Introduction

Our quarterly

US Retail Inventory Tracker reports review inventories held by US retailers in the

Coresight 100, our global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past eight quarters.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported 3Q20 results, which ended October 31. In August, US retail sales continued to rebound strongly as more stores reopened. Retail sales climbed 13.3% year over year in September, 10.7% in October and

9.0% in November. However, in October and November, the

total traffic decline steepened as several US states reinstituted more restrictive mandates owing to the surge in new coronavirus cases.

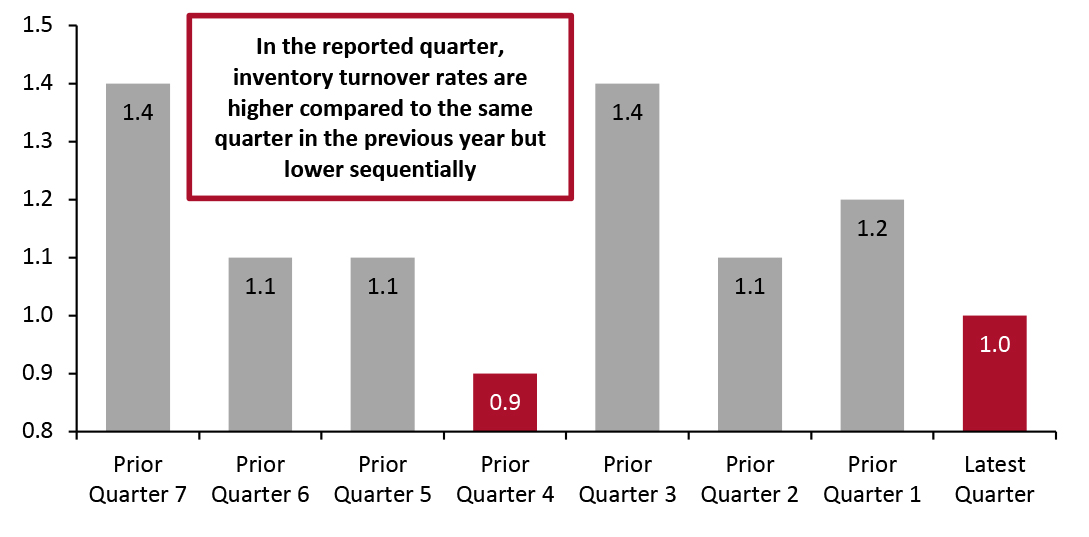

Overview: Inventory Turnover Rates Increase Year over Year

Most retailers covered here saw their inventory turnover rates increase compared to the same quarter in the previous year but decrease sequentially (quarter over quarter). The same quarter last year saw many retailers accumulate inventory to offset the impact of potential tariffs and support their expansion plans.

Figure 1. Inventory Turnover Ratios by Quarter: All Retailers

[caption id="attachment_121403" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

3Q20 continued to see a rebound from the point of inventory turnovers, mainly led by soaring digital sales. Home remains an outperforming category at most department stores, discount stores, mass merchandisers and off-price retailers. Further reflecting demand for home categories, home-improvement retailers witnessed 15% growth in inventory turnover ratios.

Apparel specialty retailers saw their inventory turnover ratios increase by 13% year over year versus a 2% increase in the prior quarter—mainly supported by strong demand for casual and athletic wear. Essential retailers such as food, drug and mass retailers, maintained their growth momentum from the last quarter, with inventory turnover ratios increasing by 6% year over year, following 12% growth in the prior quarter.

Luxury retailers posted a significant 21% year-over-year decline in inventory turnover ratios as demand for luxury goods remained subdued. Department stores saw their inventory turnover ratio increase by 19% year over year—versus an 11% decline in the prior quarter—driven by strong demand for home, beauty, and activewear and athleisure categories. Department stores see these categories as a key part of their strategy going forward.

