Nitheesh NH

US Department Store Insights

Kohl’s, Macy’s and Nordstrom are the leading US department stores. In fiscal 2019, the three department stores’ revenue totaled $61.2 billion, and in fiscal 2020, their combined revenue declined by 27.2% to $44.8 billion amid the Covid pandemic. Coresight Research’s US Department Store Insights quarterly series covers the recent performance of Kohl’s, Macy’s and Nordstrom, highlighting trends in comparable sales, revenue, digital sales, product categories and areas of note by management. As we are lapping one full year from the pandemic, we compare the three major department stores' third-quarter 2021 performance, ended October 30, 2021, (3Q21) to last year (3Q20) and the previous year (3Q19) to assess each retailer’s performance as a comparison and the outlook for recovery. We detail three reasons why we are analyzing the department store sector:- As the department store sector has become smaller, the dominant players including Macy’s, Kohl’s, and Nordstrom are becoming more competitive in terms of total revenue, categories, and customers they serve.

- Digital sales have become increasingly important for the department store. Compared to other sectors, department stores were traditionally more focused on physical stores channels prior to the pandemic. Now, department stores are heavily investing in digital, with each taking a different approach to digital integration. It will be instrumental to learn from all retailers, as increasing digital sales while maintaining physical sales is an industry-wide goal.

- Each department store has different growth strategies; tracking and monitoring these innovations will be informative for the sector.

US Department Store Insights: Coresight Research Analysis

Comparable Sales: Continued Positive Growth as Consumers Shop in Stores Comparable sales at all three department stores continued to be strong in the third quarter, beating consensus estimates. Management teams reported that strong store traffic was driving consumers back to physical locations: Macy’s store traffic was up 37.2% in the quarter compared to (21)% in the year-ago period, the highest increase of the three retailers, as shown in figure 1.Figure 1. Comparable Sales at Kohl’s, Macy’s and Nordstrom [wpdatatable id=1566]

*Nordstrom reports only changes in net sales, which are represented in the table as approximate to comparable sales Source: Company reports/S&P Capital IQ

Store Traffic Trends- Kohl’s launched its first 200 Sephora at Kohl’s shop-in-shop location in the quarter and reported that these stores saw a boost of new traffic, with more than 25% of the Sephora-at-Kohl’s customers representing new shoppers at Kohl’s.

- Macy’s reported that traffic in its non-downtown (suburban) locations continues to sequentially improve while its downtown (urban) stores are seeing a slower traffic return due to the lack of office workers and international tourism. Management reported that its urban store trends lag significantly behind those for its suburban stores versus the same quarter in 2019. The company reported that it seeing ongoing trend improvement in store conversion.

- Nordstrom reported that store traffic improved sequentially in the third quarter, even as digital sales penetration remained elevated at 40% of total sales.

