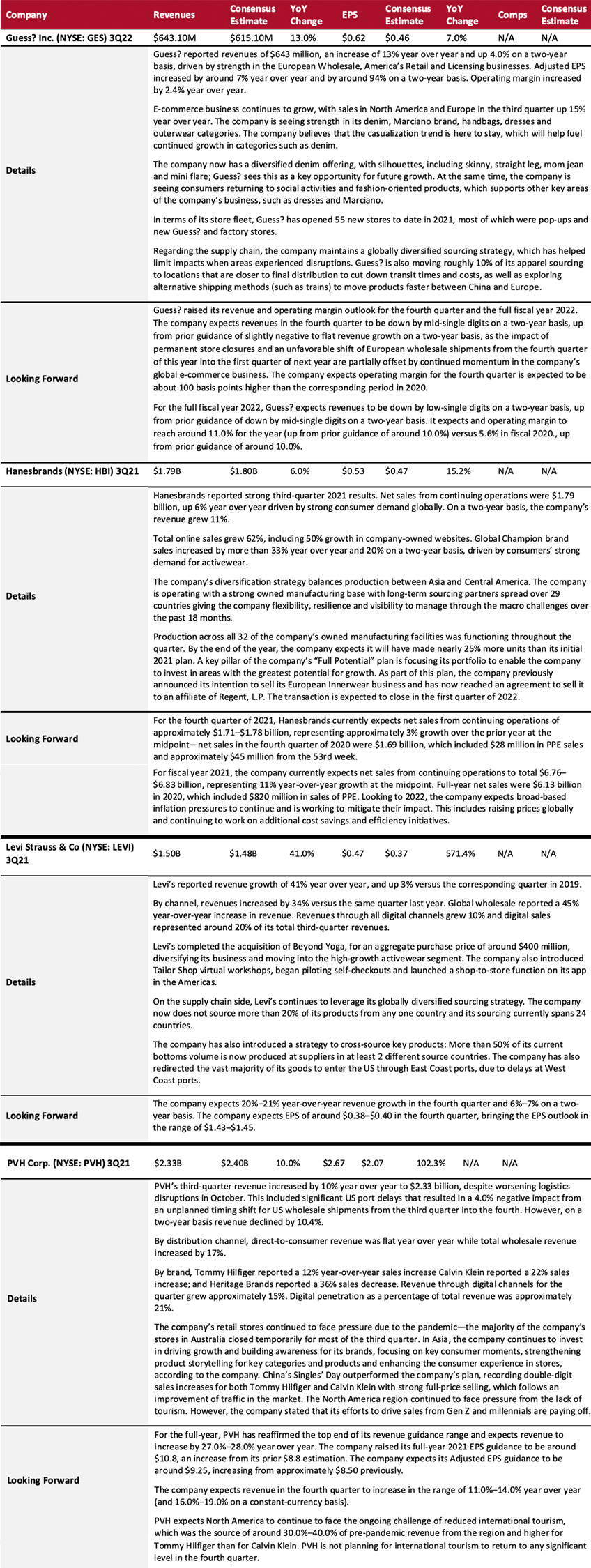

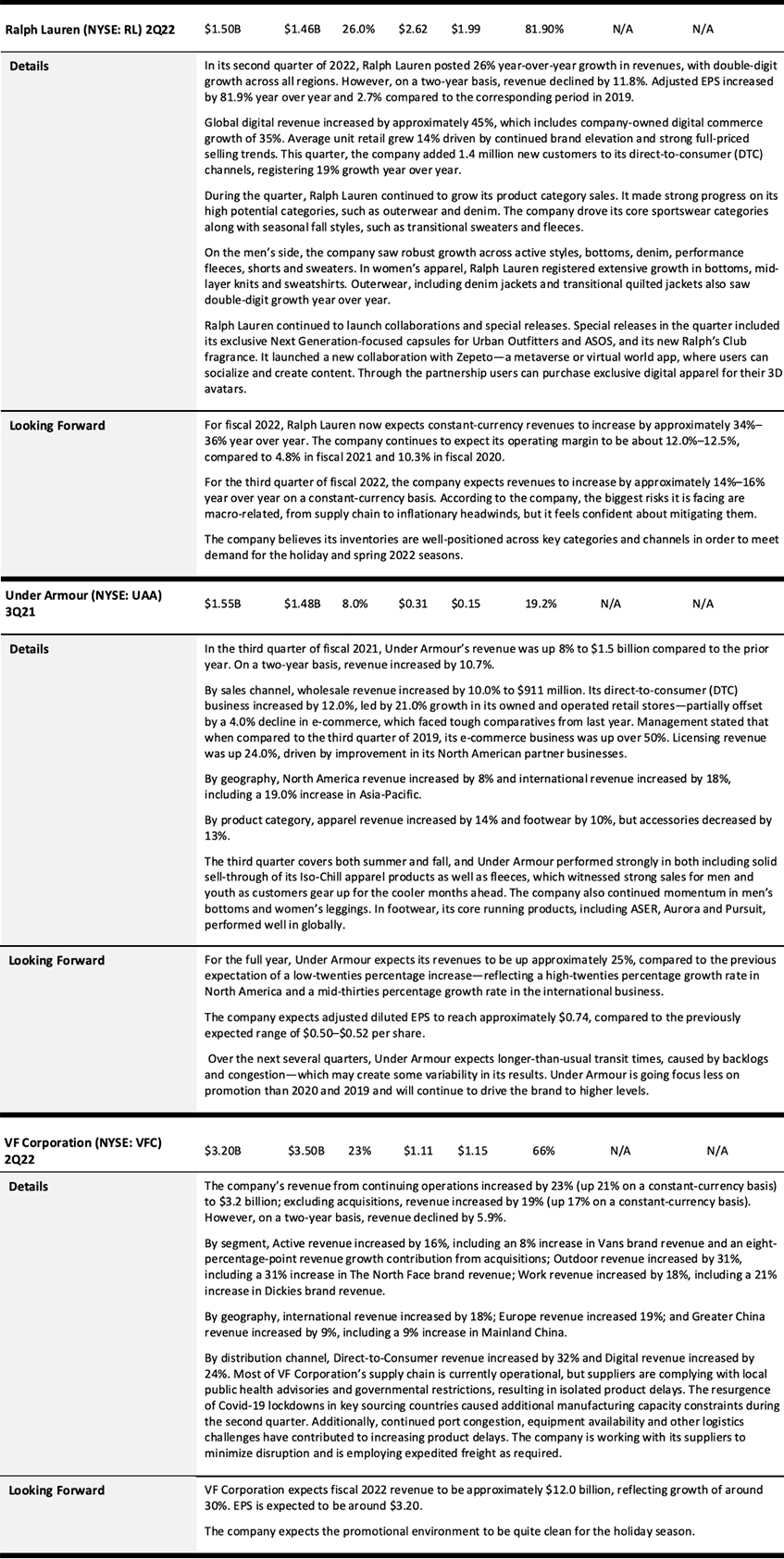

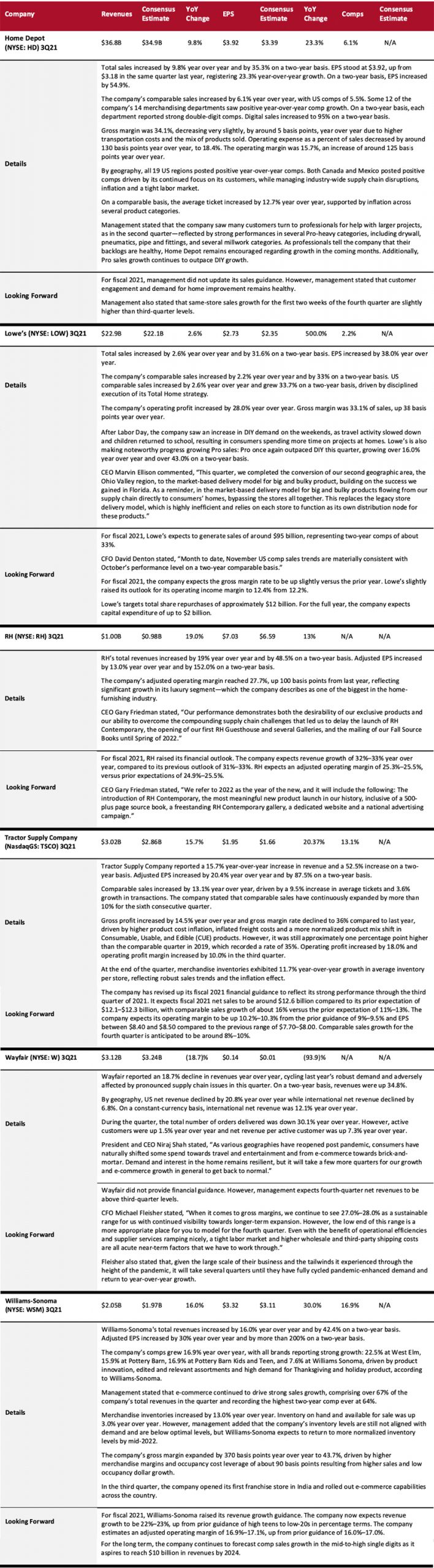

Overall, apparel and footwear brand owners are enjoying a strong recovery, although pockets of weakness remain. On a two-year basis (versus the corresponding quarter in 2019), Guess?, Hanesbrands, Levi Strauss and Under Armour reported positive sales growth, while PVH Corp., Ralph Lauren and VF Corporation experienced declines.