Our one covered beauty retailer (Ulta Beauty) saw a 7% increase in its inventory turnover ratio, versus an 18% decline in the prior quarter, driven by increased demand for skincare products and eye makeup but offset by weak demand in the overall makeup category (except eye makeup).

Our covered electronics retailer (Best Buy) saw 24% growth in its inventory turnover ratio, following a 33% increase in the prior quarter. The company saw demand spike in certain categories, including computing and both large and small appliances.

In the third quarter, some retailers, such as Burlington Stores, recognized inventory reserves to account for a rise in inventory obsolescence or spoilage due to store closures. This reserve uses the money taken out of earnings to pay cash or noncash future costs associated with inventory—in accounting terms, an inventory reserve is a contra asset account that writes down the value of the inventory in the balance sheet.

On a sequential (quarter-over-quarter) basis, luxury retailers witnessed positive growth in their inventory turnover ratios, while department stores and our covered beauty retailer posted flat growth. On the other hand, apparel specialty retailers, electronics retailers, food, drug and mass retailers, and home-goods retailers reported a sequential decline in their inventory turnover ratios versus a strong increase in the prior quarter. This may be due to strong comparatives in the last quarter.

Figure 2. Inventory Turnover Ratios by Quarter

[wpdatatable id=668 table_view=regular]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