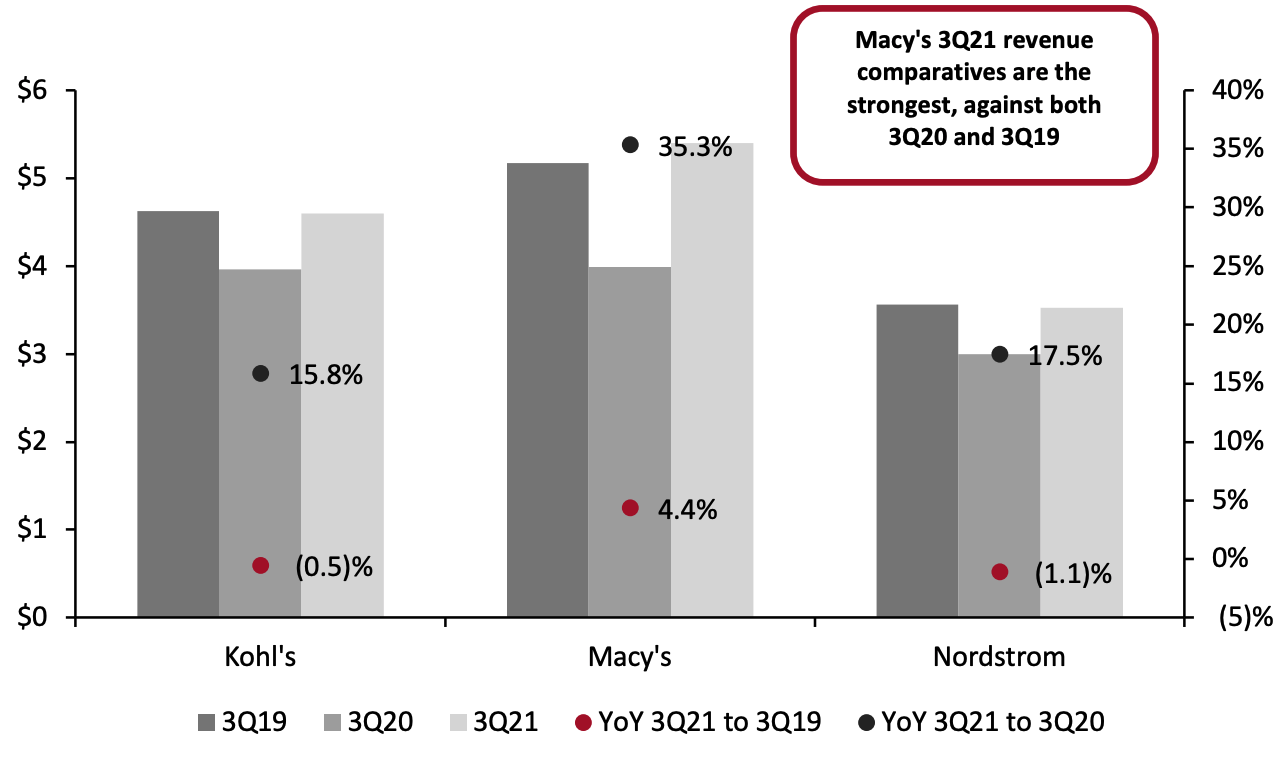

- Macy’s showed the most resilience across the three department stores again in the third quarter with an increase of 4.4%.

- Nordstrom reported the deepest decline of the three department stores at (1.1)%.

- Macy’s had the largest year-over-year increase of the three department stores at 35.3%.

- Kohl’s had the lowest year-over-year increase at 15.8%.

Figure 2. Third-Quarter Revenue Comparisons (USD Bil., Left Axis) and YoY % (Right Axis) [caption id="attachment_138507" align="aligncenter" width="700"]

Source: Company reports[/caption]