Apparel Specialty Retailers

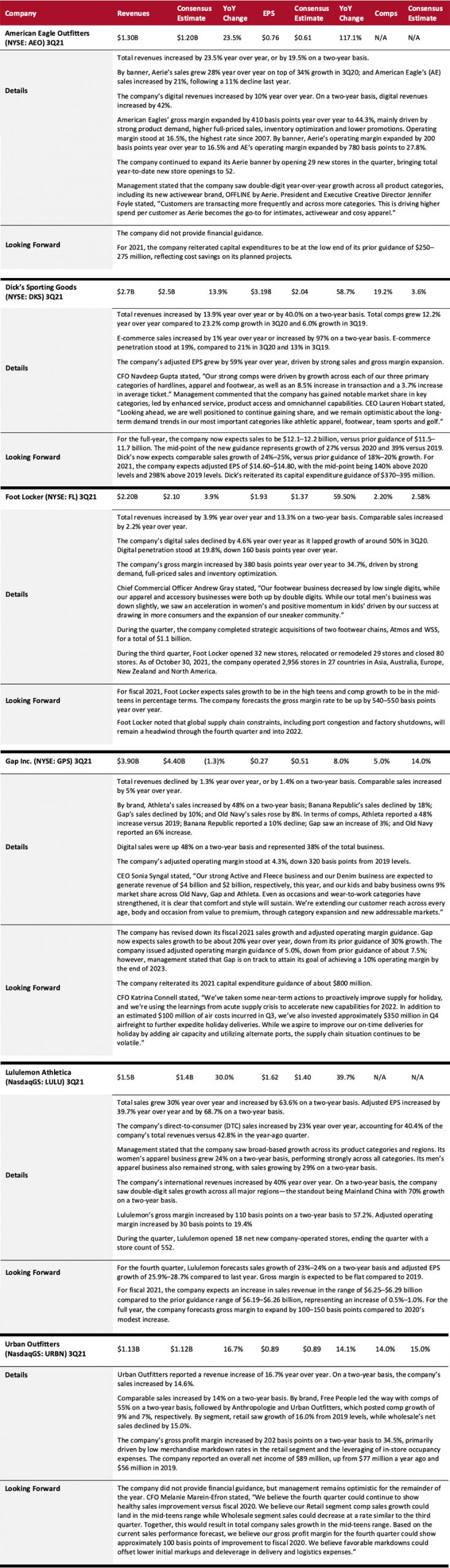

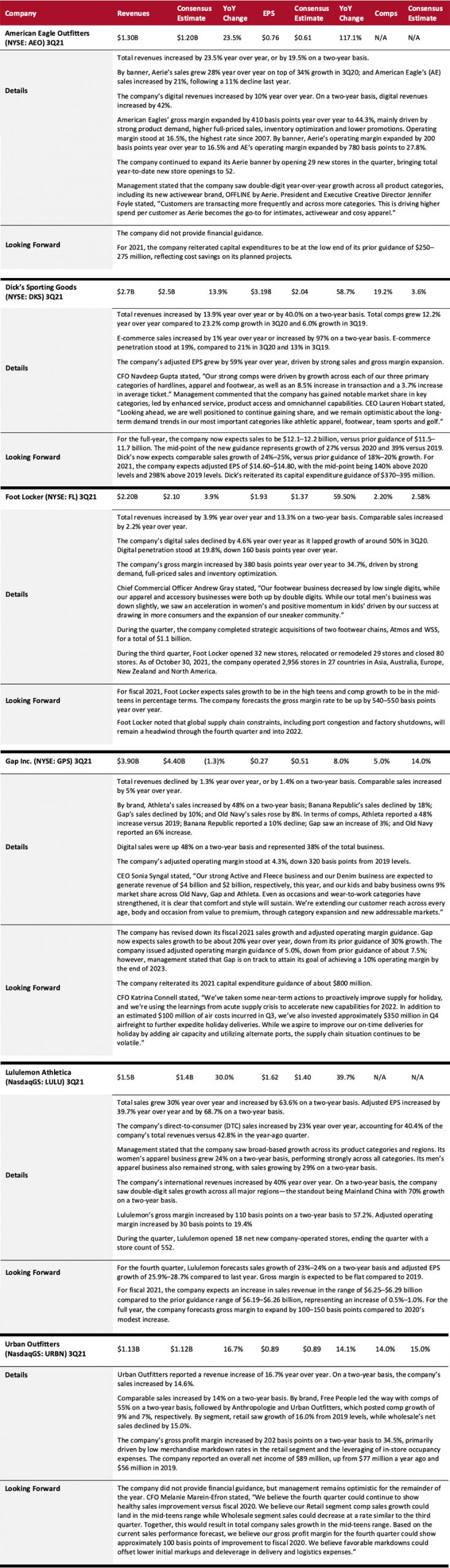

Apparel specialists reported another strong quarter: American Eagle Outfitters, Dick’s Sporting Goods, Foot Locker, Lululemon and Urban Outfitters witnessed strong positive sales growth on a two-year basis, while Gap witnessed a decline.

While athleisure, casualwear and intimates remained strong catalysts, apparel specialty retailers are also witnessing a rebound in demand for dresswear, as more consumers are returning to socializing.

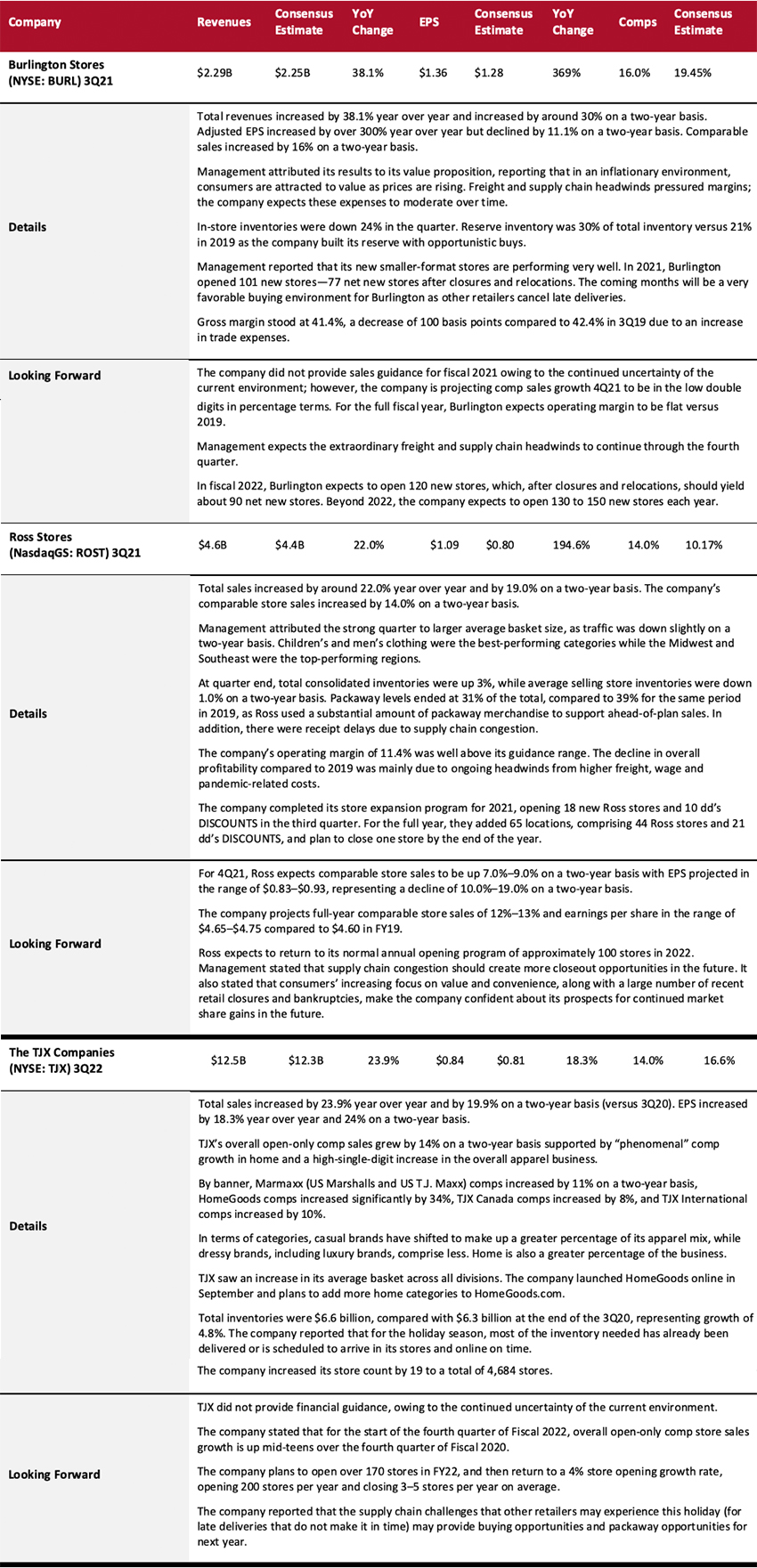

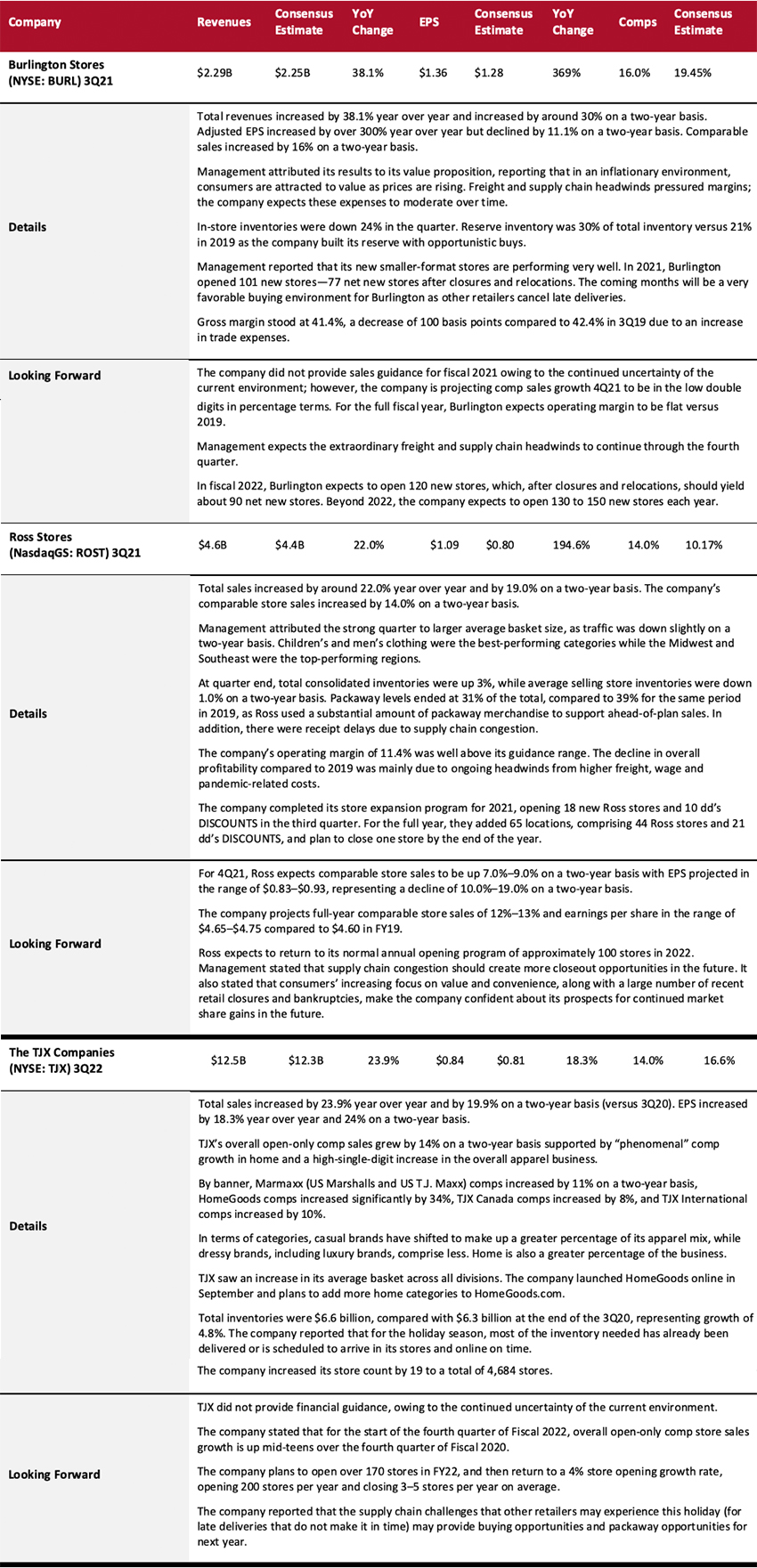

Off-Price Retailers

Off-price retailers witnessed a strong quarter, with all covered companies posting double-digit sales growth on a two-year basis. While the home category continues to outperform for these retailers, apparel is also witnessing strong demand as consumers resume social activities and refresh their wardrobes.

Online Apparel Retailers

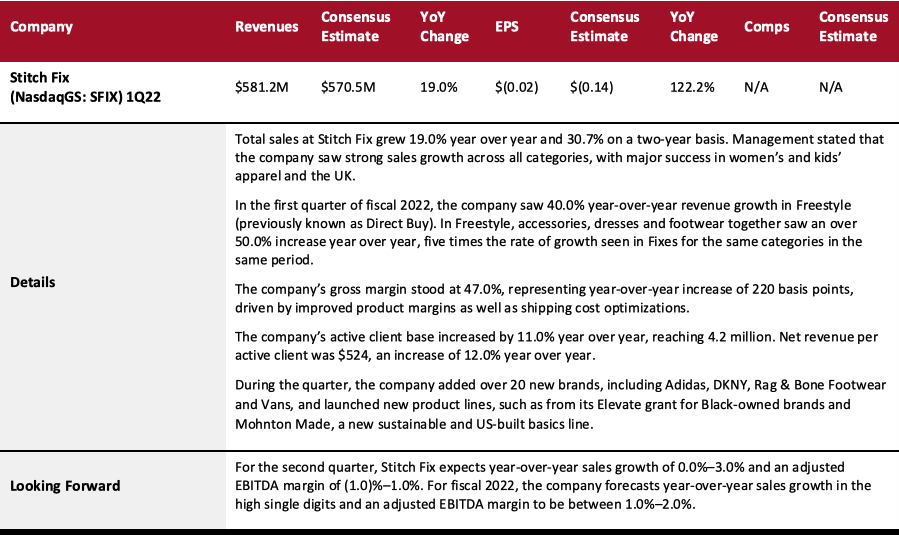

Stitch Fix reported over 30% growth on a two-year basis this quarter, driven by a very strong increase in its active client base. For fiscal 2022, Stitch Fix forecasts year-over-year sales growth in high single digits and adjusted operating margin expansion.