*Excludes Wayfair, an outlier

Source: Company reports/Coresight Research

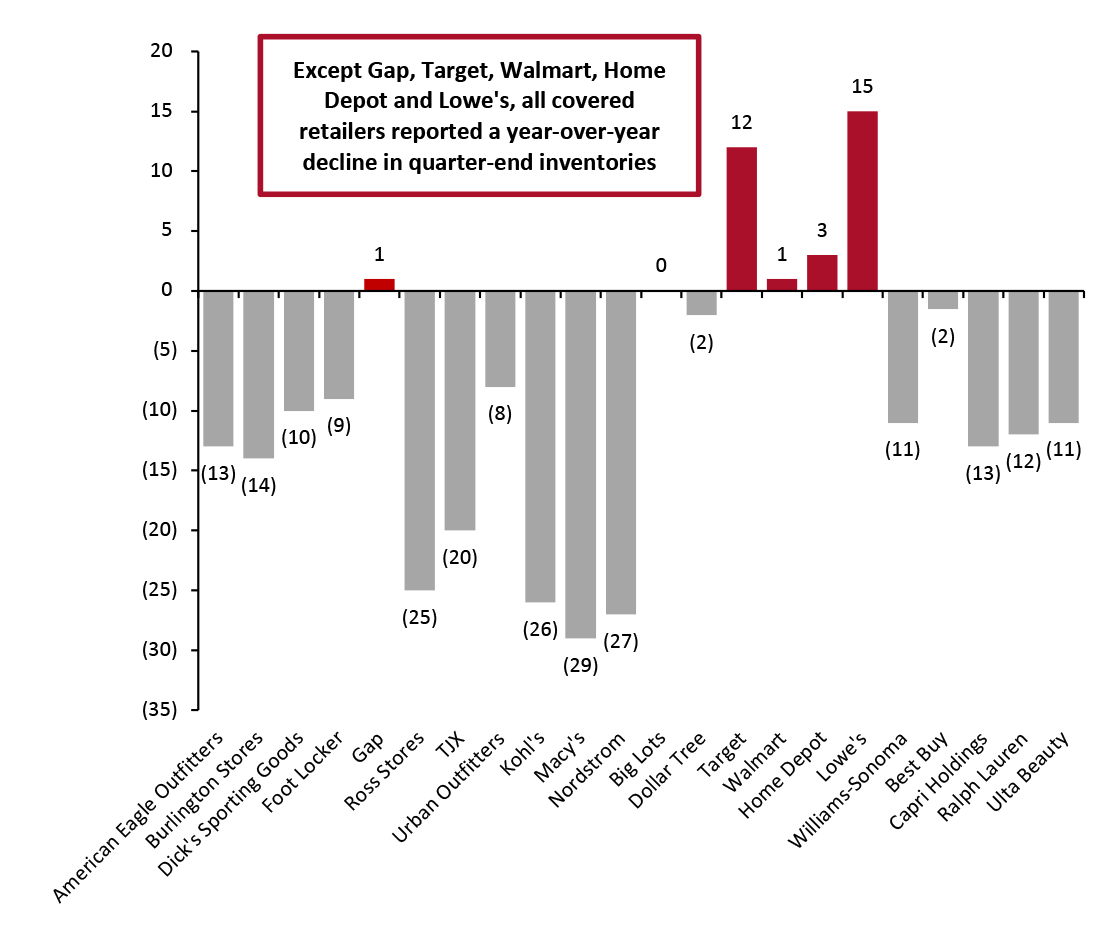

Sector and Company Overview

We look at the inventory levels of selected retailers across sectors and assess why inventory levels changed from the year-ago period.

Figure 3. Latest Quarter Inventory Values of Covered US Retailers: YoY % Change

[caption id="attachment_121404" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes or simply making misjudgments about the selection and design of products.

Most apparel specialty retailers saw a growing preference for casual and athletic wear, while the

demand for structured apparel—such as for the office and events—remains weak. The majority of apparel companies reported higher inventory turnover ratios as compared to the year-ago period.

Off-price retailers Burlington Stores, Ross Stores and TJX saw major year-over-year declines in their inventories as they aggressively cleared aged merchandise through markdowns. This was compounded by challenges in replenishing depleted inventory levels in their stores due to delays in getting through receipt backlogs and owing to their conservative approaches to planning in the current coronavirus-impacted environment. Furthermore, staffing shortages at distribution centers hindered their abilities to get their facilities up to full capacity.

| |

Commentary |

| American Eagle Outfitters |

The company ended the third quarter with inventory down 13% year over year, mainly driven by reductions in American Eagle (AE) stock. The company cut receipts due to its inventory optimization initiatives, which focus on choice and SKU count reductions. In Aerie, the company continued to invest in inventory to support its growth momentum. The company expects the benefits from inventory optimization and reduction to continue in 2021. |

| Burlington Stores |

The company’s total inventory was down 14% at the end of the quarter. The company’s in-store inventories were down 20% on a comp-store basis. Reserve inventory, which includes stock that is being stored for later release, either later in the season or in a subsequent season, was up 8% and comprised 25% of total inventory versus 19% last year.

In the fourth quarter, the company will continue to manage in-store inventories conservatively and expects to significantly increase its reserve inventory. The company expects faster inventory turns, driving lower markdowns and higher margins in the fourth quarter.

Burlington stores pushed some of its reserve inventory purchases from the third quarter to the fourth quarter to free up supply chain capacity for current and holiday merchandise. The company reported that it expects the buying environment for this merchandise to be more attractive in the fourth quarter. The company further expects the reserve inventory to be up by more than 50% by the end of January. |

| Dick’s Sporting Goods

|

The company’s quarter-end inventory levels were down 9.8% year over year. Management said that the company’s inventory is clean, and it will continue to chase product to improve its in-stock positions in the most in-demand categories, such as athletic apparel and footwear. |

| Foot Locker

|

The company ended the third quarter with inventory down 9.3% year over year on a constant-currency basis, compared to a 7.7% growth in sales. The company expects its promotional activity to be lower in the fourth quarter compared to the two previous quarters. |

| Gap

|

The company’s inventory was up 1% year over year at quarter end. Excluding pack-and-hold inventory, total inventory declined by 7%. In the third quarter, the company chased back inventory in some in-demand categories, such as activewear, baby wear and kids wear.

For the fourth quarter, the company expects inventory, excluding pack-and-hold, to be down at a similar rate as in the third quarter. |

| Ross Stores

|

The company’s total inventories were down 25% year over year, with average store inventories declining by 8%. Packaway inventory levels were 26% of the total inventory versus last year’s 39%, as the company used packaway inventory to replenish store inventory throughout the quarter.