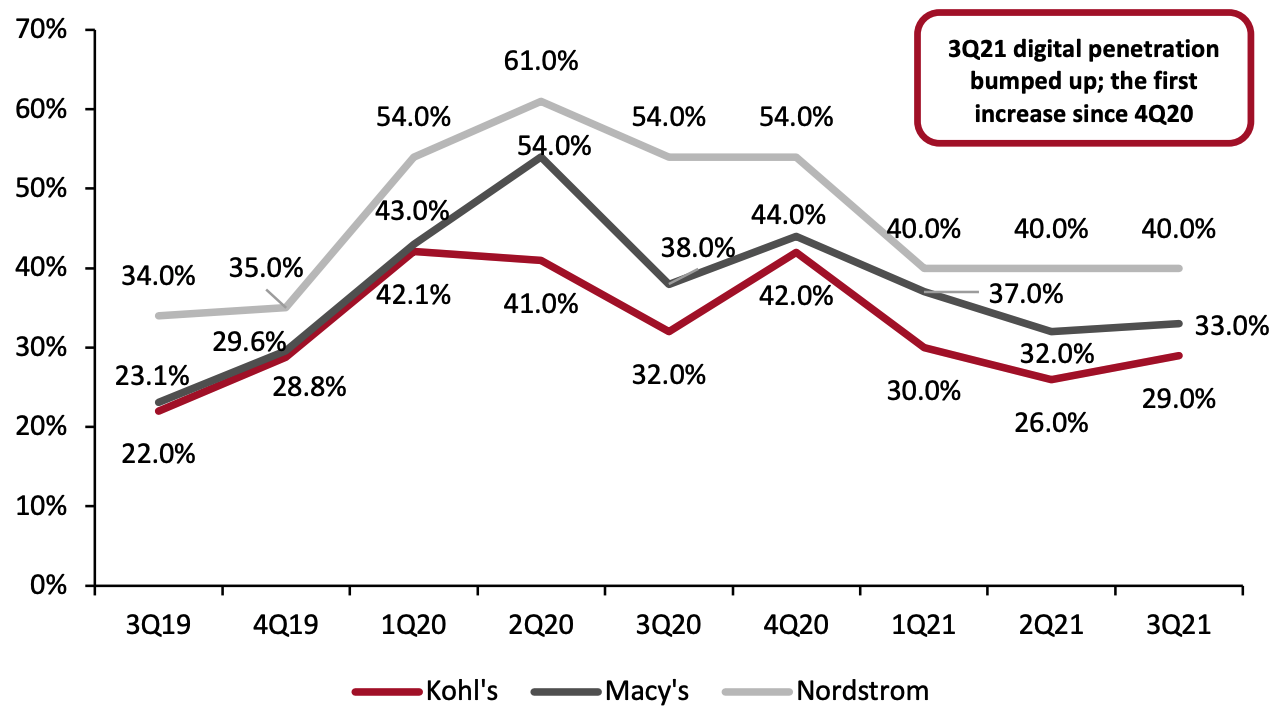

Digital Sales: Penetration Increases After Declining Since 4Q20

E-commerce penetration levels have been slowing from 4Q20. However, e-commerce penetration levels saw a slight bump in the third quarter at Macy’s and Kohl’s and remained steady at Nordstrom.

Total digital penetration across the three major department stores increased from 32.1% in 2Q21 to 33.5%—compared to 45.4% in 4Q20.

Source: Company reports[/caption]

Digital Sales: Penetration Increases After Declining Since 4Q20

E-commerce penetration levels have been slowing from 4Q20. However, e-commerce penetration levels saw a slight bump in the third quarter at Macy’s and Kohl’s and remained steady at Nordstrom.

Total digital penetration across the three major department stores increased from 32.1% in 2Q21 to 33.5%—compared to 45.4% in 4Q20.

- Kohl’s recorded digital sales at 29% of total sales, $1.3 billion, up from 26% 2Q21. This compares to 32% of e-commerce sales in 3Q20 at $1.3 billion.

- Macy’s reported 33% digital penetration, a slight increase from 32% in 2Q21, representing $1.8 billion. This compares to 38% in 3Q20 at $1.5 billion.

- Nordstrom recorded 40% of its sales through e-commerce sales totaling $1.4 billion, level with its 2Q21 penetration. This is below the extreme high of 54% in 3Q20 at $1.6 billion.

Figure 3. Digital Sales Penetration Within Total Revenue, 3Q19–3Q21 [caption id="attachment_138508" align="aligncenter" width="700"]

Source: Company reports[/caption]

The three retailers expect more moderate e-commerce penetration than fiscal 2020 for fiscal 2021.

Source: Company reports[/caption]

The three retailers expect more moderate e-commerce penetration than fiscal 2020 for fiscal 2021.

- Kohl’s ended fiscal 2020 with nearly 40% e-commerce penetration. The retailer reported at the Goldman Sachs Global Retailing Conference in September 2021 that it expects its e-commerce penetration to be a little over 30% in fiscal 2021. Management stated that it expects online sales to grow to 40% of total sales by 2023.

- Macy’s increased its full-year e-commerce sales outlook in the third quarter, projecting sales to be $8.75–8.8 billion for the full fiscal year, up from $8.35–8.45 billion in the second quarter, equating to e-commerce penetration of 36.0%–36.5%. Macy’s e-commerce penetration was 44.5% in fiscal 2020.

- Nordstrom anticipates that e-commerce will comprise 50% of its total fiscal 2021 sales, compared to 55% in fiscal 2020.

- The retailer expanded the number of drive-up parking spots for customer pickup to leverage stores to fulfill digital orders during the holiday season.

- Kohl’s piloted self-returns and self-pickup in select stores.

- The retailer announced the launch of a digital marketplace for third-party sellers’ merchandise. The marketplace will launch in the second half of 2022.

- Macy’s refreshed its mobile app and launched live shopping at Macy's and Bloomingdale's. It also launched a personalized Fragrance Finder to help consumers select their desired scent.

- The retailer launched a 3D room planning expansion.

- Macy’s added PayPal and Venmo to in-store and online payments.

- The retailer launched a dedicated sustainability product site.

- Macy’s is testing various automated fulfillment options in select stores.