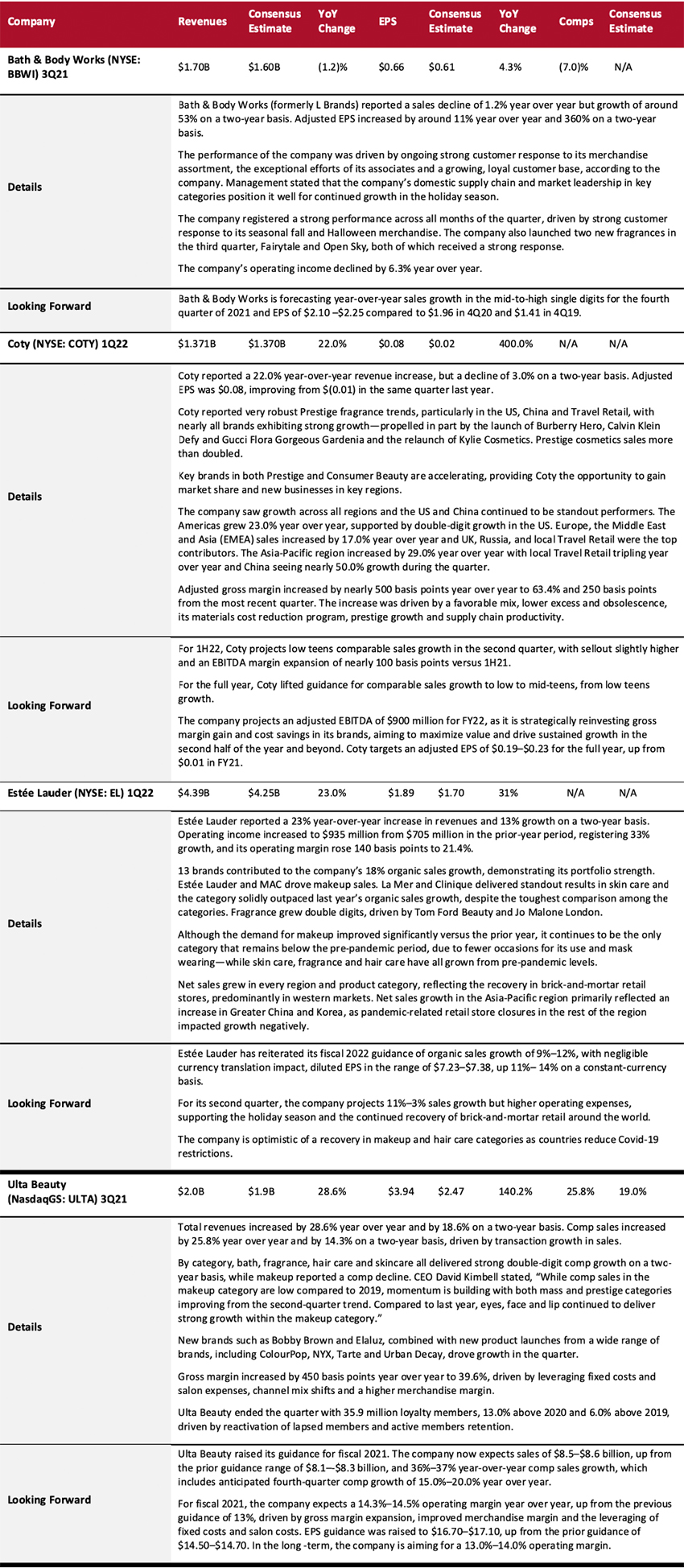

Beauty Brands and Retailers

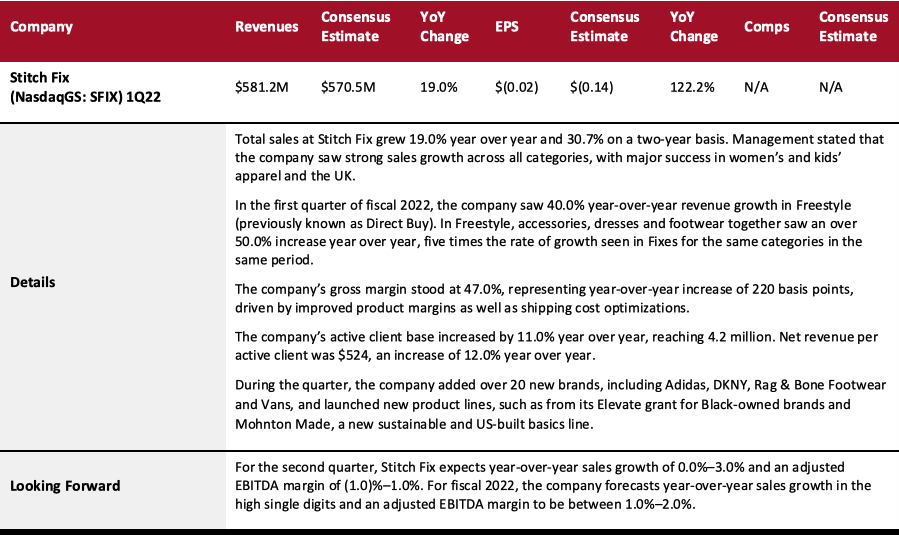

Overall, the beauty category continues to recovery strongly, with Bath & Body Works, Estée Lauder and Ulta Beauty posting positive sales growth on a two-year basis. However, Coty reported a sales decline on a two-year basis.

Within the category, bath, fragrance, haircare and skincare are trending, while demand for makeup is recovering gradually.

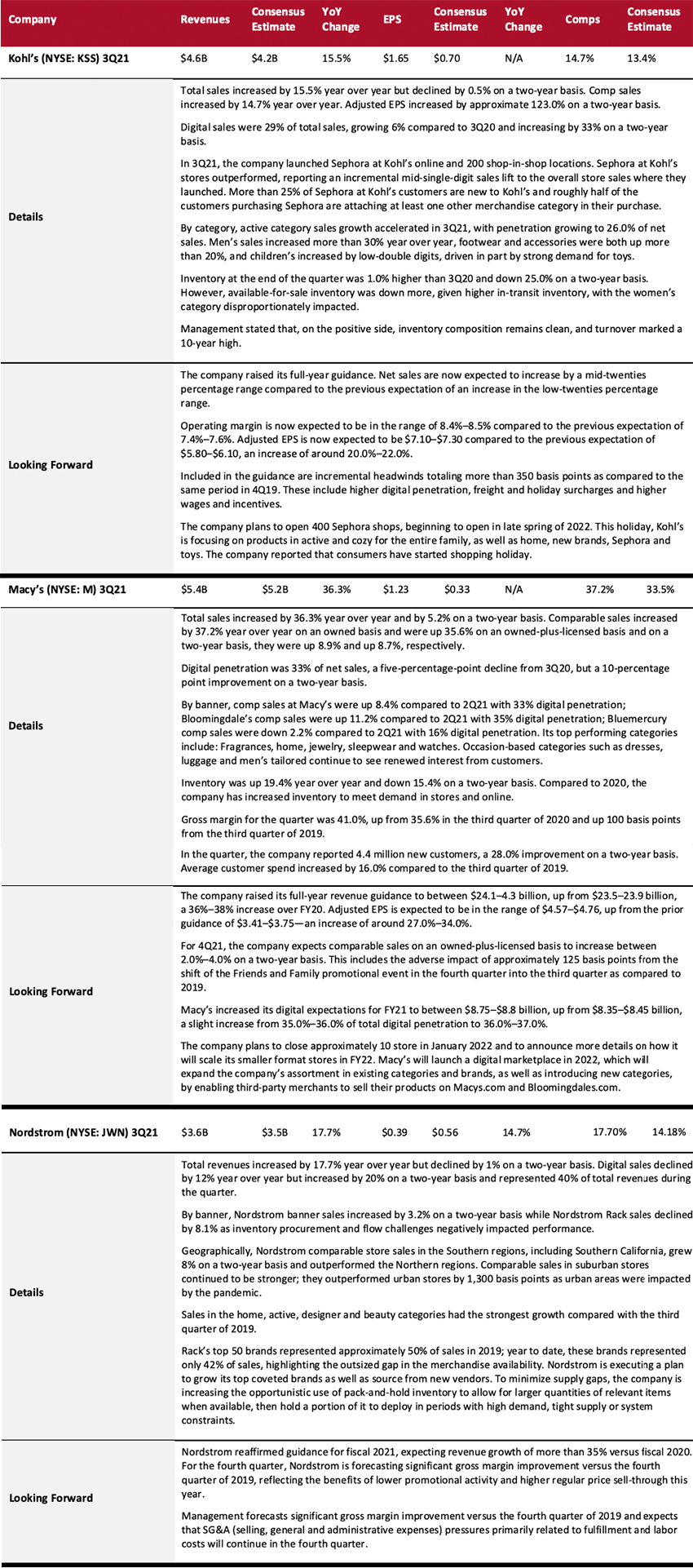

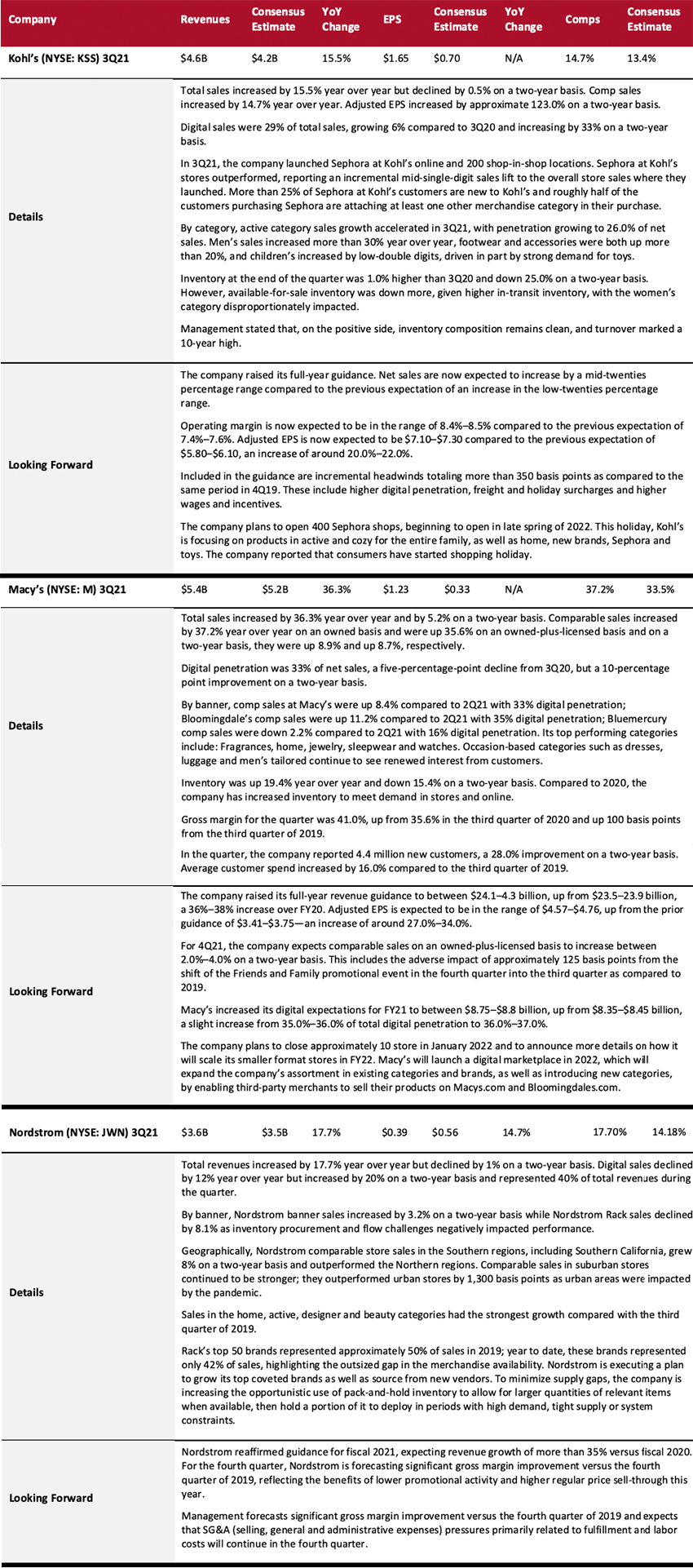

Department Stores

Major department stores are recovering strongly from the crisis, with all companies covered here reporting double-digit sales growth year over year. Macy’s reported mid-single-digit sales growth on a two-year basis; however, Kohl’s and Nordstrom posted a low-single-digit sales decline on a two-year basis.

The department stores covered here are seeing strong trends in various accessories, apparel and footwear categories, such as activewear, denim, dresses, fine jewelry and sneakers.