In the fourth quarter, the company will continue to manage its in-store inventory conservatively. For the first quarter of fiscal year 2021, the company will adopt a conservative approach with regard to its total inventory. Management thinks that the Easter 2021 holiday season will not be as big as has been historically, owing to the pandemic. |

| The TJX Companies

|

The company ended the quarter with inventory down 20% year over year. TJX management said that mark-up was very strong during the quarter, with outstanding overall inventory availability. The company noted that markdowns were better than anticipated as sales exceeded its expectations and consumers responded favorably to its fresh merchandise mix. |

| Urban Outfitters

|

The company’s inventory was down 8% year over year. Management said that each of the company’s brands managed their inventories well and ended the quarter with inventory below their sales performance, recording lower markdown rates, with Urban Outfitters and Free People delivering exceptionally low rates. |

Department Stores

All the covered department stores witnessed a year-over-year decline in inventory levels at the end of the quarter.

| |

Commentary |

| Kohl’s

|

The company’s inventory was down 26% year over year, with the turnover rate reaching a five-year high due to tighter inventory management. For the fourth quarter, the company is continuing to manage its inventory tightly and chasing into the trending categories, such as activewear, athleisure, beauty and home. |

| Macy’s

|

The company ended the third quarter with inventory down 29% year over year and entered the fourth quarter with a clean inventory position. The Macy’s management team reported that the company has very good sales-to-stock parity, which will be helpful in managing markdowns and driving higher sell-throughs in the fourth quarter. Management said that the company will manage its inventory conservatively for the first quarter of fiscal year 2021. |

| Nordstrom

|

The company’s inventory was down 27% year over year. Excluding the impact of its anniversary shift from the second quarter to the third quarter, the company’s inventory decreased in line with sales, which fell by 15.8%.

In the fourth quarter, the company is seeing an increase in receipts across both of its full-price and off-price businesses. |

Food, Drug and Mass Retailers

Most food retailers, drug retailers and mass merchants witnessed higher than anticipated demand, leading to out-of-stocks in certain categories. However, retailers expect inventory levels to move to a more normal position in the next quarter.

| |

Commentary |

| Big Lots

|

The company’s total inventory was flat year over year. Total inventory included significant growth in in-transit inventory as the company chased sales and worked to get stock back ahead of the holiday selling season.

Including in-transit, the company expects its inventory decline to move closer to flat in the fourth quarter owing to acceleration in the first quarter’s receipts due to the Chinese New Year. |

| Dollar Tree |

The company’s total inventory declined by 2.0%. At Dollar Tree, inventory declined by 1.8%, while inventory per selling square foot decreased by 5.8%. At Family Dollar, inventory decreased by 2.9%, while inventory per selling square foot declined by 4.0%. Family Dollar inventory reflects higher-than-normal out-of-stocks in certain categories. |

| Target

|

The company ended the quarter with inventory up 12%, versus a sales increase of over 20%. Target is witnessing inventory shortfalls in several of its leading categories, such as apparel, electronics and home. |

| Walmart

|

Total inventory increased by 1.0%, which the company attributed to the timing of holiday merchandise flow and the continued recovery of in-stock levels from the first half of the year.

For the fourth quarter, Walmart said that it is making good progress to get certain in-demand categories, such as electronics, home goods and sporting goods to higher in-stock levels. |

Home and Home-Improvement Retailers

Most of the home and home-improvement retailers reported a strong improvement in their inventory turnover ratio compared to the year-ago period.

| |

Commentary |

| Home Depot |

The company’s merchandise inventories increased by 2.8%, driven by strong demand during the quarter. Inventory turns were 5.9x, up from 5.0x in the same quarter last year. |

| Lowe’s

|

The company’s inventory was 15% higher than the previous year’s levels as it stocked up on products to meet elevated customer demand. The company noted that lumber inflation increased inventory values by about $250 million. |

| Williams-Sonoma |

The company’s merchandise inventories were down 10.6% year over year.