- One-third of next-day Nordstrom.com orders were picked up at Nordstrom Rack stores.

- Since launching order pickup at Nordstrom Rack last year, the retailer has seen 70% growth in the program.

Figure 4. Category Highlights

| Department Store | 3Q21 Category Highlights |

| Kohl’s | Active sales showed the most significant growth in the quarter, with an increase of 25% year over year and 20% on a two-year basis. The company’s active sales nearly doubled year over year in 1Q21, growing to 23% of sales. Within active, Kohl’s is gaining traction in athleisure and size-inclusive offerings.

Other strong categories include children’s, men’s and women’s apparel and footwear:

|

| Macy’s | Management reported that products and categories that were strong during the pandemic, including fragrances, home, jewelry, sleepwear and watches, continued to perform well. Customers are showing interest in occasionwear categories including dresses, men's tailored clothing and luggage. Management reported that it expects emerging categories to supplement and complement core categories. |

| Nordstrom | The retailer saw continued strength in pandemic-related categories, particularly home and active. Sales increased by 95% and 57%, respectively, compared to 2019 levels. Nordstrom’s designer category saw a strong double-digit sales increase over 2019 levels led by strength in designer shoes, handbags and designer men's apparel. Sunglasses and swimwear posted double-digit increases over 2019 levels, which management suggests is a positive sign of consumers returning to travel. Management reported a sequential trend improvement in occasionwear categories. Dresses; makeup; and men's suits, dress shirts and dress shoes showed sequential improvement during the third quarter, closing the gap with 2019 sales levels. The company reported that it experienced inventory shortages in the quarter in core categories, such as women's apparel and shoes where demand came back stronger than expected. |

Source: Company reports

Areas of Note by Management Kohl’s: Sephora Shop-in-Shop Launch and Category Expansion Kohl’s launched 200 of its Sephora shop-in-shop locations during the third quarter. Management reported that it is seeing an incremental mid-single-digit sales lift to overall store sales in the stores that launched the partnership. The partnership is also bringing in new customers—more than 25% of Sephora at Kohl’s shoppers are new to Kohl's—and many are younger and more diverse than the department store’s typical customer. Customers are shopping across the store, with approximately half of Sephora at Kohl’s customers adding at least one other category to their purchase from the assortment at Kohl’s. Looking ahead, Kohl’s is planning to add 400 shop-in-shop locations at Kohl's stores in spring 2022. Furthermore, Kohl’s has increased its activewear sales from 20% to 30%. This includes increasing dedicated space in stores, expanding the company’s product assortment and addressing white space opportunities in athleisure and inclusive sizing. As the company renovates stores for Sephora shop-in-shop locations, it is making investments to elevate the overall store environment. This includes prioritizing categories to deliver against its new strategy as an active and casual destination. Macy’s: Digital Expansion and Category Expansion Macy’s is aggressively focusing on growing its digital sales, with the aim of reaching $10 billion in digital sales by 2023. The company announced that it will launch a marketplace to enable third-party merchants to sell their products on macys.com and bloomingdales.com in spring 2022. This will expand the company’s existing assortment and help to introduce new categories. Macy’s has also been diversifying and expanding its own categories. The company highlighted two key category expansions in 3Q21, which it achieved through partnerships. In August 2021, Macy’s and Toys“R”Us entered a partnership; Toys“R”Us products are available online at Macys’.com and will be available in more than 400 Macy’s stores in 2022. Management stated that since bringing the Toys“R”Us business to macys.com, its toy sales have more than doubled in stores and online compared to 2019. Macy’s also added Fanatics as a new brand partner, offering customers licensed sports products. The merchandise assortment drove a 22% average unit retail (AUR) increase in sports apparel and headgear compared to 2019. Nordstrom: Personalized Content and Endless Inventory The company is focusing on enhancing its digital capabilities to improve customer experiences across the shopping journey. It sees a key opportunity in offering customers more choices, with plans to increase its product choice count to approximately 1.5 million over the next few years. The company reported that it entered 4Q21 with a record choice count and will continue to significantly expand its merchandise selection using customer insights. To drive personalized content for the 2021 holiday season, Nordstrom is leveraging analytics in combination with learnings from its Anniversary Sale to provide consumers with the right product assortment.