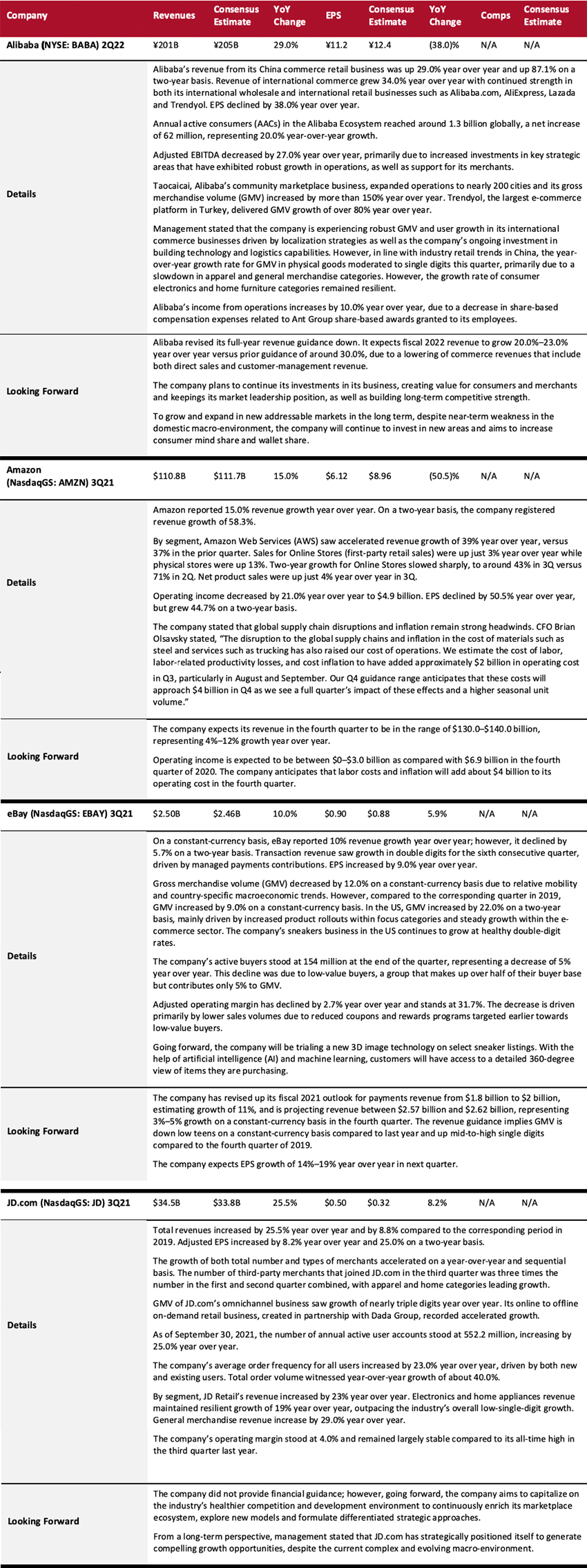

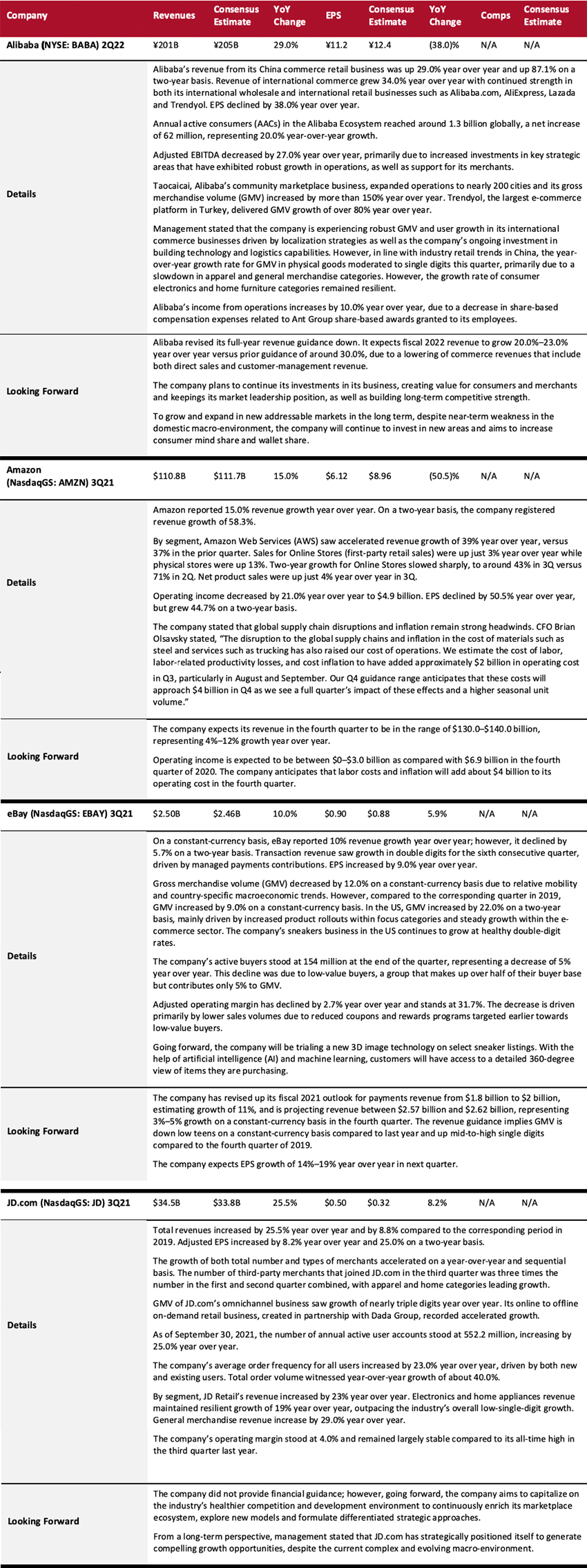

E-Commerce Platforms

E-commerce players reported slow growth in the quarter. While Alibaba, Amazon, eBay and JD.com all reported double-digit year-over-year total sales growth, focusing on online retail-related metrics, Amazon and eBay faltered in this quarter compared to last year. For the next quarter, Amazon expects single-to-double-digit year-over-year sales growth, while eBay expects mid-single-digits growth. For the full fiscal year, Alibaba revised down its guidance; however, it expects double-digits sales growth.

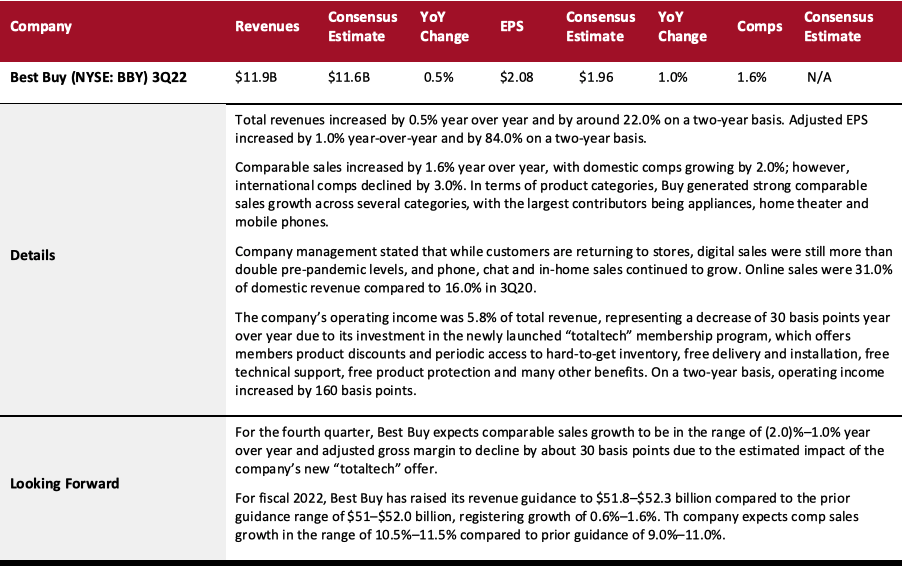

Electronics Retailers

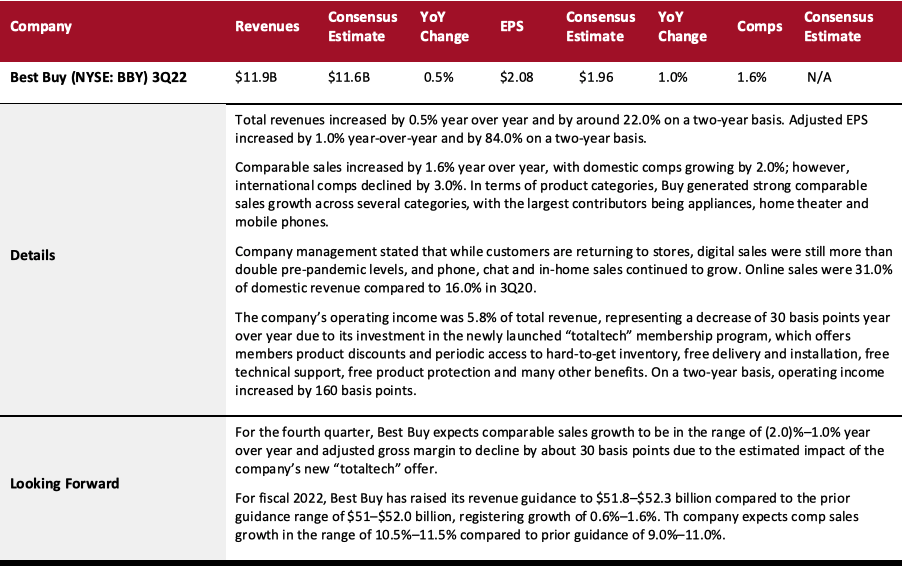

Best Buy reported comp growth of 1.6% year over year, mainly driven by strong contributions from appliances, home theater and mobile phones categories.