CFO Julie Whalen said, “We have been working closely with our vendor partners to manage through the Covid disruptions and to expand capacity. But given the ongoing elevated demand in our high back orders, we do not expect to be fully back in stock until the second quarter of next year. What this means is that we have 700 basis points of demand sales from the third quarter that we expect to fill in future quarters when the inventory is available and delivered to the customer.” |

Electronics Retailer

| |

Commentary |

| Best Buy |

The company ended the quarter with inventory down 1.5% compared to the same period last year. Best Buy management said that the company experienced inventory constraints in a number of categories, such as large appliances and computing, which moderated its sales growth. The company expects the inventory constraints in key categories to continue in the fourth quarter. |

Luxury Retailers

Most luxury retailers expect inventory to sequentially decline in the next couple of quarters to align stocks with expected demand and revenue decline.

| |

Commentary |

| Capri Holdings |

The company’s inventory declined by 13% year over year. The company expects inventory to sequentially decline over the next two quarters owing to the cancellation of holiday receipts and the repurposing of spring/summer 2020 products for later seasons. The company expects to end 2020 with inventory decline in line with its full-year revenue decline. |

| Ralph Lauren |

The company’s total inventory declined by 12%, while net inventory, which excludes inventory reserve and allocated goods and materials, was down 12% year over year, with double-digit declines in North America and Europe, but a 9% increase in Asia. Over the next few quarters, the company expects further pressure on reported sell-in as it continues to manage inventories conservatively. |

Beauty Retailer

| |

Commentary |

| Ulta Beauty |

The company’s total inventory decreased by 11.0%, while inventory per store declined by 12.5% as it adjusted its inventory receipts to recent demand trends and reduced holiday receipts. To manage inventory risk, the company has reduced its exposure to limited edition holiday sets and is leaning more into the core products. |

Looking Forward

In the third quarter of 2020, most retailers reported a year-over-year increase in their inventory turnover ratios. During August and September, we saw a significant return to in-store shopping, with many states reopening stores and indoor malls owing to a decline in coronavirus cases. However, in October and November, store traffic saw a sequential decline due to a rise in coronavirus cases and restrictions in place in several parts of the US.

In the reported quarter, retailers turned to aggressive markdowns to clear aged inventory. However, as many retailers managed their inventory conservatively, they witnessed depleting store inventory levels that impacted their sales. Some retailers, such as Burlington Stores, have invested substantially in inventory reserves to keep their inventories aligned with consumer demand and protect against a future need to make additional markdowns. On the other hand, mass merchandisers, such as Target and Walmart, are investing to offset out-of-stocks in multiple categories, such as electronics and home.

Next quarter, we expect to see an improvement in inventory turnover ratios for most covered retailers, driven by the holiday season. As the e-commerce channel continues to help retailers to reduce their in-store inventory and offset losses from brick-and-mortar closures, some retailers, such as American Eagle Outfitters, Capri Holdings, Kohl’s, Macy’s and Urban Outfitters are looking to strengthen their digital model. This involves looking to expand curbside pickup and ship-from-store capabilities and implement automated fulfillment technology at stores and distribution centers (DCs). These measures will likely help retailers to adjust inventory levels in stores quickly and help DCs to meet changing consumer demand.

Furthermore, retailers need to reassess their usual assortment and accumulate more stock in some categories and less in others, given the fluctuations in consumer demand. An efficient inventory management system could reroute in-store stock that has low demand in some areas to locations where demand is high. Similarly,

data-driven insights can facilitate more efficient inventory planning and in-store innovation—which have proved key for retailers amid the Covid-19 crisis. Given the recent surge in coronavirus cases in some parts of the US, retailers should also be prepared for potential inventory shortages. To reduce the risk of supply chain disruptions going forward, retailers could diversify sourcing options and work with a variety of suppliers and manufacturers.