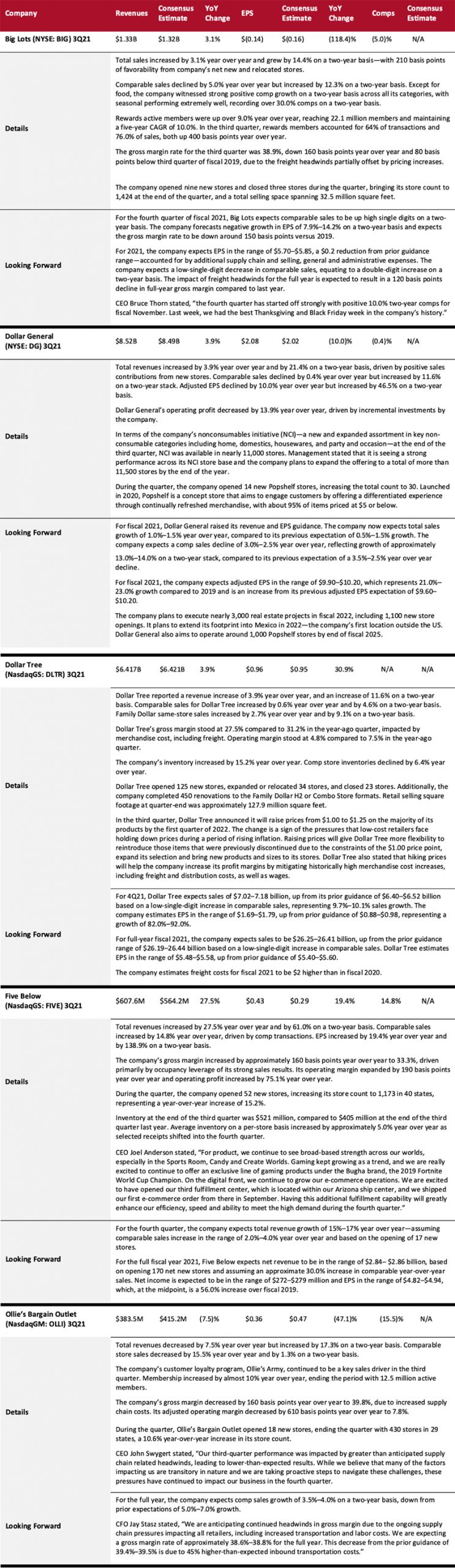

Food, Drug and Mass Retailers: Discount Stores

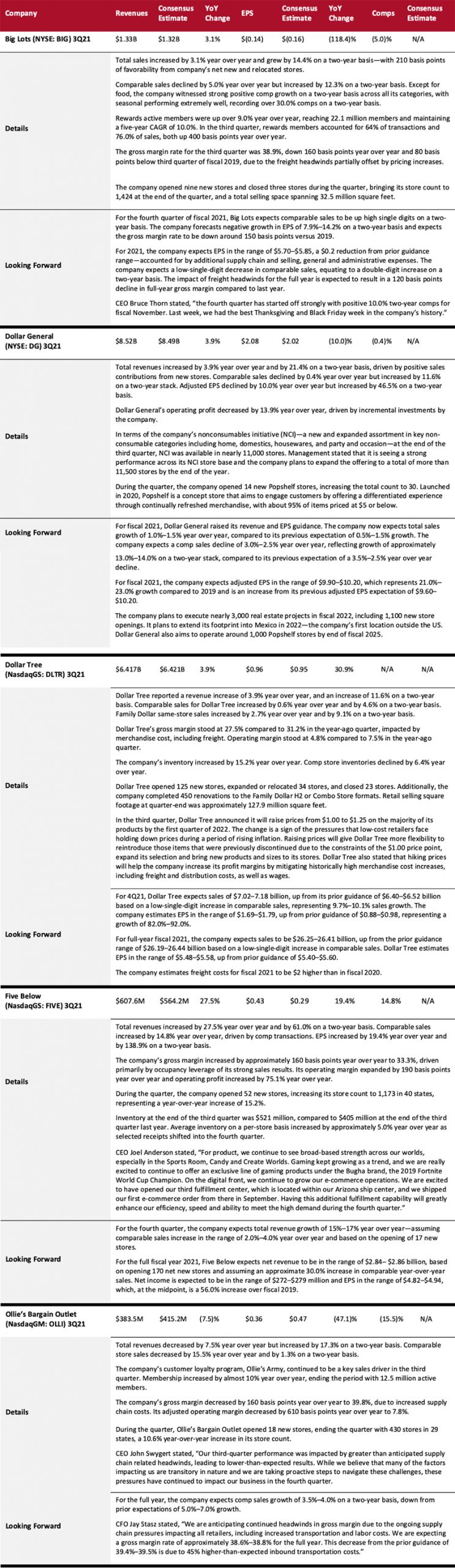

Discount stores continued their solid run this quarter, with Big Lots, Dollar General, Dollar Tree, Five Below and Ollie’s Bargain Outlets reporting double-digit revenue growth on a two-year basis. Unlike most retailers, which are shrinking their physical footprints, discounter’s real estate plans remain firmly in place—including new store expansions.

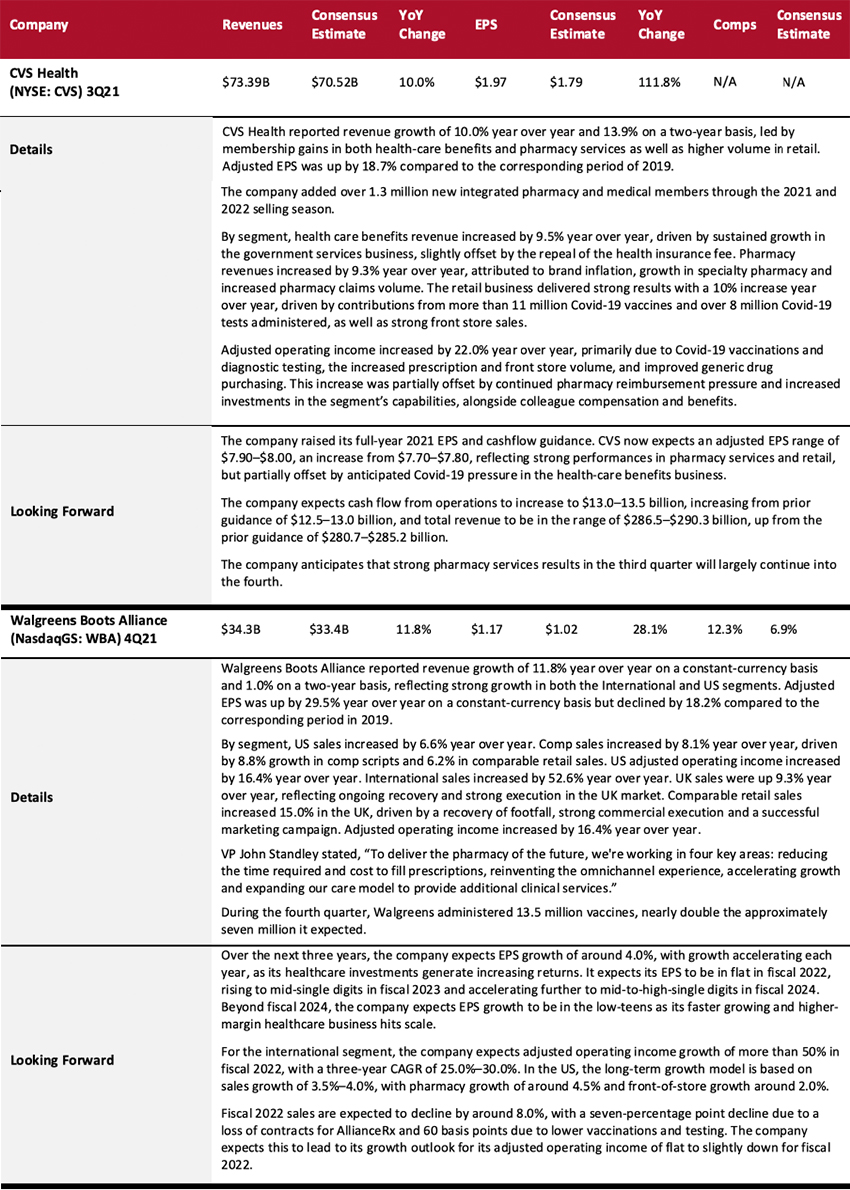

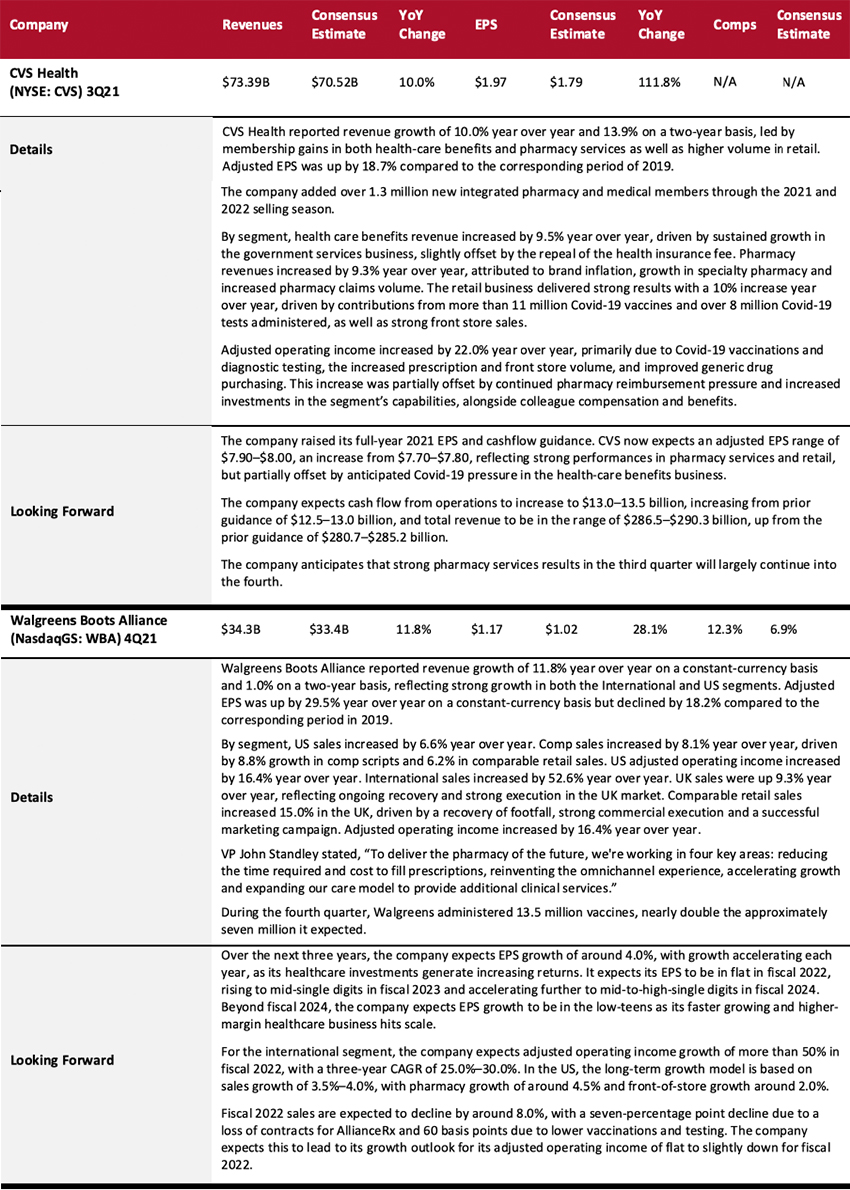

Food, Drug and Mass Retailers: Drugstores

Drugstore owners continue to report strong expansion, with CVS Health and Walgreens Boots Alliance posting positive sales growth on a two-year basis. Growth was driven by increased prescription volumes, alongside higher pharmacy and front-of-store sales—led by a rise in demand for health and wellness products.

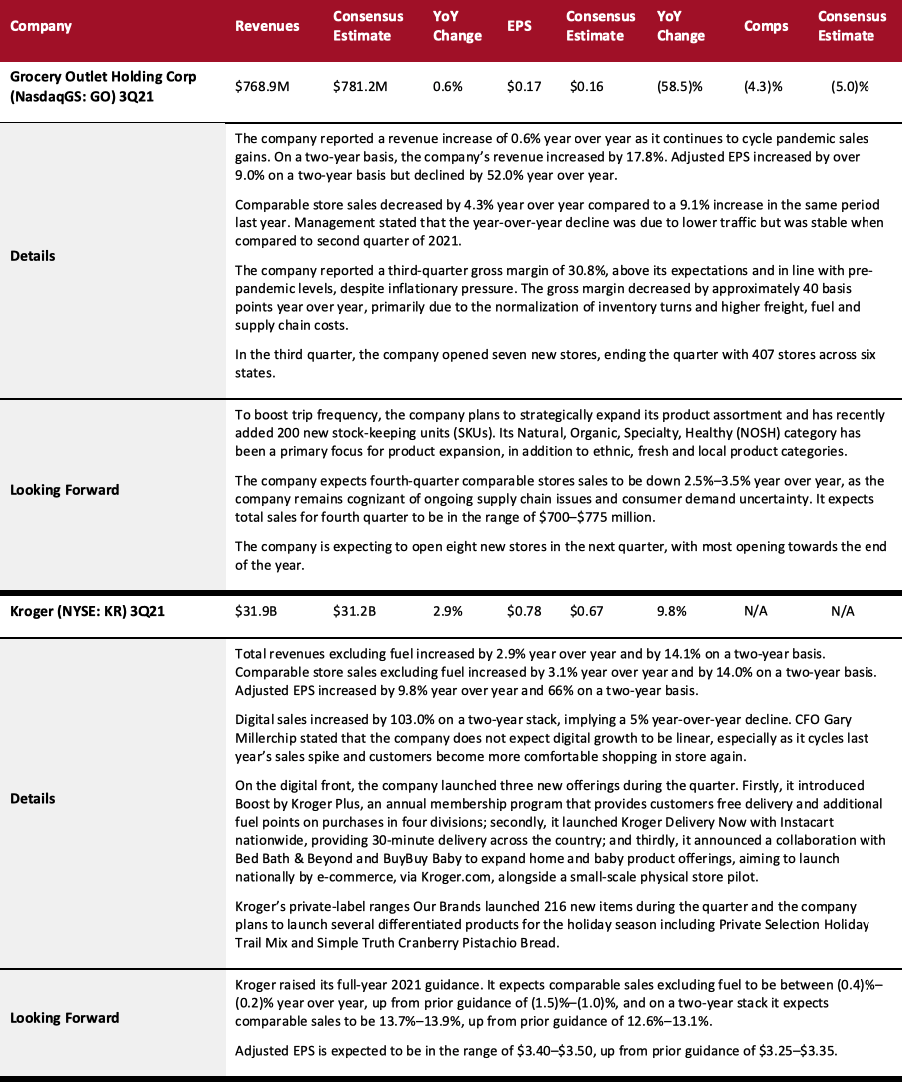

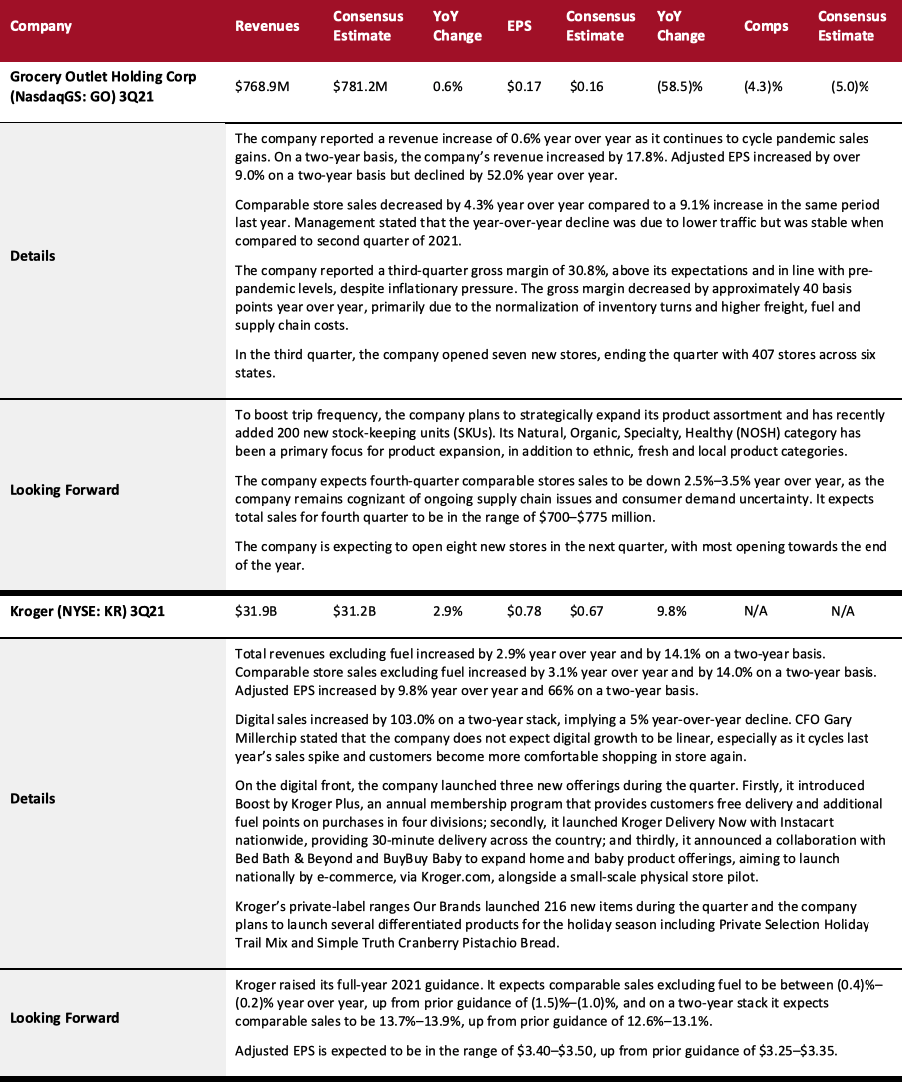

Food, Drug and Mass Retailers: Food and Grocery Retailers

Kroger reported a low-single-digit year-over-year increase in comps, while Grocery Outlet reported a low single-digits year-over-year decline. For the next quarter, both Kroger and Grocery Outlet expect comps to be in the negative single digits.

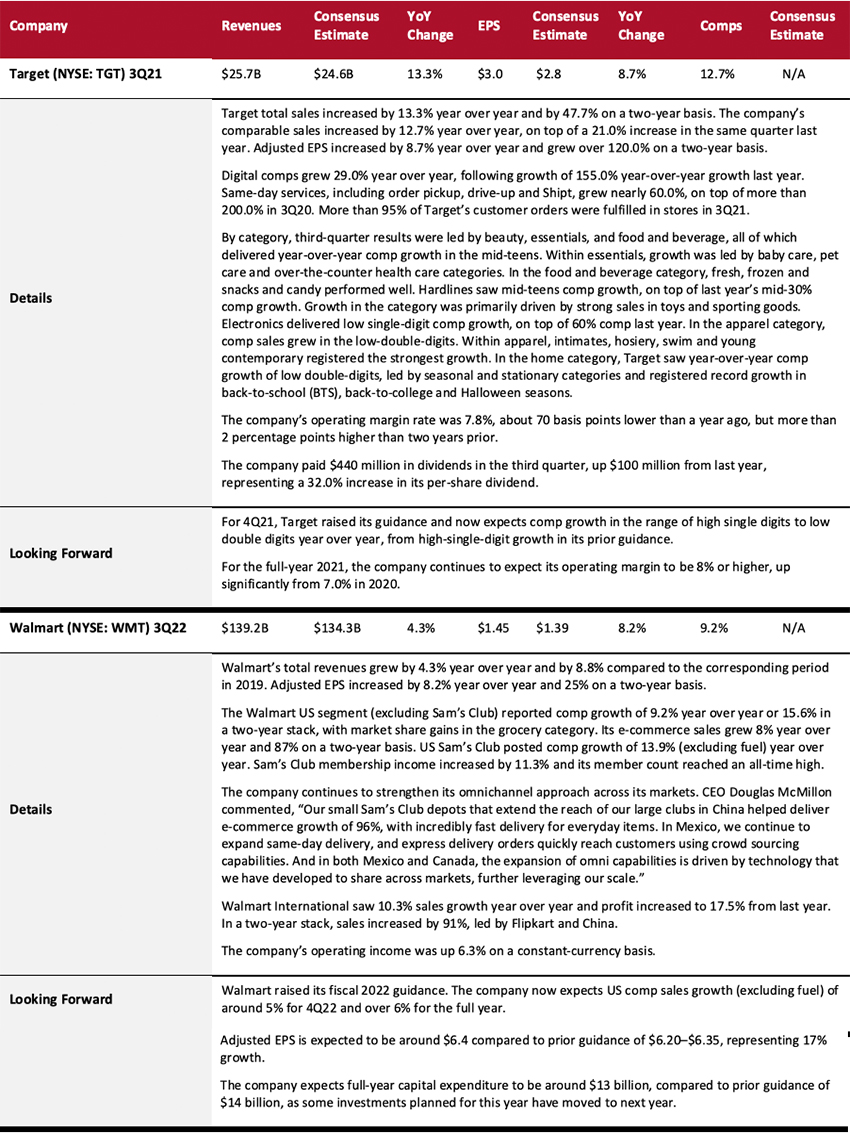

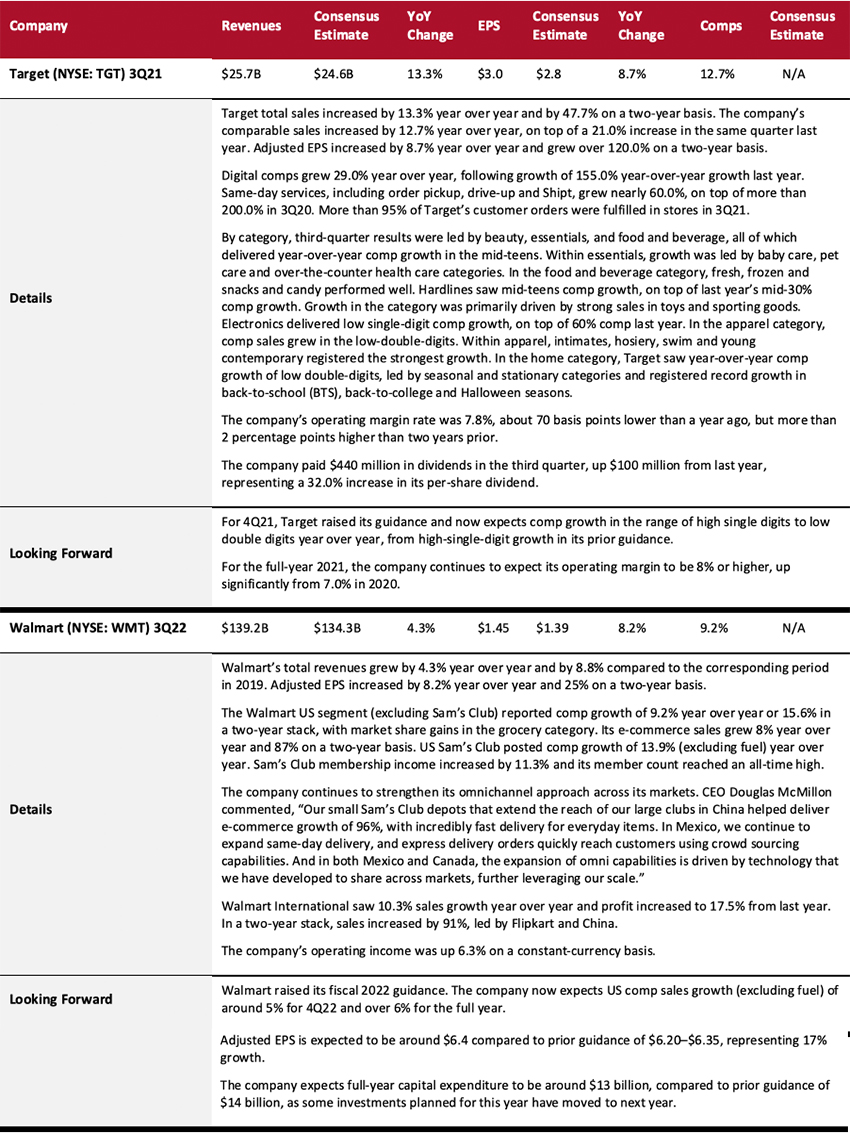

Food, Drug and Mass Retailers: Mass Merchandisers

Mass merchandisers sustained their growth momentum in the latest quarter. On a two-year basis, Target reported double-digit sales growth, while Walmart posted high single-digit sales growth.

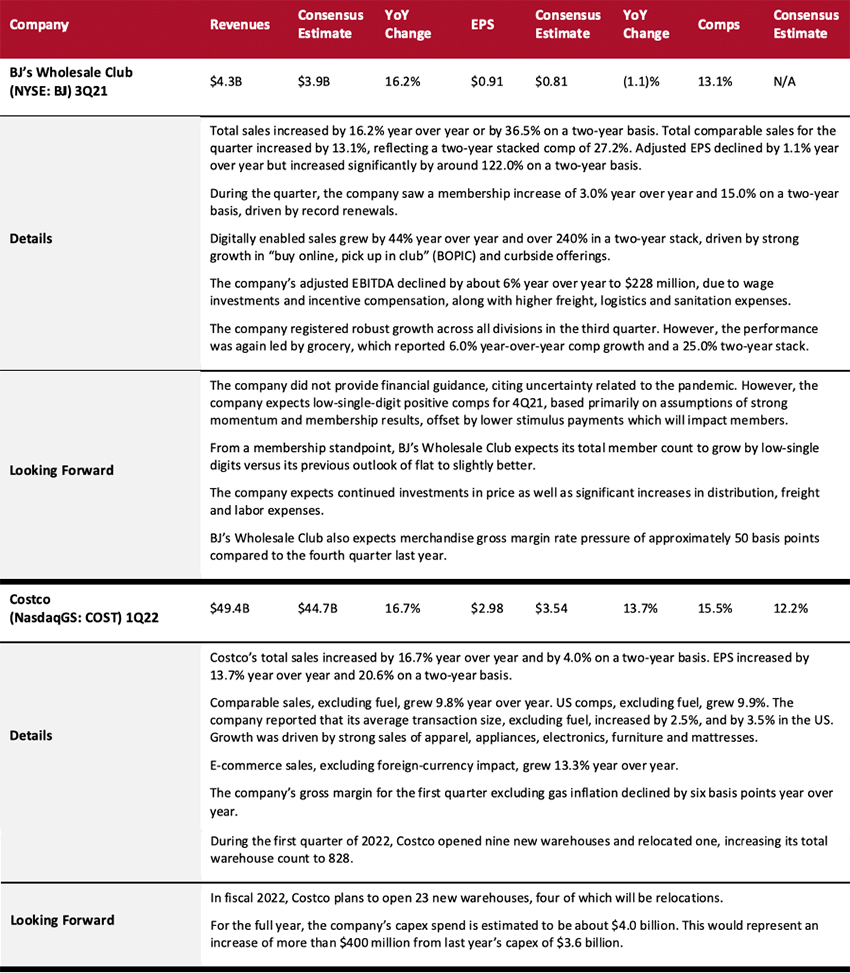

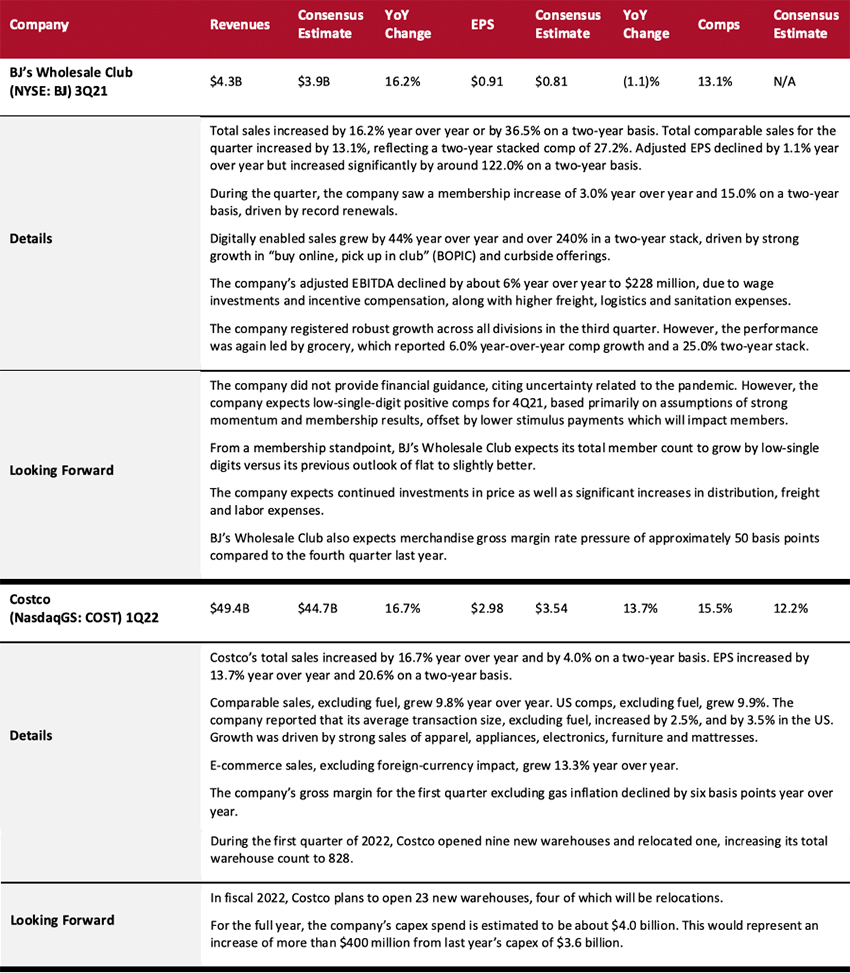

Food, Drug and Mass Retailers: Warehouse Clubs

Warehouse clubs continue to perform strongly. Apparel, electronics, household goods, furniture and mattresses saw strong sales in the quarter.

Warehouse clubs continue to open new stores, as well as see positive core member trends, new member opportunities and growing e-commerce businesses.

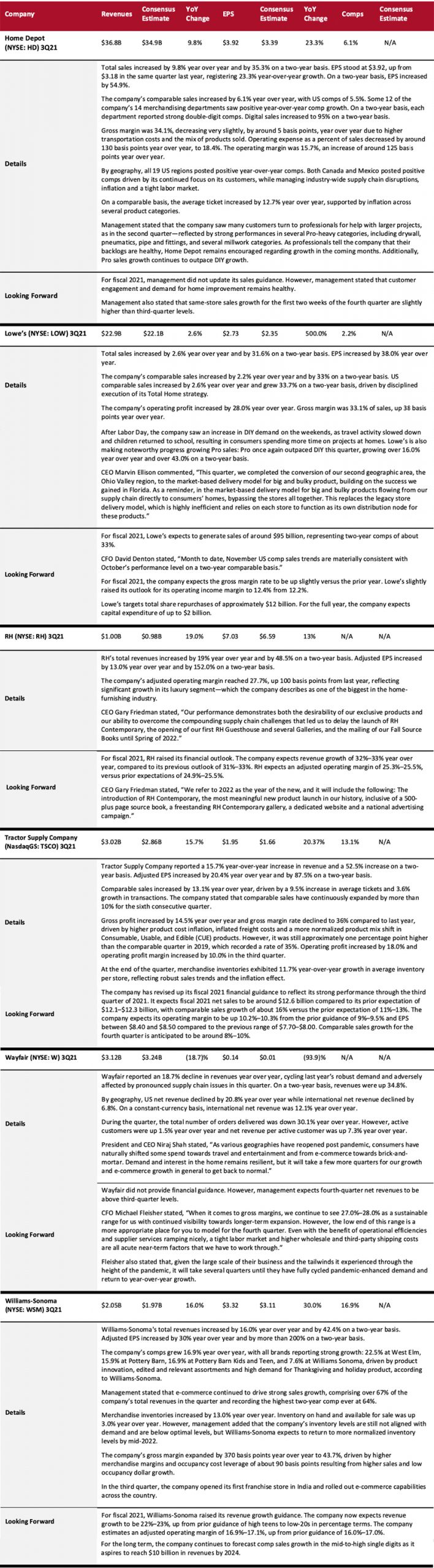

Home and Home-Improvement Retailers

Home and home-improvement retailers sustained their growth momentum—all covered retailers reported sales growth of more than 30% on a two-year basis.

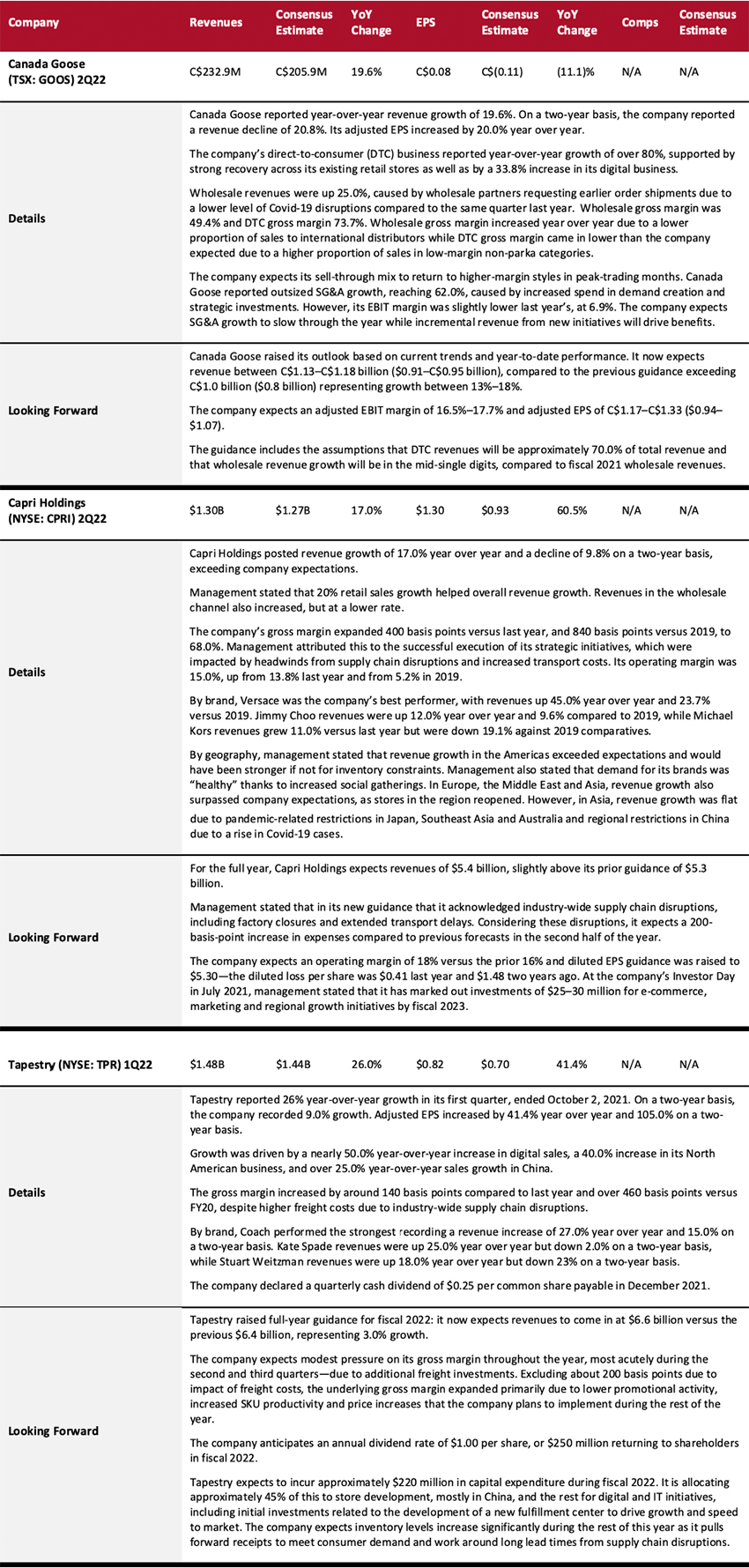

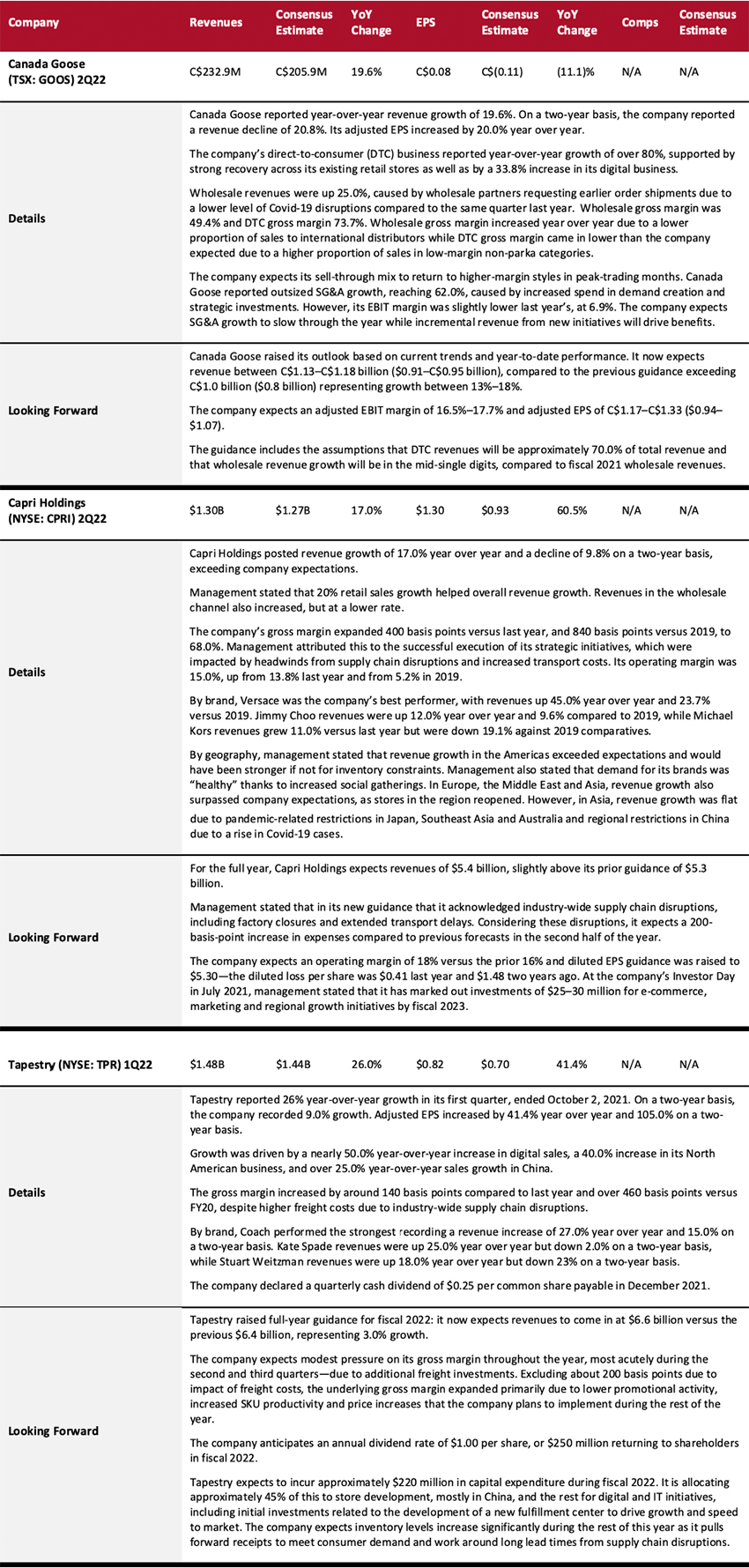

Luxury Companies

US-based luxury companies are reporting slow sales recoveries from pre-pandemic levels (slower than European firms, such as LVMH). On a two-year basis, Canada Goose reported a double-digit sales decline, Capri Holdings posted a high-single-digit sales decline; however, Tapestry posted high-single-digit sales growth.

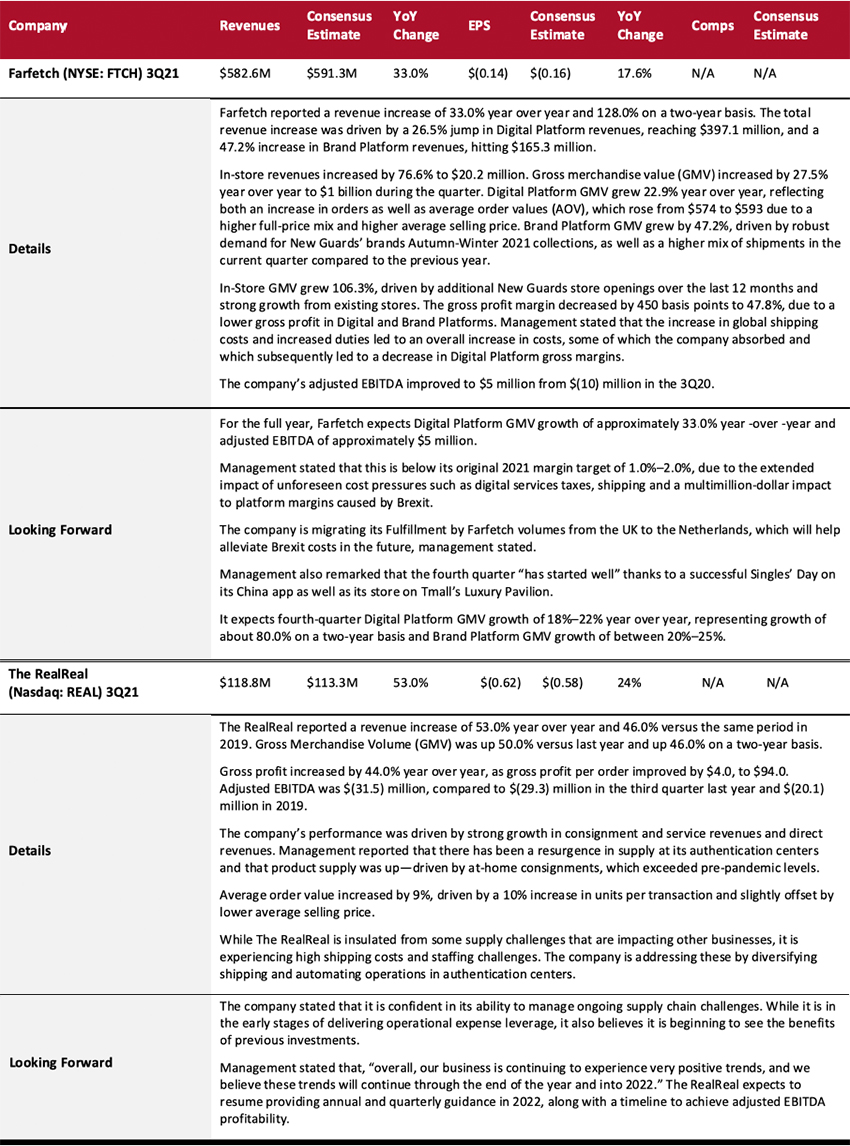

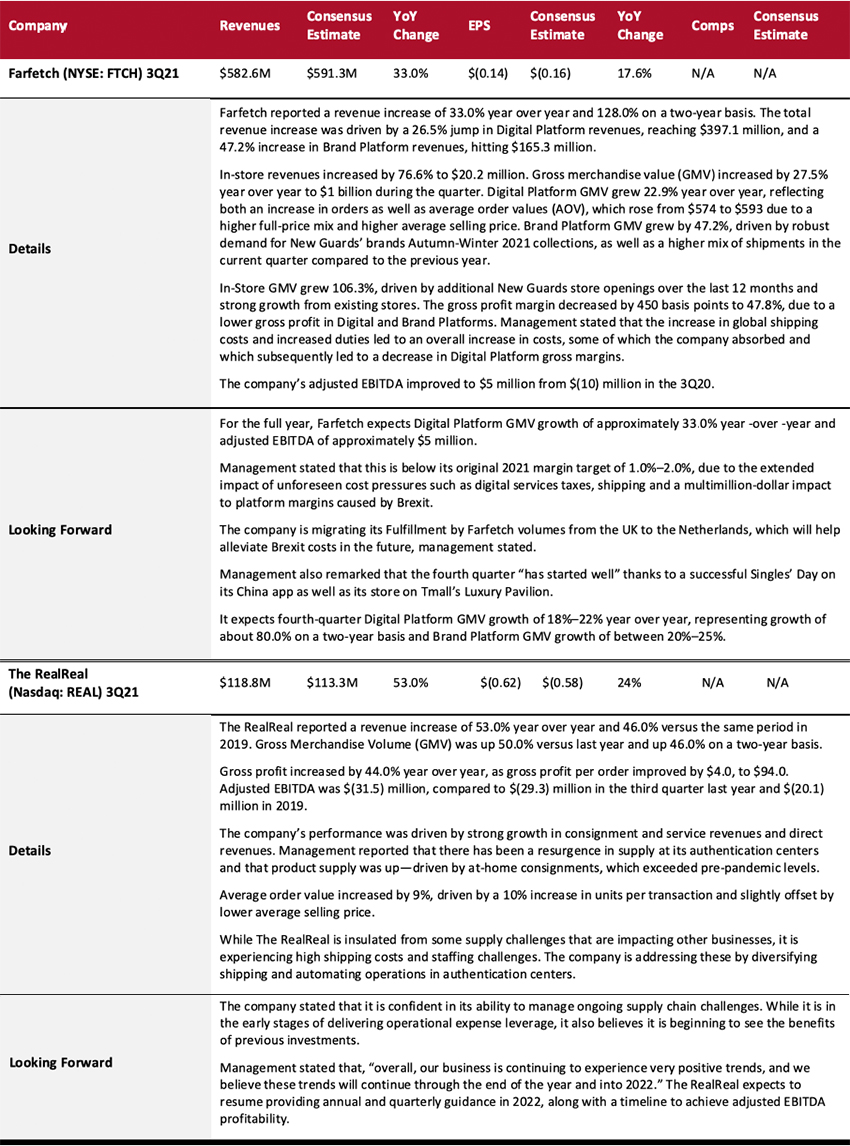

Luxury E-commerce

Luxury e-commerce platforms are recovering robustly. On a two-year basis, Farfetch posted triple-digit sales growth in its latest quarter and The RealReal reported double-digit sales growth.

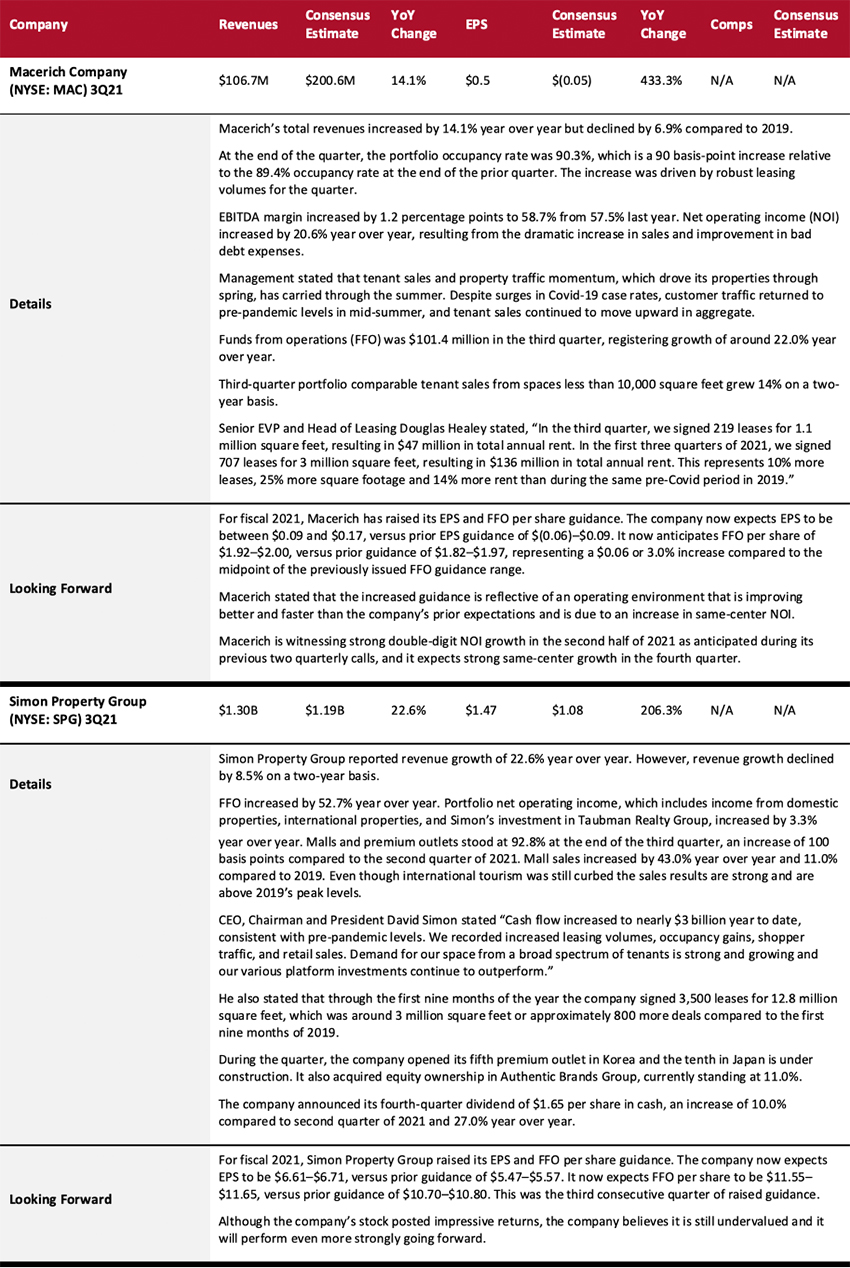

REITs

Both Macerich and Simon Property Group reported a decline in revenues on a two-year basis. However, both remain optimistic about sales recovery in the next quarter and raised their full-year 2021 earnings guidance. Both companies also stated that they are observing encouraging trends in retail demand, sales and traffic.

Looking Forward

With a strong-demand, higher-cost environment driving fewer markdowns, we are seeing gross margin expansion at a number of full-price discretionary retailers. Supply chain costs are compressing margins in some discount formats such as selected dollar stores or off-pricers. Strong consumer demand has continued into the holiday season, meaning lower promotional activity is likely to carry elevated gross margins through the next quarter for many retailers that have the benefit of a less-price-sensitive customer.

E-commerce players have, in aggregate, underperformed this quarter, led by Wayfair’s somewhat disastrous 20.8% decline in US revenues—even while demand for home goods has proven resilient. Amazon grew its Online Stores revenues by low single digits and eBay’s GMV slumped in the quarter. These performances are in the context of sustained growth in US e-commerce: Total online retail sales were up 5.8% in the third calendar quarter, according to our analysis of Census Bureau data—implying that multichannel retailers are gaining share of e-commerce at the expense of digital-first players.

Overall, apparel and footwear brand owners are witnessing a strong recovery, although pockets of weakness remain. Apparel specialty retailers reported another robust quarter, with all covered retailers except Gap posting strong positive sales growth on a two-year basis. While athleisure, casualwear and intimates remained catalysts for these retailers, they are also witnessing a strong rebound in demand for dresswear as consumers return to socializing.

Beauty retailers and brand owners continue to see a strong recovery. Within the category, bath, fragrance, haircare and skincare are recovering strongly, while demand for makeup is recovering gradually.

Major department stores are seeing solid recoveries from the crisis and they remain optimistic about the rest of 2021: All the covered retailers have raised or reaffirmed their full-year 2021 guidance. These department stores are seeing strong trends in various accessories, apparel and footwear categories, such as activewear, denim, dresses, jewelry and sneakers.